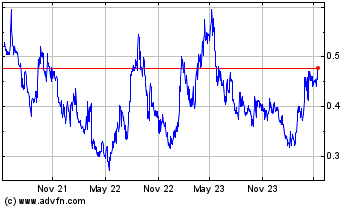

TRX Gold (AMEX:TRX)

Historical Stock Chart

From Apr 2021 to Apr 2024

Tanzanian Gold Corporation (TSX:TNX) (NYSE American:TRX) (TanGold or the Company) today reported its results for the fourth quarter (“Q4 2021”) and year end 2021. Financial results will be available on the Company’s website on or before November 30, 2021. Major Highlights Include:

- Significant Exploration Potential: Discovery of two new gold bearing shear zones in the Buckreef West and Anfield Zones. Assuming successful exploration results from ongoing diamond drilling, both new zones and the Buckreef Main Zone have the potential to significantly add to the 2.0 million ounces of gold in the measured and indicated mineral resources category and 0.6 million ounces of gold contained in inferred mineral resource category.

- Low Cost, High Return Production Expansions: The capital cost of the 360 tpd gold processing plant expansion was $1.6 million, which is expected to increase production to 750-800 ounces of gold per month1 at a total average Cash Cost2 of US$725-825/oz once steady state processing has been achieved. Assuming a gold price of US$1,750 per ounce, the project exhibits a quick capital payback and high operating return. The 1,000+ tpd expansion is estimated to have a capital cost of approximately US$4.0 million, with a targeted completion in calendar Q2/Q3 2022. The 360 tpd gold processing plant expansion was completed in-house in approximately 5 months, on-time and on-budget.

- Improved Liquidity Profile: Recapitalization of the Balance Sheet and execution of low-cost, high return gold production expansion projects.

- De-risked Production: Achievement of +90% recovery rates in the gold (oxide) test plant.

- Simple Processing Technology: Preliminary metallurgical test work on the sulphide project indicates a straightforward flowsheet similar to the CIL plants currently in operation and at comparable gold recovery rates.

- Solid ESG Credentials: Buckreef Gold: (i) is connected to the national electricity grid which primarily sources electricity from hydroelectric facilities; (ii) recycles all water and has no water discharge from operations; (iii) focuses on maximizing local content; (iv) exhibits a ‘100 mile diet’ by sourcing food locally; and (v) CSR activity is focused on local education and health programs in partnership with regional and district councils for ‘win-win’ solutions.

- High Performing Team: Reset of the management team with significant mining backgrounds from high performing organizations, including 100% Tanzanian team on the ground at Buckreef Gold.

“We closed 2021 on a strong note. Buckreef Gold has been repositioned to have significant exploration potential with an increasing production profile. We are enthusiastic about continually developing our ‘high return - low cost’ projects and are very excited about the drilling prospects at Anfield and Buckreef West. The 1,000+ tpd mine plan only represents approximately 10% of existing measured and indicated resources. Consequently, we have considerable expansion potential, particularly in the Buckreef Main Zone ‘sulphides,’ which accounts for approximately 90% of our current measured and indicated mineral resources. The Company has a safety-first, high-performance culture in which we invest in the well-being of employees and the community in which we operate. Along with our rejuvenated, results oriented, experienced and energetic new team, I am extremely excited for 2022,” noted Stephen Mullowney, TanGold’s Chief Executive Officer.

Fiscal 2022 Outlook

- The 360 tpd processing plant is expected to increase production to 750-800 ounces of gold per month1 at a total average Cash Cost2 of US$725-825/oz once steady state processing has been achieved.

- Operating cash flow from the larger 360 tpd processing plant is anticipated to mitigate the negative operating cash flow at Buckreef Gold from the testing period of the 120 tpd test processing plant. Anticipated cash flow generated from the larger plant will be reinvested in Buckreef Gold with a focus on the following value enhancing activities: (i) exploration and drilling; (ii) additional capital programs focused on growth and efficiencies; and (iii) enhanced CSR/ESG programs.

- Buckreef Gold will advance and construct a 1,000+ tpd operation while simultaneously operating the 360 tpd operation. Project capital expenditures for an expanded 1,000+ tpd processing plant are estimated to be approximately US$4.0 million with a targeted completion in calendar Q2/Q3 2022. Buckreef Gold has procured two additional 360 tpd ball mills (from the same manufacturer). The two additional ball mills have been shipped and scheduled to arrive in Tanzania by calendar year end. The 1,000+ tpd operation is expected to be capable of producting 15,000 – 20,000 ounces of gold per year based on the initial mine plan and grade profile.

- The anticipated increase in cash flow from the 1,000+ processing plant will fund value enhancing activities at Buckreef Gold, which are similar to those mentioned above for the 360 tpd processing plant, including but not limited to: (i) further expansion of the exploration program in the Buckreef Main Zone, Buckreef West and the newly discovered Anfield Zone, which if successful, may expand mineral reserves and mineral resources; and (ii) additional capital expansion programs to increase the Company’s production profile; and (iii) further investments in CSR/ESG initiatives.

- The Company has retained STAMICO for diamond drilling services for a 10,000 meter program, which will cover:

- PQ/HQ size holes for testing metallurgical variability in the top 150 meters of the sulphide deposit;

- Infill drilling on the inferred mineral resource, which if successful will upgrade that resource to the measured or indicated mineral resource category, and;

- Exploration of the Main Zone deposit to the north-east / south-west, and to commence drilling on the recently discovered Anfield Zone.

- Metallurgical testing for sulphide project development moved to variability testing of the first 5-7 years of production and will continue into 2022, including tailing characteristics for dry stack tailings. Geotechnical and groundwater work will continue on identified areas (i.e. plant, tailings, waste rock storage facility). To date, the metallurgical program of 18 holes (2,337 meters) has been completed and the holes are being logged in preparation for shipment for metallurgical testing. The drill program has now switched to the exploration phase.

- The land compensation process is expected to be completed by the end of calendar 2021 and has been fully accrued in the Company’s financial statements. As of November 29, 2021, approximately 95% of project affected persons have been paid representing 91% of the overall dollar amount.

- Geological work has commenced in evaluating the full extent of exploration potential at the Buckreef Project. Analysis of Inferred Mineral Resources, exploration targets, advanced exploration, geophysical data, geochemical data, and grassroots exploration through to conceptual targets have been evaluated. The Company will provide updates on its exploration targets and strategy which will be finalized and provided in Q1-2022, including the Anfield Zone.

- The Company will continue a review of its broader exploration portfolio and strategy to meet core strategic objectives, including consideration of acquiring new licenses and/or partnerships. The Buckreef Project licenses cover highly prospective ground with many geochemical and soil anomalies. The Company is located in highly favorable Archean geological terrane in the prospective and producing Lake Victoria Greenstone Belt, where numerous anomalous gold bearing shear zones have been identified.

Accomplishments During Fiscal Year Ended August 31, 2021

Operations

- Buckreef Gold reported zero lost time injuries, zero medical aid incidents and had no COVID-19 related cases in 2021. There were also no reportable environmental or community related incidents in 2021.

- During October 2021, the Company completed construction of a 360 tpd processing plant expansion. Buckreef Gold also continued to operate the 120 tpd processing plant subsequent to concluding the test period, which achieved a 90% gold recovery rate as reported in September 2021. The existing 120 tpd processing plant has been integrated into the new processing plant circuit as a ‘regrind mill’. The new processing plant construction was completed in line with the scheduled completion date of late September/October 2021 at a capital cost of US$1.6 million, also within guidance. The run-of-mine mill feed commenced on November 6th, 2021 and continues to ramp up throughput. The 360 tpd throughput is expected to increase production to 750-800 ounces of gold per month1 at a total average Cash Cost2 of US$725-825/oz once steady state processing has been achieved. The 360 tpd processing plant was completed by the Buckreef Gold and TanGold teams in conjunction with key consultants/contractors, including: (i) Ausenco; (ii) Solo Resources; and (iii) CSI Energy Group. Anticipated operating cash flow from the new processing plant is expected to mitigate the negative cash flow from the testing period of the 120 tpd test processing plant.

- Buckreef Gold will continue with plans and construction to advance a 1,000+ tpd operation while simultaneously operating the 360 tpd operation. It was determined that the most cost effective and timely approach to building a 1,000+ tpd processing plant was to self-construct this operation, in effect, as an expansion to the 360 tpd processing plant. Project capital expenditures for an expanded 1,000+ tpd processing plant is estimated to be approximately US$4.0 million, which includes an upgraded elution circuit and other capital equipment to accommodate the increased throughput. Ausenco has been retained as TanGold’s owner engineer and the process circuit will be primarily locally sourced and constructed by the same local teams in a manner similar to the 360 tpd processing plant expansion. The targeted completion of the 1,000+ tpd operation is calendar Q2/Q3 2022 and is expected to produce 15,000 – 20,000 ounces of gold per year based on the initial mine plan and grade profile.

- The operation of the 120 tpd test plant continued in the fourth quarter 2021, operating 7 days a week with two 12-hour shifts. Through the testing phase, objectives related to oxide mill feed grind, processing of clays, retention times and optimized recovery rates have been achieved. Consequently, the testing phase concluded in September 2021. The 120 tpd test plant produced 396 ounces of pure gold in the fourth quarter and 1,836 ounces of pure gold on a year-to-date basis.

- During the year ended August 31, 2021, the Company attained recovery rates of 90% on a consistent basis at the 120 tpd oxide test plant. During the test phase, the Company established that a grind size of 80% passing 75 microns and a retention time of approximately 30 hours led to consistent gold recovery of greater than 90%.

- Through its testing program in 2021, Buckreef Gold has been able to substantiate the grade control block model, confirm forecasted operating cost inputs such as mining and processing costs for 360 tpd and 1,000+ tpd oxide mining operations, and develop a comprehensive understanding of oxide mill feed grind, processing of clays, retention times and how to optimize recovery rates. This knowledge has been applied to the design of the 360 tpd and 1,000+ tpd mine operations, substantially de-risking these operations.

- During the year the Company hired a Tanzanian mining contractor (FEMA) on a two-year contract to mine ore, waste and a tailings storage facility at Buckreef. During October and November 2021, the Company, through FEMA, successfully and safely completed two blasts in high grade areas where transitional ore reached near surface enabling access to high grade ore blocks.

- During the year, TanGold through Buckreef Gold hired a surveying consultant (Property Matrix Company Limited) to commence the land compensation process required under Tanzanian mining law. The land compensation survey has been completed, and to date, the land compensation process is approximately 90% complete. Land Compensation has been fully accrued and is anticipated to be finalized by the end of calendar 2021.

- As previously disclosed, TanGold and STAMICO agreed in principle to amendments to the Buckreef Joint Venture Agreement (the “JV Agreement”) to bring the JV Agreement in line with recent changes in Tanzanian mining laws and to modernize the working arrangement between the parties (the original JV Agreement was entered into in 2011). Discussions between the Company and STAMICO remain ongoing and are expected to continue.

Sulphide Development and Exploration

- Favourable Metallurgical Test Results: The Company announced updated and highly favorable metallurgical test results from the sulphide component of the Buckreef mineral resource. Three diamond drill core samples were taken from the fresh rock (‘sulphide’ mineral resource) of the Buckreef deposit for the purposes of metallurgical test work. Highlights include:

- The following intercepts and gold recoveries have been confirmed in the report:

- MC01: 0.54 g/t Au over 78.88m – 94.1%

- MC02: 19.4 g/t Au over 27.99m – 95.4%

- MC03: 1.71 g/t Au over 52.53m – 85.3%

- A straightforward flowsheet consisting of:

- Primary grinding to P80 = ~100-150 µm

- Rougher flotation

- Regrind of the rougher concentrate to ~15-20 µm (P80)

- Cyanide leaching of the reground flotation concentrate

- Cyanide leaching of the flotation tailing

- No refractory association of gold with arsenic sulphide was detected;

- The samples tested did not exhibit any preg-robbing or other refractory characteristics;

- Clean tailings, high probability of mine tailings not being acid generating, confirming the approach of dry stack tailings going forward; and

- Further opportunities to improve gold extraction from MC03 have been identified through diagnostic leach testing.

- Buckreef West Discovery: The Company announced the discovery of Buckreef West, which lies in close proximity to the Buckreef Main Zone, defining a near vertical shear zone, over a strike length of 400 meters (“m”), with interpreted gold mineralization shallowly plunging to the northeast. The mineralized zone remains open to the south and at depth. Highlights include:

- Shallow depth: All reported intercepts are at shallow depth on a well-defined structure which is interpreted as a splay off the Buckreef Main Zone;

- Open at depth and along strike: Over 400m of strike length has been drilled to date and the deposit remains open at depth and along strike in both directions; and

- Select intercepts:

- Hole BWDD017 intersected 4.57m @ 6.4 g/t Au from 44.9m;

- Hole BWDD015, on the same line as Hole BWDD017, had two intersections: 2.18m @ 1.24 g/t Au from 86.9m and (ii) 2.49m @1.3 g/t Au from 105.1m;

- Hole BWDD012 intersected 5.57m @ 4.95 g/t Au from 98.4m and 4.0m @ 2.19 g/t Au from 92.0m;

- Hole BWDD013, on the same line as Hole BWDD012 intersected 1.5m @ 2.2 g/t Au from 59.5m;

- BWDD0018 intersected 7.0m @ 2.03 g/t Au from 44.0m and 3.85m @ 2.86 g/t from 56.0m; and

- BWDD0031 intersected 2.5m @ 7.29 g/t Au from 46.1m.

- Anfield Zone Discovery: The Company announced that it has made a new discovery of three closely spaced parallel, gold bearing structures at Buckreef, collectively now known as the Anfield Zone. Follow-up field work and diamond drilling is planned for 2021 and 2022. Highlights include:

- The new prospective gold mineralized zones, totaling a combined 2.9-kilometer (km) strike length were identified through geological (field) mapping, sampling and examination of artisanal workings. Collectively, they have been named the Anfield Zone;

- Grab samples of mineralized bed (fresh) rock have been assayed, with highlights of:

- 37.52 g/t

- 28.55 g/t

- 14.42 g/t

- Located approximately 500m to the east of the Buckreef Main Zone; and

- Aligns with and trends towards the Eastern Porphyry Mineral Resource.

Management

- Appointed on December 1, 2020, Mr. Stephen Mullowney, CPA, CA, CFA as Chief Executive Officer (CEO) of Tanzanian Gold Corporation. He also accepted an appointment to the Board of Directors of the Company. Mr. Mullowney was previously a Partner and Managing Director of PricewaterhouseCoopers LLP (PwC) and PwC Canada’s mining deals leader. He has an extensive mining background, working with miners, Governments, and institutional investors across the world and supporting them in making key strategic business, financing, and policy decisions.

- On February 8, 2021, the Company appointed Andrew Cheatle, P.Geo., MBA, FGS, ARSM as Chief Operating Officer of Tanzanian Gold Corporation. A graduate of the Royal School of Mines, Imperial College, London, his 30-plus-years international career has encompassed operations/production, development, and exploration in both the senior & junior mining sectors. His considerable operational and project management experience includes senior positions with the development of (at that time) Anglo American Corporation’s Moab Khotsong Gold Mine, JCI’s South Deep Project and major expansions of Placer Dome’s/Goldcorp’s Musselwhite Mine.

- On March 1, 2021, the Company appointed Michael P. Leonard, CPA, CA as Chief Financial Officer. He was previously at Barrick Gold Corporation in a series of progressively senior financial leadership positions and brings a wealth of experience in investor relations and corporate global finance. He will fill a vital role for the Company’s strategy moving forward including use of state-of-the-art technology and development and implementation of financial models, financial controls and procedures for financial management.

- On March 4, 2021, the Company, through Buckreef Gold, appointed Isaac Bisansaba and Gaston Mujwahuzi as Co-Acting General Managers for Buckreef, on an alternating basis. Mr. Bisansaba and Mr. Mujwahuzi are directly responsible for monitoring and improving the mining and processing operations at Buckreef Gold. Mr. Bisansaba has a BS.Geo, Masters in Mining Engineering, Mineral Resources Evaluation, and twenty years of experience in the gold mining industry. Mr. Mujwahuzi has a BS, Mineral Processing Engineering, and over sixteen years of experience in the gold mining industry. Collectively, their experience encompasses all aspects of gold mining operations, including managing mining, process plant and exploration activities. Their prior experience includes roles with AngloGold Ashanti, Barrick Gold, Teranga Gold, PanAust Limited and various consulting firms. Together, they possess the knowledge and experience Buckreef Gold requires going forward, as well as strong team leadership capabilities for safe, smooth and ongoing management of on-site operations.

- On March 17, 2021, the Company appointed Shubo Rakhit, CPA, CA to the Board of Directors of Tanzanian Gold Corporation. His 30+ year career has included positions at several large investment banks and advisory firms including Canada’s major bank owned investment banks, Bank of America Securities, KPMG Corporate Finance and Echelon Wealth Partners where he most recently served as Managing Director, Head of Mergers and Acquisitions. His career includes leading over $80B of M&A transactions and over $100 billion of global capital markets issuance including many complex strategic and capital solutions. His background and experience will assist the Company in broadening its access to capital markets at a time of rapid growth for the organization.

- On April 27, 2021, TanGold announced that Mr. Sinclair turned 80 years old and retired as Executive Chairman to continue service as Chairman of the Board of Directors of the Company. TanGold has had the privilege of being founded and directed since 2000 by the leadership of the renowned James E. Sinclair. It is with profound gratitude that the Company acknowledges his contribution to the present success and long-term resilience of our enterprise.

- On June 1, 2021, the Company appointed Khalaf Rashid as Senior Vice President, Tanzania and as Managing Director of the Company’s wholly owned subsidiary in Tanzania, Tanzam2000. Mr. Rashid is a Tanzanian citizen and resident and joins the TanGold Executive Team bringing a wealth of experience and family history in Tanzanian business, politics and Government that dates back to the formation of the country. He is highly respected and recognized in the business community having held senior executive positions in multiple sectors including industrials, education and marketing communications.

- The Company changed its nominees to the Buckreef Gold Board of Directors to: (i) Stephen Mullowney; (ii) Andrew Cheatle; (iii) Michael Leonard; and (iv) Shubo Rakhit to better reflect the new management team and vision for the Company. Stephen Mullowney was nominated Chairman of Buckreef Gold.

Financing

- As at August 31, 2021, the Company had cash of $13.4 million and net working capital of $8.0 million. After adjusting for $2.1 million in derivative liabilities, working capital on an adjusted basis is $10.1 million. This reflects a significant improvement in in overall liquidity and financial flexibility compared to August 31, 2020.

- On February 11, 2021, the Company completed the sale of 32,923,078 common shares together with warrants to purchase 16,461,539 common shares for $21.4 million in the aggregate. The common shares and warrants were issued at $0.65 for each common share and a one-half purchase warrant with the right of each whole warrant to purchase one common share at $0.80 for a period of five years from the issue date. The Company also issued 1,152,307 broker warrants with the same terms.On December 23, 2020, the Company completed the sale of 5,554,588 common shares together with warrants to purchase 2,777,268 common shares for $3.0 million in the aggregate. The common shares and warrants were issued at $0.54 for each common share and a one-half purchase warrant with the right of each whole warrant to purchase one common share at $1.50 for a period of three years from the issue date.

- During the year ended August 31, 2021 $7.0 million of Tranche A Convertible Debentures, representing the entire outstanding balance, were converted and retired resulting in the issuance of 12,150,447 common shares of the Company.

ESG

- The Company is committed to working to the highest ESG standards and has initiated several programs, whilst developing a broader framework and policies.

- Buckreef Gold’s operations: (i) are connected to the Tanzanian national electricity grid and utilizes grid power which is sourced from hydroelectric facilities in Tanzania; (ii) recycles all water used in its operations; (iii) do not discharge water from its operations; (iv) workforce are 100% Tanzanian citizens; (v) development and building activities are focused on maximizing local content; (vi) exhibit a ‘100 mile diet’ by procuring all food locally; and (vii) sulphide development is expected to utilize dry stack tailings.

- The Company is actively working with the Geita District Council and local Wards to collaboratively identify key programs that focus on short to long-term educational needs, which in turn aligned with the Company’s local hiring practices, which includes STEM and gender goals.

- The Company, through Buckreef Gold, procured and donated 300 school desks to the Kaseme Secondary School in Geita District. The desks were sourced from local artisans.

- The Buckreef Gold Mine site has a 100% Tanzanian workforce.

- The Company supports local procurement in all activities by first sourcing within the immediate wards, then out to district, region and nation. Only those items or services not available within country are purchased externally from Tanzania, first prioritizing East Africa, Africa then globally.

Other

- A mine-based assay / chemical laboratory has been installed at Buckreef Gold. The laboratory has commenced test work and is in the process of being fully commissioned.

- The accommodations and camp facilities at Buckreef Gold have been upgraded and renovated during fiscal 2021.

About Tanzanian Gold Corporation

TanGold along with its joint venture partner, STAMICO, is building a significant gold project at Buckreef in Tanzania that is based on an expanded Mineral Resource. Measured Mineral Resource is 19.98MT at 1.99g/t gold containing 1,281,161 ounces of gold and Indicated Mineral Resource is 15.89MT at 1.48g/t gold containing 755,119 ounces of gold for a combined tonnage of 35.88MT at 1.77g/t gold containing 2,036,280 ounces of gold. The Buckreef Gold Project also contains an Inferred Mineral Resource of 17.8MT at 1.11g/t gold for contained gold of 635,540 ounces of gold. The Company is actively investigating and assessing multiple exploration targets on its property. Please refer to the Company’s Updated Mineral Resources Estimate for Buckreef Gold Project, dated May 15, 2020, for more information.

Tanzanian Gold Corporation is advancing on three value-creation tracks:

- Strengthening its balance sheet by expanding near-term production to 15,000 - 20,000 oz. of gold per year from the expanded 1,000+ tpd plant.

- Advancing Sulphide Development that is substantially larger than previously modelled and targeting significant annual gold production.

- Continuing with a drilling program to further test the potential of its property, exploration targets and Mineral Resource base by: (i) infill drilling to upgrade Mineral Resources currently in the Inferred category in Buckreef Main; (ii) step-out drilling in the northeast extension of Buckreef Main; (iii) infill drilling program of Buckreef West; (iv) develop exploration program for the newly discovered Anfield Zone; (v) upgrade historical resources at Bingwa and Tembo; (vi) identification of new prospects at Buckreef Gold Project and in the region.

For further information, please contact Michael Martin, Investor Relations, m.martin@tangoldcorp.com, 860-248-0999, or visit the Company website at www.tangoldcorp.com

Andrew M. Cheatle, P.Geo., the Company’s COO and Director, is the Qualified Person as defined by the NI 43-101 who has reviewed and assumes responsibility for the technical content of this press release.

The Toronto Stock Exchange and NYSE American have not reviewed and do not accept responsibility for the adequacy or accuracy of this release.

Endnotes

1 The 360 tpd Plant estimates have not been prepared in accordance with the results of the Company’s 2018 Prefeasibility Study, reflected in the Company’s May 15, 2020 Updated Mineral Resource Estimate. The 18-Month mining plan estimates are based upon an internal mine model reviewed by SGSC and cost inputs as validated by actual mining and processing costs from the 120 tpd test plan over the 9 months ended May 31, 2021. No assurance can be given that the 18-Month Estimate (Monthly Average) will reflect actual results. See “Cautionary Note Regarding Forward-Looking Statements”.

2 ‘Total Cash Cost’ includes mine site operating costs such as mining, processing and local administrative costs, royalties, production taxes, mine standby costs and current inventory write downs, if any. Production costs are exclusive of depreciation and depletion, reclamation, capital and exploration costs. Total cash costs are net of by-product sales and are divided by gold ounces sold to arrive at a per ounce figure. Total Cash Costs is a non-IFRS financial performance measure often used in conjunction with conventional IFRS measures to evaluate performance. Total Cash Cost does not have a standardized meaning under IFRS and therefore may not be comparable to similar measures of performance disclosed by other issuers; it is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

Forward-Looking Statements

This press release contains certain forward-looking statements as defined in the applicable securities laws. All statements, other than statements of historical facts, are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as “expects”, “anticipates”, “believes”, “hopes”, “intends”, “estimated”, “potential”, “possible” and similar expressions, or statements that events, conditions or results “will”, “may”, “could” or “should” occur or be achieved. Forward-looking statements relate to future events or future performance and reflect TanGold management’s expectations or beliefs regarding future events and include, but are not limited to, statements with respect to the estimation of mineral reserves and resources, recoveries, subsequent project testing, success, scope and viability of mining operations, the timing and amount of estimated future production, and capital expenditure. No assurance can be given that Tanzanian Gold will be able to achieve the same level of gold recovery in the future as it did at the test oxide test plant during the months of July and August 2021.

Although TanGold believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance. The actual achievements of TanGold or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and other factors. These risks, uncertainties and factors include general business, legal, economic, competitive, political, regulatory and social uncertainties; actual results of exploration activities and economic evaluations; fluctuations in currency exchange rates; changes in costs; future prices of gold and other minerals; mining method, production profile and mine plan; delays in exploration, development and construction activities; changes in government legislation and regulation; the ability to obtain financing on acceptable terms and in a timely manner or at all; contests over title to properties; employee relations and shortages of skilled personnel and contractors; the speculative nature of, and the risks involved in, the exploration, development and mining business. These risks are set forth in reports that Tanzanian Gold files with the SEC. You can review and obtain copies of these filings from the SEC's website at http://www.sec.gov/edgar.shtml. In addition, this press release refers to Measured, Indicated and Inferred Resources at the Company’s Buckreef gold project. No assurance can be given that the Buckreef gold project has the amount of the mineral resources indicated or that such mineral resources may be economically extracted.

The information contained in this press release is as of the date of the press release and TanGold assumes not duty to update such information.