We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Share Name | Share Symbol | Market | Type |

|---|---|---|---|

| Golden Shield Resources Inc | CSE:GSRI | CSE | Common Stock |

| Price Change | % Change | Share Price | Bid Price | Offer Price | High Price | Low Price | Open Price | Shares Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|---|---|

| -0.005 | -12.50% | 0.035 | 0.035 | 0.04 | 0.04 | 0.035 | 0.04 | 371,000 | 19:33:16 |

GOLDEN SHIELD PROVIDES UPDATE ON EXPLORATION ACTIVITIES

AT MARUDI PROJECT

Vancouver, British Columbia, Canada -- February 23, 2022 -- InvestorsHub NewsWire -- Golden Shield Resources Inc. (CSE:GSRI) (the "Company" or "Golden Shield") is pleased to announce that it has completed an initial drill program consisting of 2,364 metres of diamond drilling in 13 drill holes (the "Initial Drill Program") at the Company's Marudi Mountain gold project (the "Marudi Project"). The Marudi Project, located in the Rupununi District of southwestern Guyana, covers 5,457 hectares. Exploration activities at the Marudi Project can be conducted year-round. Gold mineralization at the Marudi Project is hosted in Proterozoic greenstones and occurs within a distinctive quartzite unit. Samples from the Initial Drill Program have been submitted to Activation Laboratories Ltd. ("Actlabs") in Guyana, and the Company expects to disseminate results in the coming weeks.

Hilbert Shields, Chief Executive Officer of the Company commented "The Marudi Project is a large property and earlier exploration efforts focused mostly on the Mazoa Hill area. Golden Shield geologists have quickly gained a strong understanding of mineralization controls and are discovering new areas that will be explored and drill-tested. We feel confident that the Marudi Project has significant exploration potential".

Mazoa Hill Zone

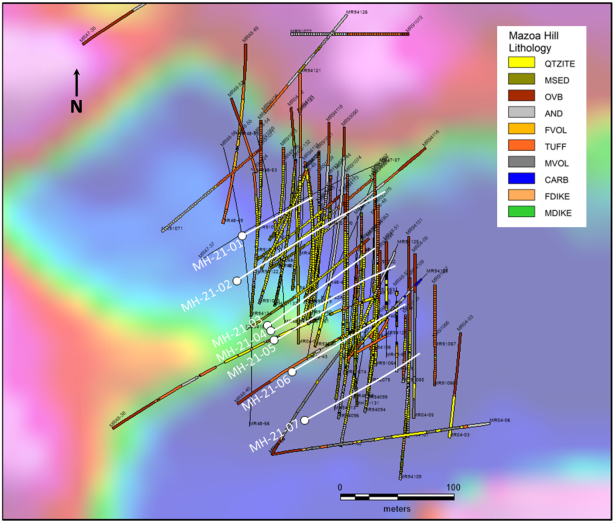

As part of the Initial Drill Program, seven holes (1,516 metres) were drilled at the Mazoa Hill zone of the Marudi Project ("Mazoa Hill"). The Company's geologists interpret mineralization at Mazoa Hill to occur in a series of en-echelon zones and recent drilling infilled areas of sparse drilling within these, as well as stepping out into the footwall to the east.

A historical mineral resource estimate on Mazoa Hill1 (the "Historical Resource Estimate") specified total indicated resources of 259,100 ounces of gold and inferred resources of 86,200 ounces of gold1,2 (for details on resource categories, tonnages and grades see Table 1).

A qualified person has not done sufficient work to classify the Historical Resource Estimate as a current resource and the Company is not treating the Historical Resource Estimate as a current resource. Significant data compilation, re-drilling, re-sampling and data verification may be required by a qualified person before the Historical Resource Estimate can be classified as a current resource.

The Historical Resource Estimate was based on approximately 63 drillholes that intersected a northwest striking, steeply dipping mineralized quartzite unit over a strike length of approximately 300 metres.

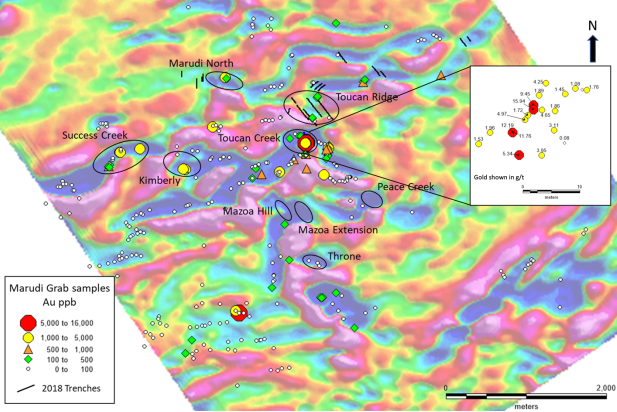

Figure 1. Marudi Project; Map

The following map shows heli-magnetic first derivative results, grab sample results and locations of main prospects. Trenches appear as black lines with those appearing in Table 2 labelled.

Table 1. Mazoa Hill; Historical Mineral Resource Estimate1,2

|

Category |

Tonnes |

Au Capped g/t |

Au Uncapped g/t |

Ounces - Capped |

Ounces - Uncapped |

|

Indicated |

4,428,000 |

1.8 |

1.9 |

259,100 |

269,700 |

|

Inferred |

1,653,000 |

1.6 |

1.6 |

86,200 |

87,600 |

Notes:

(1) Source: G. Mosher, P. Geo., 2018. "Marudi Property Mazoa Hill Mineral Resource Estimate", NI 43-101 technical report prepared for Guyana Goldstrike Inc. The Historical Resource Estimate was based on the following assumptions: (a) open pit resources were stated as contained within a conceptual open pit above a 0.50 g/t Au cut-off; (b) pit constraints were based on an assumed gold price of US$1,500/oz., mining cost of US$2.30/t and processing cost of US$16.80/t; (c) assay grades were capped at 30 g/t Au; (d) mineral resource tonnage and contained metal were rounded to reflect the accuracy of the estimate, and numbers may not add due to rounding; (e) mineral resource tonnage and grades were reported as undiluted; and (f) contained Au ounces are in-situ and did not include recovery losses.

(2) Readers are cautioned that the Historical Resource Estimate is considered historical in nature and as such is based on prior data and reports prepared by a previous property owner. A qualified person has not done sufficient work to classify the Historical Resource Estimate as a current resource and the Company is not treating the Historical Resource Estimate as a current resource. Significant data compilation, re-drilling, re-sampling and data verification may be required by a qualified person before the Historical Resource Estimate can be classified as a current resource. There can be no assurance that the historical mineral resource, in-whole or in part, will ever become economically viable. In addition, mineral resources are not mineral reserves and do not have demonstrated economic viability. Even if classified as a current resource, there is no certainty as to whether further exploration will result in any inferred mineral resources being upgraded to an indicated or measured mineral resource category.

Figure 2. Marudi Project; Drill Map

The following map shows colored heli-magnetic first derivative results and the Company's drilling in white and historic drilling colored by lithology, with mineralized quartzite shown in yellow.

Toucan Creek and Ridge Zones

As part of the Initial Drill Program, six holes (848 metres) were drilled at the Toucan Creek zone of the Marudi Project ("Toucan Creek") where no previous drilling had taken place.

Here, a similar quartzite to that at Mazoa Hill is exposed at surface and 19 recent grab samples taken over an area of 25m x 20m returned 13 values above 1.50g/t gold, with a highest value of 15.94g/t gold and an average of 4.26g/t gold.

At Toucan Ridge, which is located approximately 400 metres to the northeast of Toucan Creek, four historical trenches3, TTR-18-5, TTR-18-7, TTR-18-8 and TTR-18-9 returned the results3,4 shown in Table 2 and located in Figure 1. The Company plans to test the area connecting Toucan Creek and Toucan Ridge by completing trenching and drilling.

Table 2. Toucan Ridge; Historical Trenching Results3,4

|

Trench Name |

Interval (m) |

# of samples |

Average gold Grade (g/t) |

|

TTR-18-5 |

3 |

1 |

3.48 |

|

TTR-18-7 |

3 |

1 |

4.91 |

|

TTR-18-7 |

3 |

1 |

5.32 |

|

TTR-18-8 |

3 |

1 |

5.40 |

|

TTR-18-8 |

6 |

2 |

5.04 |

|

TTR-18-9 |

3 |

1 |

3.63 |

|

TTR-18-9 |

3 |

1 |

2.36 |

|

TTR-18-9 |

11.40 |

4 |

2.70 |

Notes:

(3) Source: Romanex internal report, 2018.

(4) The data disclosed above relating to trenching results is historical in nature. Neither the Company nor a qualified person has yet verified this data and therefore investors should not place undue reliance on such data. The Company's future exploration work will include verification of the data.

Since January 2022, the Company's geologists have been undertaking an extensive property mapping and sampling program designed to identify additional drill targets at the Marudi Project. This has involved a series of traverses across target areas identified from the interpretation of geophysical data. Drilling on the Marudi Project is scheduled to continue in March.

Quality Assurance

All Golden Shield sample assay results were sent to Actlabs' ISO-17025 certified laboratory in Georgetown, Guyana for preparation and analysis. Gold content is determined by fire assay of a 30-gram charge with atomic absorption analysis following an Aqua Regia digestion. Samples returning gold assays above 10 parts per million are re-analyzed using a 50-gram fire assay fusion with gravimetric finish. Actlabs is independent from Golden Shield and the Company is not aware of any sampling or other factors that could materially affect the accuracy or reliability of the data referred to herein.

Qualified Person

Leo Hathaway, P. Geo, Executive Chair of Golden Shield and a Qualified Person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has reviewed, verified and approved the scientific and technical information in this news release and has verified the data underlying that scientific and technical information.

About Golden Shield

Golden Shield Resources was founded by experienced professionals who are convinced that Guyana is highly prospective for gold. The Company is well-financed and has operates three high grade gold projects; the Marudi, Arakaka and Fish Creek projects. Additional information can be found on the Company's website: www.goldenshield.ca

For further information, please contact:

Leo Hathaway

Executive Chair

Email: info@goldenshield.ca

Telephone: +1 778-654-9665

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release includes certain "Forward-Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" under applicable Canadian securities laws. When used in this news release, the words "anticipate", "believe", "estimate", "expect", "target", "plan", "forecast", "may", "would", "could", "schedule" and similar words or expressions, identify forward-looking statements or information. These forward-looking statements or information relate to, among other things: the exploration and development of the Company's mineral projects; and release of drilling results.

Forward-looking statements and forward-looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of Golden Shield, future growth potential for Golden Shield and its business, and future exploration plans are based on management's reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management's experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of gold and other metals; no escalation in the severity of the COVID-19 pandemic; costs of exploration and development; the estimated costs of development of exploration projects; Golden Shield's ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect Golden Shield's respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements or forward-looking information and Golden Shield has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the Company's dependence on one mineral project; precious metals price volatility; risks associated with the conduct of the Company's mineral exploration activities in Guyana; regulatory, consent or permitting delays; risks relating to reliance on the Company's management team and outside contractors; risks regarding mineral resources and reserves; the Company's inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of COVID-19; the economic and financial implications of COVID-19 to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company's interactions with surrounding communities and artisanal miners; the Company's ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified under the caption "Risk Factors" in Golden Shield's management discussion and analysis. Readers are cautioned against attributing undue certainty to forward-looking statements or forward-looking information. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

1 Year Golden Shield Resources Chart |

1 Month Golden Shield Resources Chart |

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions