| Share Name | Share Symbol | Market | Type |

|---|---|---|---|

| IT Tech Packaging Inc | AMEX:ITP | AMEX | Common Stock |

| Price Change | % Change | Share Price | High Price | Low Price | Open Price | Shares Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|

| -0.0005 | -0.18% | 0.2845 | 0.30 | 0.271 | 0.286 | 145,925 | 01:00:00 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For the quarterly period ended

or

For the transition period from to

Commission file number:

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of | (IRS Employer | |

| incorporation or organization) | identification No.) |

Hebei Province, The People’s Republic

of

(Address of principal executive offices and Zip Code)

011 -

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act.): Yes ☐ No

As of August 12, 2024, there were

TABLE OF CONTENTS

| Part I. - FINANCIAL INFORMATION | 1 | |

| Item 1. | Financial Statements | 1 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 29 |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 48 |

| Item 4. | Controls and Procedures | 48 |

| Part II. - OTHER INFORMATION | 49 | |

| Item 1. | Legal Proceedings | 49 |

| Item 1A. | Risk Factors | 49 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 49 |

| Item 3. | Defaults Upon Senior Securities | 49 |

| Item 4. | Mine Safety Disclosures | 49 |

| Item 5. | Other Information | 50 |

| Item 6. | Exhibits | 50 |

| SIGNATURES | 51 | |

i

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

IT TECH PACKAGING, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

AS OF JUNE 30, 2024 AND DECEMBER 31, 2023

(unaudited)

| June 30, | December 31, | |||||||

| 2024 | 2023 | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and bank balances | $ | $ | ||||||

| Restricted cash | ||||||||

| Accounts receivable (net of allowance for doubtful accounts of $ | ||||||||

| Inventories | ||||||||

| Prepayments and other current assets | ||||||||

| Due from related parties | | | ||||||

| Total current assets | ||||||||

| Operating lease right-of-use assets, net | ||||||||

| Property, plant, and equipment, net | ||||||||

| Value-added tax recoverable | ||||||||

| Deferred tax asset non-current | ||||||||

| Total Assets | $ | $ | ||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current Liabilities | ||||||||

| Short-term bank loans | $ | $ | ||||||

| Current portion of long-term loans | ||||||||

| Lease liability | ||||||||

| Accounts payable | ||||||||

| Advance from customers | ||||||||

| Notes payable | ||||||||

| Due to related parties | ||||||||

| Accrued payroll and employee benefits | ||||||||

| Other payables and accrued liabilities | ||||||||

| Income taxes payable | | |||||||

| Total current liabilities | ||||||||

| Long-term loans | ||||||||

| Lease liability - non-current | ||||||||

| Derivative liability | ||||||||

| Total liabilities (including amounts of the consolidated VIE without recourse to the Company of $ | | | ||||||

| Commitments and Contingencies | ||||||||

| Stockholders’ Equity | ||||||||

| Common stock, | ||||||||

| Additional paid-in capital | ||||||||

| Statutory earnings reserve | ||||||||

| Accumulated other comprehensive loss | ( | ) | ( | ) | ||||

| Retained earnings | ||||||||

| Total stockholders’ equity | ||||||||

| Total Liabilities and Stockholders’ Equity | $ | $ | ||||||

See accompanying notes to condensed consolidated financial statements.

1

IT TECH PACKAGING, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2024 AND 2023

(Unaudited)

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Revenues | $ | $ | $ | $ | ||||||||||||

| Cost of sales | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Gross Profit | ||||||||||||||||

| Selling, general and administrative expenses | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Loss on impairment of assets | ( | ) | ( | ) | ||||||||||||

| Income (Loss) from Operations | ( | ) | ( | ) | ( | ) | ||||||||||

| Other Income (Expense): | ||||||||||||||||

| Interest income | ||||||||||||||||

| Interest expense | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Gain (Loss) on derivative liability | ( | ) | ( | ) | ||||||||||||

| Income (Loss) before Income Taxes | ( | ) | ( | ) | ( | ) | ||||||||||

| Provision for Income Taxes | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Net Loss | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Other Comprehensive Loss | ||||||||||||||||

| Foreign currency translation adjustment | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Total Comprehensive Loss | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||||

| Losses Per Share: | ||||||||||||||||

| $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | |||||

See accompanying notes to condensed consolidated financial statements.

2

IT TECH PACKAGING, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE SIX MONTHS ENDED JUNE 30, 2024 AND 2023

(Unaudited)

| Six Months Ended | ||||||||

| June 30, | ||||||||

| 2024 | 2023 | |||||||

| Cash Flows from Operating Activities: | ||||||||

| Net income | $ | ( | ) | $ | ( | ) | ||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Depreciation and amortization | ||||||||

| (Gain) Loss on derivative liability | ( | ) | ||||||

| Loss from disposal and impairment of property, plant and equipment | ||||||||

| (Recovery from) Allowance for bad debts | ( | ) | ||||||

| Allowances for inventories, net | ( | ) | ||||||

| Deferred tax | ||||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | ( | ) | ( | ) | ||||

| Prepayments and other current assets | ||||||||

| Inventories | ( | ) | ( | ) | ||||

| Accounts payable | ( | ) | ||||||

| Advance from customers | ( | ) | ||||||

| Notes payable | ||||||||

| Related parties | ( | ) | ( | ) | ||||

| Accrued payroll and employee benefits | ||||||||

| Other payables and accrued liabilities | ||||||||

| Income taxes payable | ( | ) | ||||||

| Net Cash Provided by Operating Activities | | | ||||||

| Cash Flows from Investing Activities: | ||||||||

| Purchases of property, plant and equipment | ( | ) | ( | ) | ||||

| Proceeds from sale of property, plant and equipment | ||||||||

| Acquisition of land | ||||||||

| Net Cash Used in Investing Activities | ( | ) | ( | ) | ||||

| Cash Flows from Financing Activities: | ||||||||

| Proceeds from issuance of shares and warrants, net | ||||||||

| Proceeds from short term bank loans | ||||||||

| Proceeds from long term loans | ||||||||

| Repayment of bank loans | ( | ) | ( | ) | ||||

| Payment of capital lease obligation | ( | ) | ||||||

| Loan to a related party (net) | ||||||||

| Net Cash Provided by Financing Activities | | | ||||||

| Effect of Exchange Rate Changes on Cash and Cash Equivalents | ( | ) | ( | ) | ||||

| Net Increase in Cash and Cash Equivalents | ||||||||

| Cash, Cash Equivalents and Restricted Cash - Beginning of Period | | | ||||||

| Cash, Cash Equivalents and Restricted Cash - End of Period | $ | $ | ||||||

| Supplemental Disclosure of Cash Flow Information: | ||||||||

| Cash paid for interest, net of capitalized interest cost | $ | $ | ||||||

| Cash paid for income taxes | $ | $ | ||||||

| Cash and bank balances | ||||||||

| Restricted cash | ||||||||

| Total cash, cash equivalents and restricted cash shown in the statement of cash flows | ||||||||

See accompanying notes to condensed consolidated financial statements.

3

IT TECH PACKAGING, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

FOR THE SIX MONTHS ENDED JUNE 30, 2024 AND 2023

(Unaudited)

| Accumulated | ||||||||||||||||||||||||||||

| Additional | Statutory | Other | ||||||||||||||||||||||||||

| Common Stock | Paid-in | Earnings | Comprehensive | Retained | ||||||||||||||||||||||||

| Shares | Amount | Capital | Reserve | Income (loss) | Earnings | Total | ||||||||||||||||||||||

| Balance at December 31, 2022 | $ | $ | $ | $ | ( | ) | $ | $ | ||||||||||||||||||||

| Foreign currency translation adjustment | ( | ) | ( | ) | ||||||||||||||||||||||||

| Net loss | ( | ) | ( | ) | ||||||||||||||||||||||||

| Balance at June 30, 2023 | $ | $ | $ | $ | ( | ) | $ | $ | ||||||||||||||||||||

| Balance at December 31, 2023 | $ | $ | $ | $ | ( | ) | $ | $ | ||||||||||||||||||||

| Foreign currency translation adjustment | ( | ) | ( | ) | ||||||||||||||||||||||||

| Net loss | ( | ) | ( | ) | ||||||||||||||||||||||||

| Balance at June 30, 2024 | $ | $ | $ | $ | ( | ) | $ | $ | ||||||||||||||||||||

See accompanying notes to condensed consolidated financial statements.

4

IT TECH PACKAGING, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(1) Organization and Business Background

IT Tech Packaging, Inc. (the “Company”) was incorporated in the State of Nevada on December 9, 2005, under the name “Carlateral, Inc.” Through the steps described immediately below, we became the holding company for Hebei Baoding Dongfang Paper Milling Company Limited (“Dongfang Paper”), a producer and distributor of paper products in China, on October 29, 2007.

Effective on August 1, 2018, we changed our corporate name to IT Tech Packaging, Inc.. The name change was effected through a parent/subsidiary short-form merger of IT Tech Packaging, Inc., our wholly-owned Nevada subsidiary formed solely for the purpose of the name change, with and into us. We were the surviving entity. In connection with the name change, our common stock began being traded under a new NYSE symbol, “ITP,” and a new CUSIP number, 46527C100, at such time.

On June 9, 2022, the Board of Directors of the

Company approved a reverse stock split of the Company’s issued and outstanding shares of common stock, par value $

On October 29, 2007, pursuant to an agreement

and plan of merger (the “Merger Agreement”), the Company acquired DongfangZhiye Holding Limited (“Dongfang Holding”),

a corporation formed on November 13, 2006 under the laws of the British Virgin Islands, and issued the shareholders of Dongfang Holding

an aggregate of

Dongfang Holding, as the

On June 24, 2009, the Company consummated a number of restructuring transactions pursuant to which it acquired all of the issued and outstanding shares of Shengde Holdings Inc., a Nevada corporation. Shengde Holdings Inc. was incorporated in the State of Nevada on February 25, 2009. On June 1, 2009, Shengde Holdings Inc. incorporated Baoding Shengde, a limited liability company organized under the laws of the PRC. Because Baoding Shengde is a wholly-owned subsidiary of Shengde Holdings Inc., it is regarded as a wholly foreign-owned entity under PRC law.

5

IT TECH PACKAGING, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

To ensure proper compliance of the Company’s

control over the ownership and operations of Dongfang Paper with certain PRC regulations, on June 24, 2009, the Company entered into a

series of contractual agreements (the “Contractual Agreements”) with Dongfang Paper and Dongfang Paper Equity Owners via the

Company’s wholly owned subsidiary Shengde Holdings Inc. (“Shengde Holdings”) a Nevada corporation and Baoding Shengde

Paper Co., Ltd. (“Baoding Shengde”), a wholly foreign-owned enterprise in the PRC with an original registered capital of $

On February 10, 2010, Baoding Shengde and the

Dongfang Paper Equity Owners entered into a Termination of Loan Agreement to terminate the above- mentioned $

An agreement was also entered into among Baoding

Shengde, Dongfang Paper and the Dongfang Paper Equity Owners on December 31, 2010, reiterating that Baoding Shengde is entitled to

On June 25, 2019, Dongfang Paper entered into

an acquisition agreement with the shareholder of Tengsheng Paper Co., Ltd. (“Tengsheng Paper”), a limited liability company

organized under the laws of the PRC, pursuant to which Dongfang Paper would acquire Tengsheng Paper. Full payment of the consideration

in the amount of RMB

QianrongQianhui Hebei Technology Co., Ltd, a wholly owned subsidiary of Shengde holding, was incorporated on July 15, 2021. It is a service provider of high quality material solutions for textile, cosmetics and paper production.

6

IT TECH PACKAGING, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

The Company has no direct equity interest in Dongfang Paper. However,

through the Contractual Agreements described above, the Company is found to be the primary beneficiary (the “Primary Beneficiary”)

of Dongfang Paper and is deemed to have the effective control over Dongfang Paper’s activities that most significantly affect its

economic performance, resulting in Dongfang Paper and its subsidiary, being treated as a controlled variable interest entity of the Company

in accordance with Topic 810 - Consolidation of the Accounting Standards Codification (the “ASC”) issued by the FinancialAccounting

Standard Board (the “FASB”). The revenue generated from Dongfang Paper and Tengsheng Paper for the three months ended June

30, 2024 and 2023 was accounted for

| Name | Date of Incorporation or Establishment | Place of Incorporation or Establishment | Percentage of Ownership | Principal Activity | ||||

| Subsidiary: | ||||||||

| Dongfang Holding | ||||||||

| Shengde Holdings | ||||||||

| Baoding Shengde | ||||||||

| Qianrong | ||||||||

| Variable interest entity (“VIE”): | ||||||||

| Dongfang Paper | ||||||||

| Tengsheng Paper |

| * |

| ** |

However, uncertainties in the PRC legal system could cause the Company’s current ownership structure to be found to be in violation of any existing and/or future PRC laws or regulations and could limit the Company’s ability, through its subsidiary, to enforce its rights under these contractual arrangements. Furthermore, shareholders of the VIE may have interests that are different than those of the Company, which could potentially increase the risk that they would seek to act contrary to the terms of the aforementioned agreements.

In addition, if the current structure or any of the contractual arrangements were found to be in violation of any existing or future PRC law, the Company may be subject to penalties, which may include, but not be limited to, the cancellation or revocation of the Company’s business and operating licenses, being required to restructure the Company’s operations or being required to discontinue the Company’s operating activities. The imposition of any of these or other penalties may result in a material and adverse effect on the Company’s ability to conduct its operations. In such case, the Company may not be able to operate or control the VIE, which may result in deconsolidation of the VIE. The Company believes the possibility that it will no longer be able to control and consolidate its VIE will occur as a result of the aforementioned risks and uncertainties is remote.

7

IT TECH PACKAGING, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

The Company has aggregated the financial information of Dongfang Paper in the table below. The aggregate carrying value of Dongfang Paper’s assets and liabilities (after elimination of intercompany transactions and balances) in the Company’s condensed consolidated balance sheets as of June 30, 2024 and December 31, 2023 are as follows:

| June 30, | December 31, | |||||||

| 2024 | 2023 | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and bank balances | $ | $ | ||||||

| Restricted cash | ||||||||

| Accounts receivable | ||||||||

| Inventories | ||||||||

| Prepayments and other current assets | ||||||||

| Due from related parties | ||||||||

| Total current assets | ||||||||

| Operating lease right-of-use assets, net | ||||||||

| Property, plant, and equipment, net | ||||||||

| Deferred tax asset non-current | ||||||||

| Total Assets | $ | $ | ||||||

| LIABILITIES | ||||||||

| Current Liabilities | ||||||||

| Short-term bank loans | $ | $ | ||||||

| Current portion of long-term loans | ||||||||

| Lease liability | ||||||||

| Accounts payable | ||||||||

| Advance from customers | ||||||||

| Accrued payroll and employee benefits | ||||||||

| Other payables and accrued liabilities | ||||||||

| Income taxes payable | ||||||||

| Total current liabilities | ||||||||

| Long-term loans | ||||||||

| Lease liability - non-current | ||||||||

| Total liabilities | $ | $ | ||||||

8

IT TECH PACKAGING, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(2) Basis of Presentation and Significant Accounting Policies

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission (“SEC”) for reporting on Form 10-Q. Accordingly, certain information and notes required by the United States of America generally accepted accounting principles (“GAAP”) for annual financial statements are not included herein. These interim statements should be read in conjunction with the consolidated financial statements and notes thereto included in the Annual Report on Form 10-K for the year ended December 31, 2023 of the Company, and its subsidiaries and variable interest entity (which we sometimes refer to collectively as “the Company”, “we”, “us” or “our”).

Principles of Consolidation

Our unaudited condensed consolidated financial statements reflect all adjustments, which are, in the opinion of management, necessary for a fair presentation of our financial position and results of operations. Such adjustments are of a normal recurring nature, unless otherwise noted. The balance sheet as of June 30, 2024 and the results of operations for the six months ended June 30, 2024 are not necessarily indicative of the results to be expected for any future period.

Our unaudited condensed consolidated financial statements are prepared in accordance with GAAP. These accounting principles require us to make certain estimates, judgments and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. We believe that the estimates, judgments and assumptions are reasonable, based on information available at the time they are made. Actual results could differ materially from those estimates.

Valuation of long-lived asset

The Company reviews the carrying value of long-lived assets to be held and used when events and circumstances warrants such a review. The carrying value of a long-lived asset is considered impaired when the anticipated undiscounted cash flow from such asset is separately identifiable and is less than its carrying value. In that event, a loss is recognized based on the amount by which the carrying value exceeds the fair market value of the long-lived asset and intangible assets. Fair market value is determined primarily using the anticipated cash flows discounted at a rate commensurate with the risk involved. Losses on long-lived assets and intangible assets to be disposed are determined in a similar manner, except that fair market values are reduced for the cost to dispose.

Fair Value Measurements

The Company has adopted ASC Topic 820, Fair Value Measurements and Disclosures, which defines fair value, establishes a framework for measuring fair value in GAAP, and expands disclosures about fair value measurements. It does not require any new fair value measurements, but provides guidance on how to measure fair value by providing a fair value hierarchy used to classify the source of the information. It establishes a three-level valuation hierarchy of valuation techniques based on observable and unobservable inputs, which may be used to measure fair value and include the following:

Level 1 - Quoted prices in active markets for identical assets or liabilities.

Level 2 - Inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities.

Level 3 - Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

9

IT TECH PACKAGING, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Classification within the hierarchy is determined based on the lowest level of input that is significant to the fair value measurement.

The Company estimates the fair value of financial instruments using the available market information and valuation methods. Considerable judgment is required in estimating fair value. Accordingly, the estimates of fair value may not be indicative of the amounts that the Company could realize in a current market exchange. As of June 30, 2024 and December 31, 2023, the carrying value of the Company’s short term financial instruments, such as cash and cash equivalents, accounts receivable, accounts and notes payable, short-term bank loans, balance due to a related party and obligation under capital lease, approximate at their fair values because of the short maturity of these instruments; while loans from credit union and loans from a related party approximate at their fair value as the interest rates thereon are close to the market rates of interest published by the People’s Bank of China.

Management determined that liabilities created by beneficial conversion features associated with the issuance of certain warrants (see “Derivative liabilities” under Note (12)), meet the criteria of derivatives and are required to be measured at fair value. The fair value of these derivative liabilities was determined based on management’s estimate of the expected future cash flows required to settle the liabilities. This valuation technique involves management’s estimates and judgment based on unobservable inputs and is classified in level 3.

Non-Recurring Fair Value Measurements

The Company reviews long-lived assets for impairment annually or more frequently if events or changes in circumstances indicate the possibility of impairment. For the continuing operations, long-lived assets are measured at fair value on a nonrecurring basis when there is an indicator of impairment, and they are recorded at fair value only when impairment is recognized. For discontinued operations, long-lived assets are measured at the lower of carrying amount or fair value less cost to sell. The fair value of these assets were determined using models with significant unobservable inputs which were classified as Level 3 inputs, primarily the discounted future cash flow.

Share-Based Compensation

The Company uses the fair value recognition provision of ASC Topic 718, Compensation-Stock Compensation, which requires the Company to expense the cost of employee services received in exchange for an award of equity instruments based on the grant date fair value of such instruments over the vesting period.

The Company also applies the provisions of ASC Topic 505-50, Equity Based Payments to Non-Employees to account for stock-based compensation awards issued to non-employees for services. Such awards for services are recorded at either the fair value of the consideration received or the fair value of the instruments issued in exchange for such services, whichever is more reliably measurable.

10

IT TECH PACKAGING, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(3) Restricted Cash

Out of the restricted cash, $

(4) Inventories

Raw materials inventory includes mainly recycled paper board and recycled

white scrap paper. Finished goods include mainly products of corrugating medium paper, offset printing paper and tissue paper products.

| June 30, | December 31, | |||||||

| 2024 | 2023 | |||||||

| Raw Materials | ||||||||

| Recycled paper board | $ | $ | ||||||

| Recycled white scrap paper | ||||||||

| Gas | ||||||||

| Base paper and other raw materials | ||||||||

| Semi-finished Goods | ||||||||

| Finished Goods | ||||||||

| Total inventory, gross | ||||||||

| Inventory reserve | ( | ) | ||||||

| Total inventory, net | $ | $ | ||||||

(5) Prepayments and other current assets

| June 30, | December 31, | |||||||

| 2024 | 2023 | |||||||

| Prepayment for purchase of materials | $ | $ | ||||||

| Value-added tax recoverable | ||||||||

| Prepaid gas | ||||||||

| Others | ||||||||

| $ | $ | |||||||

(6) Property, plant and equipment, net

| June 30, | December 31, | |||||||

| 2024 | 2023 | |||||||

| Land use rights | $ | $ | ||||||

| Building and improvements | ||||||||

| Machinery and equipment | ||||||||

| Vehicles | ||||||||

| Construction in progress | ||||||||

| Totals | ||||||||

| Less: accumulated depreciation and amortization | ( | ) | ( | ) | ||||

| Property, Plant and Equipment, net | $ | $ | ||||||

As of June 30, 2024 and December 31, 2023, land use rights represented

twenty three parcels of state-owned lands located in Xushui District and Wei County of Hebei Province in China, with lease terms of

11

IT TECH PACKAGING, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

As of June 30, 2024

and December 31, 2023, certain property, plant and equipment of Dongfang Paper with net values of $, have been pledged pursuant to

a long-term loan from credit union of Dongfang Paper. Land use right of Tengsheng Paper with net value of $

Depreciation and amortization of property, plant and equipment was

$

(7) Leases

Financing with Sale-Leaseback

The Company entered

into a sale-leaseback arrangement (the “Lease Financing Agreement”) with TAC Leasing Co., Ltd.(“TLCL”) on August

6, 2020, for a total financing proceeds in the amount of RMB

Tengsheng Paper made payments due according to the schedule. On July 17, 2023, the Company made a final payment on outstanding obligations and bought back the Lease Equipment at nominal price according to the agreement. The lease assets were reclassified as own assets and balance of Leased Equipment net of amortization were $ as of June 30, 2024 and December 31, 2023.

Amortization of the Leased Equipment was

$ and $

Operating lease lessor

The Company has a

non-cancellable agreement to lease plant to tenant under operating lease for

Operating lease as lessee

The Company leases space under non-cancelable operating leases for plant and production equipment. The lease does not have significant rent escalation holidays, concessions, leasehold improvement incentives, or other build-out clauses. Further, the lease does not contain contingent rent provisions.

The lease include option to renew in condition that it is agreed by the landlord before expiry. Therefore, the majority of renewals to extend the lease terms are not included in its right-of-use assets and lease liabilities as they are not reasonably certain of exercise. The Company regularly evaluate the renewal options and when they are reasonably certain of exercise, the Company includes the renewal period in its lease term.

As the Company’s leases do not provide an implicit rate, it uses its incremental borrowing rate based on the information available at the lease commencement date in determining the present value of the lease payments.

12

IT TECH PACKAGING, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

| Six Months Ended | ||||

| June 30, 2024 | ||||

| RMB | ||||

| Operating lease cost | ||||

| Short-term lease cost | ||||

| Lease cost | ||||

Supplemental cash flow information related to its operating leases was as follows for the period ended June 30, 2024:

| Six Months Ended | ||||

| June 30, 2024 | ||||

| RMB | ||||

| Cash paid for amounts included in the measurement of lease liabilities: | ||||

| Operating cash outflow from operating leases | ||||

| June 30, | Amount | |||

| 2025 | ||||

| 2026 | ||||

| 2027 | ||||

| 2028 | ||||

| 2029 | ||||

| Thereafter | ||||

| Total operating lease payments | $ | |||

| Less: Interest | ( | ) | ||

| Present value of lease liabilities | ||||

| Less: current portion, record in current liabilities | ( | ) | ||

| Present value of lease liabilities | ||||

| June 30, | ||||

| 2024 | ||||

| RMB | ||||

| Remaining lease term and discount rate: | ||||

| Weighted average remaining lease term (years) | ||||

| Weighted average discount rate | % | |||

13

IT TECH PACKAGING, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(8) Loans Payable

| June 30, | December 31, | |||||||

| 2024 | 2023 | |||||||

| Bank of Cangzhou 1 | $ | $ | ||||||

| Bank of Cangzhou 2 | ||||||||

| Industrial and Commercial Bank of China (“ICBC”) Loan 1 | ||||||||

| ICBC Loan 2 | ||||||||

| ICBC Loan 3 | ||||||||

| ICBC Loan 4 | ||||||||

| ICBC Loan 5 | ||||||||

| ICBC Loan 6 | ||||||||

| ICBC Loan 7 | ||||||||

| Total short-term bank loans | $ | $ | ||||||

On December 31, 2023,

the Company entered into a working capital loan agreement with the Bank of Cangzhou, to borrow $

On December 31, 2023,

the Company entered into a working capital loan agreement with the Bank of Cangzhou, to borrow $

On September 15, 2023,

the Company entered into a working capital loan agreement with the ICBC, with a balance of $ and $

On September 22, 2023,

the Company entered into a working capital loan agreement with the ICBC, with a balance of $ and $

On September 22, 2023,

the Company entered into a working capital loan agreement with the ICBC, with a balance of $ and $

On June 11, 2024,

the Company entered into a working capital loan agreement with the ICBC, with a balance of $

On June 21, 2024,

the Company entered into a working capital loan agreement with the ICBC, with a balance of $

On June 22, 2024,

the Company entered into a working capital loan agreement with the ICBC, with a balance of $

14

IT TECH PACKAGING, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

On June 24, 2024,

the Company entered into a working capital loan agreement with the ICBC, with a balance of $

As of June 30, 2024,

there were guaranteed short-term borrowings of $ and unsecured bank loans of $

The average short-term

borrowing rates for the three months ended June 30, 2024 and 2023 were approximately

Long-term loans

| June 30, | December 31, | |||||||

| 2024 | 2023 | |||||||

| Rural Credit Union of Xushui District Loan 1 | $ | $ | ||||||

| Rural Credit Union of Xushui District Loan 2 | ||||||||

| Rural Credit Union of Xushui District Loan 3 | ||||||||

| Rural Credit Union of Xushui District Loan 4 | ||||||||

| Rural Credit Union of Xushui District Loan 5 | ||||||||

| Total | ||||||||

| Less: Current portion of long-term loans | ( | ) | ( | ) | ||||

| Long-term loans | $ | $ | ||||||

| Amount | ||||

| Fiscal year | ||||

| Remainder of 2024 | $ | |||

| 2025 | ||||

| 2026 & after | ||||

| Total | ||||

On July 15, 2013,

the Company entered into a loan agreement with the Rural Credit Union of Xushui District for a term of

15

IT TECH PACKAGING, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

On April 17, 2019,

the Company entered into a loan agreement with the Rural Credit Union of Xushui District for a term of

On December 12, 2019,

the Company entered into a loan agreement with the Rural Credit Union of Xushui District for a term of

On February 26, 2023,

the Company entered into a loan agreement with the Rural Credit Union of Xushui District for a term of

On December 5, 2023,

the Company entered into a loan agreement with the Rural Credit Union of Xushui District for a term of

Total interest expenses

for the short-term bank loans and long-term loans for the three months ended June 30, 2024 and 2023 were $

(9) Related Party Transactions

Mr. Zhenyong Liu,

the Company’s CEO has loaned money to Dongfang Paper for working capital purposes over a period of time. On January 1, 2013,Dongfang

Paper and Mr. Zhenyong Liu renewed the three-year term loan previously entered on January 1, 2010, and extended the maturity date further

to December 31, 2015. On December 31, 2015, the Company paid off the loan of $

16

IT TECH PACKAGING, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

On December 10, 2014,

Mr. Zhenyong Liu provided a loan to the Company, amounted to $

On March 1, 2015,

the Company entered an agreement with Mr. Zhenyong Liu which allows Dongfang Paper to borrow from the CEO an amount up to $

As of June 30, 2024

and December 31, 2023, total amount of loans due to Mr. Zhenyong Liu were $. The interest expense incurred for such related party

loans were $ for the three and six months ended June 30, 2024 and 2023. The accrued interest owing to Mr. Zhenyong Liu was approximately

$

In October 2022 and

November 2022, the Company entered into two agreements with Mr. Zhenyong Liu, which allowed Mr. Zhenyong Liu to borrow from the Company

an amount of $

As of June 30, 2024

and December 31, 2023, amount due to shareholder was $

17

IT TECH PACKAGING, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(10) Notes payable

As of June 30, 2024,

the Company had bank acceptance notes of $

(11) Other payables and accrued liabilities

| June 30, | December 31, | |||||||

| 2024 | 2023 | |||||||

| Accrued electricity | $ | $ | ||||||

| Value-added tax payable | ||||||||

| Accrued interest to a related party | ||||||||

| Payable for purchase of property, plant and equipment | ||||||||

| Accrued commission to salesmen | ||||||||

| Accrued bank loan interest | ||||||||

| Others | ||||||||

| Totals | $ | $ | ||||||

(12) Derivative Liabilities

The Company analyzed the warrant for derivative accounting consideration under ASC 815, “Derivatives and Hedging, and hedging,” and determined that the instrument should be classified as a liability since the warrant becomes effective at issuance resulting in there being no explicit limit to the number of shares to be delivered upon settlement of the above conversion options.

ASC 815 requires we assess the fair market value of derivative liability at the end of each reporting period and recognize any change in the fair market value as other income or expense item.

The Company determined

its derivative liabilities to be a Level 3 fair value measurement and used the Black-Scholes pricing model to calculate the fair value

as of June 30, 2024. The Black-Scholes model requires six basic data inputs: the exercise or strike price, time to expiration, the risk-free

interest rate, the current stock price, the estimated volatility of the stock price in the future, and the dividend rate. Changes to

these inputs could produce a significantly higher or lower fair value measurement. The fair value of each warrant is estimated using

the Black-Scholes valuation model.

| Six months ended | ||

| June 30, 2024 | ||

| Expected term | ||

| Expected average volatility | ||

| Expected dividend yield | ||

| Risk-free interest rate |

The following table summarizes the changes in the derivative liabilities during the six months ended June 30, 2024: Fair

| Balance at December 31, 2023 | $ | |||

| Change in fair value of derivative liability | ( | ) | ||

| Balance at June 30, 2024 | $ |

18

IT TECH PACKAGING, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(13) Common Stock

Issuance of common stock to investors

On January 20, 2021,

the Company offered and sold to certain institutional investors an aggregate of

On March 1, 2021,

the Company offered and sold to the public investors an aggregate of

Reverse stock split

On June 9, 2022, the

Board of Directors of the Company approved the Reverse Stock Split, at a ratio of

(14) Warrants

On April 29, 2020,

the Company and certain institutional investors entered into a securities purchase agreement, as amended on May 4, 2020 (the “2020

Purchase Agreement”), pursuant to which the Company agreed to sell to such investors an aggregate of

On January 20, 2021,

the Company offered and sold to certain institutional investors an aggregate of

On March 1, 2021,

the Company offered and sold to the public investors an aggregate of

The Company classified warrants as liabilities and accounted for the issuance of the warrants as a derivative.

19

IT TECH PACKAGING, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

| Six months

ended June 30, 2024 | ||||||||

| Number | Weight

average exercise price | |||||||

| Outstanding and exercisable at beginning of the period | $ | |||||||

| Issued during the period | ||||||||

| Exercised during the period | ||||||||

| Cancelled or expired during the period | ||||||||

| Outstanding and exercisable at end of the period | $ | |||||||

| Warrants Outstanding | Warrants Exercisable | |||||||||||||||

| Number of Shares | Weighted Average Remaining Contractual life (in years) | Weighted Average Exercise Price | Number of Shares | Weighted Average Exercise Price | ||||||||||||

| $ | $ | |||||||||||||||

Aggregate intrinsic value is the sum of the amounts by which the quoted market price of the Company’s stock exceeded the exercise price of the warrants at June 30, 2024 for those warrants for which the quoted market price was in excess of the exercise price (“in-the-money” warrants). The intrinsic value of the warrants as of June 30, 2024 and December 31, 2023 are .

(15) Earnings Per Share

| Three Months Ended June 30, | ||||||||

| 2024 | 2023 | |||||||

| Basic loss per share | ||||||||

| Net loss for the period - numerator | $ | ( | ) | $ | ( | ) | ||

| Weighted average common stock outstanding - denominator | ||||||||

| Net loss per share | $ | ( | ) | $ | ( | ) | ||

| Diluted income per share | ||||||||

| Net income for the period - numerator | $ | ( | ) | $ | ( | ) | ||

| Weighted average common stock outstanding - denominator | ||||||||

| Effect of dilution | ||||||||

| Weighted average common stock outstanding - denominator | ||||||||

| Diluted loss per share | $ | ( | ) | $ | ( | ) | ||

20

IT TECH PACKAGING, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

For the six months ended June 30, 2024 and 2023, basic and diluted net loss per share are calculated as follows:

| Six Months Ended June 30, | ||||||||

| 2024 | 2023 | |||||||

| Basic loss per share | ||||||||

| Net loss for the period - numerator | $ | ( | ) | $ | ( | ) | ||

| Weighted average common stock outstanding - denominator | ||||||||

| Net loss per share | $ | ( | ) | $ | ( | ) | ||

| Diluted loss per share | ||||||||

| Net loss for the period - numerator | $ | ( | ) | $ | ( | ) | ||

| Weighted average common stock outstanding - denominator | ||||||||

| Effect of dilution | ||||||||

| Weighted average common stock outstanding - denominator | ||||||||

| Diluted loss per share | $ | ( | ) | $ | ( | ) | ||

For the three and six months ended June 30, 2024 and 2023 there were no securities with dilutive effect issued and outstanding.

(16) Income Taxes

United States

The Company may be

subject to the United States of America Tax laws at a tax rate of

PRC

Dongfang Paper and

Baoding Shengde are PRC operating companies and are subject to PRC Enterprise Income Tax. Pursuant to the PRC New Enterprise Income Tax

Law, Enterprise Income Tax is generally imposed at a statutory rate of

21

IT TECH PACKAGING, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

| Three Months Ended | ||||||||

| June 30, | ||||||||

| 2024 | 2023 | |||||||

| Provision for Income Taxes | ||||||||

| Current Tax Provision U.S. | $ | $ | ||||||

| Current Tax Provision PRC | ||||||||

| Deferred Tax Provision PRC | ||||||||

| Total Provision for (Deferred tax benefit)/ Income Taxes | $ | $ | ||||||

| Six Months Ended | ||||||||

| June 30, | ||||||||

| 2024 | 2023 | |||||||

| Provision for Income Taxes | ||||||||

| Current Tax Provision U.S. | $ | $ | ||||||

| Current Tax Provision PRC | ||||||||

| Deferred Tax Provision PRC | ||||||||

| Total Provision for (Deferred tax benefit)/ Income Taxes | $ | $ | ||||||

In addition to the

reversible future PRC income tax benefits stemming from the timing differences of items such as recognition of asset disposal gain or

loss and asset depreciation, the Company was incorporated in the United States and incurred net operating losses of approximately $

| June 30, | December 31, | |||||||

| 2024 | 2023 | |||||||

| Deferred tax assets (liabilities) | ||||||||

| Depreciation and amortization of property, plant and equipment | $ | $ | ||||||

| Impairment of property, plant and equipment | ||||||||

| Miscellaneous | ||||||||

| Net operating loss carryover of PRC company | ||||||||

| (Gain) Loss on asset disposal | ( | ) | ( | ) | ||||

| Total deferred tax assets | ||||||||

| Less: Valuation allowance | ( | ) | ( | ) | ||||

| Total deferred tax assets, net | $ | |||||||

22

IT TECH PACKAGING, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

| Three Months Ended | ||||||||

| June 30, | ||||||||

| 2024 | 2023 | |||||||

| PRC Statutory rate | % | % | ||||||

| Effect of different tax jurisdiction | ||||||||

| Effect of tax and book difference | ( | )% | ( | )% | ||||

| Change in valuation allowance | % | % | ||||||

| Effective income tax rate | % | ( | )% | |||||

| Six Months Ended | ||||||||

| June 30, | ||||||||

| 2024 | 2023 | |||||||

| PRC Statutory rate | % | % | ||||||

| Effect of different tax jurisdiction | ||||||||

| Effect of tax and book difference | ( | )% | ( | )% | ||||

| Change in valuation allowance | % | % | ||||||

| Effective income tax rate | ( | )% | ( | )% | ||||

As of June 30, 2024, except for the one-time transition tax under the 2017 TCJA which imposes a U.S. tax liability on all unrepatriated foreign E&Ps, the Company does not believe that its future dividend policy and the available U.S. tax deductions and net operating losses will cause the Company to recognize any other substantial current U.S. federal or state corporate income tax liability in the near future. Nor does it believe that the amount of the repatriation of the VIE’s earnings and profits for purposes of paying dividends will change the Company’s position that its PRC subsidiary Baoding Shengde and the VIE, Dongfang Paper are considered or are expected to be indefinitely reinvested offshore to support our future capacity expansion. If these earnings are repatriated to the U.S. resulting in U.S. taxable income in the future, or if it is determined that such earnings are to be remitted in the foreseeable future, additional tax provisions would be required.

The Company has adopted

ASC Topic 740-10-05, Income Taxes. To date, the adoption of this interpretation has not impacted the Company’s financial position,

results of operations, or cash flows. The Company performed self-assessment and the Company’s liability for income taxes includes

the liability for unrecognized tax benefits, interest and penalties which relate to tax years still subject to review by taxing authorities.

Audit periods remain open for review until the statute of limitations has passed, which in the PRC is usually

23

IT TECH PACKAGING, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(17) Stock Incentive Plans

2023 Incentive Stock Plan

On October 31, 2023,

the Company’s Annual General Meeting adopted and approved the 2023 Omnibus Equity Incentive Plan of IT Tech Packaging, Inc. (the”2023

ISP”). Under the 2023 ISP, the Company has reserved a total of

All shares of common stock under the 2023 ISP, including shares originally authorized by equity holders and shares remaining for future issuance as of June 30, 2024, have been reserved.

(18) Commitments and Contingencies

Xushui Land Lease

The Company leases

| June 30, | Amount | |||

| 2025 | ||||

| 2026 | ||||

| 2027 | ||||

| 2028 | ||||

| 2029 | ||||

| Thereafter | ||||

| Total operating lease payments | ||||

Sale of Headquarters Compound Real Properties

On August 7, 2013,

the Company’s Audit Committee and the Board of Directors approved the sale of the land use right of the Headquarters Compound (the

“LUR”), the office building and essentially all industrial-use buildings in the Headquarters Compound (the “Industrial

Buildings”), and three employee dormitory buildings located within the Headquarters Compound (the “Dormitories”) to

Hebei Fangsheng for cash prices of approximately $

In connection with

the sale of the Industrial Buildings, Hebei Fangsheng agreed to lease the Industrial Buildings back to the Company for its original use

with an annual rental payment of approximately $

24

IT TECH PACKAGING, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Capital commitment

As of June 30, 2024,

the Company has entered into several contracts for the purchase of paper machine of a new tissue paper production line PM10 and the improvement

of Industrial Buildings. Total outstanding commitments under these contracts were $

Guarantees and Indemnities

The

Company agreed with Baoding Huanrun Trading Co., a major supplier of raw materials, to guarantee certain obligations of this third party,

and as of June 30, 2024 and December 31, 2023, the Company guaranteed its long-term loan from financial institutions amounting to $

(19) Segment Reporting

Since March 10, 2010,

Baoding Shengde started its operations and thereafter the Company manages its operations through

The Company evaluates performance of its operating segments based on net income. Administrative functions such as finance, treasury, and information systems are centralized. However, where applicable, portions of the administrative function expenses are allocated among the operating segments based on gross revenue generated. The operating segments do share facilities in Xushui County, Baoding City, Hebei Province, China. All sales were sold to customers located in the PRC.

25

IT TECH PACKAGING, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

| Three Months Ended | ||||||||||||||||||||||||

| June 30, 2024 | ||||||||||||||||||||||||

| Dongfang | Tengsheng | Baoding | Not Attributable | Elimination of | Enterprise- wide, | |||||||||||||||||||

| Paper | Paper | Shengde | to Segments | Inter-segment | consolidated | |||||||||||||||||||

| Revenues | $ | $ | $ | $ | $ | $ | ||||||||||||||||||

| Gross profit | ||||||||||||||||||||||||

| Depreciation and amortization | ||||||||||||||||||||||||

| Interest income | ||||||||||||||||||||||||

| Interest expense | ||||||||||||||||||||||||

| Income tax expense(benefit) | ||||||||||||||||||||||||

| Net income (loss) | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||||||||||

| Three Months Ended | ||||||||||||||||||||||||

| June 30, 2023 | ||||||||||||||||||||||||

| Dongfang | Tengsheng | Baoding | Not Attributable | Elimination of | Enterprise- wide, | |||||||||||||||||||

| Paper | Paper | Shengde | to Segments | Inter-segment | consolidated | |||||||||||||||||||

| Revenues | $ | $ | $ | $ | $ | $ | ||||||||||||||||||

| Gross profit | ( | ) | ( | ) | ||||||||||||||||||||

| Depreciation and amortization | ||||||||||||||||||||||||

| Loss on impairment of assets | ||||||||||||||||||||||||

| Interest income | ||||||||||||||||||||||||

| Interest expense | ||||||||||||||||||||||||

| Income tax expense(benefit) | ||||||||||||||||||||||||

| Net income (loss) | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||||||||||

| Six Months Ended | ||||||||||||||||||||||||

| June 30, 2024 | ||||||||||||||||||||||||

| Dongfang | Tengsheng | Baoding | Not Attributable | Elimination of | Enterprise- wide, | |||||||||||||||||||

| Paper | Paper | Shengde | to Segments | Inter-segment | consolidated | |||||||||||||||||||

| Revenues | $ | |||||||||||||||||||||||

| Gross profit | ||||||||||||||||||||||||

| Depreciation and amortization | ||||||||||||||||||||||||

| Interest income | ||||||||||||||||||||||||

| Interest expense | ||||||||||||||||||||||||

| Income tax expense(benefit) | ||||||||||||||||||||||||

| Net income (loss) | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||||||||||

26

IT TECH PACKAGING, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

| Six Months Ended | ||||||||||||||||||||||||

| June 30, 2023 | ||||||||||||||||||||||||

| Dongfang | Tengsheng | Baoding | Not Attributable | Elimination of | Enterprise- wide, | |||||||||||||||||||

| Paper | Paper | Shengde | to Segments | Inter-segment | consolidated | |||||||||||||||||||

| Revenues | $ | |||||||||||||||||||||||

| Gross profit | ( | ) | ( | ) | ||||||||||||||||||||

| Depreciation and amortization | ||||||||||||||||||||||||

| Loss from impairment and disposal of property, plant and equipment | ||||||||||||||||||||||||

| Interest income | ||||||||||||||||||||||||

| Interest expense | ||||||||||||||||||||||||

| Income tax expense(benefit) | ||||||||||||||||||||||||

| Net income (loss) | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||||||||||

| As of June 30, 2024 | ||||||||||||||||||||||||

| Dongfang | Tengsheng | Baoding | Not Attributable | Elimination of | Enterprise- wide, | |||||||||||||||||||

| Paper | Paper | Shengde | to Segments | Inter-segment | consolidated | |||||||||||||||||||

| Total assets | $ | |||||||||||||||||||||||

| As of December 31, 2023 | ||||||||||||||||||||||||

| Dongfang | Tengsheng | Baoding | Not Attributable | Elimination of | Enterprise- wide, | |||||||||||||||||||

| Paper | Paper | Shengde | to Segments | Inter-segment | consolidated | |||||||||||||||||||

| Total assets | $ | |||||||||||||||||||||||

27

IT TECH PACKAGING, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(20) Concentration and Major Customers and Suppliers

For the three and six months ended June 30, 2024

and 2023, the Company had no single customer contributed over

For the three months ended June 30, 2024, the Company had three major

suppliers accounted for

For the six months ended June 30, 2024, the Company

had three major suppliers accounted for

(21) Concentration of Credit Risk

Financial instruments for which the Company is

potentially subject to concentration of credit risk consist principally of cash. The Company places its cash in reputable financial institutions

in the PRC and the United States. Although it is generally understood that the PRC central government stands behind all of the banks in

China in the event of bank failure, there is no deposit insurance system in China that is similar to the protection provided by the Federal

Deposit Insurance Corporation (“FDIC”) of the United States as of as of June 30, 2024 and December 31, 2023. On May 1, 2015,

the new “Deposit Insurance Regulations” was effective in the PRC that the maximum protection would be up to RMB

(22) Risks and Uncertainties

The Company is subject to substantial risks from, among other things, intense competition associated with the industry in general, other risks associated with financing, liquidity requirements, rapidly changing customer requirements, foreign currency exchange rates, and operating in the PRC under its various laws and restrictions.

(23) Subsequent Event

None.

28

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations Cautionary Notice Regarding Forward-Looking Statements

The following discussion of the financial condition and results of operations of the Company for the periods ended June 30, 2024 and 2023 should be read in conjunction with the financial statements and the notes to the financial statements that are included elsewhere in this quarterly report.

In this quarterly report, references to “the Company,” “we,” “our” and “us” refer to IT Tech Packaging, Inc. and its PRC subsidiary and variable interest entity unless the context requires otherwise.

We make certain forward-looking statements in this report. Statements concerning our future operations, prospects, strategies, financial condition, future economic performance (including growth and earnings), demand for our products, and other statements of our plans, beliefs, or expectations, including the statements contained under the captions “Management’s Discussion and Analysis of Financial Condition and Results of Operations” as well as captions elsewhere in this document, are forward-looking statements. In some cases these statements are identifiable through the use of words such as “anticipate”, “believe”, “estimate”, “expect”, “intend”, “plan”, “project”, “target”, “can”, “could”, “may”, “should”, “will”, “would”, and similar expressions. We intend such forward-looking statements to be covered by the safe harbor provisions contained in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and in Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The forward-looking statements we make are not guarantees of future performance and are subject to various assumptions, risks, and other factors that could cause actual results to differ materially from those suggested by these forward-looking statements. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by the forward-looking statements. Indeed, it is likely that some of our assumptions may prove to be incorrect. Our actual results and financial position may vary from those projected or implied in the forward-looking statements and the variances may be material. You are cautioned not to place undue reliance on such forward-looking statements. These risks and uncertainties, together with the other risks described from time to time in reports and documents that we file with the Securities and Exchange Commission (the “SEC”) should be considered in evaluating forward-looking statements. In evaluating the forward-looking statements contained in this report, you should consider various factors, including, without limitation, the following: (a) those risks and uncertainties related to general economic conditions, (b) whether we are able to manage our planned growth efficiently and operate profitably, (c) whether we are able to generate sufficient revenues or obtain financing to sustain and grow our operations, and (d) whether we are able to successfully fulfill our primary requirements for cash. We assume no obligation to update forward-looking statements, except as otherwise required under federal securities laws.

Results of Operations

Comparison of the Three months ended June 30, 2024 and 2023

Revenue for the three months ended June 30, 2024 was $26,249,788, a decrease of $3,770,126, or 12.56%, from $30,019,914 for the same period in the previous year. This was mainly due to the production suspension of offset printing paper and tissue paper products in the second quarter of 2024.

29

Revenue of Offset Printing Paper, Corrugating Medium Paper and Tissue Paper Products

Revenue from sales of offset printing paper, corrugating medium paper (“CMP”) and tissue paper products for the three months ended June 30, 2024 was $26,212,815, representing a decrease of $3,762,919, or 12.55%, from $29,975,734 for the second quarter of 2023. Total offset printing paper, CMP and tissue paper products sold during the three months ended June 30, 2024 amounted to 75,365 tonnes, representing a decrease of 3,271 tonnes, or 4.16%, compared to 78,636 tonnes sold in the comparable period in the previous year. Production of offset printing paper and tissue paper products was suspended due to the rising natural gas prices in the first half of 2024. It is expected that production will resume in the third quarter of 2024. The changes in revenue dollar amount and in quantity sold for the three months ended June 30, 2024 and 2023 are summarized as follows:

| Three Months Ended | Three Months Ended | Percentage | ||||||||||||||||||||||||||||||

| June 30, 2024 | June 30, 2023 | Change in | Change | |||||||||||||||||||||||||||||

| Sales Revenue | Quantity (Tonne) | Amount | Quantity (Tonne) | Amount | Quantity (Tonne) | Amount | Quantity | Amount | ||||||||||||||||||||||||

| Regular CMP | 62,813 | $ | 21,983,621 | 60,063 | $ | 21,931,330 | 2,750 | $ | 52,291 | 4.58 | % | 0.24 | % | |||||||||||||||||||

| Light-Weight CMP | 12,552 | $ | 4,229,194 | 12,877 | $ | 4,544,190 | (325 | ) | $ | (314,996 | ) | (2.52 | )% | (6.93 | )% | |||||||||||||||||

| Total CMP | 75,365 | $ | 26,212,815 | 72,940 | $ | 26,475,520 | 2,425 | $ | (262,705 | ) | 3.32 | % | (0.99 | )% | ||||||||||||||||||

| Offset Printing Paper | - | $ | - | 5,403 | $ | 3,155,882 | (5,403 | ) | $ | (3,155,882 | ) | (100.00 | )% | (100.00 | )% | |||||||||||||||||

| Tissue Paper Products | - | $ | - | 293 | $ | 344,332 | (293 | ) | $ | (344,332 | ) | (100.00 | )% | (100.00 | )% | |||||||||||||||||

| Total CMP, Offset Printing Paper and Tissue Paper Revenue | 75,365 | $ | 26,212,815 | 78,636 | $ | 29,975,734 | (3,271 | ) | $ | (3,762,919 | ) | (4.16 | )% | (12.55 | )% | |||||||||||||||||

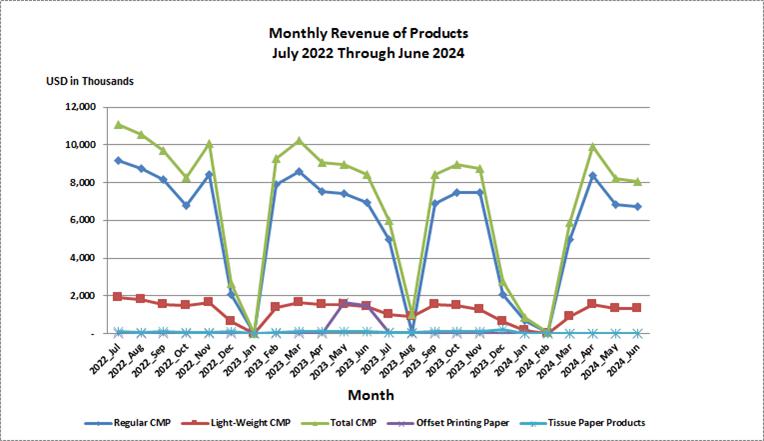

Monthly sales revenue for the 24 months ended June 30, 2024, are summarized below:

30

The Average Selling Prices (ASPs) for our main products in the three months ended June 30, 2024 and 2023 are summarized as follows:

| Offset Printing Paper ASP | Regular CMP ASP | Light-Weight CMP ASP | Tissue Paper Products ASP | |||||||||||||

| Three Months ended June 30, 2024 | $ | - | $ | 350 | $ | 337 | $ | - | ||||||||

| Three Months ended June 30, 2023 | $ | 584 | $ | 365 | $ | 353 | $ | 1,175 | ||||||||

| Decrease from comparable period in the previous year | $ | (584 | ) | $ | (15 | ) | $ | (16 | ) | $ | (1,175 | ) | ||||

| Decrease by percentage | (100 | )% | (4.11 | )% | (4.53 | )% | (100 | )% | ||||||||

The following chart shows the month-by-month ASPs for the 24-month period ended June 30, 2024:

Corrugating Medium Paper

Revenue from CMP amounted to $26,212,815 (100.00% of the total offset printing paper, CMP and tissue paper products revenues) for the three months ended June 30, 2024, representing a decrease of $262,705, or 0.99%, from $26,475,520 for the comparable period in 2023. Production of offset printing paper and tissue paper products was suspended in the second quarter of 2024.

We sold 75,365 tonnes of CMP in the three months ended June 30, 2024 as compared to 72,940 tonnes for the same period in 2023, representing a 3.32% increase in quantity sold.

31

ASP for regular CMP decreased from $365/tonne for the three months ended June 30, 2023 to $350/tonne for the three months ended June 30, 2024, representing a 4.11% decrease. ASP in RMB for regular CMP for the second quarter of 2023 and 2024 was RMB2,574 and RMB2,488, respectively, representing a 3.35% decrease. The quantity of regular CMP sold increased by 2,750 tonnes, from 60,063 tonnes in the second quarter of 2023 to 62,813 tonnes in the second quarter of 2024.

Our PM6 production line, which produces regular CMP, has a designated capacity of 360,000 tonnes /year. The utilization rates for the second quarter of 2024 and 2023 were 68.02% and 66.61%, respectively, representing an increase of 1.41%.

Quantities sold for regular CMP that was produced by the PM6 production line from July 2022 to June 2024 are as follows:

Offset printing paper

Revenue from offset printing paper was $nil for the three months ended June 30, 2024, representing a decrease of $3,155,882, or 100.00%, from $3,155,882 for the three months ended June 30, 2023. Production of offset printing paper was suspended during the second quarter of 2024.

Tissue Paper Products

Revenue from tissue paper products was $nil for the three months ended June 30, 2024, representing a decrease of $344,332, or 100.00%, from $344,332 for the three months ended June 30, 2023. Production of tissue paper products was suspended during the second quarter of 2024.

32

Revenue of Face Mask

Revenue generated from selling face mask were $nil and $44,246 for the three months ended June 30, 2024 and 2023, respectively.

Cost of Sales

Total cost of sales for CMP, offset printing paper and tissue paper products for the quarter ended June 30, 2024 was $22,984,488, a decrease of $5,807,701, or 20.17%, from $28,792,189 for the comparable period in 2023. This was mainly due to the decrease in sales quantity of offset printing paper and tissue paper products and the decrease of the unit material cost of CMP products.

Cost of sales for CMP was $22,984,488 for the quarter ended June 30, 2024, as compared to $24,658,830 for the comparable period in 2023. The decrease in the cost of sales of $1,674,342 for CMP was mainly due to the decrease in average unit cost of sales of CMP, partially offset by the increase in sales volume of regular CMP. Average cost of sales per tonne for CMP decreased by 9.76%, from $338 in the second quarter of 2023 to $305 in the second quarter of 2024. The decrease in average cost of sales was mainly attributable to the lower average unit purchase costs (net of applicable value added tax) of recycled paper board in the second quarter of 2024 compared to the second quarter of 2023.

Cost of sales for offset printing paper was $nil for the quarter ended June 30, 2024, as compared to $3,079,485 for the comparable period in 2023. The production of offset printing paper was suspended in the second quarter of 2024.

Cost of sales for tissue paper products was $nil for the quarter ended June 30, 2024, as compared to $1,053,874 for the comparable period in 2023. The production of tissue paper products was suspended in the second quarter of 2024.

Changes in cost of sales and cost per tonne by product for the quarters ended June 30, 2024 and 2023 are summarized below:

| Three Months Ended | Three Months Ended | Change in | ||||||||||||||||||||||||||||||

| June 30, 2024 | June 30, 2023 | Change in | percentage | |||||||||||||||||||||||||||||

| Cost of Sales | Cost per Tonne | Cost of Sales | Cost per Tonne | Cost of Sales | Cost per Tonne | Cost of Sales | Cost per Tone | |||||||||||||||||||||||||

| Regular CMP | $ | 19,297,669 | $ | 307 | $ | 20,438,880 | $ | 340 | $ | (1,141,211 | ) | $ | (33 | ) | (5.58 | )% | (9.71 | )% | ||||||||||||||

| Light-Weight CMP | $ | 3,686,819 | $ | 294 | $ | 4,219,950 | $ | 328 | $ | (533,131 | ) | $ | (34 | ) | (12.63 | )% | (10.37 | )% | ||||||||||||||

| Total CMP | $ | 22,984,488 | $ | 305 | $ | 24,658,830 | $ | 338 | $ | (1,674,342 | ) | $ | (33 | ) | (6.79 | )% | (9.76 | )% | ||||||||||||||

| Offset Printing Paper | $ | - | $ | - | $ | 3,079,485 | $ | 570 | $ | (3,079,485 | ) | $ | (570 | ) | (100.00 | )% | (100.00 | )% | ||||||||||||||

| Tissue Paper Products | $ | - | $ | - | 1,053,874 | $ | 3,597 | $ | (1,053,874 | ) | $ | (3,597 | ) | (100.00 | )% | (100.00 | )% | |||||||||||||||

| Total CMP, Offset Printing Paper and Tissue Paper | $ | 22,984,488 | $ | n/a | $ | 28,792,189 | $ | n/a | $ | (5,807,701 | ) | $ | n/a | (20.17 | )% | n/a | ||||||||||||||||

Our average unit purchase costs (net of applicable value added tax) of recycled paper board in the three months ended June 30, 2024 were RMB 1,167/tonne (approximately $164/tonne), as compared to RMB 1,340/tonne (approximately $192/tonne) for the three months ended June 30, 2023. These changes (in US dollars) represent a year-over-year decrease of 14.58% for the recycled paper board. We use domestic recycled paper (sourced mainly from the Beijing-Tianjin metropolitan area) exclusively. Although we do not rely on imported recycled paper, the pricing of which tends to be more volatile than domestic recycled paper, our experience suggests that the pricing of domestic recycled paper bears some correlation to the pricing of imported recycled paper.

33

The pricing trends of our major raw materials for the 24-month period from July 2022 to June 2024 are shown below:

Electricity and gas are our two main energy sources. Electricity and gas accounted for approximately 5% and 12.9% of total sales in the second quarter of 2024, respectively, compared to 5% and 14.9% of total sales in the second quarter of 2023. The monthly energy cost as a percentage of total monthly sales of our main paper products for the 24 months ended June 30, 2024 are summarized as follows:

Gross Profit (Loss)

Gross profit for the three months ended June 30, 2024 was $3,265,300 (representing 12.44% of the total revenue), representing an increase of $2,085,442, or 176.75%, from the gross profit of $1,179,858 (representing 3.93% of the total revenue) for the three months ended June 30, 2023, as a result of factors described above.

34

Offset Printing Paper, CMP and Tissue Paper Products

Gross profit for offset printing paper, CMP and tissue paper products for the three months ended June 30, 2024 was $3,228,327, representing an increase of $2,044,782, or 172.77%, from the gross profit of $1,183,544 for the three months ended June 30, 2023. The increase was mainly the result of the factors discussed above.

The overall gross profit margin for offset printing paper, CMP and tissue paper products increased by 8.37 percentage points, from 3.95% for the three months ended June 30, 2023, to 12.32% for the three months ended June 30, 2024.

Gross profit margin for regular CMP for the three months ended June 30, 2024 was 12.22%, or 5.41 percentage points higher, as compared to gross profit margin of 6.81% for the three months ended June 30, 2023. Such increase was mainly due to the decrease in cost of recycled paper board, partially offset by the decrease in ASP of regular CMP in the second quarter of 2024.

Gross profit margin for light-weight CMP for the three months ended June 30, 2024 was 12.82%, or 5.68 percentage points higher, as compared to gross profit margin of 7.14% for the three months ended June 30, 2023. The increase was mainly due to the decrease in cost of recycled paper board, partially offset by the decrease of ASP of light-weight CMP in the second quarter of 2024.

Monthly gross profit margins on the sales of our CMP and offset printing paper for the 24-month period ended June 30, 2024 are as follows:

35

Face Masks

Gross loss for face masks for the three months ended June 30, 2024 and 2023 were $nil and $3,568.

Selling, General and Administrative Expenses

Selling, general and administrative expenses for the three months ended June 30, 2024 were $2,717,548, an increase of $1,394,143, or 105.35% from $1,323,405 for the three months ended June 30, 2023. The increase was mainly due to the increase in depreciation of idle fixed assets during production suspension.

Income (Loss) from Operations

Operating income for the quarter ended June 30, 2024 was $547,752, an increase of $1,066,435, or 205.60%, from loss from operations of $518,683 for the quarter ended June 30, 2023. The increase in income from operations was primarily due to the increase gross profit, partially offset by the increase in selling, general and administrative expenses.

Other Income and Expenses

Interest expense for the three months ended June 30, 2024 decreased by $91,941, from $270,681 in the three months ended June 30, 2023, to $178,740. The Company had short-term and long-term interest-bearing loans, related party loans and leasing obligations that aggregated $12,149,914 as of June 30, 2024, as compared to $17,607,943 as of June 30, 2023.

Gain on derivative liability

The Company analyzed the warrant for derivative accounting consideration under ASC 815, “Derivatives and Hedging, and hedging,” and determined that the instrument should be classified as a liability. ASC 815 requires we assess the fair market value of derivative liability at the end of each reporting period and recognize any change in the fair market value as other income or expense item. The change in fair value of derivative liability for the three months ended June 30, 2024 and 2023 was a gain of $15 and a loss of $166,506, respectively.

Net Loss

As a result and the factors discussed above, net loss was $77,747 for the quarter ended June 30, 2024, representing a decrease of loss of $1,175,746, or 93.80%, from $1,253,493 for the quarter ended June 30, 2023.

36

Comparison of the Six months ended June 30, 2024 and 2023

Revenue for the six months ended June 30, 2024 was $33,113,629, representing a decrease of $16,697,162, or 33.52%, from $49,810,791 for the same period in the previous year. This was mainly due to the production suspension of CMP in January and February of 2024, and production suspension of offset printing paper and tissue paper products in the first half of 2024.

Revenue of Offset Printing Paper, Corrugating Medium Paper and Tissue Paper Products

Revenue from sales of offset printing paper, CMP and tissue paper products for the six months ended June 30, 2024 was $33,039,615, a decrease of $16,687,267, or 33.56%, from $49,726,882 for the six months ended June 30, 2023. This was mainly due to the decrease in sales volume of CMP, offset printing paper and tissue paper products, and the decrease in ASPs of CMP. Total quantities of offset printing paper, CMP and tissue paper products sold during the six months ended June 30, 2024 amounted to 94,034 tonnes, a decrease of 34,475 tonnes, or 26.83%, compared to 128,509 tonnes sold during the six months ended June 30, 2023. Total quantities of CMP and offset printing paper sold decreased by 33,991 tonnes in the six months of 2024 as compared to the same period of 2023. Production of CMP was suspended in January and February of 2024 and resumed in mid of March 2024, and production of offset printing paper and tissue paper products was suspended in the first half of 2024 due to energy price rise and Chinese New Year holiday. The production of offset printing paper and tissue paper products is expected to resume in the third quarter of 2024. The changes in revenue and quantity sold for the six months ended June 30, 2024 and 2023 are summarized as follows:

| Six Months Ended | Six Months Ended | Percentage | ||||||||||||||||||||||||||||||

| June 30, 2024 | June 30, 2023 | Change in | Change | |||||||||||||||||||||||||||||

| Sales Revenue | Quantity (Tonne) | Amount | Quantity (Tonne) | Amount | Quantity (Tonne) | Amount | Quantity | Amount | ||||||||||||||||||||||||

| Regular CMP | 78,452 | $ | 27,734,222 | 101,726 | $ | 38,399,299 | (23,274 | ) | $ | (10,665,077 | ) | (22.88 | )% | (27.77 | )% | |||||||||||||||||

| Light-Weight CMP | 15,582 | $ | 5,305,393 | 20,896 | $ | 7,604,416 | (5,314 | ) | $ | (2,299,023 | ) | (25.43 | )% | (30.23 | )% | |||||||||||||||||

| Total CMP | 94,034 | $ | 33,039,615 | 122,622 | $ | 46,003,715 | (28,588 | ) | $ | (12,964,100 | ) | (23.31 | )% | (28.18 | )% | |||||||||||||||||

| Offset Printing Paper | - | $ | - | 5,403 | $ | 3,155,882 | (5,403 | ) | $ | (3,155,882 | ) | (100.00 | )% | (100.00 | )% | |||||||||||||||||

| Tissue Paper Products | - | $ | - | 484 | $ | 567,285 | (484 | ) | $ | (567,285 | ) | (100.00 | )% | (100.00 | )% | |||||||||||||||||

| Total CMP, Offset Printing Paper and Tissue Paper Revenue | 94,034 | $ | 33,039,615 | 128,509 | $ | 49,726,882 | (34,475 | ) | $ | (16,687,267 | ) | (26.83 | )% | (33.56 | )% | |||||||||||||||||

ASPs for our main products in the six-month period ended June 30, 2024 and 2023 are summarized as follows:

| Offset Printing Paper ASP | Regular CMP ASP | Light-Weight CMP ASP | Tissue Paper Products ASP | |||||||||||||

| Six Months Ended June 30, 2024 | $ | - | $ | 354 | $ | 340 | $ | - | ||||||||

| Six Months Ended June 30, 2023 | $ | 584 | $ | 377 | $ | 364 | $ | 1,172 | ||||||||

| Decrease from comparable period in the previous year | $ | (584 | ) | $ | (23 | ) | $ | (24 | ) | $ | (1,172 | ) | ||||

| Decrease by percentage | (100 | )% | (6.10 | )% | (6.59 | )% | (100.00 | )% | ||||||||

37

Revenue of Face Masks

Revenue generated from selling face masks were $nil and $79,883 for the six months ended June 30, 2024 and 2023.

Cost of Sales

Total cost of sales for CMP, offset printing paper and tissue paper products in the six months ended June 30, 2024 was $29,448,953, a decrease of $19,361,616, or 39.67%, from $48,810,569 for the six months ended June 30, 2023. This was mainly due to the decrease in sales quantity and the decrease in the unit material costs of CMP.

Cost of sales for CMP was $29,448,953for the six months ended June 30, 2024, as compared to $43,747,945 in the same period of 2023. The decrease in the cost of sales of $14,298,992 for CMP was mainly due to the decreases in sales volume and average unit cost of sales of CMP. Average cost of sales per tonne for CMP decreased by 12.32%, from $357 for the six months ended June 30, 2023, to $313 in the same period of 2024. This was mainly attributable to the lower average unit purchase costs (net of applicable value added tax) of recycled paper board.