We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Share Name | Share Symbol | Market | Type |

|---|---|---|---|

| Aemetis Inc | NASDAQ:AMTX | NASDAQ | Common Stock |

| Price Change | % Change | Share Price | Bid Price | Offer Price | High Price | Low Price | Open Price | Shares Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|---|---|

| -0.06 | -1.47% | 4.03 | 4.00 | 4.13 | 4.179 | 4.005 | 4.14 | 797,351 | 00:00:29 |

|

|

|

|

|

State or other jurisdiction of incorporation

|

Commission File Number

|

IRS Employer Identification Number

|

|

|

|

|

| Title of class of registered securities | Trading Symbol | Name of exchange on which registered |

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (240.12b-2 of this chapter)

|

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

|

February 20, 2024

|

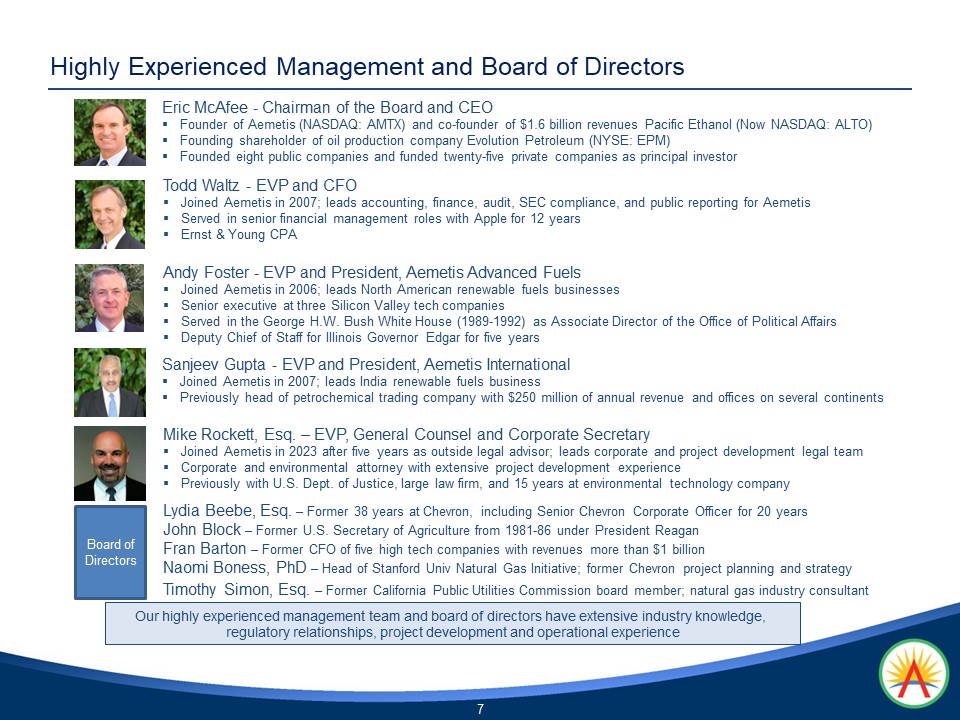

/s/ Eric A. McAfee

|

|

Eric A. McAfee

|

|

|

Chair and Chief Executive Officer

|

|

|

|

External Investor Relations Contact:

Kirin Smith

PCG Advisory Group

(646) 863-6519

ksmith@pcgadvisory.com

Company Investor Relations/Media Contact:

Todd Waltz

(408) 213-0940

investors@aemetis.com

Aemetis Announces Updated Five Year Plan Projecting Growth to $1.95 Billion of Revenue and $645 Million of Adjusted EBITDA in 2028

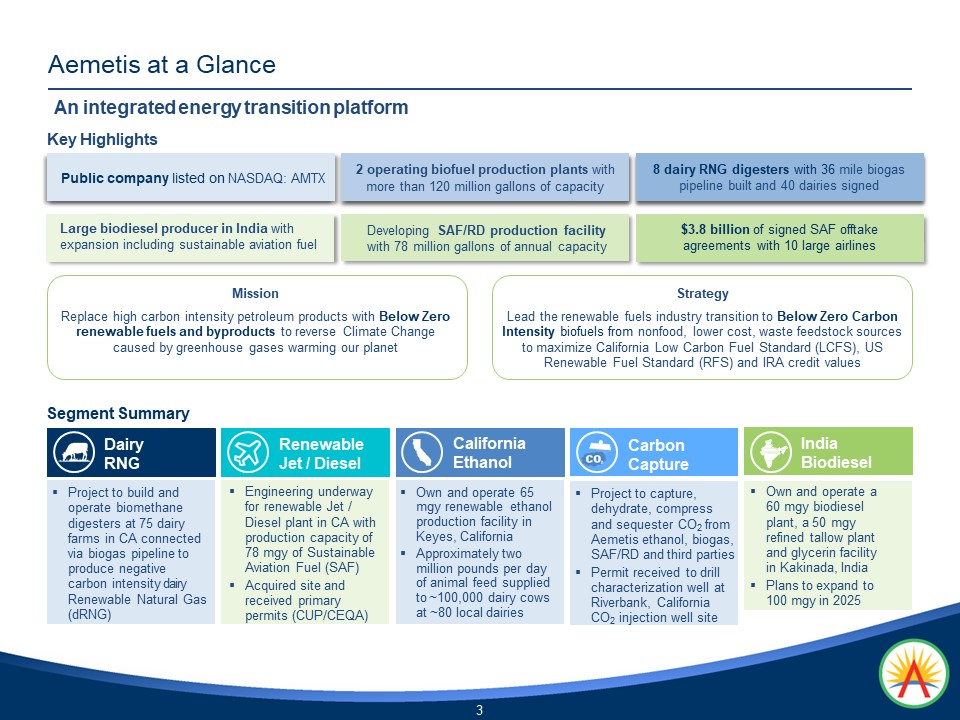

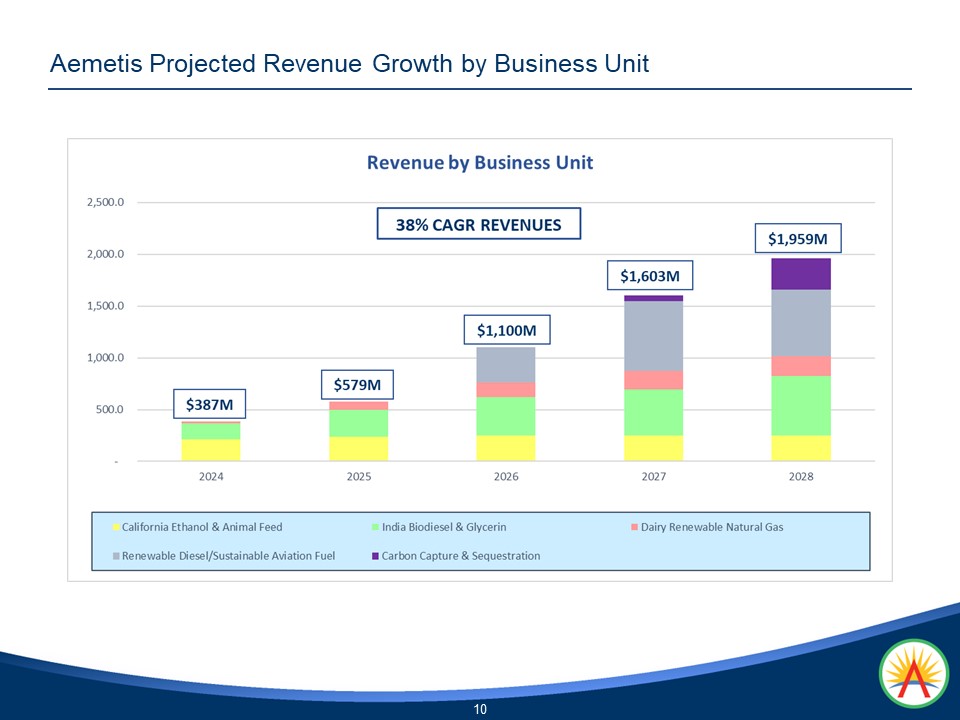

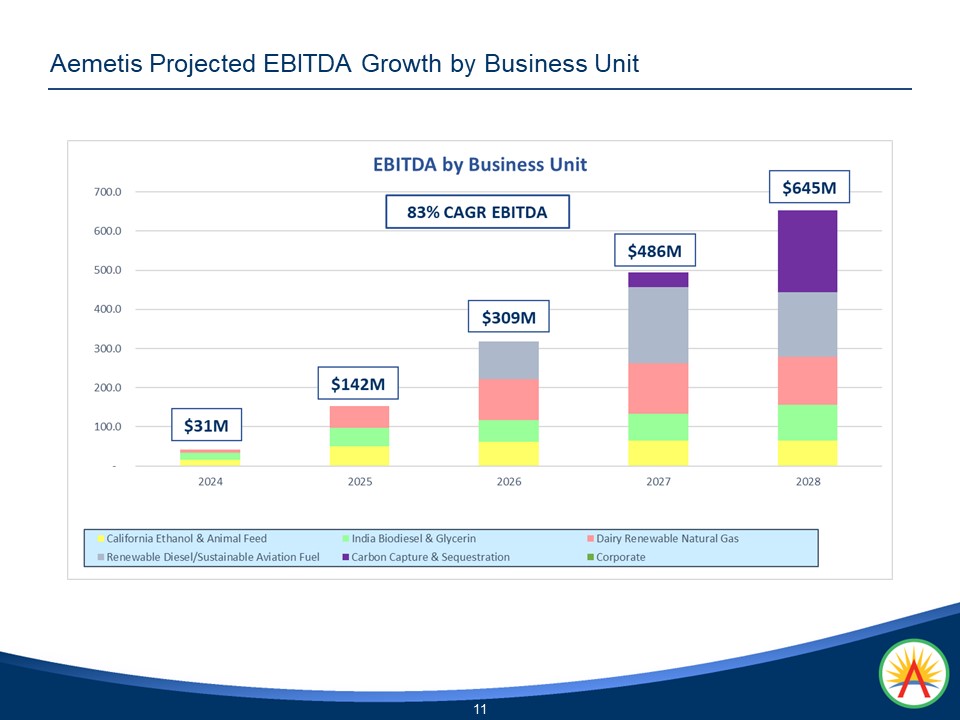

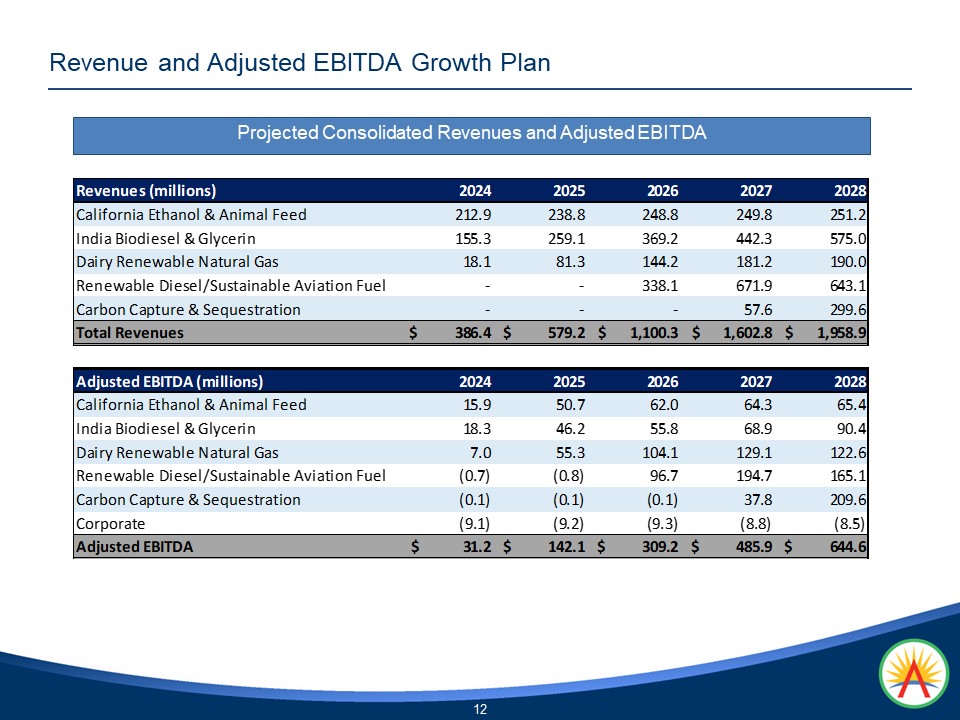

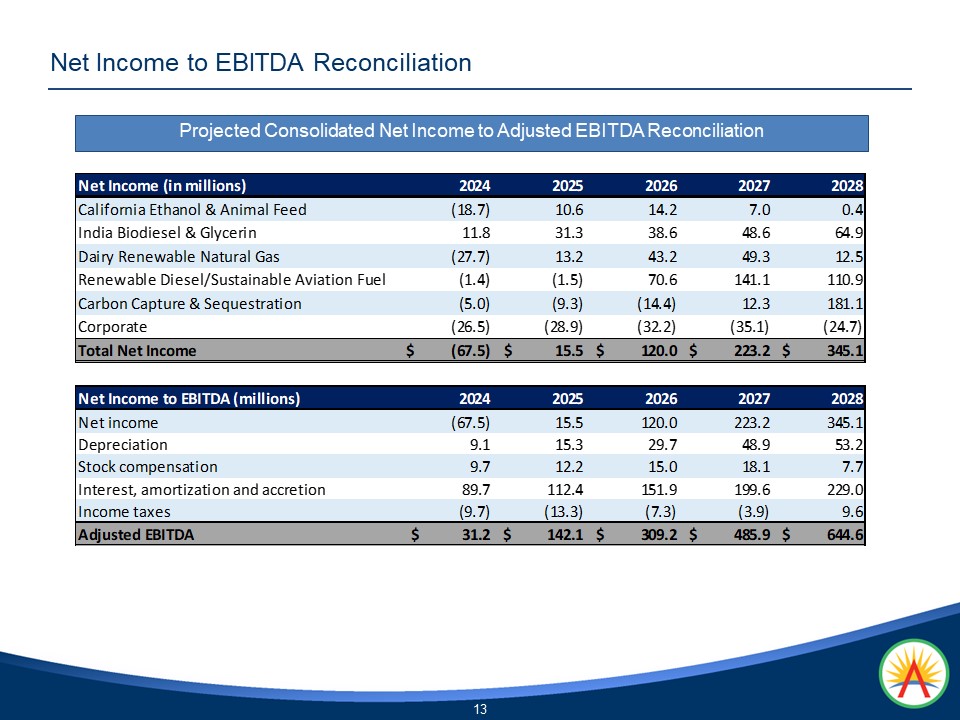

CUPERTINO, CA – February 20, 2024 – Aemetis, Inc. (NASDAQ: AMTX), a renewable natural gas and renewable fuels company focused on negative carbon intensity products, today announced an updated Aemetis Five Year Plan (the “2024 Plan”) that projects the company will generate $1.95 billion in revenues and $645 million of adjusted EBITDA in year 2028.

The 2024 Plan states revenues are expected to grow at a compound annual growth rate of 38%, and adjusted EBITDA is expected to grow at a projected compound annual growth rate of 83% for the years 2024 to 2028.

A presentation summarizing the updated Five Year Plan is available for review on the Aemetis website at www.aemetis.com/Five-Year-Plan.

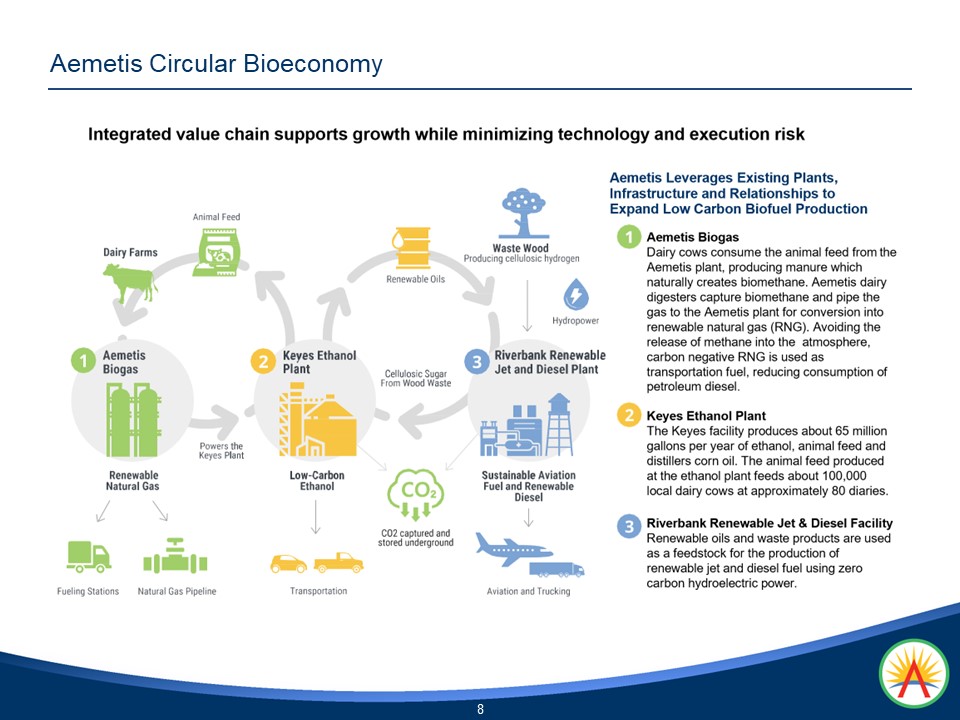

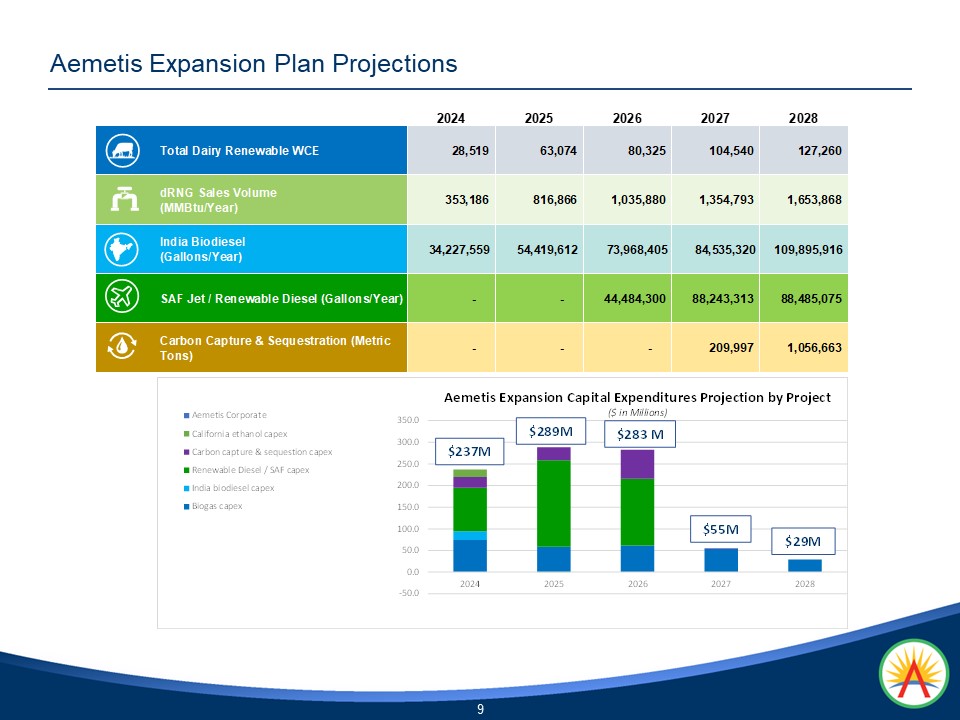

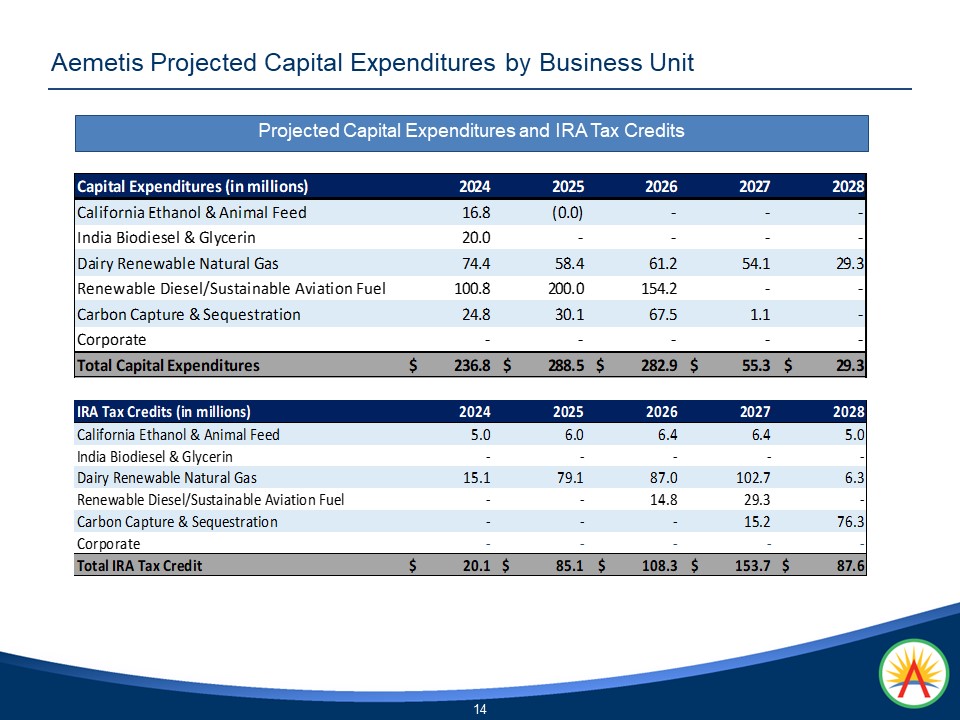

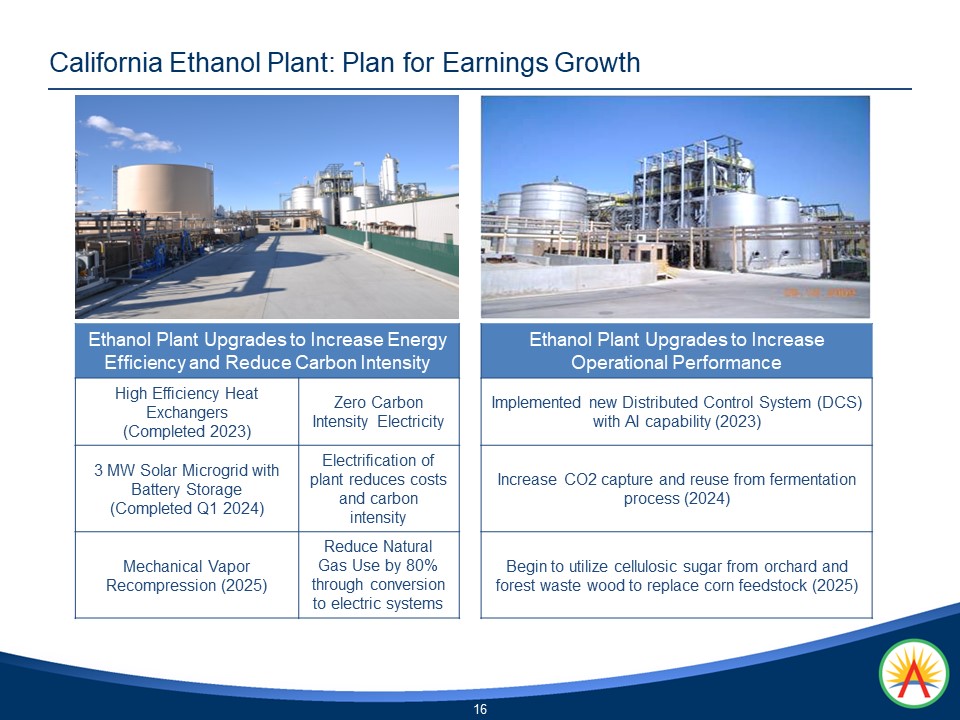

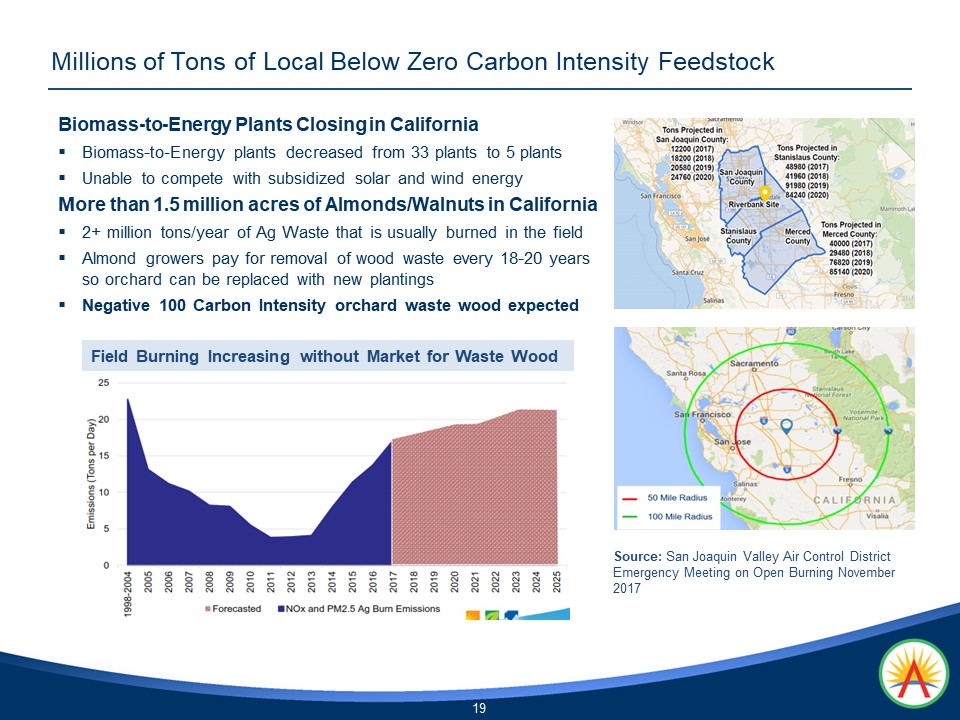

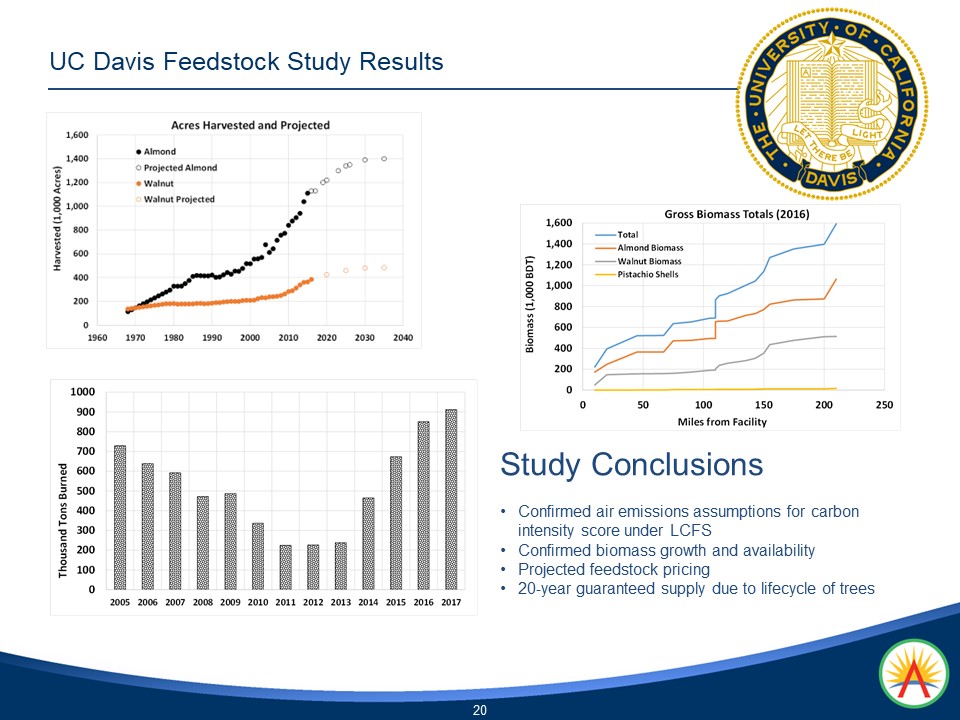

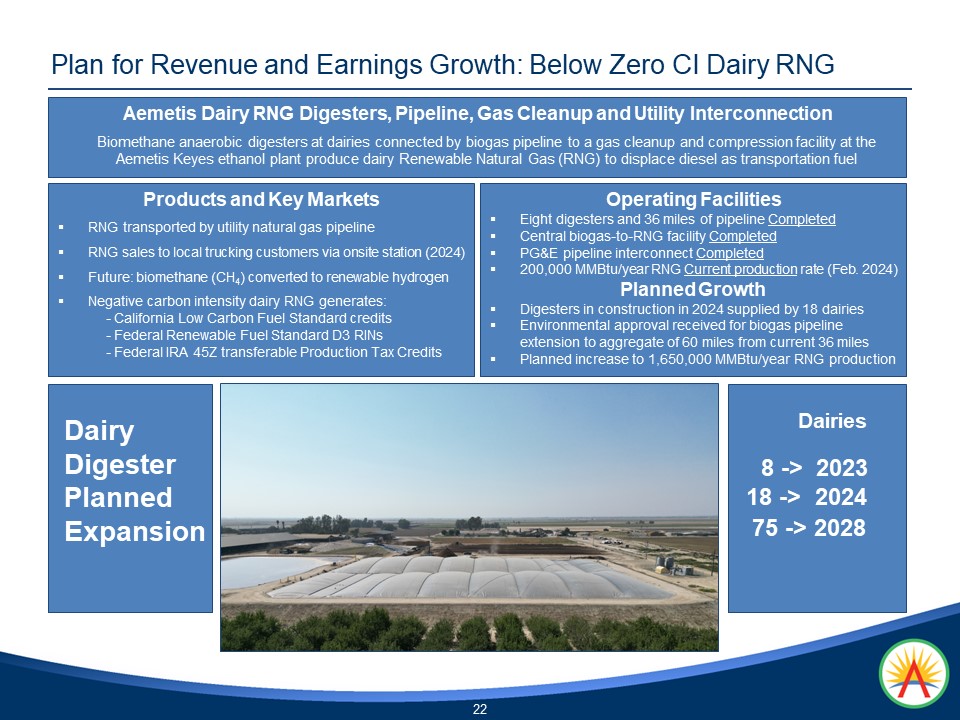

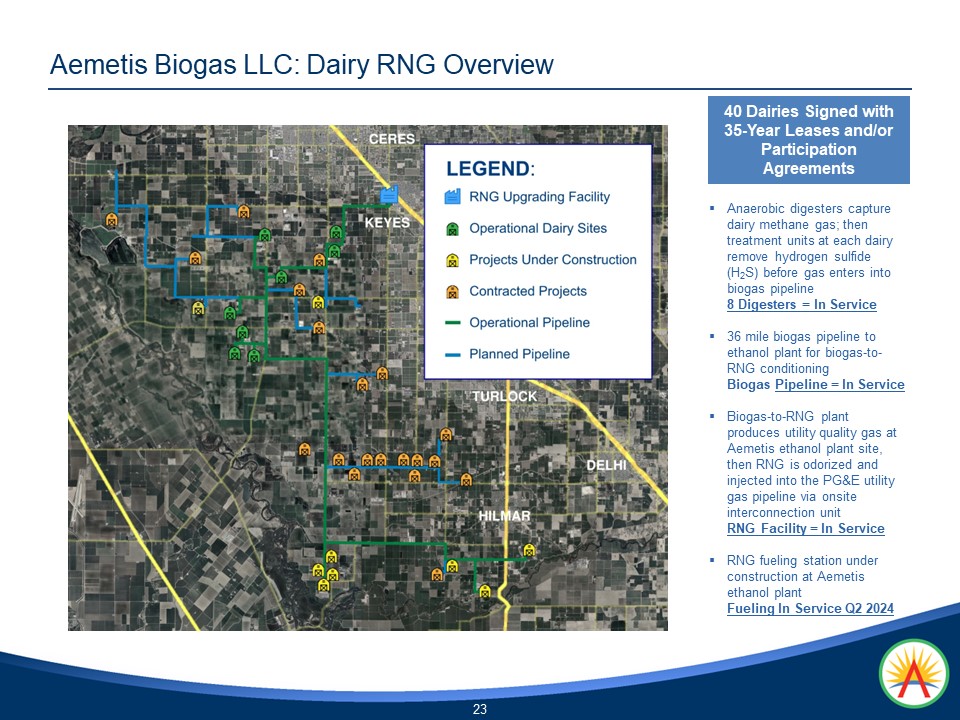

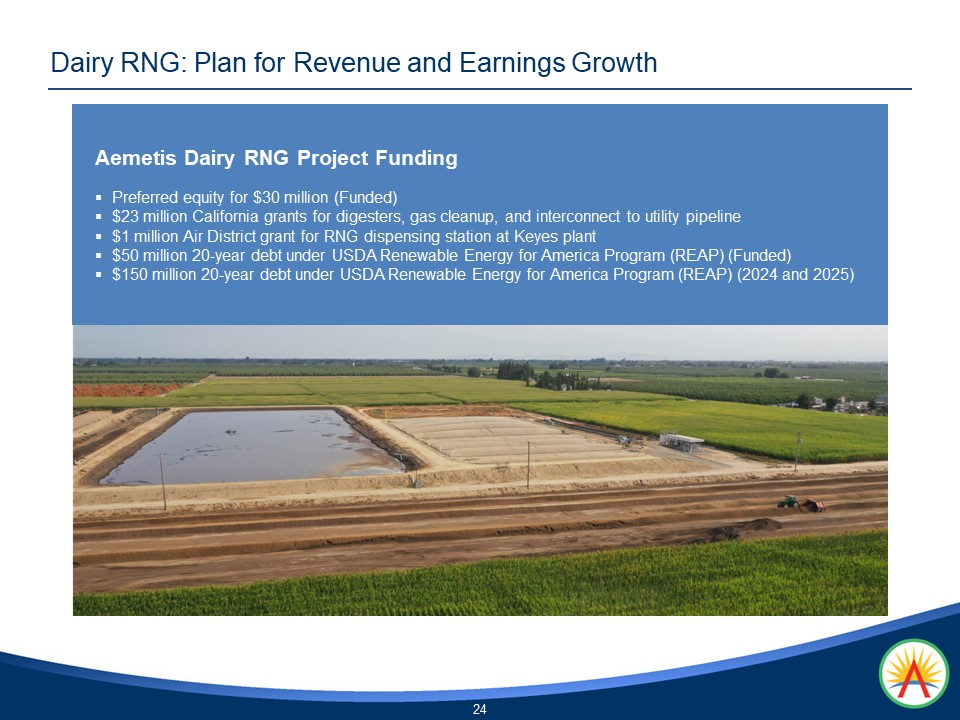

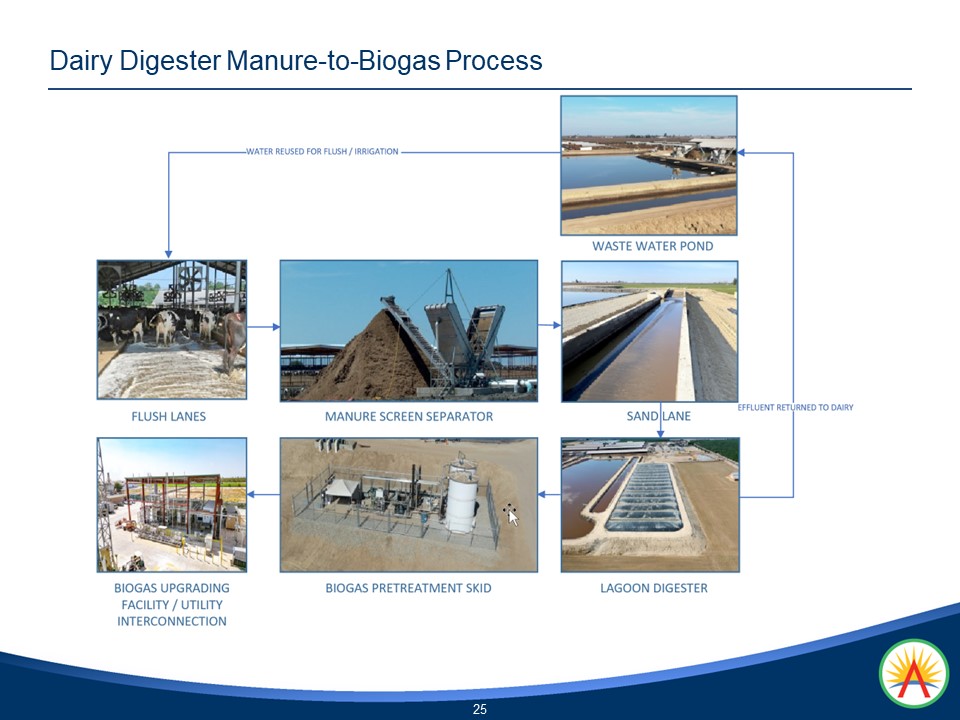

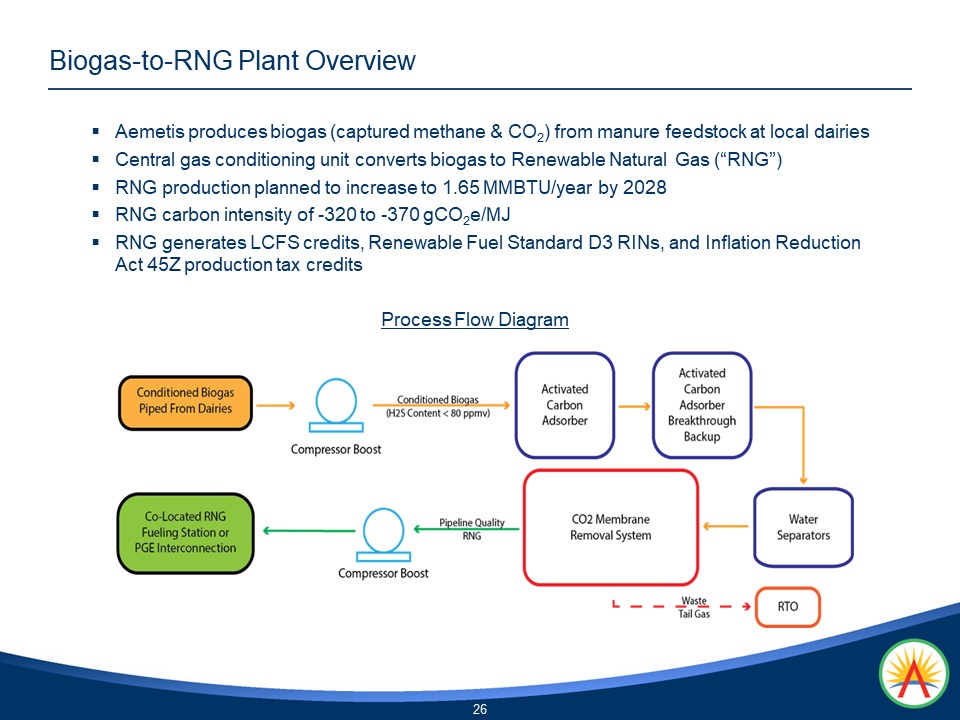

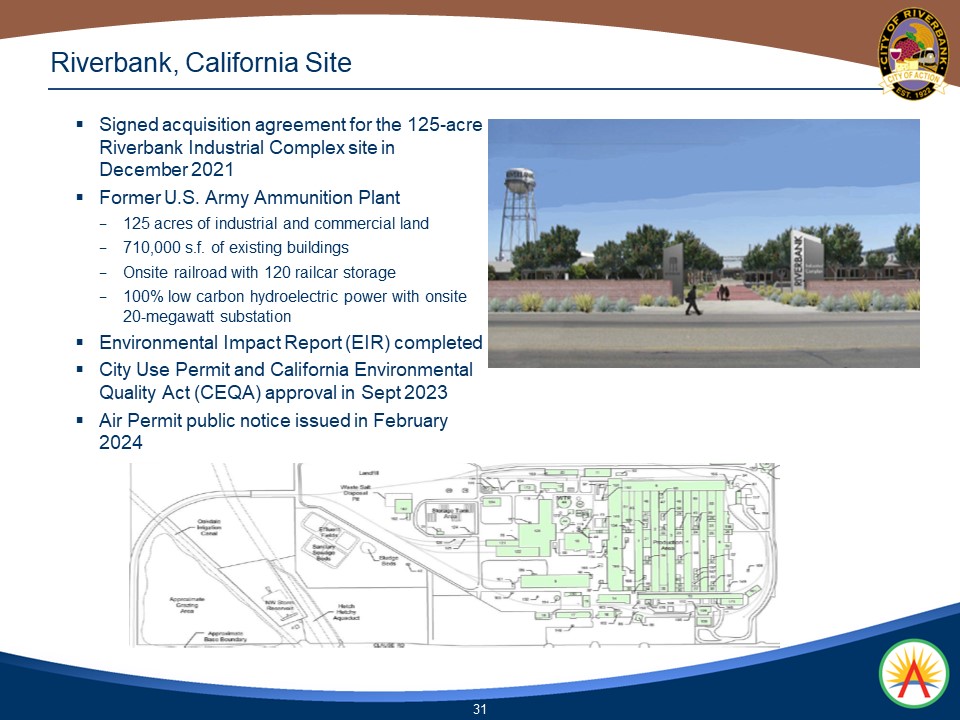

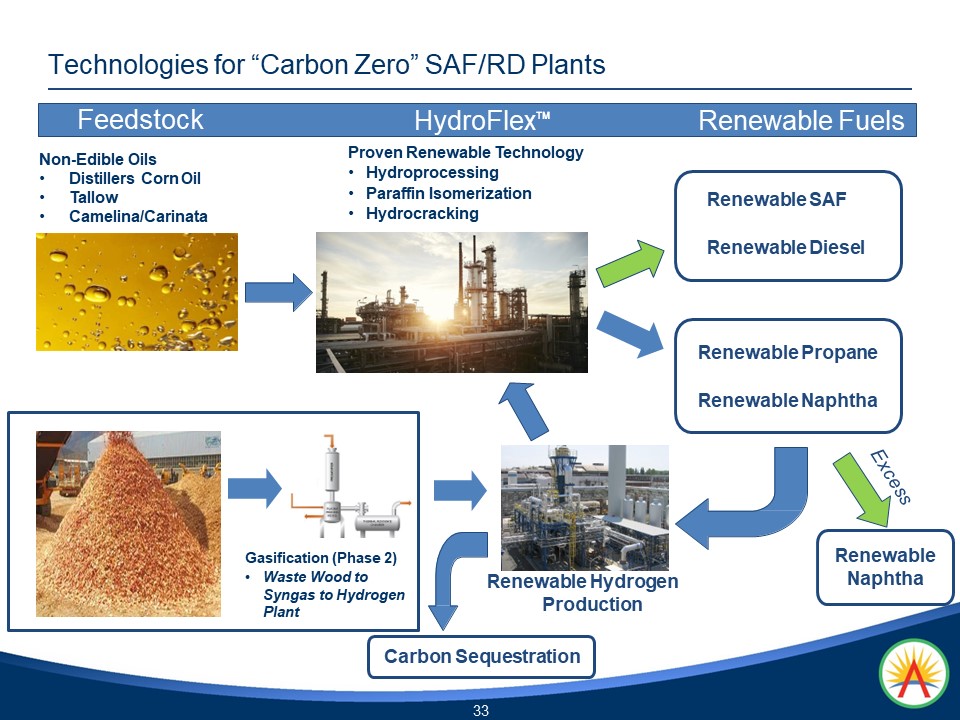

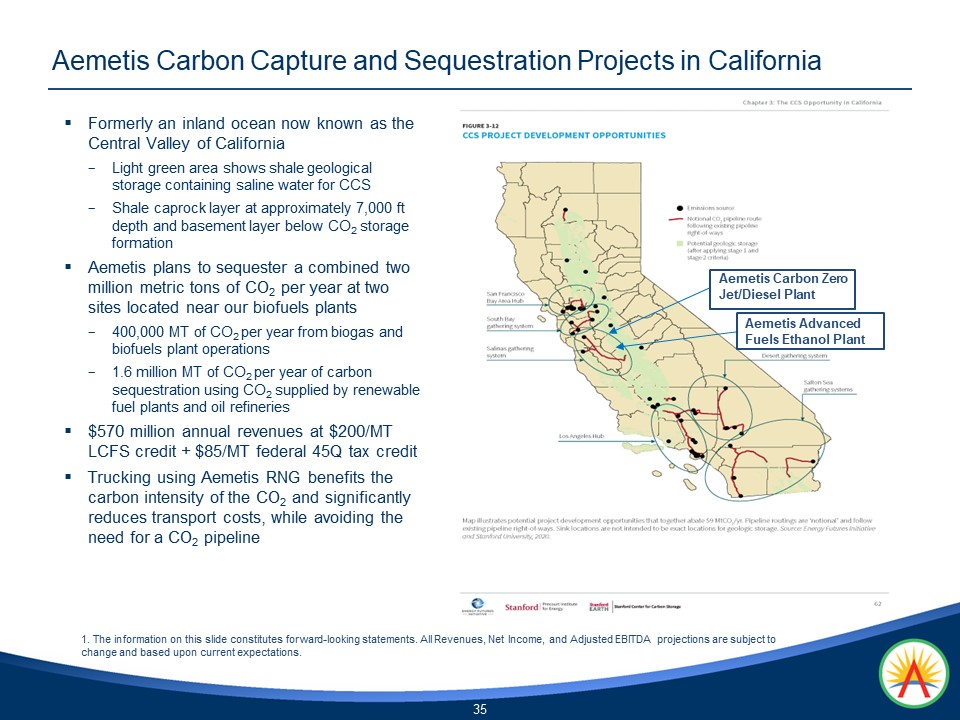

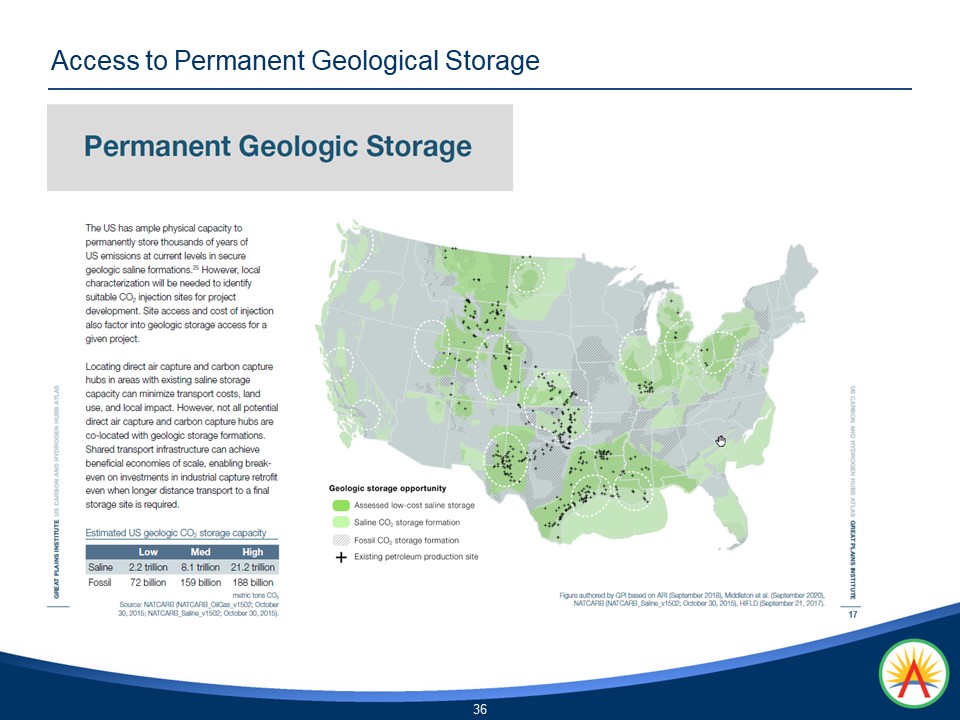

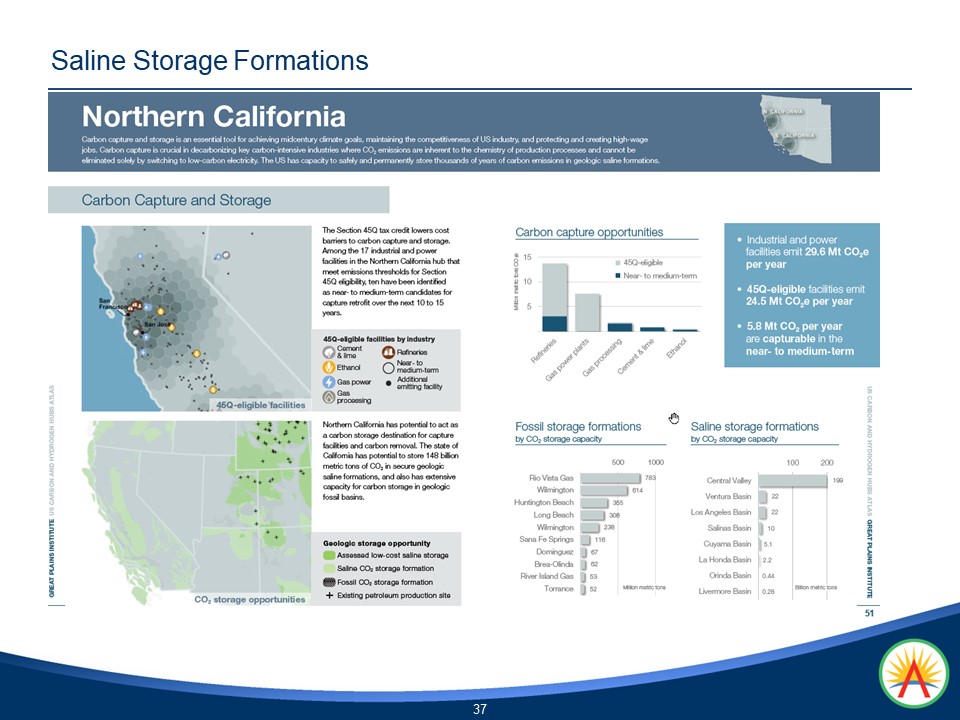

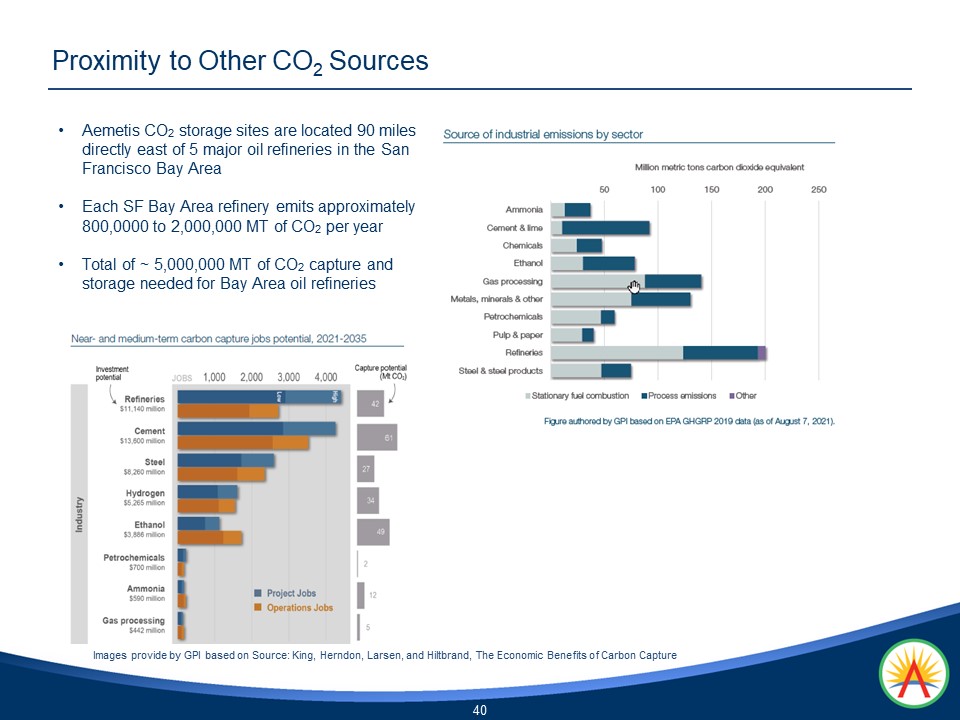

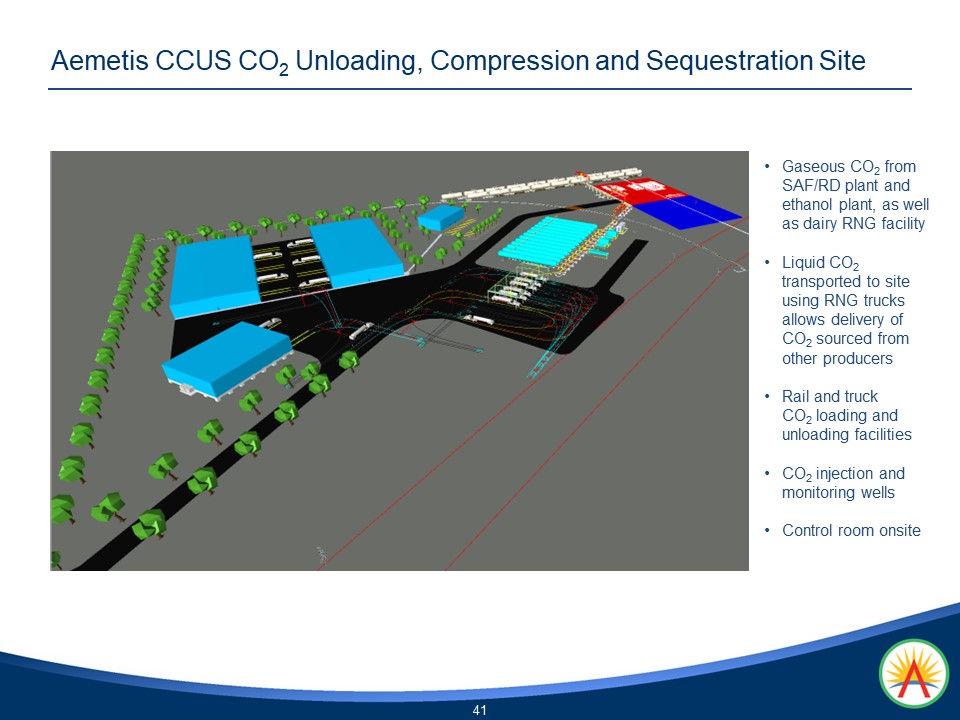

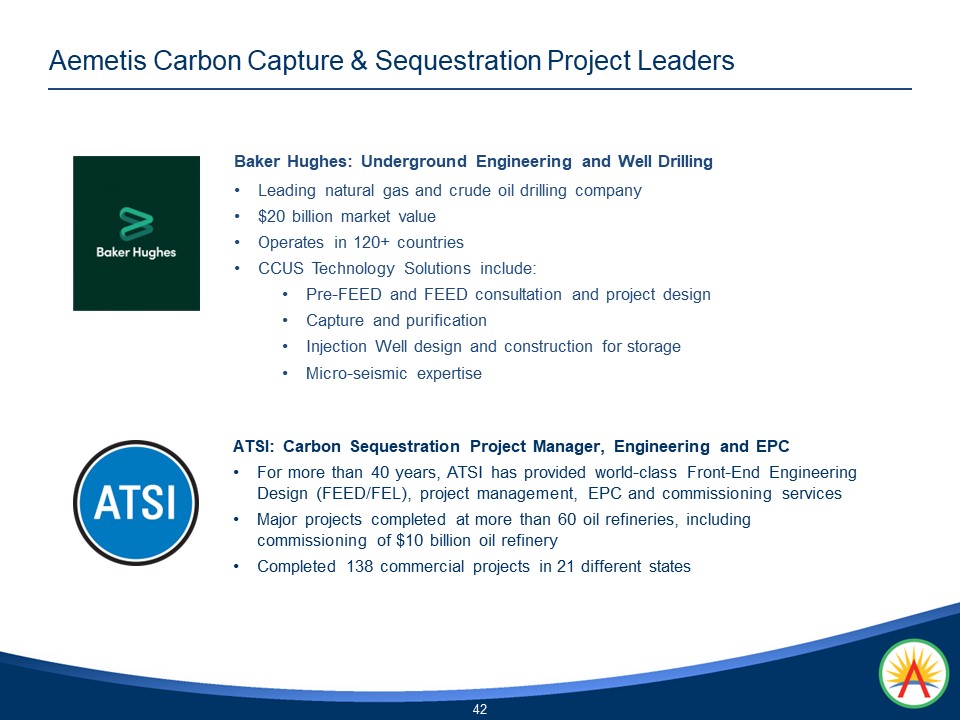

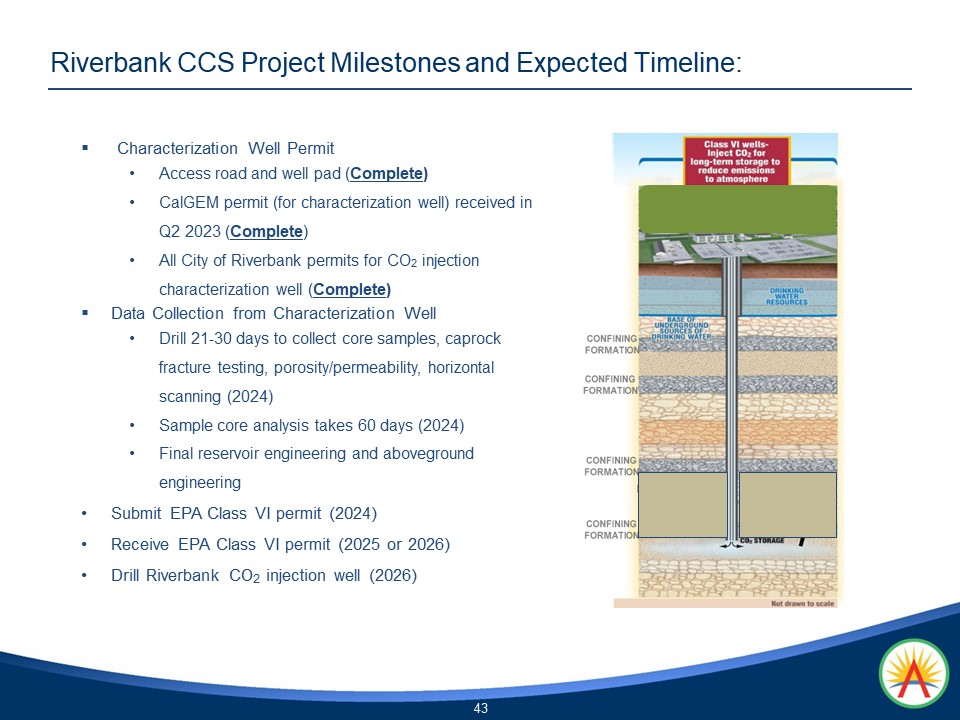

In the Aemetis 2024 Five Year Plan, the Company’s revenue and adjusted EBITDA growth is expected from 75 dairies producing RNG by 2028; from a 90 million gallon per year sustainable aviation fuel and renewable diesel (SAF/RD) plant in Riverbank, California; from a CO2 Carbon Sequestration and Underground Storage (CCUS) well located near the Riverbank and Keyes biofuels plant sites in California; from the completion of solar, mechanical vapor recompression and other energy efficiency, carbon emission reduction, and electrification projects at our Keyes biofuels plant; and from the continued expansion of biodiesel and tallow refining production at the Aemetis plant in India. The presentation also describes the tax credits expected to be received by Aemetis from the Inflation Reduction Act (IRA) for its renewable fuel and sequestration projects.

“Through the expansion of our RNG, biodiesel, SAF/RD, CCUS, and ethanol businesses, Aemetis is poised to rapidly grow revenue to almost $2 billion by the end of 2028,” said Eric McAfee, Chairman and CEO of Aemetis. “Additionally, Aemetis closed $50 million of new USDA funding and received $55 million from the sale of IRA tax credits in the past year. With strong financing support from the USDA for renewable fuels projects, the passage of the $380 billion Inflation Reduction Act to provide funding to renewable energy projects, and EPA approval allowing 15% ethanol blends in 49 states which expands the ethanol market by almost 50%, the regulatory and financial climate for renewable energy projects continues to support our overall growth plan,” added McAfee.

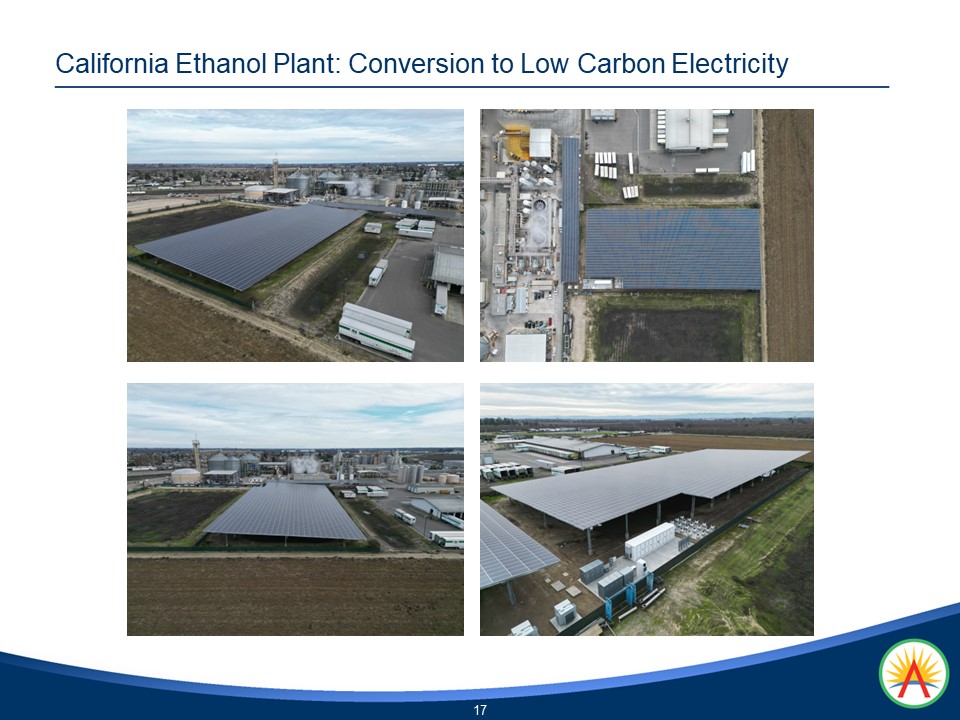

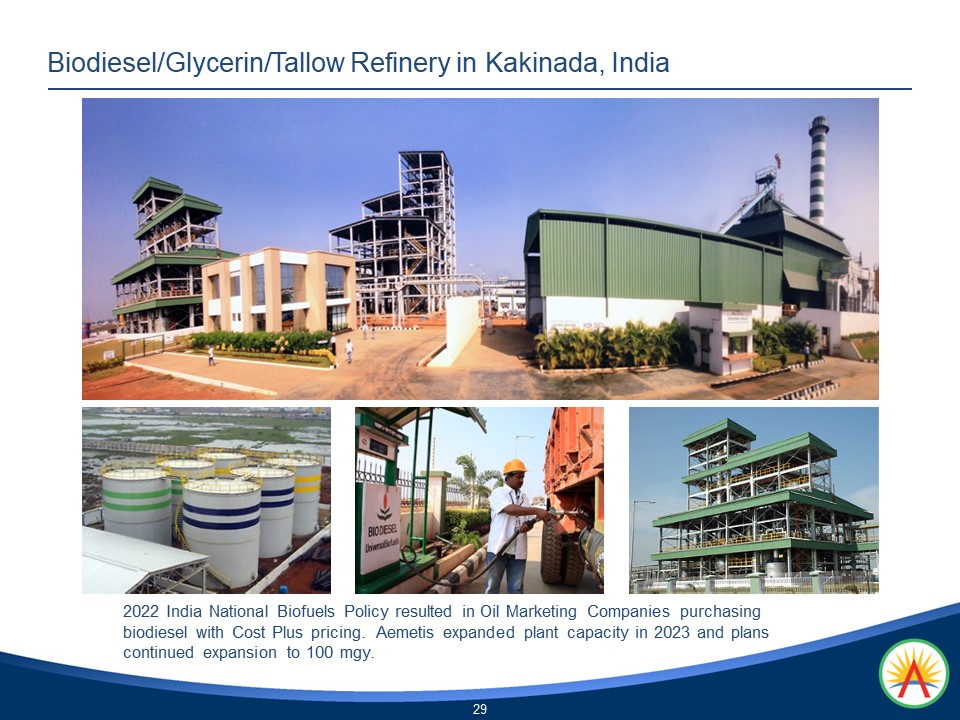

Significant milestones were achieved in the past year under the previous 2023 Five Year Plan, including the transition to receiving revenue and positive operational cash flow from the biogas-to-RNG upgrading facility and dairy digesters; receiving the Use Permit and CEQA approval for the SAF/RD plant at the Riverbank site; receiving the first private carbon sequestration characterization well drilling permit issued by the State of California; completing construction and commissioning of the 1.9 megawatt solar microgrid with battery backup; installed an Allen Bradley distributed control system with AI capabilities to optimize energy use and other operational performance of the Keyes ethanol plant; completing design engineering and are now procuring equipment for the Mechanical Vapor Recompression (MVR) unit at the Keyes plant to utilize low carbon intensity electricity instead of fossil natural gas; completing deliveries of biodiesel to the Oil Marketing Companies in India under the first $40 million of contracts; and receiving awards for an additional $150 million of allocations from the three India government Oil Marketing Companies to be fulfilled using a Cost-Plus pricing formula.

Due to uncertainties regarding timing, the 2024 Plan does not include several other growth initiatives that are actively under development at Aemetis, including revenues and EBITDA from the planned operation of the 50 million gallon per year capacity, debt-free, India refined tallow plant. The export of tallow from India to North America customers at approximately $4 to $5 per gallon for 50 million gallons per year, increasing revenues by up to $250 million per year, is excluded. The 2024 Plan projections include using the refined tallow from India as a feedstock supply source for the operations of the SAF/RD plant under development in California to improve profit margins.

In addition to the $55 million received in Q4 2024 from the sale of transferable tax credits, the Inflation Reduction Act is expected to provide transferable investment and production tax credits to Aemetis related to our U.S. renewable fuels and CO2 sequestration projects, which are included in the 2024 Plan.

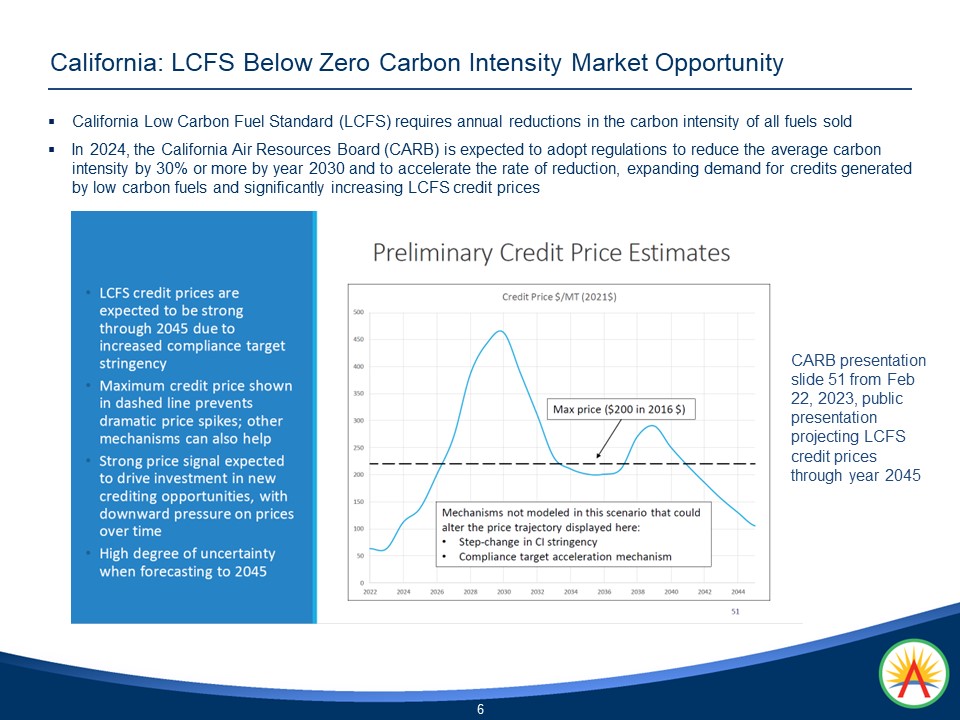

The Five Year Plan for Aemetis Dairy RNG operations projects revenues will grow from $18 million in 2024 to $190 million in 2028, while Dairy RNG project EBITDA is expected to expand from $7 million in 2024 to $123 million in 2028. The RNG plan accounts for the delays in receiving LCFS revenue that are caused by the current regulatory process to obtain LCFS pathway approvals for each dairy digester that may be shortened if pending regulatory changes are adopted by the California Air Resources Board.

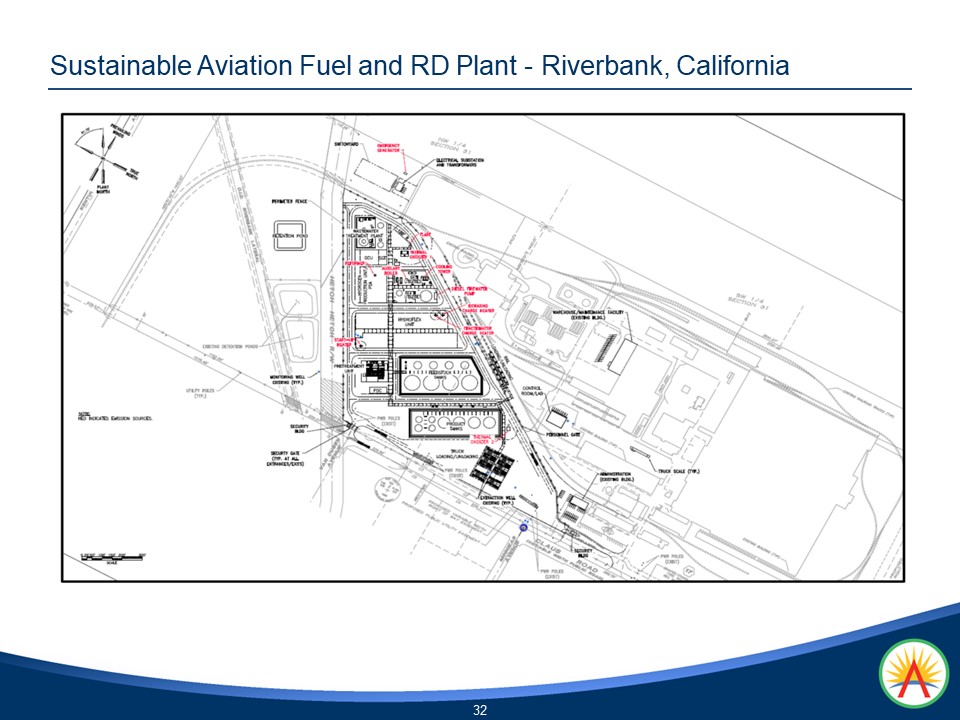

The Five Year Plan projects that the Aemetis Sustainable Aviation Fuel and Renewable Diesel plant will provide revenue of $672 million with adjusted EBITDA of $195 million in year 2027 from the 90 million gallon plant that received the Use Permit and CEQA approval in September 2023 to be built at the 125-acre Riverbank Industrial Complex which has 100% renewable hydroelectricity; a rail line and storage for 120 railcars; 710,000 square feet of buildings; and 50 acres of developable industrial land.

In connection with the carbon reduction upgrades at the Keyes plant, expansions of the India biodiesel plant, and expanded market opportunities resulting from changes to governmental policies, the Five Year Plan projects that the Company will generate annual revenue from ethanol and biodiesel of approximately $826 million in 2028, up from $368 million of expected revenue in 2024.

About Aemetis

Headquartered in Cupertino, California, Aemetis is a renewable natural gas, renewable fuel and biochemicals company focused on the acquisition, development and commercialization of innovative technologies that replace petroleum-based products and reduce greenhouse gas emissions. Founded in 2006, Aemetis is operating and actively expanding a California biogas digester network and pipeline system to convert dairy waste gas into Renewable Natural Gas. Aemetis owns and operates a 65 million gallon per year ethanol production facility in California’s Central Valley near Modesto that supplies about 80 dairies with animal feed. Aemetis owns and operates a 60 million gallon per year production facility on the East Coast of India producing high quality distilled biodiesel and refined glycerin for customers in India and Europe. Aemetis is developing the sustainable aviation fuel (SAF) and renewable diesel fuel biorefinery in California to utilize renewable hydrogen, hydroelectric power, and renewable oils to produce low carbon intensity renewable jet and diesel fuel. For additional information about Aemetis, please visit www.aemetis.com.

Safe Harbor Statement

This news release contains forward-looking statements, including statements regarding assumptions, projections, expectations, targets, intentions or beliefs about future events or other statements that are not historical facts. Forward-looking statements include, without limitation, projections of financial results in 2024 and future years, statements relating to the development, construction, and operation of the Aemetis Biogas RNG operations, the SAF and renewable diesel plant, and the carbon capture and sequestration wells, modifications to the Keyes plant, future changes to our India operations., and our ability to promote, develop and deploy technologies to produce renewable fuels and biochemicals. Words or phrases such as “anticipates,” “may,” “will,” “should,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “showing signs,” “targets,” “view,” “will likely result,” “will continue” or similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on current assumptions and predictions and are subject to numerous risks and uncertainties. Actual results or events could differ materially from those set forth or implied by such forward-looking statements and related assumptions due to certain factors, including, without limitation, competition in the ethanol, biodiesel and other industries in which we operate, commodity market risks including those that may result from current weather conditions, financial market risks, customer adoption, counter-party risks, risks associated with changes to federal policy or regulation, and other risks detailed in our reports filed with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2022, and in our subsequent filings with the SEC. We are not obligated, and do not intend, to update any of these forward-looking statements at any time unless an update is required by applicable securities laws.

Exhibit 99.2

Document And Entity Information |

Feb. 20, 2024 |

|---|---|

| Document Information [Line Items] | |

| Entity, Registrant Name | Aemetis, Inc. |

| Document, Type | 8-K |

| Document, Period End Date | Feb. 20, 2024 |

| Entity, Incorporation, State or Country Code | DE |

| Entity, File Number | 001-36475 |

| Entity, Tax Identification Number | 26-1407544 |

| Entity, Address, Address Line One | 20400 Stevens Creek Blvd., Suite 700 |

| Entity, Address, City or Town | Cupertino |

| Entity, Address, State or Province | CA |

| Entity, Address, Postal Zip Code | 95014 |

| City Area Code | 408 |

| Local Phone Number | 213-0940 |

| Title of 12(b) Security | Common Stock, par value $0.001 |

| Trading Symbol | AMTX |

| Security Exchange Name | NASDAQ |

| Written Communications | false |

| Soliciting Material | false |

| Pre-commencement Tender Offer | false |

| Pre-commencement Issuer Tender Offer | false |

| Entity, Emerging Growth Company | false |

| Amendment Flag | false |

| Entity, Central Index Key | 0000738214 |

1 Year Aemetis Chart |

1 Month Aemetis Chart |

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions