Click here to read about Moving Averages.

Similar to the Simple Moving Average. The way in which the EMA differs, is that the present price(s) are given more significance than the past prices. The significance for each older datum point decreases exponentially. Consequently the EMA reacts quicker than the SMA to any change in the price. When looking at an upward trend, we see that the EMA shows the trend faster than a SMA.

Although this sounds good, remember that the EMA can sometimes be subject to false signals. As with the SMA you can adjust the number of periods, and offset the line by another number of periods.

Parameters: Period & Offset.

For additional help on what the different parameters mean, that isn't included on this page, click here.

Exponential Moving Average

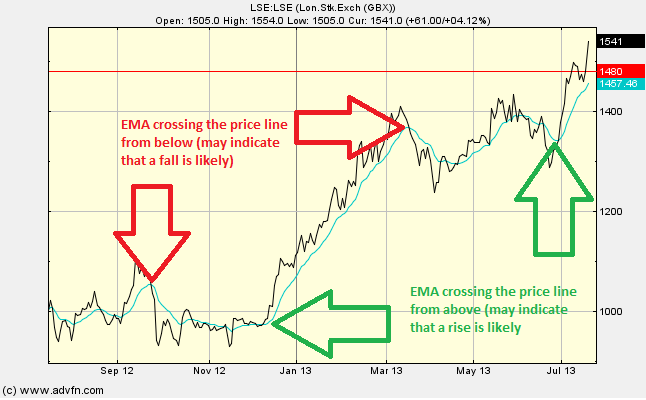

Here is an example of an Exponential Moving Average chart study (on a London Stock Exchange graph)

Trade it the same way as the Simple Moving Average. When the EMA crosses from above the price line its a good time to buy, while when it crosses from below it is a good time to sell.

EMA Crossings

Here is an example of a EMA crossing the price line (of the London Stock Exchange), and what it may indicate

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions