We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Share Name | Share Symbol | Market | Type |

|---|---|---|---|

| abrdn Australia Equity Fund Inc | AMEX:IAF | AMEX | Common Stock |

| Price Change | % Change | Share Price | High Price | Low Price | Open Price | Shares Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|

| 0.02 | 0.45% | 4.46 | 4.4689 | 4.44 | 4.44 | 115,619 | 01:00:00 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number: | 811-04438 |

| Exact name of registrant as specified in charter: | abrdn Australia Equity Fund, Inc. |

| Address of principal executive offices: | 1900 Market Street, Suite 200 |

| Philadelphia, PA 19103 | |

| Name and address of agent for service: | Sharon Ferrari |

| abrdn Inc. | |

| 1900 Market Street, Suite 200 | |

| Philadelphia, PA 19103 | |

| Registrant’s telephone number, including area code: | 1-800-522-5465 |

| Date of fiscal year end: | October 31 |

| Date of reporting period: | April 30, 2023 |

Item 1. Reports to Stockholders.

(a) A copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “1940 Act”) is filed herewith.

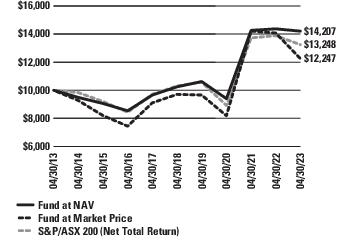

| 1 | Past performance is no guarantee of future results. Investment returns and principal value will fluctuate and shares, when sold, may be worth more or less than original cost. Current performance may be lower or higher than the performance quoted. Net asset value return data includes investment management fees, custodial charges and administrative fees (such as Director and legal fees) and assumes the reinvestment of all distributions. |

| 2 | Assuming the reinvestment of dividends and distributions. |

| 3 | The Fund’s total return is based on the reported net asset value (“NAV”) for each financial reporting period end and may differ from what is reported on the Financial Highlights due to financial statement rounding or adjustments. |

| 4 | The S&P/ASX 200 is a market-capitalization weighted and float-adjusted stock market index of Australian stocks listed on the Australian Securities Exchange from S&P Global Ratings. The index is calculated net of withholding taxes to which the Fund is generally subject. Indexes are unmanaged and have been provided for comparison purposes only. No fees or expenses are reflected. You cannot invest directly in an index. |

| abrdn Australia Equity Fund, Inc. | 1 |

| 2 | abrdn Australia Equity Fund, Inc. |

| 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | |

| Net Asset Value (NAV) | 12.63% | -1.16% | 14.76% | 6.76% | 3.57% |

| Market Price | 15.29% | -13.00% | 14.37% | 4.76% | 2.05% |

| S&P/ASX 200 (Net Total Return) | 12.24% | -4.59% | 14.10% | 5.16% | 2.85% |

| abrdn Australia Equity Fund, Inc. | 3 |

| Sectors | |

| Financials | 26.9% |

| Banks | 17.4% |

| Capital Markets | 6.2% |

| Insurance | 3.3% |

| Materials | 21.1% |

| Health Care | 15.8% |

| Consumer Staples | 7.9% |

| Energy | 6.9% |

| Consumer Discretionary | 6.8% |

| Real Estate | 6.3% |

| Communication Services | 5.8% |

| Information Technology | 2.4% |

| Industrials | 2.1% |

| Utilities | 1.5% |

| Short-Term Investment | 0.5% |

| Liabilities in Excess of Other Assets | (4.0%) |

| 100.0% |

| Top Ten Holdings | |

| BHP Group Ltd. | 10.9% |

| CSL Ltd. | 8.9% |

| Commonwealth Bank of Australia | 8.0% |

| National Australia Bank Ltd. | 5.7% |

| Woodside Energy Group Ltd. | 5.3% |

| Woolworths Group Ltd. | 4.3% |

| Telstra Group Ltd. | 4.2% |

| Macquarie Group Ltd. | 4.2% |

| Rio Tinto PLC | 3.9% |

| ANZ Group Holdings Ltd. | 3.7% |

| 4 | abrdn Australia Equity Fund, Inc. |

| Shares | Description | Industry and Percentage of Net Assets | Value |

| COMMON STOCKS—103.5% | |||

| AUSTRALIA—94.0% | |||

| 289,813 | ANZ Group Holdings Ltd. | Banks—3.7% | $ 4,706,050 |

| 95,000 | Aristocrat Leisure Ltd. | Hotels, Restaurants & Leisure—1.9% | 2,403,069 |

| 54,800 | ASX Ltd. | Capital Markets—2.0% | 2,493,922 |

| 2,089,200 | Beach Energy Ltd. | Oil, Gas & Consumable Fuels—1.6% | 2,056,376 |

| 464,600 | BHP Group Ltd. | Metals & Mining—10.9% | 13,788,154 |

| 221,300 | Charter Hall Group, REIT | Diversified REITs—1.3% | 1,646,438 |

| 25,210 | Cochlear Ltd. | Health Care Equipment & Supplies—3.3% | 4,133,623 |

| 153,200 | Commonwealth Bank of Australia | Banks—8.0% | 10,138,178 |

| 56,600 | CSL Ltd. | Biotechnology—8.9% | 11,299,434 |

| 157,100 | Elders Ltd. | Food Products—0.7% | 845,830 |

| 511,100 | Endeavour Group Ltd. | Consumer Staples Distribution & Retail—1.8% | 2,303,629 |

| 314,006 | Goodman Group | Industrial REITs—3.2% | 4,048,049 |

| 172,300 | IDP Education Ltd. | Diversified Consumer Services—2.6% | 3,236,960 |

| 571,700 | Insurance Australia Group Ltd. | Insurance—1.5% | 1,894,091 |

| 62,590 | James Hardie Industries PLC | Construction Materials—1.1% | 1,396,702 |

| 43,250 | Macquarie Group Ltd. | Capital Markets—4.2% | 5,276,144 |

| 972,600 | Medibank Pvt Ltd. | Insurance—1.8% | 2,301,714 |

| 534,700 | Metcash Ltd. | Consumer Staples Distribution & Retail—1.1% | 1,385,683 |

| 1,413,775 | Mirvac Group | Diversified REITs—1.8% | 2,269,711 |

| 376,600 | National Australia Bank Ltd. | Banks—5.7% | 7,249,983 |

| 454,000 | Northern Star Resources Ltd. | Metals & Mining—3.2% | 4,049,592 |

| 875,500 | Pilbara Minerals Ltd. | Metals & Mining—2.0% | 2,491,857 |

| 51,700 | Pro Medicus Ltd. | Health Care Technology—1.7% | 2,122,124 |

| 77,980 | Rio Tinto PLC | Metals & Mining—3.9% | 4,957,373 |

| 1,833,200 | Telstra Group Ltd. | Diversified Telecommunication Services—4.2% | 5,318,506 |

| 84,080 | Wesfarmers Ltd. | Broadline Retail—2.3% | 2,908,613 |

| 293,760 | Woodside Energy Group Ltd. | Oil, Gas & Consumable Fuels—5.3% | 6,665,509 |

| 212,440 | Woolworths Group Ltd. | Consumer Staples Distribution & Retail—4.3% | 5,480,275 |

| Total Australia | 118,867,589 | ||

| NEW ZEALAND—7.6% | |||

| 494,840 | Auckland International Airport Ltd.(a) | Transportation Infrastructure—2.1% | 2,697,306 |

| 499,400 | Mercury NZ Ltd. | Electric Utilities—1.5% | 1,943,063 |

| 620,400 | Spark New Zealand Ltd. | Diversified Telecommunication Services—1.6% | 1,999,608 |

| 48,000 | Xero Ltd.(a) | Software—2.4% | 2,996,435 |

| Total New Zealand | 9,636,412 | ||

| UNITED STATES—1.9% | |||

| 107,503 | ResMed, Inc., GDR | Health Care Equipment & Supplies—1.9% | 2,414,979 |

| Total Common Stocks | 130,918,980 | ||

| SHORT-TERM INVESTMENT—0.5% | |||

| UNITED STATES—0.5% | |||

| 674,278 | State Street Institutional U.S. Government Money Market Fund, Premier Class, 4.76%(b) | 674,279 | |

| Total Short-Term Investment | 674,279 | ||

| Total Investments—104.0% (cost $116,871,742)(c) | 131,593,259 | ||

| Liabilities in Excess of Other Assets—(4.0%) | (5,101,827) | ||

| Net Assets—100.0% | $126,491,432 | ||

| (a) | Non-income producing security. |

| (b) | Registered investment company advised by State Street Global Advisors. The rate shown is the 7 day yield as of April 30, 2023. |

| (c) | See accompanying Notes to Financial Statements for tax unrealized appreciation/(depreciation) of securities. |

| abrdn Australia Equity Fund, Inc. | 5 |

| GDR | Global Depositary Receipt |

| PLC | Public Limited Company |

| REIT | Real Estate Investment Trust |

| 6 | abrdn Australia Equity Fund, Inc. |

| Assets | |

| Investments, at value (cost $116,197,463) | $130,918,980 |

| Short-term investments, at value (cost $674,279) | 674,279 |

| Foreign currency, at value (cost $3,717,318) | 3,678,621 |

| Receivable for investments sold | 1,266,031 |

| Interest and dividends receivable | 84,945 |

| Prepaid expenses and other assets | 61,893 |

| Total assets | 136,684,749 |

| Liabilities | |

| Revolving credit facility payable (Note 7) | 9,912,748 |

| Investment management fees payable (Note 3) | 103,157 |

| Investor relations fees payable (Note 3) | 34,737 |

| Interest payable on credit facility | 28,506 |

| Administration fees payable (Note 3) | 8,971 |

| Other accrued expenses | 105,198 |

| Total liabilities | 10,193,317 |

| Net Assets | $126,491,432 |

| Composition of Net Assets | |

| Common stock (par value $0.01 per share) (Note 5) | $254,693 |

| Paid-in capital in excess of par | 118,674,973 |

| Distributable earnings | 7,561,766 |

| Net Assets | $126,491,432 |

| Net asset value per share based on 25,469,347 shares issued and outstanding | $4.97 |

| abrdn Australia Equity Fund, Inc. | 7 |

| Net Investment Income | |

| Investment Income: | |

| Dividends (net of foreign withholding taxes of $46,245) | $2,668,477 |

| Interest and other income | 31,864 |

| Total investment income | 2,700,341 |

| Expenses: | |

| Investment management fee (Note 3) | 624,719 |

| Directors' fees and expenses | 98,391 |

| Administration fee (Note 3) | 54,395 |

| Revolving credit facility fees and expenses (Note 7) | 40,870 |

| Independent auditors’ fees and expenses | 35,759 |

| Investor relations fees and expenses (Note 3) | 35,096 |

| Transfer agent’s fees and expenses | 31,842 |

| Reports to shareholders and proxy solicitation | 23,888 |

| Custodian’s fees and expenses | 13,842 |

| Legal fees and expenses | 10,603 |

| Miscellaneous | 27,314 |

| Total operating expenses, excluding interest expense | 996,719 |

| Interest expense (Note 7) | 211,258 |

| Total operating expenses before reimbursed/waived expenses | 1,207,977 |

| Less: Investor relations fee waiver (Note 3) | (3,612) |

| Net expenses | 1,204,365 |

| Net Investment Income/(Loss) | 1,495,976 |

| Net Realized/Unrealized Gain/(Loss) from Investments and Foreign Currency Related Transactions: | |

| Net realized gain/(loss) from: | |

| Investment transactions | (1,115,852) |

| Foreign currency transactions | 76,486 |

| (1,039,366) | |

| Net change in unrealized appreciation/(depreciation) on: | |

| Investments | 8,825,737 |

| Foreign currency translation | 4,735,111 |

| 13,560,848 | |

| Net realized and unrealized gain from investments and foreign currencies | 12,521,482 |

| Change in Net Assets Resulting from Operations | $14,017,458 |

| 8 | abrdn Australia Equity Fund, Inc. |

| For the Six-Month Period Ended April 30, 2023 (unaudited) | For the Year Ended October 31, 2022 | |

| Increase/(Decrease) in Net Assets: | ||

| Operations: | ||

| Net investment income | $1,495,976 | $5,169,337 |

| Net realized gain/(loss) from investments and foreign currency transactions | (1,039,366) | 7,514,894 |

| Net change in unrealized appreciation/(depreciation) on investments and foreign currency translation | 13,560,848 | (41,156,375) |

| Net increase/(decrease) in net assets resulting from operations | 14,017,458 | (28,472,144) |

| Distributions to Shareholders From: | ||

| Distributable earnings | (6,265,531) | (14,311,534) |

| Net decrease in net assets from distributions | (6,265,531) | (14,311,534) |

| Issuance of 537,168 and 1,015,591 shares of common stock, respectively due to stock distribution | 2,335,559 | 5,187,678 |

| Change in net assets | 10,087,486 | (37,596,000) |

| Net Assets: | ||

| Beginning of period | 116,403,946 | 153,999,946 |

| End of period | $126,491,432 | $116,403,946 |

| abrdn Australia Equity Fund, Inc. | 9 |

| For the Six-Months Ended April 30, | For the Fiscal Years Ended October 31, | |||||

| 2023 (unaudited) | 2022 | 2021 | 2020 | 2019 | 2018 | |

| PER SHARE OPERATING PERFORMANCE(a): | ||||||

| Net asset value, beginning of period | $4.67 | $6.44 | $5.16 | $5.77 | $5.51 | $6.39 |

| Net investment income | 0.06 | 0.21 | 0.11 | 0.08 | 0.17 | 0.16 |

| Net realized and unrealized gains/(losses) on investments and foreign currency transactions | 0.50 | (1.39) | 1.77 | (0.16) | 0.67 | (0.40) |

| Total from investment operations | 0.56 | (1.18) | 1.88 | (0.08) | 0.84 | (0.24) |

| Distributions from: | ||||||

| Net investment income | (0.25) | (0.22) | (0.17) | (0.04) | (0.15) | (0.14) |

| Net realized gains | – | (0.37) | (0.42) | (0.14) | (0.13) | (0.43) |

| Return of capital | – | – | – | (0.34) | (0.30) | (0.07) |

| Total distributions | (0.25) | (0.59) | (0.59) | (0.52) | (0.58) | (0.64) |

| Capital Share Transactions: | ||||||

| Impact of Stock Distribution (Note 5) | (0.01) | – | (0.01) | (0.01) | – | – |

| Net asset value, end of period | $4.97 | $4.67 | $6.44 | $5.16 | $5.77 | $5.51 |

| Market price, end of period | $4.39 | $4.03 | $6.08 | $4.47 | $5.16 | $5.17 |

| Total Investment Return Based on(b): | ||||||

| Market price | 15.29% | (25.72%) | 50.49% | (2.98%) | 11.15% | (8.37%) |

| Net asset value | 12.63% | (18.74%) | 38.09% | 0.16% | 16.62% | (4.48%) |

| Ratio to Average Net Assets/Supplementary Data: | ||||||

| Net assets, end of period (000 omitted) | $126,491 | $116,404 | $154,000 | $119,290 | $131,157 | $125,219 |

| Average net assets applicable to common shareholders (000 omitted) | $126,983 | $133,947 | $143,765 | $120,590 | $129,377 | $143,263 |

| Net operating expenses | 1.91%(c) | 1.67% | 1.55% | 1.53% | 1.48% | 1.46% |

| Net operating expenses, excluding fee waivers | 1.92%(c) | 1.67% | 1.55% | 1.53% | 1.48% | 1.46% |

| Net operating expenses, excluding interest expense | 1.58%(c) | 1.55% | 1.49% | – | – | – |

| Net Investment income | 2.38%(c) | 3.86% | 1.76% | 1.43% | 3.03% | 2.47% |

| Portfolio turnover | 3%(d) | 23% | 23% | 32% | 20% | 36% |

| Senior securities (loan facility) outstanding (000 omitted) | $9,913 | $9,592 | $7,511 | $7,023 | $– | $– |

| Asset coverage ratio on revolving credit facility at period end(e) | 1,376% | 1,314% | 2,150% | 1,799% | – | – See Notes to Financial Statements.

|

| 10 | abrdn Australia Equity Fund, Inc. |

| For the Six-Months Ended April 30, | For the Fiscal Years Ended October 31, | |||||

| 2023 (unaudited) | 2022 | 2021 | 2020 | 2019 | 2018 | |

| Asset coverage per $1,000 on revolving credit facility at period end | $13,760 | $13,136 | $21,503 | $17,987 | $– | $– |

| (a) | Based on average shares outstanding. |

| (b) | Total investment return based on market value is calculated assuming that shares of the Fund’s common stock were purchased at the closing market price as of the beginning of the period, dividends, capital gains and other distributions were reinvested as provided for in the Fund’s dividend reinvestment plan and then sold at the closing market price per share on the last day of the period. The computation does not reflect any sales commission investors may incur in purchasing or selling shares of the Fund. The total investment return based on the net asset value is similarly computed except that the Fund’s net asset value is substituted for the closing market value. |

| (c) | Annualized. |

| (d) | Not annualized |

| (e) | Asset coverage ratio is calculated by dividing net assets plus the amount of any borrowings, for investment purposes by the amount of the Revolving Credit Facility. |

| abrdn Australia Equity Fund, Inc. | 11 |

| 12 | abrdn Australia Equity Fund, Inc. |

| Security Type | Standard Inputs |

| Foreign equities utilizing a fair value factor | Depositary receipts, indices, futures, sector indices/ETFs, exchange rates, and local exchange opening and closing prices of each security. |

| Investments, at Value | Level 1 – Quoted Prices | Level 2 – Other Significant Observable Inputs | Level 3 – Significant Unobservable Inputs | Total |

| Assets | ||||

| Investments in Securities | ||||

| Common Stocks | $1,943,063 | $128,975,917 | $– | $130,918,980 |

| Short-Term Investment | 674,279 | – | – | 674,279 |

| Total Investments | $2,617,342 | $128,975,917 | $– | $131,593,259 |

| Total Assets | $2,617,342 | $128,975,917 | $– | $131,593,259 |

| abrdn Australia Equity Fund, Inc. | 13 |

| 14 | abrdn Australia Equity Fund, Inc. |

| abrdn Australia Equity Fund, Inc. | 15 |

| 16 | abrdn Australia Equity Fund, Inc. |

| Maturity Date | Interest Rate | Notional/ Carrying Amount | Estimated Fair Value |

| October 13, 2023 | 4.63 | AUD 10,000,000 | AUD 10,022,394 |

| October 13, 2023 | 4.59 | AUD 5,000,000 | AUD 4,978,660 |

| abrdn Australia Equity Fund, Inc. | 17 |

| 18 | abrdn Australia Equity Fund, Inc. |

| Tax Cost of Securities | Unrealized Appreciation | Unrealized Depreciation | Net Unrealized Appreciation/ (Depreciation) |

| $109,011,769 | $24,750,444 | $(2,168,954) | $22,581,490 |

| abrdn Australia Equity Fund, Inc. | 19 |

| 20 | abrdn Australia Equity Fund, Inc. |

| abrdn Australia Equity Fund, Inc. | 21 |

(b) Not applicable.

Item 2. Code of Ethics.

This item is inapplicable to semi-annual report on Form N-CSR.

Item 3. Audit Committee Financial Expert.

This item is inapplicable to semi-annual report on Form N-CSR.

Item 4. Principal Accountant Fees and Services.

This item is inapplicable to semi-annual report on Form N-CSR.

Item 5. Audit Committee of Listed Registrants.

This item is inapplicable to semi-annual report on Form N-CSR.

Item 6. Investments.

(a) Schedule of Investments in securities of unaffiliated issuers as of close of the reporting period is included as part of the Report to Shareholders filed under Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

This item is inapplicable to the semi-annual report on Form N-CSR.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

(a)(1) Not applicable to the semi-annual report on Form N-CSR.

(b) As of the date of filing this report, described below are changes to the portfolio managers identified in response to paragraph (a)(1) of this Item in the registrant’s most recently filed annual report on Form N-CSR.

Effective March 17, 2023, Camille Simeon and Natalie Tam ceased serving as members of the team having primary responsibility for the day-to-day management of the Fund’s portfolio. As of the date of filing this report, the members of the team that are primarily responsible for the day-to-day management of the Fund's portfolio are Flavia Cheong and Christina Woon.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

No such purchases were made by or on behalf of the Registrant during the period covered by the report.

Item 10. Submission of Matters to a Vote of Security Holders.

During the period ended April 30, 2023, there were no material changes to the procedures by which shareholders may recommend nominees to the Registrant’s Board of Directors.

Item 11. Controls and Procedures.

| (a) | The Registrant’s principal executive and principal financial officers, or persons performing similar functions, have concluded that the Registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”) (17 CFR 270.30a-3(c))) are effective, as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on the evaluation of these controls and procedures required by Rule 30a-3(b) under the Act (17 CFR 270.30a3(b)) and Rule 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934, as amended (17 CFR 240.13a-15(b) or 240.15d15(b)). |

| (b) | There were no changes in the Registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act (17 CFR 270.30a-3(d))) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant’s internal control over financial reporting. |

Item 12 - Disclosure of Securities Lending Activities for Closed-End Management Investment Companies

Not applicable

Item 13. Exhibits.

| (a)(1) | Not applicable. |

| (a)(2) | The certifications of the registrant as required by Rule 30a-2(a) under the Act are exhibits to this Form N-CSR. |

| (a)(3) | Any written solicitation to purchase securities under Rule 23c-1 under the 1940 Act (17 CFR 270.23c-1) sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable. |

| (a)(4) | Change in Registrant’s independent public accountant. Not applicable. |

| (b) | The certifications of the registrant as required by Rule 30a-2(b) under the Act are exhibits to this Form N-CSR. |

| (c) | A copy of the Registrant’s notices to stockholders, which accompanied distributions paid, pursuant to the Registrant’s Managed Distribution Policy since the Registrant’s last filed N-CSR, are filed herewith as Exhibits (c)(1), (c)(2) and (c)(3) as required by the terms of the Registrant’s SEC exemptive order. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| abrdn Australia Equity Fund, Inc. | ||

| By: | /s/ Christian Pittard | |

| Christian Pittard, | ||

| Principal Executive Officer of | ||

| abrdn Australia Equity Fund, Inc. | ||

Date: July 10, 2023

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

| By: | /s/ Christian Pittard | |

| Christian Pittard, | ||

| Principal Executive Officer of | ||

| abrdn Australia Equity Fund, Inc. |

Date: July 10, 2023

| By: | /s/ Sharon Ferrari | |

| Sharon Ferrari, | ||

| Principal Financial Officer of | ||

| abrdn Australia Equity Fund, Inc. |

Date: July 10, 2023

Exhibit 99.CERT

Certification

Pursuant to Rule 30a-2(a) under the 1940 Act and

Section 302 of the Sarbanes-Oxley Act

I, Sharon Ferrari, certify that:

| 1. | I have reviewed this report on Form N-CSR of abrdn Australia Equity Fund, Inc. (the “Registrant”); |

| 2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| 3. | Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations, changes in net assets, and cash flows (if the financial statements are required to include a statement of cash flows) of the Registrant as of, and for, the periods presented in this report; |

| 4. | The Registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940) and internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) for the Registrant and have: |

| (a) | Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the Registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| (b) | Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| (c) | Evaluated the effectiveness of the Registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of a date within 90 days prior to the filing date of this report based on such evaluation; and |

| (d) | Disclosed in this report any change in the Registrant’s internal control over financial reporting that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant’s internal control over financial reporting; and |

| 5. | The Registrant’s other certifying officer(s) and I have disclosed to the Registrant’s auditors and the audit committee of the Registrant’s board of directors (or persons performing the equivalent functions): |

| (a) | All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the Registrant’s ability to record, process, summarize, and report financial information; and |

| (b) | Any fraud, whether or not material, that involves management or other employees who have a significant role in the Registrant’s internal control over financial reporting. |

| Date: | July 10, 2023 |

| /s/ Sharon Ferrari | |

| Sharon Ferrari | |

| Principal Financial Officer |

Certification

Pursuant to Rule 30a-2(a) under the 1940 Act and

Section 302 of the Sarbanes-Oxley Act

I, Christian Pittard, certify that:

| 1. | I have reviewed this report on Form N-CSR of abrdn Australia Equity Fund, Inc. (the “Registrant”); |

| 2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| 3. | Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations, changes in net assets, and cash flows (if the financial statements are required to include a statement of cash flows) of the Registrant as of, and for, the periods presented in this report; |

| 4. | The Registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940) and internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) for the Registrant and have: |

| (a) | Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the Registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| (b) | Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| (c) | Evaluated the effectiveness of the Registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of a date within 90 days prior to the filing date of this report based on such evaluation; and |

| (d) | Disclosed in this report any change in the Registrant’s internal control over financial reporting that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant’s internal control over financial reporting; and |

| 5. | The Registrant’s other certifying officer(s) and I have disclosed to the Registrant’s auditors and the audit committee of the Registrant’s board of directors (or persons performing the equivalent functions): |

| (a) | All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the Registrant’s ability to record, process, summarize, and report financial information; and |

| (b) | Any fraud, whether or not material, that involves management or other employees who have a significant role in the Registrant’s internal control over financial reporting. |

| Date: | July 10, 2023 |

| /s/ Christian Pittard | |

| Christian Pittard | |

| Principal Executive Officer |

Exhibit 99.906CERT

Certification

Pursuant to Rule 30a-2(b) under the 1940 Act and

Section 906 of the Sarbanes-Oxley Act

Christian Pittard, Principal Executive Officer, and Sharon Ferrari, Principal Financial Officer, of abrdn Australia Equity Fund, Inc. (the “Registrant”), each certify that:

| 1. | The Registrant’s periodic report on Form N-CSR for the period ended April 30, 2023 (the “Form N-CSR”) fully complies with the requirements of Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934, as amended, as applicable; and |

| 2. | The information contained in the Form N-CSR fairly presents, in all material respects, the financial condition and results of operations of the Registrant. |

| PRINCIPAL EXECUTIVE OFFICER | |

| abrdn Australia Equity Fund, Inc. | |

| /s/ Christian Pittard | |

| Christian Pittard | |

| Date: July 10, 2023 | |

| PRINCIPAL FINANCIAL OFFICER | |

| abrdn Australia Equity Fund, Inc. | |

| /s/ Sharon Ferrari | |

| Sharon Ferrari | |

| Date: July 10, 2023 |

This certification is being furnished solely pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and is not being filed as part of Form N-CSR or as a separate disclosure document. A signed original of this written statement, or other document authenticating, acknowledging, or otherwise adopting the signature that appears in typed form within the electronic version of this written statement required by Section 906, has been provided to the Registrant and will be retained by the Registrant and furnished to the Securities and Exchange Commission or its staff upon request.

Exhibit 99.13(c)(1)

Press Release

FOR IMMEDIATE RELEASE

For More Information Contact:

abrdn U.S. Closed-End Funds

Investor Relations

1-800-522-5465

Investor.Relations@abrdn.com

ABRDN U.S. CLOSED-END FUNDS

ANNOUNCE DISTRIBUTION PAYMENT DETAILS

abrdn Global Infrastructure Income Fund (“ASGI”)

abrdn Asia-Pacific Income Fund, Inc. (“FAX”)

abrdn Australia Equity Fund, Inc. (“IAF”)

The India Fund, Inc. (“IFN”)

abrdn Japan Equity Fund, Inc. (“JEQ”)

(Philadelphia, January 11, 2023) -The above-noted abrdn U.S. Closed-End Funds (the “Funds” or individually the “Fund”), today announced that the Funds paid the distributions noted in the table below on January 11, 2023, on a per share basis to all shareholders of record as of December 30, 2022 (ex-dividend date December 29, 2022). These dates apply to the Funds listed below with the exception of the abrdn Australia Equity Fund, Inc. (IAF), the India Fund, Inc. (IFN) and the abrdn Japan Equity Fund, Inc. (JEQ) which paid the distribution on January 11, 2023 to all shareholders of record as of November 22, 2022 (ex-dividend date November 21, 2022).

| Ticker | Exchange | Fund | Amount | |||||

| ASGI | NYSE | abrdn Global Infrastructure Income Fund | $ | 0.1200 | ||||

| FAX | NYSE American | abrdn Asia-Pacific Income Fund, Inc. | $ | 0.0275 | ||||

| IAF | NYSE American | abrdn Australia Equity Fund, Inc. | $ | 0.1200 | ||||

| IFN | NYSE | The India Fund, Inc. | $ | 1.6100 | ||||

| JEQ | NYSE | abrdn Japan Equity Fund, Inc. | $ | 0.1000 | ||||

Each Fund has adopted a distribution policy to provide investors with a stable distribution out of current income, supplemented by realized capital gains and, to the extent necessary, paid-in capital.

For the abrdn Australia Equity Fund, Inc. (IAF), the India Fund, Inc. (IFN) and the abrdn Japan Equity Fund, Inc. (JEQ) the stock distributions were automatically paid in newly issued shares of the Fund unless otherwise instructed by the shareholder to be paid in cash. Shares of common stock were issued at the lower of the net asset value (“NAV”) per share or the market price per share with a floor for the NAV of not less than 95% of the market price on December 20, 2022. The reinvestment prices per share for these distributions were as follows: $4.38 for the abrdn Australia Equity Fund, Inc. (IAF); $15.26 for the India Fund, Inc. (IFN) and $5.42 for the abrdn Japan Equity Fund, Inc. (JEQ). Fractional shares were generally settled in cash, except for registered shareholders with book entry accounts at Computershare Investor Services who had whole and fractional shares added to their account.

To have received the abrdn Australia Equity Fund, Inc. (IAF), the India Fund, Inc. (IFN) and the abrdn Japan Equity Fund, Inc. (JEQ) quarterly distributions payable in January 2023 in cash instead of shares of common stock, for shareholders who hold shares in “street name,” the bank, brokerage or nominee who holds the shares must have advised the Depository Trust Company as to the full and fractional shares for which they want the distribution paid in cash by December 16, 2022; and for shares that are held in registered form, written notification for the election of cash by registered shareholders must have been received by Computershare Investor Services prior to December 16, 2022.

Under applicable U.S. tax rules, the amount and character of distributable income for each Fund’s fiscal year can be finally determined only as of the end of the Fund’s fiscal year. However, under Section 19 of the Investment Company Act of 1940, as amended (the “1940 Act”) and related rules, the Funds may be required to indicate to shareholders the estimated source of certain distributions to shareholders.

The following tables set forth the estimated amounts of the sources of the distributions for purposes of Section 19 of the 1940 Act and the rules adopted thereunder. The tables have been computed based on generally accepted accounting principles. The tables include estimated amounts and percentages for the current distributions paid this month as well as for the cumulative distributions paid relating to fiscal year to date, from the following sources: net investment income; net realized short-term capital gains; net realized long-term capital gains; and return of capital. The estimated compositions of the distributions may vary because the estimated composition may be impacted by future income, expenses and realized gains and losses on securities and currencies.

Each Fund’s estimated sources of the current distribution paid this month and for its current fiscal year to date are as follows:

Estimated Amounts of Current Distribution per Share

| Fund* | Distribution Amount | Net Investment Income | Net Realized Short- Term Gains** | Net Realized Long- Term Gains | Return of Capital | |||||||||||||||||||||||||||||||

| ASGI | $ | 0.1200 | $ | 0.0024 | 2 | % | - | - | $ | 0.1176 | 98 | % | - | - | ||||||||||||||||||||||

| FAX | $ | 0.0275 | $ | 0.0140 | 51 | % | - | - | - | - | $ | 0.0135 | 49 | % | ||||||||||||||||||||||

| IAF | $ | 0.1200 | $ | 0.0096 | 8 | % | - | - | $ | 0.0408 | 34 | % | $ | 0.0696 | 58 | % | ||||||||||||||||||||

| IFN | $ | 1.6100 | $ | 0.4186 | 26 | % | - | - | $ | 1.1914 | 74 | % | - | - | ||||||||||||||||||||||

| JEQ | $ | 0.1000 | $ | 0.0020 | 2 | % | $ | 0.0090 | 9 | % | - | - | $ | 0.0890 | 89 | % | ||||||||||||||||||||

Estimated Amounts of Fiscal Year* to Date Cumulative Distributions per Share

| Fund | Distribution Amount | Net Investment Income | Net Realized Short- Term Gains ** | Net Realized Long- Term Gains | Return of Capital | |||||||||||||||||||||||||||||||

| ASGI | $ | 0.3600 | $ | 0.0072 | 2 | % | - | - | $ | 0.3528 | 98 | % | - | - | ||||||||||||||||||||||

| FAX | $ | 0.0550 | $ | 0.0281 | 51 | % | - | - | - | - | $ | 0.0269 | 49 | % | ||||||||||||||||||||||

| IAF | $ | 0.1200 | $ | 0.0096 | 8 | % | - | - | $ | 0.0408 | 34 | % | $ | 0.0696 | 58 | % | ||||||||||||||||||||

| IFN+ | $ | 3.1800 | $ | 0.8268 | 26 | % | - | - | $ | 2.3532 | 74 | % | - | - | ||||||||||||||||||||||

| JEQ | $ | 0.1000 | $ | 0.0020 | 2 | % | $ | 0.0090 | 9 | % | - | - | $ | 0.0890 | 89 | % | ||||||||||||||||||||

* ASGI has a 9/30 fiscal year end; FAX, IAF and JEQ have a 10/31 fiscal year end; IFN has a 12/31 fiscal year end.

**includes currency gains

+ The distribution consists of the regular quarterly distribution of $0.47 and a special capital gains distribution of $1.14 required to meet US tax regulations.

Where the estimated amounts above show a portion of the distribution to be a “Return of Capital,” it means that Fund estimates that it has distributed more than its income and capital gains; therefore, a portion of your distribution may be a return of capital. A return of capital may occur for example, when some or all of the money that you invested in a Fund is paid back to you. A return of capital distribution does not necessarily reflect the Fund’s investment performance and should not be confused with “yield” or “income.”

As of December 31, 2022, after giving effect to this payment, JEQ estimates it has a net deficit of $8,052,149. A net deficit results when the Fund has net unrealized losses that are in excess of any net realized gains that have not yet been distributed.

The amounts and sources of distributions reported in this notice are only estimates and are not being provided for tax reporting purposes. The final determination of the source of all distributions for the current year will only be made after year-end. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the Fund’s investment experience during the remainder of the fiscal year and may be subject to change based on tax regulations. After the end of each calendar year, a Form 1099-DIV will be sent to shareholders for the prior calendar year that will tell you how to report these distributions for federal income tax purposes.

The following table provides the Funds’ total return performance based on net asset value (NAV) over various time periods compared to the Funds’ annualized and cumulative distribution rates.

Fund Performance and Distribution Rate Information

| Fund | Average Annual Total Return on NAV for the 5 Year Period Ending 11/30/20221 | Current Fiscal Period’s Annualized Distribution Rate on NAV | Cumulative Total Return on NAV1 | Cumulative Distribution Rate on NAV2 | ||||||||||||

| ASGI2 | 9.27 | %3 | 6.80 | % | 14.34 | % | 1.13 | % | ||||||||

| FAX2 | -2.34 | % | 10.75 | % | 8.84 | % | 0.90 | % | ||||||||

1 Return data is net of all Fund expenses and fees and assumes the reinvestment of all distributions reinvested at prices obtained under the Fund’s dividend reinvestment plan.

2 Based on the Fund’s NAV as of November 30, 2022.

3 The Fund launched within the past 5 years; the performance and distribution rate information presented reflects data from inception (July 29, 2020) through November 30, 2022.

Fund Performance and Distribution Rate Information

| Fund | Average Annual Total Return on NAV for the 5 Year Period Ending 10/31/20221 | Current Fiscal Period’s Annualized Distribution Rate on NAV | Cumulative Total Return on NAV1 | Cumulative Distribution Rate on NAV2 | ||||||||||||

| IAF2 | 4.60 | % | 12.63 | % | -18.74 | % | 12.63 | % | ||||||||

| IFN2 | 4.14 | % | 11.16 | % | -15.42 | % | 8.63 | % | ||||||||

| JEQ2 | -2.86 | % | 8.14 | %3 | -32.88 | % | 22.60 | % | ||||||||

1 Return data is net of all Fund expenses and fees and assumes the reinvestment of all distributions reinvested at prices obtained under the Fund’s dividend reinvestment plan.

2 Based on the Fund’s NAV as of October 31, 2022.

3 The percentage shown does not include the Fund’s annual distribution policy in place in 2021.

Shareholders should not draw any conclusions about a Fund’s investment performance from the amount of the Fund’s current distributions or from the terms of the distribution policy (the “Distribution Policy”).

While NAV performance may be indicative of the Fund’s investment performance, it does not measure the value of a shareholder’s investment in the Fund. The value of a shareholder’s investment in the Fund is determined by the Fund’s market price, which is based on the supply and demand for the Fund’s shares in the open market.

Pursuant to an exemptive order granted by the Securities and Exchange Commission, the Funds may distribute any long-term capital gains more frequently than the limits provided in Section 19(b) under the 1940 Act and Rule 19b-1 thereunder. Therefore, distributions paid by the Funds during the year may include net income, short-term capital gains, long-term capital gains and/or a return of capital. Net income dividends and short-term capital gain dividends, while generally taxable at ordinary income rates, may be eligible, to the extent of qualified dividend income earned by the Funds, to be taxed at a lower rate not to exceed the maximum rate applicable to your long-term capital gains. Distributions made in any calendar year in excess of investment company taxable income and net capital gain are treated as taxable ordinary dividends to the extent of undistributed earnings and profits, and then as a return of capital that reduces the adjusted basis in the shares held. To the extent return of capital distributions exceed the adjusted basis in the shares held, capital gain is recognized with a holding period based on the period the shares have been held at the date such amount is received.

The payment of distributions in accordance with the Distribution Policy may result in a decrease in the Fund’s net assets. A decrease in the Fund’s net assets may cause an increase in the Fund’s annual operating expense ratio and a decrease in the Fund’s market price per share to the extent the market price correlates closely to the Fund’s net asset value per share. The Distribution Policy may also negatively affect the Fund’s investment activities to the extent that the Fund is required to hold larger cash positions than it typically would hold or to the extent that the Fund must liquidate securities that it would not have sold, for the purpose of paying the distribution. Each Fund’s Board has the right to amend, suspend or terminate the Distribution Policy at any time. The amendment, suspension or termination of the Distribution Policy may affect the Fund’s market price per share. Investors should consult their tax advisor regarding federal, state and local tax considerations that may be applicable in their particular circumstances.

Circular 230 disclosure: To ensure compliance with requirements imposed by the U.S. Treasury, we inform you that any U.S. tax advice contained in this communication (including any attachments) is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any transaction or matter addressed herein.

In the United States, abrdn is the marketing name for the following affiliated, registered investment advisers: abrdn Inc., Aberdeen Asset Managers Ltd., abrdn Australia Limited, abrdn Asia Limited, Aberdeen Capital Management, LLC, abrdn ETFs Advisors LLC and Aberdeen Standard Alternative Funds Limited.

Closed-end funds are traded on the secondary market through one of the stock exchanges. A Fund’s investment return and principal value will fluctuate so that an investor’s shares may be worth more or less than the original cost. Shares of closed-end funds may trade above (a premium) or below (a discount) the net asset value (NAV) of the fund’s portfolio. There is no assurance that a Fund will achieve its investment objective. Past performance does not guarantee future results.

If you wish to receive this information electronically, please contact Investor.Relations@abrdn.com

https://www.abrdn.com/en-us/cefinvestorcenter

###

Exhibit 99.13(c)(2)

Press Release

FOR IMMEDIATE RELEASE

For More Information Contact:

abrdn U.S. Closed-End Funds

Investor Relations

1-800-522-5465

Investor.Relations@abrdn.com

ABRDN U.S. CLOSED-END FUNDS

ANNOUNCE DISTRIBUTION PAYMENT DETAILS

abrdn Global Infrastructure Income Fund (“ASGI”)

abrdn Asia-Pacific Income Fund, Inc. (“FAX”)

abrdn Australia Equity Fund, Inc. (“IAF”)

The India Fund, Inc. (“IFN”)

abrdn Japan Equity Fund, Inc. (“JEQ”)

(Philadelphia, March 31, 2023) -The above-noted abrdn U.S. Closed-End Funds (the “Funds” or individually the “Fund”), today announced that the Funds paid the distributions noted in the table below on March 31, 2023, on a per share basis to all shareholders of record as of March 24, 2023 (ex-dividend date March 23, 2023). These dates apply to the Funds listed below with the exception of the abrdn Australia Equity Fund, Inc. (IAF), the India Fund, Inc. (IFN) and the abrdn Japan Equity Fund, Inc. (JEQ) which paid the distribution on March 31, 2023 to all shareholders of record as of February 21, 2023 (ex-dividend date February 17, 2023).

| Ticker | Exchange | Fund | Amount | |||||

| ASGI | NYSE | abrdn Global Infrastructure Income Fund | $ | 0.1200 | ||||

| FAX | NYSE American | abrdn Asia-Pacific Income Fund, Inc. | $ | 0.0275 | ||||

| IAF | NYSE American | abrdn Australia Equity Fund, Inc. | $ | 0.1300 | ||||

| IFN | NYSE | The India Fund, Inc. | $ | 0.4300 | ||||

| JEQ | NYSE | abrdn Japan Equity Fund, Inc. | $ | 0.1000 | ||||

Each Fund has adopted a distribution policy to provide investors with a stable distribution out of current income, supplemented by realized capital gains and, to the extent necessary, paid-in capital.

For the abrdn Australia Equity Fund, Inc. (IAF), the India Fund, Inc. (IFN) and the abrdn Japan Equity Fund, Inc. (JEQ) the stock distributions were automatically paid in newly issued shares of the Fund unless otherwise instructed by the shareholder to be paid in cash. Shares of common stock were issued at the lower of the net asset value (“NAV”) per share or the market price per share with a floor for the NAV of not less than 95% of the market price on March 17, 2023. The reinvestment prices per share for these distributions were as follows: $4.32 for the abrdn Australia Equity Fund, Inc. (IAF); $14.76 for the India Fund, Inc. (IFN) and $5.32 for the abrdn Japan Equity Fund, Inc. (JEQ). Fractional shares were generally settled in cash, except for registered shareholders with book entry accounts at Computershare Investor Services who had whole and fractional shares added to their account.

To have received the abrdn Australia Equity Fund, Inc. (IAF), the India Fund, Inc. (IFN) and the abrdn Japan Equity Fund, Inc. (JEQ) quarterly distributions payable in March 2023 in cash instead of shares of common stock, for shareholders who hold shares in “street name,” the bank, brokerage or nominee who holds the shares must have advised the Depository Trust Company as to the full and fractional shares for which they want the distribution paid in cash by March 16, 2023; and for shares that are held in registered form, written notification for the election of cash by registered shareholders must have been received by Computershare Investor Services prior to March 16, 2023.

Under applicable U.S. tax rules, the amount and character of distributable income for each Fund’s fiscal year can be finally determined only as of the end of the Fund’s fiscal year. However, under Section 19 of the Investment Company Act of 1940, as amended (the “1940 Act”) and related rules, the Funds may be required to indicate to shareholders the estimated source of certain distributions to shareholders.

The following tables set forth the estimated amounts of the sources of the distributions for purposes of Section 19 of the 1940 Act and the rules adopted thereunder. The tables have been computed based on generally accepted accounting principles. The tables include estimated amounts and percentages for the current distributions paid this month as well as for the cumulative distributions paid relating to fiscal year to date, from the following sources: net investment income; net realized short-term capital gains; net realized long-term capital gains; and return of capital. The estimated compositions of the distributions may vary because the estimated composition may be impacted by future income, expenses and realized gains and losses on securities and currencies.

Each Fund’s estimated sources of the current distribution paid this month and for its current fiscal year to date are as follows:

Estimated Amounts of Current Distribution per Share

| Fund | Distribution Amount | Net

Investment Income | Net

Realized Short- Term Gains** | Net

Realized Long- Term Gains | Return of Capital | |||||||||||||||||||||||||||||||

| ASGI | $ | 0.1200 | $ | 0.0060 | 5 | % | $ | 0.0012 | 1 | % | $ | 0.0984 | 82 | % | $ | 0.0144 | 12 | % | ||||||||||||||||||

| FAX | $ | 0.0275 | $ | 0.0151 | 55 | % | - | - | - | - | $ | 0.0124 | 45 | % | ||||||||||||||||||||||

| IAF | $ | 0.1300 | $ | 0.0351 | 27 | % | $ | 0.0026 | 2 | % | $ | 0.0130 | 10 | % | $ | 0.0793 | 61 | % | ||||||||||||||||||

| IFN | $ | 0.4300 | - | - | - | - | $ | 0.4300 | 100 | % | - | - | ||||||||||||||||||||||||

| JEQ | $ | 0.1000 | $ | 0.0150 | 15 | % | $ | 0.0040 | 4 | % | - | - | $ | 0.0810 | 81 | % | ||||||||||||||||||||

Estimated Amounts of Fiscal Year* to Date Cumulative Distributions per Share

| Fund | Distribution Amount | Net

Investment Income | Net

Realized Short- Term Gains ** | Net

Realized Long- Term Gains | Return of Capital | |||||||||||||||||||||||||||||||

| ASGI | $ | 0.7200 | $ | 0.0360 | 5 | % | $ | 0.0072 | 1 | % | $ | 0.5904 | 82 | % | $ | 0.0864 | 12 | % | ||||||||||||||||||

| FAX | $ | 0.1375 | $ | 0.0756 | 55 | % | - | - | - | - | $ | 0.0619 | 45 | % | ||||||||||||||||||||||

| IAF | $ | 0.2500 | $ | 0.0675 | 27 | % | $ | 0.0050 | 2 | % | $ | 0.0250 | 10 | % | $ | 0.1525 | 61 | % | ||||||||||||||||||

| IFN | $ | 0.4300 | - | - | - | - | $ | 0.4300 | 100 | % | - | - | ||||||||||||||||||||||||

| JEQ | $ | 0.2000 | $ | 0.0300 | 15 | % | $ | 0.0080 | 4 | % | - | - | $ | 0.1620 | 81 | % | ||||||||||||||||||||

* ASGI has a 9/30 fiscal year end; FAX, IAF and JEQ have a 10/31 fiscal year end; IFN has a 12/31 fiscal year end.

**includes currency gains

Where the estimated amounts above show a portion of the distribution to be a “Return of Capital,” it means that Fund estimates that it has distributed more than its income and capital gains; therefore, a portion of your distribution may be a return of capital. A return of capital may occur for example, when some or all of the money that you invested in a Fund is paid back to you. A return of capital distribution does not necessarily reflect the Fund’s investment performance and should not be confused with “yield” or “income.”

The amounts and sources of distributions reported in this notice are only estimates and are not being provided for tax reporting purposes. The final determination of the source of all distributions for the current year will only be made after year-end. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the Fund’s investment experience during the remainder of the fiscal year and may be subject to change based on tax regulations. After the end of each calendar year, a Form 1099-DIV will be sent to shareholders for the prior calendar year that will tell you how to report these distributions for federal income tax purposes.

The following table provides the Funds’ total return performance based on net asset value (NAV) over various time periods compared to the Funds’ annualized and cumulative distribution rates.

Fund Performance and Distribution Rate Information

| Fund | Average Annual Total Return on NAV for the 5 Year Period Ending 02/28/20231 | Current

Fiscal Period’s Annualized Distribution Rate on NAV | Cumulative Total Return on NAV1 | Cumulative Distribution Rate on NAV2 | ||||||||||||

| ASGI3 | 7.77 | %3 | 7.03 | % | 12.77 | % | 2.93 | % | ||||||||

| FAX | -1.29 | % | 10.48 | % | 14.99 | % | 3.49 | % | ||||||||

1 Return data is net of all Fund expenses and fees and assumes the reinvestment of all distributions reinvested at prices obtained under the Fund’s dividend reinvestment plan.

2 Based on the Fund’s NAV as of February 28, 2023.

3 The Fund launched within the past 5 years; the performance and distribution rate information presented reflects data from inception (July 29, 2020) through February 28, 2023.

Fund Performance and Distribution Rate Information

| Fund | Average Annual Total Return on NAV for the 5 Year Period Ending 01/31/20231 | Current

Fiscal Period’s Annualized Distribution Rate on NAV | Cumulative Total Return on NAV1 | Cumulative Distribution Rate on NAV2 | ||||||||||||

| IAF | 6.87 | % | 8.71 | % | 21.22 | % | 2.18 | % | ||||||||

| IFN | 2.57 | % | N/A | * | 0.61 | % | N/A | * | ||||||||

| JEQ | -2.16 | % | 5.99 | %3 | 13.01 | % | 1.50 | % | ||||||||

1 Return data is net of all Fund expenses and fees and assumes the reinvestment of all distributions reinvested at prices obtained under the Fund’s dividend reinvestment plan.

2 Based on the Fund’s NAV as of January 31, 2023.

3 The percentage shown does not include the Fund’s annual distribution policy in place in 2021.

Shareholders should not draw any conclusions about a Fund’s investment performance from the amount of the Fund’s current distributions or from the terms of the distribution policy (the “Distribution Policy”).

While NAV performance may be indicative of the Fund’s investment performance, it does not measure the value of a shareholder’s investment in the Fund. The value of a shareholder’s investment in the Fund is determined by the Fund’s market price, which is based on the supply and demand for the Fund’s shares in the open market.

Pursuant to an exemptive order granted by the Securities and Exchange Commission, the Funds may distribute any long-term capital gains more frequently than the limits provided in Section 19(b) under the 1940 Act and Rule 19b-1 thereunder. Therefore, distributions paid by the Funds during the year may include net income, short-term capital gains, long-term capital gains and/or a return of capital. Net income dividends and short-term capital gain dividends, while generally taxable at ordinary income rates, may be eligible, to the extent of qualified dividend income earned by the Funds, to be taxed at a lower rate not to exceed the maximum rate applicable to your long-term capital gains. Distributions made in any calendar year in excess of investment company taxable income and net capital gain are treated as taxable ordinary dividends to the extent of undistributed earnings and profits, and then as a return of capital that reduces the adjusted basis in the shares held. To the extent return of capital distributions exceed the adjusted basis in the shares held, capital gain is recognized with a holding period based on the period the shares have been held at the date such amount is received.

The payment of distributions in accordance with the Distribution Policy may result in a decrease in the Fund’s net assets. A decrease in the Fund’s net assets may cause an increase in the Fund’s annual operating expense ratio and a decrease in the Fund’s market price per share to the extent the market price correlates closely to the Fund’s net asset value per share. The Distribution Policy may also negatively affect the Fund’s investment activities to the extent that the Fund is required to hold larger cash positions than it typically would hold or to the extent that the Fund must liquidate securities that it would not have sold, for the purpose of paying the distribution. Each Fund’s Board has the right to amend, suspend or terminate the Distribution Policy at any time. The amendment, suspension or termination of the Distribution Policy may affect the Fund’s market price per share. Investors should consult their tax advisor regarding federal, state and local tax considerations that may be applicable in their particular circumstances.

Circular 230 disclosure: To ensure compliance with requirements imposed by the U.S. Treasury, we inform you that any U.S. tax advice contained in this communication (including any attachments) is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any transaction or matter addressed herein.

In the United States, abrdn is the marketing name for the following affiliated, registered investment advisers: abrdn Inc., abrdn Investments Limited, abrdn Australia Limited, abrdn Asia Limited, Aberdeen Capital Management, LLC, abrdn ETFs Advisors LLC and abrdn Alternative Funds Limited.

Closed-end funds are traded on the secondary market through one of the stock exchanges. A Fund’s investment return and principal value will fluctuate so that an investor’s shares may be worth more or less than the original cost. Shares of closed-end funds may trade above (a premium) or below (a discount) the net asset value (NAV) of the fund’s portfolio. There is no assurance that a Fund will achieve its investment objective. Past performance does not guarantee future results.

https://www.abrdn.com/en-us/cefinvestorcenter

###

Exhibit 99.13(c)(3)

Press Release

FOR IMMEDIATE RELEASE

For More Information Contact:

abrdn U.S. Closed-End Funds

Investor Relations

1-800-522-5465

Investor.Relations@abrdn.com

ABRDN U.S. CLOSED-END FUNDS

ANNOUNCE DISTRIBUTION PAYMENT DETAILS

abrdn Global Infrastructure Income Fund (“ASGI”)

abrdn Asia-Pacific Income Fund, Inc. (“FAX”)

(Philadelphia, June 30, 2023) -The above-noted abrdn U.S. Closed-End Funds (the “Funds” or individually the “Fund”), today announced that the Funds paid the distributions noted in the table below on June 30, 2023, on a per share basis to all shareholders of record as of June 23, 2023 (ex-dividend date June 22, 2023). These dates apply to the Funds listed below with the exception of the abrdn Australia Equity Fund, Inc. (IAF), the India Fund, Inc. (IFN) and the abrdn Japan Equity Fund, Inc. (JEQ) which paid the distribution on June 30, 2023, to all shareholders of record as of May 19, 2023 (ex-dividend date May 18, 2023).

| Ticker | Exchange | Fund | Amount | |||||

| ASGI | NYSE | abrdn Global Infrastructure Income Fund | $ | 0.1200 | ||||

| FAX | NYSE American | abrdn Asia-Pacific Income Fund, Inc. | $ | 0.0275 | ||||

| IAF | NYSE American | abrdn Australia Equity Fund, Inc. | $ | 0.1300 | ||||

| IFN | NYSE | The India Fund, Inc. | $ | 0.3900 | ||||

| JEQ | NYSE | abrdn Japan Equity Fund, Inc. | $ | 0.1000 | ||||

Each Fund has adopted a distribution policy to provide investors with a stable distribution out of current income, supplemented by realized capital gains and, to the extent necessary, paid-in capital.

For the abrdn Australia Equity Fund, Inc. (IAF), the India Fund, Inc. (IFN) and the abrdn Japan Equity Fund, Inc. (JEQ) the stock distributions were automatically paid in newly issued shares of the Fund unless otherwise instructed by the shareholder to be paid in cash. Shares of common stock were issued at the lower of the net asset value (“NAV”) per share or the market price per share with a floor for the NAV of not less than 95% of the market price on June 16, 2023. The reinvestment prices per share for these distributions were as follows: $4.44 for the abrdn Australia Equity Fund, Inc. (IAF); $16.03 for the India Fund, Inc. (IFN) and $6.15 for the abrdn Japan Equity Fund, Inc. (JEQ). Fractional shares were generally settled in cash, except for registered shareholders with book entry accounts at Computershare Investor Services who had whole and fractional shares added to their account.

To have received the abrdn Australia Equity Fund, Inc. (IAF), the India Fund, Inc. (IFN) and the abrdn Japan Equity Fund, Inc. (JEQ) quarterly distributions payable in June 2023 in cash instead of shares of common stock, for shareholders who hold shares in “street name,” the bank, brokerage or nominee who holds the shares must have advised the Depository Trust Company as to the full and fractional shares for which they want the distribution paid in cash by June 15, 2023; and for shares that are held in registered form, written notification for the election of cash by registered shareholders must have been received by Computershare Investor Services prior to June 15, 2023.

Under applicable U.S. tax rules, the amount and character of distributable income for each Fund’s fiscal year can be finally determined only as of the end of the Fund’s fiscal year. However, under Section 19 of the Investment Company Act of 1940, as amended (the “1940 Act”) and related rules, the Funds may be required to indicate to shareholders the estimated source of certain distributions to shareholders.

The following tables set forth the estimated amounts of the sources of the distributions for purposes of Section 19 of the 1940 Act and the rules adopted thereunder. The tables have been computed based on generally accepted accounting principles. The tables include estimated amounts and percentages for the current distributions paid this month as well as for the cumulative distributions paid relating to fiscal year to date, from the following sources: net investment income; net realized short-term capital gains; net realized long-term capital gains; and return of capital. The estimated compositions of the distributions may vary because the estimated composition may be impacted by future income, expenses and realized gains and losses on securities and currencies.

Each Fund’s estimated sources of the current distribution paid this month and for its current fiscal year to date are as follows:

Estimated Amounts of Current Distribution per Share

| Fund | Distribution Amount | Net Investment Income | Net Realized Short- Term Gains** | Net Realized Long- Term Gains | Return of Capital | |||||||||||||||||||||||||||||||

| ASGI | $ | 0.1200 | $ | 0.0372 | 31 | % | $ | 0.0132 | 11 | % | $ | 0.0696 | 58 | % | - | - | ||||||||||||||||||||

| FAX | $ | 0.0275 | $ | 0.0151 | 55 | % | - | - | - | - | $ | 0.0124 | 45 | % | ||||||||||||||||||||||

| IAF | $ | 0.1300 | $ | 0.0247 | 19 | % | $ | 0.0013 | 1 | % | $ | 0.0078 | 6 | % | $ | 0.0962 | 74 | % | ||||||||||||||||||

| IFN | $ | 0.3900 | - | - | $ | 0.0039 | 1 | % | $ | 0.3861 | 99 | % | - | - | ||||||||||||||||||||||

| JEQ | $ | 0.1000 | $ | 0.0090 | 9 | % | $ | 0.0020 | 2 | % | - | - | $ | 0.0890 | 89 | % | ||||||||||||||||||||

Estimated Amounts of Fiscal Year* to Date Cumulative Distributions per Share

| Fund | Distribution Amount | Net Investment Income | Net Realized Short- Term Gains ** | Net Realized Long- Term Gains | Return of Capital | |||||||||||||||||||||||||||||||

| ASGI | $ | 1.0800 | $ | 0.3348 | 31 | % | $ | 0.1188 | 11 | % | $ | 0.6264 | 58 | % | - | - | ||||||||||||||||||||

| FAX | $ | 0.2200 | $ | 0.1210 | 55 | % | - | - | - | - | $ | 0.0990 | 45 | % | ||||||||||||||||||||||

| IAF | $ | 0.3800 | $ | 0.0722 | 19 | % | $ | 0.0038 | 1 | % | $ | 0.0228 | 6 | % | $ | 0.2812 | 74 | % | ||||||||||||||||||

| IFN | $ | 0.8200 | - | - | $ | 0.0082 | 1 | % | $ | 0.8118 | 99 | % | - | - | ||||||||||||||||||||||

| JEQ | $ | 0.3000 | $ | 0.0270 | 9 | % | $ | 0.0060 | 2 | % | - | - | $ | 0.2670 | 89 | % | ||||||||||||||||||||

* ASGI has a 9/30 fiscal year end; FAX, IAF and JEQ have a 10/31 fiscal year end; IFN has a 12/31 fiscal year end.

**includes currency gains

Where the estimated amounts above show a portion of the distribution to be a “Return of Capital,” it means that Fund estimates that it has distributed more than its income and capital gains; therefore, a portion of your distribution may be a return of capital. A return of capital may occur for example, when some or all of the money that you invested in a Fund is paid back to you. A return of capital distribution does not necessarily reflect the Fund’s investment performance and should not be confused with “yield” or “income.”

As of June 22, 2023, after giving effect to this payment, IAF estimates it has a net deficit of $541,000. A net deficit results when the Fund has net unrealized losses that are in excess of any net realized gains that have not yet been distributed.

As of June 22, 2023, after giving effect to this payment, JEQ estimates it has a net deficit of $5,391,000.00. A net deficit results when the Fund has net unrealized losses that are in excess of any net realized gains that have not yet been distributed.

The amounts and sources of distributions reported in this notice are only estimates and are not being provided for tax reporting purposes. The final determination of the source of all distributions for the current year will only be made after year-end. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the Fund’s investment experience during the remainder of the fiscal year and may be subject to change based on tax regulations. After the end of each calendar year, a Form 1099-DIV will be sent to shareholders for the prior calendar year that will tell you how to report these distributions for federal income tax purposes.

The following table provides the Funds’ total return performance based on net asset value (NAV) over various time periods compared to the Funds’ annualized and cumulative distribution rates.

Fund Performance and Distribution Rate Information

| Fund | Average Annual Total Return on NAV for the 5 Year Period Ending 05/31/20231 | Current Fiscal Period’s Annualized Distribution Rate on NAV | Cumulative Total Return on NAV1 | Cumulative Distribution Rate on NAV2 | ||||||||||||

| ASGI3 | 7.42 | %3 | 7.11 | % | 13.85 | % | 4.74 | % | ||||||||

| FAX | -0.73 | % | 10.68 | % | 16.24 | % | 6.23 | % | ||||||||

1 Return data is net of all Fund expenses and fees and assumes the reinvestment of all distributions reinvested at prices obtained under the Fund’s dividend reinvestment plan.

2 Based on the Fund’s NAV as of May 31, 2023.

3 The Fund launched within the past 5 years; the performance and distribution rate information presented reflects data from inception (July 29, 2020) through May 31, 2023.

Fund Performance and Distribution Rate Information

| Fund | Average Annual Total Return on NAV for the 5 Year Period Ending 04/30/20231 | Current Fiscal Period’s Annualized Distribution Rate on NAV | Cumulative Total Return on NAV1 | Cumulative Distribution Rate on NAV2 | ||||||||||||

| IAF | 6.76 | % | 10.26 | % | 12.63 | % | 5.03 | % | ||||||||

| IFN | 3.36 | % | 10.72 | % | 1.40 | % | 2.68 | % | ||||||||

| JEQ | -1.20 | % | 6.13 | % | 12.55 | % | 3.06 | % | ||||||||

1 Return data is net of all Fund expenses and fees and assumes the reinvestment of all distributions reinvested at prices obtained under the Fund’s dividend reinvestment plan.

2 Based on the Fund’s NAV as of April 30, 2023.

Shareholders should not draw any conclusions about a Fund’s investment performance from the amount of the Fund’s current distributions or from the terms of the distribution policy (the “Distribution Policy”).

While NAV performance may be indicative of the Fund’s investment performance, it does not measure the value of a shareholder’s investment in the Fund. The value of a shareholder’s investment in the Fund is determined by the Fund’s market price, which is based on the supply and demand for the Fund’s shares in the open market.

Pursuant to an exemptive order granted by the Securities and Exchange Commission, the Funds may distribute any long-term capital gains more frequently than the limits provided in Section 19(b) under the 1940 Act and Rule 19b-1 thereunder. Therefore, distributions paid by the Funds during the year may include net income, short-term capital gains, long-term capital gains and/or a return of capital. Net income dividends and short-term capital gain dividends, while generally taxable at ordinary income rates, may be eligible, to the extent of qualified dividend income earned by the Funds, to be taxed at a lower rate not to exceed the maximum rate applicable to your long-term capital gains. Distributions made in any calendar year in excess of investment company taxable income and net capital gain are treated as taxable ordinary dividends to the extent of undistributed earnings and profits, and then as a return of capital that reduces the adjusted basis in the shares held. To the extent return of capital distributions exceed the adjusted basis in the shares held, capital gain is recognized with a holding period based on the period the shares have been held at the date such amount is received.

The payment of distributions in accordance with the Distribution Policy may result in a decrease in the Fund’s net assets. A decrease in the Fund’s net assets may cause an increase in the Fund’s annual operating expense ratio and a decrease in the Fund’s market price per share to the extent the market price correlates closely to the Fund’s net asset value per share. The Distribution Policy may also negatively affect the Fund’s investment activities to the extent that the Fund is required to hold larger cash positions than it typically would hold or to the extent that the Fund must liquidate securities that it would not have sold, for the purpose of paying the distribution. Each Fund’s Board has the right to amend, suspend or terminate the Distribution Policy at any time. The amendment, suspension or termination of the Distribution Policy may affect the Fund’s market price per share. Investors should consult their tax advisor regarding federal, state and local tax considerations that may be applicable in their particular circumstances.

Circular 230 disclosure: To ensure compliance with requirements imposed by the U.S. Treasury, we inform you that any U.S. tax advice contained in this communication (including any attachments) is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any transaction or matter addressed herein.

In the United States, abrdn is the marketing name for the following affiliated, registered investment advisers: abrdn Inc., abrdn Investments Limited, abrdn Australia Limited, abrdn Asia Limited, Aberdeen Capital Management, LLC, abrdn ETFs Advisors LLC and abrdn Alternative Funds Limited.

Closed-end funds are traded on the secondary market through one of the stock exchanges. A Fund’s investment return and principal value will fluctuate so that an investor’s shares may be worth more or less than the original cost. Shares of closed-end funds may trade above (a premium) or below (a discount) the net asset value (NAV) of the fund’s portfolio. There is no assurance that a Fund will achieve its investment objective. Past performance does not guarantee future results.

https://www.abrdn.com/en-us/cefinvestorcenter

###

1 Year abrdn Australia Equity Chart |

1 Month abrdn Australia Equity Chart |

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions