Aedifica NV/SA: Annual press release – 2021 annual results

23/02/2022 6:30am

GlobeNewswire Inc.

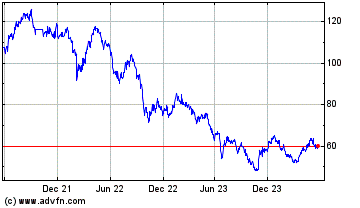

Aedifica (EU:AED)

Historical Stock Chart

From Jul 2021 to Jul 2024

Please find below a press release from Aedifica (a public regulated real estate company under Belgian law, listed on Euronext Brussels and Euronext Amsterdam), regarding the 2021 annual results.

- EPRA Earnings* amounted to €151.5 million as of 31 December 2021 (+30% compared to 31 December 2020), or €4.35/share

- Rental income increased to €232.1 million as of 31 December 2021 (+24% compared to 31 December 2020)

- Confirmation of the proposed dividend of €3.40/share (gross)

- Real estate portfolio* of approx. €4.9 billion as of 31 December 2021, an increase of approx. €1.1 billion (+28%) compared to 31 December 2020, the end of the previous financial year

- 587 healthcare sites for 44,000 users across 8 countries:

- €1,213 million in Belgium (83 sites)

- €1,058 million in Germany (101 sites)

- €860 million in Finland (198 sites)

- €822 million in the United Kingdom (102 sites)

- €564 million in the Netherlands (72 sites)

- €92 million in Ireland (9 sites)

- €78 million in Sweden (22 sites)

- Investment programme of €767 million in construction and renovation projects. In 2021, 41 projects were delivered for a total investment budget of approx. €289 million

- Weighted average unexpired lease term of 20 years and occupancy rate of 100%

- More than €330 million raised on capital markets through a capital increase via an accelerated private placement (€286 million) and 2 contributions in kind

- 42.6% debt-to-assets ratio as of 31 December 2021

- First issuer credit rating from S&P Global: BBB with a stable outlook

- Successful issuance of inaugural €500 million Sustainability Bond

- Outlook for the 2022 financial year: proposed dividend of €3.70/share (gross)

-

Press release EN

-

Communiqué de presse FR

-

Persbericht NL