We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Name | Symbol | Market | Type |

|---|---|---|---|

| HCI Group Inc (PK) | USOTC:HCIIP | OTCMarkets | Preference Share |

| Price Change | % Change | Price | Bid Price | Offer Price | High Price | Low Price | Open Price | Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0.00 | 0.00% | 10.10 | 9.00 | 0.00 | 22:00:01 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported):

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|||

(State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification Number) |

|

||||

(Address of Principal Executive Offices) |

||||

Registrant’s telephone number, including area code:

(

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrants under any of the following provisions (see General Instruction A.2. below):

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

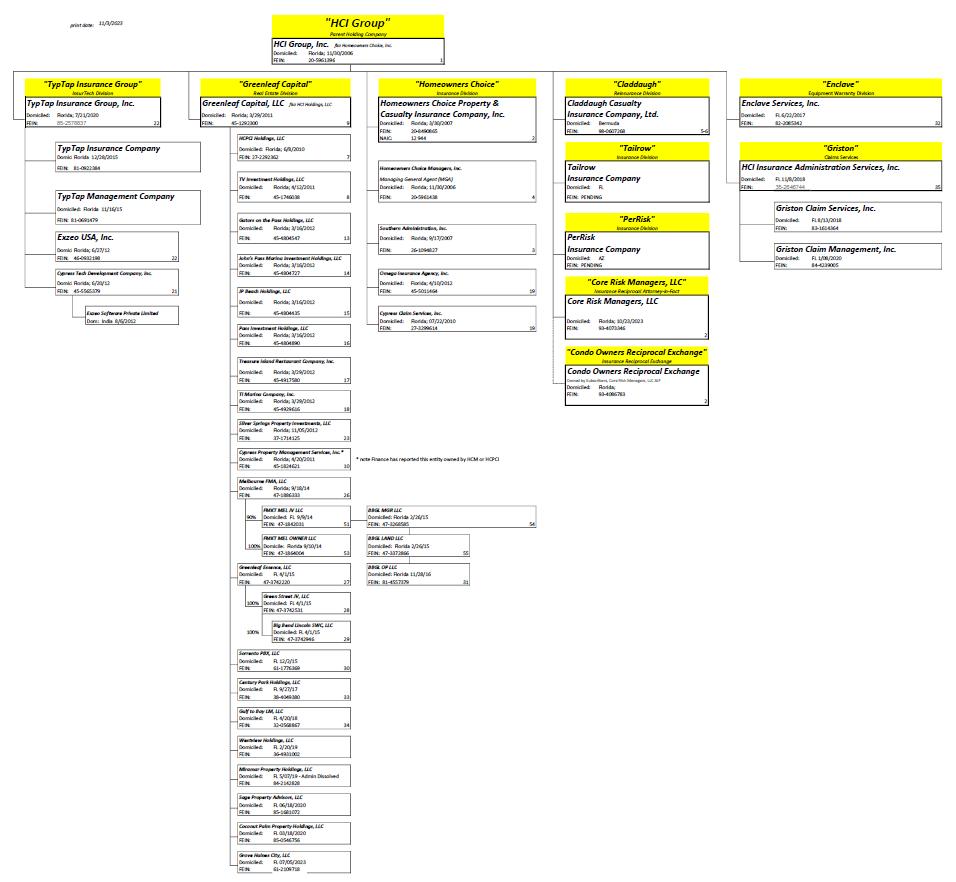

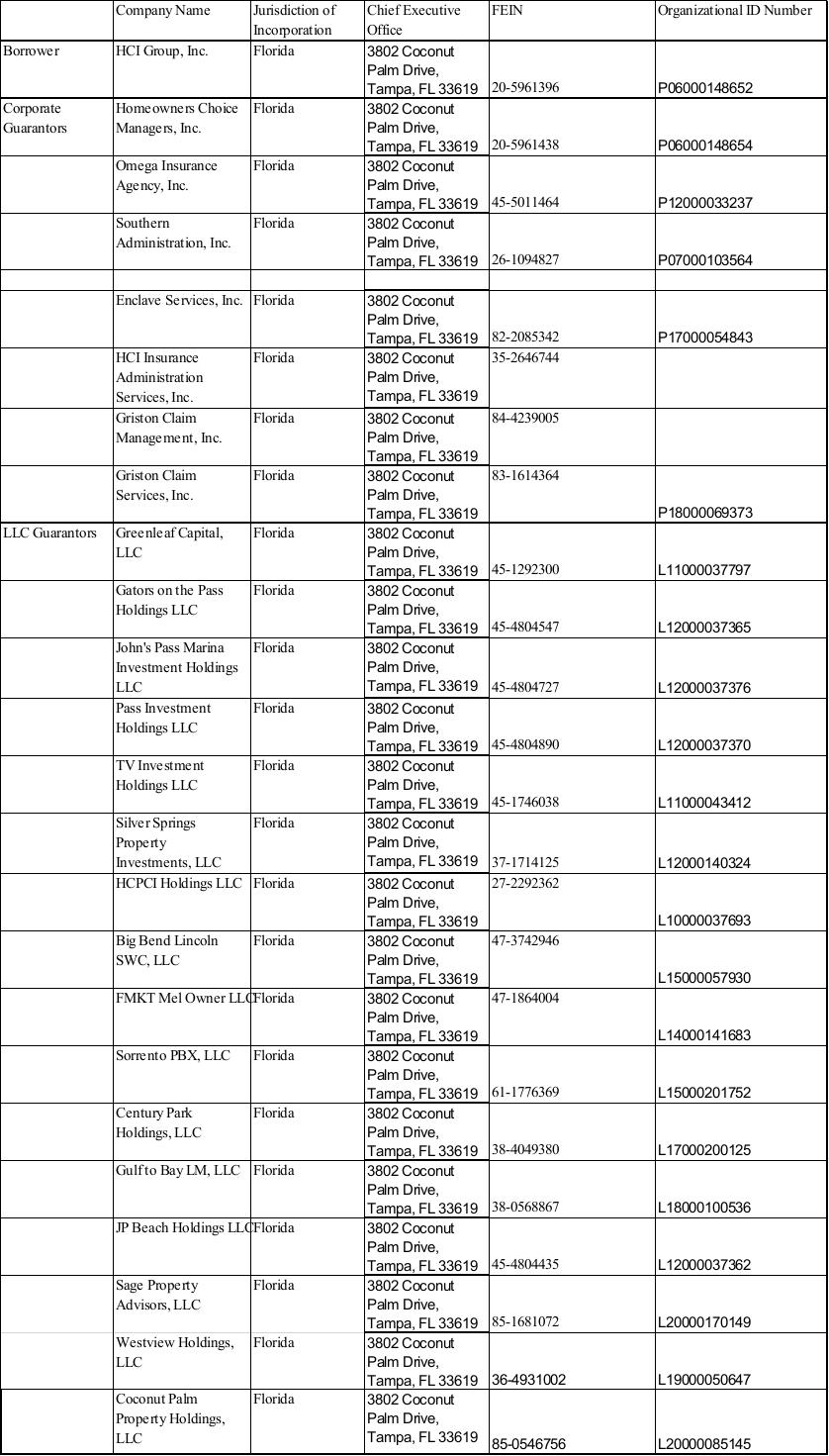

On November 3, 2023, we executed a Second Amended and Restated Credit Agreement to extend the term of our revolving credit facility from Fifth Third Bank until November 3, 2028. Under the terms of the amendment, the maximum Debt to Capital Ratio as defined in the Credit Agreement is 67.5%. The maximum balance of the line of credit is increased to $75,000,000 and the borrowing rate is based partially on the one or three month Secured Overnight Finance Rate (known as SOFR) plus a 10 basis points adjustment.

The summary of the foregoing transaction is qualified in its entirety by reference to the Second Amended and Restated Credit Agreement and other amended documents, which are filed as Exhibits 99.1 through 99.3 to this Form 8-K and are incorporated herein by reference.

Item 2.03. Creation of a Direct Financial Obligation or an Off-Balance Sheet Arrangement of a Registrant.

See Item 1.01 above.

Item 9.01. Exhibits.

Exhibit 99.1 Second Amended and Restated Credit Agreement

Exhibit 99.2 Second Amended and Restated Security and Pledge Agreement

Exhibit 99.3 Renewed, Amended and Restated Revolving Credit Promissory Note

Exhibit 104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

HCI GROUP, INC. |

||

|

|

|

|

|||

Date: November 9, 2023 |

|

|

|

By: |

|

/s/ James Mark Harmsworth |

|

|

|

|

Name: |

|

James Mark Harmsworth |

|

|

|

|

Title: |

|

Chief Financial Officer |

Exhibit 99.1

SECOND AMENDED AND RESTATED CREDIT AGREEMENT

THIS SECOND AMENDED AND RESTATED CREDIT AGREEMENT (this "Agreement") is made and entered into as of this 3rd day of November, 2023, by and among Borrower (defined herein), Guarantors (defined herein) and Lender (defined herein).

W I T N E S S E T H:

WHEREAS, Lender made available to Borrower a revolving line of credit loan (the "Loan") pursuant to that certain Amended and Restated Credit Agreement dated June 2, 2023 (the "Prior Credit Agreement"). This Agreement amends and restates the Prior Credit Agreement in its entirety;

NOW, THEREFORE, in consideration of the premises and the mutual covenants herein contained, Borrower, Guarantors and Lender agree as follows:

"Accounts" shall mean "accounts", as defined in Article 9 of the UCC.

"Acquisition" shall mean (a) any Investment by Borrower or any of its Subsidiaries in any other Person pursuant to which such Person shall become a Subsidiary or shall be merged with Borrower or any of its Subsidiaries or (b) any acquisition by Borrower or any of its Subsidiaries of the assets of any Person (other than a Subsidiary) that constitute all or a substantial portion of the assets of such Person or a division or business unit of such Person.

"Advance" means a disbursement of the proceeds of the Revolving Loan.

"Advance Rates" shall have the meaning set forth in the Letter Agreement.

"Affiliate" shall mean, as to any Person, any other Person that directly, or indirectly through one or more intermediaries, Controls, is Controlled by, or is under common Control with, such Person.

"Agreement" shall have the meaning set forth in the introductory paragraph hereto.

"Anti-Corruption Laws" shall mean all laws, rules, and regulations of any jurisdiction applicable to Borrower or its Subsidiaries from time to time concerning or relating to bribery or corruption.

"Applicable Margin" shall have the meaning set forth in the Letter Agreement.

"Asset Sale" shall mean the sale, transfer, license, lease or other disposition of any property by Borrower or any Subsidiary, including any sale and leaseback transaction and any sale, assignment, transfer or other disposal, with or without recourse, of any notes or accounts receivable or any rights and claims associated therewith, but excluding (a) the sale of inventory in the ordinary course of business; (b) the sale or disposition for fair market value of obsolete or worn out property or other property not necessary for operations of Borrower and its Subsidiaries disposed of in the ordinary course of business; (c) the disposition of property (including the cancellation of Indebtedness permitted by Section 7.1 to Borrower or

DOCVARIABLE BABC_DocID4891-7708-7367.4

any Subsidiary; provided, that if the transferor of such property is a Loan Party then the transferee thereof must be a Loan Party; (d) the disposition of accounts receivable in connection with the collection or compromise thereof; (e) licenses, sublicenses, leases or subleases granted to others in the ordinary course of business or not interfering in any material respect with the business of Borrower or any Subsidiary; and (f) the sale or disposition of Cash Equivalents for fair market value in the ordinary course of business.

"Assignment of Rents" shall mean any Assignment of Leases and Rents that purports to grant to Lender a security interest in the leases and rents of any Loan Party related to any Real Property.

"Authorized Control Level Risk Based Capital Ratio" shall mean the ratio of (x) Total Adjusted Capital to (y) Authorized Control Level Risk Based Capital, in each case as set forth for such fiscal year under the section titled "Five Year Historical Data" in HCPCIC's statutory financial statements for such fiscal year and TypTap's statutory financial statements for such fiscal year, as applicable.

"Availability Period" shall mean the period from the Effective Date to but excluding the Revolving Commitment Termination Date.

"Bank Product" means any of the following products, services or facilities extended to any Loan Party from time to time by Lender or any of Affiliate of Lender or any Person who was Lender or an Affiliate of Lender at the time it provided such products, services or facilities: (a) any services in connection with operating, collections, payroll, trust, or other depository or disbursement accounts, including automated clearinghouse, e-payable, electronic funds transfer, wire transfer, controlled disbursement, overdraft, depository, information reporting, lockbox services, stop payment services, and other treasury management services; (b) commercial credit card and merchant card services; and (c) other banking products or services as may be requested by any Loan Party, other than Letters of Credit and Rate Contracts.

"Base Rate" means a variable per annum rate, as of any date of determination, equal to the Prime Rate. The Base Rate is a reference rate and does not necessarily represent the lowest or best rate actually charged to any customer. Lender may make commercial loans or other loans at rates of interest at, above or below the Base Rate. Any change in the Base Rate shall be effective for purposes of this Agreement on the date of such change without notice to Borrower.

"Base Rate Loans" means Advances that accrue interest by reference to the Base Rate, in accordance with the terms of this Agreement.

"Borrower" shall mean HCI Group, Inc., a Florida corporation.

"Borrowing Base" means, as of the relevant date of determination, the sum of the Advance Rates for all Eligible Collateral, as reasonably determined by Lender; provided, however, that the aggregate amount arising from Securities Account Collateral shall be limited to $15,000,000.00.

"Borrowing Base Certificate" shall mean a company prepared Borrowing Base certificate in a form acceptable to Lender, which shall include (a) with respect to security collateral, the eligible collateral type, name, CUSIP, current value (face and market) and the eligible value (lower of face and market) and (b) with respect to real estate, the asset name, address, book value, appraised value, debt service coverage, profit and loss before taxes, funds from operations, net operating income, net operating income budget, OCC and cap rate.

"Business Day" means (a) with respect to all notices and determinations, including Interest Payment Dates, in connection with the Tranche Rate, any day that commercial banks in New York, New York are required by law to be open for business and that is a U.S. Government Securities Business Day, which

2

DOCVARIABLE BABC_DocID4891-7708-7367.4

means any day other than a Saturday, Sunday, or day on which the Securities Industry and Financial Markets Association recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in United States government securities and (b) in all other cases, any day on which commercial banks in New York, NY or Cincinnati, Ohio are required by Law to be open for business; provided that, notwithstanding anything to the contrary in this definition of "Business Day", at any time during which a Rate Contract with Lender is then in effect with respect to all or a portion of the Obligations, then the definitions of "Business Day" and "Banking Day", as applicable, pursuant to such Rate Contract shall govern with respect to all applicable notices and determinations in connection with such portion of the Obligations arising under such Rate Contract. Periods of days referred to in the Loan Documents will be counted in calendar days unless Business Days are expressly prescribed.

"Capital" shall mean all interest-bearing Indebtedness plus Shareholders' Equity.

"Capital Expenditures" shall mean for any period, without duplication, (a) the additions to property, plant and equipment and other capital expenditures of Borrower and its Subsidiaries that are (or would be) set forth on a consolidated statement of cash flows of Borrower for such period and (b) Capital Lease Obligations incurred by Borrower and its Subsidiaries during such period.

"Capital Lease Obligations" of any Person shall mean all obligations of such Person to pay rent or other amounts under any lease (or other arrangement conveying the right to use) of real or personal property, or a combination thereof, which obligations are required to be classified and accounted for as capital leases on a balance sheet of such Person, and the amount of such obligations shall be the capitalized amount thereof.

"Capital Stock" shall mean all shares, options, warrants, general or limited partnership interests, membership interests or other equivalents (regardless of how designated) of or in a corporation, partnership, limited liability company or equivalent entity whether voting or nonvoting, including common stock, preferred stock or any other "equity security" (as such term is defined in Rule 3a11‑1 of the General Rules and Regulations promulgated by the SEC under the Securities Exchange Act of 1934).

"Cash Equivalents" shall mean:

3

DOCVARIABLE BABC_DocID4891-7708-7367.4

"Centerbridge Advance Cap" means Revolving Loan proceeds in an amount not to exceed $50,000,000.00 in the aggregate, which may be used to refinance the Centerbridge Debt.

"Centerbridge Debt" means the $100,000,000.00 capital investment transaction dated February 26, 2021 with Centerbridge Partners, L.P.

"Centerbridge Permitted Refinancing Indebtedness" means unsecured Indebtedness of Borrower or its Subsidiaries incurred from and after the Effective Date in an aggregate amount not to exceed $100,000,000.00 for the sole purpose of refinancing the Centerbridge Debt; provided, however, that if the existing Centerbridge Debt is partially refinanced, the Centerbridge Permitted Refinancing Indebtedness will be capped at the remaining amount of the Centerbridge Indebtedness or $20,000,000.00, whichever is higher.

"Centerbridge Proceeds" means the amount of the Revolving Loan, if any, utilized by Borrower to refinance the Centerbridge Debt, which shall not exceed the amount of the Centerbridge Advance Cap.

"Change in Law" means the occurrence, after the date of this Agreement, of any of the following: (a) the adoption or taking effect of any law, rule, regulation or treaty, (b) any change in any law, rule, regulation or treaty or in the administration, interpretation, implementation or application thereof by any Governmental Authority or (c) the making or issuance of any request, rule, guideline or directive (whether or not having the force of law) by any Governmental Authority; provided that notwithstanding anything herein to the contrary, (x) the Dodd-Frank Wall Street Reform and Consumer Protection Act and all requests, rules, guidelines or directives thereunder or issued in connection therewith and (y) all requests, rules, guidelines or directives promulgated by the Bank for International Settlements, the Basel Committee on Banking Supervision (or any successor or similar authority) or the United States or foreign regulatory authorities, in each case pursuant to Basel III, shall in each case be deemed to be a "Change in Law", regardless of the date enacted, adopted or issued.

"Charles Schwab Accounts" means the Securities Account (as defined in the Charles Schwab Account Security Agreement).

"Charles Schwab Account Security Agreement" means that certain Amended and Restated Security Agreement: Securities Account dated on or about the date hereof by and between Borrower and Lender.

"Code" shall mean the Internal Revenue Code of 1986, as amended and in effect from time to time.

"Collateral" shall mean a collective reference to all real and personal property with respect to which Liens in favor of Lender are granted pursuant to and in accordance with the terms of the Collateral Documents.

"Collateral Documents" shall mean a collective reference to the Security Agreement, any Mortgage, any Assignment of Rents, each deposit account control agreement or securities account control agreement in a form acceptable to Lender and any other security documents executed and delivered by any Loan Party pursuant to this Agreement.

"Commodity Exchange Act" shall mean the Commodity Exchange Act (7 U.S.C. § 1 et seq.), as amended from time to time, and any successor statute.

4

DOCVARIABLE BABC_DocID4891-7708-7367.4

"Compliance Certificate" shall mean a certificate from the principal executive officer or the principal financial officer of Borrower in a form acceptable to Lender.

"Conforming Changes" means, with respect to the use, administration of, or any conventions associated with the Tranche Rate or any proposed Successor Rate, as applicable, any changes to the terms of this Agreement related to the timing, frequency, and methodology of determining rates and making payments of interest, including changes to the definition of Business Day, lookback periods or observation shift, prepayments, and borrowing, conversion, or continuation notices, and other technical, administrative, or operational matters, as may be appropriate, in the discretion of Lender, to reflect the adoption and implementation of such applicable rate and to permit the administration thereof by Lender in an operationally feasible manner and, to the extent feasible, consistent with market practice.

"Consolidated Assumed Management Fees" shall mean the management fees due under any Management Agreement.

"Contractual Obligation" of any Person shall mean any provision of any security issued by such Person or of any agreement, instrument or undertaking under which such Person is obligated or by which it or any of the property in which it has an interest is bound.

"Control" shall mean the power, directly or indirectly, either to (a) vote five percent (5%) or more of the securities having ordinary voting power for the election of directors (or persons performing similar functions) of a Person or (b) direct or cause the direction of the management and policies of a Person, whether through the ability to exercise voting power, by control or otherwise. The terms "Controlling", "Controlled by", and "under common Control with" have the meanings correlative thereto.

"Daily Simple SOFR" means a rate based on SOFR with interest accruing on a simple daily basis in arrears with a methodology and conventions selected by Lender.

"Debt-To-Capital Ratio" shall mean total Indebtedness divided by total Capital.

"Debtor Relief Laws" shall mean the Bankruptcy Code of the United States of America, and all other liquidation, conservatorship, bankruptcy, assignment for the benefit of creditors, moratorium, rearrangement, receivership, insolvency, reorganization, or similar debtor relief Laws of the United States or other applicable jurisdictions from time to time in effect.

"Default" shall mean any condition or event that, with the giving of notice or the lapse of time or both, would constitute an Event of Default.

"Default Rate" shall have the meaning given such term in Section 2.5(c).

"Disqualified Capital Stock" shall mean Capital Stock that by its terms (or by the terms of any security into which they are convertible or for which they are exchangeable) (a) require the payment of any cash dividends (other than dividends payable solely in shares of Qualified Capital Stock or, in the case of any pass through entity, in respect of taxes), (b) mature or are mandatorily redeemable or subject to mandatory repurchase or redemption or repurchase at the option of the holders thereof, in whole or in part and whether upon the occurrence of any event, pursuant to a sinking fund obligation, on a fixed date or otherwise, prior to the date that is ninety-one (91) days after the Revolving Commitment Termination Date or (c) are convertible or exchangeable, automatically or at the option of any holder thereof, into any Indebtedness other than Indebtedness otherwise permitted under Section 7.1.

"Dollar(s)" and the sign "$" shall mean lawful money of the United States of America.

5

DOCVARIABLE BABC_DocID4891-7708-7367.4

"EBITDA" shall mean, on a consolidated basis, the amount of Borrower's earnings before interest, taxes, depreciation and amortization expense for the measurement period.

"Effective Date" shall mean the date hereof.

"Eligible Collateral" means Collateral reviewed and approved by Lender and meeting Lender's requirements under this Agreement. Eligible Collateral may include (i) securities issued by the U.S. Treasury and U.S. Government Agencies, (ii) corporate bonds, (iii) state, municipal and political sub, (iv) equity securities, (v) Unencumbered Real Estate, (vi) Encumbered Real Estate, and (vii) Unimproved Raw Land. To be included in Eligible Collateral, (a) security collateral shall be restricted to publicly listed security instruments trading on a major exchange with a valid CUSIP, (b) Borrower shall have delivered Encumbered Real Property Security Documents with respect to any Encumbered Real Property, and (c) Borrower shall have delivered Real Property Security Documents with respect to any Unencumbered Real Property.

"Eligible Swap Counterparty" means Lender and any Affiliate of Lender that at any time it occupies such role or capacity (whether or not it remains in such capacity) enters into a Rate Contract permitted hereunder with Borrower or any Subsidiary of Borrower.

"Encumbered Real Estate" means any fee or leasehold interest of Borrower or a Subsidiary of Borrower in real property that is encumbered by a Lien in favor of a Party other than Lender.

"Encumbered Real Property Security Documents" shall mean:

(a) a fully executed and notarized Non-Taxable Agreement Not to Encumber encumbering the fee or leasehold interest of such Loan Party in such real property;

(b) if requested by Lender in its reasonable discretion, a current ALTA survey and a surveyor's certificate, in form and substance satisfactory to Lender, certified to Lender and to the title company that issues the title report required in subsection (c) hereof with respect thereto by a licensed professional surveyor reasonably satisfactory to Lender;

(c) an Ownership and Encumbrances Report or other title search acceptable to Lender;

(d) "life of loan" flood determination certificates evidencing (i) whether such real property is in an area designated by the Federal Emergency Management Agency as having special flood or mud slide hazards (a "Flood Hazard Property") and (ii) if such real property is a Flood Hazard Property, (A) whether the community in which such real property is located is participating in the National Flood Insurance Program, (B) the applicable Loan Party's written acknowledgment of receipt of written notification from Lender (1) as to the fact that such real property is a Flood Hazard Property and (2) as to whether the community in which each such Flood Hazard Property is located is participating in the National Flood Insurance Program and (C) copies of flood insurance policies under the National Flood Insurance Program (or private insurance endorsed to cause such private insurance to be fully compliant with the federal law as regards private placement insurance applicable to the National Flood Insurance Program, with financially sound and reputable insurance companies not Affiliates of Borrower) or certificates of insurance of Borrower and its Subsidiaries evidencing such flood insurance coverage in such amounts and with such deductibles as Lender may request and naming Lender and its successors and/or assigns as sole loss payee;

(e) if requested by Lender, (i) environmental questionnaires or (ii) Phase I Environmental Site Assessment Reports, consistent with American Society of Testing and Materials (ASTM)

6

DOCVARIABLE BABC_DocID4891-7708-7367.4

Standard E 1527-05, and applicable state requirements, on all of the owned real property, dated no more than six (6) months prior to the Effective Date (or date of the applicable Mortgage if provided post-closing), prepared by environmental engineers satisfactory to Lender, all in form and substance satisfactory to Lender, and such environmental review and audit reports, including Phase II reports, with respect to the real property of any Loan Party as Lender shall have requested, in each case together with letters executed by the environmental firms preparing such environmental reports, in form and substance satisfactory to Lender, authorizing Lender to rely on such reports, and Lender shall be satisfied with the contents of all such environmental questionnaires or reports;

"Environmental Indemnity" shall mean each environmental indemnity made by a Loan Party with respect to real property required to be pledged as Collateral in favor of Lender, in each case in form and substance satisfactory to Lender.

"Environmental Laws" shall mean all laws, rules, regulations, codes, ordinances, orders, decrees, judgments, injunctions, notices or binding agreements issued, promulgated or entered into by or with any Governmental Authority, relating in any way to the environment, preservation or reclamation of natural resources, the management, Release or threatened Release of any Hazardous Material or to health and safety matters.

"Environmental Liability" shall mean any liability, contingent or otherwise (including any liability for damages, costs of environmental investigation and remediation, costs of administrative oversight, fines, natural resource damages, penalties or indemnities), of Borrower or any Subsidiary directly or indirectly resulting from or based upon (a) any actual or alleged violation of any Environmental Law, (b) the generation, use, handling, transportation, storage, treatment or disposal of any Hazardous Materials, (c) any actual or alleged exposure to any Hazardous Materials, (d) the Release or threatened Release of any Hazardous Materials or (e) any contract, agreement or other consensual arrangement pursuant to which liability is assumed or imposed with respect to any of the foregoing.

"ERISA" shall mean the Employee Retirement Income Security Act of 1974, as amended from time to time, and any successor statute.

"Event of Default" shall have the meaning set forth in Article VIII.

"Excluded Swap Obligation" means any Swap Obligation that arises from any guaranty or collateral pledge with respect to the Obligations that becomes impermissible under the Commodity Exchange Act or any rule, regulation or order of the Commodity Futures Trading Commission (or the application or official interpretation of any thereof) by virtue of such Guarantor's failure for any reason to constitute an "eligible contract participant" as defined in the Commodity Exchange Act at the time a Guaranty Agreement becomes effective with respect to such related Swap Obligation or, as to Borrower, as of the date of the Security Agreement.

7

DOCVARIABLE BABC_DocID4891-7708-7367.4

"Fees" means any and all fees payable to Lender pursuant to this Agreement or any of the other Loan Documents.

"Fifth Third" means Fifth Third Bank, National Association.

"Fifth Third Lease Obligations" means any and all liabilities, obligations and other Indebtedness of any Loan Party owed to Fifth Third, Fifth Third Equipment Finance Company, or any other Affiliate of Fifth Third Bancorp of every kind and description, whether now existing or hereafter arising, including those owed by any Loan Party to others and acquired by Fifth Third or any Affiliate of Fifth Third Bancorp, by purchase, assignment or otherwise, whether direct or indirect, primary or as guarantor or surety, absolute or contingent, liquidated or unliquidated, matured or unmatured, related or unrelated, and howsoever and whensoever (whether now or hereafter) created, arising, evidenced or acquired (including all renewals, extensions and modifications thereof and substitutions therefor), in each case arising out of, pursuant to, in connection with or under any lease or other transfer of the right to possession and use of goods for a term in return for consideration.

"Fiscal Quarter" shall mean any fiscal quarter of Borrower.

"Fiscal Year" shall mean any fiscal year of Borrower.

"GAAP" shall mean generally accepted accounting principles in the United States applied on a consistent basis and subject to the terms of Section 1.2.

"Governmental Authority" shall mean the government of the United States of America, any other nation or any political subdivision thereof, whether state or local, and any agency, authority, instrumentality, regulatory body, court, central bank or other entity exercising executive, legislative, judicial, taxing, regulatory or administrative powers or functions of or pertaining to government.

"Guarantee" of or by any Person (the "guarantor") shall mean any obligation, contingent or otherwise, of the guarantor guaranteeing or having the economic effect of guaranteeing any Indebtedness or other obligation of any other Person (the "primary obligor") in any manner, whether directly or indirectly and including any obligation, direct or indirect, of the guarantor (a) to purchase or pay (or advance or supply funds for the purchase or payment of) such Indebtedness or other obligation or to purchase (or to advance or supply funds for the purchase of) any security for the payment thereof, (b) to purchase or lease property, securities or services for the purpose of assuring the owner of such Indebtedness or other obligation of the payment thereof, (c) to maintain working capital, equity capital or any other financial statement condition or liquidity of the primary obligor so as to enable the primary obligor to pay such Indebtedness or other obligation, or (d) as an account party in respect of any letter of credit or letter of guaranty issued in support of such Indebtedness or obligation; provided, that the term "Guarantee" shall not include endorsements for collection or deposit in the ordinary course of business. The amount of any Guarantee shall be deemed to be an amount equal to the stated or determinable amount of the primary obligation in respect of which Guarantee is made or, if not so stated or determinable, the maximum reasonably anticipated liability in respect thereof (assuming such Person is required to perform thereunder) as determined by such Person in good faith. The term "Guarantee" used as a verb has a corresponding meaning.

"Guarantor Joinder Agreement" shall mean a joinder agreement in a form acceptable to Lender executed and delivered by a Subsidiary in accordance with the provisions of Section 5.10.

"Guarantors" shall mean, collectively, (a) each Subsidiary identified as a "Guarantor" on the signature pages hereto, and (b) each Person that joins as a Guarantor pursuant to Section 5.10 or otherwise.

8

DOCVARIABLE BABC_DocID4891-7708-7367.4

"Guaranty" shall mean the Guaranty made by the Guarantors in favor of Lender pursuant to Article IX.

"Hazardous Materials" shall mean all explosive or radioactive substances or wastes and all hazardous or toxic substances, wastes or other pollutants, including petroleum or petroleum distillates, asbestos or asbestos containing materials, polychlorinated biphenyls, radon gas, infectious or medical wastes and all other substances or wastes of any nature regulated pursuant to any Environmental Law.

"HCPCIC" means Homeowners Choice Property & Casualty Company, Inc., a Florida corporation.

"Hostile Acquisition" shall mean the Acquisition of the Capital Stock of a Person through a tender offer or similar solicitation of the owners of such Capital Stock which has not been approved (prior to such Acquisition) by resolutions of the Board of Directors of such Person (or by similar action if such Person is not a corporation) or if such approval has been withdrawn.

"Indebtedness" of any Person shall mean, without dupli cation (a) all obligations of such Person for borrowed money, (b) all obligations of such Person evidenced by bonds, debentures, notes or other similar instruments, (c) all obligations of such Person in respect of the deferred purchase price of property or services (other than trade payables incurred in the ordinary course of business, (d) all obligations of such Person under any conditional sale or other title retention agreement(s) relating to property acquired by such Person, (e) all Capital Lease Obligations of such Person, (f) all obligations, contingent or otherwise, of such Person in respect of letters of credit, acceptances or similar extensions of credit, (g) all obligations of such Person, contingent or otherwise, to purchase, redeem, retire or otherwise acquire for value any Disqualified Capital Stock of such Person, (h) Off-Balance Sheet Liabilities, (i) all Guarantees of such Person of the type of Indebtedness described in clauses (a) through (i) above, and (j) all Indebtedness of a third party secured by any Lien on property owned by such Person, whether or not such Indebtedness has been assumed by such Person. The Indebtedness of any Person shall include the Indebtedness of any partnership or joint venture in which such Person is a general partner or a joint venturer, except to the extent that the terms of such Indebtedness provide that such Person is not liable therefor. For purposes of this Agreement, the obligations of Borrower in connection with the Parent Guaranty shall be included as Indebtedness of Borrower.

"Index Floor" has the meaning given to such term in the definition of "Tranche Rate."

"Interest Payment Date" means, all as determined by Lender in accordance with the Loan Documents and Lender's loan systems and procedures periodically in effect (and subject to the terms of any BillPayer Service, as applicable), the first Business Day after the end of each December, March, June and September; provided that, in addition to the foregoing, each of (x) the date upon which the Revolving Loan Commitment has been terminated and the Advances have been paid in full and (y) the Revolving Commitment Termination Date shall be deemed to be an "Interest Payment Date" with respect to any interest that has then accrued under this Agreement.

"Interest Period" means, with respect to any Tranche Rate Loan, a period commencing on the date of such Tranche Rate Loan and ending on the numerically corresponding day in the calendar month that is one or three months thereafter, as designated by Borrower to Lender from time to time in a Notice of Borrowing or Notice of Conversion or as otherwise set pursuant to the terms of this Agreement, as applicable, determined by Lender in accordance with this Agreement and Lender's loan systems and procedures periodically in effect, including in accordance with the following terms and conditions, as applicable:

9

DOCVARIABLE BABC_DocID4891-7708-7367.4

"Investments" shall mean, as to any Person, any direct or indirect acquisition or investment by such Person, whether by means of (a) purchase or other acquisition of any Capital Stock of another Person, (b) a loan, advance, other evidence of indebtedness or capital contribution to, Guarantee or assumption of debt of, or purchase or other acquisition of any other indebtedness or equity participation or interest in, another Person, or (c) an Acquisition. For purposes of covenant compliance, the amount of any Investment shall be the amount actually invested, without adjustment for subsequent increases or decreases in the value of such Investment.

"IRS" shall mean the United States Internal Revenue Service.

"Laws" or "Law" shall mean, collectively, all international, foreign, federal, state and local statutes, treaties, rules, guidelines, regulations, ordinances, codes and administrative or judicial precedents or authorities, including the interpretation or administration thereof by any Governmental Authority charged with the enforcement, interpretation or administration thereof, and all applicable administrative orders, directed duties, requests, licenses, authorizations and permits of, and agreements with, any Governmental Authority, in each case whether or not having the force of law.

"Lender" shall mean Fifth Third Bank, National Association, and its successors and assigns.

"Letter Agreement" shall mean that certain Second Amended and Restated Letter Agreement between Borrower and Lender dated as of the Effective Date.

"Letters of Credit" means commercial or standby letters of credit issued for the account of Borrower by Lender.

"Lien" shall mean any mortgage, pledge, security interest, lien (statutory or otherwise), charge, encumbrance, hypothecation, assignment, deposit arrangement, or other arrangement having the practical effect of any of the foregoing or any preference, priority or other security agreement or preferential arrangement of any kind or nature whatsoever (including any conditional sale or other title retention agreement and any capital lease having the same economic effect as any of the foregoing).

"Loan Documents" shall mean, collectively, this Agreement, the Collateral Documents, the Management Fee Subordination Agreements, all Borrowing Base Certificates, all Compliance Certificates, all UCC Financing Statements, all stock powers and similar instruments of transfer, the Note, including, without limitation, any Rate Management Agreement, together with all amendments, restatements, supplements and modifications thereof and any and all other instruments, agreements, documents and writings executed in connection with any of the foregoing.

10

DOCVARIABLE BABC_DocID4891-7708-7367.4

"Loan Expenses" means (a) without limitation, any points, loan fees, service charges, commitment fees or other fees due to Lender in connection with the Loan; (b) all amounts due under any Rate Management Agreement; (c) all title examination, survey, escrow, filing, search, recording and registration fees and charges; (d) all reasonable fees and disbursements of architects, engineers and consultants engaged by Borrower and Lender; (e) all documentary stamp and other taxes and charges imposed by law on the issuance or recording of any of the Loan Documents; (f) all Collateral appraisal fees; (g) all title, casualty, liability, payment, performance or other insurance premiums; (h) all fees and disbursements of legal counsel engaged by Lender in connection with the Loan, including, without limitation, counsel engaged in connection with the enforcement, negotiation, preparation or administration of this Agreement or any of the Loan Documents; and (i) any costs or expenses required to be paid by Borrower under this Agreement, the Security Agreement or any Loan Document after the occurrence of an Event of Default.

"Loan Parties" shall mean, collectively, Borrower and each Guarantor.

"Management Agreement" shall mean any agreement made by (or on behalf of) any Loan Party with respect to any payment of fees for administrative services, management or consulting to an Affiliate or non-affiliated third party.

"Management Fees" shall have the meaning set forth in Section 5.14.

"Management Fee Subordination Agreement" shall mean each management fee subordination agreement entered into by the Person acting as manager or administrative services provider under any Management Agreement.

"Material Adverse Effect" shall mean, with respect to any event, act, condition or occurrence of whatever nature (including any adverse determination in any litigation, arbitration, or governmental investigation or proceeding), whether singularly or in conjunction with any other event or events, act or acts, condition or conditions, occurrence or occurrences whether or not related, resulting in a material adverse change in, or a material adverse effect on, (a) the business, results of operations, finan cial condition, assets, liabilities or prospects of Borrower and its Subsidiaries taken as a whole, (b) the ability of Borrower or any Guarantor to perform any of its respective obligations under the Loan Documents, (c) the rights and remedies of Lender under any of the Loan Documents or (d) the legality, validity or enforceability of any of the Loan Documents.

"Material Indebtedness" shall mean any Indebtedness (other than the Revolving Loan) of Borrower or any of its Subsidiaries, individually or in an aggregate, with a committed or outstanding principal amount exceeding $250,000.

"Maturity Date" shall mean the Revolving Commitment Termination Date.

"Moody's" shall mean Moody's Investors Service, Inc.

"Mortgaged Property" shall mean any real property that is owned or leased by a Loan Party and is subject to a Mortgage.

"Mortgages" shall mean the mortgages, deeds of trust or deeds to secure debt that purport to grant to Lender a security interest in the fee interests and/or leasehold interests of any Loan Party in any real property.

"Net Cash Proceeds" shall mean the aggregate cash or Cash Equivalents proceeds received by Borrower or any Subsidiary in respect of any Asset Sale, Recovery Event or any issuance of Indebtedness

11

DOCVARIABLE BABC_DocID4891-7708-7367.4

or equity securities net of (a) direct costs incurred in connection therewith (including legal, accounting and investment banking fees, and sales commissions), (b) taxes paid or payable as a result thereof and (c) in the case of any Asset Sale or any Recovery Event, the amount necessary to retire any Indebtedness secured by a Lien permitted by Section 7.2 (ranking senior to any Lien of Lender) on the related property.

"Non-Taxable Agreement Not to Encumber" shall mean any Non-Taxable Agreement Not to Encumber in a form approved by Lender executed by any Loan Party with respect to Encumbered Real Estate owned by such Loan Party and to be recorded in the Public Records of the county in which the Encumbered Real Estate is located.

"Note" shall mean that certain Renewed, Amended and Restated Revolving Credit Promissory Note dated of even date herewith from Borrower in favor of Lender in the amount of $75,000,000.00.

"Notice of Borrowing" shall mean a notice of borrowing with respect to any Advance hereunder, which notice shall be in form and substance, and delivered by Borrower to Lender in a manner, acceptable to Lender in its sole discretion.

"Notice of Conversion" shall mean a notice of conversion with respect to any Advance hereunder, which notice shall be in form and substance, and delivered by Borrower to Lender in a manner, acceptable to Lender in its sole discretion.

"Obligations" means all loans, advances, debts, liabilities and obligations for the performance of covenants, tasks or duties or for payment of monetary amounts (whether or not such performance is then required or contingent, or such amounts are liquidated or determinable) owing by any Loan Party to Lender, or any Affiliate of Lender, and all covenants and duties regarding such amounts, of any kind or nature, present or future, whether direct or indirect (including acquired by assignment), related or unrelated, absolute or contingent, due or to become due, now existing or hereafter arising and however acquired, and whether or not evidenced by any note, agreement, letter of credit agreement or other instrument. The term "Obligations" includes all principal, interest, Fees, expenses, reasonable attorneys' fees and any other sum chargeable to any Loan Party under, or arising out of, this Agreement, the Note, any of the other Loan Documents or any agreement entered into in respect of Bank Products, all Fifth Third Lease Obligations, and all Rate Contract Obligations (including all amounts that accrue after the commencement of any case or proceeding by or against any Loan Party in bankruptcy, whether or not allowed in such case or proceeding). Notwithstanding the foregoing, "Obligations" of a Guarantor shall not include Excluded Swap Obligations with respect to such Guarantor.

"OFAC" shall mean the U.S. Department of the Treasury's Office of Foreign Assets Control.

"Off-Balance Sheet Liabilities" of any Person shall mean (a) any repurchase obligation or liability of such Person with respect to accounts or notes receivable sold by such Person, (b) any liability of such Person under any sale and leaseback transactions that do not create a liability on the balance sheet of such Person, (c) any Synthetic Lease Obligation or (d) any obligation arising with respect to any other transaction which is the functional equivalent of or takes the place of borrowing but which does not constitute a liability on the balance sheet of such Person.

"Organization Documents" shall mean, (a) with respect to any corporation, the certificate or articles of incorporation and the bylaws (or equivalent or comparable constitutive documents with respect to any non-U.S. jurisdiction); (b) with respect to any limited liability company, the certificate or articles of formation or organization and operating agreement; and (c) with respect to any partnership, joint venture, trust or other form of business entity, the partnership, joint venture or other applicable agreement of formation or organization and any agreement, instrument, filing or notice with respect thereto filed in

12

DOCVARIABLE BABC_DocID4891-7708-7367.4

connection with its formation or organization with the applicable Governmental Authority in the jurisdiction of its formation or organization and, if applicable, any certificate or articles of formation or organization of such entity.

"OSHA" shall mean the Occupational Safety and Health Act of 1970, as amended from time to time, and any successor statute.

"Parent Guaranty" means that certain Parent Guaranty Agreement dated February 26, 2021 by and between Borrower and CB Snowbird Holdings, L.P., a Delaware limited partnership, whereby Borrower guaranteed certain obligations of TypTap.

"Permitted Encumbrances" shall mean:

provided, that the term "Permitted Encumbrances" shall not include any Lien securing Indebtedness.

"Permitted Tax Distributions" shall mean cash distributions made by Borrower (with respect to any period for which Borrower is an entity disregarded as separate from its owner for federal income tax purposes, and its direct or indirect owner is a pass-through entity for federal income tax purposes) to the holders of its Capital Stock to solely provide such holders (or their direct or indirect owners) with funds

13

DOCVARIABLE BABC_DocID4891-7708-7367.4

sufficient to pay, at the highest marginal tax rate applicable for any holder, any federal, state or local income taxes for the current period as a result of the items of income, gain, loss and deduction of such Borrower allocated to such holders (net of all taxable losses allocated to such holders and not previously taken into account pursuant to this sentence and assuming the deductibility of state and local income taxes for federal income tax purposes). Such distributions shall not be made more frequently than quarterly with respect to each taxable year for which an installment of estimated tax is required to be paid by such holders.

"Person" shall mean any individual, partnership, firm, corporation, association, joint venture, limited liability company, trust or other entity, or any Governmental Authority.

"Prime Rate" means, as of any date, the greater of: (a) 3.0% or (b) the rate that Fifth Third publicly announces, publishes or designates from time to time as its index rate or prime rate, or any successor rate thereto, in effect at its principal office. Such rate is a reference rate and does not necessarily represent the lowest or best rate actually charged to any customer. Fifth Third may make commercial loans or other loans at rates of interest at, above or below its index rate or prime rate.

"Pro Forma Basis" shall mean, for purposes of calculating compliance with respect to any Asset Sale, Recovery Event, Restricted Payment or incurrence of Indebtedness, or any other transaction subject to calculation on a "Pro Forma Basis" as indicated herein, that such transaction shall be deemed to have occurred as of the first day of the period of four (4) Fiscal Quarters most recently ended for which Borrower have delivered financial statements pursuant to Section 5.1(a) or (b).

"Qualified Capital Stock" shall mean any Capital Stock other than Disqualified Capital Stock.

"Rate Contract" means any agreement, device or arrangement providing for payments which are related to fluctuations of commodities, currencies, or interest rates, exchange rates, forward rates, or equity prices, including Dollar denominated or cross currency interest rate exchange agreements, forward currency exchange agreements, interest rate cap or collar protection agreements, forward rate currency or interest rate options, puts and warrants, and any agreement pertaining to equity derivative transactions (e.g., equity or equity index swaps, options, caps, floors, collars and forwards), including any ISDA Master Agreement (including the Existing ISDA), and any schedules, confirmations and documents and other confirming evidence between the parties confirming transactions thereunder, all whether now existing or hereafter arising, and in each case as amended, modified or supplemented from time to time.

"Rate Contract Obligations" means any and all obligations of a Loan Party to an Eligible Swap Counterparty, whether absolute, contingent or otherwise and howsoever and whensoever (whether now or hereafter) created, arising, evidenced or acquired (including all renewals, extensions and modifications thereof and substitutions therefor), under or in connection with (a) any and all Rate Contracts between a Loan Party and an Eligible Swap Counterparty, and (b) any and all cancellations, buy-backs, reversals, terminations or assignments of any such Rate Contract.

"Rate Management Agreements" means any Rate Contract.

"Rate Management Obligations" means any Rate Contract Obligations.

"Real Property" means any and all Encumbered Real Estate, Unencumbered Real Estate and Unimproved Raw Land.

"Real Property Security Documents" shall mean:

14

DOCVARIABLE BABC_DocID4891-7708-7367.4

(a) a fully executed and notarized Mortgage and a fully executed and notarized Assignment of Rents encumbering the fee or leasehold interest of such Loan Party in such real property;

(b) a current ALTA survey and a surveyor's certificate, in form and substance satisfactory to Lender, certified to Lender and to the title company that issues the title insurance policies required in subsection (c) hereof with respect thereto by a licensed professional surveyor reasonably satisfactory to Lender;

(c) an ALTA mortgagee title insurance policies issued by a title insurance company reasonably acceptable to Lender with respect to such real property, assuring Lender that the Mortgage covering such real property creates a valid and enforceable first priority mortgage lien on such real property, free and clear of all defects and encumbrances except Permitted Encumbrances, which title insurance policies shall otherwise be in form and substance satisfactory to Lender and shall include such endorsements as are requested by Lender;

(d) "life of loan" flood determination certificates evidencing (i) whether such real property is in an area designated by the Federal Emergency Management Agency as a Flood Hazard Property and (ii) if such real property is a Flood Hazard Property, (A) whether the community in which such real property is located is participating in the National Flood Insurance Program, (B) the applicable Loan Party's written acknowledgment of receipt of written notification from Lender (1) as to the fact that such real property is a Flood Hazard Property and (2) as to whether the community in which each such Flood Hazard Property is located is participating in the National Flood Insurance Program and (C) copies of flood insurance policies under the National Flood Insurance Program (or private insurance endorsed to cause such private insurance to be fully compliant with the federal law as regards private placement insurance applicable to the National Flood Insurance Program, with financially sound and reputable insurance companies not Affiliates of Borrower) or certificates of insurance of Borrower and its Subsidiaries evidencing such flood insurance coverage in such amounts and with such deductibles as Lender may request and naming Lender and its successors and/or assigns as sole loss payee;

(e) a duly executed Environmental Indemnity with respect thereto;

(f) if requested by Lender, (i) environmental questionnaires or (ii) Phase I Environmental Site Assessment Reports, consistent with American Society of Testing and Materials (ASTM) Standard E 1527-05, and applicable state requirements, on all of the owned real property, dated no more than six (6) months prior to the Effective Date (or date of the applicable Mortgage if provided post-closing), prepared by environmental engineers satisfactory to Lender, all in form and substance satisfactory to Lender, and such environmental review and audit reports, including Phase II reports, with respect to the real property of any Loan Party as Lender shall have requested, in each case together with letters executed by the environmental firms preparing such environmental reports, in form and substance satisfactory to Lender, authorizing Lender to rely on such reports, and Lender shall be satisfied with the contents of all such environmental questionnaires or reports;

(g) if requested by Lender, evidence satisfactory to Lender that such real property, and the uses of such real property, are in compliance in all material respects with all applicable zoning Laws (the evidence submitted as to which should include the zoning designation made for such real property, the permitted uses of such real property under such zoning designation and, if available, zoning requirements as to parking, lot size, ingress, egress and building setbacks);

15

DOCVARIABLE BABC_DocID4891-7708-7367.4

"Recovery Event" shall mean any loss of, damage to or destruction of, or any condemnation or other taking for public use of, any property of Borrower or any Subsidiary.

"Regulation T" shall mean Regulation T of the Board of Governors of the Federal Reserve System, as the same may be in effect from time to time, and any successor regulations.

"Regulation U" shall mean Regulation U of the Board of Governors of the Federal Reserve System, as the same may be in effect from time to time, and any successor regulations.

"Related Parties" shall mean, with respect to any specified Person, such Person's Affiliates and the respective managers, administrators, trustees, partners, directors, officers, employees, agents, advisors, legal counsel, consultants or other representatives of such Person and such Person's Affiliates.

"Release" shall mean any release, spill, emission, leaking, dumping, injection, pouring, deposit, disposal, discharge, dispersal, leaching or migration into the environment (including ambient air, surface water, groundwater, land surface or subsurface strata) or within any building, structure, facility or fixture.

"Responsible Officer" shall mean, with respect to any Person, any of the president, the chief executive officer, the chief operating officer, the chief financial officer, the treasurer or a vice president of such Person or such other representative of such Person as may be designated in writing by any one of the foregoing with the consent of Lender; and, with respect to the financial covenants only, the chief financial officer or the treasurer of such Person.

"Restricted Payment" shall mean any dividend or other distribution (whether in cash, securities or other property) with respect to any Capital Stock of any Person, or any payment (whether in cash, securities or other property), including any sinking fund or similar deposit, on account of the purchase, redemption, retirement, defeasance, acquisition, cancellation or termination of any such Capital Stock or on account of any return of capital to such Person's stockholders, partners or members (or the equivalent Person thereof).

16

DOCVARIABLE BABC_DocID4891-7708-7367.4

"Revolving Commitment" shall mean the commitment of Lender to make Advances to Borrower in an aggregate principal amount not exceeding $75,000,000.00, as such commitment may subsequently be increased or decreased pursuant to terms hereof.

"Revolving Commitment Termination Date" shall mean the earliest of (i) November 3, 2028, (ii) the date on which the Revolving Commitment is terminated pursuant to Section 2.3 and (iii) the date on which all amounts outstanding under this Agreement have been declared or have automatically become due and payable (whether by acceleration or otherwise).

"Revolving Credit Exposure" shall mean, at any time, the outstanding principal amount of Advances.

"Revolving Loan" shall mean the loan made by Lender to Borrower in the amount of the Revolving Commitment. Any reference to the "Loan" in this Agreement or any other Loan Document shall mean the Revolving Loan.

"Revolving Loan Availability" shall have the meaning given such term in Section 2.1.

"S&P" shall mean Standard & Poor's Financial Services LLC, a subsidiary of The McGraw-Hill Companies, Inc., and any successor thereto.

"Sanctioned Country" shall mean, at any time, a country or territory that is, or whose government is, the subject or target of any Sanctions.

"Sanctioned Person" shall mean, at any time, (a) any Person listed in any Sanctions-related list of designated Persons maintained by OFAC, the U.S. Department of State, the United Nations Security Council, the European Union or any European Union member state, (b) any Person located, organized or resident in a Sanctioned Country or (c) any Person controlled by any such Person.

"Sanctions" shall mean economic or financial sanctions or trade embargoes administered or enforced from time to time by (a) the U.S. government, including those administered by OFAC or the U.S. Department of State or (b) the United Nations Security Council, the European Union or Her Majesty's Treasury of the United Kingdom.

"SEC" shall mean the Securities and Exchange Commission, or any Governmental Authority succeeding to any of its principal functions.

"Securities Account Collateral" means Collateral in the Charles Schwab Accounts and any other securities account.

"Security Agreement" shall mean, collectively, the Amended and Restated Security and Pledge Agreement dated of even date herewith executed in favor of Lender by each of the Loan Parties and the Charles Schwab Account Security Agreement.

"Shareholders' Equity" shall mean total assets minus total liabilities.

"Social Security Act" shall mean the Social Security Act of 1965 as set forth in Title 42 of the United States Code, as amended, and any successor statute thereto, as interpreted by the rules and regulations issued thereunder, in each case, as in effect from time to time. References of sections of the Social Security Act shall be construed to refer to any successor sections.

17

DOCVARIABLE BABC_DocID4891-7708-7367.4

"SOFR" means, with respect to any Business Day, a rate per annum equal to the secured overnight financing rate published by the Federal Reserve Bank of New York (or a successor administrator) on the administrator's website (or any successor source for the secured overnight financing rate identified as such by the administrator) at approximately 2:30 p.m. (New York City time) on the immediately succeeding Business Day.

"Spread Adjustment" means a mathematical or other adjustment to an alternate benchmark rate selected pursuant to Section 2.6(b) or 2.6(c) of this Agreement and such adjustment may be positive, negative, or zero, subject to the specific Spread Adjustments set forth in Section 2.6(c).

"Solvent" shall mean, with respect to any Person on a particular date, that on such date (a) the fair value of the property of such Person is greater than the total amount of liabilities, including subordinated and contingent liabilities, of such Person; (b) the present fair saleable value of the assets of such Person is not less than the amount that will be required to pay the probable liability of such Person on its debts and liabilities, including subordinated and contingent liabilities as they become absolute and matured; (c) such Person does not intend to, and does not believe that it will, incur debts or liabilities beyond such Person's ability to pay as such debts and liabilities mature; (d) such Person is not engaged in a business or transaction, and is not about to engage in a business or transaction, for which such Person's property would constitute an unreasonably small capital; (e) such Person is able to pay its debts and other liabilities, contingent obligations and other commitments as they mature in the ordinary course of business; and (f) such Person does not intend, in any transaction, to hinder, delay or defraud either present or future creditors or any other person to which such Person is or will become, through such transaction, indebted. The amount of contingent liabilities (such as litigation, guaranties and pension plan liabilities) at any time shall be computed as the amount that, in light of all the facts and circumstances existing at the time, represents the amount that would reasonably be expected to become an actual or matured liability.

"Subsidiary" shall mean, with respect to any Person (the "parent"), any corporation, partnership, joint venture, limited liability company, association or other entity the accounts of which would be consolidated with those of the parent in the parent's consolidated financial statements if such financial statements were prepared in accordance with GAAP as of such date, (a) of which securities or other ownership interests representing more than fifty percent (50%) of the equity or more than fifty percent (50%) of the ordinary voting power, or in the case of a partnership, more than fifty percent (50%) of the general partnership interests are, as of such date, owned, controlled or held, or (b) that is, as of such date, otherwise controlled, by the parent or one or more subsidiaries of the parent or by the parent and one or more subsidiaries of the parent. Unless otherwise indicated, all references to "Subsidiary" hereunder shall mean a Subsidiary of Borrower.

"Successor Rate" means any successor index rate determined pursuant to Section 2.6(c) from time to time, including any applicable Spread Adjustment.

"Swap Obligation" means any Rate Management Obligation that constitutes a "swap" within the meaning of Section 1a(47) of the Commodity Exchange Act.

"Synthetic Lease" shall mean a lease transaction under which the parties intend that (a) the lease will be treated as an "operating lease" by the lessee pursuant to Accounting Standards Codification Sections 840-10 and 840-20, as amended and (b) the lessee will be entitled to various tax and other benefits ordinarily available to owners (as opposed to lessees) of like property.

"Synthetic Lease Obligations" shall mean, with respect to any Person, the sum of (a) all remaining rental obligations of such Person as lessee under Synthetic Leases which are attributable to principal and, without duplication, (b) all rental and purchase price payment obligations of such Person under such

18

DOCVARIABLE BABC_DocID4891-7708-7367.4

Synthetic Leases assuming such Person exercises the option to purchase the lease property at the end of the lease term.

"Tangible Net Worth" shall mean as of any applicable date, the consolidated total assets of Borrower and its Subsidiaries minus, without duplication, (i) the sum of any amounts attributable to (a) goodwill, (b) intangible items such as unamortized debt discount and expense, patents, trade and service marks and names, copyrights and research and development expenses except prepaid expenses, and (c) all reserves not already deducted from assets, and (ii) total liabilities.

"Taxes" shall mean all present or future taxes, assessments, levies and charges imposed by any public or quasi-public authority having jurisdiction over the Collateral that are or may affect, or become a lien upon, the Collateral, or interest therein, or imposed by any Governmental Authority upon Borrower, any Loan Party or Lender by reason of their respective interests in the Collateral or by reason of any payment, or portion thereof, made to Lender hereunder or pursuant to any Obligation or any of the other Loan Documents, other than taxes which are measured by and imposed upon Lender's general net income.

"Term SOFR" means, with respect to a Tranche Rate Loan for any Interest Period, the forward-looking SOFR rate administered by CME Group, Inc. (or other administrator selected by Lender) and published on the applicable Bloomberg LP screen page (or such other commercially available source providing such quotations as may be selected by Lender), fixed by the administrator thereof two Business Days prior to the commencement of the applicable Interest Period (provided, however, that if Term SOFR is not published for such Business Day, then Term SOFR shall be determined by reference to the immediately preceding Business Day on which such rate is published), rounded upwards, if necessary, to the next 1/8th of 1% and adjusted for reserves if Lender is required to maintain reserves with respect to the relevant Advances, all as determined by Lender in accordance with this Agreement and Lender's loan systems and procedures periodically in effect.

"Trading with the Enemy Act" shall mean the Trading with the Enemy Act of the United States of America (50 U.S.C. App. §§ 1 et seq.), as amended and in effect from time to time.

"Tranche Rate" means, with respect to any Interest Period, the greater of (a) 0% (the "Index Floor") and (b) Term SOFR relating to quotations for 1 or 3 months, as selected by Borrower in its Notice of Borrowing or Notice of Conversion, or as otherwise set pursuant to the terms of this Agreement, as applicable, in each case plus a 0.10% Spread Adjustment. Each determination by Lender of the Tranche Rate shall be conclusive and binding in the absence of manifest error. Notwithstanding anything to the contrary contained in this Agreement, at any time during which a Rate Contract is then in effect with respect to all or a portion of the Obligations bearing interest based upon the Tranche Rate or any Successor Rate, the provision that rounds up the Tranche Rate to the next 1/8th of 1% shall be disregarded and no longer of any force and effect with respect to such portion of the Obligations that are subject to such Rate Contract.

"Tranche Rate Loans" means any Advances that accrue interest by reference to the Tranche Rate for an Interest Period elected by Borrower in accordance with Section 2.6(a) of this Agreement and the other terms of this Agreement.

"TypTap" means TypTap Insurance Group, Inc., a Florida corporation.

"TypTap Articles" means the Amended and Restated Articles of Incorporation of TypTap Insurance Group, Inc. dated February 26, 2021.

19

DOCVARIABLE BABC_DocID4891-7708-7367.4

"UCC" shall mean the Uniform Commercial Code (or any similar or equivalent legislation) as in effect in the State of Florida (or any other applicable jurisdiction, as the context may require).

"Unencumbered Real Estate" means any fee or leasehold interest of Borrower or a Subsidiary of Borrower in real property that is not encumbered by a Lien (except for a Lien in favor of Lender).

"Unimproved Raw Land" means any fee or leasehold interest of Borrower or a Subsidiary of Borrower in unimproved real property that is not encumbered by a Lien (except for a Lien in favor of Lender).

"United States" or "U.S." shall mean the United States of America.

"U.S. Person" shall mean any Person that is a "United States person" as defined in Section 7701(a)(30) of the Code.

20

DOCVARIABLE BABC_DocID4891-7708-7367.4

21

DOCVARIABLE BABC_DocID4891-7708-7367.4

22

DOCVARIABLE BABC_DocID4891-7708-7367.4

23

DOCVARIABLE BABC_DocID4891-7708-7367.4

At any time (including in connection with the implementation of a Successor Rate), Lender may remove any tenor of a Tranche Rate that is unavailable, non-representative, or not in compliance with or aligned with the International Organization of Securities Commissions (IOSCO) Principles for Financial Benchmarks, in Lender's sole discretion, for Tranche Rate settings; provided however that Lender may reinstate such previously removed tenor for Tranche Rate settings, if Lender determines in its sole discretion that such tenor has become available and representative again.

(c) Tranche Rate Replacement.

24

DOCVARIABLE BABC_DocID4891-7708-7367.4

(vii) Notwithstanding anything to the contrary contained herein, if, after the Effective Date, Borrower enters into a Rate Contract with respect to all or part of a Tranche Rate

25

DOCVARIABLE BABC_DocID4891-7708-7367.4

Loan and the floating interest rate under the Rate Contract is Daily Simple SOFR, Lender may replace the Tranche Rate hereunder with Daily Simple SOFR and a Spread Adjustment without the consent of any other party hereto; provided further that, if subsequent thereto, Lender and Borrower amend such Rate Contract to include, or terminate such Rate Contract and enter into a new Rate Contract with, a floating interest rate thereunder of the original Tranche Rate, then Lender may further replace Daily Simple SOFR hereunder with the original Tranche Rate (and a Spread Adjustment, if applicable) hereunder without the consent of any other party hereto; and, in either such event, (A) such rate shall be a Successor Rate hereunder, and (B) Lender shall provide written notice thereof to Borrower.

26

DOCVARIABLE BABC_DocID4891-7708-7367.4

Section 2.7 Releases. Borrower may request a release of Real Property from the Collateral so long as (a) no Default or Event of Default exists immediately before or immediately after giving effect thereto and (b) Borrower submits a Borrowing Base Certificate to Lender reflecting that after such release, the Revolving Loan will be in compliance with Section 2.1 of this Agreement and, to the extent necessary, Borrower shall reduce the then outstanding principal balance of the Revolving Loan so that no Overadvance exists after such release. In connection with the release of any Real Property from the Collateral, Lender shall take such action, and execute and deliver all such instruments of release and agreements, as may reasonably be requested by Borrower, all at Borrower's sole cost and expense.

Section 2.8 Appraisals.

27

DOCVARIABLE BABC_DocID4891-7708-7367.4

28

DOCVARIABLE BABC_DocID4891-7708-7367.4

Section 3.2 Each Advance. The obligation of Lender to make any Advance or convert or continue any Advance as a Tranche Rate Loan is subject to the satisfaction of the following conditions:

29

DOCVARIABLE BABC_DocID4891-7708-7367.4

Each Advance (including the conversion or continuance of any Advance as a Tranche Rate Loan) shall be deemed to constitute a representation and warranty by Borrower on the date thereof as to the matters specified in clauses (a) and (b) of this Section 3.2.

Section 3.3 Delivery of Documents. All of the Loan Documents, certificates, legal opinions and other documents and papers referred to in this Article III, unless otherwise specified, shall be delivered to Lender and shall be in form and substance satisfactory in all respects to Lender.

Each Loan Party represents and warrants to Lender as follows:

30

DOCVARIABLE BABC_DocID4891-7708-7367.4

() None of Borrower or any Subsidiary is in default under or with respect to any Contractual Obligation that could reasonably be expected to have a Material Adverse Effect.

() No Default has occurred and is continuing.

31

DOCVARIABLE BABC_DocID4891-7708-7367.4

32

DOCVARIABLE BABC_DocID4891-7708-7367.4

33

DOCVARIABLE BABC_DocID4891-7708-7367.4

Each Loan Party covenants and agrees that so long as the Revolving Loan Commitment has not expired or been terminated or any Obligation remains unpaid or outstanding, such Loan Party shall and shall cause each Subsidiary to:

34

DOCVARIABLE BABC_DocID4891-7708-7367.4

If at any time Borrower is required to file periodic reports under Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934, as amended, Borrower may satisfy its obligation to deliver the financial statements referred to in clauses (a) and (b) above by delivering such financial statements by electronic mail to such e-mail addresses as Lender shall have provided to Borrower from time to time.

35

DOCVARIABLE BABC_DocID4891-7708-7367.4

Each notice delivered under this Section 5.2 shall be accompanied by a written statement of a Responsible Officer setting forth the details of the event or development requiring such notice and any action taken or proposed to be taken with respect thereto.

36

DOCVARIABLE BABC_DocID4891-7708-7367.4

37

DOCVARIABLE BABC_DocID4891-7708-7367.4

38

DOCVARIABLE BABC_DocID4891-7708-7367.4

Borrower covenants and agrees, on a consolidated basis, that so long as the Revolving Loan Commitment has not expired or been terminated or any Obligation remains unpaid or outstanding, Borrower shall not:

39

DOCVARIABLE BABC_DocID4891-7708-7367.4

Each Loan Party covenants and agrees that so long as the Revolving Loan Commitment has not expired or been terminated or any Obligation remains unpaid or outstanding, no Loan Party shall, directly or indirectly:

40

DOCVARIABLE BABC_DocID4891-7708-7367.4

41

DOCVARIABLE BABC_DocID4891-7708-7367.4

Section 7.16 Parent Guaranty. Amend the Parent Guaranty in any material respect or cause or permit the TypTap Articles to be amended in any material respect.

42

DOCVARIABLE BABC_DocID4891-7708-7367.4

43

DOCVARIABLE BABC_DocID4891-7708-7367.4

then, and in every such event (other than an event with respect to Borrower or any Subsidiary described in clause (g) or (h) of this Section 8.1) and at any time thereafter during the continuance of such event, Lender may, take any or all of the following actions, at the same or different times: (i) terminate the Revolving Commitment, whereupon the Revolving Commitment shall terminate immediately, (ii) declare the principal

44

DOCVARIABLE BABC_DocID4891-7708-7367.4

of and any accrued interest on the Revolving Loan, and all other Obligations owing hereunder, to be, whereupon the same shall become, due and payable immediately, without presentment, demand, protest or other notice of any kind, all of which are hereby waived by Borrower, (iii) exercise all remedies contained in any other Loan Document, and (iv) exercise any other remedies available at Law or in equity; and that, if an Event of Default specified in either clause (g) or (h) shall occur, the Revolving Commitment shall automatically terminate and the principal of the Revolving Loan then outstanding, together with accrued interest thereon, and all fees, and all other Obligations shall automatically become due and payable, without presentment, demand, protest or other notice of any kind, all of which are hereby waived by Borrower.

At the election of Lender, after the occurrence of an Event of Default and for so long as it continues, the Tranche Rate election will not be available to Borrower and as the Interest Periods for Tranche Rate Loans then in effect expire, such Advances shall be converted into Base Rate Loans.

After the exercise of remedies provided for in Section 8.1 (or immediately after an Event of Default specified in either clause (g) or (h) of Section 8.1), any amounts received on account of the Obligations shall be applied by Lender in the following order:

Excluded Swap Obligations with respect to any Guarantor shall not be paid with amounts received from such Guarantor or its assets, but appropriate adjustments shall be made with respect to payments from other Loan Parties to preserve the allocation to Obligations otherwise set forth above in this Section.

45

DOCVARIABLE BABC_DocID4891-7708-7367.4

Notwithstanding any provision to the contrary contained herein or in any other of the Loan Documents or the other documents relating to the Obligations, the obligations of each Guarantor under this Agreement and the other Loan Documents shall not exceed an aggregate amount equal to the largest amount that would not render such obligations subject to avoidance under applicable Debtor Relief Laws.

With respect to its obligations hereunder, each Guarantor hereby expressly waives diligence, presentment, demand of payment, protest and all notices whatsoever and any requirement that Lender or any other holder of the Obligations exhaust any right, power or remedy or proceed against any Person under any of the Loan Documents or any other document relating to the Obligations or against any other Person under any other guarantee of, or security for, any of the Obligations.

46

DOCVARIABLE BABC_DocID4891-7708-7367.4

47

DOCVARIABLE BABC_DocID4891-7708-7367.4

To any Loan Party: HCI Group, Inc.

3802 Coconut Palm Drive

Tampa, Florida 33619

Attention: Gil Simon and Andrew Jakubowicz

With a copy to:

Brook Baker, Esquire

3802 Coconut Palm Drive

Tampa, Florida 33619

To Lender: Fifth Third Bank, National Association

38 Fountain Square Plaza

MD 1090RF

Cincinnati, Ohio 45202

Attention: Michael Schaltz, Managing Director & SVP

Email: Michael.Schaltz@53.com

With a copy to:

Fifth Third Bank, National Association

222 South Riverside Plaza

Chicago, Illinois 60606

Attn: Dave Meier

Email: david.meier@53.com

And a copy to:

Bradley Arant Boult Cummings LLP

100 N. Tampa Street, Suite 2200

Tampa, Florida 33602

Attn: Stephanie Kane