We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Share Name | Share Symbol | Market | Type |

|---|---|---|---|

| Advantage Solutions Inc | NASDAQ:ADV | NASDAQ | Common Stock |

| Price Change | % Change | Share Price | Bid Price | Offer Price | High Price | Low Price | Open Price | Shares Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|---|---|

| -0.25 | -9.51% | 2.38 | 2.00 | 4.50 | 2.585 | 2.38 | 2.58 | 381,252 | 05:00:01 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): |

(Exact name of Registrant as Specified in Its Charter)

(State or Other Jurisdiction |

(Commission File Number) |

(IRS Employer |

||

|

|

|

|

|

|

||||

|

||||

(Address of Principal Executive Offices) |

|

(Zip Code) |

||

Registrant’s Telephone Number, Including Area Code: ( |

Not Applicable |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

Securities registered pursuant to Section 12(b) of the Act:

|

|

Trading |

|

|

|

|

|||

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 – Results of Operations and Financial Condition.

On August 7, 2024, Advantage Solutions Inc. (the “Company”) issued a press release announcing its financial results for the three and six months ended June 30, 2024. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

On August 7, 2024, at 8:30 a.m. ET, the Company will host a conference call announcing its financial results for the three and six months ended June 30, 2024. A copy of management’s earnings presentation materials is attached as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated by reference herein. The presentation will be accessible, live via audio broadcast, through a link posted on the Investor Relations section of the Company’s website at https://ir.advantagesolutions.net. This presentation will be available for audio replay for one week following the call.

The Company makes reference to non-GAAP financial information in the press release and earnings presentation materials. The Company’s non-GAAP financial measures should be viewed in addition to and not as a substitute for or superior to the Company’s reported results prepared in accordance with GAAP. Reconciliation of these non-GAAP financial measures to the nearest comparable GAAP financial measures are contained in the data tables at the end of the press release and earnings presentation materials.

The information in this Item 2.02, including Exhibits 99.1 and 99.2 furnished under Item 9.01, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section. Furthermore, the information in this Item 2.02, including Exhibit 99.1 and 99.2 furnished under Item 9.01, shall not be deemed incorporated by reference into the filings of the Company under the Securities Act of 1933 or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit No. |

|

Description |

|

99.1 |

|

|

|

99.2 |

|

Management’s Earnings Presentation for Advantage Solutions Inc., dated August 7 2024. |

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: |

August 7, 2024 |

|

ADVANTAGE SOLUTIONS INC. |

|

|

|

|

|

|

By: |

/s/ Christopher Growe |

|

|

|

Christopher Growe |

Advantage Solutions Reports 2024 Second Quarter Results and Reaffirms its Full-Year Outlook

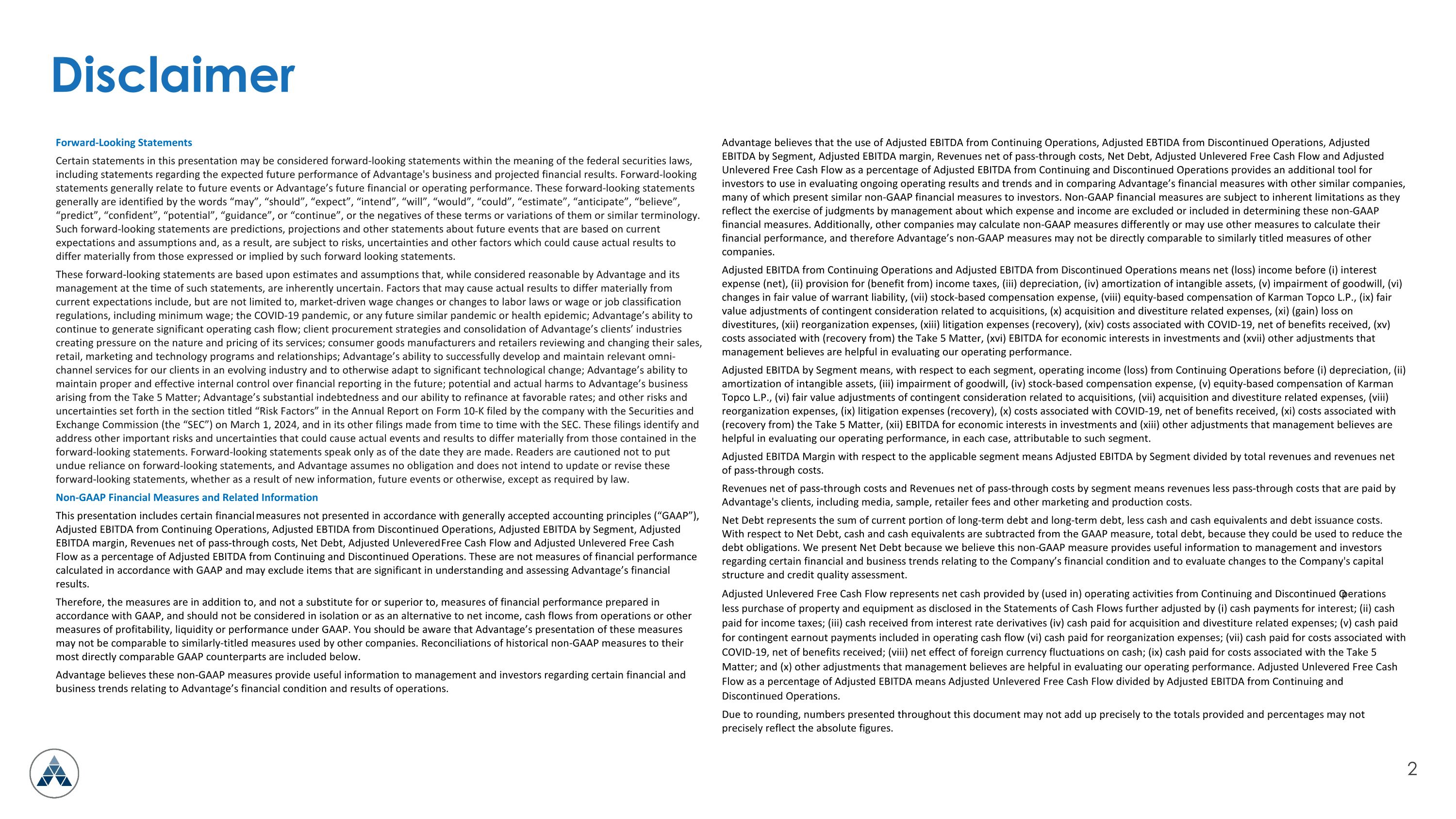

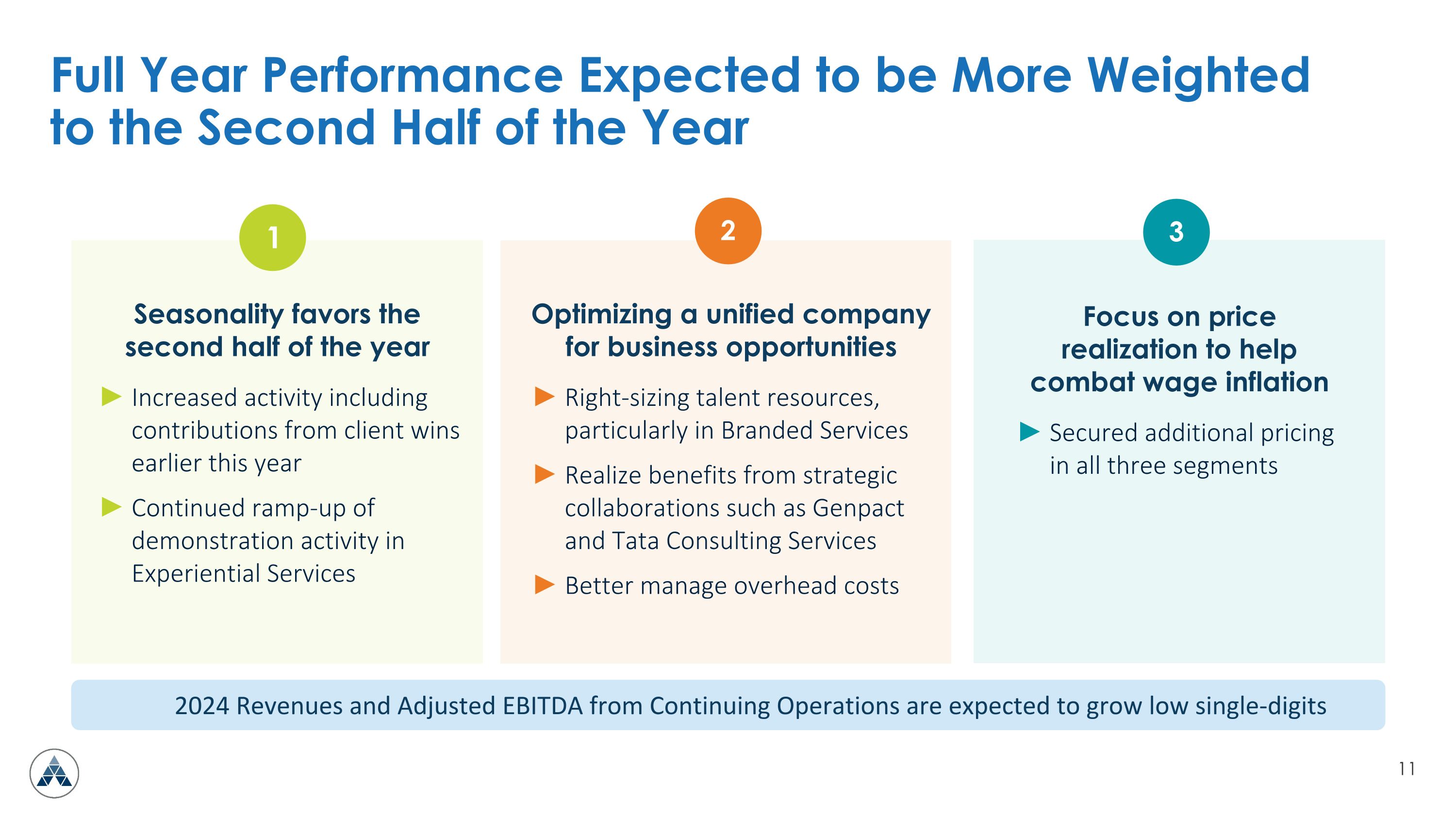

Management expects 2024 revenues and Adjusted EBITDA to grow low single digits on a continuing operations basis.

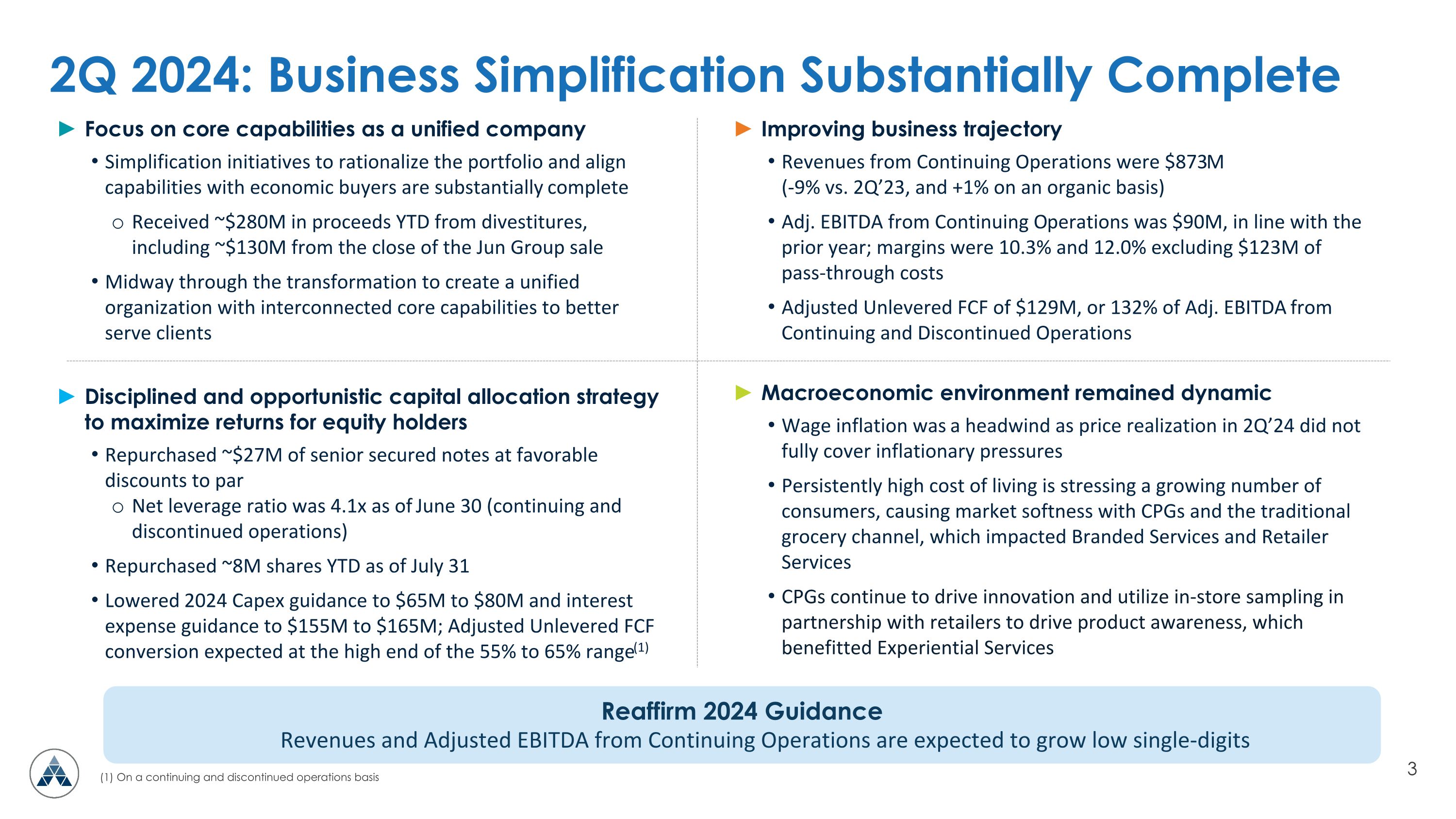

Actions to simplify the business are substantially complete, marking an important milestone in the Company's strategic transformation.

Divestiture of non-core assets in 2024 generated proceeds of ~$280 million available to opportunistically reduce debt.

ST. LOUIS, August 7, 2024 – Advantage Solutions Inc. (NASDAQ: ADV) (“Advantage,” “Advantage Solutions,” the “Company,” “we,” or “our”), a leading business solutions provider to consumer goods manufacturers and retailers, today reported financial results for the three and six months ended June 30, 2024. Unless otherwise noted, results presented in this release are on a continuing operations basis. Revenues for the three months ended June 30, 2024 were $873 million, compared with $964 million a year ago. Net loss from continuing operations was $113 million, compared to a net loss of $13 million for the second quarter of 2023.

“I want to thank our teammates for their hard work and focus in delivering improved underlying second quarter performance in a dynamic market environment,” said Advantage Solutions CEO Dave Peacock. “Importantly, we made meaningful progress on our strategic transformation by substantially completing the divestitures of non-core assets to simplify our business and pay down debt."

"As we look to the second half of the year, we remain committed to enhancing our core capabilities through investments in technology and third-party collaborations to offer clients unmatched interconnected service offerings. We are excited about our progress and pleased to reaffirm our full-year guidance to deliver growth during a year of significant investment.”

Second Quarter 2024 Highlights

Revenues

|

|

Three Months Ended June 30, |

|

|

Change |

|

||||||||||

(amounts in thousands) |

|

2024 |

|

|

2023 |

|

|

$ |

|

|

% |

|

||||

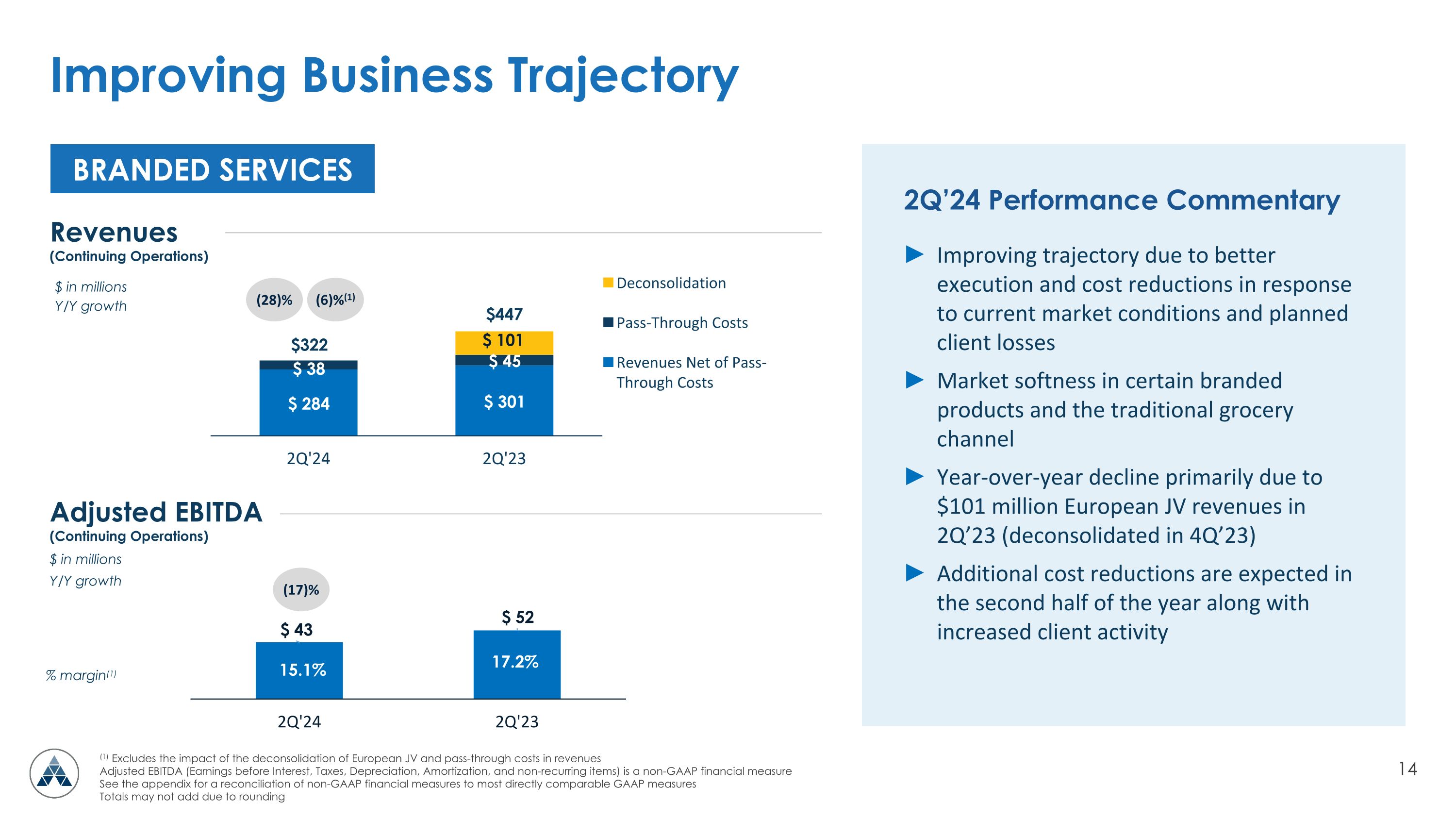

Branded Services |

|

$ |

322,340 |

|

|

$ |

447,265 |

|

|

$ |

(124,925 |

) |

|

|

(27.9 |

)% |

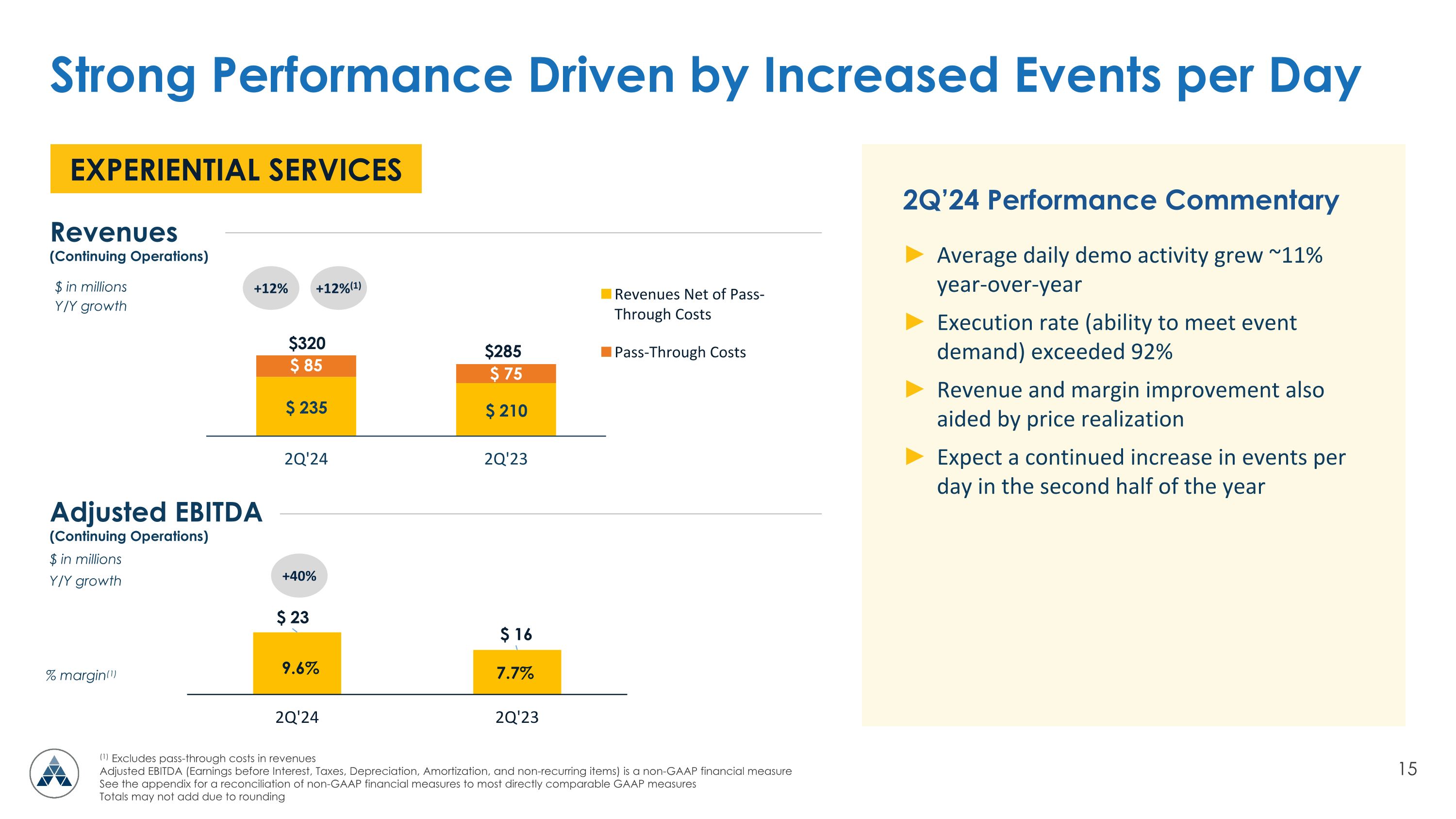

Experiential Services |

|

|

319,508 |

|

|

|

285,174 |

|

|

|

34,334 |

|

|

|

12.0 |

% |

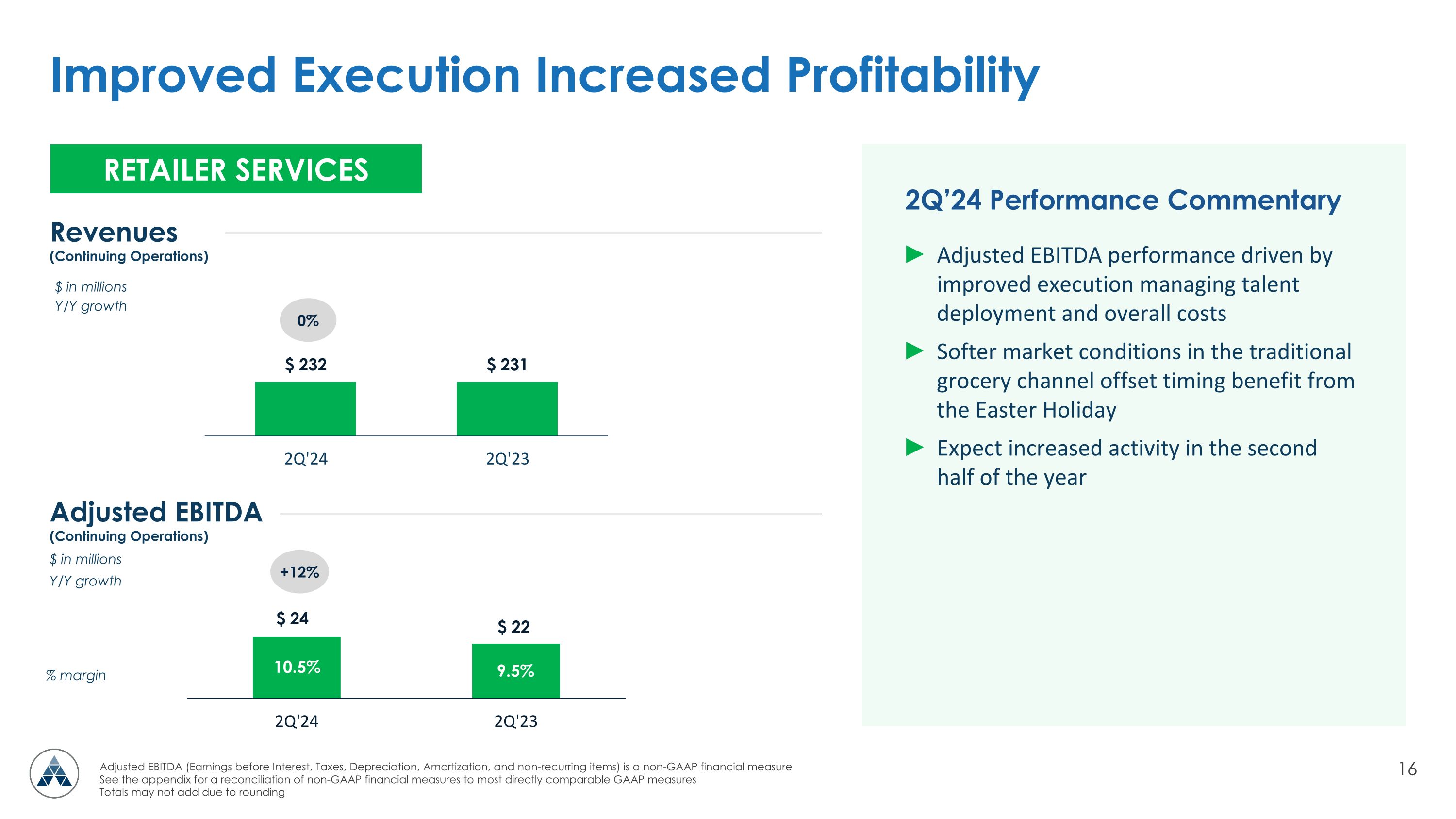

Retailer Services |

|

|

231,509 |

|

|

|

231,319 |

|

|

|

190 |

|

|

|

0.1 |

% |

Total revenues |

|

$ |

873,357 |

|

|

$ |

963,758 |

|

|

$ |

(90,401 |

) |

|

|

(9.4 |

)% |

1

Adjusted EBITDA from Continuing Operations

|

|

Three Months Ended June 30, |

|

|

Change |

|

||||||||||

(amounts in thousands) |

|

2024 |

|

|

2023 |

|

|

$ |

|

|

% |

|

||||

Branded Services |

|

$ |

42,856 |

|

|

$ |

51,787 |

|

|

$ |

(8,931 |

) |

|

|

(17.2 |

)% |

Experiential Services |

|

|

22,611 |

|

|

|

16,202 |

|

|

|

6,409 |

|

|

|

39.6 |

% |

Retailer Services |

|

|

24,431 |

|

|

|

21,865 |

|

|

|

2,566 |

|

|

|

11.7 |

% |

Total Adjusted EBITDA from Continuing Operations |

|

$ |

89,898 |

|

|

$ |

89,854 |

|

|

$ |

44 |

|

|

|

0.0 |

% |

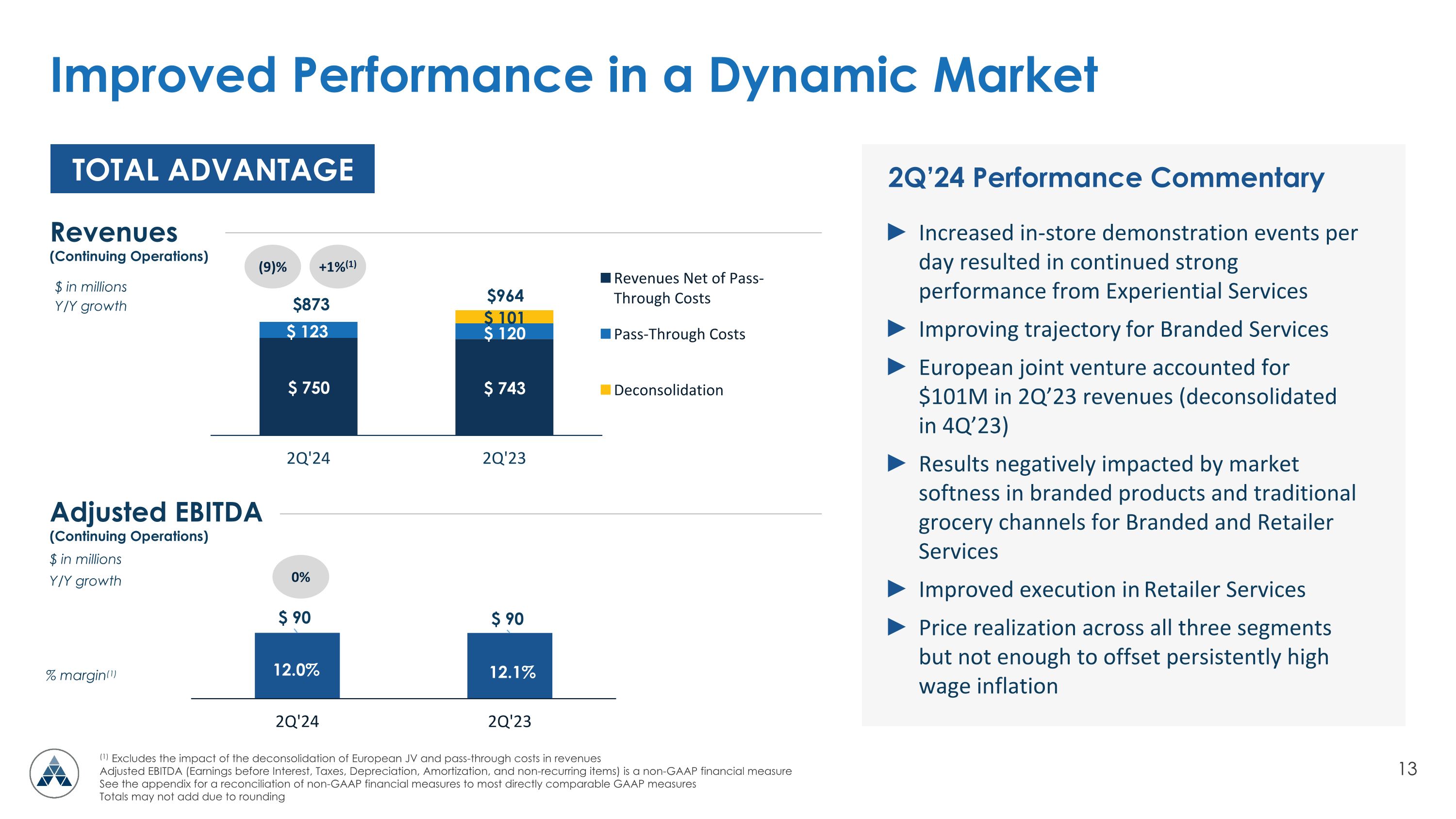

Revenues declined 9% to $873 million and increased by approximately 1% when excluding the impact of $101 million related to the deconsolidation of the European joint venture in 4Q'23. Pass-through costs were approximately $123 million and $120 million in 2Q’24 and 2Q’23, respectively.

Branded Services' revenue decline was due primarily to the deconsolidation. Pass-through costs in 2Q’24 and 2Q’23 were $38 million and $45 million, respectively. Excluding these items, revenues declined by approximately 6%. Revenues were adversely impacted by the planned client exits and continued soft market conditions affecting brokerage and omni-commerce marketing services for consumer product companies.

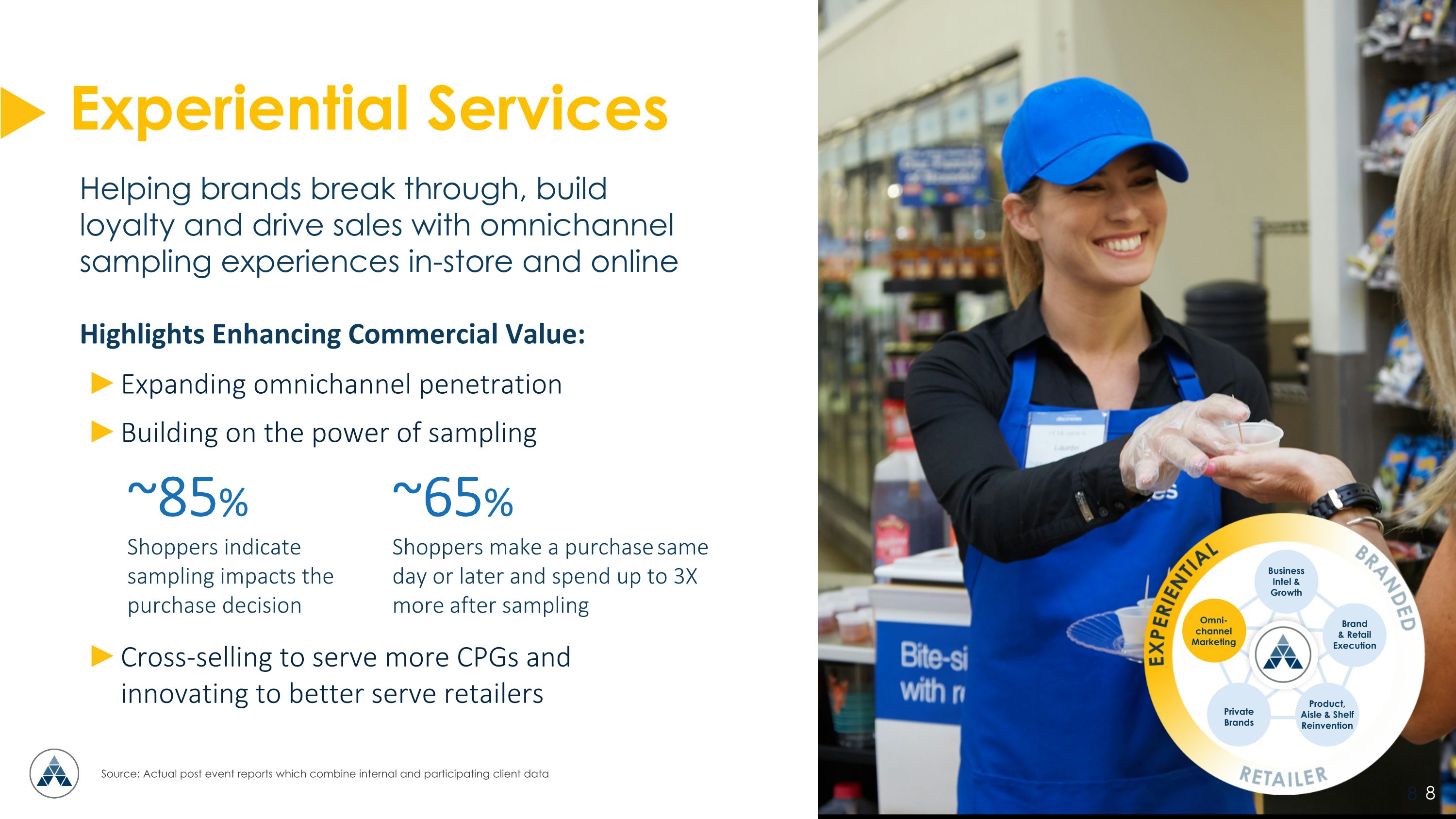

Revenue growth for Experiential Services was driven by increased events per day and price realization. Excluding pass-through costs of approximately $85 million and $75 million in 2Q’24 and 2Q’23, respectively, the year-over-year revenue growth was approximately 12%.

Retailer Services revenues were relatively unchanged year-over-year due to softer market conditions in the traditional grocery channel, which offset the benefits from the timing of the Easter Holiday, increased activities associated with agency-related services, and price realization.

The operating loss of $91 million was due to a non-cash goodwill impairment of approximately $100 million related to the Jun Group divestiture and an increase in costs associated with transformation activities to enhance its service offerings and reorganize the Company, in particular Branded Services.

Adjusted EBITDA from Continuing Operations was $90 million, which was in line with the prior year, and benefited from higher events per day in Experiential Services and more efficient deployment of labor and cost discipline in Retailer Services. These favorable results helped to offset the adverse effects of high wage inflation that were not fully covered by price realization, soft market conditions, investment to implement the Company's transformation strategy and planned client exits affecting Branded Services.

The reported net loss attributable to stockholders was $101 million compared to a net loss of $9 million in the prior year, largely driven by the non-cash impairment of goodwill.

First Half 2024 Highlights

Revenues

|

|

Six Months Ended June 30, |

|

|

Change |

|

||||||||||

(amounts in thousands) |

|

2024 |

|

|

2023 |

|

|

$ |

|

|

% |

|

||||

Branded Services |

|

$ |

651,394 |

|

|

$ |

875,962 |

|

|

$ |

(224,568 |

) |

|

|

(25.6 |

)% |

Experiential Services |

|

|

626,859 |

|

|

|

542,341 |

|

|

|

84,518 |

|

|

|

15.6 |

% |

Retailer Services |

|

|

456,516 |

|

|

|

470,168 |

|

|

|

(13,652 |

) |

|

|

(2.9 |

)% |

Total revenues |

|

$ |

1,734,769 |

|

|

$ |

1,888,471 |

|

|

$ |

(153,702 |

) |

|

|

(8.1 |

)% |

2

Adjusted EBITDA from Continuing Operations

|

|

Six Months Ended June 30, |

|

|

Change |

|

||||||||||

(amounts in thousands) |

|

2024 |

|

|

2023 |

|

|

$ |

|

|

% |

|

||||

Branded Services |

|

$ |

77,191 |

|

|

$ |

103,588 |

|

|

$ |

(26,397 |

) |

|

|

(25.5 |

)% |

Experiential Services |

|

|

39,304 |

|

|

|

23,208 |

|

|

|

16,096 |

|

|

|

69.4 |

% |

Retailer Services |

|

|

44,044 |

|

|

|

45,310 |

|

|

|

(1,266 |

) |

|

|

(2.8 |

)% |

Total Adjusted EBITDA from Continuing Operations |

|

$ |

160,539 |

|

|

$ |

172,106 |

|

|

$ |

(11,567 |

) |

|

|

(6.7 |

)% |

Revenues declined 8% to $1,735 million and increased by approximately 2%, excluding $194 million related to the deconsolidation. Pass-through costs were $255 million and $229 million in 1H’24 and 1H’23, respectively.

The operating loss was $121 million due to the non-cash goodwill impairment of approximately $100 million for the Jun Group divestiture and an increase in Company reorganization costs related to the strategic business transformation in both quarters.

Adjusted EBITDA from Continuing Operations was $161 million, led by a better-than-expected performance by Experiential Services and Retailer Services. This helped to offset the adverse effects of high wage inflation that were not fully covered by price realization, soft market conditions, investments and planned client exits affecting Branded Services.

The reported net loss attributable to stockholders was $106 million compared to a net loss of $56 million in the prior year, which included the gain in discontinued operations related to the sale of businesses and non-cash impairment noted above.

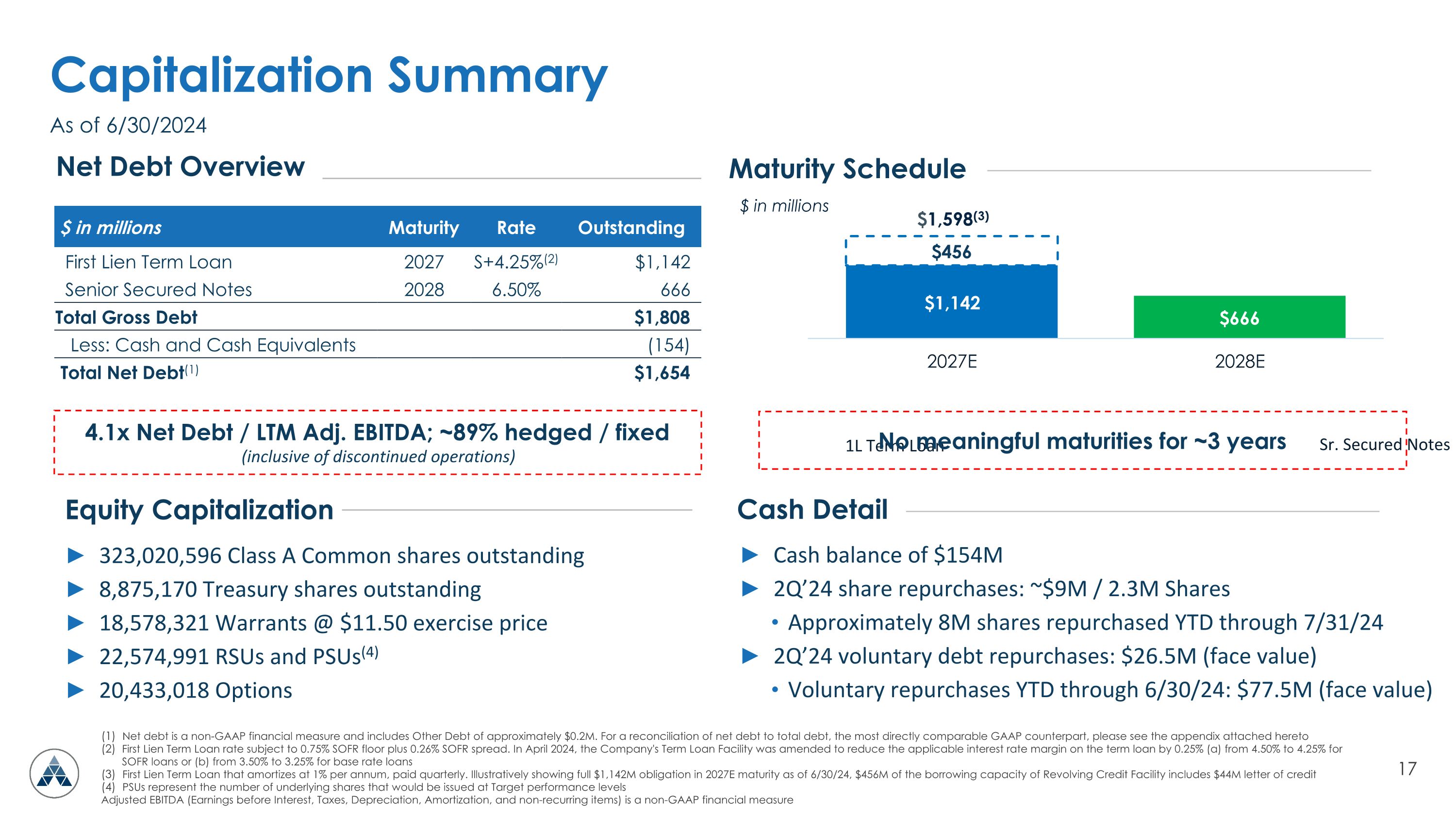

Capital Structure and Balance Sheet Highlights

The Company closed the Jun Group sale to Verve Group SE on July 31, 2024, and received approximately $130 million in cash. Two additional installments are expected to be paid 12 and 18 months after closing, bringing the total gross proceeds to approximately $185 million. Management plans to use most of the approximately $280 million in divestiture proceeds generated in 2024 to pay down debt and reinvest in the business. The Company expects to reduce its net leverage ratio to less than 3.5 times over the long term.

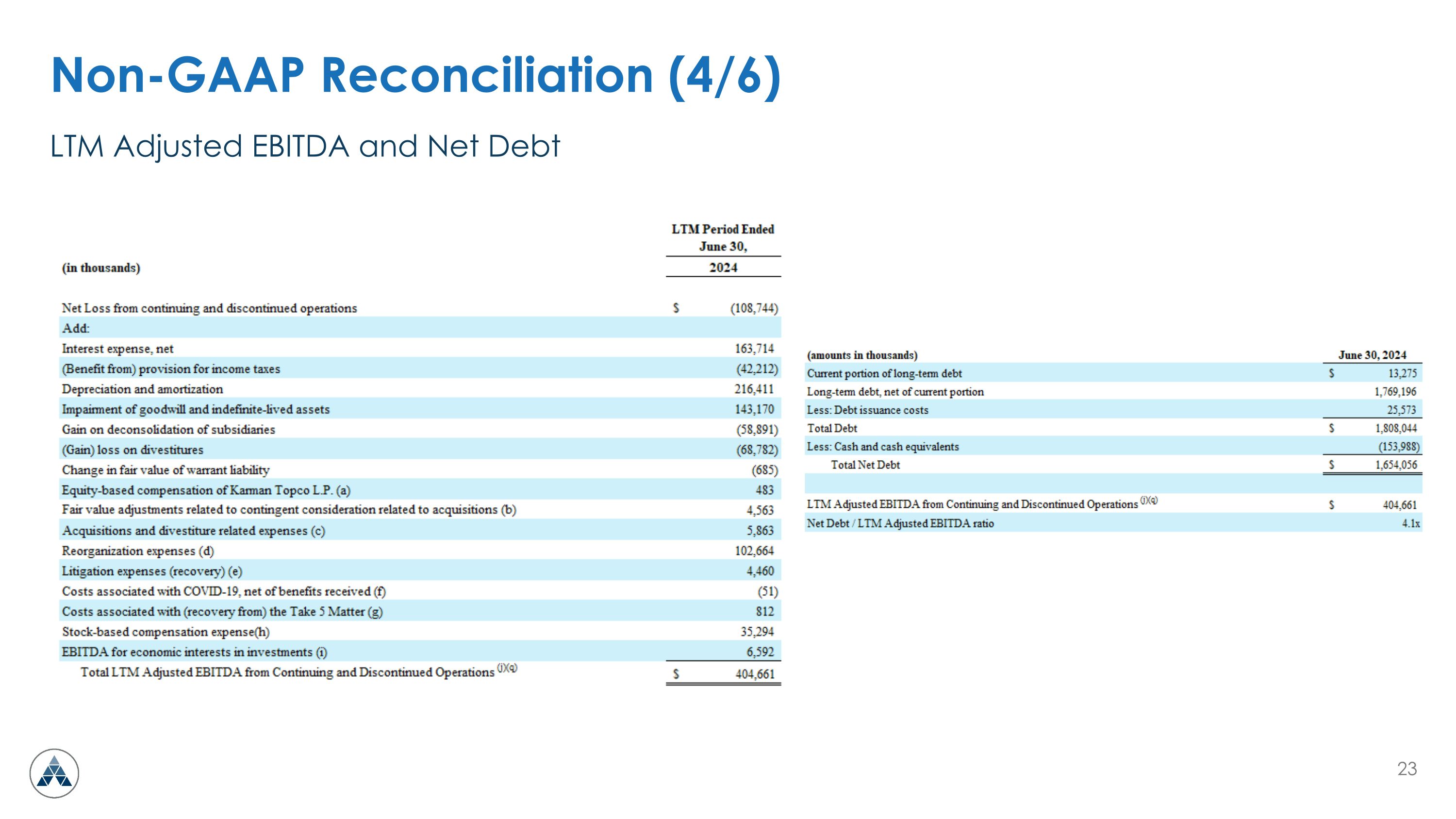

In the second quarter, the Company voluntarily repurchased $27 million of its senior secured notes at attractive discounts. As of June 30, 2024, the net debt ratio was approximately 4.1x Adjusted EBITDA from Continuing and Discontinued Operations. Approximately 90% of the debt outstanding is hedged or at a fixed interest rate.

Under its stock repurchase program, the Company repurchased approximately 8 million of its outstanding shares from the start of the year through July 31, 2024. These purchases are consistent with Advantage’s capital allocation philosophy to maximize returns for equity holders, which includes deleveraging its balance sheet and investing behind core business offerings to fuel future growth.

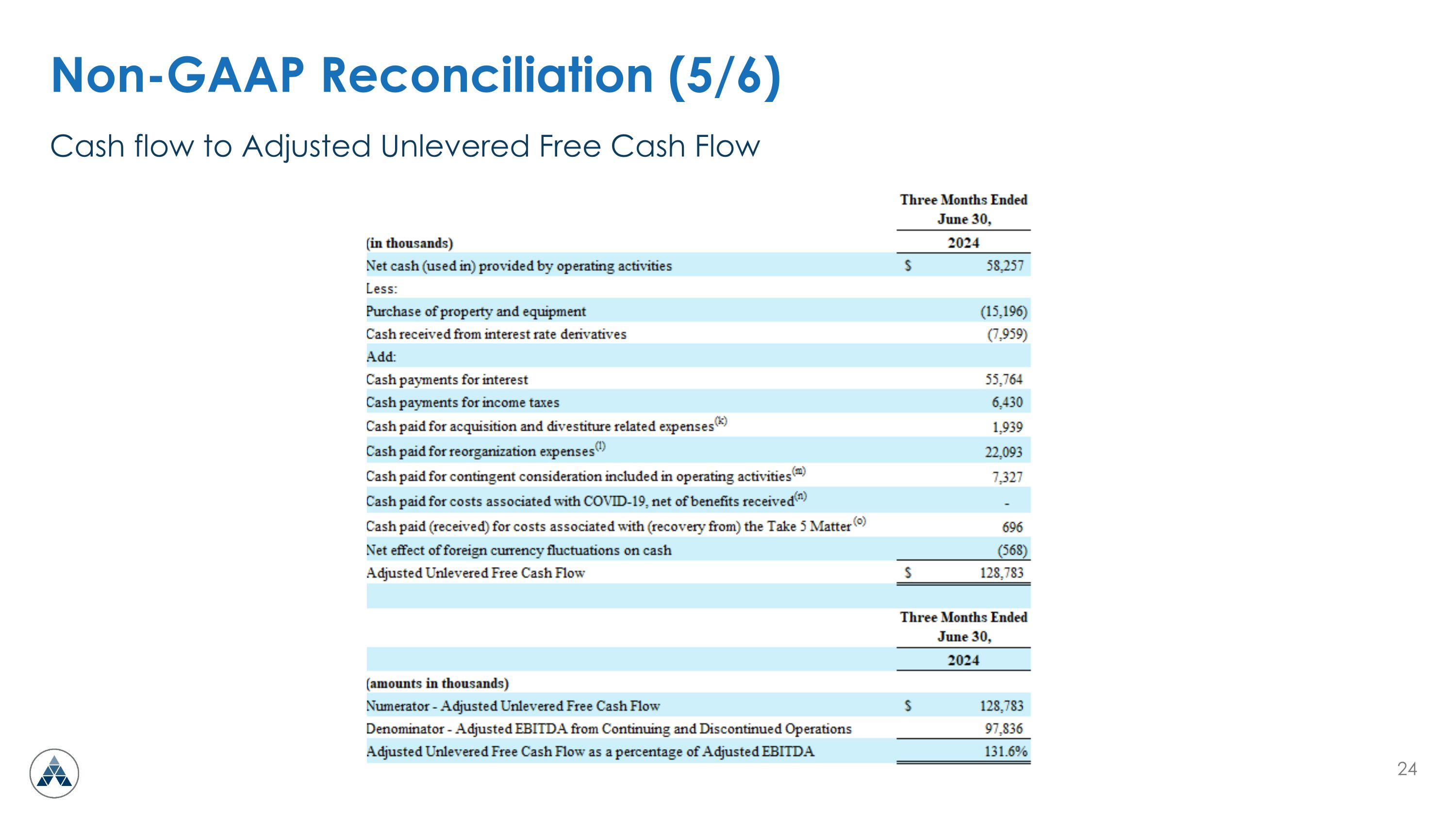

Capital expenditures were approximately $15 million in the second quarter, primarily supporting investments to modernize, transform and further differentiate Advantage Solutions for future growth. Adjusted Unlevered Free Cash Flow was $129 million, or approximately 132% of Adjusted EBITDA from Continuing and Discontinued Operations.

Fiscal Year 2024 Outlook

With the divestitures substantially complete, management expects revenues and Adjusted EBITDA from Continuing Operations to grow low single digits. Management conducted a periodic review of the IT transformation plan to improve operating efficiencies and potential benefits from divestitures and partnerships. As a result, the three-year IT transformation capital expenditures are now expected to be $140 million to $150 million, down from the initial range of $160 million to $170 million. For 2024, capital expenditures are expected to be in the range of $65 million to $80 million versus the original estimate of $90 million to $110 million. The strategic objectives remain the same, and the plan includes a tapering in capital expenditures in 2025 and a return to historical capital spending levels in 2026.

The efficient conversion of earnings into cash is a priority for the Company, and the expectation for 2024 is for Adjusted Unlevered Free Cash Flow conversion to be at the high end of the 55% to 65% range, based on Adjusted EBITDA from Continuing and Discontinued Operations. Because of the investments, changes to the organization to transform the

3

business, and cash needs of the business, management expects minimal excess cash in 2024. However, cash proceeds from the divestitures provide sufficient liquidity to continue paying down debt. Additional guidance metrics can be found in the Company’s supplemental earnings presentation.

Conference Call Details

Advantage will host a conference call at 8:30 am EDT on August 7, 2024, to discuss its second quarter 2024 financial performance and business outlook. To participate, please dial 800-267-6316 within the United States or +1-203-518-9783 outside the United States approximately 10 minutes before the call's scheduled start. The conference call code is ADVQ2. The conference call will also be accessible live via audio broadcast on the Investor Relations section of the Advantage website at ir.advantagesolutions.net.

A conference call replay will be available online on the investor section of the Advantage website. In addition, an audio replay of the call will be available for one week following the call. It can be accessed by dialing 844-512-2921 within the United States or +1-412-317-6671 outside the United States. The replay ID is 11156139.

About Advantage Solutions

Advantage Solutions is a leading provider of outsourced sales, experiential and marketing solutions uniquely positioned at the intersection of brands and retailers. Our data- and technology-driven services — which include headquarter sales, retail merchandising, in-store and online sampling, digital commerce, omni-channel marketing, retail media and others — help brands and retailers of all sizes get products into the hands of consumers, wherever they shop. As a trusted partner and problem solver, we help our clients sell more while spending less. Advantage has offices throughout North America and strategic investments in select markets throughout Africa, Asia, Australia, Latin America and Europe through which the Company serves the global needs of multinational, regional and local manufacturers. For more information, please visit advantagesolutions.net.

Included with this press release are the Company’s consolidated and condensed financial statements as of and for the three months ended June 30, 2024. These financial statements should be read in conjunction with the information contained in the Company’s Quarterly Report on Form 10-Q, to be filed with the Securities and Exchange Commission (the "SEC") on or about August 9, 2024.

Forward-Looking Statements

Certain statements in this press release may be considered forward-looking statements within the meaning of the federal securities laws, including statements regarding the expected future performance of Advantage's business and projected financial results. Forward-looking statements generally relate to future events or Advantage’s future financial or operating performance. These forward-looking statements generally are identified by the words “may”, “should”, “expect”, “intend”, “will”, “would”, “could”, “estimate”, “anticipate”, “believe”, “predict”, “confident”, “potential” or “continue”, or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks, uncertainties and other factors which could cause actual results to differ materially from those expressed or implied by such forward looking statements.

These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Advantage and its management at the time of such statements, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to, market-driven wage changes or changes to labor laws or wage or job classification regulations, including minimum wage; the COVID-19 pandemic and other future potential pandemics or health epidemics; Advantage’s ability to continue to generate significant operating cash flow; client procurement strategies and consolidation of Advantage’s clients’ industries creating pressure on the nature and pricing of its services; consumer goods manufacturers and retailers reviewing and changing their sales, retail, marketing and technology programs and relationships; Advantage’s ability to successfully develop and maintain relevant omni-channel services for our clients in an evolving industry and to otherwise adapt to significant technological change; Advantage’s ability to maintain proper and effective internal control over financial reporting in the future; potential and actual harms to Advantage’s business arising from the Take 5 Matter; Advantage’s substantial indebtedness and our ability to refinance at favorable rates; and other risks and uncertainties set forth in the section titled “Risk Factors” in the Annual Report on Form 10-K filed by the Company with the SEC on March 1, 2024, and in its other filings made from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking

4

statements, and Advantage assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Non-GAAP Financial Measures and Related Information

This press release includes certain financial measures not presented in accordance with generally accepted accounting principles (“GAAP”), including Adjusted EBITDA from Continuing Operations, Adjusted EBITDA from Discontinued Operations, Adjusted EBITDA by Segment, Adjusted Unlevered Free Cash Flow and Net Debt. These are not measures of financial performance calculated in accordance with GAAP and may exclude items that are significant in understanding and assessing Advantage’s financial results. Therefore, the measures are in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP, and should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of profitability, liquidity or performance under GAAP. You should be aware that Advantage’s presentation of these measures may not be comparable to similarly titled measures used by other companies. Reconciliations of historical non-GAAP measures to their most directly comparable GAAP counterparts are included below.

Advantage believes these non-GAAP measures provide useful information to management and investors regarding certain financial and business trends relating to Advantage’s financial condition and results of operations. Advantage believes that the use of Adjusted EBITDA from Continuing Operations, Adjusted EBITDA from Discontinued Operations, Adjusted EBITDA by Segment, Adjusted Unlevered Free Cash Flow, and Net Debt provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing Advantage’s financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. Non-GAAP financial measures are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non-GAAP financial measures. Additionally, other companies may calculate non-GAAP measures differently, or may use other measures to calculate their financial performance, and therefore Advantage’s non-GAAP measures may not be directly comparable to similarly titled measures of other companies.

Adjusted EBITDA from Continuing Operations and Adjusted EBITDA from Discontinued Operations means net (loss) income before (i) interest expense (net), (ii) provision for (benefit from) income taxes, (iii) depreciation, (iv) amortization of intangible assets, (v) impairment of goodwill, (vi) changes in fair value of warrant liability, (vii) stock-based compensation expense, (viii) equity-based compensation of Karman Topco L.P., (ix) fair value adjustments of contingent consideration related to acquisitions, (x) acquisition and divestiture related expenses, (xi) (gain) loss on divestitures, (xii) reorganization expenses, (xiii) litigation expenses (recovery), (xiv) costs associated with COVID-19, net of benefits received, (xv) costs associated with (recovery from) the Take 5 Matter, (xvi) EBITDA for economic interests in investments and (xvii) other adjustments that management believes are helpful in evaluating our operating performance.

Adjusted EBITDA by Segment means, with respect to each segment, operating income (loss) before (i) depreciation, (ii) amortization of intangible assets, (iii) loss (gain) on divestitures, (iv) equity-based compensation of Karman Topco L.P., (v) stock-based compensation expense, (vi) fair value adjustments of contingent consideration related to acquisitions, (vii) acquisition and divestiture related expenses, (viii) costs associated with COVID-19, net of benefits received, (ix) EBITDA for economic interests in investments, (x) reorganization expenses, (xi) litigation expenses (recovery), (xii) costs associated with (recovery from) the Take 5 Matter and (xiii) other adjustments that management believes are helpful in evaluating our operating performance, in each case, attributable to such segment.

Adjusted Unlevered Free Cash Flow represents net cash provided by (used in) operating activities from continuing and discontinued operations less purchase of property and equipment as disclosed in the Statements of Cash Flows further adjusted by (i) cash payments for interest; (ii) cash paid for income taxes; (iii) cash received from interest rate derivatives (iv) cash paid for acquisition and divestiture related expenses; (v) cash paid for contingent earnout payments included in operating cash flow (vi) cash paid for reorganization expenses; (vii) cash paid for costs associated with COVID-19, net of benefits received; (viii) net effect of foreign currency fluctuations on cash; (ix) cash paid for costs associated with the Take 5 Matter; and (x) other adjustments that management believes are helpful in evaluating our operating performance. Adjusted Unlevered Free Cash Flow as a percentage of Adjusted EBITDA means Adjusted Unlevered Free Cash Flow divided by Adjusted EBITDA from Continuing Operations and Adjusted EBITDA from Discontinued Operations.

Net Debt represents the sum of the current portion of long-term debt and long-term debt, less cash and cash equivalents and debt issuance costs. With respect to Net Debt, cash and cash equivalents are subtracted from the GAAP measure, total debt, because they could be used to reduce the debt obligations. We present Net Debt because we believe this non-GAAP measure provides useful information to management and investors regarding certain financial and business

5

trends relating to the Company’s financial condition and to evaluate changes to the Company's capital structure and credit quality assessment.

Due to rounding, numbers presented throughout this document may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures.

This press release also includes certain estimates and projections of Adjusted EBITDA from Continuing Operations, including with respect to expected fiscal 2024 results. Due to the high variability and difficulty in making accurate estimates and projections of some of the information excluded from Adjusted EBITDA from Continuing Operations, together with some of the excluded information not being ascertainable or accessible, Advantage is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measures without unreasonable effort. Consequently, no disclosure of estimated or projected comparable GAAP measures is included and no reconciliation of such forward-looking non-GAAP financial measures is included.

6

Advantage Solutions Inc.

Consolidated Statements of Operations and Comprehensive (Loss) Income

(Unaudited)

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

||||||||||

(in thousands, except share and per share data) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Revenues |

|

$ |

873,357 |

|

|

$ |

963,758 |

|

|

$ |

1,734,769 |

|

|

$ |

1,888,471 |

|

Cost of revenues (exclusive of depreciation and amortization shown separately below) |

|

|

751,337 |

|

|

|

847,549 |

|

|

|

1,503,181 |

|

|

|

1,660,295 |

|

Selling, general, and administrative expenses |

|

|

62,858 |

|

|

|

48,481 |

|

|

|

151,939 |

|

|

|

103,881 |

|

Impairment of goodwill |

|

|

99,670 |

|

|

|

— |

|

|

|

99,670 |

|

|

|

— |

|

Depreciation and amortization |

|

|

51,317 |

|

|

|

52,477 |

|

|

|

101,065 |

|

|

|

105,021 |

|

(Income) loss from unconsolidated investments |

|

|

(566 |

) |

|

|

— |

|

|

|

123 |

|

|

|

— |

|

Total operating expenses |

|

|

964,616 |

|

|

|

948,507 |

|

|

|

1,855,978 |

|

|

|

1,869,197 |

|

Operating (loss) income from continuing operations |

|

|

(91,259 |

) |

|

|

15,251 |

|

|

|

(121,209 |

) |

|

|

19,274 |

|

Other (income) expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Change in fair value of warrant liability |

|

|

(686 |

) |

|

|

73 |

|

|

|

(399 |

) |

|

|

— |

|

Interest expense, net |

|

|

39,754 |

|

|

|

30,446 |

|

|

|

75,515 |

|

|

|

77,608 |

|

Total other expenses |

|

|

39,068 |

|

|

|

30,519 |

|

|

|

75,116 |

|

|

|

77,608 |

|

Loss from continuing operations before income taxes |

|

|

(130,327 |

) |

|

|

(15,268 |

) |

|

|

(196,325 |

) |

|

|

(58,334 |

) |

Benefit from income taxes for continuing operations |

|

|

(17,311 |

) |

|

|

(2,244 |

) |

|

|

(33,176 |

) |

|

|

(9,416 |

) |

Net loss from continuing operations |

|

|

(113,016 |

) |

|

|

(13,024 |

) |

|

|

(163,149 |

) |

|

|

(48,918 |

) |

Net income (loss) from discontinued operations, net of tax |

|

|

12,181 |

|

|

|

5,178 |

|

|

|

59,199 |

|

|

|

(6,606 |

) |

Net loss |

|

|

(100,835 |

) |

|

|

(7,846 |

) |

|

|

(103,950 |

) |

|

|

(55,524 |

) |

Less: net income from continuing operations attributable to noncontrolling interest |

|

|

— |

|

|

|

909 |

|

|

|

— |

|

|

|

909 |

|

Less: net income (loss) from discontinued operations attributable to noncontrolling interest |

|

|

— |

|

|

|

7 |

|

|

|

2,192 |

|

|

|

(84 |

) |

Net loss attributable to stockholders of Advantage Solutions Inc. |

|

$ |

(100,835 |

) |

|

$ |

(8,762 |

) |

|

$ |

(106,142 |

) |

|

$ |

(56,349 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net loss per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Basic loss per common share from continuing operations |

|

$ |

(0.35 |

) |

|

$ |

(0.04 |

) |

|

$ |

(0.51 |

) |

|

$ |

(0.15 |

) |

Basic earnings (loss) per common share from discontinued operations |

|

$ |

0.04 |

|

|

$ |

0.02 |

|

|

$ |

0.18 |

|

|

$ |

(0.02 |

) |

Basic loss per common share attributable to stockholders of Advantage Solutions Inc. |

|

$ |

(0.31 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.33 |

) |

|

$ |

(0.17 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Diluted net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Diluted loss per common share from continuing operations |

|

$ |

(0.35 |

) |

|

$ |

(0.04 |

) |

|

$ |

(0.51 |

) |

|

$ |

(0.15 |

) |

Diluted earnings (loss) per common share from discontinued operations |

|

$ |

0.04 |

|

|

$ |

0.02 |

|

|

$ |

0.18 |

|

|

$ |

(0.02 |

) |

Diluted loss per common share attributable to stockholders of Advantage Solutions Inc. |

|

$ |

(0.31 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.33 |

) |

|

$ |

(0.17 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Weighted-average number of common shares: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Basic |

|

|

322,791,242 |

|

|

|

324,178,691 |

|

|

|

322,124,698 |

|

|

|

322,665,312 |

|

Diluted |

|

|

322,791,242 |

|

|

|

324,178,691 |

|

|

|

322,124,698 |

|

|

|

322,665,312 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Comprehensive (Loss) Income: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net loss attributable to stockholders of Advantage Solutions Inc. |

|

$ |

(100,835 |

) |

|

$ |

(8,762 |

) |

|

$ |

(106,142 |

) |

|

$ |

(56,349 |

) |

Other comprehensive income, net of tax: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Foreign currency translation adjustments |

|

|

(2,340 |

) |

|

|

3,722 |

|

|

|

(5,057 |

) |

|

|

5,246 |

|

Total comprehensive loss attributable to stockholders of Advantage Solutions Inc. |

|

$ |

(103,175 |

) |

|

$ |

(5,040 |

) |

|

$ |

(111,199 |

) |

|

$ |

(51,103 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

7

Advantage Solutions Inc.

Consolidated Balance Sheet

(Unaudited)

|

|

June 30, |

|

|

December 31, |

|

||

(in thousands, except share data) |

|

2024 |

|

|

2023 |

|

||

ASSETS |

|

|

|

|

|

|

||

Current assets |

|

|

|

|

|

|

||

Cash and cash equivalents |

|

$ |

153,988 |

|

|

$ |

120,839 |

|

Restricted cash |

|

|

15,382 |

|

|

|

16,363 |

|

Accounts receivable, net of allowance for expected credit losses from continuing operations of $16,054 and $29,294 respectively |

|

|

647,397 |

|

|

|

659,499 |

|

Prepaid expenses and other current assets |

|

|

106,957 |

|

|

|

115,921 |

|

Current assets of discontinued operations |

|

|

152,892 |

|

|

|

99,412 |

|

Total current assets |

|

|

1,076,616 |

|

|

|

1,012,034 |

|

Property and equipment, net |

|

|

86,862 |

|

|

|

64,708 |

|

Goodwill |

|

|

610,521 |

|

|

|

710,191 |

|

Other intangible assets, net |

|

|

1,463,303 |

|

|

|

1,551,828 |

|

Investments in unconsolidated affiliates |

|

|

220,088 |

|

|

|

210,829 |

|

Other assets |

|

|

40,021 |

|

|

|

43,543 |

|

Other assets of discontinued operations |

|

|

— |

|

|

|

186,190 |

|

Total assets |

|

$ |

3,497,411 |

|

|

$ |

3,779,323 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

||

Current liabilities |

|

|

|

|

|

|

||

Current portion of long-term debt |

|

$ |

13,275 |

|

|

$ |

13,274 |

|

Accounts payable |

|

|

204,903 |

|

|

|

172,894 |

|

Accrued compensation and benefits |

|

|

138,890 |

|

|

|

161,447 |

|

Other accrued expenses |

|

|

118,895 |

|

|

|

144,415 |

|

Deferred revenues |

|

|

28,852 |

|

|

|

26,598 |

|

Current liabilities of discontinued operations |

|

|

4,136 |

|

|

|

22,669 |

|

Total current liabilities |

|

|

508,951 |

|

|

|

541,297 |

|

Long-term debt, net of current portion |

|

|

1,769,196 |

|

|

|

1,848,118 |

|

Deferred income tax liabilities |

|

|

174,179 |

|

|

|

204,136 |

|

Other long-term liabilities |

|

|

71,351 |

|

|

|

74,555 |

|

Other liabilities of discontinued operations |

|

|

— |

|

|

|

7,140 |

|

Total liabilities |

|

|

2,523,677 |

|

|

|

2,675,246 |

|

Commitments and contingencies (Note 9) |

|

|

|

|

|

|

||

Common stock, $0.0001 par value, 3,290,000,000 shares authorized; 323,020,596 and 322,235,261 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively |

|

|

32 |

|

|

|

32 |

|

Additional paid in capital |

|

|

3,452,358 |

|

|

|

3,449,261 |

|

Accumulated deficit |

|

|

(2,420,792 |

) |

|

|

(2,314,650 |

) |

Loans to Karman Topco L.P. |

|

|

(6,707 |

) |

|

|

(6,387 |

) |

Accumulated other comprehensive loss |

|

|

(11,433 |

) |

|

|

(3,945 |

) |

Treasury stock, at cost; 8,875,170 and 3,600,075 shares as of June 30, 2024 and December 31, 2023, respectively |

|

|

(39,724 |

) |

|

|

(18,949 |

) |

Total equity attributable to stockholders of Advantage Solutions Inc. |

|

|

973,734 |

|

|

|

1,105,362 |

|

Noncontrolling interest |

|

|

— |

|

|

|

(1,285 |

) |

Total stockholders’ equity |

|

|

973,734 |

|

|

|

1,104,077 |

|

Total liabilities, noncontrolling interest, and stockholders’ equity |

|

$ |

3,497,411 |

|

|

$ |

3,779,323 |

|

8

Advantage Solutions Inc.

Consolidated Statements of Cash Flows

(Unaudited)

|

|

Six Months Ended June 30, |

|

|||||

(in thousands) |

|

2024 |

|

|

2023 |

|

||

CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

|

|

|

||

Net loss |

|

$ |

(103,950 |

) |

|

$ |

(55,524 |

) |

Net income (loss) from discontinued operations, net of tax |

|

|

59,199 |

|

|

|

(6,606 |

) |

Net loss from continuing operations |

|

|

(163,149 |

) |

|

|

(48,918 |

) |

Adjustments to reconcile net loss to net cash provided by operating activities |

|

|

|

|

|

|

||

Noncash interest income |

|

|

(5,427 |

) |

|

|

(9,500 |

) |

Deferred financing fees related to repricing of long-term debt |

|

|

1,079 |

|

|

|

— |

|

Amortization of deferred financing fees |

|

|

3,470 |

|

|

|

4,238 |

|

Impairment of goodwill |

|

|

99,670 |

|

|

|

— |

|

Depreciation and amortization |

|

|

101,065 |

|

|

|

105,021 |

|

Change in fair value of warrant liability |

|

|

(399 |

) |

|

|

— |

|

Fair value adjustments related to contingent consideration |

|

|

1,678 |

|

|

|

8,969 |

|

Deferred income taxes |

|

|

(29,546 |

) |

|

|

(33,403 |

) |

Equity-based compensation of Karman Topco L.P. |

|

|

(480 |

) |

|

|

(3,487 |

) |

Stock-based compensation |

|

|

16,082 |

|

|

|

20,417 |

|

Loss from unconsolidated investments |

|

|

(123 |

) |

|

|

(3,002 |

) |

Distribution received from unconsolidated affiliates |

|

|

3,289 |

|

|

|

1,611 |

|

Gain on repurchases of Senior Secured Notes and Term Loan Facility debt |

|

|

(5,103 |

) |

|

|

(4,969 |

) |

Changes in operating assets and liabilities, net of effects from divestitures: |

|

|

|

|

|

|

||

Accounts receivable, net |

|

|

9,268 |

|

|

|

32,854 |

|

Prepaid expenses and other assets |

|

|

26,233 |

|

|

|

63,109 |

|

Accounts payable |

|

|

32,834 |

|

|

|

(35,944 |

) |

Accrued compensation and benefits |

|

|

(21,602 |

) |

|

|

2,435 |

|

Deferred revenues |

|

|

2,449 |

|

|

|

12,501 |

|

Other accrued expenses and other liabilities |

|

|

(27,233 |

) |

|

|

(11,523 |

) |

Net cash provided by operating activities from continuing operations |

|

|

44,055 |

|

|

|

100,409 |

|

Net cash provided by operating activities from discontinued operations |

|

|

6,368 |

|

|

|

4,581 |

|

Net cash provided by operating activities |

|

|

50,423 |

|

|

|

104,990 |

|

CASH FLOWS FROM INVESTING ACTIVITIES |

|

|

|

|

|

|

||

Purchase of investment in unconsolidated affiliates |

|

|

(10,932 |

) |

|

|

— |

|

Purchase of property and equipment |

|

|

(25,029 |

) |

|

|

(14,046 |

) |

Proceeds from divestitures, net of cash |

|

|

146,828 |

|

|

|

12,763 |

|

Net cash provided by (used in) investing activities from continuing operations |

|

|

110,867 |

|

|

|

(1,283 |

) |

Net cash used in investing activities from discontinued operations |

|

|

(7,332 |

) |

|

|

(4,506 |

) |

Net cash provided by (used in) investing activities |

|

|

103,535 |

|

|

|

(5,789 |

) |

CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

|

|

|

|

||

Borrowings under lines of credit |

|

|

— |

|

|

|

72,735 |

|

Payments on lines of credit |

|

|

— |

|

|

|

(71,278 |

) |

Principal payments on long-term debt |

|

|

(6,637 |

) |

|

|

(6,741 |

) |

Repurchases of Senior Secured Notes and Term Loan Facility debt |

|

|

(71,749 |

) |

|

|

(49,427 |

) |

Debt issuance costs |

|

|

(971 |

) |

|

|

— |

|

Proceeds from issuance of common stock |

|

|

1,167 |

|

|

|

1,193 |

|

Payments for taxes related to net share settlement under 2020 Incentive Award Plan |

|

|

(11,113 |

) |

|

|

(1,277 |

) |

Contingent consideration payments |

|

|

(4,455 |

) |

|

|

(1,867 |

) |

Holdback payments |

|

|

— |

|

|

|

(656 |

) |

Redemption of noncontrolling interest |

|

|

— |

|

|

|

(154 |

) |

Purchase of treasury stock |

|

|

(20,775 |

) |

|

|

— |

|

Net cash used in financing activities from continuing operations |

|

|

(114,533 |

) |

|

|

(57,472 |

) |

Net cash (used in) provided by financing activities from discontinued operations |

|

|

(4,243 |

) |

|

|

397 |

|

Net cash used in financing activities |

|

|

(118,776 |

) |

|

|

(57,075 |

) |

Net effect of foreign currency changes on cash from continuing operations |

|

|

(2,579 |

) |

|

|

1,843 |

|

Net effect of foreign currency changes on cash from discontinued operations |

|

|

(435 |

) |

|

|

(349 |

) |

Net effect of foreign currency changes on cash |

|

|

(3,014 |

) |

|

|

1,494 |

|

Net change in cash, cash equivalents and restricted cash |

|

|

32,168 |

|

|

|

43,620 |

|

Cash, cash equivalents and restricted cash, beginning of period |

|

|

137,202 |

|

|

|

138,532 |

|

Cash, cash equivalents and restricted cash, end of period |

|

|

169,370 |

|

|

|

182,152 |

|

Less: Cash, cash equivalents and restricted cash of discontinued operations |

|

|

— |

|

|

|

2,824 |

|

Cash, cash equivalents and restricted cash, end of period |

|

$ |

169,370 |

|

|

$ |

179,328 |

|

SUPPLEMENTAL CASH FLOW INFORMATION |

|

|

|

|

|

|

||

(Gain) loss on divestitures from discontinued operations |

|

$ |

(70,195 |

) |

|

$ |

17,655 |

|

Purchase of property and equipment recorded in accounts payable and accrued expenses |

|

$ |

10,660 |

|

|

$ |

1,507 |

|

9

Advantage Solutions Inc.

Reconciliation of Net Income (Loss) to Adjusted EBITDA

(Unaudited)

Continuing Operations |

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

||||||||||

(in thousands) |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

||||

Net loss from continuing operations |

$ |

(113,016 |

) |

|

$ |

(13,024 |

) |

|

$ |

(163,149 |

) |

|

$ |

(48,918 |

) |

Add: |

|

|

|

|

|

|

|

|

|

|

|

||||

Interest expense, net |

|

39,754 |

|

|

|

30,446 |

|

|

|

75,515 |

|

|

|

77,608 |

|

Benefit from income taxes |

|

(17,311 |

) |

|

|

(2,244 |

) |

|

|

(33,176 |

) |

|

|

(9,416 |

) |

Depreciation and amortization |

|

51,317 |

|

|

|

52,477 |

|

|

|

101,065 |

|

|

|

105,021 |

|

Impairment of goodwill |

|

99,670 |

|

|

|

— |

|

|

|

99,670 |

|

|

|

— |

|

Change in fair value of warrant liability |

|

(686 |

) |

|

|

73 |

|

|

|

(399 |

) |

|

|

— |

|

Stock-based compensation expense(h) |

|

7,528 |

|

|

|

10,012 |

|

|

|

16,082 |

|

|

|

20,417 |

|

Equity-based compensation of Karman Topco L.P.(a) |

|

(872 |

) |

|

|

(1,218 |

) |

|

|

(480 |

) |

|

|

(3,487 |

) |

Fair value adjustments related to contingent consideration related to acquisitions(b) |

|

900 |

|

|

|

4,648 |

|

|

|

1,678 |

|

|

|

8,969 |

|

Acquisition and divestiture related expenses(c) |

|

(1,774 |

) |

|

|

395 |

|

|

|

(1,334 |

) |

|

|

2,732 |

|

Reorganization expenses(d) |

|

20,291 |

|

|

|

5,794 |

|

|

|

55,343 |

|

|

|

16,932 |

|

Litigation (recovery) expenses(e) |

|

(993 |

) |

|

|

4,350 |

|

|

|

(709 |

) |

|

|

4,350 |

|

Costs associated with COVID-19, net of benefits received(f) |

|

— |

|

|

|

2,317 |

|

|

|

— |

|

|

|

3,334 |

|

Costs associated with the Take 5 Matter, net of (recoveries)(g) |

|

456 |

|

|

|

(1,576 |

) |

|

|

696 |

|

|

|

(1,496 |

) |

EBITDA for economic interests in investments(i) |

|

4,634 |

|

|

|

(2,596 |

) |

|

|

9,737 |

|

|

|

(3,940 |

) |

Adjusted EBITDA from Continuing Operations |

$ |

89,898 |

|

|

$ |

89,854 |

|

|

$ |

160,539 |

|

|

$ |

172,106 |

|

Discontinued Operations |

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

||||||||||

(in thousands) |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

||||

Net income (loss) from discontinued operations |

$ |

12,181 |

|

|

$ |

5,178 |

|

|

$ |

59,199 |

|

|

$ |

(6,606 |

) |

Add: |

|

|

|

|

|

|

|

|

|

|

|

||||

Interest expense, net |

|

16 |

|

|

|

14 |

|

|

|

48 |

|

|

|

43 |

|

Benefit from income taxes |

|

(2,377 |

) |

|

|

1,828 |

|

|

|

11,860 |

|

|

|

1,304 |

|

Depreciation and amortization |

|

1,883 |

|

|

|

4,261 |

|

|

|

4,491 |

|

|

|

8,821 |

|

Fair value adjustments related to contingent consideration related to acquisitions(b) |

|

1,972 |

|

|

|

420 |

|

|

|

1,883 |

|

|

|

391 |

|

Acquisition and divestiture related expenses(c) |

|

2,224 |

|

|

|

103 |

|

|

|

3,103 |

|

|

|

198 |

|

(Gain) loss on divestitures |

|

(13,179 |

) |

|

|

1,158 |

|

|

|

(70,195 |

) |

|

|

17,655 |

|

Reorganization expenses(d) |

|

5,211 |

|

|

|

43 |

|

|

|

7,285 |

|

|

|

53 |

|

Stock-based compensation expense(h) |

|

102 |

|

|

|

1,214 |

|

|

|

(1,232 |

) |

|

|

2,019 |

|

EBITDA for economic interests in investments(i) |

|

(95 |

) |

|

|

139 |

|

|

|

(385 |

) |

|

|

298 |

|

Adjusted EBITDA from Discontinued Operations |

$ |

7,938 |

|

|

$ |

14,358 |

|

|

$ |

16,057 |

|

|

$ |

24,176 |

|

Branded Services Segment |

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

||||||||||

(in thousands) |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

||||

Operating (loss) income from continuing operations |

$ |

(107,280 |

) |

|

$ |

8,920 |

|

|

$ |

(129,398 |

) |

|

$ |

12,206 |

|

Add: |

|

|

|

|

|

|

|

|

|

|

|

||||

Depreciation and amortization |

|

32,327 |

|

|

|

35,609 |

|

|

|

64,314 |

|

|

|

71,181 |

|

Impairment of goodwill |

|

99,670 |

|

|

|

— |

|

|

|

99,670 |

|

|

|

— |

|

Stock-based compensation expense(h) |

|

2,797 |

|

|

|

4,318 |

|

|

|

6,723 |

|

|

|

7,620 |

|

Equity-based compensation of Karman Topco L.P(a) |

|

24 |

|

|

|

(463 |

) |

|

|

522 |

|

|

|

(1,484 |

) |

Fair value adjustments related to contingent consideration related to acquisitions(b) |

|

900 |

|

|

|

4,632 |

|

|

|

1,678 |

|

|

|

8,953 |

|

Acquisition and divestiture related expenses(c) |

|

30 |

|

|

|

258 |

|

|

|

104 |

|

|

|

1,325 |

|

Reorganization expenses(d) |

|

9,248 |

|

|

|

3,015 |

|

|

|

22,904 |

|

|

|

9,550 |

|

Litigation (recovery) expenses(e) |

|

50 |

|

|

|

— |

|

|

|

241 |

|

|

|

— |

|

Costs associated with COVID-19, net of benefits received(f) |

|

— |

|

|

|

(361 |

) |

|

|

— |

|

|

|

(332 |

) |

Costs associated with the Take 5 Matter, net of (recoveries)(g) |

|

456 |

|

|

|

(1,576 |

) |

|

|

696 |

|

|

|

(1,496 |

) |

EBITDA for economic interests in investments (i) |

|

4,634 |

|

|

|

(2,565 |

) |

|

|

9,737 |

|

|

|

(3,935 |

) |

Branded Services Segment Adjusted EBITDA |

$ |

42,856 |

|

|

$ |

51,787 |

|

|

$ |

77,191 |

|

|

$ |

103,588 |

|

10

Experiential Services Segment |

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

||||||||||

(in thousands) |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

||||

Operating income from continuing operations |

$ |

6,453 |

|

|

$ |

4,805 |

|

|

$ |

2,811 |

|

|

$ |

479 |

|

Add: |

|

|

|

|

|

|

|

|

|

|

|

||||

Depreciation and amortization |

|

11,015 |

|

|

|

9,002 |

|

|

|

20,935 |

|

|

|

18,065 |

|

Stock-based compensation expense(h) |

|

2,170 |

|

|

|

(646 |

) |

|

|

4,098 |

|

|

|

(1,082 |

) |

Equity-based compensation of Karman Topco L.P(a) |

|

(458 |

) |

|

|

(358 |

) |

|

|

(502 |

) |

|

|

(905 |

) |

Fair value adjustments related to contingent consideration related to acquisitions(b) |

|

— |

|

|

|

7 |

|

|

|

— |

|

|

|

7 |

|

Acquisition and divestiture related expenses(c) |

|

(101 |

) |

|

|

48 |

|

|

|

5 |

|

|

|

422 |

|

Reorganization expenses(d) |

|

3,472 |

|

|

|

1,304 |

|

|

|

11,724 |

|

|

|

3,270 |

|

Litigation (recovery) expenses(e) |

|

60 |

|

|

|

— |

|

|

|

233 |

|

|

|

— |

|

Costs associated with COVID-19, net of benefits received(f) |

|

— |

|

|

|

2,040 |

|

|

|

— |

|

|

|

2,952 |

|

Experiential Services Segment Adjusted EBITDA |

$ |

22,611 |

|

|

$ |

16,202 |

|

|

$ |

39,304 |

|

|

$ |

23,208 |

|

Retailer Services Segment |

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

||||||||||

(in thousands) |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

||||

Operating income from continuing operations |

$ |

9,568 |

|

|

$ |

1,526 |

|

|

$ |

5,378 |

|

|

$ |

6,589 |

|

Add: |

|

|

|

|

|

|

|

|

|

|

|

||||

Depreciation and amortization |

|

7,975 |

|

|

|

7,866 |

|

|

|

15,816 |

|

|

|

15,775 |

|

Stock-based compensation expense(h) |

|

2,561 |

|

|

|

6,340 |

|

|

|

5,261 |

|

|

|

13,879 |

|

Equity-based compensation of Karman Topco L.P(a) |

|

(438 |

) |

|

|

(397 |

) |

|

|

(500 |

) |

|

|

(1,098 |

) |

Fair value adjustments related to contingent consideration related to acquisitions(b) |

|

— |

|

|

|

9 |

|

|

|

— |

|

|

|

9 |

|

Acquisition and divestiture related expenses(c) |

|

(1,703 |

) |

|

|

89 |

|

|

|

(1,443 |

) |

|

|

985 |

|

Reorganization expenses(d) |

|

7,571 |

|

|

|

1,475 |

|

|

|

20,715 |

|

|

|

4,112 |

|

Litigation (recovery) expenses(e) |

|

(1,103 |

) |

|

|

4,350 |

|

|

|

(1,183 |

) |

|

|

4,350 |

|

Costs associated with COVID-19, net of benefits received(f) |

|

— |

|

|

|

638 |

|

|

|

— |

|

|

|

714 |

|

EBITDA for economic interests in investments(i) |

|

— |

|

|

|

(31 |

) |

|

|

— |

|

|

|

(5 |

) |

Retailer Services Segment Adjusted EBITDA |

$ |

24,431 |

|

|

$ |

21,865 |

|

|

$ |

44,044 |

|

|

$ |

45,310 |

|

11

Advantage Solutions Inc.

Adjusted Unlevered Free Cash Flow Reconciliation

(Unaudited)

(in thousands) |

|

Three Months Ended June 30, 2024 |

|

|

Net cash (used in) provided by operating activities |

|

$ |

58,257 |

|

Less: |

|

|

|

|

Purchase of property and equipment |

|

|

(15,196 |

) |

Cash received from interest rate derivatives |

|

|

(7,959 |

) |

Add: |

|

|

|

|

Cash payments for interest |

|

|

55,764 |

|

Cash payments for income taxes |

|

|

6,430 |

|

Cash paid for acquisition and divestiture related expenses(j) |

|

|

1,939 |

|

Cash paid for reorganization expenses(k) |

|

|

22,093 |

|

Cash paid for contingent consideration included in operating activities(l) |

|

|

7,327 |

|

Cash paid (received) for costs associated with (recovery from) the Take 5 Matter (n) |

|

|

696 |

|

Net effect of foreign currency fluctuations on cash |

|

|

(568 |

) |

Adjusted Unlevered Free Cash Flow |

|

$ |

128,783 |

|

|

|

|

|

|

|

|

Three Months Ended June 30, 2024 |

|

|

(amounts in thousands) |

|

|

|

|

Numerator - Adjusted Unlevered Free Cash Flow |

|

$ |

128,783 |

|

Denominator - Adjusted EBITDA from Continuing and Discontinued Operations |

|

$ |

97,836 |

|

Adjusted Unlevered Free Cash Flow as a percentage of Adjusted EBITDA |

|

|

131.6 |

% |

12

Advantage Solutions Inc.

Reconciliation of Total Debt to Net Debt

(Unaudited)

(amounts in thousands) |

|

June 30, 2024 |

|

|

Current portion of long-term debt |

|

$ |

13,275 |

|

Long-term debt, net of current portion |

|

|

1,769,196 |

|

Less: Debt issuance costs |

|

|

25,573 |

|

Total Debt |

|

$ |

1,808,044 |

|

Less: Cash and cash equivalents |

|

|

(153,988 |

) |

Total Net Debt |

|

$ |

1,654,056 |

|

|

|

|

|

|

LTM Adjusted EBITDA from Continuing and Discontinued Operations |

|

$ |

404,661 |

|

Net Debt / LTM Adjusted EBITDA ratio |

|

4.1x |

|

|

_______________________

(a) |

Represents non-cash compensation expense related to performance stock units, restricted stock units, and stock options under the 2020 Advantage Solutions Incentive Award Plan and the Advantage Solutions 2020 Employee Stock Purchase Plan. |

(b) |

Represents expenses related to (i) equity-based compensation expense associated with grants of Common Series D Units of Topco made to one of the Advantage Sponsors, and (ii) equity-based compensation expense associated with the Common Series C Units of Topco. |

(c) |

Represents adjustments to the estimated fair value of our contingent consideration liabilities related to our acquisitions, for the applicable periods. |

(d) |

Represents fees and costs associated with activities related to our acquisitions, divestitures, and related reorganization activities, including professional fees, due diligence, and integration activities. |

(e) |

Represents fees and costs associated with various internal reorganization activities, including professional fees, lease exit costs, severance, and nonrecurring compensation costs. |

(f) |

Represents legal settlements, reserves, and expenses that are unusual or infrequent costs associated with our operating activities. |

(g) |

Represents (i) costs related to implementation of strategies for workplace safety in response to COVID-19, including employee-relief fund, additional sick pay for front-line associates, medical benefit payments for furloughed associates, and personal protective equipment; and (ii) benefits received from government grants for COVID-19 relief. |

(h) |

Represents cash receipts from an insurance policy for claims related to the Take 5 Matter and costs associated with investigation and remediation activities related to the Take 5 Matter, primarily, professional fees and other related costs. |

(i) |

Represents additions to reflect our proportional share of Adjusted EBITDA related to our equity method investments and reductions to remove the Adjusted EBITDA related to the minority ownership percentage of the entities that we fully consolidate in our financial statements. |

(j) |

Represents cash paid for fees and costs associated with activities related to our acquisitions, divestitures and reorganization activities including professional fees, due diligence, and integration activities. |

(k) |

Represents cash paid for fees and costs associated with various reorganization activities, including professional fees, lease exit costs, severance, and nonrecurring compensation costs. |

(l) |

Represents cash paid included in operating cash flow for our contingent consideration liabilities related to our acquisitions. |

(m) |

Represents cash paid or (cash received) for (a) costs related to implementation of strategies for workplace safety in response to COVID-19, including additional sick pay for front-line associates and personal protective equipment; and (b) benefits received from government grants for COVID-19 relief. |

(n) |

Represents cash paid for costs associated with the Take 5 Matter, primarily, professional fees and other related costs. |

|

|

Investor Contacts:

Ruben Mella

ruben.mella@advantagesolutions.net

Media Contacts:

Peter Frost

peter.frost@advantagesolutions.net

13

2Q 2024 Earnings Presentation August 7, 2024