000153412012/312024Q3FALSE0.00420.00420.0042http://fasb.org/us-gaap/2024#DerivativeLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2024#DerivativeLiabilitiesNoncurrenthttp://www.avalotherapeutics.com/20240930#PropertyPlantAndEquipmentAndOperatingLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://www.avalotherapeutics.com/20240930#PropertyPlantAndEquipmentAndOperatingLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2024#AccruedLiabilitiesAndOtherLiabilitieshttp://fasb.org/us-gaap/2024#AccruedLiabilitiesAndOtherLiabilitieshttp://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrentP1YP6Mxbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:pureavtx:propertyavtx:renewal_optionavtx:class_of_stockavtx:milestoneavtx:unit00015341202024-01-012024-09-3000015341202024-11-0600015341202024-09-3000015341202023-12-310001534120us-gaap:SeriesCPreferredStockMember2023-12-310001534120us-gaap:SeriesCPreferredStockMember2024-09-300001534120us-gaap:SeriesDPreferredStockMember2024-09-300001534120us-gaap:SeriesDPreferredStockMember2023-12-310001534120us-gaap:SeriesEPreferredStockMember2024-09-300001534120us-gaap:SeriesEPreferredStockMember2023-12-310001534120us-gaap:ProductMember2024-01-012024-09-300001534120us-gaap:ProductMember2023-07-012023-09-300001534120us-gaap:ProductMember2023-01-012023-09-3000015341202024-07-012024-09-3000015341202023-07-012023-09-3000015341202023-01-012023-09-3000015341202023-12-282023-12-2800015341202024-06-300001534120us-gaap:CommonStockMember2024-06-300001534120us-gaap:AdditionalPaidInCapitalMember2024-06-300001534120us-gaap:RetainedEarningsMember2024-06-300001534120us-gaap:CommonStockMemberavtx:ConversionOfConvertiblePreferredStockMember2024-07-012024-09-300001534120us-gaap:AdditionalPaidInCapitalMemberavtx:ConversionOfConvertiblePreferredStockMember2024-07-012024-09-300001534120avtx:ConversionOfConvertiblePreferredStockMember2024-07-012024-09-300001534120us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300001534120us-gaap:RetainedEarningsMember2024-07-012024-09-300001534120us-gaap:CommonStockMember2024-09-300001534120us-gaap:AdditionalPaidInCapitalMember2024-09-300001534120us-gaap:RetainedEarningsMember2024-09-300001534120us-gaap:CommonStockMember2023-12-310001534120us-gaap:AdditionalPaidInCapitalMember2023-12-310001534120us-gaap:RetainedEarningsMember2023-12-310001534120us-gaap:CommonStockMember2024-01-012024-09-300001534120us-gaap:CommonStockMemberavtx:AlmataBioTransactionMember2024-01-012024-09-300001534120us-gaap:AdditionalPaidInCapitalMemberavtx:AlmataBioTransactionMember2024-01-012024-09-300001534120avtx:AlmataBioTransactionMember2024-01-012024-09-300001534120us-gaap:SeriesCPreferredStockMemberavtx:AlmataBioTransactionMember2024-01-012024-09-300001534120us-gaap:SeriesCPreferredStockMemberus-gaap:PrivatePlacementMember2024-01-012024-09-300001534120us-gaap:SeriesDPreferredStockMemberus-gaap:PrivatePlacementMember2024-01-012024-09-300001534120us-gaap:SeriesEPreferredStockMemberus-gaap:PrivatePlacementMember2024-01-012024-09-300001534120us-gaap:CommonStockMemberavtx:ConversionOfConvertiblePreferredStockMember2024-01-012024-09-300001534120us-gaap:AdditionalPaidInCapitalMemberavtx:ConversionOfConvertiblePreferredStockMember2024-01-012024-09-300001534120avtx:ConversionOfConvertiblePreferredStockMember2024-01-012024-09-300001534120us-gaap:AdditionalPaidInCapitalMember2024-01-012024-09-300001534120us-gaap:RetainedEarningsMember2024-01-012024-09-300001534120us-gaap:CommonStockMember2023-06-300001534120us-gaap:AdditionalPaidInCapitalMember2023-06-300001534120us-gaap:RetainedEarningsMember2023-06-3000015341202023-06-300001534120us-gaap:CommonStockMember2023-07-012023-09-300001534120us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001534120us-gaap:RetainedEarningsMember2023-07-012023-09-300001534120us-gaap:CommonStockMember2023-09-300001534120us-gaap:AdditionalPaidInCapitalMember2023-09-300001534120us-gaap:RetainedEarningsMember2023-09-3000015341202023-09-300001534120us-gaap:CommonStockMember2022-12-310001534120us-gaap:AdditionalPaidInCapitalMember2022-12-310001534120us-gaap:RetainedEarningsMember2022-12-3100015341202022-12-310001534120us-gaap:CommonStockMember2023-01-012023-09-300001534120us-gaap:AdditionalPaidInCapitalMember2023-01-012023-09-300001534120us-gaap:RetainedEarningsMember2023-01-012023-09-300001534120us-gaap:PreferredStockMemberus-gaap:PrivatePlacementMember2024-01-012024-03-310001534120us-gaap:PrivatePlacementMember2024-01-012024-03-310001534120us-gaap:WarrantMemberus-gaap:PrivatePlacementMember2024-09-300001534120us-gaap:WarrantMemberus-gaap:PrivatePlacementMember2024-03-282024-03-280001534120us-gaap:WarrantMemberus-gaap:SubsequentEventMemberus-gaap:PrivatePlacementMember2024-10-012024-11-060001534120avtx:AlmataBioTransactionMember2024-03-272024-03-270001534120us-gaap:SeriesCPreferredStockMemberavtx:AlmataTransactionAndMarch2024FinancingMember2024-03-272024-03-270001534120us-gaap:CommonStockMemberavtx:AlmataBioTransactionMember2024-03-272024-03-270001534120avtx:AlmataBioTransactionMember2024-03-282024-03-280001534120avtx:AlmataBioTransactionMember2024-04-012024-04-300001534120avtx:MilestoneOneMemberus-gaap:SubsequentEventMemberavtx:AlmataBioTransactionMember2024-10-080001534120avtx:MilestoneTwoMemberus-gaap:SubsequentEventMemberavtx:AlmataBioTransactionMember2024-10-080001534120avtx:MilestoneOneMemberus-gaap:SubsequentEventMemberavtx:AlmataBioTransactionMember2024-10-012024-10-310001534120avtx:AlmataBioTransactionMember2024-09-300001534120avtx:AlmataBioTransactionMember2024-03-270001534120avtx:MillipredMember2021-07-012021-07-010001534120avtx:MillipredMember2024-09-300001534120avtx:MillipredMember2024-01-012024-09-300001534120avtx:EmployeeConsultantsAndDirectorsStockOptionsMember2024-07-012024-09-300001534120avtx:EmployeeConsultantsAndDirectorsStockOptionsMember2023-07-012023-09-300001534120avtx:WarrantCommonStockMember2024-07-012024-09-300001534120avtx:WarrantCommonStockMember2023-07-012023-09-300001534120us-gaap:SeriesCPreferredStockMember2024-07-012024-09-300001534120us-gaap:SeriesCPreferredStockMember2023-07-012023-09-300001534120us-gaap:RestrictedStockUnitsRSUMember2024-07-012024-09-300001534120us-gaap:RestrictedStockUnitsRSUMember2023-07-012023-09-300001534120avtx:PrefundedWarrantsMember2023-07-012023-09-300001534120avtx:PrefundedWarrantsMember2023-01-012023-09-300001534120avtx:PrefundedWarrantsMember2024-09-300001534120us-gaap:SeriesCPreferredStockMember2024-09-300001534120us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-09-300001534120us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-09-300001534120us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-09-300001534120us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001534120us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001534120us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001534120us-gaap:FairValueInputsLevel3Memberus-gaap:WarrantMember2024-06-300001534120us-gaap:FairValueInputsLevel3Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2024-06-300001534120us-gaap:FairValueInputsLevel3Member2024-06-300001534120us-gaap:FairValueInputsLevel3Memberus-gaap:WarrantMember2024-07-012024-09-300001534120us-gaap:FairValueInputsLevel3Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2024-07-012024-09-300001534120us-gaap:FairValueInputsLevel3Member2024-07-012024-09-300001534120us-gaap:FairValueInputsLevel3Memberus-gaap:WarrantMember2024-09-300001534120us-gaap:FairValueInputsLevel3Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2024-09-300001534120us-gaap:FairValueInputsLevel3Member2024-09-300001534120us-gaap:FairValueInputsLevel3Memberus-gaap:WarrantMember2023-12-310001534120us-gaap:FairValueInputsLevel3Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2023-12-310001534120us-gaap:FairValueInputsLevel3Member2023-12-310001534120us-gaap:FairValueInputsLevel3Memberus-gaap:WarrantMember2024-01-012024-09-300001534120us-gaap:FairValueInputsLevel3Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2024-01-012024-09-300001534120us-gaap:FairValueInputsLevel3Member2024-01-012024-09-300001534120us-gaap:FairValueInputsLevel3Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2023-06-300001534120us-gaap:FairValueInputsLevel3Member2023-06-300001534120us-gaap:FairValueInputsLevel3Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2023-07-012023-09-300001534120us-gaap:FairValueInputsLevel3Member2023-07-012023-09-300001534120us-gaap:FairValueInputsLevel3Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2023-09-300001534120us-gaap:FairValueInputsLevel3Member2023-09-300001534120us-gaap:FairValueInputsLevel3Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2022-12-310001534120us-gaap:FairValueInputsLevel3Member2022-12-310001534120us-gaap:FairValueInputsLevel3Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2023-01-012023-09-300001534120us-gaap:FairValueInputsLevel3Member2023-01-012023-09-300001534120us-gaap:SeriesCPreferredStockMemberus-gaap:PrivatePlacementMember2024-03-282024-03-280001534120us-gaap:SubsequentEventMemberus-gaap:PrivatePlacementMember2024-10-012024-11-060001534120us-gaap:FairValueInputsLevel3Memberus-gaap:WarrantMember2024-09-300001534120us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputExpectedTermMemberus-gaap:WarrantMember2024-09-300001534120us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputPriceVolatilityMemberus-gaap:WarrantMember2024-09-300001534120us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputRiskFreeInterestRateMemberus-gaap:WarrantMember2024-09-300001534120us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputExpectedDividendRateMemberus-gaap:WarrantMember2024-09-3000015341202024-03-310001534120avtx:ESTherapeuticsMemberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2022-10-012022-12-310001534120avtx:AVTX501Member2022-12-310001534120avtx:MilestoneOneMemberavtx:AVTX007Member2022-12-310001534120avtx:MilestoneTwoMemberavtx:AVTX007Member2022-12-310001534120avtx:AVTX611Member2022-12-310001534120avtx:AVTX501AndAVTX007Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2022-10-012022-12-310001534120avtx:AVTX501Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2022-10-012022-12-310001534120avtx:AVTX007Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2022-10-012022-12-310001534120avtx:AVTX007Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2024-01-012024-09-300001534120avtx:AVTX501Memberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2024-01-012024-09-300001534120us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberavtx:MeasurementInputProbabilityOfSuccessMemberavtx:AVTX501Member2022-12-310001534120us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberus-gaap:MeasurementInputExpectedTermMemberavtx:AVTX501Member2022-10-012022-12-310001534120us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberavtx:MeasurementInputSalesForecastPeakMemberavtx:AVTX007Member2022-10-012022-12-310001534120us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberavtx:MeasurementInputProbabilityOfSuccessMemberavtx:AVTX007Member2022-12-310001534120us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberus-gaap:MeasurementInputExpectedTermMemberavtx:AVTX007Member2022-10-012022-12-310001534120stpr:MDus-gaap:BuildingMember2024-09-300001534120stpr:MDus-gaap:BuildingMember2024-01-012024-09-300001534120stpr:PAus-gaap:BuildingMember2024-09-300001534120stpr:PAus-gaap:BuildingMember2024-01-012024-09-300001534120avtx:HorizonPowerscourtNotesMemberus-gaap:LoansPayableMember2021-06-040001534120avtx:HorizonPowerscourtNotesMemberus-gaap:LoansPayableMember2022-04-012022-06-300001534120avtx:HorizonPowerscourtNotesMemberus-gaap:LoansPayableMember2023-06-012023-06-300001534120avtx:HorizonPowerscourtNotesMemberus-gaap:LoansPayableMember2023-09-222023-09-220001534120us-gaap:WarrantMemberavtx:HorizonPowerscourtNotesMemberus-gaap:LoansPayableMember2021-06-042021-06-040001534120us-gaap:WarrantMemberavtx:HorizonPowerscourtNotesMemberus-gaap:LoansPayableMember2021-06-040001534120us-gaap:WarrantMemberavtx:HorizonPowerscourtNotesMemberus-gaap:LoansPayableMember2023-07-012023-09-300001534120us-gaap:WarrantMemberavtx:HorizonPowerscourtNotesMemberus-gaap:LoansPayableMember2024-01-012024-09-300001534120us-gaap:WarrantMemberavtx:HorizonPowerscourtNotesMemberus-gaap:LoansPayableMember2024-07-012024-09-300001534120us-gaap:PreferredStockMemberus-gaap:PrivatePlacementMember2024-03-282024-03-280001534120us-gaap:PrivatePlacementMember2024-03-282024-03-280001534120us-gaap:SeriesCPreferredStockMemberus-gaap:PrivatePlacementMember2024-08-132024-08-130001534120us-gaap:CommonStockMember2024-03-272024-03-270001534120us-gaap:CommonStockMemberus-gaap:SubsequentEventMember2024-10-012024-11-060001534120us-gaap:SeriesCPreferredStockMemberus-gaap:SubsequentEventMember2024-10-012024-11-060001534120us-gaap:SeriesCPreferredStockMemberus-gaap:SubsequentEventMember2024-11-060001534120us-gaap:PrivatePlacementMember2024-01-012024-09-300001534120us-gaap:OtherExpenseMember2024-01-012024-09-300001534120us-gaap:SubsequentEventMember2024-10-012024-11-060001534120us-gaap:OtherExpenseMemberus-gaap:PrivatePlacementMember2024-01-012024-09-300001534120avtx:AlmataTransactionAndMarch2024FinancingMember2024-09-300001534120us-gaap:SeriesCPreferredStockMemberavtx:AlmataTransactionAndMarch2024FinancingMember2024-09-300001534120us-gaap:SeriesCPreferredStockMemberavtx:AlmataTransactionAndMarch2024FinancingMember2024-03-310001534120us-gaap:SeriesCPreferredStockMemberavtx:AlmataTransactionAndMarch2024FinancingMember2024-01-012024-09-300001534120us-gaap:CommonStockMemberavtx:AlmataTransactionAndMarch2024FinancingMember2024-08-132024-08-130001534120avtx:AlmataTransactionAndMarch2024FinancingMember2024-08-132024-08-130001534120us-gaap:SeriesCPreferredStockMemberavtx:AlmataTransactionAndMarch2024FinancingMember2024-08-130001534120us-gaap:AdditionalPaidInCapitalMemberus-gaap:SeriesCPreferredStockMemberavtx:AlmataTransactionAndMarch2024FinancingMember2024-09-300001534120avtx:CommonStockWarrantsExpirationJune2031Memberus-gaap:CommonClassAMember2024-09-300001534120avtx:CommonStockWarrantsExpirationOnNovember82024Memberus-gaap:CommonClassAMember2024-09-300001534120us-gaap:CommonClassAMember2024-09-300001534120avtx:A2016ThirdAmendedPlanMember2024-01-012024-09-300001534120avtx:A2016ThirdAmendedPlanMember2024-01-012024-01-010001534120avtx:A2016ThirdAmendedPlanMember2024-08-132024-08-130001534120avtx:A2016ThirdAmendedPlanMember2024-09-300001534120us-gaap:StockOptionMemberavtx:A2016ThirdAmendedPlanMember2024-01-012024-09-300001534120us-gaap:ShareBasedPaymentArrangementEmployeeMemberavtx:A2016ThirdAmendedPlanMemberus-gaap:StockOptionMembersrt:MaximumMember2024-01-012024-09-300001534120avtx:A2016ThirdAmendedPlanMemberus-gaap:StockOptionMembersrt:DirectorMembersrt:MinimumMember2024-01-012024-09-300001534120avtx:A2016ThirdAmendedPlanMemberus-gaap:StockOptionMembersrt:DirectorMembersrt:MaximumMember2024-01-012024-09-300001534120us-gaap:ResearchAndDevelopmentExpenseMember2024-07-012024-09-300001534120us-gaap:ResearchAndDevelopmentExpenseMember2023-07-012023-09-300001534120us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-09-300001534120us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-09-300001534120us-gaap:GeneralAndAdministrativeExpenseMember2024-07-012024-09-300001534120us-gaap:GeneralAndAdministrativeExpenseMember2023-07-012023-09-300001534120us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-09-300001534120us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-09-300001534120avtx:ServiceBasedOptionsMember2023-12-310001534120avtx:ServiceBasedOptionsMember2023-01-012023-12-310001534120avtx:ServiceBasedOptionsMember2024-01-012024-09-300001534120avtx:ServiceBasedOptionsMember2024-09-300001534120avtx:ServiceBasedOptionsMember2024-08-132024-08-130001534120avtx:ServiceBasedOptionsMemberavtx:NonEmployeeMember2024-08-132024-08-130001534120avtx:ServiceBasedOptionsMemberavtx:ChiefLegalOfficerMember2024-06-012024-07-310001534120avtx:ServiceBasedOptionsMember2024-07-012024-09-300001534120avtx:ServiceBasedOptionsMembersrt:MaximumMember2024-09-300001534120avtx:ServiceBasedOptionsMembersrt:MaximumMember2024-01-012024-09-300001534120us-gaap:RestrictedStockUnitsRSUMember2023-12-310001534120us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-09-300001534120us-gaap:RestrictedStockUnitsRSUMember2024-09-300001534120us-gaap:RestrictedStockUnitsRSUMember2024-08-132024-08-130001534120us-gaap:RestrictedStockUnitsRSUMember2024-07-012024-09-300001534120us-gaap:EmployeeStockMember2016-04-052016-04-050001534120us-gaap:EmployeeStockMember2016-04-0500015341202024-01-012024-01-0100015341202024-08-132024-08-130001534120us-gaap:EmployeeStockMember2024-01-012024-09-300001534120avtx:LillyLicenseAgreementMemberavtx:AVTX009LillyLicenseAgreementMember2024-03-270001534120avtx:LillyLicenseAgreementMembersrt:MinimumMemberavtx:AVTX009LillyLicenseAgreementMember2024-03-270001534120avtx:LillyLicenseAgreementMembersrt:MaximumMemberavtx:AVTX009LillyLicenseAgreementMember2024-03-270001534120avtx:LillyLicenseAgreementMemberavtx:AVTX009LillyLicenseAgreementMember2024-03-272024-03-270001534120avtx:KyowaKirinCoLtdKKCMemberavtx:AVTX002KKCLicenseAgreementMember2021-03-250001534120avtx:MilestoneOneMemberavtx:KyowaKirinCoLtdKKCMemberavtx:AVTX002KKCLicenseAgreementMember2021-03-250001534120avtx:MilestoneTwoMemberavtx:KyowaKirinCoLtdKKCMemberavtx:AVTX002KKCLicenseAgreementMember2021-03-250001534120us-gaap:ContractTerminationMemberavtx:KyowaKirinCoLtdKKCMembersrt:MinimumMember2021-03-252021-03-250001534120us-gaap:ContractTerminationMemberavtx:KyowaKirinCoLtdKKCMembersrt:MaximumMember2021-03-252021-03-250001534120avtx:KyowaKirinCoLtdKKCMemberavtx:AVTX002KKCLicenseAgreementMember2024-01-012024-09-300001534120avtx:KyowaKirinCoLtdKKCMemberavtx:AVTX002KKCLicenseAgreementMember2024-09-300001534120avtx:CHOPLicenseAgreementMemberavtx:AVTX002KKCLicenseAgreementMember2020-02-030001534120avtx:CHOPLicenseAgreementMemberavtx:AVTX002KKCLicenseAgreementMember2020-01-012020-12-310001534120avtx:CHOPLicenseAgreementMemberavtx:AVTX002KKCLicenseAgreementMember2024-09-300001534120avtx:CHOPLicenseAgreementMember2020-02-032020-02-030001534120us-gaap:ContractTerminationMemberavtx:CHOPLicenseAgreementMember2020-02-032020-02-030001534120avtx:SanfordBurnhamPrebysMedicalDiscoveryInstituteMemberavtx:AVTX008SanfordBurnhamPrebysLicenseAgreementMember2021-06-210001534120avtx:SanfordBurnhamPrebysMedicalDiscoveryInstituteMemberavtx:AVTX008SanfordBurnhamPrebysLicenseAgreementMember2021-06-300001534120avtx:MilestoneOneMemberavtx:SanfordBurnhamPrebysMedicalDiscoveryInstituteMemberavtx:AVTX008SanfordBurnhamPrebysLicenseAgreementMember2021-06-210001534120avtx:MilestoneTwoMemberavtx:SanfordBurnhamPrebysMedicalDiscoveryInstituteMemberavtx:AVTX008SanfordBurnhamPrebysLicenseAgreementMember2021-06-210001534120avtx:SanfordBurnhamPrebysMedicalDiscoveryInstituteMembersrt:MinimumMemberavtx:AVTX008SanfordBurnhamPrebysLicenseAgreementMember2021-06-210001534120avtx:SanfordBurnhamPrebysMedicalDiscoveryInstituteMembersrt:MaximumMemberavtx:AVTX008SanfordBurnhamPrebysLicenseAgreementMember2021-06-210001534120us-gaap:ContractTerminationMemberavtx:SanfordBurnhamPrebysMedicalDiscoveryInstituteMember2021-06-212021-06-210001534120avtx:SanfordBurnhamPrebysMedicalDiscoveryInstituteMemberavtx:AVTX008SanfordBurnhamPrebysLicenseAgreementMember2024-01-012024-09-300001534120avtx:SanfordBurnhamPrebysMedicalDiscoveryInstituteMemberavtx:AVTX008SanfordBurnhamPrebysLicenseAgreementMember2024-09-300001534120avtx:AstellasPharmaIncAstellasMemberavtx:AVTX006AstellasLicenseAgreementMember2024-09-300001534120avtx:AstellasPharmaIncAstellasMemberavtx:AVTX006Member2019-07-152019-07-150001534120avtx:AstellasPharmaIncAstellasMember2019-07-152019-07-150001534120avtx:AstellasPharmaIncAstellasMemberavtx:AVTX006AstellasLicenseAgreementMember2024-01-012024-09-300001534120avtx:AltoMemberavtx:AVTX301OutLicenseMember2021-05-280001534120avtx:AVTX301OutLicenseMember2021-05-282021-05-280001534120avtx:AltoMemberavtx:AVTX301OutLicenseMember2024-09-300001534120avtx:MilestoneOneMemberavtx:ESMemberavtx:AVTX406LicenseAssignmentMember2021-06-090001534120avtx:MilestoneTwoMemberavtx:ESMemberavtx:AVTX406LicenseAssignmentMember2021-06-090001534120avtx:ESMemberavtx:AVTX406LicenseAssignmentMember2024-09-300001534120avtx:AUGTherapeuticsLLCMemberavtx:AVTX800SeriesAssetSaleMemberavtx:PurchaseAgreementMember2023-10-272023-10-270001534120avtx:AUGTherapeuticsLLCMemberavtx:AVTX800SeriesAssetSaleMemberavtx:PurchaseAgreementMember2023-10-270001534120avtx:MilestoneOneMemberavtx:AlmataBioTransactionMember2024-03-280001534120avtx:MilestoneTwoMemberavtx:AlmataBioTransactionMember2024-03-280001534120avtx:MilestoneTwoMemberavtx:AVTX009Member2024-09-300001534120avtx:MilestoneThreeMemberus-gaap:SubsequentEventMemberavtx:AVTX009Member2024-10-012024-10-310001534120avtx:AeviGenomicMedicineIncMember2020-01-012020-03-310001534120avtx:MilestoneOneMemberavtx:AeviGenomicMedicineIncMember2022-02-030001534120avtx:AeviGenomicMedicineIncMember2024-01-012024-09-300001534120avtx:MilestoneTwoMemberavtx:AeviGenomicMedicineIncMember2022-02-0300015341202019-07-012019-07-310001534120avtx:TRISPharmaMemberavtx:KarbinalAgreementMember2018-01-012018-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

| | | | | |

☑

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

for the quarterly period ended September 30, 2024 |

| OR |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

COMMISSION FILE NUMBER: 001-37590

AVALO THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| | | | | |

Delaware (State of incorporation) | 45-0705648 (I.R.S. Employer Identification No.) |

540 Gaither Road, Suite 400 Rockville, Maryland 20850 (Address of principal executive offices) | (410) 522-8707 (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $0.001 par value | AVTX | Nasdaq Capital Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b‑2 of the Exchange Act.

| | | | | | | | |

Large accelerated filer ☐ | | Accelerated filer ☐ |

Non-accelerated filer ☑ | | Smaller reporting company ☑ |

Emerging growth company ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Exchange Act). Yes ☐ No ☑

As of November 6, 2024, the registrant had 10,393,954 shares of common stock outstanding.

AVALO THERAPEUTICS, INC.

FORM 10-Q

For the Quarter Ended September 30, 2024

TABLE OF CONTENTS

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements.

AVALO THERAPEUTICS, INC. and SUBSIDIARIES

Condensed Consolidated Balance Sheets

(In thousands, except share and per share data)

| | | | | | | | | | | | | | |

| | September 30, 2024 | | December 31, 2023 |

| | (unaudited) | | |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 81,858 | | | $ | 7,415 | |

| | | | |

| Other receivables | | 998 | | | 136 | |

| | | | |

| Prepaid expenses and other current assets | | 3,251 | | | 843 | |

| Restricted cash, current portion | | 41 | | | 1 | |

| Total current assets | | 86,148 | | | 8,395 | |

| Property and equipment, net | | 1,674 | | | 1,965 | |

| Goodwill | | 10,502 | | | 10,502 | |

| Restricted cash, net of current portion | | 131 | | | 131 | |

| Total assets | | $ | 98,455 | | | $ | 20,993 | |

| Liabilities, mezzanine equity and stockholders’ equity | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 1,811 | | | $ | 446 | |

| Accrued expenses and other current liabilities | | 7,033 | | | 4,172 | |

| Warrant liability | | 46,830 | | | — | |

| Contingent consideration | | 5,000 | | | — | |

| Total current liabilities | | 60,674 | | | 4,618 | |

| Royalty obligation | | 2,000 | | | 2,000 | |

| Deferred tax liability, net | | 154 | | | 155 | |

| Derivative liability | | 11,810 | | | 5,550 | |

| Other long-term liabilities | | 1,083 | | | 1,366 | |

| Total liabilities | | 75,721 | | | 13,689 | |

| Mezzanine equity: | | | | |

Series C Preferred Stock—$0.001 par value; 34,326 and 0 shares of Series C Preferred Stock authorized at September 30, 2024 and December 31, 2023, respectively; 13,710 and 0 shares of Series C Preferred Stock issued and outstanding at September 30, 2024 and December 31, 2023, respectively | | 1,658 | | | — | |

Series D Preferred Stock—$0.001 par value; 1 and 0 shares of Series D Preferred Stock authorized at September 30, 2024 and December 31, 2023, respectively; 1 and 0 shares of Series D Preferred Stock issued and outstanding at September 30, 2024 and December 31, 2023, respectively | | — | | | — | |

Series E Preferred Stock—$0.001 par value; 1 and 0 shares of Series E Preferred Stock authorized at September 30, 2024 and December 31, 2023, respectively; 1 and 0 shares of Series E Preferred Stock issued and outstanding at September 30, 2024 and December 31, 2023, respectively | | — | | | — | |

| Stockholders’ equity: | | | | |

Common stock—$0.001 par value; 200,000,000 shares authorized at September 30, 2024 and December 31, 2023; 9,682,374 and 801,746 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively | | 10 | | | 1 | |

| Additional paid-in capital | | 355,990 | | | 342,437 | |

| Accumulated deficit | | (334,924) | | | (335,134) | |

| Total stockholders’ equity | | 21,076 | | | 7,304 | |

| Total liabilities, mezzanine equity and stockholders’ equity | | $ | 98,455 | | | $ | 20,993 | |

See accompanying notes to the unaudited condensed consolidated financial statements.

AVALO THERAPEUTICS, INC. and SUBSIDIARIES

Condensed Consolidated Statements of Operations and Comprehensive Income (Loss) (Unaudited)

(In thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | | September 30, | | September 30, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues: | | | | | | | | |

| Product revenue, net | | $ | 249 | | | $ | 236 | | | $ | 249 | | | $ | 1,353 | |

| | | | | | | | |

| Total revenues, net | | 249 | | | 236 | | | 249 | | | 1,353 | |

| | | | | | | | |

| Operating expenses: | | | | | | | | |

| Cost of product sales | | (714) | | | 247 | | | (453) | | | 1,505 | |

| Research and development | | 9,538 | | | 1,249 | | | 16,254 | | | 11,917 | |

| Acquired in-process research and development | | — | | | — | | | 27,641 | | | — | |

| General and administrative | | 4,286 | | | 2,490 | | | 12,008 | | | 7,624 | |

| | | | | | | | |

| Total operating expenses | | 13,110 | | | 3,986 | | | 55,450 | | | 21,046 | |

| Loss from operations | | (12,861) | | | (3,750) | | | (55,201) | | | (19,693) | |

| Other income (expense): | | | | | | | | |

| Excess of initial warrant fair value over private placement proceeds | | — | | | — | | | (79,276) | | | — | |

| Change in fair value of warrant liability | | 36,025 | | | — | | | 148,071 | | | — | |

| Private placement transaction costs | | — | | | — | | | (9,220) | | | — | |

| Change in fair value of derivative liability | | (1,100) | | | 100 | | | (6,260) | | | (120) | |

| Interest income (expense), net | | 964 | | | (1,553) | | | 2,101 | | | (3,498) | |

| Other expense, net | | (5) | | | (17) | | | (5) | | | (42) | |

| Total other income (expense), net | | 35,884 | | | (1,470) | | | 55,411 | | | (3,660) | |

| Income (loss) before taxes | | 23,023 | | | (5,220) | | | 210 | | | (23,353) | |

| Income tax (benefit) expense | | (14) | | | 8 | | | — | | | 23 | |

| Net income (loss) | | $ | 23,037 | | | $ | (5,228) | | | $ | 210 | | | $ | (23,376) | |

Net income (loss) per share of common stock1: | | | | | | | | |

| Basic | | $ | 0.98 | | | $ | (26.83) | | | $ | 0.01 | | | $ | (231.05) | |

| Diluted | | $ | (2.83) | | | $ | (26.83) | | | $ | (22.63) | | | $ | (231.05) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

1 Amounts for prior periods presented have been retroactively adjusted to reflect the 1-for-240 reverse stock split effected on December 28, 2023. See Note 1 for details.

See accompanying notes to the unaudited condensed consolidated financial statements.

AVALO THERAPEUTICS, INC. and SUBSIDIARIES

Condensed Consolidated Statements of Preferred Stock and Changes in Stockholders’ Equity (Unaudited)

(In thousands, except share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Preferred Stock | | | Common stock | | | | Additional paid-in | | Accumulated | Total stockholders’ |

| | Shares | Amount | | | Shares | | Amount | | | | | | capital | | deficit | | equity |

| Three Months Ended September 30, 2024 | | | | | | | | | | | | | | | | | |

| Balance, June 30, 2024 | 22,360 | | $ | 11,457 | | | | 1,034,130 | | | $ | 1 | | | | | | | $ | 344,352 | | | $ | (357,961) | | | $ | (13,608) | |

| Retirement of Series C Preferred Stock in exchange for issuance of common stock | (8,648) | | (9,799) | | | | — | | | — | | | | | | | — | | | — | | | — | |

| Issuance of common stock in exchange for retirement of Series C Preferred Stock | — | | — | | | | 8,648,244 | | | 9 | | | | | | | 9,790 | | | — | | | 9,799 | |

| Stock-based compensation | — | | — | | | | — | | | — | | | | | | | 1,848 | | | — | | | 1,848 | |

| Net income | — | | — | | | | — | | | — | | | | | | | — | | | 23,037 | | | 23,037 | |

| Balance, September 30, 2024 | 13,712 | | $ | 1,658 | | | | 9,682,374 | | | $ | 10 | | | | | | | $ | 355,990 | | | $ | (334,924) | | | $ | 21,076 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Preferred Stock | | | Common stock | | | | Additional paid-in | | Accumulated | Total stockholders’ |

| | Shares | Amount | | | Shares | | Amount | | | | | | capital | | deficit | | equity |

| Nine Months Ended September 30, 2024 | | | | | | | | | | | | | | | | | |

| Balance, December 31, 2023 | — | | $ | — | | | | 801,746 | | | $ | 1 | | | | | | | $ | 342,437 | | | $ | (335,134) | | | $ | 7,304 | |

| Impact of reverse split fractional share round-up | — | | — | | | | 60,779 | | | — | | | | | | | — | | | — | | | — | |

| Issuance of common stock pursuant to Almata Transaction | — | | — | | | | 171,605 | | | — | | | | | | | 815 | | | — | | | 815 | |

| Issuance of Series C Preferred Stock pursuant to Almata Transaction | 2,412 | | 11,457 | | | | — | | | — | | | | | | | — | | | — | | | — | |

| Issuance of Series C Preferred Stock in private placement | 19,946 | | — | | | | — | | | — | | | | | | | — | | | — | | | — | |

| Issuance of Series D Preferred Stock in private placement | 1 | | — | | | | — | | | — | | | | | | | — | | | — | | | — | |

| Issuance of Series E Preferred Stock in private placement | 1 | | — | | | | — | | | — | | | | | | | — | | | — | | | — | |

| Retirement of Series C Preferred Stock in exchange for issuance of common stock | (8,648) | | (9,799) | | | | — | | | — | | | | | | | — | | | — | | | — | |

| Issuance of common stock in exchange for retirement of Series C Preferred Stock | — | | — | | | | 8,648,244 | | | 9 | | | | | | | 9,790 | | | — | | | 9,799 | |

| Stock-based compensation | — | | — | | | | — | | | — | | | | | | | 2,948 | | | — | | | 2,948 | |

| Net income | — | | — | | | | — | | | — | | | | | | | — | | | 210 | | | 210 | |

| Balance, September 30, 2024 | 13,712 | | $ | 1,658 | | | | 9,682,374 | | | $ | 10 | | | | | | | $ | 355,990 | | | $ | (334,924) | | | $ | 21,076 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Preferred Stock | | | Common stock | | | | Additional paid-in | | Accumulated | Total stockholders’ |

| | Shares | Amount | | | Shares1 | | Amount1 | | | | | | capital1 | | deficit | | equity |

| Three Months Ended September 30, 2023 | | | | | | | | | | | | | | | | | |

| Balance, June 30, 2023 | — | | $ | — | | | | 58,489 | | | $ | — | | | | | | | $ | 314,769 | | | $ | (321,738) | | | $ | (6,969) | |

| Issuance of common shares pursuant to ATM Program, net | — | | — | | | | 737,557 | | | 1 | | | | | | | 25,938 | | | — | | | 25,939 | |

| Exercise of pre-funded warrants for common shares | — | | — | | | | 5,549 | | | — | | | | | | | — | | | — | | | — | |

| Stock-based compensation | — | | — | | | | — | | | — | | | | | | | 953 | | | — | | | 953 | |

| Net loss | — | | — | | | | — | | | — | | | | | | | — | | | (5,228) | | | (5,228) | |

| Balance, September 30, 2023 | — | | $ | — | | | | 801,595 | | | $ | 1 | | | | | | | $ | 341,660 | | | $ | (326,966) | | | $ | 14,695 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Preferred Stock | | | Common stock | | | | Additional paid-in | | Accumulated | Total stockholders’ |

| | Shares | Amount | | | Shares1 | | Amount1 | | | | | | capital1 | | deficit | | equity |

| Nine Months Ended September 30, 2023 | | | | | | | | | | | | | | | | | |

| Balance, December 31, 2022 | — | | $ | — | | | | 39,294 | | | $ | — | | | | | | | $ | 292,909 | | | $ | (303,824) | | | $ | (10,915) | |

| Issuance of common stock and warrants in underwritten public offering, net | — | | — | | | | 15,709 | | | — | | | | | | | 13,748 | | | — | | | 13,748 | |

| Issuance of common shares pursuant to ATM Program, net | — | | — | | | | 746,077 | | | 1 | | | | | | | 32,469 | | | — | | | 32,470 | |

| Retirement of common shares in exchange for pre-funded warrants | — | | — | | | | (5,417) | | | — | | | | | | | (3,874) | | | 234 | | | (3,640) | |

| Issuance of pre-funded warrants in exchange for retirement of common shares | — | | — | | | | — | | | — | | | | | | | 3,640 | | | — | | | 3,640 | |

| Exercise of pre-funded warrants for common shares | — | | — | | | | 5,850 | | | — | | | | | | | — | | | — | | | — | |

| Shares purchased through employee stock purchase plan | — | | — | | | | 82 | | | — | | | | | | | 67 | | | — | | | 67 | |

| Stock-based compensation | — | | — | | | | — | | | — | | | | | | | 2,701 | | | — | | | 2,701 | |

| Net loss | — | | — | | | | — | | | — | | | | | | | — | | | (23,376) | | | (23,376) | |

| Balance, September 30, 2023 | — | | $ | — | | | | 801,595 | | | $ | 1 | | | | | | | $ | 341,660 | | | $ | (326,966) | | | $ | 14,695 | |

| | | | | | | | | | | | | | | | | |

1 Amounts for prior periods presented have been retroactively adjusted to reflect the 1-for-240 reverse stock split effected on December 28, 2023. See Note 1 for details.

See accompanying notes to the unaudited condensed consolidated financial statements.

AVALO THERAPEUTICS, INC. and SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows (Unaudited)

(Amounts in thousands) | | | | | | | | | | | | | | |

| | | Nine Months Ended September 30, |

| | | 2024 | | 2023 |

| Operating activities | | | | |

| Net income (loss) | | $ | 210 | | | $ | (23,376) | |

| Adjustments to reconcile net loss used in operating activities: | | | | |

| Depreciation and amortization | | 101 | | | 115 | |

| Stock-based compensation | | 2,948 | | | 2,701 | |

| Acquired in-process research and development | | 27,641 | | | — | |

| Excess of initial warrant fair value over private placement proceeds | | 79,276 | | | — | |

| Change in fair value of warrant liability | | (148,071) | | | — | |

| Transaction costs paid pursuant to private placement | | 7,485 | | | — | |

| Contingent consideration paid pursuant to Almata Transaction | | (7,500) | | | — | |

| Transaction costs payable upon exercise of warrants issued in private placement | | 1,734 | | | — | |

| Change in fair value of derivative liability | | 6,260 | | | 120 | |

| Accretion of debt discount | | — | | | 1,828 | |

| Deferred taxes | | — | | | 23 | |

| Changes in assets and liabilities: | | | | |

| | | | |

| Other receivables | | (862) | | | 381 | |

| | | | |

| Inventory, net | | — | | | 20 | |

| Prepaid expenses and other assets | | (2,408) | | | 350 | |

| | | | |

| Lease incentive | | — | | | 158 | |

| Accounts payable | | 1,365 | | | (2,094) | |

| | | | |

| | | | |

| | | | |

| Accrued expenses and other liabilities | | (2,110) | | | (8,088) | |

| Lease liability, net | | (81) | | | (52) | |

| Net cash used in operating activities | | (34,012) | | | (27,914) | |

| Investing activities | | | | |

| Cash assumed from Almata Transaction | | 356 | | | — | |

| Leasehold improvements | | — | | | (158) | |

| Disposal of property and equipment | | — | | | 25 | |

| | | | |

| Net cash provided by (used in) investing activities | | 356 | | | (133) | |

| Financing activities | | | | |

| | | | |

| Proceeds from private placement investment, gross | | 115,625 | | | — | |

| Transaction costs paid pursuant to private placement | | (7,485) | | | — | |

| Proceeds from issuance of common stock and pre-funded warrants in underwritten public offering, net | | — | | | 13,748 | |

| Prepayment on Notes | | — | | | (21,244) | |

| Proceeds from issuance of common stock pursuant to ATM Program, net | | — | | | 32,470 | |

| | | | |

| | | | |

| Proceeds from issuance of common stock under employee stock purchase plan | | — | | | 67 | |

| Net cash provided by financing activities | | 108,140 | | | 25,041 | |

| Increase in cash, cash equivalents and restricted cash | | 74,484 | | | (3,006) | |

| Cash, cash equivalents, and restricted cash at beginning of period | | 7,546 | | | 13,318 | |

| Cash, cash equivalents, and restricted cash at end of period | | $ | 82,030 | | | $ | 10,312 | |

| Supplemental disclosures of cash flow information | | | | |

| Cash paid for interest | | $ | — | | | $ | 1,925 | |

| | | | |

| Supplemental disclosures of non-cash activities | | | | |

| Issuance of common stock and Series C Preferred Stock pursuant to Almata Transaction | | $ | 12,272 | | | $ | — | |

| Fair value of common stock retired in exchange for issuance of pre-funded warrants | | $ | — | | | $ | 3,640 | |

The following table provides a reconciliation of cash, cash equivalents and restricted cash reported within the condensed consolidated balance sheets that sum to the total of the same such amounts shown in the condensed consolidated statements of cash flows (in thousands):

| | | | | | | | | | | | | | |

| | September 30, |

| | 2024 | | 2023 |

| Cash and cash equivalents | | $ | 81,858 | | | $ | 10,180 | |

| Restricted cash, current | | 41 | | | 1 | |

| Restricted cash, non-current | | 131 | | | 131 | |

| Total cash, cash equivalents and restricted cash | | $ | 82,030 | | | 10,312 | |

See accompanying notes to the unaudited condensed consolidated financial statements.

AVALO THERAPEUTICS, INC. and SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

1. Business

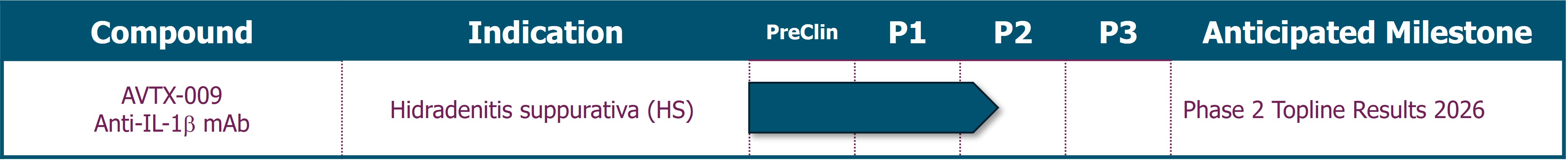

Avalo Therapeutics, Inc. (the “Company,” “Avalo” or “we”) is a clinical stage biotechnology company focused on the treatment of immune dysregulation. Avalo’s lead asset is AVTX-009, an anti-IL-1β monoclonal antibody (“mAb”), targeting inflammatory diseases. Avalo also has two additional drug candidates, which include quisovalimab (anti-LIGHT mAb) and AVTX-008 (BTLA agonist fusion protein).

Avalo was incorporated in Delaware and commenced operation in 2011, and completed its initial public offering in October 2015.

Liquidity

Since inception, we have incurred significant operating and cash losses from operations. We have primarily funded our operations to date through sales of equity securities, out-licensing transactions and sales of assets.

For the nine months ended September 30, 2024, Avalo generated net income of $0.2 million and negative cash flows from operations of $34.0 million. As of September 30, 2024, Avalo had $81.9 million in cash and cash equivalents. In the first quarter of 2024, the Company closed a private placement investment consisting of an initial upfront gross investment of $115.6 million (net proceeds were $108.1 million after deducting transaction costs) and up to an additional $69.4 million of gross proceeds upon the exercise of 11,967,526 warrants issued in the financing, which expire on November 8, 2024. Subsequent to September 30, 2024 and through November 6, 2024, the Company received gross proceeds of $58.1 million from the exercise of the warrants issued in the private placement.

Based on our current operating plans, we expect that our existing cash and cash equivalents are sufficient to fund operations for at least twelve months from the filing date of this Quarterly Report on Form 10-Q and we expect current cash on hand to fund operations into at least 2027. The Company closely monitors its cash and cash equivalents and seeks to balance the level of cash and cash equivalents with our projected needs to allow us to withstand periods of uncertainty relative to the availability of funding on favorable terms. We may satisfy any future cash needs through sales of equity securities under the Company’s at-the-market program or other equity financings, out-licensing transactions, strategic alliances/collaborations, sale of programs, and/or mergers and acquisitions. There can be no assurance that any financing or business development initiatives can be realized by the Company, or if realized, what the terms may be. To the extent that we raise capital through the sale of equity, the ownership interest of our existing stockholders will be diluted, and the terms may include liquidation or other preferences that adversely affect the rights of our stockholders. Further, if the Company raises additional funds through collaborations, strategic alliances or licensing arrangements with third parties, the Company might have to relinquish valuable rights to its technologies, future revenue streams, research programs or product candidates.

2. Basis of Presentation and Significant Accounting Policies

Basis of Presentation

The Company’s unaudited condensed consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). Any reference in these notes to applicable guidance is meant to refer to the authoritative GAAP as found in the Accounting Standards Codification (“ASC”) and Accounting Standards Updates (“ASU”) of the Financial Accounting Standards Board (“FASB”).

In the opinion of management, the accompanying unaudited condensed consolidated financial statements include all adjustments, consisting of normal recurring adjustments, which are necessary to present fairly the Company’s financial position, results of operations, and cash flows. The condensed consolidated balance sheet at December 31, 2023 has been derived from audited financial statements at that date. The interim results of operations are not necessarily indicative of the results that may occur for the full fiscal year. Certain information and footnote disclosure normally included in the financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to instructions, rules, and regulations prescribed by the United States Securities and Exchange Commission (“SEC”).

The Company believes that the disclosures provided herein are adequate to make the information presented not misleading when these unaudited condensed consolidated financial statements are read in conjunction with the December 31, 2023 audited consolidated financial statements.

On December 28, 2023, Avalo effected a 1-for-240 reverse stock split of the outstanding shares of the Company’s common stock and began trading on a split-adjusted basis on December 29, 2023. The Company retroactively applied the reverse stock split to common share and per share amounts for periods prior to December 28, 2023, including the unaudited condensed consolidated financial statements for the three and nine months ended September 30, 2023. Additionally, pursuant to their terms, a proportionate adjustment was made to the per share exercise price and number of shares issuable under all of the Company’s outstanding options and warrants, and the number of shares authorized for issuance pursuant to the Company’s equity incentive plans have been reduced proportionately. Avalo retroactively applied such adjustments in the notes to consolidated financial statements for periods presented prior to December 28, 2023, including the three and nine months ended September 30, 2023. The reverse stock split did not reduce the number of authorized shares of common and preferred stock and did not alter the par value.

Unless otherwise indicated, all amounts in the following tables are in thousands except share and per share amounts.

Significant Accounting Policies

During the three months ended September 30, 2024, there were no significant changes to the Company’s summary of significant accounting policies contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the SEC on March 29, 2024, and the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, as filed with the SEC on May 13, 2024 (as amended on July 11, 2024).

3. Asset Acquisition

Almata Transaction

On March 27, 2024, the Company acquired AVTX-009, an anti-IL-1β mAb, through a merger with AlmataBio, Inc. (“AlmataBio”) with and into its wholly owned subsidiary (the “Almata Transaction”). The Company’s acquisition of AlmataBio was structured as a stock-for-stock transaction whereby all outstanding equity interests in AlmataBio were exchanged in a merger for a combination of the Company’s common stock and shares of the Company’s non-voting convertible preferred stock (the “Series C Preferred Stock”), resulting in the issuance of 171,605 shares of Company common stock and 2,412 shares of Series C Preferred Stock. Upon Company stockholder approval on August 13, 2024 and subject to beneficial ownership limitations, 2,063 shares of Series C Preferred Stock issued to former AlmataBio stockholders automatically converted into 2,062,930 shares of common stock.

In addition to the shares issued, a cash payment of $7.5 million was due to the former AlmataBio stockholders upon the closing of a private placement investment. The private placement closed on March 28, 2024 and the Company paid the $7.5 million in April 2024. The Company is also required to pay potential development milestone payments to the former AlmataBio stockholders, including $5.0 million due upon the first patient dosed in a Phase 2 trial in patients with hidradenitis suppurativa (“HS”) for AVTX-009, and $15.0 million due upon the first patient dosed in a Phase 3 trial for AVTX-009, both of which are payable in cash or Avalo stock at the election of the former AlmataBio stockholders, subject to the terms and conditions of the definitive merger agreement. In October 2024, the first development milestone was met and the Company paid the $5.0 million cash payment, which was accrued at the transaction closing date and as of September 30, 2024.

The Company has been determined to be the acquiring company for accounting purposes. In connection with the Almata Transaction, substantially all of the consideration paid is allocable to the fair value of acquired in-process research and development (“IPR&D”), specifically AVTX-009, and as such the acquisition is treated as an asset acquisition. The Company initially recognized AlmataBio’s assets and liabilities by allocating the accumulated cost of the acquisition based on their relative fair values, as estimated by management. The net assets acquired as of the transaction date have been combined with the assets, liabilities, and results of operations of the Company on consummation of the Almata Transaction. In accordance with ASC 730, Research and Development, the portion of the consideration allocated to the acquired IPR&D, specifically AVTX-009, based on its relative fair value, is included as an operating expense as there is no alternative future use.

Below is a summary of the total consideration, assets acquired and the liabilities assumed in connection with the Almata Transaction (in thousands):

| | | | | | | | | | |

| | Nine Months Ended September 30, 2024 |

Stock consideration1 | | $ | 12,272 | | | |

Milestone payment due upon close of private placement investment2 | | 7,500 | | | |

Milestone payment due upon first patient dosed in a Phase 2 trial2 | | 5,000 | | | |

| Transaction costs | | 2,402 | | | |

| Total GAAP Purchase Price at Close | | $ | 27,174 | | | |

| | | | |

| Acquired IPR&D | | $ | 27,641 | | | |

| Cash | | 356 | | | |

| Accrued expenses and other current liabilities | | (823) | | | |

| Total net assets acquired and liabilities assumed | | $ | 27,174 | | | |

1 Equal to the aggregate common shares issued of 171,605 and the aggregate preferred shares issued of 2,412 (as-convertible to 2,412,000 shares of common stock), multiplied by the Company’s closing stock price of $4.75 on March 27, 2024. 2,063 of the 2,412 preferred shares were converted into 2,062,930 shares of common stock on August 13, 2024 upon Company stockholder approval and subject to beneficial ownership limitations.

2 Avalo deemed these milestones probable and estimable as of the transaction close date and therefore included them as part of the GAAP purchase price at close. The first milestone payment due upon the close of the private placement investment was paid in April 2024. The second milestone payment due upon the first patient dosed in a Phase 2 trial was paid in October 2024.

The cost to acquire the IPR&D asset related to AVTX-009 was expensed on the date of the Almata Transaction as it was determined to have no future alternative use. Accordingly, costs associated with the Almata Transaction to acquire the asset were expensed as incurred in acquired IPR&D.

4. Revenue

The Company’s license and supply agreement for Millipred®, an oral prednisolone indicated across a wide variety of inflammatory conditions, ended on September 30, 2023. Avalo considered Millipred® a non-core asset. Historically, the Company sold Millipred® in the United States primarily through wholesale distributors, who accounted for substantially all of the Company’s net product revenues and trade receivables. The Company continues to monitor estimates for commercial liabilities for Millipred®, such as sales returns. As additional information becomes available, the Company could recognize expense (or a benefit) for differences between actuals or updated estimates to the reserves previously recognized.

Pursuant to the Millipred® license and supply agreement, Avalo was required to pay the supplier fifty percent of the net profit of the Millipred® product following each calendar quarter, with a $0.5 million quarterly minimum payment contingent on Avalo achieving certain net profit thresholds as stipulated in the agreement. The profit share commenced on July 1, 2021 and ended on September 30, 2023. Within twenty-five months of September 30, 2023, the net profit share is subject to a reconciliation process where estimated deductions to arrive at net profit will be reconciled to actual results, which might result in Avalo owing additional amounts to the supplier or vice versa, which would be recognized in cost of product sales.

Aytu BioScience, Inc. (“Aytu”), to which the Company sold its rights, title, and interests in assets relating to certain commercialized products in 2019 (the “Aytu Transaction”), managed Millipred® commercial operations until August 31, 2021 pursuant to a transition services agreements, which included managing the third-party logistics provider. As a result, Aytu collected cash on behalf of Avalo for revenue generated by sales of Millipred® from the second quarter of 2020 through the third quarter of 2021. The transition services agreement allows Aytu to withhold up to $1.0 million until December of 2024 and requires the retention amount to remain at $1.0 million from June 1, 2024 until December 1, 2024, which resulted in the recognition of $0.4 million as an accrued expense and other current liability as of September 30, 2024. The Company assesses the collectability of the receivable, which was $0.9 million as of September 30, 2024, at each reporting period pursuant to ASC 326: Current Expected Credit Loss Standard. In the second quarter of 2022, the Company expected a full credit loss on the receivable and therefore fully reserved the receivable. Avalo considered, amongst other factors, Aytu’s conclusion within its Quarterly Report on Form 10-Q for the quarter ended March 31, 2022 that substantial doubt existed with respect to its ability to continue as a going concern within one year after the date those financial statements were issued. In September 2024, Aytu publicly disclosed in its Annual Report on Form 10-K for the year ended June 30, 2024, that it had alleviated the previously disclosed substantial doubt about its ability to continue as a going concern. As of September 30, 2024, the Company expects to collect the total receivable balance and therefore recognized the amount within other receivables on the unaudited condensed consolidated balance sheet and reversed the reserve as a benefit to cost of product sales.

5. Net Income (Loss) Per Share

The Company had two classes of stock outstanding during the three and nine months ended September 30, 2024, common stock and preferred stock, and had only common stock outstanding during the three and nine months ended September 30, 2023. The Company computes net income (loss) per share using the two-class method, as the Series C Preferred Stock participates in distributions with the Company’s common stock. The two-class method of computing net income (loss) per share is an earnings allocation formula that determines net income (loss) for common stock and any participating securities according to dividends declared and participation rights in undistributed earnings. As the Company had net income for the three and nine months ended September 30, 2024, the two-class method of calculating net income per share allocates a portion of the net income to the participating securities.

Basic net income (loss) per share for common stock is computed by dividing the sum of distributed and undistributed earnings by the weighted average number of shares outstanding for the period. The weighted average number of common shares outstanding as of September 30, 2023, includes the weighted average effect of pre-funded warrants, the exercise of which required nominal consideration for the delivery of the shares of common stock. There were no pre-funded warrants outstanding as of September 30, 2024.

Diluted net income (loss) per share includes the potential dilutive effect of common stock equivalents as if such securities were converted or exercised during the period, when the effect is dilutive. Common stock equivalents include: (i) outstanding stock options and restricted stock units, which are included under the “treasury stock method” when dilutive; (ii) common stock to be issued upon the exercise of outstanding warrants, which are included under the “treasury stock method” when dilutive, and (iii) preferred stock under the if-converted method. While the impact of these items are generally anti-dilutive during periods of net loss, the Company will determine whether the common stock equivalents should be included in diluted loss per share pursuant to sequencing rules.

The following tables set forth the computation of basic and diluted net income (loss) per share of common stock for the three and nine months ended September 30, 2024 and September 30, 2023 (in thousands, except share and per share amounts):

| | | | | | | | | | |

| | Three Months Ended September 30, 2024 | | |

| | | Common stock | | |

| | | | |

| Basic income per share: | | | | |

| Net income | | $ | 23,037 | | | |

| Net income attributed to Series C Preferred Stock | | (17,575) | | | |

| Net income - basic | | $ | 5,462 | | | |

| Weighted average shares | | 5,546,257 | | | |

| Basic net income per share | | $ | 0.98 | | | |

| | | | |

| Diluted loss per share: | | | | |

| Numerator: | | | | |

| Net income - basic | | $ | 5,462 | | | |

| Change in fair value of warrant liability | | (36,025) | | |

| Net loss - diluted | | $ | (30,563) | | | |

| | | | |

| Denominator: | | | | |

| Effect of dilutive securities: | | | | |

| Weighted average shares - basic | | 5,546,257 | | | |

| Common shares issuable for warrants | | 5,237,780 | | | |

| Weighted average shares - diluted | | 10,784,037 | | |

| Diluted net loss per share | | $ | (2.83) | | | |

| | | | | | | | | | |

| | Nine Months Ended September 30, 2024 |

| | | Common stock | | |

| | | | |

| Basic income per share: | | | | |

| Net income | | $ | 210 | | | |

| Net income attributed to Series C Preferred Stock | | (177) | | | |

| Net income - basic | | $ | 33 | | | |

| Weighted average shares | | 2,491,114 | | | |

| Basic net income per share | | $ | 0.01 | | | |

| | | | |

| Diluted loss per share: | | | | |

| Numerator: | | | | |

| Net income - basic | | $ | 33 | | | |

| Change in fair value of warrant liability | | (148,071) | | |

| Net loss - diluted | | $ | (148,038) | | | |

| | | | |

| Denominator: | | | | |

| Effect of dilutive securities: | | | | |

| Weighted average shares - basic | | 2,491,114 | | | |

| Common shares issuable for warrants | | 4,049,849 | | | |

| Weighted average shares - diluted | | 6,540,963 | | |

| Diluted net loss per share | | $ | (22.63) | | | |

| | | | | | | | |

| | Three Months Ended September 30, 2023 |

| | | Common stock |

| | |

| Net loss | | $ | (5,228) | |

| Weighted average shares | | 194,851 | |

| Basic and diluted net loss per share | | $ | (26.83) | |

| | | | | | | | |

| | Nine Months Ended September 30, 2023 |

| | | Common stock |

| | |

| Net loss | | $ | (23,376) | |

| Weighted average shares | | 101,173 | |

| Basic and diluted net loss per share | | $ | (231.05) | |

The following outstanding securities have been excluded from the computation of diluted weighted shares outstanding for the three and nine months ended September 30, 2024 and 2023, as they could have been anti-dilutive:

| | | | | | | | | | | | | | | | | | |

| | | Three and Nine Months Ended | | |

| | September 30, | | |

| | | 20243 | | 2023 | | | | |

| Stock options | | 2,000,056 | | 7,706 | | | | |

Warrants on common stock1 | | 148 | | 17,237 | | | | |

Series C Preferred Stock (as-convertible to common stock)2 | | 13,709,653 | | — | | | | |

| Restricted Stock Units | | 632,100 | | — | | | | |

1 The weighted average number of common shares outstanding for the three and nine months ended September 30, 2023 include the weighted average effect of 281 and 2,677 pre-funded warrants, respectively, because their exercise price was nominal. There were no pre-funded warrants outstanding as of September 30, 2024 and 2023.

2 Each share of the Company’s Series C Preferred Stock is convertible to 1,000 shares of common stock, subject to certain beneficial ownership limitations.

3 Pursuant to the Almata Transaction, the Company is required to pay potential development milestone payments to the former AlmataBio stockholders in cash or Avalo stock at the election of the former AlmataBio stockholders; refer to Notes 3 and 13 for more information. In the event of share settlement, the number of Avalo shares delivered will vary based on the Company’s stock price. These additional shares are not included in the computation of basic and diluted net income (loss) per share for the three and nine months ended September 30, 2024 pursuant to the guidance on contingently issuable shares.

6. Fair Value Measurements

ASC 820, Fair Value Measurements and Disclosures (“ASC 820”) defines fair value as the price that would be received to sell an asset, or paid to transfer a liability, in the principal or most advantageous market in an orderly transaction between market participants on the measurement date. The fair value standard also establishes a three‑level hierarchy, which requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The valuation hierarchy is based upon the transparency of inputs to the valuation of an asset or liability on the measurement date. The three levels are defined as follows:

•Level 1—inputs to the valuation methodology are quoted prices (unadjusted) for an identical asset or liability in an active market.

•Level 2—inputs to the valuation methodology include quoted prices for a similar asset or liability in an active market or model‑derived valuations in which all significant inputs are observable for substantially the full term of the asset or liability.

•Level 3—inputs to the valuation methodology are unobservable and significant to the fair value measurement of the asset or liability.

The following table presents, for each of the fair value hierarchy levels required under ASC 820, the Company’s assets and liabilities that are measured at fair value on a recurring basis (in thousands):

| | | | | | | | | | | | | | | | | | | | |

| | | September 30, 2024 |

| | | Fair Value Measurements Using |

| | | Quoted prices in active markets for identical assets | | Significant other observable inputs | | Significant unobservable inputs |

| | | (Level 1) | | (Level 2) | | (Level 3) |

| Assets | | | | | | |

| Investments in money market funds* | | $ | 80,935 | | | $ | — | | | $ | — | |

| Liabilities | | | | | | |

| Warrant liability | | $ | — | | | $ | — | | | $ | 46,830 | |

| Derivative liability | | $ | — | | | $ | — | | | $ | 11,810 | |

| | | | | | | | | | | | | | | | | | | | |

| | | December 31, 2023 |

| | | Fair Value Measurements Using |

| | | Quoted prices in active markets for identical assets | | Significant other observable inputs | | Significant unobservable inputs |

| | | (Level 1) | | (Level 2) | | (Level 3) |

| Assets | | | | | | |

| Investments in money market funds* | | $ | 7,077 | | | $ | — | | | $ | — | |

| Liabilities | | | | | | |

| Derivative liability | | $ | — | | | $ | — | | | $ | 5,550 | |

*Investments in money market funds are reflected in cash and cash equivalents on the accompanying unaudited condensed consolidated balance sheets.

As of September 30, 2024, the Company’s financial instruments included cash and cash equivalents, restricted cash, other receivables, prepaid and other current assets, accounts payable, accrued expenses and other current liabilities, derivative liability, and warrant liability. As of December 31, 2023, the Company’s financial instruments included cash and cash equivalents, restricted cash, accounts receivable, other receivables, prepaid and other current assets, accounts payable, accrued expenses and other current liabilities, and derivative liability.

The carrying amounts reported in the accompanying unaudited condensed consolidated financial statements for cash and cash equivalents, restricted cash, accounts receivable, other receivables, prepaid and other current assets, accounts payable, and accrued expenses and other current liabilities approximate their respective fair values because of the short-term nature of these accounts.

Level 3 Valuation

The table presented below is a summary of changes in the fair value of the Company’s Level 3 valuations for the warrant liability and derivative liability for the three and nine months ended September 30, 2024 and September 30, 2023:

| | | | | | | | | | | | | | | | | | | | |

| | | Warrant liability | | Derivative liability | | Total |

| Balance at June 30, 2024 | | $ | 82,855 | | | $ | 10,710 | | | $ | 93,565 | |

| Change in fair value | | (36,025) | | | 1,100 | | | (34,925) | |

| Balance at September 30, 2024 | | $ | 46,830 | | | $ | 11,810 | | | $ | 58,640 | |

| | | | | | | | | | | | | | | | | | | | |

| | | Warrant liability | | Derivative liability | | Total |

| Balance at December 31, 2023 | | $ | — | | | $ | 5,550 | | | $ | 5,550 | |

| Initial valuation of warrant liability | | 194,901 | | | — | | | 194,901 | |

| Change in fair value | | (148,071) | | | 6,260 | | | (141,811) | |

| Balance at September 30, 2024 | | $ | 46,830 | | | $ | 11,810 | | | $ | 58,640 | |

| | | | | | | | | | | | | | | | |

| | | | | Derivative liability | | Total |

| Balance at June 30, 2023 | | | | $ | 5,050 | | | $ | 5,050 | |

| | | | | | |

| Change in fair value | | | | (100) | | | (100) | |

| Balance at September 30, 2023 | | | | $ | 4,950 | | | $ | 4,950 | |

| | | | | | | | | | | | | | | | |

| | | | | Derivative liability | | Total |

| Balance at December 31, 2022 | | | | $ | 4,830 | | | $ | 4,830 | |

| | | | | | |

| Change in fair value | | | | 120 | | | 120 | |

| Balance at September 30, 2023 | | | | $ | 4,950 | | | $ | 4,950 | |

Warrant liability

On March 28, 2024, the Company closed a private placement investment with institutional investors in which the investors received (i) 19,946 shares of Series C Preferred Stock and (ii) warrants to purchase up to an aggregate of 11,967,526 shares of Avalo’s common stock (or a number of shares of Series C Preferred Stock convertible into the number of shares of common stock the warrant is then exercisable into). Refer to Note 10 - Capital Structure and sub-header “March 2024 Financing” for more information.

The Company determined that the warrants do not satisfy the conditions to be accounted for as equity instruments. As the warrants do not meet the equity contract scope exception, the Company classified the warrants as a derivative liability upon issuance.

The Company’s warrant liability was measured at fair value on the issuance date and is measured at fair value each reporting period thereafter until the warrants are either exercised or expire. As of September 30, 2024, there were 11,967,526 warrants outstanding. Subsequent to September 30, 2024 and through November 6, 2024, 10,026,847 warrants were exercised for gross proceeds of $58.1 million. The warrants expire on November 8, 2024, which is the thirty-first day following the public announcement of the first patient dosed in a Phase 2 trial of AVTX-009 in hidradenitis suppurativa (the “Dosing Date”). Avalo expects no warrant liability as of December 31, 2024 given the expiration on November 8, 2024. Avalo will evaluate the impact of the warrant exercises and/or expirations in the fourth quarter of 2024.

The Company utilizes the Black-Scholes option pricing model to measure fair value of the warrants, which requires assumptions including the value of the stock on the measurement date, exercise price, expected term, expected volatility, and the risk-free interest rate. Certain assumptions, including the expected term and expected volatility, are subjective and require judgment to develop. As a result, if factors or expected outcomes change and we use significantly different assumptions or estimates, our warrant liability could be materially different. The warrant liability was classified as a Level 3 instrument as its value was based on unobservable market inputs. The inputs utilized in the valuation as of September 30, 2024 include the following:

| | | | | | | | |

| | As of September 30, 2024 |

| Common stock price | | $ | 9.50 | |

| Term (in years) | | 0.1 | |

| Expected volatility | | 127 | % |

| Risk-free rate | | 4.93 | % |

| Exercise price | | $ | 5.796933 | |

| Dividend yield rate | | — | % |

The common stock price utilized is the closing stock price of Avalo’s common stock on the last trading day of the reporting period. This input is the main driver of the fair value of the warrant liability as of September 30, 2024. The closing stock price on the last day of the third quarter of 2024 was $9.50 per share compared to the closing stock price on the last day of the second quarter and first quarter of 2024 of $12.47 per share and $21.75 per share, respectively.

The term utilized as of September 30, 2024 represents the contractual expiration date of November 8, 2024, which is the thirty-first day following the Dosing Date.

The other inputs include expected volatility, which, given the short-term of the warrants, is the Company’s historical volatility, and the risk-free interest rate, which is based on the implied yield available on U.S. treasury securities with a maturity equivalent to the term.

Derivative liability

In the fourth quarter of 2022, Avalo sold its economic rights to future milestone and royalty payments for previously out-licensed assets AVTX-501, AVTX-007, and AVTX-611 to ES Therapeutics, LLC (“ES”), an affiliate of Armistice Capital LLC (“Armistice”), in exchange for $5.0 million (the “ES Transaction”). At the time of the transaction, Armistice was a significant stockholder of the Company and whose chief investment officer, Steven Boyd, and managing director, Keith Maher, served on Avalo’s Board until August 8, 2022. The ES Transaction was approved in accordance with Avalo’s related party transaction policy.

The economic rights sold include (a) rights to a milestone payment of $20.0 million upon the filing and acceptance of an NDA for AVTX-501 pursuant to an agreement with Janssen Pharmaceutics, Inc. (the “AVTX-501 Milestone”) and (b) rights to any future milestone payments and royalties relating to AVTX-007 under a license agreement with Apollo AP43 Limited (“Apollo”), including up to $6.25 million of development milestones, up to $67.5 million in sales-based milestones, and royalty payments over a ten year period of a low single digit percentage of annual net sales (which percentage increases to another low single digit percentage if annual net sales exceed a specified threshold) (the “AVTX-007 Milestones and Royalties”). In addition, Avalo waived all its rights to AVTX-611 sales-based payments of up to $20.0 million that were payable by ES.

The exchange of the economic rights of the AVTX-501 Milestone and AVTX-007 Milestones and Royalties for cash met the definition of a derivative instrument. The fair value of the derivative liability is determined using a combination of a scenario-based method and an option pricing method (implemented using a Monte Carlo simulation). The significant inputs including probabilities of success, expected timing, and forecasted sales as well as market-based inputs for volatility, risk-adjusted discount rates and allowance for counterparty credit risk are unobservable and based on the best information available to Avalo. Certain information used in the valuation is inherently limited in nature and could differ from Janssen and Apollo’s internal estimates.

The fair value of the derivative liability as of the transaction date was approximately $4.8 million, of which $3.5 million was attributable to the AVTX-501 Milestone and $1.3 million was attributable to the AVTX-007 Milestones and Royalties. Subsequent to the transaction date, at each reporting period, the derivative liability is remeasured at fair value. As of September 30, 2024, the fair value of the derivative liability was $11.8 million, of which $7.8 million was attributable to the AVTX-007 Milestones and Royalties and $4.0 million was attributable to the AVTX-501 Milestone. For the nine months ended September 30, 2024, the $6.3 million change in fair value was recognized in other income (expense), net in the accompanying unaudited condensed consolidated statements of operations and comprehensive income (loss).

The fair value of the AVTX-501 Milestone was primarily driven by an approximate 23% probability of success to reach the milestone in approximately 3.1 years. The fair value of AVTX-007 Milestones and Royalties was primarily driven by sales forecasts with peak annual net sales reaching $1.8 billion in atopic dermatitis, which is a much larger market opportunity than adult-onset Still’s disease, the previous indication being pursued that was contemplated in valuations through the first quarter of 2024, an approximate 17% probability of success, as well as time to commercialization of approximately 6.3 years. As discussed above, these unobservable inputs were estimated by Avalo based on limited publicly available information and therefore could differ from Janssen and Apollo’s internal development plans. Any changes to these inputs may result in significant changes to the fair value measurement. Notably, the peak annual net sales forecast (for the AVTX-007 Milestones and Royalties) and probability of successes (for both the AVTX-501 Milestone and the AVTX-007 Milestone and Royalties) are the largest drivers of the fair value and therefore changes to such inputs would likely result in significant changes to such fair value.

In the event that Janssen and/or Apollo are required to make payment(s) to ES Therapeutics pursuant to the underlying agreements, Avalo will recognize revenue under its existing contracts with those customers for that amount when it is no longer probable there would be a significant revenue reversal with any differences between the fair value of the derivative liability related to that payment immediately prior to the revenue recognition and revenue recognized to be recorded as other expense. However, given Avalo is no longer entitled to collect these payments, the potential ultimate settlement of the payments in the future from Janssen and/or Apollo to ES Therapeutics (and the future mark-to-market activity each reporting period) will not impact Avalo’s future cash flows.

No changes in valuation techniques occurred during the nine months ended September 30, 2024 and 2023. No transfers of assets between Level 1 and Level 2 of the fair value measurement hierarchy occurred during the nine months ended September 30, 2024 and 2023.

7. Leases

Avalo currently occupies two leased properties, both of which serve as administrative office space. The Company determined that both of these leases are operating leases based on the lease classification test performed at lease commencement.

The annual base rent for the Company’s office located in Rockville, Maryland is $0.2 million, subject to annual 2.5% increases over the term of the lease. The applicable lease provided for a rent abatement for a period of 12 months following the Company’s date of occupancy. The lease has an initial term of 10 years from the date the Company made its first annual fixed rent payment, which occurred in January 2020. The Company has the option to extend the lease two times, each for a period of five years, and may terminate the lease as of the sixth anniversary of the first annual fixed rent payment, upon the payment of a termination fee.

The initial annual base rent for the Company’s office located in Chesterbrook, Pennsylvania is $0.2 million and the annual operating expenses are approximately $0.1 million. The annual base rent is subject to periodic increases of approximately 2.4% over the term of the lease. The lease has an initial term of 5.25 years from the lease commencement on December 1, 2021.

The weighted average remaining term of the operating leases at September 30, 2024 was 3.9 years.

Supplemental balance sheet information related to the leased properties include (in thousands):

| | | | | | | | | | | | | | |

| | | As of |

| | | September 30, 2024 | | December 31, 2023 |

| Property and equipment, net | | $ | 1,139 | | | $ | 1,329 | |

| | | | |

| Accrued expenses and other current liabilities | | $ | 550 | | | $ | 537 | |

| Other long-term liabilities | | 1,083 | | | 1,366 | |

| Total operating lease liabilities | | $ | 1,633 | | | $ | 1,903 | |