We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Share Name | Share Symbol | Market | Type |

|---|---|---|---|

| Viveon Health Acquisition Corp | AMEX:VHAQ | AMEX | Common Stock |

| Price Change | % Change | Share Price | High Price | Low Price | Open Price | Shares Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|

| 0.00 | 0.00% | 10.81 | 0 | 00:00:00 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 12, 2023 and May 12, 2024

Viveon Health Acquisition Corp.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 001-39827 | 85-2788202 | ||

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

3480 Peachtree Road NE

2nd Floor - Suite #112

Atlanta, Georgia 30326

(Address of Principal Executive Offices and Zip Code)

Registrant’s telephone number, including area code: (404) 861-5393

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Units | VHAQU | NYSE American, LLC ** | ||

| Common Stock | VHAQ | NYSE American, LLC ** | ||

| Warrants | VHAQW | * | ||

| Rights | VHAQR | NYSE American, LLC ** |

* The Warrants trade on the OTC Pink Marketplace maintained by the OTC Markets Group, Inc.

** The Units, Common Stock and Rights remain listed on the NYSE American pending the outcome of an appeal. Although trading has been suspended on the NYSE American, the securities are currently traded on the OTC Pink Marketplace maintained by the OTC Markets Group, Inc.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

The disclosure set forth in Item 2.03 of this Current Report on Form 8-K is incorporated by reference herein.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

On May 12, 2023, Viveon Health Acquisition Corp. (the “Company”) entered into an unsecured promissory note with Clearday, Inc. (the “Clearday Note”). The Clearday Note is non-interest bearing, and was due to mature upon the earlier of (i) the first anniversary of the issuance date and (ii) the date of the closing of the Company’s proposed business combination with Clearday pursuant to the terms of the Merger Agreement (the “Business Combination”), dated as of April 5, 2023 (the “Merger Agreement”), as amended on August 28, 2023 (the “First Amendment”), by and among the Company, Clearday, VHAC2 Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Viveon, Viveon Health LLC, a Delaware limited liability company, and Clearday SR LLC, a Delaware limited liability company. The Merger Agreement and the First Amendment were previously disclosed on Form 8-K filed on April 11, 2023, and Form 8-K filed on August 29, 2023, respectively.

The Clearday Note may be prepaid, in whole or in part, at any time and from time to time, without penalty or premium. The principal loan amount is convertible, at the option of Clearday, into securities of the Company. Loans are made from time to time under the note, and no fixed principal loan amount or maximum loan amount has been determined. As loans are made to the Company, a notation of such amount is made on Annex A of the Clearday Note.

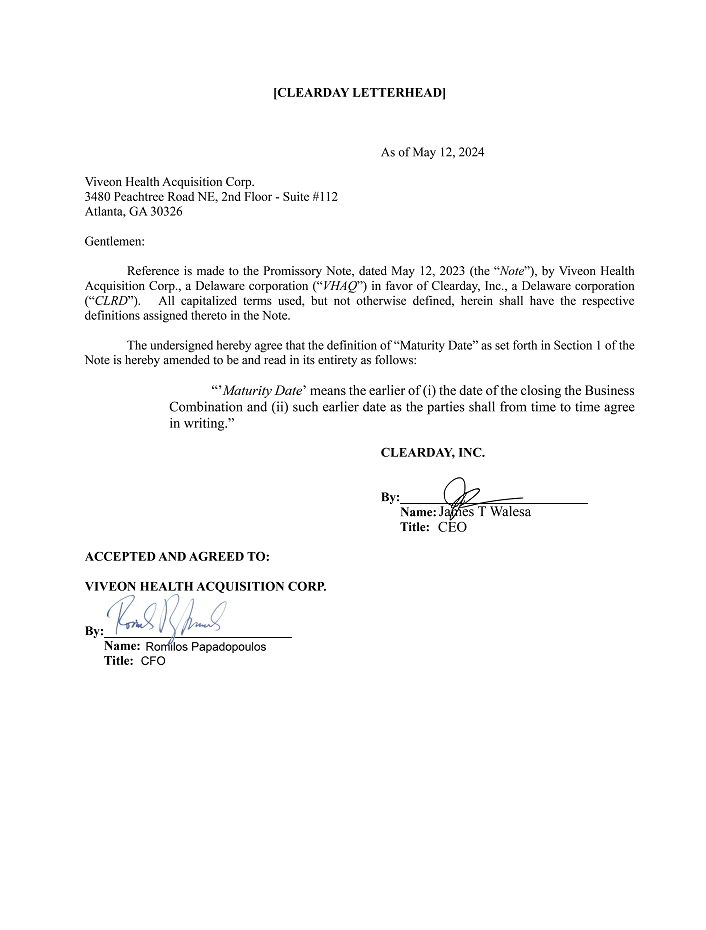

On May 12, 2024 the Company and Clearday entered into an agreement (the “Extension”) to extend the maturity date of the Clearday Note to the earlier of (i) the date of the closing the Business Combination and (ii) such earlier date as the parties shall from time to time agree in writing.

The foregoing descriptions of the Clearday Note and the Extension do not purport to be complete and are qualified in their entirety by references to the Clearday Note, filed by incorporation as Exhibit 10.1 to this Form 8-K and the Extension filed as Exhibit 10.2 to this Form 8-K, respectively, and are incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

| Exhibit | Description | |

| 10.1 | Clearday Note (incorporated by reference to Exhibit 10.22 to the Annual Report on Form 10-K/A for the fiscal year ended December 31, 2022, filed with the Securities & Exchange Commission on February 21, 2024). | |

| 10.2 | Extension of Clearday Note | |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| VIVEON HEALTH ACQUISITION CORP. | ||

| Date: June 5, 2024 | By: | /s/ Rom Papadopoulos |

| Name: | Rom Papadopoulos | |

| Title: | Chief Financial Officer | |

Exhibit 10.2

1 Year Viveon Health Acquisition Chart |

1 Month Viveon Health Acquisition Chart |

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions