We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Share Name | Share Symbol | Market | Type |

|---|---|---|---|

| Ascent Solar Technologies Inc | NASDAQ:ASTI | NASDAQ | Common Stock |

| Price Change | % Change | Share Price | Bid Price | Offer Price | High Price | Low Price | Open Price | Shares Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0.00 | 0.00% | 2.59 | 2.36 | 3.37 | 0 | 09:00:00 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

ASCENT SOLAR TECHNOLOGIES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: | |

| 2) | Aggregate number of securities to which transaction applies: | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4) | Proposed maximum aggregate value of transaction: | |

| 5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: | |

| 2) | Form, Schedule or Registration Statement No.: | |

| 3) | Filing Party: | |

| 4) | Date Filed: |

June [***], 2024

Dear Stockholder:

You are cordially invited to attend the 2024 Annual Meeting of Stockholders of Ascent Solar Technologies, Inc. to be held on August [***], 2024 (“Annual Meeting”). The meeting will be held at the corporate office of Ascent Solar Technologies, Inc., 12300 Grant Street, Thornton, CO 80241, beginning at 10:00 a.m. Mountain Time. At this year’s Annual Meeting, our stockholders will be asked (i) to elect one Class C director to our board of directors; (ii) to ratify the selection of Haynie & Company as our independent registered public accounting firm for the fiscal year ending December 31, 2024; (iii) to approve an amendment to our 2023 Equity Incentive Plan to increase the number of shares of common stock subject to the plan; (iv) to grant discretionary authority to our board of directors to amend our certificate of incorporation to combine outstanding shares of our common stock into a lesser number of outstanding shares, or a “reverse stock split”; (v) to conduct an advisory vote on the compensation of our executive officers; and (vi) to transact such other business as may properly come before the meeting or any adjournment or postponement of the meeting. Additional information about the Annual Meeting is given in the attached Notice of 2024 Annual Meeting of Stockholders and Proxy Statement.

In accordance with rules adopted by the Securities and Exchange Commission, we are pleased to again furnish these proxy materials to stockholders primarily over the Internet, rather than in paper form. We believe these rules allow us to provide our stockholders with expedited and convenient access to the information they need, while helping to conserve natural resources and lower the costs of printing and delivering proxy materials.

Whether or not you plan to attend the Annual Meeting, we hope you will vote as soon as possible. Voting your proxy will ensure your representation at the Annual Meeting. If you attend the Annual Meeting in person, you may vote your shares in person even though you have previously given your proxy.

By Order of the Board of Directors

Very truly yours,

Ascent Solar Technologies, Inc.

By: /s/ Paul Warley

Title: Director, President and CEO

Dated: June [***], 2024

ASCENT SOLAR TECHNOLOGIES, INC.

12300 Grant Street

Thornton, Colorado 80241

(720) 872-5000

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

August [***], 2024

at 10:00 a.m. Mountain Time

TO OUR STOCKHOLDERS:

NOTICE IS HEREBY GIVEN that the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Ascent Solar Technologies, Inc., a Delaware corporation (the “Company”), will be held on August [***], 2024, at 10:00 a.m. Mountain Time at the corporate office of Ascent Solar Technologies, Inc., 12300 Grant Street, Thornton, CO 80241, for the following purposes, as more fully described in the Proxy Statement accompanying this notice:

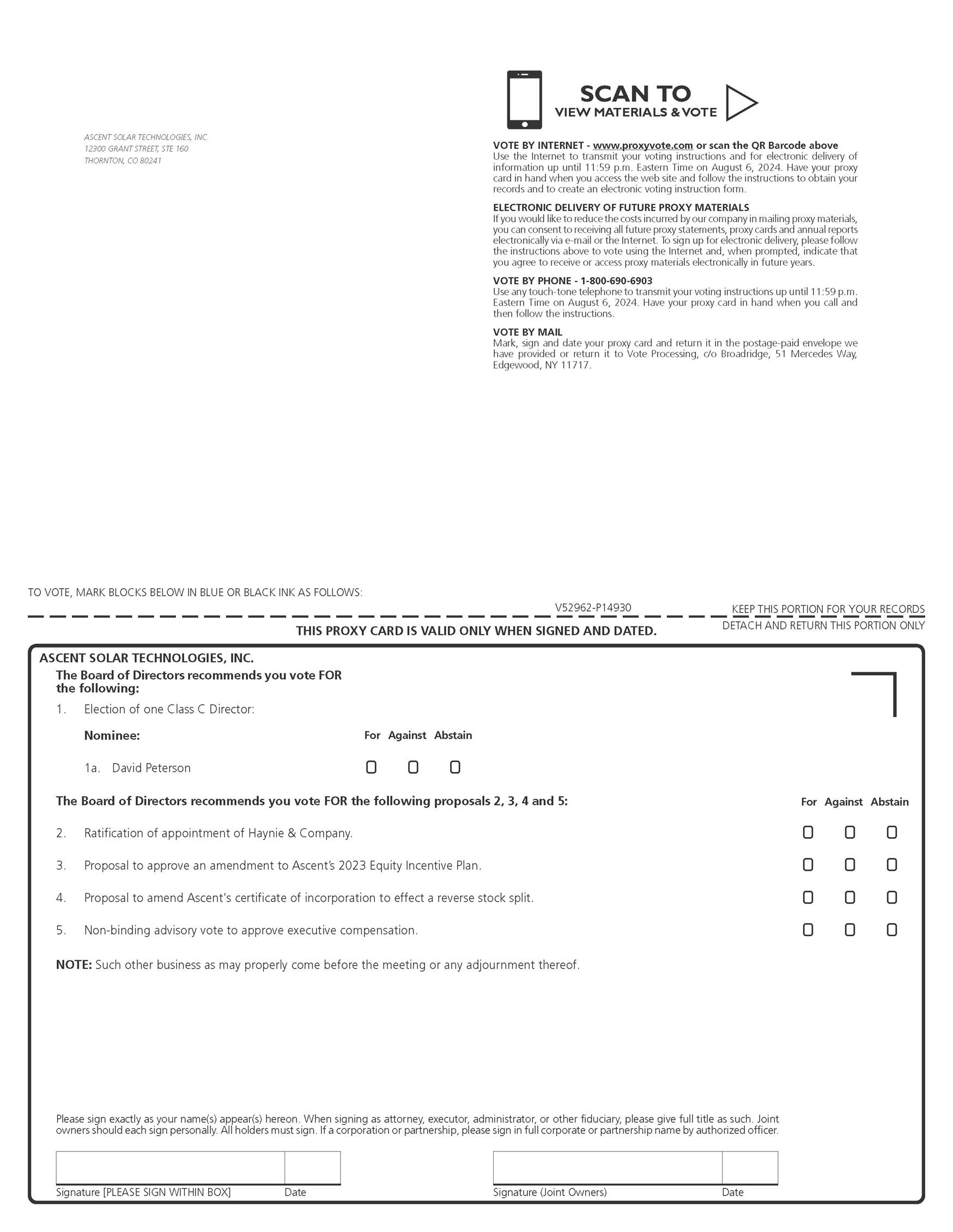

| 1. | ELECTION OF DIRECTORS. To elect: one (1) Class C director to serve until the 2027 annual meeting of stockholders, and until his or her successor has been elected and qualified. | |

| 2. | RATIFICATION OF AUDITORS. To ratify the Audit Committee’s appointment of Haynie and Company as our independent registered public accounting firm for the year ending December 31, 2024. | |

| 3. | AMENDMENT OF THE 2023 ASCENT SOLAR TECHNOLOGIES, INC. EQUITY INCENTIVE PLAN. To approve an amendment of the 2023 Ascent Solar Technologies, Inc. Equity Incentive Plan to increase the number of shares of common stock subject to the plan. | |

| 4. | REVERSE STOCK SPLIT. To grant discretionary authority to our board of directors to (i) amend our certificate of incorporation to combine outstanding shares of our common stock into a lesser number of outstanding shares, or a “reverse stock split,” at a specific ratio within a range of one-for-eight (1-for-8) to a maximum of a one-for-one hundred (1-for-100) split, with the exact ratio to be determined by our board of directors in its sole discretion; (ii) effect the reverse stock split, if at all, within one year of the date the proposal is approved by stockholders. | |

| 5. | NON-BINDING ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION. To approve a non-binding resolution on the Company's compensation of its executive officers. | |

| 6. | ANY OTHER BUSINESS. To conduct any other business that may properly come before the Annual Meeting or any adjournments or postponements thereof. | |

Stockholders who owned shares of (i) our common stock or (ii) our shares of Series Z preferred stock at the close of business on June [***], 2024 are entitled to receive notice of, attend and vote at the Annual Meeting and any adjournment or postponement thereof. A complete list of these stockholders will be available at our corporate offices listed above during regular business hours for the ten days prior to the Annual Meeting.

Your vote is important. Whether or not you plan to attend the Annual Meeting, please vote as soon as possible. If you received notice of how to access the proxy materials over the Internet, a proxy card was not sent to you, but you may vote by telephone or online. If you received a proxy card and other proxy materials by mail, you may vote by mailing a completed proxy card, by telephone or online. For specific voting instructions, please refer to the information provided in the following Proxy Statement, together with your proxy card or the voting instructions you receive by e-mail or that are provided via the Internet.

The Board of Directors recommends stockholders vote FOR the proposals listed above and described in the accompanying Proxy Statement.

By Order of the Board of Directors

Paul Warley

President and Chief Executive Officer

Thornton, Colorado

June [***], 2024

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on August [***], 2024 — The Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 are available at www.ascentsolar.com.

ASCENT SOLAR TECHNOLOGIES, INC.

12300 Grant Street

Thornton, Colorado 80241

(720) 872-5000

___________________

PROXY STATEMENT

___________________

Your proxy is being solicited by the Board of Directors (the “Board”) of Ascent Solar Technologies, Inc., a Delaware corporation, for use at the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at 10:00 a.m. Mountain Time on August [***], 2024, or at any adjournment or postponement thereof, for the purposes set forth in this Proxy Statement. The Annual Meeting will be held at the corporate office of Ascent Solar Technologies, Inc., 12300 Grant Street, Thornton, CO 80241.

These proxy materials are first being provided on or about June [***], 2024 to all common stockholders and to all Series Z preferred stockholders of the record date, June [***], 2024. Stockholders who owned our common stock or our Series Z preferred stock at the close of business on June [***], 2024 are entitled to receive notice of, attend and vote at the Annual Meeting. On the record date, there were (i) [***] shares of our common stock outstanding and (ii) one share of Series Z preferred stock outstanding.

This Proxy Statement is being furnished to you with a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “Annual Report”), which was filed with the Securities and Exchange Commission (the “SEC”) on February 21, 2024. We will provide, without charge, additional copies of our Annual Report upon request. Any exhibits listed in the Annual Report also will be furnished upon request at the actual expense we incur in furnishing such exhibit to you. Any such requests should be directed to our Corporate Secretary at our executive offices set forth above.

References to the “Company,” “Ascent Solar,” “our,” “us” or “we” mean Ascent Solar Technologies, Inc.

| 1 |

TABLE OF CONTENTS

| 2 |

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON AUGUST [***], 2024

GENERAL

Ascent Solar Technologies, Inc. (the “Company”) has made these proxy materials available to you on the internet, or, upon your request, has delivered printed proxy materials to you, in connection with the solicitation of proxies by the Board of Directors of the Company (the “Board”) for use at the Annual Meeting to be held at 10:00 a.m. Mountain Time on August [***], 2024, or at any adjournment or postponement thereof, for the purposes set forth in this Proxy Statement. The Annual Meeting will be held at the Company, 12300 Grant Street, Thornton, CO 80241.

What is a proxy?

A proxy is a person or persons whom you designate to vote your stock. If you designate someone as your proxy in a written document, that document is called a proxy card.

Who pays for the proxy solicitation?

The Company will pay the expenses of the preparation of proxy materials and the solicitation of proxies for the annual meeting. Certain of our directors, officers or employees may solicit your proxy and they will receive no additional compensation for such solicitation. We will reimburse brokers and other nominees for costs incurred by them in mailing proxy materials to beneficial owners in accordance with applicable rules.

What is the purpose of the annual meeting?

As a stockholder of the Company, you have a right to vote on certain business matters affecting us. The proposals that will be presented at the Annual Meeting, and upon which you are being asked to vote, are discussed below. Each share of our common stock you owned as of the record date entitles you to one vote on each proposal presented at the Annual Meeting.

What is the record date and what does it mean?

The Board of Directors The board of directors has fixed the close of business on June [***], 2024 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof.

How many shares are entitled to vote at the Annual Meeting?

There were [***] shares of our common stock outstanding on June [***], 2024, all of which are entitled to vote with respect to all matters to be acted upon at the Annual Meeting. Each stockholder of record as of the record date is entitled to one vote for each share of our common stock held by such stockholder.

The holder of record of the one outstanding share of the Company’s Series Z preferred stock will be entitled to 180,000,000 votes for each share of the Company’s Series Z preferred stock held on the record date, and has the right to vote only on the Reverse Stock Split Proposal, provided that such votes must be counted in the same proportion as the shares of common stock voted on such proposal (excluding any shares of common stock that are not voted). As an example, if 30,000,000 shares of common stock are voted FOR Proposal 4 and 20,000,000 shares of common stock are voted AGAINST Proposal 4, then (i) 60% (108,000,000 votes) of the votes cast by the holder of the Series Z preferred stock will be cast as votes FOR Proposal 4 and (ii) 40% (72,000,000 votes) of the votes cast by the holder of the Series Z preferred stock will be cast as votes AGAINST Proposal 4. Holders of common stock and Series Z preferred stock will vote together on Proposal 4 as a single class.

What constitutes a quorum?

The presence, in person or by proxy, of the holders of a majority of the outstanding shares entitled to vote constitutes a quorum for the transaction of business at the meeting. In the event there are not sufficient votes for a quorum, or to approve or ratify any matter being presented at the time of the Annual Meeting, the Annual Meeting may be adjourned in order to permit further solicitation of proxies.

How do I vote?

If you are a record owner of our common stock, you may vote over the Internet, by telephone, by mail or in person at the Annual Meeting. More specifically:

| · | You can vote via the Internet. The website address for Internet voting and the instructions for voting are provided on your Notice or proxy card. You will need to use the control number appearing on your Notice or proxy card to vote via the Internet. If you vote via the Internet you do not need to vote by telephone or return a proxy card. |

| · | You can vote by telephone by calling the toll-free telephone number provided on your proxy card. You will need to use the control number appearing on your Notice or proxy card to vote by telephone. If you vote by telephone you do not need to vote over the Internet or return a proxy card. |

| 3 |

| · | If you received a printed proxy card, you can vote by marking, dating and signing it, and returning it in the postage-paid envelope provided. You may also download the form of proxy card off the Internet and mail it to us. Please promptly mail your proxy card to ensure that it is received prior to the closing of the polls at the Annual Meeting. |

| · | If you attend the Annual Meeting and plan to vote in person, we will provide you with a ballot at the Annual Meeting. If your shares are registered directly in your name, you are considered the stockholder of record, and you have the right to vote in person at the Annual Meeting. If your shares are held in the name of your broker or other nominee, you are considered the beneficial owner of shares held in street name. As a beneficial owner, if you wish to vote at the Annual Meeting, you will need to bring to the Annual Meeting a legal proxy from your broker or other nominee authorizing you to vote those shares. |

How do I vote if my shares are in “street name”?

If you hold shares in “street name” (that is, through a bank, broker, or other nominee), your shares must be voted in accordance with instructions provided by the nominee. If your shares are held in the name of a nominee and you would like to attend the annual meeting and vote in person, you may contact the person in whose name your shares are registered and obtain a proxy from that person and bring it to the annual meeting.

How do I know if I hold my shares in “street name”?

If your shares are held in a brokerage account or by a bank or other nominee, you are considered the beneficial owner of those shares, and your shares are considered held in “street name.” However, if your shares are registered directly in your name with Computershare, our transfer agent, you are considered the record owner of those shares.

Will my proxy appointment on the internet be secure and accurate?

Proxies, ballots and voting tabulations are handled on a confidential basis to protect your voting privacy. This information will not be disclosed, except as required by law.

What is the deadline for submitting my proxy?

Proxy appointments must be received by 11:59 p.m., Mountain Time, on August [***], 2023. You will still have the right to vote in person at the meeting even if you submit your proxy via the internet or by telephone.

Can I revoke my proxy?

Yes. You may revoke your proxy at any time before it is voted at the Annual Meeting. To do this, you must:

| · | enter a new vote over the Internet or by telephone, or by signing and returning a replacement proxy card; |

| · | provide written notice by August [***], 2023 of the revocation to our Corporate Secretary at our principal executive offices, which are located at 12300 Grant Street Ste 160, Thornton, Colorado 80241; or |

| · | attend the Annual Meeting and vote in person. |

Where can I find voting results of the Annual Meeting?

Voting results will be announced at the Annual Meeting and published in a Form 8-K to be filed within four (4) business days after the Annual Meeting.

How are the votes counted and what vote is needed to approve each of the proposals?

Assuming that a quorum is present:

| · | the affirmative vote of a majority of the shares having voting power present in person or by proxy will be required to elect one Class C director (Proposal No. 1); |

| · | the affirmative vote of a majority of the shares having voting power present in person or by proxy will be required to ratify the appointment of Haynie & Company as our independent registered public accounting firm for the year ending December 31, 2024 (Proposal No. 2); |

| · | the affirmative vote of a majority of the shares having voting power present in person or by proxy will be required to approve the amendment to the 2023 Ascent Solar Technologies, Inc. Equity Incentive Plan (Proposal No. 3); |

| · | the reverse stock split proposal requires the affirmative vote of a majority of the voting power of the outstanding common stock and the outstanding Series Z preferred stock voting together as a single class (Proposal No. 4); |

| · | the affirmative vote of a majority of the shares having voting power present in person or by proxy will be required to approve, on an advisory basis, the compensation of the Company’s executive officers (Proposal No. 5); |

| · | unless otherwise required by our Second Amended and Restated Bylaws (the “Bylaws”) or by applicable law, the affirmative vote of a majority of the shares present having voting power in person or by proxy will be required to approve any other matter properly presented for a vote at the meeting; provided that if any stockholders are entitled to vote thereon as a class, such approval will require the affirmative vote of a majority of the shares entitled to vote as a class who are present in person or by proxy. |

| 4 |

The vote on Proposal No. 5 (advisory vote on executive compensation) is a non-binding advisory vote. The Board will consider our executive officer compensation to have been approved by stockholders if Proposal No. 5 receives more votes “For” than “Against.”

Votes cast by proxy or in person at the meeting will be tabulated by the election inspectors appointed for the meeting. Such inspectors will also determine whether a quorum is present. The election inspectors will treat abstentions as shares that are present and entitled to vote for purposes of determining the presence of a quorum, but as unvoted for purposes of determining the approval of any matter submitted to the stockholders for a vote. If your shares are held in street name and you do not instruct your broker on how to vote your shares, your brokerage firm, in its discretion, may either leave your shares unvoted or vote your shares on routine matters.

The Company believes that the election of one Class C director (Proposal No. 1), the approval of the amendment to the 2023 Ascent Solar Technologies, Inc. Equity Incentive Plan (Proposal No. 3), and the advisory vote to approve executive compensation (Proposal No. 5) are considered non-routine matters. Consequently, without your voting instructions, your brokerage firm cannot vote your shares on these proposals. These unvoted shares, called “broker non-votes,” refer to shares held by brokers who have not received voting instructions from their clients and who do not have discretionary authority to vote on non-routine matters.

The Company believes that the proposal to ratify the appointment of Haynie & Company as our independent registered public accounting firm for the current fiscal year (Proposal No. 2) and the reverse stock split proposal (Proposal No. 4) are considered routine matters. To the extent your brokerage firm votes your shares on your behalf on these proposals, your shares also will be counted as present for the purpose of determining a quorum.

Abstentions shall have the same effect as a vote against Proposal No. 1 (election of one Class C director); No. 2 (approval of auditors), No. 3 (approval of the amendment to the Equity Incentive Plan), No. 4 (reverse stock split), and No. 5 (advisory vote on executive compensation).

Broker non-votes shall have no effect on the outcome of Proposal No. 1 (election of directors), No. 3 (approval of the amendment to the Equity Incentive Plan), and No. 5 (advisory vote on executive compensation).

How does the Board recommend I vote?

The Board recommends a vote “FOR” electing the nominee for Class C director (Proposal No, 1); “FOR” the appointment of Haynie & Company as our independent registered public accounting firm for the year ending December 31, 2024 (Proposal No. 2); “FOR” the approval of the amendment to the 2023 Company Equity Incentive Plan (Proposal No. 3); “FOR” the approval of the reserve stock split (Proposal No. 4); and “FOR” the approval of the compensation of our named executive officers as disclosed in this proxy statement (Proposal No. 5).

What if I return a proxy card but do not make specific choices?

When a proxy is properly executed and returned, the shares it represents will be voted at the Annual Meeting as directed. If no specification is indicated, the shares will be voted:

| (1) | “FOR” the election of the Class C director nominee set forth in this Proxy Statement; | |

| (2) |

“FOR” the ratification of the appointment of Haynie & Company as our independent registered public accounting firm for the year ending December 31, 2024; | |

| (3) | “FOR” the approval of the amendment to the 2023 Ascent Solar Technologies, Inc. Equity Incentive Plan; | |

| (4) | “FOR” the approval of a reverse stock split; | |

| (5) | “FOR” the approval, on an advisory basis, of the compensation of our executive officers; and | |

| (6) | at the discretion of your proxies on any other matter that may be properly brought before the Annual Meeting. |

If your shares are held in street name and you do not instruct your broker on how to vote your shares, your brokerage firm, in its discretion, may either leave your shares unvoted or vote your shares on routine matters, which includes the ratification of our independent registered public accounting firm and the approval of the reverse stock split proposal.

| 5 |

What is “Householding” of Proxy Materials?

In a further effort to reduce printing costs and postage fees, we have adopted a practice approved by the SEC called “householding.” Under this practice, stockholders who have the same address and last name and do not participate in electronic delivery of proxy materials will receive only one copy of our proxy materials, unless one or more of these stockholders notifies us that he or she wishes to continue receiving individual copies.

If: (1) you share an address with another stockholder and received only one set of proxy materials, and would like to request a separate paper copy of these materials; or (2) you share an address with another stockholder and in the future together you would like to receive only a single paper copy of these materials, please notify our Corporate Secretary by mail at 12300 Grant Street, Ste 160, Thornton, Colorado 80241.

| 6 |

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

Our Bylaws provide that the size of our Board of Directors is to be determined from time to time by resolution of the Board of Directors, but shall consist of at least two and no more than nine members. Our Board of Directors currently consists of five members. The Board has determined that the following directors are “independent” as required by our corporate governance guidelines: Mr. Peterson, Mr. Reynolds, Mr. Berezovsky, and Mr. Thompson.

Our Certificate of Incorporation provides that the Board of Directors will be divided into three classes and, except as described below, are elected to serve three-year terms and in each case until their respective successors are duly elected and qualified.

Our Board currently consists of five members. The terms of our current Class A directors (Forrest Reynolds and Louis Berezovsky) will expire at our 2026 annual stockholder meeting. The terms of our current Class B directors (Gregory Thompson and Paul Warley) will expire at the 2025 annual stockholder meeting. The term of our current Class C director (David Peterson) will expire at the 2024 annual stockholder meeting.

The Board has nominated David Peterson as a Class C director to serve a three-year term expiring in 2027. Mr. Peterson is currently a director of the Company and has indicated a willingness to continue to serve as a director, if elected. If a nominee becomes unable or unwilling to serve, however, the proxies may be voted for a substitute nominee selected by our Board.

Set forth below is certain information regarding the director nominee, our continuing directors, and the executive officers of the Company who are not directors, including the terms of office of the Board members.

The following table sets forth certain information with respect to our current directors, based upon information furnished by each director, as of June [***], 2024:

| Name | Age | Position | Term Expires | |||||||

| David Peterson | 54 | Director (Class C), Chairman of the Board | 2024 | |||||||

| Gregory Thompson | 68 | Director (Class B) | 2025 | |||||||

| Paul Warley | 62 | Director (Class B) | 2025 | |||||||

| Louis Berezovsky | 58 | Director (Class A) | 2026 | |||||||

| Forrest Reynolds | 53 | Director (Class A) | 2026 |

The nominee for election as a Class C director for a term to expire in 2027 is:

David Peterson. Mr. Peterson has served on our Board since December 2020, and has been Chairman of the Board since September 2022. Mr. Peterson has over 25 years of business management experience, including 9 years as a private equity investor, 6 years as a manager at an engineering consulting firm, and over 20 years of board experience. From April 2015 to present, Mr. Peterson has worked for EPD Consultants, Inc., a privately held engineering firm headquartered in Carson, California, where he serves as Senior Project Manager. From 2010 to 2015, Mr. Peterson was President and Co-Founder of Great Circle Industries, Inc., a water recycling company in southern California. His past experience includes being a board member at AIR-serv, LLC, a tire inflation vending machine manufacturer, where Mr. Peterson managed the acquisition process, including obtaining expansion of the company's credit facility, as that company completed 10 acquisitions and grew from $10 million of EBITDA to $20 million of EBITDA in the year prior to its sale for $151 million to WindPoint Partners. Mr. Peterson has an MBA degree from the Marshall School of Business at the University of Southern California, and a B.A. from the University of California, Santa Cruz. Mr. Peterson and Michael Gilbreth, our former CFO, are cousins. We believe Mr. Peterson is well-qualified to serve as a director due to his extensive management and board experience.

The continuing Class B directors with terms expiring in 2025 are:

Gregory Thompson. Mr. Thompson has served on the Board since April 2023. He is a four-time public company CFO with extensive global experience across several industries including technology, manufacturing, chemicals, building products, medical equipment, software and services, and public accounting. From December 2016 through June 2021, Mr. Thompson was EVP and CFO of KEMET Corporation (NYSE: KEM), a manufacturer of a broad selection of capacitor technologies, and a variety of other passive electronic components. In June 2020, KEMET was acquired by Yageo Corporation for approximately $1.8 billion. From 2008 to 2016, Mr. Thompson was EVP and CFO of Axiall Corporation (NYSE: AXLL), a manufacturer and marketer of chlorovinyls and aromatics (acetone, cumene, phenol). Axiall was sold to Westlake Chemical Corporation in late 2016. Prior to Axiall, Mr. Thompson was CFO of medical equipment manufacturer Invacare Corporation (NYSE: IVC) from 2002 to 2008, CFO of Sensormatic Electronics Corporation from 2000 to 2002, and Corporate Controller of Sensormatic from 1997 to 2000. Previously at Wang Laboratories, Inc. Mr. Thompson served as Vice President and Corporate Controller from 1994 to 1997 and Assistant controller from 1990 to 1994. He began his career at Price Waterhouse and Coopers & Lybrand where he spent 13 years serving international clients in industries including chemicals, construction, distribution, manufacturing, metals, retail, and technology.

Mr. Thompson earned a Bachelor of Science, Accounting from Virginia Tech in 1977. He is a Certified Public Accountant, and a Member of the American Institute of Certified Public Accountants. We believe Mr. Thompson is well-qualified to serve as a director due to his knowledge and business experience.

| 7 |

Paul Warley. Mr. Warley has been President and Chief Executive Officer of Ascent Solar Technologies Inc. since May 2023 and was elected to our Board in December 2023. Prior to then, Mr. Warley served as our Chief Financial Officer from December 2022 to May 2023. Mr. Warley has significant experience in corporate turnarounds, restructuring, cross-border trade and capital advisory work. From 2015 to 2022, Mr. Warley was president of Warley & Company LLC, a strategic advisory firm providing executive management, capital advisory and M&A services to middle-market companies in the service, construction, technology, oil & gas, clean energy, food, retail and green-building sectors. While at Warley & Company, from 2018 to 2019 Mr. Warley was engaged as Chief Executive Officer and CFO of 360Imaging, a provider of products and services for implant surgery and digital dentistry. From 2011 to 2015, Mr. Warley served clients in the alternative energy industry as a managing director and additionally was Chief Compliance Officer with Deloitte Corporate Finance. From 1997 to 2011, Mr. Warley was Managing Director and Region Manager for GE Capital. From 1984 to 1997, Mr. Warley was with Bank of America and Bankers Trust as a Senior Vice President. Mr. Warley holds the Financial Industry Regulatory Authority Series 7, 24 and 63 licenses. He earned his B.S. degree in Business Administration from The Citadel (The Military College of South Carolina) and served in the U.S. Army, attaining the rank of Captain. While at Warley & Company LLC, Mr. Warley provided corporate finance consulting services to BD1 Investment Holding LLC, one of the Company’s largest stockholder. We believe Mr. Warley is well-qualified to serve as our CEO and as a Director due to his business experience.

The continuing Class A directors with terms expiring in 2026 are:

Forrest Reynolds. Mr. Reynolds has served on our Board since September 2022. He has over 28 years of business and management experience and is currently the Managing Partner of CalTex Capital, LLC, a privately held investment firm, as well as a Managing Director of The Vortex Group Family Office, LLC, a private family office, both of which are based in Texas. Previously, Mr. Reynolds served as the Chief Restructuring Officer for Centaur Gaming, LLC, a gaming development company located in Indianapolis, Indiana. In this capacity, Mr. Reynolds managed a $1.0 billion Chapter 11 bankruptcy reorganization for the company. Prior to that, Mr. Reynolds worked in the investment banking industry for over 14 years holding various positions with several multinational investment banks including Credit Suisse, BT Alex Brown (later Deutsche Bank) and UBS. Mr. Reynolds sits on the board of several private companies and is actively involved with several charitable organizations. Mr. Reynolds graduated from The University of Texas at Austin where he received a B.B.A. in Finance and a B.A. in Economics. We believe Mr. Reynolds is well-qualified to serve as a director due to his knowledge and business experience.

Louis Berezovsky. Mr. Berezovsky has served on our Board since September 2022. He joined Eagle Infrastructure Services in July 2013 and leads the Finance and Accounting, M&A, Human Resources, Legal and IT functions. He has more than 30 years of experience in senior financial management positions across a variety of industries including 25 years of working in private equity sponsored portfolio companies. His accomplishments include the completion more than 60 acquisitions as well as multiple recapitalizations and successful sale processes. Prior to joining Eagle, Mr. Berezovsky previously served as Executive Vice President and Chief Financial Officer of ABRA Auto Body and Glass, Chief Financial Officer of ConvergeOne, and Chief Financial Officer of AIR-serv.

After receiving his B.S. in Accounting from the University of Minnesota, Carlson School of Management, he began his career at a Minneapolis based CPA firm. He is a Certified Management Accountant (CMA). He has also served as a member of the Board of Directors and as the Chairman of the Finance Committee for the Better Business Bureau of Minnesota and North Dakota since 2012. We believe Mr. Berezovsky is well-qualified to serve as a director due to his knowledge and business experience.

Vote Required and Board of Director’s Recommendation

To be elected, the director nominated via Proposal No. 1 must receive the affirmative vote of a majority of shares with voting power present in person or by proxy at the Annual Meeting. If your shares are held in “street name” by a broker, bank or other nominee, your broker, bank or other nominee does not have authority to vote your unvoted shares held by the firm for the election of directors. As a result, any shares not voted by you will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote.

The Board of Directors recommends voting “FOR” Proposal No. 1 to elect David Peterson as a Class C director.

Board Diversity

The following chart summarizes certain self-identified personal characteristics of our directors in accordance with Nasdaq Listing Rule 5605(f). Each term used in the table has the meaning given to it in the rule and related instructions:

| Total Number of Directors: 5 | ||||||||||||||||

| Female | Male | Non-Binary | Did Not Disclose Gender | |||||||||||||

| Directors’ Gender: | — | 5 | — | — | ||||||||||||

| Number of Directors who identify in any of the categories below: | ||||||||||||||||

| African American or Black | — | — | — | — | ||||||||||||

| Alaskan Native | — | — | — | — | ||||||||||||

| Asian | — | — | — | — | ||||||||||||

| Hispanic | — | — | — | — | ||||||||||||

| Native Hawaiian or Pacific Islander | — | — | — | — | ||||||||||||

| White | — | 5 | — | — | ||||||||||||

| Two or More Races or Ethnicities | — | — | — | — | ||||||||||||

| LGBTQ+ | — | — | — | — | ||||||||||||

| Did Not Disclose Demographic Background | — | — | — | — | ||||||||||||

| 8 |

Under Nasdaq listing rule 5605(f), the Company is required to (i) have at least one diverse director or (ii) explain why it does not have at least one diverse director on its board. The Company does not currently have at least one diverse director on the board at this time.

The Company’s financial resources and liquidity at present are very limited. Because of these limitations, our board has determined not to expand the number of directors on our board at this time. The Company intends to expand the board to include one or more additional diverse members once the Company’s resources and liquidity position improves.

Executive Officers

The following table sets forth certain information with respect to the executive officers of Ascent, as of June [***], 2024, based upon information furnished by each officer:

| Name | Age | Position | ||

| Paul Warley | 62 | President and Chief Executive Officer | ||

| Jin Jo | 46 | Chief Financial Officer | ||

| Bobby Gulati | 59 | Chief Operating Officer |

Paul Warley. Mr. Warley's biographical information is included above under Proposal No. 1 – Election of Directors.

Jin Jo. Ms. Jo has been Chief Financial Officer of the Company since May 2023. Ms. Jo joined the Company in June 2021 as Financial Controller. Ms. Jo has over 20 years in accounting. From 2015 to 2021, Ms. Jo was the head of technical accounting of Empower Retirement, a financial services company, where her primary focus was accounting research for complex new products, investments and transactions, and new accounting standards implementation on International Financial Reporting Standards, US GAAP and insurance Statutory Accounting Principles. From 2011 to 2015, Ms. Jo was an Inspection Specialist at the Public Company Accounting Oversight Board where she assessed auditor compliance with audit professional standards. Ms. Jo started her career in public accounting, spending 11years in the audit and assurance practice serving both public and private companies.

Ms. Jo is a certified public accountant in the state of Colorado and earned her B.S. degree in Business Administration from the University of Colorado, Boulder. We believe Ms. Jo is well-qualified to serve as our CFO due to her business experience.

Bobby Gulati. Mr. Gulati has been Chief Operating Officer since May 2023. He has over 30 years of executive leadership experience in engineering and manufacturing roles. Mr. Gulati joined Ascent in February 2012 as Head Equipment Engineer. In March 2014, he was promoted to Director of Equipment Engineering with emphasis on International Business Development. In 2020, Mr. Gulati was promoted to Chief Information Officer.

From 2010 to 2012 Mr. Gulati was the Director of Equipment Engineering for Twin Creeks Technologies, an amorphous silicon solar manufacturing company, and was responsible for the operations of the 5MW solar cell manufacturing facility in Senatobia, Mississippi. From 2001 to 2010, Mr. Gulati was the co-founder and President of TriStar Systems, a manufacturer of automated manufacturing and assembly equipment for the solar, aerospace and disk drive industries. From 1992 to 2000, Mr. Gulati was the co-founder and Chief Operating Officer of the publicly traded company NexStar Automation, whose focus was designing and building automated production equipment for the semiconductor and medical disposable industries. Mr. Gulati earned his B.S. degree in Electrical Engineering with a minor in Computer Science and Robotics from the University of Colorado, Denver.

| 9 |

PROPOSAL NO. 2 – RATIFICATION OF APPOINTMENT OF HAYNIE & COMPANY

Overview

The Audit Committee has engaged the registered public accounting firm of Haynie & Company as our independent registered public accounting firm to audit our financial statements for the year ending December 31, 2024. Ascent’s stockholders are being asked to ratify this appointment. Haynie & Company has served as Ascent’s independent registered public accounting firm since 2017.

The Audit Committee is solely responsible for selecting Ascent’s independent registered public accounting firm for the fiscal year ending December 31, 2024. Stockholder approval is not required to appoint Haynie & Company as our independent registered public accounting firm. However, the Board believes that submitting the appointment of Haynie & Company to the stockholders for ratification is good corporate governance. If the stockholders do not ratify this appointment, the Audit Committee will reconsider whether to retain Haynie & Company. If the selection of Haynie & Company is ratified, the Audit Committee, at its discretion, may direct the appointment of a different independent registered public accounting firm at any time it decides that such a change would be in the best interest of Ascent and its stockholders.

Representatives of Haynie & Company are expected to be present at the Annual Meeting, will have the opportunity to make a statement if they desire to do so, and are expected to be available to respond to appropriate questions.

Independent Registered Public Accounting Firm Fees

Fees for audit and related services by our accounting firm, Haynie & Company, for the years ended December 31, 2023 and 2022 were as follows:

| 2023 | 2022 | |||||||

| Audit fees | $ | 160,500 | $ | 155,500 | ||||

| Audit related fees | 25,000 | 40,500 | ||||||

| Total audit and audit related fees | 185,500 | 196,000 | ||||||

| Tax fees | — | — | ||||||

| All other fees | — | — | ||||||

| Total Fees | $ | 185,500 | $ | 196,000 | ||||

Audit fees for Haynie & Company for fiscal year 2023 and 2022 represent aggregate fees during the audit of the financial statements and interim reviews of the quarterly financial statements. Audit related fees include consents and comfort letters.

Audit Committee Pre-Approval Policies and Procedures

The Audit Committee charter provides that the Audit Committee will pre-approve all audit services and non-audit services to be provided by our independent auditors before the accountant is engaged to render these services. The Audit Committee may consult with management in the decision making process, but may not delegate this authority to management. The Audit Committee may delegate its authority to pre-approve services to one or more committee members, provided that the designees present the pre-approvals to the full committee at the next committee meeting. All audit and non-audit services performed by our independent accountants have been pre-approved by our Audit Committee to assure that such services do not impair the auditors’ independence from us.

Vote Required and Board Recommendation

The affirmative vote of a majority of the shares with voting power present in person or by proxy will be required to ratify the appointment of Haynie & Company as our independent registered public accounting firm to audit our financial statements for the year ending December 31, 2024.

The Board recommends that stockholders vote “FOR” Proposal No. 2 to ratify the appointment of Haynie & Company as our independent registered public accounting firm to audit our financial statements for the year ending December 31, 2024.

| 10 |

PROPOSAL 3– APPROVAL OF AMENDMENT TO ASCENT’S 2023 EQUITY INCENTIVE PLAN

Overview

Our stockholders are asked to approve an amendment to the Company’s 2023 Equity Incentive Plan (the “2023 Incentive Plan”) to increase the number of shares of common stock subject to the 2023 Incentive Plan from 525,000 to 15,525,000. The 2023 Incentive Plan was originally adopted by our Board on October 6, 2023 and approved by the Company’s stockholders on December 5, 2023 at the 2023 annual stockholders’ meeting.

As of the record date, there were outstanding options to purchase an aggregate of [***] shares of common stock were outstanding, outstanding and unvested restricted stock units of [***] shares, and [***] shares remaining available for grants of future awards under the 2023 Incentive Plan.

On May 23, 2024, the Board approved an amendment to the 2023 Incentive Plan, subject to stockholder approval, to increase the number of shares reserved for issuance by 15,00,000, thereby increasing the total number of shares issuable under the 2023 Incentive Plan from 525,000 to 15,525,000. Subject to stockholder approval, the Company plans to register the additional 15,000,000 shares reserved under the 2023 Incentive Plan on a Registration Statement on Form S-8.

The following description of the 2023 Incentive Plan is a summary of its key provisions and is qualified by reference to the complete text of our 2023 Incentive Plan. A copy of the 2023 Incentive Plan is attached to this proxy statement as Annex A.

If the stockholders approve the 2023 Incentive Plan, it will become effective on the day of the Annual Meeting.

General Description of the 2023 Incentive Plan

The material terms of the 2023 Incentive Plan are summarized below. The following summary is qualified in its entirety by reference to the complete text of the 2023 Incentive Plan, a copy of which has been filed as Annex A to this proxy statement.

Administration of the plan

Our Board has appointed the Compensation Committee of our Board of Directors as the committee under the 2023 Incentive Plan with the authority to administer the 2023 Incentive Plan. We refer to our Board or Compensation Committee, as applicable, as the “Administrator.” The Administrator is authorized to grant awards to eligible employees, consultants and non-employee directors.

Number of authorized shares and award limits

The aggregate number of our shares of common stock that may be issued or used for reference purposes under the 2023 Incentive Plan is currently 525,000 shares (subject to adjustment as described below). Under the proposed amendment, this aggregate number of shares will be increased to 15,525,000.

Our shares of common stock that are subject to awards will be counted against the overall limit as one share for every share granted or covered by an award. If any award is cancelled, expires, terminates, or remains unexercised for any reason, the shares covered by such award will again be available for the grant of awards under the 2023 Incentive Plan, except that any shares that are not issued as the result of a net exercise or settlement or that are used to pay any exercise price or tax withholding obligation will not be available for the grant of awards. Shares of common stock that we repurchase on the open market with the proceeds of an option exercise price also will not be available for the grant of awards. Awards that may be settled solely in cash will not be deemed to use any shares.

The aggregate number of our shares of common stock that may be issued or used for reference purposes under the 2023 Incentive Plan will automatically increase on January 1st of each year starting on January 1, 2025, and ending on (and including) January 1, 2033, in an amount equal to 5% of the total number of shares outstanding on December 31st of the preceding calendar year. Notwithstanding the foregoing, the Board may act prior to January 1st of a given year to provide that there will be no January 1st increase in the share reserve for such year or that the increase in the share reserve for such year will be a lesser number of shares than would otherwise occur pursuant to the preceding sentence.

The maximum number of our shares of common stock that may be subject to any award of stock options, any restricted stock or other stock-based award denominated in shares that may be granted under the 2023 Incentive Plan during any fiscal year to each employee or consultant is currently 250,000 shares per type of award; provided that the maximum number of our shares of common stock for all types of awards during any fiscal year is currently 250,000 shares per each employee, consultant or director. The maximum number of our shares of common stock that may be granted pursuant to awards under the 2023 Incentive Plan during any fiscal year to any non-employee director is currently 250,000 shares. In addition, the maximum grant date value of any other stock-based awards denominated in cash and the maximum payment under any performance-based cash award granted under the 2023 Incentive Plan payable with respect to any fiscal year to an employee or consultant is $750,000.

Under the proposed amendment, the above-referenced 250,000 annual share limits will be increased to 3,500,000 shares per fiscal year.

The foregoing individual participant limits are cumulative; that is, to the extent that shares of common stock that may be granted to an individual in a fiscal year are not granted, the number of shares of common stock that may be granted to such individual is increased in the subsequent fiscal years during the term of the 2023 Incentive Plan until used. In addition, the foregoing limits (other than the limit on the maximum number of our shares of common stock for all types of awards during any fiscal year) will not apply (i) to options, restricted stock or other stock-based awards that constitute “restricted property” under Section 83 of the Code to the extent granted during the reliance period (as described below), or (ii) to performance-based cash awards or other types of other stock-based awards to the extent paid or otherwise settled during the reliance period.

| 11 |

The Administrator will, in accordance with the terms of the 2023 Incentive Plan, make appropriate adjustments to the above aggregate and individual limits (other than cash limitations), to the number and/or kind of shares or other property (including cash) underlying awards and to the purchase price of shares underlying awards, in each case, to reflect any change in our capital structure or business by reason of any stock split, reverse stock split (including the proposed Reverse Stock Split described herein as Proposal No. 4), stock dividend, combination or reclassification of shares, any recapitalization, merger, consolidation, spin off, split off, reorganization or any partial or complete liquidation, any sale or transfer of all or part of our assets or business, or any other corporate transaction or event that would be considered an “equity restructuring” within the meaning of FASB ASC Topic 718. In addition, the Administrator may take similar action with respect to other extraordinary events.

Eligibility and participation

All of our current and prospective employees and consultants, as well as our non-employee directors, are eligible to be granted non-qualified stock options, restricted stock, performance-based cash awards and other stock-based awards under the 2023 Incentive Plan. Only our and our subsidiaries’ employees are eligible to be granted incentive stock options (“ISOs”) under the 2023 Incentive Plan. Eligibility for awards under the 2023 Incentive Plan is determined by the Administrator in its discretion. In addition, each member of our Board who is not an employee of the company or any of our affiliates is expected to be eligible to receive awards under the 2023 Incentive Plan.

Types of awards

Stock options. The 2023 Incentive Plan authorizes the Administrator to grant ISOs to eligible employees and non-qualified stock options to purchase shares to employees, consultants, prospective employees, prospective consultants and non-employee directors. The Administrator will determine the number of shares of common stock subject to each option, the term of each option, the exercise price (which may not be less than the fair market value of the shares of common stock at the time of grant, or 110% of fair market value in the case of ISOs granted to 10% stockholders), the vesting schedule and the other terms and conditions of each option. Options will be exercisable at such times and subject to such terms as are determined by the Administrator at the time of grant. The maximum term of options under the 2023 Incentive Plan is ten years (or five years in the case of ISOs granted to 10% stockholders). Upon the exercise of an option, the participant must make payment of the full exercise price, either in cash or by check, bank draft or money order; solely to the extent permitted by law and authorized by the Administrator, through the delivery of irrevocable instructions to a broker, reasonably acceptable to us, to promptly deliver to us an amount equal to the aggregate exercise price; or on such other terms and conditions as may be acceptable to the Administrator (including, without limitation, the relinquishment of options or by payment in full or in part in the form of shares of common stock).

Restricted stock. The 2023 Incentive Plan authorizes the Administrator to grant restricted stock. Recipients of restricted stock enter into an agreement with us subjecting the restricted stock to transfer and other restrictions and providing the criteria or dates on which such awards vest and such restrictions lapse. The restrictions on restricted stock may lapse and the awards may vest over time, based on performance criteria or other factors (including, without limitation, performance goals that are intended to comply with the performance-based compensation exception under Section 162(m), as discussed below), as determined by the Administrator at the time of grant. Except as otherwise determined by the Administrator, a holder of restricted stock has all of the attendant rights of a stockholder including the right to receive dividends, if any, subject to and conditioned upon vesting and restrictions lapsing on the underlying restricted stock, the right to vote shares and, subject to and conditioned upon the vesting and restrictions lapsing for the underlying shares, the right to tender such shares. However, the Administrator may in its discretion provide at the time of grant that the right to receive dividends on restricted stock will not be subject to the vesting or lapsing of the restrictions on the restricted stock.

Other stock-based awards. The 2023 Incentive Plan authorizes the Administrator to grant awards of shares of common stock and other awards that are valued in whole or in part by reference to, or are payable in or otherwise based on, shares of common stock, including, but not limited to, shares of common stock awarded purely as a bonus and not subject to any restrictions or conditions; shares of common stock in payment of the amounts due under an incentive or performance plan sponsored or maintained by us or an affiliate; stock appreciation rights; stock equivalent units; restricted stock units; performance awards entitling participants to receive a number of shares of common stock (or cash in an equivalent value) or a fixed dollar amount, payable in cash, stock or a combination of both, with respect to a designated performance period; or awards valued by reference to book value of our shares of common stock. In general, other stock-based awards that are denominated in shares of common stock will include the right to receive dividends, if any, subject to and conditioned upon vesting and restrictions lapsing on the underlying award, but the Administrator may in its discretion provide at the time of grant that the right to receive dividends on a stock-denominated award will not be subject to the vesting or lapsing of the restrictions on the performance award.

Performance-based cash awards. The 2023 Incentive Plan authorizes the Administrator to grant cash awards that are payable or otherwise based on the attainment of pre-established performance goals during a performance period. As noted above, following the Reliance Period, performance-based cash awards granted under the 2023 Incentive Plan that are intended to satisfy the performance-based compensation exception under Code Section 162(m) will vest based on attainment of specified performance goals established by the Administrator. These performance goals will be based on the attainment of a certain target level of, or a specified increase in (or decrease where noted), criteria selected by the Administrator.

| 12 |

Such performance goals may be based upon the attainment of specified levels of company, affiliate, subsidiary, division, other operational unit, business segment or administrative department performance relative to the performance of other companies. The Administrator may designate additional business criteria on which the performance goals may be based or adjust, modify or amend those criteria, to the extent permitted by Section 162(m). Unless the Administrator determines otherwise, to the extent permitted by Section 162(m), the Administrator will disregard and exclude the impact of special, unusual or non-recurring items, events, occurrences or circumstances; discontinued operations or the disposal of a business; the operations of any business that we acquire during the fiscal year or other applicable performance period; or a change in accounting standards required by generally accepted accounting principles or changes in applicable law or regulations.

Effect of certain transactions; Change in control

In the event of a change in control, as defined in the 2023 Incentive Plan, except as otherwise provided by the Administrator, unvested awards will not vest. Instead, the Administrator may, in its sole discretion provide that outstanding awards will be: assumed and continued; purchased based on the price per share paid in the change in control transaction (less, in the case of options and stock appreciation rights (“SARs”), the exercise price), as adjusted by the Administrator for any contingent purchase price, escrow obligations, indemnification obligations or other adjustments to the purchase price; and/or in the case of stock options or other stock-based appreciation awards where the change in control price is less than the applicable exercise price, cancelled. However, the Administrator may in its sole discretion provide for the acceleration of vesting and lapse of restrictions of an award at any time including in connection with a change in control.

Non-transferability of awards

Except as the Administrator may permit, at the time of grant or thereafter, awards granted under the 2023 Incentive Plan are generally not transferable by a participant other than by will or the laws of descent and distribution. Shares of common stock acquired by a permissible transferee will continue to be subject to the terms of the 2023 Incentive Plan and the applicable award agreement.

Term

Awards under the 2023 Incentive Plan may not be made after January 1, 2034, but awards granted prior to such date may extend beyond that date. We may seek stockholder reapproval of the performance goals in the 2023 Incentive Plan. If such stockholder approval is obtained, on or after the first stockholders’ meeting in the fifth year following the year of the last stockholder approval of the performance goals in the 2023 Incentive Plan, awards under the 2023 Incentive Plan may be based on such performance goals in order to qualify for the “performance-based compensation” exception under Section 162(m).

Amendment and termination

Subject to the rules referred to in the balance of this paragraph, our Board or the Administrator (to the extent permitted by law) may at any time amend, in whole or in part, any or all of the provisions of the 2023 Incentive Plan, or suspend or terminate it entirely, retroactively or otherwise. Except as required to comply with applicable law, no such amendment, suspension or termination may reduce the rights of a participant with respect to awards previously granted without the consent of such participant. In addition, without the approval of stockholders, no amendment may be made that would: increase the aggregate number of shares of common stock that may be issued under the 2023 Incentive Plan; increase the maximum individual participant share limitations for a fiscal year or year of a performance period; change the classification of individuals eligible to receive awards under the 2023 Incentive Plan; extend the maximum term of any option; reduce the exercise price of any option or SAR or cancel any outstanding “in-the-money” option or SAR in exchange for cash; substitute any option or SAR in exchange for an option or SAR (or similar other award) with a lower exercise price; alter the performance goals; or require stockholder approval in order for the 2023 Incentive Plan to continue to comply with Section 162(m) or Section 422 of the Code.

Federal income tax implications of the 2023 Incentive Plan

The federal income tax consequences arising with respect to awards granted under the 2023 Incentive Plan will depend on the type of award. From the recipients’ standpoint, as a general rule, ordinary income will be recognized at the time of payment of cash, or delivery of actual shares. Future appreciation on shares held beyond the ordinary income recognition event will be taxable at capital gains rates when the shares are sold. We, as a general rule, will be entitled to a tax deduction that corresponds in time and amount to the ordinary income recognized by the recipient, and we will not be entitled to any tax deduction in respect of capital gain income recognized by the recipient. Exceptions to these general rules may arise under the following circumstances: (i) if shares, when delivered, are subject to a substantial risk of forfeiture by reason of failure to satisfy any employment or performance-related condition, ordinary income taxation and our tax deduction will be delayed until the risk of forfeiture lapses (unless the recipient makes a special election to ignore the risk of forfeiture); (ii) if an employee is granted an ISO, no ordinary income will be recognized, and we will not be entitled to any tax deduction, if shares acquired upon exercise of the ISO are held longer than the later of one year from the date of exercise and two years from the date of grant; (iii) for awards granted after the reliance period, we may not be entitled to a tax deduction for compensation attributable to awards granted to one of our Named Executive Officers (other than our Chief Financial Officer), if and to the extent such compensation does not qualify as “performance-based” compensation under Section 162(m), and such compensation, along with any other non-performance-based compensation paid in the same calendar year, exceeds $1 million; and (iv) an award may be taxable at 20% above ordinary income tax rates at the time it becomes vested, even if that is prior to the delivery of the cash or stock in settlement of the award, if the award constitutes “deferred compensation” under Section 409A of the Code, and the requirements of Section 409A of the Code are not satisfied. The foregoing provides only a general description of the application of federal income tax laws to certain awards under the Incentive Plans, and is not intended as tax guidance to participants in the Incentive Plans, as the tax consequences may vary with the types of awards made, the identity of the recipients and the method of payment or settlement. This summary does not address the effects of other federal taxes (including possible “golden parachute” excise taxes) or taxes imposed under state, local, or foreign tax laws.

New 2023 Incentive Plan Benefits

The number of awards that will be received by or allocated to the Company’s executive officers, directors, employees, and consultants under the 2023 Incentive Plan if the amendment is approved by stockholders is undeterminable because the awards under the 2023 Incentive Plan are discretionary.

| 13 |

Vote Required and Board’s Recommendation

The affirmative vote of a majority of the shares of common stock present in person, or represented by proxy, and entitled to vote at the Annual Meeting is required to ratify the 2023 Incentive Plan. Abstentions will be treated as shares present and entitled to vote and will therefore have the same effect as a vote against this proposal.

If your shares are held in “street name” by a broker, bank or other nominee, your broker, bank or other nominee does not have authority to vote your unvoted shares held by the firm on this proposal. As a result, any shares not voted by you will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of the vote on Proposal No. 3.

The board of directors recommends voting “FOR” Proposal No. 3 to approve the 2023 Ascent Solar Technologies, Inc. Equity Incentive Plan.

| 14 |

PROPOSAL 4 – APPROVAL OF REVERSE STOCK SPLIT

Description of the Reverse Stock Split

Our Board of directors has approved an amendment to our Certificate of Incorporation, as amended, to combine the outstanding shares of our common stock into a lesser number of outstanding shares (a “Reverse Stock Split”). If approved by the stockholders as proposed, the Board would have the sole discretion to effect the Reverse Stock Split, if at all, within one (1) year of the date the proposal is approved by stockholders and to fix the specific ratio for the combination within a range of one-for-eight (1-for-8) to a maximum of a one-for-one hundred (1-for-100) split. The Board has the discretion to abandon the amendment and not implement the Reverse Stock Split.

If approved by our stockholders, this proposal would permit (but not require) the Board of directors to effect a Reverse Stock Split of the outstanding shares of our common stock within one (1) year of the date the proposal is approved by stockholders, at a specific ratio within a range of one-for-eight (1-for-8) to a maximum of a one-for-one hundred (1-for-100) split, with the specific ratio to be fixed within this range by the Board in its sole discretion without further stockholder approval. We believe that enabling the Board to fix the specific ratio of the Reverse Stock Split within the stated range will provide us with the flexibility to implement it in a manner designed to maximize the anticipated benefits for our stockholders.

The form of the proposed amendment to our Certificate of Incorporation is attached hereto as Annex B.

As a result of the Reverse Stock Split, a certain number of outstanding shares of Common Stock, as determined by the applicable ratio, would be combined into one share of Common Stock, which is expected to result in a corresponding increase in the per share market price of our Common Stock.

The Reverse Stock Split is not intended as, and will not have the effect of, a “going private transaction” covered by Rule 13e-3 promulgated under the Exchange Act. The Reverse Stock Split is not intended to modify the rights of existing stockholders in any material respect.

The Board has the sole discretion to implement the Reverse Stock Split within a range of between 1-for-8 and 1-for-100. The Board believes that approval of a range of ratios (as opposed to approval of a specified ratio) provides the Board with maximum flexibility to achieve the purposes of the Reverse Stock Split and, therefore, is in the best interests of the Company and its stockholders.

The actual timing for implementation of the Reverse Stock Split, if approved by the stockholders, will be determined by the Board based upon its evaluation as to when such action would be most advantageous to the Company and its stockholders, but in no event would be later than the one year anniversary of the date of the stockholders’ approval. Notwithstanding the approval of the Reverse Stock Split by the stockholders, the Board will have the sole authority to elect whether or not and when to amend our Certificate of Incorporation to effect the Reverse Stock Split. Following stockholder approval, the Board will make a determination as to whether effecting the Reverse Stock Split is in the best interests of the Company and our stockholders in light of, among other things, the ability to maintain the current listing of the Company’s Common Stock on Nasdaq without effecting the Reverse Stock Split, the per share price of the Common Stock immediately prior to the Reverse Stock Split, and the expected stability of the per share price of the Common Stock following the Reverse Stock Split.

The Reverse Stock Split will become effective, if at all, on the date of filing of the Amendment to our Certificate of Incorporation effecting the Reverse Stock Split with the Secretary of State of the State of Delaware. After the Reverse Stock Split becomes effective, our Common Stock will have a new CUSIP number, which is a number used to identify our equity securities.

No fractional shares will be issued in the Reverse Stock Split. If the Reverse Stock Split is effected, each fractional share of Common Stock will be rounded up to the nearest whole share of Common Stock. Accordingly, our stockholders who otherwise would be entitled to receive a fractional share of Common Stock in the Reverse Stock Split because they hold a number of shares not evenly divisible by the Reverse Stock Split ratio will instead automatically be entitled to receive one whole additional share of our Common Stock.

Reasons for the Reverse Stock Split

The Company’s primary reason for approving and recommending the Reverse Stock Split is to make our Common Stock more attractive to certain institutional investors, which would provide for a stronger investor base, and to increase the per share price and bid price of our Common Stock to regain compliance with the continued listing requirements of Nasdaq.

On December 11, 2023, the Company received a written notice from the Listing Qualifications Department of The Nasdaq Stock Market (“Nasdaq”) indicating that the Company is not in compliance with the $1.00 minimum bid price requirement set forth in Nasdaq Listing Rule 5550(a)(2) for continued listing on The Nasdaq Capital Market (the “Minimum Bid Price Requirement”). In accordance with Nasdaq Listing Rule 5810(c)(3)(A), we were provided 180 days to regain compliance with the Minimum Bid Price Requirement.

| 15 |

Separately, on March 5, 2024, the Company received notice from Nasdaq stating that the Company was not in compliance with Nasdaq Listing Rule 5550(b)(1), which requires companies listed on Nasdaq to maintain a minimum of $2,500,000 in stockholders’ equity for continued listing the “Equity Requirement”). As a result, the Nasdaq staff determined to delist the Company’s Common Stock from Nasdaq, unless the Company timely requests an appeal of the staff’s determination to a Hearings Panel (the “Panel”), pursuant to the procedures set forth in the Nasdaq Listing Rule 5800 Series. The Company requested a hearing before the Panel. Such hearing was held on May 9, 2024.

On June 5, 2024, the Company received the decision of the Panel. The Panel granted the Company’s request for continued listing on Nasdaq subject to the following conditions: (i) the Company files a quarterly report on Form 10-Q on or before August 19, 2024 demonstrating compliance with the Equity Requirement, and (ii) the Company demonstrates compliance with the Minimum Bid Price Requirement on or before August 22, 2024.

We believe that our ability to effect the Reverse Stock Split will assist us in being able to comply with the Minimum Bid Price Requirement by the August 22, 2024 deadline contained in the Panel’s decision.

Reducing the number of outstanding shares of Common Stock should, absent other factors, generally increase the per share market price of the Common Stock. Although the intent of the Reverse Stock Split is to increase the price of the Common Stock, there can be no assurance, however, that even if the Reverse Stock Split is implemented, that the Company’s bid price of the Company’s Common Stock will be sufficient, over time, for the Company to regain or maintain compliance with the Nasdaq Minimum Bid Price Requirement.

In addition, the Company believes the Reverse Stock Split will make its Common Stock more attractive to a broader range of investors, as it believes that the current market price of the Common Stock may prevent certain institutional investors, professional investors and other members of the investing public from purchasing stock. Many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. Furthermore, some of those policies and practices may function to make the processing of trades in low-priced stocks economically unattractive to brokers. Moreover, because brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher-priced stocks, the current average price per share of Common Stock can result in individual stockholders paying transaction costs representing a higher percentage of their total share value than would be the case if the share price were higher. The Company believes that the Reverse Stock Split will make our Common Stock a more attractive and cost effective investment for many investors, which in turn would enhance the liquidity of the holders of our Common Stock.

Reducing the number of outstanding shares of our Common Stock through the Reverse Stock Split is intended, absent other factors, to increase the per share market price of our Common Stock. However, other factors, such as our financial results, market conditions and the market perception of our business may adversely affect the market price of our Common Stock. As a result, there can be no assurance that the Reverse Stock Split, if implemented, will result in the intended benefits described above, that the market price of our Common Stock will increase following the Reverse Stock Split, that as a result of the Reverse Stock Split we will be able to meet or maintain a bid price over the minimum bid price requirement of Nasdaq or that the market price of our Common Stock will not decrease in the future. Additionally, we cannot assure you that the market price per share of our Common Stock after the Reverse Stock Split will increase in proportion to the reduction in the number of shares of our Common Stock outstanding before the Reverse Stock Split. Accordingly, the total market capitalization of our Common Stock after the Reverse Stock Split may be lower than the total market capitalization before the Reverse Stock Split.

The proposal to effectuate the Reverse Stock Split did not result from our knowledge of any specific effort to accumulate our securities or to obtain control of us by means of a merger, tender offer, proxy solicitation in opposition to management or otherwise.

Determination of Reverse Stock Split Ratio

The ratio of the Reverse Stock Split Ratio, if approved and implemented, will be a ratio between 1-for-8 and 1-for-100, as determined by the Board in its sole discretion. Our Board believes that stockholder approval of a range of potential ratios for the Reverse Stock Split, rather than a single ratio for the Reverse Stock Split, is in the best interests of our stockholders because it provides the Board with the flexibility to achieve the desired results of the Reverse Stock Split and because it is difficult to predict market conditions at the time the Reverse Stock Split would be implemented.

The selection of the specific Reverse Stock Split ratio will be based on several factors, including, among other things:

| • | the per share price of our Common Stock immediately prior to the Reverse Stock Split; |

| • | the expected stability of the per share price of our Common Stock following the Reverse Stock Split; |

| • | our ability to meet the listing requirements of listing our Common Stock on Nasdaq without effecting the Reverse Stock Split; |

| • | the likelihood that the Reverse Stock Split will result in increased marketability and liquidity of our Common Stock; |

| • | prevailing market conditions; |

| • | general economic conditions in our industry; and |

| • | our expected market capitalization before and after the Reverse Stock Split. |

| 16 |

Our Board will not carry out the Reverse Stock Split if it determines that the Reverse Stock Split would not be in the best interests of our stockholders at that time. If our Board chooses to implement the Reverse Stock Split, the Company will make a public announcement regarding the determination of the Reverse Stock Split ratio.

Potential Effects of Reverse Stock Split

The Reverse Stock Split will not affect any stockholder's percentage ownership interest in our Company, except to the extent that the Reverse Stock Split would result in any stockholder receiving an additional share of Common Stock as a result of rounding up a fractional Common Stock in the Reverse Stock Split. In addition, the Reverse Stock Split will not affect any stockholder's proportionate voting power (other than as a result of the treatment of fractional shares in the Reverse Stock Split).

The Reverse Stock Split is not intended to modify the rights of existing stockholders in any material respect. After the Reverse Stock Split, the shares of our Common Stock will have the same voting rights and rights to dividends and distributions and will be identical in all other respects to our Common Stock now authorized. Our Common Stock will remain fully paid and non-assessable, and, immediately following the Reverse Stock Split, our Common Stock will continue to be quoted on Nasdaq under the symbol “ASTI.”