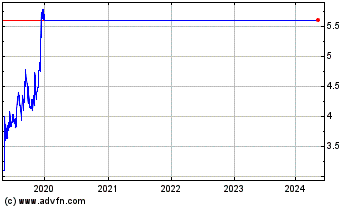

Avon Products (NYSE:AVP)

Historical Stock Chart

From Jul 2019 to Jul 2024

NEW YORK, Dec. 13, 2011 /PRNewswire-FirstCall/ -- Avon Products, Inc. (NYSE: AVP) today announced that in 2012 the company will separate the roles of Chairman and Chief Executive Officer. The company said that Andrea Jung, Avon's Chairman and CEO, will be named Executive Chairman, and that a committee of the Board of Directors will work with Ms. Jung to undertake an external search for a Chief Executive Officer. Ms. Jung will continue to serve in her dual roles throughout the recruitment process and will work closely with the new CEO to assure a successful transition.

"I believe the time is right to separate the Chairman and CEO roles and I look forward to continuing to serve Avon as Chairman as we address the company's growing scale and opportunities," said Ms. Jung, who has been Avon's CEO since 1999. "Over the past twelve years we have transformed the business from a decentralized group of local operating entities to a globally-managed business in over 100 countries with global brands and a global operating model. In the process, revenues have more than doubled, and the number of Representatives has doubled as well. As we look to the future, Avon's business model remains advantaged, with both the Beauty and Direct Selling industries growing around the world, and with our broad, geographic footprint. A new CEO will provide a fresh lens and additional operational and executive leadership."

Fred Hassan, Managing Director and Partner, Warburg Pincus LLC, and Avon's Lead Independent Director added: "Avon's Board of Directors fully supports Andrea and appreciates her commitment to continue to serve the company as Executive Chairman and assure a smooth and successful management transition. Separating the Chairman and CEO roles as well as strengthening overall management capabilities are important steps to help the company capture its future opportunities. The Board looks forward to continuing to work closely with Andrea and the new CEO to put the company back on a growth track."

Ms. Jung said that in her role as Executive Chairman she will work closely with the new CEO in support of the company's overall strategic direction and brand positioning. She will continue to be involved in maintaining strong relationships with Avon's key constituencies, including her role in motivating the company's millions of Representatives, and her critical advocacy on behalf of the Avon Foundation for Women. Ms. Jung noted that the Avon Foundation has raised and awarded $860 million to causes that help improve women's lives and has become the largest corporate philanthropy focused on women's issues.

Avon, the company for women, is a leading global beauty company, with over $10 billion in annual revenue. As the world's largest direct seller, Avon markets to women in more than 100 countries through approximately 6.5 million active independent Avon Sales Representatives. Avon's product line includes beauty products, as well as fashion and home products, and features such well-recognized brand names as Avon Color, ANEW, Skin-So-Soft, Advance Techniques, Avon Naturals, and mark. Learn more about Avon and its products at www.avoncompany.com.

CAUTIONARY STATEMENT FOR PURPOSES OF THE "SAFE HARBOR" STATEMENT UNDER THE

PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

Statements in this release that are not historical facts or information are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as "estimate," "project," "forecast," "plan," "believe," "may," "expect," "anticipate," "intend," "planned," "potential," "can," "expectation" and similar expressions, Ethe negative of those expressions, may identify forward-looking statements. Such forward-looking statements are based on management's reasonable current assumptions and expectations. Such forward-looking statements involve risks, uncertainties and other factors, which may cause the actual results, levels of activity, performance or achievement of Avon to be materially different from any future results expressed or implied by such forward-looking statements, and there can be no assurance that actual results will not differ materially from management's expectations. Such factors include, among others, the following:

- our ability to implement the key initiatives of, and realize the gross and operating margins and projected benefits (in the amounts and time schedules we expect) from, our global business strategy, including our multi-year restructuring initiatives, product mix and pricing strategies, enterprise resource planning, customer service initiatives, product line simplification program, sales and operation planning process, strategic sourcing initiative, outsourcing strategies, zero-overhead-growth philosophy, Internet platform and technology strategies, information technology and related system enhancements and cash management, tax, foreign currency hedging and risk management strategies;

- our ability to realize the anticipated benefits (including any projections concerning future revenue and operating margin increases) from our multi-year restructuring initiatives or other strategic initiatives on the time schedules or in the amounts that we expect, and our plans to invest these anticipated benefits ahead of future growth;

- the possibility of business disruption in connection with our multi-year restructuring initiatives or other strategic initiatives;

- our ability to realize sustainable growth from our investments in our brand and the direct-selling channel;

- our ability to transition our business in North America, including enhancing our Sales Leadership model and optimizing our product portfolio;

- a general economic downturn, a recession globally or in one or more of our geographic regions, such as North America, or sudden disruption in business conditions, and the ability of our broad-based geographic portfolio to withstand an economic downturn, recession, cost inflation, commodity cost pressures, competitive or other market pressures or conditions;

- the effect of political, legal, tax and regulatory risks imposed on us, our operations or our Representatives, including foreign exchange or other restrictions, adoption, interpretation and enforcement of foreign laws including any changes thereto, as well as reviews and investigations by government regulators that have occurred or may occur from time to time, including, for example, local regulatory scrutiny in China;

- our ability to effectively manage inventory and implement initiatives to reduce inventory levels, including the potential impact on cash flows and obsolescence;

- our ability to achieve growth objectives or maintain rates of growth, particularly in our largest markets and developing and emerging markets, such as Brazil or Russia;

- our ability to successfully identify new business opportunities and identify and analyze acquisition candidates, secure financing on favorable terms and negotiate and consummate acquisitions as well as to successfully integrate or manage any acquired business;

- the challenges to our acquired Silpada business, including the effect of rising silver prices, macro-economic pressures, competition, and the impact of declines in expected future cash flows and growth rates, or a change in the discount rate used to determine the fair value of expected future cash flows, which may impact the recoverability of the recorded goodwill and intangible assets;

- the effect of economic factors, including inflation and fluctuations in interest rates and currency exchange rates, as well as the designation of Venezuela as a highly inflationary economy, foreign exchange restrictions and the potential effect of such factors on our business, results of operations and financial condition;

- our ability to successfully transition and evolve our business in China in connection with the development and evolution of the direct-selling business in that market, our ability to operate using a direct-selling model permitted in that market and our ability to retain and increase the number of Active Representatives there over a sustained period of time;

- general economic and business conditions in our markets, including social, economic and political uncertainties in the international markets in our portfolio;

- any developments in or consequences of investigations and compliance reviews, and any litigation related thereto, including the ongoing internal investigation and compliance reviews of Foreign Corrupt Practices Act and related U.S. and foreign law matters in China and additional countries, as well as any disruption or adverse consequences resulting from such investigations, reviews, related actions or litigation;

- information technology systems outages, disruption in our supply chain or manufacturing and distribution operations, or other sudden disruption in business operations beyond our control as a result of events such as acts of terrorism or war, natural disasters, pandemic situations and large-scale power outages;

- the risk of product or ingredient shortages resulting from our concentration of sourcing in fewer suppliers;

- the quality, safety and efficacy of our products;

- the success of our research and development activities;

- our ability to attract and retain key personnel and executives;

- competitive uncertainties in our markets, including competition from companies in the cosmetics, fragrances, skincare and toiletries industry, some of which are larger than we are and have greater resources;

- our ability to implement our Sales Leadership program globally, to generate Representative activity, to increase the number of consumers served per Representative and their engagement online, to enhance the Representative and consumer experience and increase Representative productivity through field activation programs, Service Model Transformation and other investments in the direct-selling channel, and to compete with other direct-selling organizations to recruit, retain and service Representatives and to continue to innovate the direct-selling model;

- the impact of the seasonal nature of our business, adverse effect of rising energy, commodity and raw material prices, changes in market trends, purchasing habits of our consumers and changes in consumer preferences, particularly given the global nature of our business and the conduct of our business in primarily one channel;

- our ability to protect our intellectual property rights;

- the risk of an adverse outcome in any material pending and future litigations or with respect to the legal status of Representatives;

- our ratings, our access to cash and financing and ability to secure financing at attractive rates; and

- the impact of possible pension funding obligations, increased pension expense and any changes in pension regulations or interpretations thereof on our cash flow and results of operations.

Additional information identifying such factors is contained in Item 1A of our 2010 Form 10-K for the year ended December 31, 2010. We undertake no obligation to update any such forward-looking statements.

SOURCE Avon Products, Inc.