UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

_____________________________

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | |

☐ | Preliminary Proxy Statement |

| | | | | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | | | | |

☒ | Definitive Proxy Statement |

| | | | | |

☐ | Definitive Additional Materials |

| | | | | |

☐ | Soliciting Material under §240.14a-12 |

KORE Group Holdings, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | |

☐ | Fee paid previously with preliminary materials. |

| | | | | |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

KORE Group Holdings, Inc.

NOTICE & PROXY STATEMENT

Annual Meeting of Stockholders

June 12, 2024

9:00 a.m. (Eastern time)

CERTAIN DEFINITIONS

As used in the accompanying proxy statement, unless otherwise indicated, references to “KORE,” the “Company,” “we,” “us,” and “our,” and similar references refer collectively to KORE Group Holdings, Inc. and its consolidated subsidiaries.

Unless the context otherwise requires, references in this proxy statement to:

•“ABRY Entities” are to each of ABRY Partners VII, L.P., ABRY Partners VII Co-Investment Fund, L.P., ABRY Investment Partnership, L.P., ABRY Senior Equity IV, L.P. and ABRY Senior Equity IV Co-Investment Fund, L.P.;

•“Amended and Restated Investor Rights Agreement” are to that certain Amended and Restated Investor Rights Agreement, dated as of November 15, 2023, by and among KORE, the Sponsor, the ABRY Entities and Searchlight;

•“Business Combination” are to the series of transactions contemplated by the Merger Agreement;

•“CTAC” are to Cerberus Telecom Acquisition Corp., a predecessor entity of the Company;

•“Closing” are to the consummation of the Business Combination;

•“Exchange Act” are to the Securities Exchange Act of 1934, as amended;

•“Incentive Plan” are to the KORE Group Holdings, Inc. 2021 Long-Term Stock Incentive Plan, as it may be amended from time to time;

•“IoT” are to Internet of Things;

•“Common Stock” are to shares of our common stock, par value $0.0001 per share;

•“KORE Wireless” are to KORE Wireless Group Inc., a Delaware corporation and wholly owned and principal operating subsidiary of KORE;

•“Merger Agreement” are to that certain Agreement and Plan of Merger, dated as of March 12, 2021, as amended on July 27, 2021 and September 21, 2021, by and among CTAC, KORE, King Corp Merger Sub, Inc., King LLC Merger Sub, LLC and Maple Holdings Inc.;

•“NYSE” are to the New York Stock Exchange;

•“SaaS” are to Software-as-a-Service;

•“Searchlight” are to Searchlight IV KOR, L.P.; and

•“Sponsor” and “Cerberus” are to Cerberus Telecom Acquisition Holdings, LLC.

KORE Group Holdings, Inc.

3 Ravinia Drive NE, Suite 500

Atlanta, Georgia 30346

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 12, 2024

The Annual Meeting of Stockholders (the “Annual Meeting”) of KORE Group Holdings, Inc., a Delaware corporation (the “Company”), will be held at 9:00 a.m. Eastern time on June 12, 2024. The Annual Meeting will be a completely virtual meeting and will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/KORE2024 and entering your 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials. The Annual Meeting will be held for the following purposes:

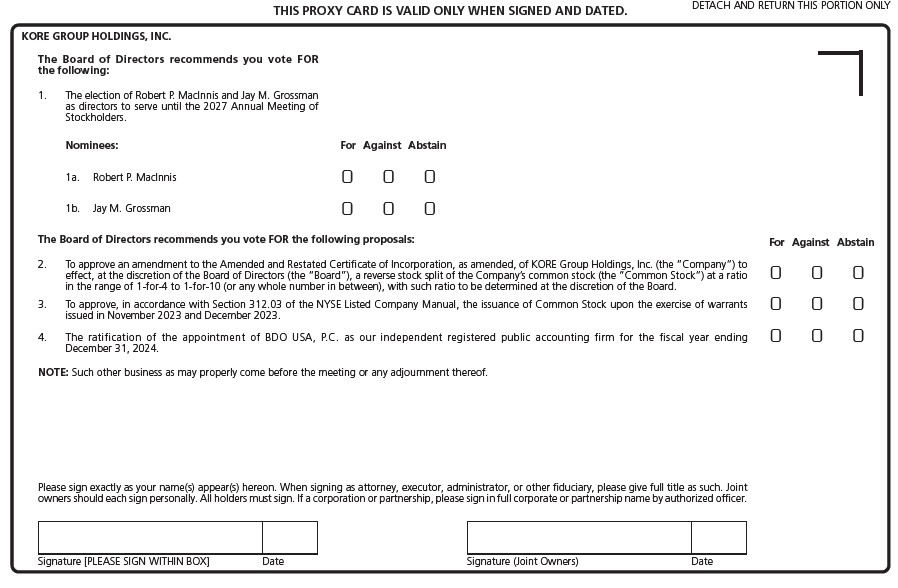

•to elect Robert P. MacInnis and Jay M. Grossman as Class III directors to serve until the 2027 Annual Meeting of Stockholders, and until their respective successors shall have been duly elected and qualified;

•to approve an amendment to the Amended and Restated Certificate of Incorporation of the Company to effect, at the discretion of the Board of Directors (the “Board”), a reverse stock split of the Company’s common stock (the “common stock”) at a ratio in the range of 1-for-4 to 1-for-10 (or any whole number in between), with such ratio to be determined at the discretion of the Board;

•to approve, in accordance with Section 312.03 of the NYSE Listed Company Manual, the issuance of common stock upon the exercise of warrants issued in November 2023 and December 2023;

•to ratify the appointment of BDO USA, P.C. as our independent registered public accounting firm for the fiscal year ending December 31, 2024; and

•to transact such other business as may properly come before the Annual Meeting or any continuation, postponement, or adjournment of the Annual Meeting.

Holders of record of our common stock as of the close of business on April 16, 2024, are entitled to notice of and to vote at the Annual Meeting, or any continuation, postponement or adjournment of the Annual Meeting. A complete list of such stockholders will be open to the examination of any stockholder for a period of ten days prior to the Annual Meeting for a purpose germane to the meeting by sending an email to Jack W. Kennedy Jr., Executive Vice President, Chief Legal Officer and Secretary, at investors@korewireless.com, stating the purpose of the request and providing proof of ownership of common stock. The list of these stockholders will also be available on the bottom of your screen during the Annual Meeting after entering the 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials. The Annual Meeting may be continued or adjourned from time to time without notice other than by announcement at the Annual Meeting.

It is important that your shares be represented regardless of the number of shares you may hold. Whether or not you plan to attend the Annual Meeting online, we urge you to vote your shares via the toll-free telephone number or over the Internet, as described in the enclosed materials. You may sign, date and mail the proxy card in the enclosed return envelope. Promptly voting your shares will ensure the presence of a quorum at the Annual Meeting and will save us the expense of further solicitation. Submitting your proxy now will not prevent you from voting your shares at the Annual Meeting if you desire to do so, as your proxy is revocable at your option.

By Order of the Board of Directors

/s/ Jack W. Kennedy Jr.

Jack W. Kennedy Jr.

Executive Vice President, Chief Legal Officer and Secretary

Atlanta, GA

May 13, 2024

KORE Group Holdings, Inc.

3 Ravinia Drive NE, Suite 500

Atlanta, Georgia 30346

PROXY STATEMENT

This proxy statement is furnished in connection with the solicitation by the board of directors (the “Board”) of KORE Group Holdings, Inc. (the “Company” or “KORE”) of proxies to be voted at our Annual Meeting of Stockholders to be held on June 12, 2024, (the “Annual Meeting”), at 9:00 a.m. Eastern time, and at any continuation, postponement, or adjournment of the Annual Meeting. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/KORE2024 and entering your 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials.

Holders of record of shares of our common stock as of the close of business on April 16, 2024 (the “Record Date”), will be entitled to notice of and to vote at the Annual Meeting and any continuation, postponement, or adjournment of the Annual Meeting, and will vote together as a single class on all matters presented at the Annual Meeting. As of the Record Date, there were 83,196,842 shares of common stock outstanding and entitled to vote at the Annual Meeting. Each share of common stock is entitled to one vote per share on any matter presented to stockholders at the Annual Meeting.

This proxy statement and the enclosed proxy card are first being mailed to stockholders on or about May 15, 2024. A copy of the 2023 Annual Report to Stockholders, including the Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as filed with the Securities and Exchange Commission (the “SEC”), is being mailed with this proxy statement.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON JUNE 12, 2024

This Proxy Statement and our 2023 Annual Report to Stockholders are available at http://www.proxyvote.com/

Proposals

At the Annual Meeting, our stockholders will be asked:

•to elect Robert P. MacInnis and Jay M. Grossman as Class III directors to serve until the 2027 Annual Meeting of Stockholders, and until their respective successors shall have been duly elected and qualified;

•to approve an amendment to the Amended and Restated Certificate of Incorporation (the “Charter”), of the Company to effect, at the discretion of the Board, a reverse stock split of the Company’s common stock (the “common stock”) at a ratio in the range of 1-for-4 to 1-for-10 (or any whole number in between), with such ratio to be determined at the discretion of the Board (the “Reverse Stock Split Proposal”);

•to approve, in accordance with Section 312.03 of the NYSE Listed Company Manual, the issuance of common stock upon the exercise of warrants issued in November 2023 and December 2023 (the “Stock Issuance Proposal”);

•to ratify the appointment of BDO USA, P.C. as our independent registered public accounting firm for the fiscal year ending December 31, 2024; and

•To transact such other business as may properly come before the Annual Meeting or any continuation, postponement, or adjournment of the Annual Meeting.

We know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the stockholders for a vote at the Annual Meeting, however, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

Recommendations of the Board

The Board recommends that you vote your shares as indicated below. If you return a properly completed proxy card, or vote your shares by telephone or Internet, your shares of common stock will be voted on your behalf as you direct. If not otherwise specified, the shares of common stock represented by the proxies will be voted, and the Board recommends that you vote:

•FOR the election of Robert P. MacInnis and Jay M. Grossman as directors to serve until the 2027 Annual Meeting of Stockholders;

•FOR the approval of an amendment to the Charter of the Company to effect, at the discretion of the Board, a reverse stock split of the Company’s common stock at a ratio in the range of 1-for-4 to 1-for-10 (or any whole number in between), with such ratio to be determined at the discretion of the Board;

•FOR the approval, in accordance with Section 312.03 of the NYSE Listed Company Manual, of the issuance of common stock upon the exercise of warrants issued in November 2023 and December 2023; and

•FOR the ratification of the appointment of BDO USA, P.C. as our independent registered public accounting firm for the fiscal year ending December 31, 2024.

If any other matter properly comes before the stockholders for a vote at the Annual Meeting, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

Information About This Proxy Statement

Why you received this proxy statement. You are viewing or have received these proxy materials because KORE’s Board is soliciting your proxy to vote your shares at the Annual Meeting. This proxy statement includes information that we are required to provide to you under the rules of the SEC and that is designed to assist you in voting your shares.

Printed Copies of Our Proxy Materials. Instructions regarding how you can vote are contained on the proxy card included in the printed copies of our proxy materials.

Householding. The SEC’s rules permit us to deliver a single set of proxy materials to one address shared by two or more of our stockholders. This delivery method is referred to as “householding” and can result in significant cost savings. To take advantage of this opportunity, we have delivered only one set of proxy materials to multiple stockholders who share an address, unless we received contrary instructions from the impacted stockholders prior to the mailing date. We agree to deliver promptly, upon written or oral request, a separate copy of the proxy materials, as requested, to any stockholder at the shared address to which a single copy of those documents was delivered. If you prefer to receive separate copies of the proxy materials, contact Broadridge Financial Solutions, Inc. (“Broadridge”) at 1-866-540-7095 or in writing at Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717.

If you are currently a stockholder sharing an address with another stockholder and wish to receive only one copy of future proxy materials for your household, please contact Broadridge at the above phone number or address.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

Who is entitled to vote at the Annual Meeting?

The Record Date for the Annual Meeting is April 16, 2024. You are entitled to vote at the Annual Meeting only if you were a stockholder of record at the close of business on that date, or if you hold a valid proxy for the Annual Meeting. Each outstanding share of common stock is entitled to one vote per share for all matters before the Annual Meeting in accordance with the provisions of our Charter and the Amended and Restated Investor Rights Agreement. At the close of business on the Record Date, there were 83,196,842 shares of common stock outstanding and entitled to vote at the Annual Meeting.

What is the difference between being a “record holder” and holding shares in “street name”?

A record holder holds shares in his or her name. Shares held in “street name” means shares that are held in the name of a bank or broker on a person’s behalf.

Am I entitled to vote if my shares are held in “street name”?

Yes. If your shares are held by a bank or a brokerage firm, you are considered the “beneficial owner” of those shares held in “street name.” If your shares are held in street name, these proxy materials are being provided to you by your bank or brokerage firm, along with a voting instruction card. As the beneficial owner, you have the right to direct your bank or brokerage firm how to vote your shares and the bank or brokerage firm is required to vote your shares in accordance with your instructions. If your shares are held in street name, you should contact your bank or broker to obtain your 16-digit control number or otherwise vote through the bank or broker.

How many shares must be present to hold the Annual Meeting?

A quorum must be present at the Annual Meeting for any business to be conducted. The presence at the Annual Meeting, online or by proxy, of the holders of a majority in voting power of the common stock issued and outstanding and entitled to vote will constitute a quorum.

Who can attend the Annual Meeting?

In order to enable increased stockholder attendance and participation at the Annual Meeting, KORE has decided to hold the Annual Meeting entirely online this year. You may attend and participate in the Annual Meeting by visiting the following website: www.virtualshareholdermeeting.com/KORE2024. To attend and participate in the Annual Meeting, you will need the 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials. If your shares are held in “street name,” you should contact your bank or broker to obtain your 16-digit control number or otherwise vote through the bank or broker. If you lose your 16-digit control number, you may join the Annual Meeting as a “Guest” but you will not be able to vote, ask questions or access the list of stockholders as of the Record Date. The meeting webcast will begin promptly at 9:00 a.m. Eastern time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 8:45 a.m., Eastern time, and you should allow ample time for the check-in procedures.

What if a quorum is not present at the Annual Meeting?

If a quorum is not present at the scheduled time of the Annual Meeting, pursuant to our Bylaws, the person presiding over the meeting, or a majority in voting power of the stockholders entitled to vote at the meeting, present online or represented by proxy, shall have power to recess the Annual Meeting or adjourn the Annual Meeting.

What does it mean if I receive more than one set of proxy materials?

It means that your shares are held in more than one account at the transfer agent and/or with banks or brokers. Please vote all of your shares. To ensure that all of your shares are voted, for each set of proxy materials, please submit your proxy by phone, via the Internet, or by signing, dating and returning the enclosed proxy card in the enclosed envelope.

How do I vote?

Stockholders of Record. If you are a stockholder of record, you may vote:

•by Internet - You can vote over the Internet at www.proxyvote.com by following the instructions on the proxy card;

•by Telephone - You can vote by telephone by calling 1-800-690-6903 and following the instructions on the proxy card;

•by Mail - You can vote by mail by signing, dating and mailing the proxy card that accompanied your proxy materials; or

•Electronically at the Meeting - If you attend the meeting online, you will need the 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials to vote electronically during the meeting.

Internet and telephone voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. Eastern time on June 11, 2024. To participate in the Annual Meeting, including to vote via the Internet or telephone, you will need the 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials.

Whether or not you expect to attend the Annual Meeting online, we urge you to vote your shares as promptly as possible to ensure your representation and the presence of a quorum at the Annual Meeting. If you submit your proxy, you may still decide to attend the Annual Meeting and vote your shares electronically.

Beneficial Owners of Shares Held in “Street Name.” If your shares are held in “street name” through a bank or broker, you will receive instructions on how to vote from the bank or broker. You must follow their instructions in order for your shares to be voted. Internet and telephone voting also may be offered to stockholders owning shares through certain banks and brokers. If your shares are not registered in your own name and you would like to vote your shares online at the Annual Meeting, you should contact your bank or broker to obtain your 16-digit control number or otherwise vote through the bank or broker. If you lose your 16-digit control number, you may join the Annual Meeting as a “Guest” but you will not be able to vote, ask questions or access the list of stockholders as of the Record Date. You will need to obtain your own Internet access if you choose to attend the Annual Meeting online and/or vote over the Internet.

Can I change my vote after I submit my proxy?

Yes.

If you are a stockholder of record, you may revoke your proxy and change your vote:

•by submitting a duly executed proxy bearing a later date;

•by granting a subsequent proxy through the Internet or telephone;

•by giving written notice of revocation to the Secretary of KORE prior to the Annual Meeting; or

•by voting online at the Annual Meeting.

Your most recent proxy card or Internet or telephone proxy is the one that is counted. Your attendance at the Annual Meeting by itself will not revoke your proxy unless you give written notice of revocation to the Secretary before your proxy is voted or you vote online at the Annual Meeting.

If your shares are held in street name, you may change or revoke your voting instructions by following the specific directions provided to you by your bank or broker, or you may vote online at the Annual Meeting using your 16-digit control number or otherwise voting through your bank or broker.

Who will count the votes?

A representative of Broadridge Financial Solutions, Inc., our inspector of election, will tabulate and certify the votes.

What if I do not specify how my shares are to be voted?

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote in accordance with the recommendations of the Board. The Board’s recommendations are indicated on page 4 of this proxy statement, as well as with the description of each proposal in this proxy statement.

Will any other business be conducted at the Annual Meeting?

We know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the stockholders for a vote at the Annual Meeting, however, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

Why hold a virtual meeting?

We believe that hosting a virtual meeting this year is in the best interest of the Company and its stockholders. A virtual meeting enables increased stockholder attendance and participation because stockholders can participate from any location around the world. You will be able to

attend the Annual Meeting online and submit your questions by visiting www.virtualshareholdermeeting.com/KORE2024. You also will be able to vote your shares electronically at the Annual Meeting by following the instructions above.

What if during the check-in time or during the Annual Meeting I have technical difficulties or trouble accessing the virtual meeting website?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting website, and the information for assistance will be located on www.virtualshareholdermeeting.com/KORE2024.

Will there be a question and answer session during the Annual Meeting?

As part of the Annual Meeting, we will hold a live Q&A session, during which we intend to answer questions submitted online during the meeting that are pertinent to the Company and the meeting matters, as time permits. Only stockholders that have accessed the Annual Meeting as a stockholder (rather than a “Guest”) by following the procedures outlined above in “Who can attend the Annual Meeting?” will be permitted to submit questions during the Annual Meeting. Each stockholder is limited to no more than two questions. Questions and answers may be grouped by topic, and substantially similar questions may be grouped and answered as one. We will not address questions that are not pertinent to the business of the Company or the business of the Annual Meeting, or that we otherwise believe are not appropriate under the circumstances.

How many votes are required for the approval of the proposals to be voted upon and how will abstentions and broker non-votes be treated?

| | | | | | | | | | | | | | |

| Proposal | | Votes required | | Effect of Abstentions and Broker Non-Votes |

| Proposal 1: Election of Directors | | The plurality of the votes cast. This means that the two (2) nominees receiving the highest number of affirmative “FOR” votes will be elected as directors. | | Abstentions and broker non-votes will have no effect. |

| | | | |

| Proposal 2: Reverse Stock Split Proposal | | The affirmative vote of the holders of a majority in voting power of the votes cast. | | Abstentions and broker non-votes will have no effect. |

| | | | |

| Proposal 3: Stock Issuance Proposal | | The affirmative vote of the holders of a majority in voting power of the votes cast. | | Abstentions and broker non-votes will have no effect. |

| | | | |

| Proposal 4: Ratification of Appointment of Independent Registered Public Accounting Firm | | The affirmative vote of the holders of a majority in voting power of the votes cast. | | Abstentions will have no effect. |

What is an “abstention” and how will abstentions be treated?

Abstentions are counted as present and entitled to vote for purposes of determining a quorum. Abstentions have no effect on the outcome of the proposals.

What are broker non-votes and do they count for determining a quorum?

Generally, broker non-votes occur when shares held by a bank, broker or other agent acting as a nominee in “street name” for a beneficial owner are not voted with respect to a particular proposal because the broker (1) has not received voting instructions from the beneficial owner and (2) lacks discretionary voting power to vote those shares. A broker is entitled to vote shares held for a beneficial owner on matters that are deemed “routine” by the NYSE, such as the ratification of the appointment of BDO USA, P.C. as our independent registered public accounting firm, without instructions from the beneficial owner of those shares. On the other hand, absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on matters that are deemed “non-routine” by the NYSE, such as the election of directors, the Reverse Stock Split Proposal and the Stock Issuance Proposal. Broker non-votes count for purposes of determining whether a quorum is present.

Where can I find the voting results of the Annual Meeting?

We plan to announce preliminary voting results at the Annual Meeting and we will report the final results in a Current Report on Form 8-K, which we intend to file with the SEC after the Annual Meeting.

PROPOSAL 1:

ELECTION OF DIRECTORS

At the Annual Meeting, two (2) Class III directors are to be elected to hold office until the Annual Meeting of Stockholders to be held in 2027 and until each such director’s respective successor is elected and qualified or until each such director’s earlier death, resignation or removal.

We currently have nine (9) directors on our Board. Our current directors are Timothy Donahue, Cheemin Bo-Linn, Michael K. Palmer, Robert MacInnis, Andrew Frey, David Fuller, James Geisler, H. Paulett Eberhart, and Jay M. Grossman.

Each of Robert P. MacInnis and Jay M. Grossman has been nominated by the Board as a director nominee subject to election at the Annual Meeting to serve until the Annual Meeting of Stockholders in 2027. Mr. MacInnis and Mr. Grossman were appointed as directors in 2021 and 2023, respectively, and are each standing for election for the first time. Mr. MacInnis and Mr. Grossman were each designated by the ABRY Entities pursuant to the Amended and Restated Investor Rights Agreement.

On April 29, 2024, the Company announced that the Board and Mr. Bahl had mutually agreed that Mr. Bahl would step down as President and Chief Executive Officer and a member of the Board, effective as of May 3, 2024. Accordingly, Mr. Bahl will not stand for re-election at the Annual Meeting.

The proposal regarding the election of directors requires the approval of a plurality of the votes cast. This means that the two (2) nominees receiving the highest number of affirmative “FOR” votes will be elected as directors. Abstentions and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal.

On November 15, 2023, the Company entered into the Amended and Restated Investor Rights Agreement, pursuant to which the Company agreed to take all necessary actions to cause the Board to be comprised of up to ten (10) directors, including: (i) up to two (2) individuals designated by the ABRY Entities; (ii) up to two (2) individuals designated by the Sponsor; (iii) up to two (2) individuals designated by Searchlight; (iv) the Chief Executive Officer; and (v) up to three (3) independent directors recommended by the Company’s Nominating and Corporate Governance Committee.

Pursuant to the Amended and Restated Investor Rights Agreement, the directors are divided into three (3) classes of directors, with each class serving for staggered three (3)-year terms. Subject in each case to the terms and conditions of the Amended and Restated Investor Rights Agreement, (i) the Class I directors shall include two (2) independent directors nominated by the Nominating and Corporate Governance Committee, one (1) director designated by Searchlight, and one (1) director designated by the Sponsor; (ii) the Class II directors shall include one (1) independent director nominated by the Nominating and Corporate Governance Committee, one (1) director designated by Searchlight, and one (1) director designated by the Sponsor; and (iii) the Class III directors shall include the Chief Executive Officer, and two (2) directors designated by the ABRY Entities. The chairperson of the Board is selected by a majority of the Board. As a result of the Amended and Restated Investor Rights Agreement and the aggregate voting power of the parties to the agreement, the parties to the agreement acting in conjunction control the election of directors of KORE. For more information, see “Directors, Executive Officers and Corporate Governance — Corporate Governance—Amended and Restated Investor Rights Agreement.”

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote the shares of common stock represented thereby for the election as a director of the person whose name and biography appears below. In the event that any of the director nominees should become unable to serve, or for good cause will not serve, as a director, it is intended that votes will be cast for a substitute nominee designated by the Board or the Board may elect to reduce its size. The Board has no reason to believe that any of the director nominees will be unable to serve if elected. Each of the director nominees has consented to being named in this proxy statement and to serve if elected.

Vote Required

The proposal regarding the election of directors requires the approval of a plurality of the votes cast. This means that the two (2) nominees receiving the highest number of affirmative “FOR” votes will be elected as directors.

Abstentions and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal.

Recommendation of the Board

The Board unanimously recommends a vote FOR the election of each of the below director nominees.

The nominees for election to the Board as directors, both of whom are currently serving on the Board, are as follows:

| | | | | | | | | | | | | | |

| Name | | Age | | Position with the Company |

| Robert P. MacInnis | | 57 | | Director |

| Jay M. Grossman | | 64 | | Director |

The principal occupations and business experience, for at least the past five years, of each director nominee for election at the Annual Meeting are as follows:

Robert P. MacInnis

Mr. MacInnis has served as a member of our Board since 2021. Mr. MacInnis has worked at ABRY Partners, LLC, a private equity fund (“ABRY Partners”), since December 1998, where he is currently a Partner. Mr. MacInnis also currently serves on the board of directors of Aegis Sciences Corp. and Automated Healthcare Solutions. In the past, Mr. MacInnis has served on the board of Consolidated Theatres, RCN Cable, Sidera Networks, Network Communications, Inc., XAnd, Datapipe, North American Dental Group, Muzak LLC, Proquest, Psychological Services, Inc., and several others. Prior to working at ABRY Partners, Mr. MacInnis was a senior manager at PricewaterhouseCoopers LLP from June 1991 through May 1997. Mr. MacInnis graduated summa cum laude from Merrimack College with a B.S. in business and received an M.B.A. summa cum laude from Boston University. Mr. MacInnis’ qualifications to serve as a member of our Board include his significant transactional and management experience developed over his career with ABRY Partners.

Jay M. Grossman

Mr. Grossman has served as a member of our Board since 2023. Mr. Grossman is the Chair of ABRY Partners, which he joined in 1996. Prior to joining ABRY Partners, Mr. Grossman was Managing Director and co-head of the Media and Entertainment Group at Prudential Securities, Inc., a financial services company, and a member of the corporate finance department of Kidder, Peabody & Company, a securities firm. Mr. Grossman is currently a director of Nexstar Media Group, Inc. (“Nexstar”), where he has served since 1997, and was its Vice President and Assistant Secretary from 1997 until March 2002. He has been Chair of Nexstar’s Compensation Committee since September 2022. Mr. Grossman also serves as a director (or the equivalent) of several private companies including Hometown Cable, Grande Communications Networks and RCN Telecom Services. Previously, Mr. Grossman served on the board of directors of a wide variety of companies including Atlantic Broadband, Q9 Networks, Sidera Networks, WideOpenWest Holdings, Consolidated Theaters, Country Road Communications, Monitronics International, Caprock Communications, Cyrus One Networks, Executive Health Resources and Hosted Solutions. Mr. Grossman received an MBA from Harvard Business School and is an honors graduate of Dickinson College. Mr. Grossman’s qualifications to serve as a member of the Board include his long-term experience as a public company director with Nexstar and his service on the boards of various private companies in diverse industries.

PROPOSAL 2:

REVERSE STOCK SPLIT PROPOSAL

General

Our Board has unanimously approved, and recommended that our stockholders approve, an amendment, substantially in the form set forth as Annex A to this proxy statement (the “Certificate of Amendment”), to our Charter to effect a reverse stock split at a ratio of not less than 1-for-4 and not greater than 1-for-10 (or any whole number in between) (the “Reverse Stock Split”), with the final decision of whether to proceed with the Reverse Stock Split, the effective time of the Reverse Stock Split, and the exact ratio of the Reverse Stock Split to be determined by the Board, in its discretion. If the stockholders approve the Reverse Stock Split, and the Board decides to implement it, the Reverse Stock Split will become effective as of 12:01 a.m. Eastern Time on a date to be determined by the Board that will be specified in the Certificate of Amendment. If the Board does not decide to implement the Reverse Stock Split within twelve months from the date of the Annual Meeting, the authority granted in this Reverse Stock Split Proposal to implement the Reverse Stock Split will terminate.

The Reverse Stock Split, if implemented, will be realized simultaneously for all outstanding common stock. The Reverse Stock Split will affect all holders of common stock uniformly and each stockholder will hold the same percentage of common stock outstanding immediately following the Reverse Stock Split as that stockholder held immediately prior to the Reverse Stock Split, except for immaterial adjustments that may result from the treatment of fractional shares as described below. The Reverse Stock Split will not change the par value of our common stock and will not reduce the number of authorized shares of common stock.

Reasons for the Reverse Stock Split

The principal reason for the Reverse Stock Split is to increase the per share trading price of our common stock in order to help ensure a share price high enough to satisfy the $1.00 per share minimum average closing price requirement for continued listing on the NYSE, although there can be no assurance that the trading price of our common stock would be maintained at such level or that we will be able to maintain the listing of our common stock on the NYSE.

As previously reported, on September 5, 2023, we received a written notification (the “Notice”) from the NYSE indicating that we were not in compliance with Section 802.01C of the NYSE’s Listed Company Manual, as the average closing price of our common stock was less than $1.00 per share over a consecutive 30 trading-day period. Pursuant to Section 802.01C, the Company was provided a period of six months following the receipt of the Notice to regain compliance with the minimum share price requirement. The Company would have regained compliance during the six-month cure period if, on the last trading day of any calendar month during the six-month cure period or on the last day of the cure period, the common stock had a closing price of at least $1.00 per share and an average closing price of at least $1.00 per share over the 30 trading-day period ending on the last trading day of that month. The Company did not regain compliance with Section 802.01C during the six-month cure period. The NYSE has provided the Company with additional time to cure this noncompliance.

The Board has considered the potential harm to the Company and our stockholders should the NYSE delist our common stock. Delisting from the NYSE would likely adversely affect our ability to raise additional financing through the public or private sale of securities and would significantly affect the ability of investors to trade our securities. Delisting would also likely negatively affect the value and liquidity of our common stock because alternatives, such as the OTC Bulletin Board and the pink sheets, are generally considered to be less efficient markets.

We believe that our best option to meet the NYSE’s $1.00 per share minimum average closing price requirement is to effect the Reverse Stock Split to increase the per-share trading price of our common stock. Given the volatility and fluctuations in the capital markets, the likelihood of our stock price increasing to meet the NYSE listing requirements without the Reverse Stock Split cannot be determined, and we may have to take additional actions to comply with the NYSE requirements.

In addition, we believe that the low per share market price of our common stock could impair its marketability to, and acceptance by, institutional investors and other members of the investing public and could create a negative impression of the Company. Theoretically, decreasing the number of shares of common stock outstanding should not, by itself, affect the marketability of the shares, the type of investor who would be interested in acquiring them, or our reputation in the financial community. In practice, however, many investors, brokerage firms and market makers consider low-priced stocks as unduly speculative in nature and, as a matter of policy, avoid investment and trading in such stocks. Moreover, the analysts at many brokerage firms do not monitor the trading activity or otherwise provide coverage of lower priced stocks. The presence of these factors may be adversely affecting, and may continue to adversely affect, not only the pricing of our common stock but also its trading liquidity. In addition, these factors may affect our ability to raise additional capital through the sale of stock.

Further, we believe that a higher stock price could help us establish business development relationships with other companies. Theoretically, decreasing the number of shares of common stock outstanding should not, by itself, affect our reputation in our business community. In practice, however, we believe that potential business development partners may be less confident in the prospects of a company with a low stock price and less likely to enter into business relationships with such a company. If the Reverse Stock Split successfully increases the per share price of our common stock, we believe this may increase our ability to attract business development partners.

We further believe that a higher stock price could help us attract and retain employees and other service providers. We believe that some potential employees and service providers are less likely to work for a company with a low stock price, regardless of the size of the company’s market capitalization. If the Reverse Stock Split successfully increases the per share price of our common stock, we believe this increase will enhance our ability to attract and retain employees and service providers.

We hope that the decrease in the number of shares of our outstanding common stock as a consequence of the Reverse Stock Split, and the anticipated increase in the price per share, will encourage greater interest in our common stock by the financial community and the investing public, help us attract and retain employees and other service providers, help us raise additional capital through the sale of stock in the future if needed, and possibly promote greater liquidity for our stockholders with respect to those shares presently held by them. However, the possibility also exists that liquidity may be adversely affected by the reduced number of shares which would be outstanding if the Reverse Stock Split is effected, particularly if the price per share of our common stock begins a declining trend after the Reverse Stock Split is effected.

The Board believes that stockholder adoption of a range of Reverse Stock Split ratios (as opposed to adoption of a single reverse stock split ratio or a set of fixed ratios) provides maximum flexibility to achieve the purposes of a reverse stock split and, therefore, is in the best interests of the Company. In determining a ratio following the receipt of stockholder adoption, the Board (or any authorized committee of the Board) may consider, among other things, factors such as:

•the historical trading price and trading volume of our common stock;

•the number of shares of our common stock outstanding;

•the then-prevailing trading price and trading volume of our common stock and the anticipated impact of the Reverse Stock Split on the trading market for our common stock;

•the anticipated impact of a particular ratio on our ability to reduce administrative and transactional costs;

•the continued listing requirements of the NYSE; and

•prevailing general market and economic conditions.

The Board (or any authorized committee of the Board) reserves the right to elect to abandon the Reverse Stock Split, notwithstanding stockholder adoption thereof, if it determines, in its sole discretion, that the Reverse Stock Split is no longer in the best interests of the Company.

Principal Effects of the Reverse Stock Split

If the stockholders approve the proposal to authorize the Board to implement the Reverse Stock Split and the Board implements the Reverse Stock Split, we will file the Certificate of Amendment. The form of Certificate of Amendment is set forth as Annex A to this proxy statement. By approving this amendment, stockholders will approve the combination of any whole number of shares of common stock between and including four (4) and ten (10), with the exact number to be determined by the Board, into one (1) share. The Certificate of Amendment to be filed with the Secretary of State of the State of Delaware will include only that number determined by the Board to be in the best interests of the Company and its stockholders.

As explained above, the Reverse Stock Split will be effected simultaneously for all issued and outstanding shares of common stock and the exchange ratio will be the same for all issued and outstanding shares of stockholder’s percentage ownership interests in the Company, except as explained in the section titled “— Fractional Shares” below with respect to fractional shares. Common stock issued pursuant to the Reverse Stock Split will remain fully paid and non-assessable. The Reverse Stock Split will not affect the Company’s continuing obligations under the periodic reporting requirements of the Exchange Act. Following the Reverse Stock Split, our common stock will continue to be listed on the NYSE, under the symbol “KORE,” although it would receive a new CUSIP number.

Upon effectiveness of the Reverse Stock Split, the number of authorized shares of common stock that are not issued or outstanding will increase substantially, because the proposed amendment will not reduce the number of authorized shares, while it will reduce the number of outstanding shares by a factor of between and including four and ten, depending on the exchange ratio selected by the Board.

The shares that are authorized but unissued after the Reverse Stock Split will be available for issuance, and, if we issue these shares, the ownership interest of holders of our common stock may be diluted. We may issue such shares to raise capital and/or as consideration in acquiring other businesses or establishing strategic relationships with other companies. Such acquisitions or strategic relationships may be effected using shares of common stock or other securities convertible into common stock and/or by using capital that may need to be raised by selling such securities. We do not have any agreement, arrangement or understanding at this time with respect to any specific transaction or acquisition for which the newly unissued authorized shares would be issued.

Procedure for Effecting Reverse Stock Split and Exchange of Stock Certificates

If the Reverse Stock Split is approved by the Company’s stockholders, and if at such time the Board still believes that a Reverse Stock Split is in the best interests of the Company and its stockholders, the Board will determine the ratio of the Reverse Stock Split to be implemented. The Reverse Stock Split will become effective as of 12:01 a.m. Eastern Time on the date specified in the Certificate of Amendment as filed with the office of the Secretary of State of the State of Delaware (the “effective time”). The Board will determine the exact timing of the filing of the Certificate of Amendment based on its evaluation as to when the filing would be the most advantageous to the Company and its stockholders. If the Board does not decide to implement the Reverse Stock Split within twelve months from the date of the Annual Meeting, the authority granted in this Reverse Stock Split Proposal to implement the Reverse Stock Split will terminate.

Except as described below under the section titled “— Fractional Shares,” at the effective time, each whole number of issued and outstanding pre-reverse split shares that the Board has determined will be combined into one post-reverse split share, will, automatically and without any further action on the part of our stockholders, be combined into and become one share of common stock, and each certificate which, immediately prior to the effective time represented pre-reverse stock split shares, will be deemed for all corporate purposes to evidence ownership of post-reverse split shares.

Fractional Shares

No fractional shares will be issued in connection with the Reverse Stock Split. Stockholders of record at the effective time of the Reverse Stock Split who otherwise would be entitled to receive fractional shares because they hold a number of pre-split shares not evenly divisible by the number of pre-split shares for which each post-split share is to be exchanged, will automatically, in lieu of a fractional share, be entitled, to have their fractional shares rounded up to the next whole share and receive an additional whole share of common stock in lieu of such fractional shares. In any event, cash will not be paid for fractional shares.

Risks Associated with the Reverse Stock Split

We cannot predict whether the Reverse Stock Split will increase the market price for our common stock. The history of similar stock split combinations for companies in like circumstances is varied, and the market price of our common stock will also be based on our performance and other factors, some of which are unrelated to the number of shares outstanding. Further, there are a number of risks associated with the Reverse Stock Split, including:

•The market price per share of our shares of common stock post-Reverse Stock Split may not remain in excess of the $1.00 per share minimum average closing price requirement as required by the NYSE, or the Company may fail to meet the other requirements for continued listing on the NYSE, resulting in the delisting of our common stock.

•Although the Board believes that a higher stock price may help generate the interest of new investors, the Reverse Stock Split may not result in a per-share price that will successfully attract certain types of investors and such resulting share price may not satisfy the investing guidelines of institutional investors or investment funds. Further, other factors, such as our financial results, market conditions and the market perception of our business, may adversely affect the interest of new investors in the shares of our common stock. As a result, the trading liquidity of the shares of our common stock may not improve as a result of the Reverse Stock Split and there can be no assurance that the Reverse Stock Split, if completed, will result in the intended benefits described above.

•The Reverse Stock Split could be viewed negatively by the market and other factors, such as those described above, may adversely affect the market price of the shares of our common stock. Consequently, the market price per post-Reverse Stock Split shares may not increase in proportion to the reduction of the number of shares of our common stock outstanding before the implementation of the Reverse Stock Split. Accordingly, the total market capitalization of our shares of common stock after the Reverse Stock Split may be lower than the total market capitalization before the Reverse Stock Split.

•The Reverse Stock Split may result in some stockholders owning “odd lots” of less than 100 shares of common stock. Odd lot shares may be more difficult to sell, and brokerage commissions and other costs of transactions in odd lots are generally somewhat higher than the costs of transactions in “round lots” of even multiples of 100 shares.

Book-Entry Shares

If the Reverse Stock Split is effected, stockholders who hold uncertificated shares (i.e., shares held in book-entry form and not represented by a physical stock certificate), either as direct or beneficial owners, will have their holdings electronically adjusted automatically by our transfer agent (and, for beneficial owners, by their brokers or banks that hold in “street name” for their benefit, as the case may be) to give effect to the Reverse Stock Split. Stockholders who hold uncertificated shares as direct owners will be sent a statement of holding from our transfer agent that indicates the number of post-reverse stock split shares of our common stock owned in book-entry form.

Certificated Shares

As soon as practicable after the effective time of the Reverse Stock Split, stockholders will be notified that the Reverse Stock Split has been effected. We expect that our transfer agent will act as exchange agent for purposes of implementing the exchange of stock certificates. Holders of pre-split shares will be asked to surrender to the exchange agent certificates representing pre-split shares in exchange for certificates representing post-split shares in accordance with the procedures to be set forth in a letter of transmittal to be sent by us or our exchange agent. No new certificates will be issued to a stockholder until such stockholder has surrendered such stockholder’s outstanding certificate(s) together with the properly completed and executed letter of transmittal to the exchange agent. Any pre-split shares submitted for transfer, whether pursuant to a sale or other disposition, or otherwise, will automatically be exchanged for post-split shares.

STOCKHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

Principal Effects of Reverse Stock Split on Outstanding Options, Warrants, and Incentive Plan

As of the Record Date, there were no outstanding stock options, and warrants to purchase an aggregate of 20,936,456 shares of common stock with a weighted average exercise price of $4.90 per share. If and when the Reverse Stock Split becomes effective, the number of shares of common stock covered by such rights will be reduced to between and including one-fourth and one-tenth the number currently covered, and the exercise or conversion price per share will be increased by between and including four and ten times the current exercise or conversion price, resulting in the same aggregate price being required to be paid therefor upon exercise or conversion thereof as was required immediately preceding the Reverse Stock Split.

In addition, the number of shares of common stock and number of shares of common stock subject to stock options or similar rights authorized under the Incentive Plan will be proportionately adjusted by our Compensation Committee for the Reverse Stock Split ratio, such that fewer shares will be subject to such plans. Further, our Compensation Committee will proportionately adjust the per share exercise price under the Incentive Plan to reflect the Reverse Stock Split.

Accounting Matters

The Reverse Stock Split will not affect the common stock capital account on our balance sheet. However, because the par value of our common stock will remain unchanged at the effective time of the split, the components that make up the common stock capital account will change by offsetting amounts. Depending on the size of the Reverse Stock Split the Board decides to implement, the stated capital component will be reduced proportionately based upon the Reverse Stock Split and the additional paid-in capital component will be increased with the amount by which the stated capital is reduced. Immediately after the Reverse Stock Split, the per share net income or loss and net book value of our common stock will be increased because there will be fewer shares of common stock outstanding. All historic share and per share amounts in our financial statements and related footnotes will be adjusted accordingly for the Reverse Stock Split.

Effect on Par Value

The proposed amendment to our Charter will not affect the par value of our common stock, which will remain at $0.0001 per share.

No Going Private Transaction

Notwithstanding the decrease in the number of outstanding shares following the proposed Reverse Stock Split, the Board does not intend for this transaction to be the first step in a “going private transaction” within the meaning of Rule 13e-3 of the Exchange Act.

No Dissenters’ Appraisal Rights

Under the Delaware General Corporation Law, the Company’s stockholders are not entitled to dissenters’ appraisal rights with respect to the Reverse Stock Split, and the Company will not independently provide stockholders with any such right.

Material United States Federal Income Tax Consequences of the Reverse Stock Split

The following is not intended as tax or legal advice. Each holder should seek advice based on his, her or its particular circumstances from an independent tax advisor.

The following is a summary of certain United States federal income tax consequences of the Reverse Stock Split generally applicable to beneficial holders of shares of our common stock but does not purport to be a complete analysis of all potential tax effects. This summary addresses only such stockholders who hold their pre-reverse stock split shares as capital assets and will hold the post-reverse stock split shares as capital assets. This discussion does not address all United States federal income tax considerations that may be relevant to particular stockholders in light of their individual circumstances or to stockholders that are, insurance companies, dealers in securities, and foreign stockholders. The following summary is based upon the provisions of the Internal Revenue Code of 1986, as amended (the “Code”), applicable Treasury Regulations thereunder, judicial decisions and current administrative rulings, as of the date hereof, all of which are subject to change, possibly on a retroactive basis. Tax consequences under state, local, foreign, and other laws are not addressed herein. Each stockholder should

consult its tax advisor as to the particular facts and circumstances which may be unique to such stockholder and also as to any estate, gift, state, local or foreign tax considerations arising out of the Reverse Stock Split.

This discussion is limited to holders of our common stock that are U.S. Holders. For purposes of this discussion, a “U.S. Holder” is a beneficial owner of our common stock that, for U.S. federal income tax purposes, is or is treated as:

•an individual who is a citizen or resident of the United States;

•a corporation (or other entity taxable as a corporation for U.S. Federal income tax purposes) created or organized under the laws of the United States, any state thereof, or the District of Columbia;

•an estate, the income of which is subject to U.S. federal income tax regardless of its source; or

•a trust if either a court within the United States is able to exercise primary supervision over the administration of such trust and one or more United States persons (within the meaning of Section 7701(a)(30) of the Code) have the authority to control all substantial decisions of such trust, or the trust has a valid election in effect under applicable Treasury Regulations to be treated as a United States person for U.S. federal income tax purposes.

Furthermore, the following discussion does not address any tax consequences of transactions effectuated before, after or at the same time as the Reverse Stock Split, whether or not they are in connection with the Reverse Stock Split.

Exchange Pursuant to Reverse Stock Split

The Reverse Stock Split should constitute a “recapitalization” for U.S. federal income tax purposes. Assuming that such treatment is correct, no gain or loss will be recognized by a stockholder upon such stockholder’s exchange of pre-reverse stock split shares for post-reverse stock split shares pursuant to the Reverse Stock Split, except potentially with respect to any additional fractions of a share of our common stock received as a result of the rounding up of any fractional shares that otherwise would be issued, as discussed below. Subject to the following discussion regarding a stockholder’s receipt of a whole share of our common stock in lieu of a fractional share, the adjusted basis of the new shares of common stock will be the same as the adjusted basis of the common stock exchanged for such new shares. The holding period of the new, post-reverse stock split shares of the common stock resulting from implementation of the reverse stock split will include the stockholder’s respective holding periods for the pre-reverse stock split shares. Treasury Regulations provide detailed rules for allocating the tax basis and holding period of the shares of our common stock surrendered to the shares of our common stock received in a recapitalization pursuant to the Reverse Stock Split. U.S. Holders of shares of our common stock acquired on different dates and at different prices should consult their tax advisors regarding the allocation of the tax basis and holding period of such shares.

As noted above, we will not issue fractional shares in connection with the Reverse Stock Split. Instead, stockholders who would be entitled to receive fractional shares because they hold a number of shares not evenly divisible by the reverse stock split ratio will automatically be entitled to receive an additional fraction of a share of common stock to round up to the next whole share of common stock. The U.S. federal income tax consequences of the receipt of such additional fraction of a share of our common stock are not clear. A stockholder who receives one (1) whole share of our common stock in lieu of a fractional share may recognize income as a deemed distribution or gain in an amount not to exceed the excess of the fair market value of such share over the fair market value of the fractional share to which such stockholder was otherwise entitled. We are not making any representation as to whether the receipt of one (1) whole share in lieu of a fractional share will result in income as a deemed distribution or gain to any stockholder, and stockholders are urged to consult their own tax advisors as to the possible tax consequences of receiving a whole share in lieu of a fractional share in the Reverse Stock Split.

Information Reporting and Backup Withholding

A U.S. Holder of our common stock may be subject to information reporting and backup withholding on cash paid in lieu of fractional shares in connection with the Reverse Stock Split. A U.S. Holder of our common stock will be subject to backup withholding if such holder is not otherwise exempt and such holder does not provide its taxpayer identification number in the manner required or otherwise fails to comply with applicable backup withholding tax rules.

Backup withholding is not an additional tax. Any amounts withheld under the backup withholding rules may be refunded or allowed as a credit against a U.S. Holder’s federal income tax liability, if any, provided the required information is timely furnished to the Internal Revenue Service. U.S. Holders should consult their tax advisors regarding their qualification for an exemption from backup withholding and the procedures for obtaining such an exemption.

Interests of Directors and Executive Officers

Our directors and executive officers have no substantial interests, directly or indirectly, in the matters set forth in this Reverse Stock Split Proposal except to the extent of their ownership of shares of our common stock.

Reservation of Right to Abandon Reverse Stock Split

The Board reserves the right to not file the Certificate of Amendment and to abandon any Reverse Stock Split without further action by our stockholders at any time before the effectiveness of the filing with the Secretary of the State of Delaware of the Certificate of Amendment, even if the authority to effect these amendments is approved by our stockholders at the Annual Meeting. By voting in favor of a Reverse Stock Split, you are expressly also authorizing the Board to delay, not proceed with, and abandon, these proposed amendments if it should so decide, in its sole discretion, that such action is in the best interests of our stockholders.

Vote Required

This proposal requires the affirmative vote of the holders of a majority in voting power of the votes cast. Abstentions and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal.

Recommendation of the Board

The Board unanimously recommends a vote FOR the Reverse Stock Split Proposal.

PROPOSAL 3:

STOCK ISSUANCE PROPOSAL

Background

On November 9, 2023, the Company entered into an Investment Agreement (the “Investment Agreement”) with Searchlight, whereby the Company agreed to issue and sell to Searchlight (i) shares of Series A-1 Preferred Stock of the Company, par value of $0.0001 per share (the “Series A-1 Preferred Stock”), at a price per share of $1,000, and (ii) a warrant (the “Original Warrant”) to purchase shares of common stock, with an exercise price of $0.01 per share (as may be adjusted in accordance with the Original Warrant) in a private placement (collectively, the “Financing”) for an aggregate purchase price of $150 million. The First Financing closed on November 15, 2023 (the “First Closing”), and the Company issued to Searchlight an aggregate of 150,000 shares of the Series A-1 Preferred Stock and an Original Warrant to purchase up to an aggregate of 11,800,000 shares of common stock (as may be adjusted in accordance with the Original Warrant).

In addition, on the terms and subject to the conditions set forth in the Investment Agreement, from and after the First Closing until the date that is six months following the First Closing, the Company had the option, exercisable once during such period, to issue and sell to Searchlight for an aggregate purchase price of up to $20 million, additional shares of Series A-1 Preferred Stock and additional warrants to purchase shares of common stock. On December 13, 2023 (the “Second Closing” and, together with the First Closing, the “Closings”), the Company issued and sold to Searchlight (i) an additional 2,857 shares of Series A-1 Preferred Stock, at a price per share of $1,000, and (ii) a warrant (the “Additional Warrant”) to purchase an additional 224,711 shares of common stock, with an exercise price of $0.01 per share (as may be adjusted in accordance with the Additional Warrant) in a private placement for an aggregate purchase price of approximately $2.9 million.

At the Second Closing, the Company (i) amended the form of warrant in the Investment Agreement (the “Amendment”) and (ii) amended and restated the Original Warrant (the “Amended and Restated Original Warrant” and together with the Additional Warrant, the “Warrants”), dated as of November 15, 2023, by and among the Company and Searchlight, in each case, to prohibit the issuance by the Company of shares of common stock upon the exercise of the each of the Warrants (together, the “Exercise Shares”) in an amount that would exceed 19.9% of the total outstanding shares of common stock or more than 19.9% of the total voting power of the Company’s securities, in each case, immediately preceding November 9, 2023, unless the Company has obtained the approval of its stockholders (the “Stockholder Approval”) as required by the applicable rules of the NYSE for issuances of shares of common stock in excess of such amount. The purpose of this Stock Issuance Proposal is to seek the requisite approval for the issuance of the Exercise Shares under Section 312.03 of the NYSE Listed Company Manual.

In addition, the Company entered into a voting agreement (the “Stock Issuance Proposal Voting Agreement”) with the ABRY Entities, pursuant to which the ABRY Entities have agreed to vote their shares of common stock in favor of any Company proposals to stockholders to obtain the Stockholder Approval.

The numerical and price information included in this Stock Issuance Proposal do not give effect to the potential actions contemplated by the Reverse Stock Split Proposal.

Terms of the Warrants

The Company issued the Amended and Restated Warrant to Searchlight to purchase up to an aggregate of 11,800,000 shares of common stock. Subject to the terms and conditions of the Warrants, the Amended and Restated Warrant can be exercised at any time and from time to time after November 15, 2023 and on or prior to the close of business on November 15, 2033 (the “Warrant Expiration Date”).

The Company issued the Additional Warrant to Searchlight to purchase up to an aggregate of 224,711 shares of common stock. Subject to the terms and conditions of the Additional Warrant, the Additional Warrant can be exercised at any time and from time to time after December 13, 2023 and on or prior to the close of business on the Warrant Expiration Date. The Warrants are exercisable at either $0.01 per share of common stock or by using a formula for cashless exercise.

The terms of the Amended and Restated Original Warrant and the terms of the Additional Warrant are more fully described, respectively, in the Amended and Restated Original Warrant and the Additional Warrant, copies of which are included as Exhibits 4.5 and 4.4, respectively, to our Annual Report on Form 10-K filed with the SEC on April 15, 2024.

Reason for Request for Stockholder Approval

The Company’s common stock is listed on the NYSE and, as a result, the Company is subject to the rules and regulations of the NYSE. Section 312.03 of the NYSE Listed Company Manual requires an issuer to obtain stockholder approval prior to the issuance of common stock in any transaction or series of related transactions, if, among other things: (i) the common stock has, or will have upon issuance, voting power equal to or in excess of 20% of the voting power outstanding before the issuance of such stock; or (ii) the number of shares of common stock to be issued is, or will be upon issuance, equal to or in excess of 20% of the number of shares of common stock outstanding before the issuance of common stock. The issuance of the Exercise Shares could result in the aggregate shares of common stock being issued in the Closings exceeding 20% of the voting power on the Company’s common stock immediately preceding November 9, 2023.

The Exercise Shares will have the same rights and privileges as the shares of common stock currently authorized and outstanding. Holders of common stock are not entitled to preemptive rights to purchase common stock or other securities or to cumulative voting rights in relation to the potential issuance of the Exercise Shares.

The Board believes that authorizing the issuance of the Exercise Shares is fair to and in the best interests of the Company and the Company’s stockholders.

Effect of Vote in Favor of this Stock Issuance Proposal

A vote in favor of this Stock Issuance Proposal is a vote in favor of approving, for purposes of the rules of the NYSE, the issuance of the Exercise Shares, which could exceed 19.99% of the voting power of the Company’s common stock before the entrance into the Investment Agreement, as amended by the Amendment (the “Amended Investment Agreement”).

Approval of this Stock Issuance Proposal will not affect the rights or privileges of current holders of outstanding shares of common stock but such issuance will have a dilutive effect on the existing stockholders, including the voting power and economic rights of the existing stockholders. If this Stock Issuance Proposal is approved, Searchlight will have the ability to acquire up to 12,024,711 shares of common stock by exercising its Warrants (without giving effect to any approval of the Reverse Stock Split Proposal by the Company’s stockholders or any Reverse Stock Split). If this Stock Issuance Proposal is approved and assuming all of the Warrants issued in November 2023 and December 2023 are exercised solely for cash, Searchlight would hold, as of the Record Date, 14.5% of the voting power of our Company.

Interests of Certain Persons

When you consider the Board’s recommendation in favor of this Stock Issuance Proposal, you should be aware the Company’s directors and some stockholders may have interests that may be different from, or in addition to, the interests of other stockholders. In particular, Searchlight is an existing stockholder of the Company and holds (i) 152,857 shares of Series A-1 Preferred Stock and (ii) Warrants to purchase 12,024,711 shares of common stock. In addition, pursuant to the Amended and Restated Investor Rights Agreement, Searchlight may designate up to two (2) individuals to the Board. Pursuant to this, the Board appointed Andrew Frey to serve as a Class I director of the Company until the 2025 Annual Meeting of Stockholders and David Fuller to serve as a Class II director of the Company until the 2026 Annual Meeting of Stockholders.

Also, as described above, under the Stock Issuance Proposal Voting Agreement, the ABRY Entities have agreed to vote their shares of common stock in favor of any Company proposals to stockholders to obtain the Stockholder Approval. As of the Record Date, the ABRY Entities held 24,252,912 shares of common stock, which constitutes approximately 29.2% of the Company’s outstanding common stock. As discussed above, if this Stock Issuance Proposal is approved and Searchlight exercises the Warrants in full solely for cash, Searchlight would hold, as of the Record Date, approximately 14.5% of the Company’s outstanding common stock.

The Company has the following agreements and arrangements with Searchlight and the ABRY Entities:

Amended and Restated Investor Rights Agreement

On November 15, 2023, the Company entered into the Amended and Restated Investor Rights Agreement, pursuant to which the Company agreed to take all necessary actions to cause the Board to be comprised of up to ten (10) directors, including: (i) up to two (2) individuals designated by the ABRY Entities; (ii) up to two (2) individuals designated by the Sponsor; (iii) up to two (2) individuals designated by Searchlight; (iv) the Chief Executive Officer; and (v) up to three (3) independent directors recommended by the Company’s Nominating and Corporate Governance Committee.

Pursuant to the Amended and Restated Investor Rights Agreement, the directors are divided into three (3) classes of directors, with each class serving for staggered three (3)-year terms. Subject in each case to the terms and conditions of the Amended and Restated Investor Rights Agreement, (i) the Class I directors shall include two (2) independent directors nominated by the Nominating and Corporate Governance Committee, one (1) director designated by Searchlight, and one (1) director designated by the Sponsor; (ii) the Class II directors shall include one (1) independent director nominated by the Nominating and Corporate Governance Committee, one (1) director designated by Searchlight, and one (1) director designated by the Sponsor; and (iii) the Class III directors shall include the Chief Executive Officer, and two (2) directors designated by the ABRY Entities. The chairperson of the Board is selected by a majority of the Board.

Searchlight has designated, and the Board has appointed, Andrew Frey to serve as a Class I director of the Company until the 2025 Annual Meeting of Stockholders and David Fuller to serve as a Class II director of the Company until the 2026 Annual Meeting of Stockholders. The ABRY Entities have designated, and the Board has appointed, Robert P. MacInnis and Jay M. Grossman to serve as Class III directors of the Company until the 2024 Annual Meeting of Stockholders. Mr. MacInnis and Mr. Grossman are currently standing for re-election.

Stock Issuance Proposal Voting Agreement

As discussed above, we entered into the Stock Issuance Proposal Voting Agreement with the ABRY Entities.

Effect of Not Obtaining Required Vote for Approval of this Stock Issuance Proposal

If the Company is unable to obtain approval of this Stock Issuance Proposal, it will not be able to issue the Exercise Shares to Searchlight and the Warrants would remain outstanding subject to the terms and conditions of the Warrants. The Warrants have an expiration date of November 15, 2033. If the Warrants remain outstanding, pursuant to the terms and conditions of the Warrants, the Company will be required to use reasonable best efforts to obtain stockholder approval for the issuance of the Exercise Shares at the Annual Meeting of Stockholders to be held in 2025 and each subsequent Annual Meeting of Stockholders thereafter.

Vote Required

This proposal requires the affirmative vote of the holders of a majority in voting power of the votes cast. Abstentions and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal.

Recommendation of the Board

The Board unanimously recommends a vote FOR the Stock Issuance Proposal.

PROPOSAL 4:

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our Audit Committee has appointed BDO USA, P.C. as our independent registered public accounting firm for the fiscal year ending December 31, 2024. Our Board has directed that this appointment be submitted to our stockholders for ratification at the Annual Meeting. Although ratification of our appointment of BDO USA, P.C. is not required, we value the opinions of our stockholders and believe that stockholder ratification of our appointment is a good corporate governance practice.

BDO USA, P.C. also served as our independent registered public accounting firm for the fiscal years ended December 31, 2022 and December 31, 2023. Neither the accounting firm nor any of its members has any direct or indirect financial interest in or any connection with us in any capacity other than as our auditors, providing audit and non-audit related services. A representative of BDO USA, P.C. is expected to attend the Annual Meeting and to have an opportunity to make a statement and be available to respond to appropriate questions from stockholders.

In the event that the appointment of BDO USA, P.C. is not ratified by the stockholders, the Audit Committee will consider this fact when it appoints the independent auditors for the fiscal year ending December 31, 2024. Even if the appointment of BDO USA, P.C. is ratified, the Audit Committee retains the discretion to appoint a different independent auditor at any time if it determines that such a change is in the interest of the Company.

Vote Required

This proposal requires the affirmative vote of the holders of a majority in voting power of the votes cast. Abstentions are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal. Because brokers have discretionary authority to vote on the ratification of the appointment of BDO USA, P.C., we do not expect any broker non-votes in connection with this proposal.

Recommendation of the Board

The Board unanimously recommends a vote FOR the Ratification of the Appointment of BDO USA, P.C. as our Independent Registered Public Accounting Firm for the fiscal year ending December 31, 2024.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD