We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Share Name | Share Symbol | Market | Type |

|---|---|---|---|

| abrdn Global Income Fund Inc | AMEX:FCO | AMEX | Common Stock |

| Price Change | % Change | Share Price | High Price | Low Price | Open Price | Shares Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|

| 0.06 | 1.01% | 5.98 | 5.99 | 5.92 | 5.99 | 32,490 | 21:00:06 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: | 811-06342 |

| Exact name of registrant as specified in charter: | |

| Address of principal executive offices: | 1900 Market Street, Suite 200 |

| Philadelphia, PA 19103 | |

| Name and address of agent for service: | Sharon Ferrari |

| abrdn Inc. | |

| 1900 Market Street, Suite 200 | |

| Philadelphia, PA 19103 | |

| Registrant’s telephone number, including area code: | 1-800-522-5465 |

| Date of fiscal year end: | October 31 |

| Date of reporting period: | April 30, 2023 |

Item 1. Reports to Stockholders.

(a) A copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “1940 Act”) is filed herewith.

| 1 | Past performance is no guarantee of future results. Investment returns and principal value will fluctuate and shares, when sold, may be worth more or less than original cost. Current performance may be lower or higher than the performance quoted. Net asset value return data include investment management fees, custodial charges and administrative fees (such as Director and legal fees) and assumes the reinvestment of all distributions. |

| 2 | Assuming the reinvestment of dividends and distributions. |

| 3 | The Fund’s total return is based on the reported NAV for each financial reporting period end and may differ from what is reported on the Financial Highlights due to financial statement rounding or adjustments. |

| 4 | Blended Benchmark as defined in Total Investment Return section on Page 5. |

| abrdn Global Income Fund, Inc. | 1 |

| 2 | abrdn Global Income Fund, Inc. |

| • | Visit: https://www.abrdn.com/en-us/cefinvestorcenter |

| • | Email: Investor.Relations@abrdn.com; or |

| • | Call: 1-800-522-5465 (toll free in the U.S.). |

| abrdn Global Income Fund, Inc. | 3 |

| 4 | abrdn Global Income Fund, Inc. |

| abrdn Global Income Fund, Inc. | 5 |

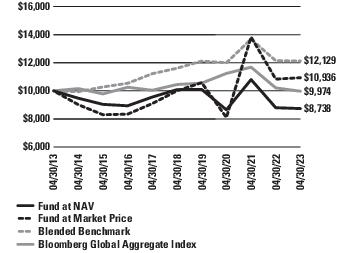

| 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | |

| Net Asset Value (NAV) | 12.41% | -0.69% | 0.33% | -2.83% | -1.34% |

| Market Price | 22.65% | 0.92% | 10.52% | 1.80% | 0.90% |

| Blended Benchmark* | 9.92% | -0.14% | 0.35% | 0.87% | 1.95% |

| Bloomberg Global Aggregate Index1 | 8.92% | -2.31% | -3.91% | -0.93% | -0.03% |

| * | The blended benchmark is summarized in the table below: |

| Constituent Index | Weight |

| ICE Bank of America Merrill Lynch Australian Government Bond Index2 | 10.0% |

| ICE Bank of America Merrill Lynch New Zealand Government Bond Index3 | 5.0% |

| iBoxx Asia Government (U.S. dollar unhedged)4 | 25.0% |

| J.P. Morgan Emerging Markets Bond (EMBI) Global Diversified Index5 | 35.0% |

| ICE Bank of America Global High Yield Constrained Index6 | 25.0% |

| 1 | The Bloomberg Global Aggregate Index is a measure of global investment grade debt from 24 local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. |

| 2 | The ICE Bank of America Merrill Lynch Australian Government Bond Index tracks the performance of AUD denominated sovereign debt publicly issued by the Australian government in its domestic market. |

| 3 | The ICE Bank of America Merrill Lynch New Zealand Government Bond Index tracks the performance of NZD denominated sovereign debt publicly issued by the New Zealand government in its domestic market. |

| 4 | The iBoxx Asia Government (U.S. dollar unhedged) tracks the performance of local currency-denominated sovereign and quasi-sovereign debt from 11 Asian countries/territories. |

| 5 | The J.P. Morgan Emerging Markets Bond (EMBI) Global Diversified Index is a comprehensive global local emerging markets index comprising liquid, fixed rate, domestic currency government bonds. |

| 6 | The ICE Bank of America Global High Yield Constrained Index contains all securities in the ICE BofA Global High Yield Index but caps issuer exposure at 2%. Index constituents are capitalization-weighted, based on their current amount outstanding, provided the total allocation to an individual issuer does not exceed 2%. Issuers that exceed the limit are reduced to 2% and the face value of each of their bonds is adjusted on a pro-rata basis. |

| 6 | abrdn Global Income Fund, Inc. |

| abrdn Global Income Fund, Inc. | 7 |

| Date | AAA/Aaa % | AA/Aa % | A % | BBB/Baa % | BB/Ba % | B % | CCC/CC/C % | D % | NR % |

| April 30, 2023 | 1.6 | 2.2 | 5.0 | 24.4 | 31.9 | 20.2 | 6.6 | 0.0 | 8.1 |

| October 31, 2022 | 1.7 | 2.6 | 4.9 | 11.9 | 34.9 | 24.1 | 6.9 | 0.2 | 13.5 |

| April 30, 2022 | 1.8 | 2.4 | 3.1 | 9.6 | 34.3 | 27.9 | 7.8 | 0.2 | 13.6 |

| (1) | For financial reporting purposes, credit quality ratings shown above reflect the lowest rating assigned by either S&P, Moody’s or Fitch if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated NR are not rated by these rating agencies. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. The Investment Manager evaluates the credit quality of unrated investments based upon, but not limited to, credit ratings for similar investments. |

| Date | Developed Markets % | Investment Grade Developing Markets % | Sub-Investment Grade Developing Markets % |

| April 30, 2023 | 51.2 | 21.6 | 27.2 |

| October 31, 2022 | 51.3 | 22.2 | 26.5 |

| April 30, 2022 | 49.8 | 19.7 | 30.5 |

| Date | Developed Markets % | Investment Grade Developing Markets % | Sub-Investment Grade Developing Markets % |

| April 30, 2023 | 77.3 | 13.9 | 8.8 |

| October 31, 2022 | 82.8 | 12.8 | 4.4 |

| April 30, 2022 | 77.8 | 15.1 | 7.1 |

| 8 | abrdn Global Income Fund, Inc. |

| Date | Under 3 Years % | 3 to 5 Years % | 5 to 10 Years % | 10 Years & Over % |

| April 30, 2023 | 28.4 | 17.0 | 35.1 | 19.5 |

| October 31, 2022 | 26.0 | 17.4 | 35.0 | 21.6 |

| April 30, 2022 | 20.3 | 17.4 | 34.6 | 26.1 |

| * | Modified duration is a measure of the sensitivity of the price of a bond to the fluctuations in interest rates. |

| abrdn Global Income Fund, Inc. | 9 |

| Apr–23 | Oct–22 | Apr-22 | ||

| Australia | 90 day Bank Bills | 3.68% | 3.09% | 0.70% |

| 10 yr bond | 0.00% | 3.14% | 1.83% | |

| currency local per 1USD | $1.51 | $1.56 | $1.41 | |

| New Zealand | 90 day Bank Bills | 5.56% | 4.10% | 1.97% |

| 10 yr bond | 4.09% | 1.72% | 3.64% | |

| currency local per 1USD | $1.62 | $1.72 | $1.54 | |

| Malaysia | 3-month T-Bills | 2.85% | 2.71% | 1.80% |

| 10 yr bond | 3.73% | 4.37% | 4.38% | |

| currency local per 1USD | RM4.46 | RM4.37 | RM4.35 | |

| India | 3-month T-Bills | 6.78% | 6.42% | 4.04% |

| 10 yr bond | 7.11% | 7.45% | 7.14% | |

| currency local per 1USD | ₹81.84 | ₹82.78 | ₹76.44 | |

| Indonesia | 3 months deposit rate | 3.94% | 3.55% | 3.26% |

| 10 yr bond | 6.51% | 7.51% | 6.97% | |

| currency local per 1USD | Rp14,670.00 | Rp15,597.50 | Rp14,497.00 | |

| Russia | Zero Cpn 3m | 7.23% | 7.48% | 13.09% |

| 10 yr bond | 15.99% | 15.99% | 15.99% | |

| currency local per 1USD | ₽80.20 | ₽61.70 | ₽70.83 | |

| USD Denominated Bonds | Mexico | 5.28% | 6.48% | 5.00% |

| Indonesia | 4.44% | 23.20% | 4.01% | |

| Argentina | 23.20% | 23.20% | 23.20% | |

| Romania | 4.95% | 5.49% | 3.45% |

| 10 | abrdn Global Income Fund, Inc. |

| abrdn Global Income Fund, Inc. | 11 |

| 12 | abrdn Global Income Fund, Inc. |

| abrdn Global Income Fund, Inc. | 13 |

| 14 | abrdn Global Income Fund, Inc. |

| abrdn Global Income Fund, Inc. | 15 |

| 16 | abrdn Global Income Fund, Inc. |

| abrdn Global Income Fund, Inc. | 17 |

| At April 30, 2023, the Fund held the following forward foreign currency contracts: |

| Purchase Contracts Settlement Date* | Counterparty | Currency Purchased | Amount Purchased | Currency Sold | Amount Sold | Fair Value | Unrealized Appreciation/ (Depreciation) | |

| Chinese Renminbi/United States Dollar | ||||||||

| 05/19/2023 | Morgan Stanley & Co. | CNY | 17,905,483 | USD | 2,612,704 | $ 2,589,982 | $ (22,722) | |

| 05/24/2023 | UBS AG | CNY | 17,905,483 | USD | 2,605,870 | 2,591,036 | (14,834) | |

| Indonesian Rupiah/United States Dollar | ||||||||

| 06/26/2023 | Citibank N.A. | IDR | 31,055,400,000 | USD | 2,077,285 | 2,116,437 | 39,152 | |

| Singapore Dollar/United States Dollar | ||||||||

| 05/19/2023 | Citibank N.A. | SGD | 5,428,895 | USD | 4,068,009 | 4,070,695 | 2,686 | |

| South Korean Won/United States Dollar | ||||||||

| 06/15/2023 | UBS AG | KRW | 3,476,568,000 | USD | 2,672,932 | 2,606,028 | (66,904) | |

| $13,974,178 | $(62,622) | |||||||

| Sale Contracts Settlement Date* | Counterparty | Currency Purchased | Amount Purchased | Currency Sold | Amount Sold | Fair Value | Unrealized Appreciation/ (Depreciation) | |

| United States Dollar/British Pound | ||||||||

| 05/19/2023 | Deutsche Bank AG | USD | 1,261,792 | GBP | 1,010,674 | $ 1,270,623 | $ (8,831) | |

| United States Dollar/Chinese Renminbi | ||||||||

| 05/24/2023 | Morgan Stanley & Co. | USD | 2,613,512 | CNY | 17,905,483 | 2,591,036 | 22,476 | |

| United States Dollar/Euro | ||||||||

| 05/19/2023 | JPMorgan Chase Bank N.A. | USD | 122,764 | EUR | 111,100 | 122,534 | 230 | |

| 05/19/2023 | Morgan Stanley & Co. | USD | 4,435,580 | EUR | 4,056,933 | 4,474,459 | (38,879) | |

| $8,458,652 | $(25,004) | |||||||

| Unrealized appreciation on forward foreign currency exchange contracts | $ 64,544 | |||||||

| Unrealized depreciation on forward foreign currency exchange contracts | $(152,170) | |||||||

| * | Certain contracts with different trade dates and like characteristics have been shown net. |

| At April 30, 2023, the Fund held the following centrally cleared interest rate swaps: |

| Currency | Notional Amount | Expiration Date | Counterparty | Receive (Pay) Floating Rate | Floating Rate Index | Fixed Rate | Frequency of Paid Payments Made | Premiums Paid (Received) | Value | Unrealized Appreciation/ (Depreciation) |

| USD | 7,350,000 | 03/17/2033 | UBS AG | Receive | 12-month SOFR | 3.38% | Annually | $- | $ (114,932) | $ (114,932) |

| USD | 5,000,000 | 03/17/2030 | UBS AG | Receive | 12-month SOFR | 3.46% | Annually | - | (62,649) | (62,649) |

| USD | 5,000,000 | 03/17/2032 | UBS AG | Receive | 12-month SOFR | 3.40% | Annually | - | (74,769) | (74,769) |

| $- | $(252,350) | $(252,350) | ||||||||

| 18 | abrdn Global Income Fund, Inc. |

| Assets | |

| Investments, at value (cost $71,685,447) | $ 63,083,415 |

| Short-term investments, at value (cost $4,507,657) | 4,507,657 |

| Foreign currency, at value (cost $270,793) | 240,302 |

| Cash | 13,194 |

| Cash at broker for interest rate swaps | 894,626 |

| Cash at broker for forward foreign currency contracts | 60,000 |

| Receivable for investments sold | 169,401 |

| Interest and dividends receivable | 1,163,358 |

| Receivable for common shares issued | 223,158 |

| Unrealized appreciation on forward foreign currency exchange contracts | 64,544 |

| Variation margin receivable for centrally cleared swaps | 191,254 |

| Prepaid expenses in connection with the at-the-market stock offering (Note 5) | 129,341 |

| Prepaid expenses in connection with the shelf registration (Note 5) | 51,235 |

| Prepaid expenses in connection with revolving credit facility (Note 7) | 36,785 |

| Prepaid expenses | 3,884 |

| Total assets | 70,832,154 |

| Liabilities | |

| Revolving credit facility payable (Note 7) | 17,350,000 |

| Payable for investments purchased | 465,473 |

| Unrealized depreciation on forward foreign currency exchange contracts | 152,170 |

| Interest payable on bank loan | 72,419 |

| Investment management fees payable (Note 3) | 37,170 |

| Cash collateral due to broker | 10,000 |

| Investor relations fees payable (Note 3) | 9,275 |

| Administration fees payable (Note 3) | 7,148 |

| Deferred foreign capital gains tax (Note 2j) | 1,656 |

| Other accrued expenses | 86,787 |

| Total liabilities | 18,192,098 |

| Net Assets | $52,640,056 |

| Composition of Net Assets | |

| Common stock (par value $0.001 per share) (Note 5) | $ 12,789 |

| Paid-in capital in excess of par | 75,889,462 |

| Distributable accumulated loss | (23,262,195) |

| Net Assets | $52,640,056 |

| Net asset value per share based on 12,788,980 shares issued and outstanding | $ 4.12(a) |

| (a) | The NAV shown above differs from the traded NAV on April 30, 2023 due to financial statement rounding and/or financial statement adjustments. |

| abrdn Global Income Fund, Inc. | 19 |

| Net Investment Income | |

| Investment Income: | |

| Interest and amortization of discount and premium (net of foreign withholding taxes of $6,615) | $ 2,199,575 |

| Total investment income | 2,199,575 |

| Expenses: | |

| Investment management fee (Note 3) | 216,869 |

| Directors' fees and expenses | 96,026 |

| Independent auditors’ fees and expenses | 44,328 |

| Administration fee (Note 3) | 41,705 |

| Bank loan fees and expenses | 36,909 |

| Investor relations fees and expenses (Note 3) | 27,470 |

| Reports to shareholders and proxy solicitation | 21,191 |

| Custodian’s fees and expenses | 17,735 |

| Transfer agent’s fees and expenses | 13,498 |

| Insurance expense | 7,633 |

| Legal fees and expenses | 7,053 |

| Miscellaneous | 20,703 |

| Total operating expenses, excluding interest expense | 551,120 |

| Interest expense (Note 7) | 477,951 |

| Total operating expenses before reimbursed/waived expenses | 1,029,071 |

| Less: Investor relations fee waiver (Note 3) | (15,090) |

| Net expenses | 1,013,981 |

| Net Investment Income/(Loss) | 1,185,594 |

| Net Realized/Unrealized Gain/(Loss) from Investments and Foreign Currency Related Transactions: | |

| Net realized gain/(loss) from: | |

| Investment transactions (including $(287) capital gains tax) | (1,443,511) |

| Interest rate swaps | 1,033 |

| Forward foreign currency exchange contracts | (472,651) |

| Foreign currency transactions | (26,918) |

| (1,942,047) | |

| Net change in unrealized appreciation/(depreciation) on: | |

| Investments (including change in deferred capital gains tax of $1,361) | 4,166,436 |

| Interest rate swaps | (252,350) |

| Forward foreign currency exchange contracts | 525,918 |

| Foreign currency translation | 1,266,768 |

| 5,706,772 | |

| Net realized and unrealized gain from investments, interest rate swaps, forward foreign currency exchange contracts and foreign currencies | 3,764,725 |

| Change in Net Assets Resulting from Operations | $4,950,319 |

| 20 | abrdn Global Income Fund, Inc. |

| For the Six-Month Period Ended April 30, 2023 (unaudited) | For the Year Ended October 31, 2022 | |

| Increase/(Decrease) in Net Assets: | ||

| Operations: | ||

| Net investment income | $ 1,185,594 | $ 2,459,102 |

| Net realized loss from investments, interest rate swaps, forward foreign currency exchange contracts and foreign currency transactions | (1,942,047) | (4,489,942) |

| Net change in unrealized appreciation/(depreciation) on investments, interest rate swaps, forward foreign currency exchange contracts and foreign currency translation | 5,706,772 | (13,883,934) |

| Net increase/(decrease) in net assets resulting from operations | 4,950,319 | (15,914,774) |

| Distributions to Shareholders From: | ||

| Distributable earnings | (5,036,229) | (1,030,650) |

| Return of capital | – | (7,146,830) |

| Net decrease in net assets from distributions | (5,036,229) | (8,177,480) |

| Proceeds from at-the-market offering resulting in the issuance of 1,771,674 and 2,114,574 shares of common stock, respectively | 8,980,220 | 12,183,264 |

| Expenses in connection with the at-the-market stock offering (Note 5) | (85,545) | (99,522) |

| Expenses in connection with the shelf offering (Note 5) | (18,149) | (17,907) |

| Reinvestment of dividends resulting in the issuance of 14,532 and 25,019 shares of common stock, respectively | 71,401 | 138,357 |

| Change in net assets from capital transactions | 8,947,927 | 12,204,192 |

| Change in net assets | 8,862,017 | (11,888,062) |

| Net Assets: | ||

| Beginning of period | 43,778,039 | 55,666,101 |

| End of period | $52,640,056 | $43,778,039 |

| abrdn Global Income Fund, Inc. | 21 |

| Cash flows from operating activities: | |

| Net increase/(decrease) in net assets resulting from operations | $ 4,950,319 |

| Adjustments to reconcile net increase in net assets resulting from operations to net cash provided by operating activities: | |

| Investments purchased | (12,768,443) |

| Investments sold and principal repayments | 9,568,365 |

| Decrease in short-term investments, excluding foreign government | 161,868 |

| Net amortization/accretion of premium (discount) | (111,329) |

| Increase in receivable for common shares sold | (211,513) |

| Increase in cash due to broker | 10,000 |

| Decrease in cash due to broker for forward foreign currency exchange contracts | (40,000) |

| Increase in interest and dividends receivable | (125,863) |

| Net change unrealized appreciation on forward foreign currency exchange contracts | (525,918) |

| Decrease in prepaid expenses | 29,284 |

| Increase in interest payable on bank loan | 17,795 |

| Increase in accrued investment management fees payable | 3,505 |

| Increase in other accrued expenses | 32,703 |

| Net change in unrealized appreciation of investments | (4,166,436) |

| Net change in unrealized appreciation on foreign currency translations | (1,266,768) |

| Net realized loss on investments transactions | 1,443,511 |

| Total Cash flows from operating activities | (2,998,920) |

| Cash flows from financing activities: | |

| Distributions paid to shareholders | (5,036,229) |

| Proceeds from stock offering | 8,980,220 |

| Proceeds from reinvestment of dividends | $ 71,401 |

| Net cash paid (received) for swap contracts | (191,254) |

| Expenses in connection with the at-the-market and shelf offering | (103,694) |

| Net cash used in financing activities | 3,720,444 |

| Effect of exchange rate on cash | (5,240) |

| Net change in cash | 716,284 |

| Unrestricted and restricted cash and foreign currency, beginning of year | 491,838 |

| Unrestricted and restricted cash and foreign currency, end of year | $ 1,208,122 |

| Supplemental disclosure of cash flow information: | |

| Cash paid for interest and fees on borrowing | 460,156 |

| 22 | abrdn Global Income Fund, Inc. |

| Reconciliation of unrestricted and restricted cash to the statements of assets and liabilities | ||

| Six-Month Period Ended April 30, 2023 (unaudited) | Year Ended October 31, 2022 | |

| Cash | $ 13,194 | $ 28,548 |

| Foreign currency, at value | 240,302 | 143,290 |

| Cash at broker for interest rate swaps | 894,626 | – |

| Cash at broker for forward foreign currency contracts | 60,000 | 320,000 |

| $1,208,122 | $491,838 |

| abrdn Global Income Fund, Inc. | 23 |

| For the Six-Months Ended April 30, |

For the Fiscal Years Ended October 31, | |||||

| 2023 (unaudited) |

2022 | 2021 | 2020 | 2019 | 2018 | |

| PER SHARE OPERATING PERFORMANCE(a): | ||||||

| Net asset value per common share, beginning of period | $3.98 | $6.28 | $6.55 | $7.83 | $7.99 | $9.17 |

| Net investment income | 0.10 | 0.25 | 0.31 | 0.32 | 0.35 | 0.44 |

| Net realized and unrealized gains/(losses) on investments, interestrate swaps, futures contracts and foreign currency transactions | 0.35 | (1.92) | 0.22 | (0.76) | 0.33 | (0.78) |

| Total from investment operations applicable to common shareholders | 0.45 | (1.67) | 0.53 | (0.44) | 0.68 | (0.34) |

| Distributions to common shareholders from: | ||||||

| Net investment income | (0.42) | (0.10) | (0.21) | (0.17) | (0.36) | (0.16) |

| Return of capital | – | (0.74) | (0.63) | (0.67) | (0.48) | (0.68) |

| Total distributions | ( |

( |

( |

( |

( |

( |

| Capital Share Transactions: | ||||||

| Impact of shelf offering | 0.11 | 0.21 | 0.04 | – | – | – |

| Net asset value per common share, end of period | $4.12 | $3.98 | $6.28 | $6.55 | $7.83 | $7.99 |

| Market price, end of period | $5.07 | $4.50 | $8.35 | $6.80 | $8.41 | $8.22 |

| Total Investment Return Based on(b): | ||||||

| Market price | 22.65% | (37.38%) | 36.38% | (8.35%) | 13.46% | 1.27% |

| Net asset value | 12.69%(c) | (26.36%) | 6.49% | (5.18%) | 8.68% | (3.81%) |

| Ratio to Average Net Assets Applicable to Common Shareholders/Supplementary Data: | ||||||

| Net assets applicable to common shareholders, end of period (000 omitted) | $52,640 | $43,778 | $55,666 | $57,148 | $68,335 | $69,693 |

| Average net assets applicable to common shareholders (000 omitted) | $49,932 | $48,635 | $58,918 | $60,738 | $69,229 | $76,372 |

| Net operating expenses, net of fee waivers | 4.10%(d) | 3.11% | 2.62% | 2.89% | 3.45% | 3.03% |

| Net operating expenses, excluding fee waivers | 4.16%(d) | 3.18% | 2.66% | 2.93% | 3.46% | 3.06% |

| Net operating expenses, excluding interest expense, net of fee waivers | 2.16%(d) | 2.25% | 2.19% | 2.11% | 2.04% | 1.89% |

| Net Investment income | 4.79%(d) | 5.06% | 4.57% | 4.63% | 4.47% | 5.04% |

| Portfolio turnover | 15%(e) | 39% | 44% | 75% | 59% | 45% |

| Revolving credit facility outstanding (000 omitted) | $ |

$ |

$ |

$ |

$ |

$ |

| Asset coverage ratio on revolving credit facility at period end | 403% | 352% | 354% | 382% | 333% | 344% |

| Asset coverage per $1,000 on revolving credit facility at periodend(f) | $ |

$ |

$ |

$ |

$ |

$ |

| (a) | Based on average shares outstanding. |

| (b) | Total investment return based on market value is calculated assuming that shares of the Fund’s common stock were purchased at the closing market price as of the beginning of the period, dividends,capital gains and other distributions were reinvested as provided for in the Fund’s dividend reinvestment plan and then sold at the closing market price per share on the last day of the period. The computation does not reflect any sales commission investors may incur in purchasing or selling shares of the Fund. The total investment return based on the net asset value is similarly computed except that the Fund’s netasset value is substituted for the closing market value. |

| (c) |

The total return shown above includes the impact of financial statement rounding of the NAV per share and/or financial statement adjustments.

|

| 24 | abrdn Global Income Fund, Inc. |

| (d) | Annualized. |

| (e) | Not annualized. |

| (f) | Asset coverage ratio is calculated by dividing net assets plus the amount of any borrowings for investment purposes by the amount of any borrowings. |

| abrdn Global Income Fund, Inc. | 25 |

| 26 | abrdn Global Income Fund, Inc. |

| abrdn Global Income Fund, Inc. | 27 |

| Investments, at Value | Level 1 – Quoted Prices |

Level 2 – Other Significant Observable Inputs |

Level 3 – Significant Unobservable Inputs |

Total |

| Assets | ||||

| Investments in Securities | ||||

| Corporate Bonds | $ – | $ 41,159,209 | $– | $ 41,159,209 |

| Government Bonds | – | 21,924,206 | – | 21,924,206 |

| Warrants | – | – | – | – |

| Short-Term Investment | 4,507,657 | – | – | 4,507,657 |

| Total Investments | $4,507,657 | $63,083,415 | $– | $67,591,072 |

| Other Financial Instruments | ||||

| Foreign Currency Exchange Contracts | $ – | $ 64,544 | $– | $ 64,544 |

| Total Assets | $4,507,657 | $63,147,959 | $– | $67,655,616 |

| Liabilities | ||||

| Other Financial Instruments | ||||

| Centrally Cleared Interest Rate Swap Agreements | $ – | $ (252,350) | $– | $ (252,350) |

| Foreign Currency Exchange Contracts | – | (152,170) | – | (152,170) |

| Total Liabilities | $ – | $ (404,520) | $– | $ (404,520) |

| 28 | abrdn Global Income Fund, Inc. |

| abrdn Global Income Fund, Inc. | 29 |

| Risk Exposure Category | |||||||

| Interest Rate Contracts |

Foreign Currency Contracts |

Credit Contracts |

Equity Contracts |

Commodity Contracts |

Other | Total | |

| Assets: | |||||||

| Unrealized appreciation on: | |||||||

| Forward Foreign Currency Exchange Contracts | $ – | $ 64,544 | $– | $– | $– | $– | $ 64,544 |

| Total | $ – | $64,544 | $– | $– | $– | $– | $ 64,544 |

| Liabilities: | |||||||

| Unrealized depreciation on: | |||||||

| Forward Foreign Currency Exchange Contracts | $ – | $ 152,170 | $– | $– | $– | $– | $ 152,170 |

| Swap Contracts | 252,350 | – | – | – | – | – | 252,350 |

| Total | $252,350 | $152,170 | $– | $– | $– | $– | $404,520 |

| 30 | abrdn Global Income Fund, Inc. |

| Gross Amounts Not Offset in the Statement of Assets and Liabilities |

Gross Amounts Not Offset in the Statement of Assets and Liabilities |

|||||||

| Gross Amounts of Assets Presented in Statement of Assets and Liabilities |

Financial Instruments |

Collateral Received |

Net Amount |

Gross Amounts of Liabilities Presented in Statement of Assets and Liabilities |

Financial Instruments |

Collateral Pledged |

Net Amount |

|

| Description | Assets | Liabilities | ||||||

| Foreign Currency Exchange Contracts | ||||||||

| Citibank N.A. | $41,838 | $– | $– | $41,838 | $– | $– | $– | $– |

| Deutsche Bank AG | – | – | – | – | 8,831 | – | – | 8,831 |

| JPMorgan Chase Bank N.A. | 230 | – | – | 230 | – | – | – | – |

| Morgan Stanley & Co. | 22,476 | (22,476) | – | – | 61,601 | (22,476) | – | 39,125 |

| UBS AG | – | – | – | – | 81,738 | – | (60,000) | 21,738 |

| Risk Exposure Category | ||||||

| Interest Rate Contracts |

Foreign Currency Contracts |

Credit Contracts |

Equity Contracts |

Commodity Contracts |

Total | |

| Realized Gain (Loss) on Derivatives Recognized as a Result of Operations: |

||||||

| Net realized gain (loss) on: | ||||||

| Forward Currency Contracts | $ – | $ (472,651) | $– | $– | $– | $ (472,651) |

| Swap Contracts | 1,033 | – | – | – | – | 1,033 |

| Total | $ 1,033 | $(472,651) | $– | $– | $– | $(471,618) |

| Net Change in Unrealized Appreciation (Depreciation) on Derivatives Recognized as a Result of Operations: |

||||||

| Net change in unrealized appreciation (depreciation) of: | ||||||

| Forward Currency Contracts | $ – | $ 525,918 | $– | $– | $– | $ 525,918 |

| Swap Contracts | (252,350) | – | – | – | – | (252,350) |

| Total | $(252,350) | $ 525,918 | $– | $– | $– | $ 273,568 |

| abrdn Global Income Fund, Inc. | 31 |

| 32 | abrdn Global Income Fund, Inc. |

| abrdn Global Income Fund, Inc. | 33 |

| 34 | abrdn Global Income Fund, Inc. |

| abrdn Global Income Fund, Inc. | 35 |

| Tax Cost of Securities |

Unrealized Appreciation |

Unrealized Depreciation |

Net Unrealized Appreciation/ (Depreciation) |

| $75,972,236 | $857,806 | $(9,578,946) | $(8,721,140) |

| 36 | abrdn Global Income Fund, Inc. |

| abrdn Global Income Fund, Inc. | 37 |

| 38 | abrdn Global Income Fund, Inc. |

(b) Not applicable.

Item 2. Code of Ethics.

This item is inapplicable to semi-annual report on Form N-CSR.

Item 3. Audit Committee Financial Expert.

This item is inapplicable to semi-annual report on Form N-CSR.

Item 4. Principal Accountant Fees and Services.

This item is inapplicable to semi-annual report on Form N-CSR.

Item 5. Audit Committee of Listed Registrants.

This item is inapplicable to semi-annual report on Form N-CSR.

Item 6. Investments.

(a) Schedule of Investments in securities of unaffiliated issuers as of close of the reporting period is included as part of the Report to Shareholders filed under Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

This item is inapplicable to semi-annual report on Form N-CSR.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

(a) Not applicable to semi-annual report on Form N-CSR.

(b) There has been no change, as of the date of this filing, in any of the portfolio managers identified in response to paragraph (a)(1) of this Item in the registrant’s most recently filed annual report on Form N-CSR.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

No such purchases were made by or on behalf of the Registrant during the period covered by the report.

Item 10. Submission of Matters to a Vote of Security Holders.

During the period ended April 30, 2023, there were no material changes to the procedures by which shareholders may recommend nominees to the Registrant’s Board of Directors.

Item 11. Controls and Procedures.

| (a) | The Registrant’s principal executive and principal financial officers, or persons performing similar functions, have concluded that the Registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”) (17 CFR 270.30a-3(c))) are effective, as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on the evaluation of these controls and procedures required by Rule 30a-3(b) under the Act (17 CFR 270.30a3(b)) and Rule 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934, as amended (17 CFR 240.13a-15(b) or 240.15d15(b)). |

| (b) | There were no changes in the Registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act (17 CFR 270.30a-3(d))) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant’s internal control over financial reporting. |

Item 12 - Disclosure of Securities Lending Activities for Closed-End Management Investment Companies

Not applicable

Item 13. Exhibits.

| (a)(1) | Not applicable. |

| (a)(2) | The certifications of the registrant as required by Rule 30a-2(a) under the Act are exhibits to this Form N-CSR. |

| (a)(3) | Any written solicitation to purchase securities under Rule 23c-1 under the 1940 Act (17 CFR 270.23c-1) sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable. |

| (a)(4) | Change in Registrant’s independent public accountant. Not applicable. |

| (b) | The certifications of the registrant as required by Rule 30a-2(b) under the Act are exhibits to this Form N-CSR |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

abrdn Global Income Fund, Inc.

| By: | /s/ Christian Pittard | |

| Christian Pittard, | ||

| Principal Executive Officer of | ||

| abrdn Global Income Fund, Inc. |

Date: July 10, 2023

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

| By: | /s/ Christian Pittard | |

| Christian Pittard, | ||

| Principal Executive Officer of | ||

| abrdn Global Income Fund, Inc. | ||

| Date: July 10, 2023 | ||

| By: | /s/ Sharon Ferrari | |

| Sharon Ferrari, | ||

| Principal Financial Officer of | ||

| abrdn Global Income Fund, Inc. | ||

Date: July 10, 2023

Exhibit 99.CERT

Certification Pursuant to Rule 30a-2(a) under the 1940 Act and Section 302 of the Sarbanes-Oxley Act

I, Sharon Ferrari, certify that:

| 1. | I have reviewed this report on Form N-CSR of abrdn Global Income Fund, Inc. (the “Registrant”); |

| 2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| 3. | Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations, changes in net assets, and cash flows (if the financial statements are required to include a statement of cash flows) of the Registrant as of, and for, the periods presented in this report; |

| 4. | The Registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940) and internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) for the Registrant and have: |

| (a) | Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the Registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| (b) | Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| (c) | Evaluated the effectiveness of the Registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of a date within 90 days prior to the filing date of this report based on such evaluation; and |

| (d) | Disclosed in this report any change in the Registrant’s internal control over financial reporting that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant’s internal control over financial reporting; and |

| 5. | The Registrant’s other certifying officer(s) and I have disclosed to the Registrant’s auditors and the audit committee of the Registrant’s board of directors (or persons performing the equivalent functions): |

| (a) | All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the Registrant’s ability to record, process, summarize, and report financial information; and |

| (b) | Any fraud, whether or not material, that involves management or other employees who have a significant role in the Registrant’s internal control over financial reporting. |

Date: July 10, 2023

| /s/ Sharon Ferrari | |

| Sharon Ferrari | |

| Principal Financial Officer |

Certification Pursuant to Rule 30a-2(a) under the 1940 Act and Section 302 of the Sarbanes-Oxley Act

I, Christian Pittard, certify that:

| 1. | I have reviewed this report on Form N-CSR of abrdn Global Income Fund, Inc. (the “Registrant”); |

| 2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| 3. | Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations, changes in net assets, and cash flows (if the financial statements are required to include a statement of cash flows) of the Registrant as of, and for, the periods presented in this report; |

| 4. | The Registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940) and internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) for the Registrant and have: |

| (a) | Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the Registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| (b) | Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| (c) | Evaluated the effectiveness of the Registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of a date within 90 days prior to the filing date of this report based on such evaluation; and |

| (d) | Disclosed in this report any change in the Registrant’s internal control over financial reporting that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant’s internal control over financial reporting; and |

| 5. | The Registrant’s other certifying officer(s) and I have disclosed to the Registrant’s auditors and the audit committee of the Registrant’s board of directors (or persons performing the equivalent functions): |

| (a) | All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the Registrant’s ability to record, process, summarize, and report financial information; and |

| (b) | Any fraud, whether or not material, that involves management or other employees who have a significant role in the Registrant’s internal control over financial reporting. |

Date: July 10, 2023

| /s/ Christian Pittard | |

| Christian Pittard | |

| Principal Executive Officer |

Exhibit 99.906CERT

Certification Pursuant to Rule 30a-2(b) under the 1940 Act and Section 906 of the Sarbanes-Oxley Act

Christian Pittard, Principal Executive Officer, and Sharon Ferrari, Principal Financial Officer, of abrdn Global Income Fund, Inc. (the “Registrant”), each certify that:

| 1. | The Registrant’s periodic report on Form N-CSR for the period ended April 30, 2023 (the “Form N-CSR”) fully complies with the requirements of Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934, as amended, as applicable; and |

| 2. | The information contained in the Form N-CSR fairly presents, in all material respects, the financial condition and results of operations of the Registrant. |

| PRINCIPAL EXECUTIVE OFFICER | |

| abrdn Global Income Fund, Inc. | |

| /s/ Christian Pittard | |

| Christian Pittard | |

| Date: July 10, 2023 | |

| PRINCIPAL FINANCIAL OFFICER | |

| abrdn Global Income Fund, Inc. | |

| /s/ Sharon Ferrari | |

| Sharon Ferrari | |

| Date: July 10, 2023 |

This certification is being furnished solely pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and is not being filed as part of Form N-CSR or as a separate disclosure document. A signed original of this written statement, or other document authenticating, acknowledging, or otherwise adopting the signature that appears in typed form within the electronic version of this written statement required by Section 906, has been provided to the Registrant and will be retained by the Registrant and furnished to the Securities and Exchange Commission or its staff upon request.

N-2 - USD ($) |

6 Months Ended | 12 Months Ended | ||||||

|---|---|---|---|---|---|---|---|---|

Apr. 30, 2023 |

Oct. 31, 2022 |

Oct. 31, 2021 |

Oct. 31, 2020 |

Oct. 31, 2019 |

Oct. 31, 2018 |

|||

| Cover [Abstract] | ||||||||

| Entity Central Index Key | 0000876717 | |||||||

| Amendment Flag | false | |||||||

| Document Type | N-CSRS | |||||||

| Entity Registrant Name | abrdn Global Income Fund, Inc. | |||||||

| Financial Highlights [Abstract] | ||||||||

| Senior Securities Amount | $ 17,350 | $ 17,350 | $ 21,900 | $ 20,300 | $ 29,300 | $ 28,600 | ||

| Senior Securities Coverage per Unit | [1] | $ 4,034 | $ 3,523 | $ 3,542 | $ 3,815 | $ 3,332 | $ 3,437 | |

| General Description of Registrant [Abstract] | ||||||||

| Investment Objectives and Practices [Text Block] | The Fund’s principal investment objective is to provide high current income by investing primarily in fixed income securities. As a secondary investment objective, the Fund seeks capital appreciation, but only when consistent with its principal investment objective. | |||||||

| Risk Factors [Table Text Block] |

8. Portfolio Investment Risks

a. Bank Loan Risk:

There are a number of risks associated with an investment in bank loans including credit risk, interest rate risk, illiquid securities risk, and prepayment risk. There is also the possibility that the collateral securing a loan, if any, may be difficult to liquidate or be insufficient to cover the amount owed under the loan. These risks could cause the Fund to lose income or principal on a particular investment, which in turn could affect the Fund’s returns. In addition, bank loans may settle on a delayed basis, resulting in the proceeds from the sale of such loans not being readily available to make additional investments or distributions. To the extent the extended settlement process gives rise to short-term liquidity needs, the Fund may hold additional cash, sell investments or temporarily borrow from banks or other lenders.

b. Credit and Market Risk:

A debt instrument’s price depends, in part, on the credit quality of the issuer, borrower, counterparty, or underlying collateral and can decline in response to changes in the financial condition of the issuer, borrower, counterparty, or underlying collateral, or changes in specific or general market, economic, industry, political, regulatory, geopolitical, or other conditions. Funds that invest in high yield and emerging market instruments are subject to certain additional credit and market risks. The yields of high yield and emerging market debt obligations reflect, among other things, perceived credit risk. The Fund's investments in securities rated below investment grade typically involve risks not associated with higher rated securities

including, among others, greater risk of not receiving timely and/or ultimate payment of interest and principal, greater market price volatility, and less liquid secondary market trading.

c. Emerging Markets Risk:

The Fund is subject to emerging markets risk. This is a magnification of the risks that apply to foreign investments. These risks are greater for securities of companies in emerging market countries because the countries may have less stable governments, more volatile currencies and less established markets (see “Risks Associated with Foreign Securities and Currencies” below).

d. Focus Risk:

The Fund may have elements of risk not typically associated with investments in the United States due to focused investments in a limited number of countries or regions subject to foreign securities or currency risks. Such focused investments may subject the Fund to additional risks resulting from political or economic conditions in such countries or regions and the possible imposition of adverse governmental laws or currency exchange restrictions could cause the securities and their markets to be less liquid and their prices to be more volatile than those of comparable U.S. securities.

e. High-Yield Bonds and Other Lower-Rated Securities Risk:

The Fund’s investments in high-yield bonds (commonly referred to as “junk bonds”) and other lower-rated securities will subject the Fund to substantial risk of loss. Investments in high-yield bonds are speculative and issuers of these securities are generally considered to be less financially secure and less able to repay interest and principal than issuers of investment-grade securities. Prices of high-yield bonds tend to be very volatile. These securities are less liquid than investment-grade debt securities and may be difficult to price or sell, particularly in times of negative sentiment toward high-yield securities.

f. Interest Rate Risk:

The prices of fixed income securities respond to economic developments, particularly interest rate changes, as well as to perceptions about the creditworthiness of individual issuers, including governments. Generally, the Fund’s fixed income securities will decrease in value if interest rates rise and vice versa, and the volatility of lower-rated securities is even greater than that of higher-rated securities. Also, longer-term securities are generally more volatile, so the average maturity or duration of these securities affects risk.

The Fund may be subject to a greater risk of rising interest rates due to the current interest rate environment and the effect of potential government fiscal policy initiatives and resulting market reaction to those initiatives.

g. LIBOR Risk:

The Fund is subject to the risk that potential changes related to the use of the London Interbank Offered Rate (“LIBOR”) could adversely affect financial instruments that reference LIBOR as a benchmark interest rate. While some instruments may contemplate a scenario when LIBOR is no longer available by providing for an alternative rate setting methodology, not all instruments provide for an alternative rate, and the effectiveness of replacement rates is uncertain. The potential abandonment of LIBOR could affect the value and liquidity of instruments that reference LIBOR, especially those that do not have fallback provisions.

h. Risk Associated with Foreign Securities and Currencies:

Investments in securities of foreign issuers carry certain risks not ordinarily associated with investments in securities of U.S. issuers. These risks include future political and economic developments, and the possible imposition of exchange controls or other foreign governmental laws and restrictions. In addition, with respect to certain countries, there is the possibility of expropriation of assets, confiscatory taxation, and political or social instability or diplomatic developments, which could adversely affect investments in those countries. Foreign securities may also be harder to price than U.S. securities.

Certain countries also may impose substantial restrictions on investments in their capital markets by foreign entities, including restrictions on investments in issuers of industries deemed sensitive to relevant national interests. These factors may limit the investment opportunities available and result in a lack of liquidity and high price volatility with respect to securities of issuers from developing countries.

The value of foreign currencies relative to the U.S. Dollar fluctuates in response to market, economic, political, regulatory, geopolitical or

other conditions. A decline in the value of a foreign currency versus the U.S. Dollar reduces the value in U.S. Dollars of investments denominated in that foreign currency. This risk may impact the Fund more greatly to the extent the Fund does not hedge its currency risk, or hedging techniques used by the Advisers are unsuccessful.

i. Russia/Ukraine Risk:

In February 2022, Russia commenced a military attack on Ukraine. The outbreak of hostilities between the two countries and the threat of wider spread hostilities could have a severe adverse effect on the region and global economies, including significant negative impacts on the markets for certain securities and commodities, such as oil and natural gas. In addition, sanctions imposed on Russia by the United States and other countries, and any sanctions imposed in the future, could have a significant adverse impact on the Russian economy and related markets. The price and liquidity of investments may fluctuate widely as a result of the conflict and related events. How long the armed conflict and related events will last cannot be predicted. These tensions and any related events could have a significant impact on Fund performance and the value of the Fund's investments.

|

|||||||

| Annual Dividend Payment | $ 0.42 | 0.84 | $ 0.84 | $ 0.84 | $ 0.84 | $ 0.84 | ||

| Lowest Price or Bid | 4.39 | |||||||

| Highest Price or Bid | 5.79 | |||||||

| Lowest Price or Bid, NAV | 3.95 | |||||||

| Highest Price or Bid, NAV | $ 4.43 | |||||||

| Highest Price or Bid, Premium (Discount) to NAV [Percent] | 7.06% | |||||||

| Lowest Price or Bid, Premium (Discount) to NAV [Percent] | 35.71% | |||||||

| Share Price | $ 5.07 | 4.5 | ||||||

| NAV Per Share | $ 4.11 | $ 3.98 | ||||||

| Latest Premium (Discount) to NAV [Percent] | 23.36% | 13.07% | ||||||

| Capital Stock, Long-Term Debt, and Other Securities [Abstract] | ||||||||

| Outstanding Security, Title [Text Block] | common stock | |||||||

| Outstanding Security, Held [Shares] | 12,788,980 | |||||||

| Bank Loan Risk [Member] | ||||||||

| General Description of Registrant [Abstract] | ||||||||

| Risk [Text Block] |

a. Bank Loan Risk:

There are a number of risks associated with an investment in bank loans including credit risk, interest rate risk, illiquid securities risk, and prepayment risk. There is also the possibility that the collateral securing a loan, if any, may be difficult to liquidate or be insufficient to cover the amount owed under the loan. These risks could cause the Fund to lose income or principal on a particular investment, which in turn could affect the Fund’s returns. In addition, bank loans may settle on a delayed basis, resulting in the proceeds from the sale of such loans not being readily available to make additional investments or distributions. To the extent the extended settlement process gives rise to short-term liquidity needs, the Fund may hold additional cash, sell investments or temporarily borrow from banks or other lenders.

|

|||||||

| Credit And Market Risk [Member] | ||||||||

| General Description of Registrant [Abstract] | ||||||||

| Risk [Text Block] |

b. Credit and Market Risk:

A debt instrument’s price depends, in part, on the credit quality of the issuer, borrower, counterparty, or underlying collateral and can decline in response to changes in the financial condition of the issuer, borrower, counterparty, or underlying collateral, or changes in specific or general market, economic, industry, political, regulatory, geopolitical, or other conditions. Funds that invest in high yield and emerging market instruments are subject to certain additional credit and market risks. The yields of high yield and emerging market debt obligations reflect, among other things, perceived credit risk. The Fund's investments in securities rated below investment grade typically involve risks not associated with higher rated securities

|

|||||||

| Emerging Markets Risk [Member] | ||||||||

| General Description of Registrant [Abstract] | ||||||||

| Risk [Text Block] |

c. Emerging Markets Risk:

The Fund is subject to emerging markets risk. This is a magnification of the risks that apply to foreign investments. These risks are greater for securities of companies in emerging market countries because the countries may have less stable governments, more volatile currencies and less established markets (see “Risks Associated with Foreign Securities and Currencies” below).

|

|||||||

| Focus Risk [Member] | ||||||||

| General Description of Registrant [Abstract] | ||||||||

| Risk [Text Block] |

d. Focus Risk:

The Fund may have elements of risk not typically associated with investments in the United States due to focused investments in a limited number of countries or regions subject to foreign securities or currency risks. Such focused investments may subject the Fund to additional risks resulting from political or economic conditions in such countries or regions and the possible imposition of adverse governmental laws or currency exchange restrictions could cause the securities and their markets to be less liquid and their prices to be more volatile than those of comparable U.S. securities.

|

|||||||

| High Yield Bonds And Other Lower Rated Securities Risk [Member] | ||||||||

| General Description of Registrant [Abstract] | ||||||||

| Risk [Text Block] |

e. High-Yield Bonds and Other Lower-Rated Securities Risk:

The Fund’s investments in high-yield bonds (commonly referred to as “junk bonds”) and other lower-rated securities will subject the Fund to substantial risk of loss. Investments in high-yield bonds are speculative and issuers of these securities are generally considered to be less financially secure and less able to repay interest and principal than issuers of investment-grade securities. Prices of high-yield bonds tend to be very volatile. These securities are less liquid than investment-grade debt securities and may be difficult to price or sell, particularly in times of negative sentiment toward high-yield securities.

|

|||||||

| Interest Rate Risks [Member] | ||||||||

| General Description of Registrant [Abstract] | ||||||||

| Risk [Text Block] |

f. Interest Rate Risk:

The prices of fixed income securities respond to economic developments, particularly interest rate changes, as well as to perceptions about the creditworthiness of individual issuers, including governments. Generally, the Fund’s fixed income securities will decrease in value if interest rates rise and vice versa, and the volatility of lower-rated securities is even greater than that of higher-rated securities. Also, longer-term securities are generally more volatile, so the average maturity or duration of these securities affects risk.

The Fund may be subject to a greater risk of rising interest rates due to the current interest rate environment and the effect of potential government fiscal policy initiatives and resulting market reaction to those initiatives.

|

|||||||

| Libor Risk [Member] | ||||||||

| General Description of Registrant [Abstract] | ||||||||

| Risk [Text Block] |

g. LIBOR Risk:

The Fund is subject to the risk that potential changes related to the use of the London Interbank Offered Rate (“LIBOR”) could adversely affect financial instruments that reference LIBOR as a benchmark interest rate. While some instruments may contemplate a scenario when LIBOR is no longer available by providing for an alternative rate setting methodology, not all instruments provide for an alternative rate, and the effectiveness of replacement rates is uncertain. The potential abandonment of LIBOR could affect the value and liquidity of instruments that reference LIBOR, especially those that do not have fallback provisions.

|

|||||||

| Risk Associated With Foreign Securities And Currencies [Member] | ||||||||

| General Description of Registrant [Abstract] | ||||||||

| Risk [Text Block] |

h. Risk Associated with Foreign Securities and Currencies:

Investments in securities of foreign issuers carry certain risks not ordinarily associated with investments in securities of U.S. issuers. These risks include future political and economic developments, and the possible imposition of exchange controls or other foreign governmental laws and restrictions. In addition, with respect to certain countries, there is the possibility of expropriation of assets, confiscatory taxation, and political or social instability or diplomatic developments, which could adversely affect investments in those countries. Foreign securities may also be harder to price than U.S. securities.

Certain countries also may impose substantial restrictions on investments in their capital markets by foreign entities, including restrictions on investments in issuers of industries deemed sensitive to relevant national interests. These factors may limit the investment opportunities available and result in a lack of liquidity and high price volatility with respect to securities of issuers from developing countries.

The value of foreign currencies relative to the U.S. Dollar fluctuates in response to market, economic, political, regulatory, geopolitical or

|

|||||||

| Russia Or Ukraine Risk [Member] | ||||||||

| General Description of Registrant [Abstract] | ||||||||

| Risk [Text Block] |

i. Russia/Ukraine Risk:

In February 2022, Russia commenced a military attack on Ukraine. The outbreak of hostilities between the two countries and the threat of wider spread hostilities could have a severe adverse effect on the region and global economies, including significant negative impacts on the markets for certain securities and commodities, such as oil and natural gas. In addition, sanctions imposed on Russia by the United States and other countries, and any sanctions imposed in the future, could have a significant adverse impact on the Russian economy and related markets. The price and liquidity of investments may fluctuate widely as a result of the conflict and related events. How long the armed conflict and related events will last cannot be predicted. These tensions and any related events could have a significant impact on Fund performance and the value of the Fund's investments.

|

|||||||

| ||||||||

1 Year abrdn Global Income Chart |

1 Month abrdn Global Income Chart |

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions