FALSE000180770700018077072023-09-062023-09-060001807707us-gaap:CommonStockMember2023-09-062023-09-060001807707us-gaap:WarrantMember2023-09-062023-09-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 6, 2023

AppHarvest, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-39288 | 84-5042965 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | |

500 Appalachian Way Morehead, KY | 40351 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (606) 653-6100

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | | APPHQ | | None |

| Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share | | APPHWQ | | None |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events

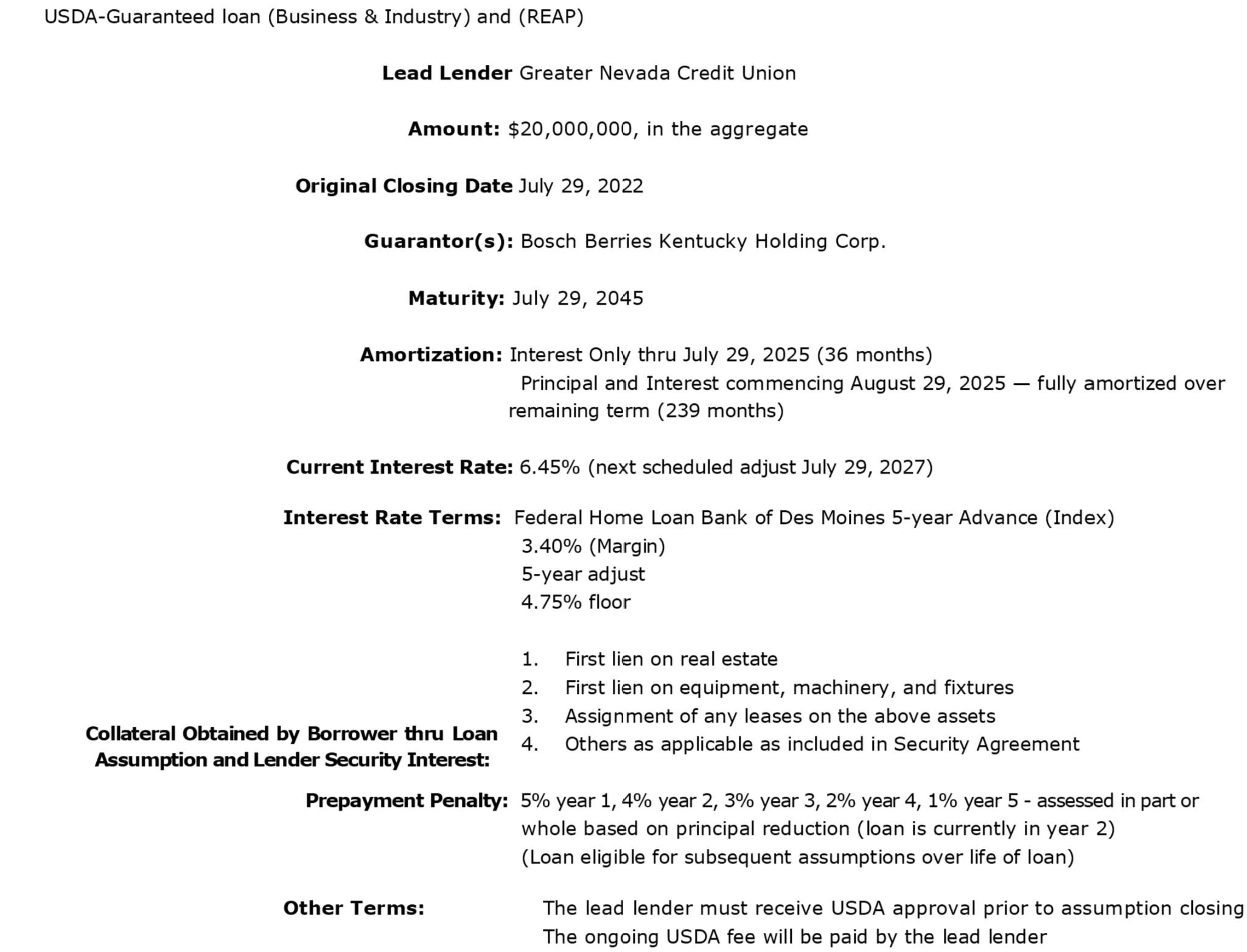

On September 6, 2023, the United States Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”) entered an order approving the sale of certain principal assets of AppHarvest Pulaski Farm, LLC (“Seller”) in connection with Seller’s facility located in Somerset, Kentucky pursuant to that certain Asset Purchase Agreement by and between Bosch Berries Kentucky Operations Corp. (“Purchaser”) and Seller, dated as of August 31, 2023 (the “Somerset APA”). Under the Somerset APA, Purchaser agreed, subject to the terms and conditions of the Somerset APA, to acquire the Transferred Assets (as defined in the Somerset APA) from Seller in exchange for Purchaser’s entry into certain Amended and Assigned GNCU Loan Documentation and an amount disbursed by GNCU to satisfy its obligations under the GNCU Letter (as each such capitalized term is defined in the Somerset APA). The Somerset APA includes customary representations and warranties, covenants, and closing conditions under the circumstances that are subject to certain limitations as set forth therein.

The foregoing description of the Somerset APA does not purport to be complete and is qualified in its entirety by reference to the Somerset APA, a copy of which is filed as Exhibit 10.1 hereto and incorporated by reference herein.

Cautionary Statements Regarding Trading in the Company’s Securities

AppHarvest, Inc’s (the “Company”) securityholders are cautioned that trading in the Company’s securities during the pendency of the Company’s chapter 11 cases (the “Chapter 11 Cases”) is highly speculative and poses substantial risks. Trading prices for the Company’s securities may bear little or no relationship to the actual recovery, if any, by holders thereof in the Chapter 11 Cases. Accordingly, the Company urges extreme caution with respect to existing and future investments in its securities.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements relate to expectations concerning matters that are not historical facts. Words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,”, “could” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” “can,” “goal,” “target” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those discussed in such forward-looking statements. Such risks and uncertainties include, without limitation, the outcome of the Chapter 11 Cases; the Company’s financial projections and cost estimates; the Company’s ability to raise additional funds during the Chapter 11 Cases; and risks associated with the Company’s business prospects, financial results and business operations. These and other factors that may affect the Company’s future business prospects, results and operations are identified and described in more detail in the Company’s filings with the SEC. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this Form 8-K. Except as required by applicable law, the Company does not intend to update any of the forward-looking statements to conform these statements to actual results, later events or circumstances or to reflect the occurrence of unanticipated events.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 10.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| AppHarvest, Inc. |

| |

| Dated: September 13, 2023 | |

| By: | /s/ Loren Eggleton |

| | Loren Eggleton |

| | Chief Financial Officer |

| | (Principal Financial Officer and Principal Accounting Officer) |

Execution Version

ASSET PURCHASE AGREEMENT

by and between

BOSCH BERRIES KENTUCKY OPERATIONS CORP., as Purchaser,

and

APPHARVEST PULASKI FARM, LLC, as Seller

Dated as of August 31, 2023

Table of Contents

Page

1.1Defined Terms 1

ARTICLE 2 THE PURCHASE AND SALE; CLOSING 13

2.1Purchase and Sale 13

2.2Excluded Assets 14

2.3Assumption of Liabilities 15

2.4Excluded Liabilities 16

2.5Excluded Contracts 17

2.6Nontransferable Assets and Liabilities 17

2.7Closing 18

2.8Closing Deliveries of the Parties 18

2.10Transfer Taxes 19

ARTICLE 3 REPRESENTATIONS AND WARRANTIES OF THE SELLER 20

3.1Organization, Good Standing and Other Matters 20

3.2Authority and Enforceability 21

3.3No Conflict; Required Filings and Consents 21

3.5Litigation 22

3.7Environmental Matters 22

3.8Assigned Contracts 22

3.9Brokers and Finders 23

3.10Employees 23

3.11Employee Benefit Plans 23

3.12No Other Representations or Warranties 23

ARTICLE 4 REPRESENTATIONS AND WARRANTIES OF PURCHASER 23

4.1Organization, Good Standing and Other Matters 23

4.2Authority and Enforceability 23

4.3No Conflict: Required Filings and Consents 24

4.5Solvency 24

4.6Litigation 25

4.7Brokers and Finders 25

4.8Investigation and Agreement by Purchaser; Non-Reliance of

Purchaser; No Other Representations and Warranties 25

4.9No Other Representations or Warranties 26

5.1Competing Transaction 26

ARTICLE 6 PRE-CLOSING COVENANTS 28

6.1Conduct of Business 28

6.3Efforts to Consummate; Cooperation 30

6.4Notices and Consents 31

6.6Public Announcements 33

6.7Update of Schedules; Knowledge of Breach 33

6.8GNCU Amended and Restated Loan Documentation 34

6.9Notification of Certain Matters 34

6.10Sale Order 34

ARTICLE 7 POST-CLOSING COVENANTS 34

7.1Access to Information; Books and Records 34

8.1Conditions to Each Party’s Obligation 38

8.2Conditions to Obligation of Purchaser 38

8.3Conditions to Obligations of the Seller 39

8.4Waiver of Condition; Frustration of Conditions 40

9.1Events of Termination 40

10.1Survival of Representations, Warranties and Covenants 41

10.2Entire Agreement 42

10.3Amendment; No Waiver 42

10.4Severability; Specific Versus General Provisions 42

10.5Expenses and Obligations 43

10.6Notices 43

10.7Counterparts 44

10.8Governing Law 44

10.10Waiver of Jury Trial 45

10.11Rights Cumulative 45

10.12Assignment 45

10.13Specific Enforcement; Remedies 45

10.14Third-Party Beneficiaries 46

10.15No Personal Liability of Directors, Officers and Owners 46

10.17Legal Representation 48

EXHIBITS

GNCU Letter

Loan Term Sheet

ASSET PURCHASE AGREEMENT

THIS ASSET PURCHASE AGREEMENT (this “Agreement”), dated as of August 31, 2023 is entered into by and between BOSCH BERRIES KENTUCKY OPERATIONS CORP., a Delaware corporation (“Purchaser”), and APPHARVEST PULASKI FARM, LLC, a Delaware limited liability company (the “Seller”).

RECITALS

WHEREAS, on June 23, 2023, (the “Petition Date”) AppHarvest, Inc. and its affiliates, including Seller, filed voluntary petitions for relief under chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the Southern District of Texas, Houston Division (the “Bankruptcy Court”) thereby commencing chapter 11 cases, Case No. 23-90745 (DRJ) (the “Bankruptcy Cases”);

WHEREAS, the Seller is a debtor-in-possession under the Bankruptcy Code and manages its properties and assets pursuant to Sections 1107(a) and 1108 of the Bankruptcy Code;

WHEREAS, the Seller is engaged in the Business and owns all of the Transferred

Assets;

WHEREAS, the Seller desires to sell (or cause to be sold) to Purchaser, and Purchaser desires to purchase from the Seller, all of the Transferred Assets Free and Clear, and the Seller desires Purchaser to assume, and Purchaser desires to assume from the Seller, all of the Assumed Liabilities, in each case upon the terms and subject to the conditions hereof, pursuant to a Sale Order and Sections 101(a), 363 and 365 of the Bankruptcy Code and Rules 6004 and 6006 of the Federal Rules of Bankruptcy Procedure;

WHEREAS, to facilitate the transactions contemplated by this Agreement, GNCU has provided the executed letter attached hereto as Exhibit A, expressing its commitment to satisfy any senior liens and encumbrances on the Owned Real Property as necessary to clear the title acquired by Purchaser; provided, that Purchaser is selected as the Successful Bidder (as defined in the Bid Procedures) (the “GNCU Letter”);

WHEREAS, the Transactions contemplated by this Agreement are subject to approval by the Bankruptcy Court and will only be consummated pursuant, among other things, to the Sale Order to be entered in the Bankruptcy Cases.

NOW, THEREFORE, in consideration of the premises and the mutual representations, warranties, covenants, agreements and conditions set forth herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto, intending to be legally bound, hereby agree as follows:

ARTICLE 1 DEFINED TERMS

1.1Defined Terms. The following terms shall have the following meanings in this Agreement:

“Action” means any action, proceeding, arbitration or litigation (whether civil, criminal or administrative) commenced, brought, conducted or heard by or before any Governmental Authority or arbitrator.

“Accounts Payable” means all trade accounts payable and other obligations of payment to any Person by Seller arising prior to the Closing Date to the extent attributable to a Transferred Asset or otherwise related to the Business, in each case, as determined in accordance with GAAP.

“Affiliate” of any particular Person means any other Person, directly or indirectly, controlling, controlled by, or under common control with, such particular Person. For the purposes of this definition, “control” (including, with correlative meaning, the terms “controlled by” and “under common control with”) means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through ownership of voting securities, by contract or otherwise.

“Agreement” has the meaning set forth in the preamble.

“Alternate Transaction” has the meaning set forth in Section 9.1(b).

“Amended and Assigned GNCU Loan Documentation” means the Loan Agreement among Seller (as borrower), AppHarvest Operations Inc. (as guarantor) and GNCU (as lender) and related documentation, as amended immediately prior to the Closing to forgive any outstanding accrued interest, forgive any existing defaults and to reduce the aggregate principal amount to

$[34,600,000], all on terms consistent with the Loan Term Sheet attached hereto as Exhibit B. “Antitrust Laws” has the meaning set forth in Section 6.5(b).

“Asset Tax Return” means a Tax Return relating to an obligation to pay Taxes that are determined based upon the ownership or operation of the Transferred Assets (but, for the avoidance of doubt, not including any Tax Returns relating to Taxes based on net or gross income or Transfer Taxes).

“Asset Taxes” means any Taxes with respect to the ownership or operation of the Transferred Assets other than (a) Taxes based on net or gross income, and (b) Transfer Taxes.

“Assigned Contracts” has the meaning set forth in Section 2.1(c).

“Assumed Liabilities” has the meaning set forth in Section 2.3.

“Assumption Notice” has the meaning set forth in Section 5.3(a).

“Attorney-Client Information” has the meaning set forth in Section 10.17. “Auction” has the meaning set forth in Section 5.2(b).

“Avoidance Actions” means any and all avoidance, recovery, subordination, or other claims, actions, or remedies that may be brought by or on behalf of the Seller or its estate or other authorized parties in interest under the Bankruptcy Code or applicable non-bankruptcy law, including actions or remedies under sections 502, 510, 542, 544, 545, and 547 through and including 553 of the Bankruptcy Code.

“Back-Up Bid” means the second highest or otherwise best bid if the successful bidder fails to consummate its bid in accordance with the Bid Procedures.

“Back-up Termination Date” means the first to occur of (a) forty-five (45) days after the entry of the Sale Order, (b) consummation of the Transactions with the winning bidder at the Auction,

(c) Purchaser’s receipt of notice from the Seller of the release by the Seller of Purchaser’s obligations under Section 5.2(b) and (d) the Outside Date.

“Bankruptcy Cases” has the meaning set forth in the Recitals. “Bankruptcy Code” has the meaning set forth in the Recitals. “Bankruptcy Court” has the meaning set forth in the Recitals.

“Bid Procedures” means those certain bidding procedures set forth as Exhibit 1 to the Bid Procedures Order, as such procedures may be amended from time to time thereafter in accordance with the Bid Procedures Order.

“Bid Procedures Order” means the Order (I)(A) Approving Bidding Procedures; (B) Approving the Selection of Stalking Horse Purchaser; (C) Approving the Debtors’ Entry Into the Stalking Horse APA and Approving Bid Protections; (D) Scheduling Auctions and Sale Hearing; (E) Approving Form and Manner of Sale Notice; (F) Approving Form and Manner of Potential Assumption and Assignment Notice; (G) Approving the Form and Manner of Post-Auction Notice; (H) Approving Assumption and Assignment Procedures; and (II) Granting Related Relief [Docket No. 298] entered on August 25, 2023.

“Business” means the business of owning and operating a business as a cultivator, grower, harvester, producer, packager, seller or marketer of protected agricultural grown fresh produce, including berries and cucumbers, at its facility located in Somerset, Kentucky.

“Business Day” means any day other than (a) a Saturday, Sunday or federal holiday or (b) a day on which commercial banks in Dallas, Texas are authorized or required to be closed.

“Closing” has the meaning set forth in Section 2.7.

“Closing Date” has the meaning set forth in Section 2.7.

“Code” means the Internal Revenue Code of 1986, or any successor law, and regulations issued by the IRS pursuant thereto.

“Competing Bid” has the meaning set forth in Section 5.1.

“Confirmation” means the entry by the Bankruptcy Court of an Order confirming the Joint Plan of Liquidation of AppHarvest Products, LLC and Its Debtor Affiliates (as may be amended, supplemented, or otherwise modified from time to time) pursuant to section 1129 of the Bankruptcy Code.

“Confidentiality Agreement” means that certain Confidentiality Agreement, dated on or about August 2023, by and between the Seller and an Affiliate of Purchaser.

“Consent” means any consent, approval, authorization, waiver or license.

“Contract” means any written agreement, mortgage, indenture, lease (whether for real or personal property), contract or subcontract.

“Contracting Parties” has the meaning set forth in Section 10.15

“Cure Costs” means any and all costs, expenses or actions that Purchaser is required to pay or perform to assume any of the Assigned Contracts pursuant to section 365(f) of the Bankruptcy Code.

“Deed” has the meaning set forth in Section 2.8(c)(ii).

“Designated Contracts” has the meaning set forth in Section 5.3(b). “Designation Deadline” has the meaning set forth in Section 5.3(b).

“Determined Cure Costs” means, in the aggregate, all Cure Costs payable in respect of the Assigned Contracts as determined pursuant to the Sale Order.

“DOJ” has the meaning set forth in Section 6.5(a).

“Enforceability Exceptions” means applicable bankruptcy, insolvency, reorganization, moratorium, receivership and similar Laws affecting the enforcement of creditors’ rights generally and general equitable principles.

“Environmental Laws” means any applicable Law relating to pollution or protection of the environment or worker health and safety (in respect of exposure to Hazardous Substances), including such Laws relating to the use, treatment, storage, disposal, Release or transportation of Hazardous Substances.

“ERISA” means the Employee Retirement Income Security Act of 1974.

“Estimated Unpaid Pre-Closing Asset Taxes” has the meaning set forth in Section 7.3(c).

“Excluded Assets” has the meaning set forth in Section 2.2.

“Excluded Books and Records” means the following originals and copies of those books and records, documents, data and information (in whatever form maintained) of the Seller and the Business: (i) all corporate minute books (and other similar corporate records) and stock records of the Seller, (ii) any books and records relating to the Excluded Assets or Taxes paid or payable by the Seller, (iii) all Tax Returns of the Seller, or (iv) any books, records or other materials that the Seller (x) is required by Law to retain (copies of which, to the extent permitted by Law, will be made available to Purchaser upon Purchaser’s reasonable request), (y) reasonably believes is necessary to enable it to prepare and/or file Tax Returns (copies of which will be made available to Purchaser upon Purchaser’s reasonable request) or (z) are prohibited by Law from delivering to Purchaser.

“Excluded Contracts” has the meaning set forth in Section 2.5. “Excluded Liabilities” has the meaning set forth in Section 2.4.

“Final Order” means an Order, judgment or other decree of the Bankruptcy Court or any other Governmental Authority of competent jurisdiction that has not been reversed, vacated, modified or amended, is not stayed and remains in full force and effect; provided, that such Order shall be considered a Final Order only after the time period for third parties seeking appeal has expired without the filing of any appeal or motion for reconsideration.

“Free and Clear” means free and clear of all Liens (other than the Permitted Liens and the Assumed Liabilities).

“FTC” has the meaning set forth in Section 6.5(a).

“GAAP” means generally accepted accounting principles in the United States as of the date hereof.

“GNCU” means Greater Nevada Credit Union, a domestic non-profit co-operative organized under the laws of the State of Nevada.

“GNCU Letter” has the meaning set forth in the Recitals.

“Governmental Authority” means any domestic or foreign national, provincial, state, multi-state or municipal or other local government, any subdivision, agency, commission or authority thereof, any court (including the Bankruptcy Court) or tribunal or any quasi-governmental or private body exercising any regulatory or taxing authority thereunder (including the IRS).

“Hazardous Substances” means any substances, materials or wastes which are defined as or included in the definition of “hazardous substances”, “hazardous wastes”, “hazardous materials”, “toxic substances”, “pollutants” or “contaminants” under any Environmental Law, including any petroleum or refined petroleum products, radioactive materials, friable asbestos or polychlorinated biphenyls.

“HSR Act” means the Hart-Scott-Rodino Antitrust Improvements Act of 1976.

“Intracompany Payables” means all account, note or loan payables recorded on the books of Seller or any of its Affiliates for goods or services purchased by or provided to the Business or advances (cash or otherwise), debt or any other extensions of credit to the Business by and/or among Seller or any of its Affiliates, whether current or non-current or due.

“Intellectual Property” means any and all intellectual property rights arising from the following:

(i) patents and patent applications; (ii) trademarks, service marks, trade dress, service names, trade names, brand names, logos, business names, corporate names and other source or business identifiers, all registrations and applications for registration thereof, and, in each case, together with all of the goodwill associated therewith; (iii) copyrights and all registrations and applications for registration thereof; (iv) trade secrets and know-how; and (v) internet domain name registrations.

“IRS” means the United States Internal Revenue Service.

“Knowledge” means (a) with regard to the Seller, the actual knowledge, without any implication of verification or investigation concerning such knowledge, of Tony Martin, Loren Eggleton, Gary Broadbent, and Jonathan Webb, in each case as of the date of this Agreement (or, with respect to a certificate delivered pursuant to this Agreement, as of the date of delivery of such certificate) and (b) with regard to Purchaser, the actual knowledge, without any implication of verification or investigation concerning such knowledge, of Tijmen van den Bosch as of the date of this Agreement (or, with respect to a certificate delivered pursuant to this Agreement, as of the date of delivery of such certificate).

“Law” means any federal, provincial, state, local law, ordinance, principle of common law, code, regulation or statute.

“Law Firm” means Sidley Austin LLP and its successors.

“Liabilities” shall mean debts, liabilities, duties, obligations or commitments of any nature whatsoever, whether direct or indirect, asserted or unasserted, known or unknown, absolute or contingent, accrued or unaccrued, matured or unmatured or otherwise, whenever or however arising (including whether arising out of any Contract or in a tort claim based on negligence or strict liability).

“Lien” means all forms of lien (including mechanic’s, contractor’s or other similar liens arising under or relating to the provision of goods or services on or to any Transferred Assets, and liens issued pursuant to Section 361, 363 or 364 of the Bankruptcy Code), encumbrance, defect or irregularity in title, pledge, mortgage, deed of trust, deed to secure debt, security interest, charge, transfer restriction or similar agreement or encumbrance, including any dedication under any gathering, transportation, treating, processing, fractionating, purchase, sale or similar agreements, or any other rights granted or consensual as or against any Transferred Assets including easements, encroachments, rights of first refusal, options, or any other interest or right in property that constitutes a lien or interest within the definition or adjudication of such terms under the Bankruptcy Code.

“Losses” means, with respect to any Person, any actual losses, Liabilities, claims, demands, judgments, damages, fines, suits, actions, out-of-pocket costs and expenses (including reasonable attorneys’ fees) against or affecting such Person; provided, however, that the parties hereto agree that “Losses” shall not include (a) any consequential, incidental, indirect, special, punitive, exemplary or treble damages, (b) calculations of damages or loss using loss of future revenue, income or profits or diminution of value, (c) damages based on a multiple of value or (d) loss of business reputation or opportunity.

“Material Adverse Effect” means a material adverse effect on the business, financial condition or results of operations of the Business (including the Transferred Assets and Assumed Liabilities) taken as a whole; provided, however, that none of the following shall be deemed (either alone or in combination) to constitute, and none of the following shall be taken into account in determining whether there has been or may be, a Material Adverse Effect: (a) any change in, or effects arising from or relating to, general business or economic conditions affecting any industry in which the Business operates; (b) any change in, or effects arising from or relating to, the United States or foreign economies, or securities, banking or financial markets in general, or other general business, banking, financial or economic conditions (including (i) any disruption in any of the foregoing markets, (ii) debt defaults or other restructuring events of any country with respect to which bondholders take a discount to the debt of any country or any increases in the interest rates for any country’s debt, (iii) any change in currency exchange rates,

(iv) any decline or rise in the price of any security, commodity, contract or index and (v) any increased cost, or decreased availability, of capital or pricing or terms related to any financing for the Transactions); (c) any change from, or effects arising from or relating to, the occurrence, escalation or material worsening of any act of God or other calamity, natural disaster, pandemic or disease, outbreak, hostility, act of war, sabotage, cyber-attack or terrorism or military action, unless such event disproportionately affects the Business as compared to other participants in Seller’s industry; (d) any action taken by Purchaser or its Affiliates with respect to the Transactions or with respect to the Business; (e) any action taken, or failed to be taken, by the Seller at the request of or with the consent of Purchaser or otherwise in compliance with the terms of this Agreement or any change from, or effects arising from or relating to, Purchaser’s failure to consent to any action restricted by Section 6.1; (f) any change in, or effects arising from or relating to changes in, Laws or accounting rules (including GAAP) or any interpretation thereof; (g) the failure of the Business to meet any of its projections, forecasts, estimates, plans, predictions, performance metrics or operating statistics or the inputs into such items (whether or not shared with Purchaser or its Affiliates or representatives); (h) national or international political, labor or social conditions; (i) any matter described in the Schedules; (j) the public announcement of, entry into or pendency of, actions required or contemplated by or performance of obligations under, this Agreement and the Transactions or the identity of the parties to this Agreement, including any termination of, reduction in or similar adverse impact on relationships, contractual or otherwise, with any customers, suppliers, financing sources, licensors, licensees, distributors, partners, employees or others having relationships with the Business; (k) the sale of any assets other than the Transferred Assets to any third parties by the Seller or any of its Affiliates; (l) any effect arising or resulting from or related to the filing of the Bankruptcy Cases;

(m) seasonal changes in the results of operations of the Seller; or (n) any epidemic, pandemic, outbreak of disease or other public health emergency (including COVID-19) or any escalation or worsening of any such conditions.

“Non-Transferred Asset” has the meaning set forth in Section 2.6. “Nonparty Affiliates” has the meaning set forth in Section 10.15. “Offer Date” has the meaning set forth in Section 7.4(a).

“Offered Employees” has the meaning set forth in Section 7.4(a).

“Order” means any award, decision, injunction, judgment, ruling or verdict entered, issued, made or rendered by any Governmental Authority or arbitrator.

“Organizational Documents” means (a) the articles or certificates of incorporation and the by-laws of a corporation, (b) the partnership agreement and any statement of partnership of a general partnership, (c) the limited partnership agreement and the certificate of limited partnership of a limited partnership, (d) the operating or limited liability company agreement and the certificate of formation of a limited liability company, (e) any charter, joint venture agreement or similar document adopted or filed in connection with the creation, formation or organization of a Person not described in clauses (a) through (d), and (f) any amendment to or equivalent of any of the foregoing.

“Outside Date” has the meaning set forth in Section 9.1(g).

“Owned Intellectual Property” means the Intellectual Property owned by the Seller or any of its Affiliates.

“Owned Real Property” has the meaning set forth in Section 3.6(a).

“Permit” means all permits, authorizations, license, registration, certificates, franchises, consents and other approvals from any Governmental Authority.

“Permitted Liens” means (a) zoning, entitlement and building regulations and land use restrictions; (b) covenants, conditions, restrictions, easements and other similar matters affecting title to Owned Real Property (in the case of clauses (a) and (b), which collectively do not materially impact the operations of the Business); (c) the Liens arising from the Amended and Assigned GNCU Loan Documentation; and (d) any Liens below $25,000 individually, not to exceed $100,000 in the aggregate.

“Person” means any individual, corporation (including any non-profit corporation), partnership, limited liability company, joint venture, estate, trust, association, organization, labor union or any other entity or Governmental Authority.

“Personal Information” means any information in the possession or control of the Seller (solely as related to the Business) about an identifiable individual other than the name, title or business address, business email address or telephone number of any employee of the Seller.

“Petition Date” has the meaning set forth in the Recitals.

“Public Health Measures” means any closures, “shelter-in-place,” “stay at home,” workforce reduction, social distancing, shut down, closure, curfew or other restrictions or any other Laws, Orders, directives, guidelines or recommendations issued by any Governmental Authority, the Centers for Disease Control and Prevention, the World Health Organization, or any industry group in connection with COVID-19 or any other epidemic, pandemic, or outbreak of disease, or in connection with or in response to any other public health conditions.

“Purchaser” has the meaning set forth in the preamble.

“Purchaser Group Members” has the meaning set forth in Section 10.17. “Purchaser Releasing Party” has the meaning set forth in Section 10.16(b).

“Related Claims” means all claims or causes of action (whether in contract or tort, in law or in equity, or granted by statute or otherwise) that may be based upon, arise out of or relate to this Agreement, the Related Documents and any other document or instrument delivered pursuant to this Agreement or the Related Documents, or the negotiation, execution, termination, validity, interpretation, construction, enforcement, performance or nonperformance of this Agreement or the Related Documents or otherwise arising from the Transactions or the relationship between the parties (including any claim or cause of action based upon, arising out of or related to any representation or warranty made in or in connection with, or as an inducement to enter into, this Agreement or the Related Documents).

“Related Documents” means the Deed and any other document, agreement, certificate or instrument entered into in connection with this Agreement; provided, however, that the Deed shall not be a Related Document solely for purposes of applying the provisions in Article 10 to the extent, and only to the extent, that any such document expressly conflicts with Article 10.

“Release” means any spilling, leaking, pumping, pouring, emitting, emptying, discharging, injecting, escaping, leaching, dumping, or disposing into the environment of any Hazardous Substances.

“Sale Motion” means the Debtors’ Emergency Motion for Entry of an Order (I) Approving the Sale of Assets to the Stalking Horse Bidder and/or Other Parties, (II) Authorizing Assumption and Assignment of Certain Executory Contracts and Unexpired Leases Related Thereto, and

(III) Granting Related Relief [Docket No. 303], filed on August 25, 2023.

“Sale Order” means an Order of the Bankruptcy Court issued pursuant to sections 105(a), 363 and 365 of the Bankruptcy Code in form and substance acceptable to Purchaser and the Seller, in each party’s commercially reasonable discretion, approving this Agreement and all of the terms and conditions hereof and approving and authorizing the Seller to consummate the Transactions contemplated hereby and the transfer and assignment of all of the Seller’s or its Affiliate’s rights, title and interest in the Transferred Assets to Purchaser on the terms and conditions set forth herein Free and Clear (including of any successor liability) to the maximum extent permitted by Section 363(f) of the Bankruptcy Code and containing a finding that Purchaser has acted in “good faith” within the meaning of Section 363(m) of the Bankruptcy Code.

“Seller” has the meaning set forth in the preamble.

“Seller Benefit Plan” means each employee benefit plan, program, agreement, policy or arrangement covering one or present or former employees of the Business, and which is maintained or contributed to by Seller or any Affiliate of Seller.

“Seller Permits” has the meaning set forth in Section 3.4(b).

“Seller Releasing Party” has the meaning set forth in Section 10.16(a) “Seller Schedules” has the meaning set forth in Article 3.

“Seller Tax Claim” has the meaning set forth in Section 7.3(e).

“Solvent” when used with respect to any Person, means that, as of any date of determination,

(a) the fair salable value (determined on a going concern basis) of its assets and property will, as of such date, exceed the amounts required to pay its debts as they become absolute and mature, as of such date, (b) such Person will have adequate capital to carry on its business and (c) such Person will be able to pay its debts as they become absolute and mature, in the ordinary course of business, taking into account the timing of and amounts of cash to be received by it and the timing of and amounts of cash to be payable on or in respect of its indebtedness.

“Successful Bidder” shall mean, if an Auction is conducted, the prevailing party designated by the Seller with respect to the Transferred Assets at the conclusion of such Auction.

“Tax” means any tax (including any income tax, franchise tax, branch profits tax, capital gains tax, value-added tax, sales tax, use tax, property tax, personal property tax, transfer tax, payroll tax, social security tax or withholding tax), and any related fine, penalty, interest, or addition to tax with respect thereto, imposed, assessed or collected by or under the authority of any Governmental Authority.

“Tax Return” means any return (including any information return), report, statement, schedule, notice, form, or other document or information (whether in tangible, electronic or other form), including any amendments, schedules attachments, supplements, appendices and exhibits thereto, filed with or submitted to, or required to be filed with or submitted to, any Governmental Authority in connection with the determination, assessment, collection, or payment, of any Tax.

“Transactions” means the transactions contemplated by this Agreement and the Related Documents.

“Transferring Employees” has the meaning set forth in Section 7.4(a). “Transfer Taxes” has the meaning set forth in Section 2.10. “Transferred Assets” has the meaning set forth in Section 2.1.

1.2Other Definitional and Interpretive Matters.

(a)Unless otherwise expressly provided, for purposes of this Agreement and the Related Documents, the following rules of interpretation shall apply:

(i)Calculation of Time Period. All references to a day or days shall be deemed to refer to a calendar day or days, as applicable, unless otherwise specifically provided. When calculating the period of time before which, within which or following which any act is to be done or step taken pursuant to this Agreement, the date that is the reference date in calculating such period shall be excluded. If the last day of such period is a non-Business Day, the period in question shall end on the next succeeding Business Day.

(ii)Dollars. Any reference to $ shall mean U.S. dollars, which is the currency used for all purposes in this Agreement and the Related Documents. The specification of any dollar amount in the representations and warranties or otherwise in this Agreement, the Related Documents or the Schedules is not intended and shall not be deemed to be an admission or acknowledgement of the materiality of such amounts or items, nor shall the same be used in any dispute or controversy between the parties hereto to determine whether any obligation, item or matter (whether or not described herein or included in any schedule) is or is not material for purposes of this Agreement, the Related Documents or the Schedules.

(iii)Exhibits/Schedules. The Exhibits and Schedules to this Agreement are an integral part of this Agreement. All Exhibits and Schedules annexed hereto or referred to herein are hereby incorporated in and made a part of this Agreement as if set forth in full herein. Any matter or item disclosed on one Schedule shall be deemed to have been disclosed on each other Schedule. Disclosure of any item on any Schedule shall not constitute an admission or indication that any such item is required to be disclosed, or that such item or matter is material or has resulted in or will result in a Material Adverse Effect or that the included items or actions are not in the ordinary course of business. No disclosure on a Schedule relating to a possible breach or violation of any Contract, Law or Order shall be construed as an admission or indication that a breach or violation exists or has actually occurred. Any capitalized terms used in any Schedule or Exhibit but not otherwise defined therein shall be defined as set forth in this Agreement.

(iv)Gender and Number. Any reference to gender shall include all genders, and words imparting the singular number only shall include the plural and vice versa.

(v)Headings. The provision of a table of contents, the division of this Agreement or Related Documents into articles, sections and other subdivisions and the insertion of headings are for convenience of reference only and shall not affect or be utilized in construing or interpreting this Agreement or Related Document, as applicable. Unless otherwise specified, all references in this Agreement to any “Section” or other subdivision are to the corresponding section or subdivision of this Agreement, and all

references in a Related Document to any “Section” or other subdivision are to the corresponding section or subdivision of such Related Document.

(vi)Herein. The words such as “herein,” “hereinafter,” “hereof” and “hereunder” that are used in this Agreement refer to this Agreement as a whole and not merely to a subdivision in which such words appear unless the context otherwise requires. Uses of such words in the Related Documents shall refer to such Related Document as a whole and not merely to a subdivision in which such words appear unless the context otherwise requires.

(vii)Or. The word “or” shall be construed in the inclusive sense of “and/or” unless otherwise specified.

(viii)Including. The word “including”, or any variation thereof, means (unless the context of its usage otherwise requires) “including, without limitation” and shall not be construed to limit any general statement that it follows to the specific or similar items or matters immediately following it.

(ix)Successors. A reference to any party to this Agreement, any Related Document or any other agreement or document shall include such party’s successors and permitted assigns.

(x)Legislation. A reference to any legislation or to any provision of any legislation shall include any amendment thereto, and any modification or re-enactment thereof, any legislative provision substituted therefor, and all regulations and statutory instruments issued thereunder or pursuant thereto.

(xi)Reflected On or Set Forth In. An item arising with respect to a specific representation or warranty shall be deemed to be “reflected on” or “set forth in” a balance sheet or financial statement, to the extent any such phrase appears in such representation or warranty, if (a) there is a reserve, accrual or other similar item underlying a number on such balance sheet or financial statement that relates to the subject matter of such representation, (b) such item is otherwise specifically set forth on the balance sheet or financial statement or (c) such item is set forth in the notes to the balance sheet or financial statement.

(xii)Made Available. Any reference in this Agreement to “made available” means a document or other item of information that was provided or made available to Purchaser or its representatives in any “data rooms,” “virtual data rooms,” management presentations or in any other form in expectation of, or in connection with, the Transactions.

(b)All representations and warranties set forth in this Agreement or the Related Documents are contractual in nature only and subject to the sole and exclusive remedies set forth herein. No Person is asserting the truth of any representation and warranty set forth in this Agreement or the Related Documents; rather, the parties have agreed that should any representations and warranties of any party prove untrue, the other parties shall have the specific rights and remedies herein specified as the exclusive remedy therefor, but that no other rights,

remedies or causes of action (whether in law or in equity or whether in contract or in tort or otherwise) are permitted to any party hereto as a result of the untruth of any such representation and warranty. The phrase “to Seller’s Knowledge” and phrases of similar import or effect are used herein to qualify and limit the scope of any representation or warranty in which they appear and are not affirmations of any Person’s “superior knowledge” that the representation or warranty in which they are used is true.

(c)The parties hereto have participated jointly in the negotiation and drafting of this Agreement and the Related Documents and, in the event an ambiguity or question of intent or interpretation arises, this Agreement and the Related Documents shall be construed as jointly drafted by the parties hereto and no presumption or burden of proof shall arise favoring or disfavoring any party by virtue of the authorship of any provision of this Agreement and the Related Documents. The parties hereto agree that changes from earlier drafts to the final version of this Agreement do not necessarily imply that the party agreeing to such change is agreeing to a change in meaning (as the party agreeing to such change may believe the change is stylistic and non-substantive); consequently, no presumption should exist by virtue of a change from a prior draft.

ARTICLE 2

THE PURCHASE AND SALE; CLOSING

2.1Purchase and Sale. Upon the terms and subject to the conditions set forth in this Agreement and the Sale Order, at the Closing, in exchange for an aggregate payment from Purchaser to the Seller equal to the Purchase Price, Purchaser shall purchase, assume and accept from the Seller, and the Seller shall sell, transfer, assign, convey and deliver (or shall cause the sale, transfer, assignment, conveyance and delivery) to Purchaser, Free and Clear, all of the rights, title and interests in, to and under the following assets and interests used primarily in connection with the Business (collectively, the “Transferred Assets”):

(a)all supplies and other inventories purchased for use in the Business or produced in the Business, including all crops, finished goods, raw materials, work in progress, packaging, supplies and parts whether held at any location or facility of Seller or any of its Affiliates or in transit to Seller or any of its Affiliates;

(b)to the extent transferable, the Permits held by Seller or its Affiliates (including any applications that are in process) exclusively used in the Business;

(c)subject to the provisions of Section 5.3, each Seller Contract listed on Schedule 2.1(c) (excluding any such Seller Contracts that expire or are terminated prior to the Closing), and all Designated Contracts that Purchaser elects to assume pursuant to Section 5.3 (collectively, the “Assigned Contracts”);

(d)all material original books and records, documents, data and information of the Seller to the extent related to the Business, other than the Excluded Books and Records; provided, however, that the Seller shall be entitled to retain copies of any such materials;

(e)the Owned Real Property, including, in each case, all of the right, title and interest of the Seller to all building structures or improvements thereon, and all easements and other rights and interests appurtenant thereto and any associated rights to off-site parking;

(f)all equipment and other tangible personal property, including furniture and fixtures, computers, networking equipment, industrial farming and maintenance equipment and supplies, including those assets listed on Schedule 2.1(f);

(g)all of the Seller’s rights, claims or causes of action against third parties to the extent related to the Transferred Assets and the Assumed Liabilities (including all guaranties, warranties, indemnities and similar rights in favor of the Seller or any of its Affiliates to the extent related to the Transferred Assets or the Assumed Liabilities), in each case, whether arising by way of counterclaim or otherwise, and whether arising out of transactions occurring prior to, on or after the Closing Date; and

(h)all prepaid expenses, claims, rights to insurance policy proceeds, deposits (including any utility and security deposits and escrows under the Owned Real Property), prepayments, refunds, causes of action, demands, actions, suits, choses in action, rights of recovery, rights under guarantees, warranties, indemnities and all similar rights against third parties, rights of setoff and rights of recoupment, in each case, to the extent used in or held for use for the Transferred Assets listed in clauses (a) through (g) above or the Assumed Liabilities but excluding any refunds of Taxes to the extent included in Section 2.2(f) and any prepayments or deposits of any Asset Taxes prior to the date hereof for which the Seller shall receive credit to the extent provided in Section 7.3(c).

2.2Excluded Assets. Notwithstanding the provisions of Section 2.1 or anything to the contrary herein, any and all assets, rights and properties of the Seller that are not specifically identified in Section 2.1 as Transferred Assets (collectively, the “Excluded Assets”), including those listed in this Section 2.2, shall be retained by the Seller, and Purchaser and its designees shall acquire no right, title or interest in the Excluded Assets in connection with the Transaction:

(a)all (i) cash and cash equivalents, wherever located, including bank balances and bank accounts or safe deposit boxes, monies in the possession of any banks, checks, funds in time and demand deposits, savings and loans or trust companies and similar cash items, (ii) escrow monies and deposits in the possession of landlords and utility companies, and (iii) investment securities and other short- and medium-term investments;

(b)all of the Seller’s right, title and interest in Owned Intellectual Property;

(c)any interest of the Seller under this Agreement or the Related Documents, including the right to receive the Purchase Price and to enforce the Seller’s rights and remedies thereunder;

(d)all Excluded Contracts and Contracts, other than the Designated Contracts, to which the Seller or any of its respective Affiliates is a party;

(e)any (i) Attorney-Client Information arising from communications between the Seller (including any one or more officers, directors or stockholders), on the one hand, and its

counsel, on the other hand, and (ii) claims under any director and officer, errors and omissions, fiduciary and commercial crime insurance policies;

(f)(i) all Tax assets and attributes of the Seller, (ii) all rights to Tax refunds or credits of the Seller, (iii) any rights to Tax refunds or credits paid by or on behalf of the Seller or attributable to any taxable period (or portion thereof) ending on or before the Closing Date other than refunds of Asset Taxes allocable to Purchaser pursuant to Section 7.3(c), and (iv) all rights to Tax refunds or credits with respect to any Excluded Asset or Excluded Liability;

(g)all Permits (including applications therefor and any trade or import/export Permits) to the extent (i) not related to the Business or (ii) not transferable to Purchaser under applicable Law;

(h)the Excluded Books and Records;

(i)any shares or other interests in any Person or any securities of any Person;

(j)all invoices, shipping documents, purchase orders and other preprinted business forms;

(k)all cash in Seller’s adequate assurance account relating to utilities under Section 366 of the Bankruptcy Code;

(l)any and all proceeds relating to any and all bonds, letters of credit, guarantees or other security provided by the Seller related to the Excluded Contracts;

(m)all prepaid expenses related to the Excluded Contracts;

(n)any assets not otherwise designated as Transferred Assets or from time to time designated by the parties hereto as Excluded Assets;

(o)the Avoidance Actions;

(p)all of the Seller’s rights, claims or causes of action against third parties relating to the assets, properties, business or operations of the Seller (including all guaranties, warranties, indemnities and similar rights in favor of the Seller or any of its Affiliates) to the extent arising under the Bankruptcy Code and relating to any of the Excluded Assets or Excluded Liabilities, in each case, whether arising by way of counterclaim or otherwise, and whether arising out of transactions occurring prior to, on or after the Closing Date;

(q)all consideration received by the Seller or its Affiliates pursuant to, and all rights of the Seller and its Affiliates under, this Agreement or any Related Document, subject to the terms hereof and thereof;

(r)all Seller Benefit Plans; and

(s)all prepaid expenses, claims, deposits, prepayments, refunds, causes of action, demands, actions, suits, rights of recovery, rights under guarantees, warranties (express or

implied), indemnities and all similar rights against third parties, rights of setoff and rights of recoupment, in each case, to the extent related to or used in or held with use for the Excluded Assets listed in clauses (a) through (r) above.

Notwithstanding anything to the contrary contained in this Agreement or any of the other Related Documents, Purchaser acknowledges and agrees that all of the following are also Excluded Assets, and all right, title and interest in and to all Excluded Assets shall be retained by the Seller and shall remain the property of the Seller (and shall expressly be excluded from the sale, transfer, assignment and conveyance to Purchaser hereunder), and neither Purchaser nor any of its Affiliates shall have any interest therein: (x) all records and reports prepared or received by the Seller or any of its Affiliates in connection with the sale of the Business and the Transactions, including all analyses relating to the Business or Purchaser so prepared or received; and (y) all confidentiality agreements with prospective purchasers of the Business or any portion thereof and all bids and expressions of interest received from third parties with respect thereto.

2.3Assumption of Liabilities. On the terms and subject to the conditions set forth in this Agreement, Purchaser shall, effective as of the Closing, assume and agree to pay, discharge and perform in accordance with their terms all Liabilities of the Seller to the extent related to the Business or the Transferred Assets as the same shall exist on the Closing Date and irrespective of whether the same shall arise prior to, on or after the Closing Date (collectively, the “Assumed Liabilities”), including:

(a)all Liabilities arising under the Designated Contracts, whether incurred or arising prior to, at or after the Closing, and all of the Determined Cure Costs;

(b)all Taxes for which Purchaser is liable pursuant to this Agreement;

(c)all Determined Cure Costs;

(d)all Liabilities relating to the Transferring Employees arising from their employment by the Purchaser after the Closing; and

(e)all Liabilities arising out of or relating to any action, charge, claim (including any cross-claim or counter-claim), suit, litigation, arbitration, proceeding (including any civil, criminal, administrative, investigative or appellate proceeding), hearing, inquiry, audit, examination or investigation with respect to the Business relating exclusively to any period after the Closing.

2.4Excluded Liabilities. Notwithstanding anything to the contrary set forth in this Agreement or in any of the other Related Documents, the parties hereto expressly acknowledge and agree that, except as set forth in Section 2.3, Purchaser will not assume, be obligated to pay, perform or otherwise discharge or in any other manner be liable or responsible for, any Liabilities of Seller, including those arising from or in connection with the Transferred Assets of the Business, or for any Action against Seller or relating to the Transferred Assets or the Business, whether existing on the Closing or arising thereafter as a result of any act, omission, event, thing or circumstances taking place or not taking place prior to the Closing, including the

following (all such Liabilities that Purchaser is not assuming being referred to collectively, as the “Excluded Liabilities”):

(a)all Taxes for which Seller is liable pursuant to this Agreement;

(b)all Liabilities relating to or arising out of the Excluded Assets;

(c)all product Liability or similar claims for injury to a Person or property which arises out of or is based upon any express or implied representation, warranty, agreement or guaranty made by Seller or based on any tort claim, or by reason of the improper performance or malfunctioning of a product, improper design or manufacture, failure to adequately package, label or warn of hazards or other related product defects of any products at any time manufactured or sold or any service performed by Seller prior to the Closing Date;

(d)all recall, design defect, improper installation, manufacturing defect or similar or related claims of any products manufactured or sold or any service performed by Seller prior to the Closing Date;

(e)all Liabilities arising under or in connection with any Seller Benefit Plan or any other present or former employee benefit plan providing benefits to any present or former employee of Seller or any Seller’s Affiliate, whenever incurred;

(f)all Liabilities arising out of, relating to or resulting from any present or former employees, officers, directors, independent contractors or consultants of Seller, whenever incurred, including Liabilities for wages or other work-related benefits, bonuses, fees, accrued vacation, unused paid time off, workers’ compensation, employee deferred compensation including stock option plans, equity grants, other grants and agreements, severance, retention, termination or other payments, except for the Liabilities assumed in Section 2.3(d);

(g)all Accounts Payable;

(h)all pre-Closing Liabilities of the Business relating to or arising from unfulfilled commitments, quotations, purchase orders, customer orders or work orders that do not constitute part of the Transferred Assets or Assumed Liabilities including without limitation undetermined or inchoate liens, charges and privileges (including mechanics’, construction, carriers’, workers’, repairers’, storers’ or similar liens), except to the extent arising under a Designated Contract;

(i)all Liabilities to indemnify, reimburse, or advance amounts to any present or former officer, director, employee, agent or independent contractors of Seller (including with respect to any breach of fiduciary obligations by the same) to the extent such Liabilities relate to conduct that was undertaken prior to Closing;

(j)all Liabilities under the Excluded Contracts and Intracompany Payables (and/or resulting from the termination of any Intracompany Payables);

(k)all Liabilities associated with debt, loans, notes, bonds, guarantees, indemnifications or credit facilities of Seller and/or the Business or the Transferred Assets, except to the extent arising under a Designated Contract; and

(l)all Liabilities arising out of, in respect of, or in connection with the failure by Seller to comply with any Law prior to the Closing Date, except to the extent arising under an Designated Contract.

2.5Excluded Contracts. Pursuant to Section 5.3(b), Purchaser shall be entitled, in its sole discretion, by written notice to the Seller up to three Business Days prior to the Closing Date, to elect not to purchase or assume one or more Assigned Contract, in which case, notwithstanding anything in this Agreement or any Related Document to the contrary, such Assigned Contract shall be considered an excluded contract (“Excluded Contract”) (and shall constitute an Excluded Asset and not be included in the Transferred Assets) for all purposes of this Agreement and Purchaser shall not have any obligation to satisfy or pay any Cure Costs or other Liabilities with respect to such Excluded Contract. Each assignable Assigned Contract that Purchaser does not elect to remove from the list of Assigned Contracts pursuant to Section 5.3(b) shall be a Designated Contract.

2.6Nontransferable Assets and Liabilities. Notwithstanding any other provision of this Agreement to the contrary, this Agreement shall not constitute an agreement to assign or transfer any Transferred Asset or any claim, right or benefit arising thereunder or resulting therefrom if an attempted assignment or transfer thereof, without the Consent of a third party (including any Governmental Authority) (after giving effect to the Sale Order or any other applicable order of the Bankruptcy Court that effects such transfer without any required Consents), would constitute a breach or other contravention thereof or a violation of Law (each, a “Non-Transferred Asset”).

2.7Closing. The closing of the Transactions (the “Closing”) will take place remotely by electronic exchange of documents on the date (the “Closing Date”) that is the second Business Day after the date on which all of the conditions set forth in Article 8 (excluding conditions that, by their terms, are to be satisfied at the Closing, but subject to the satisfaction or waiver of all such conditions at the Closing), have been satisfied or waived by the party hereto entitled the benefit of the same, unless another time or date is agreed to in writing by the parties hereto. Except as otherwise set forth herein, all proceedings to be taken and all documents to be executed and delivered by all parties hereto at the Closing will be deemed to have been taken and executed simultaneously and no proceedings will be deemed to have been taken nor documents executed or delivered until all have been taken, executed and delivered.

2.8Closing Deliveries of the Parties. At or prior to the Closing:

(a)Purchaser and the Seller shall deliver to one another the Related Documents and such instruments of assumption and other instruments or documents, including bills of sale and/or assignment and assumption agreements, in form and substance reasonably acceptable to Purchaser and Seller, as may be necessary to effect Purchaser’s assumption of the Assumed Liabilities and the assignment of any Transferred Assets, including the Designated

Contracts, to Purchaser in accordance with the requirements of applicable Law and this Agreement, in each case duly executed by Purchaser and the Seller.

(b)Purchaser shall deliver, or cause to be delivered, to the Seller or the applicable Person each of the following:

(i)a certificate, dated as of the Closing Date, executed by or on behalf of Purchaser as to the satisfaction of the conditions set forth in Section 8.3(a) and Section 8.3(b); and

(ii)evidence reasonably satisfactory to the Seller of execution and delivery of the Amended and Assigned GNCU Loan Documentation;

(iii)the Determined Cure Costs set forth in Section 5.3(c).

(c)the Seller shall deliver, or cause to be delivered, to Purchaser or the applicable Person each of the following:

(i)a certificate, dated as of the Closing Date, executed by or on behalf of the Seller as to the satisfaction of the conditions set forth in Section 8.2(a) and Section 8.2(b);

(ii)a copy of the Sale Order as entered by the Bankruptcy Court, vesting the Transferred Assets in Purchaser Free and Clear;

(iii)a special warranty deed conveying fee simple to the Owned Real Property (the “Deed”), subject to Permitted Encumbrances, and an Owner’s Affidavit in the form and substance reasonably acceptable to the Seller and Purchaser, good standing certificates and authorizing documents;

(iv)the Estimated Unpaid Asset Taxes to the corresponding Governmental Authority; and

(v)an IRS Form W-9 with respect to the Seller, duly completed and

executed.

2.9Purchase Price; Assumed Liabilities; Deposits.

(a)At the Closing, upon the terms and subject to the conditions set forth herein, in full consideration for the sale, transfer, conveyance, assignment and delivery of the Transferred Assets to Purchaser, Purchaser shall enter into the Amended and Assigned GNCU Loan Documentation, the principal amount of which together with the amount disbursed by GNCU to satisfy its obligations under the GNCU Letter will constitute the purchase price (the “Purchase Price”).

(b)At the Closing, on the terms and subject to the conditions set forth in this Agreement, Purchaser will assume and become responsible for the Assumed Liabilities. Purchaser agrees to pay, perform, honor, and discharge, or cause to be paid, performed, honored

and discharged, all Assumed Liabilities in a timely manner in accordance with the terms hereof, including paying or causing to be paid, at or prior to the Closing, all Determined Cure Costs.

2.10Transfer Taxes. It is the intention of the Purchaser and the Seller that any Transactions closing after the Confirmation be exempt from all transfer, documentary, sales, use, excise, stock transfer, value-added, stamp, recording, registration and other similar taxes, levies and fees (including any penalties, fines and interest), together with any conveyance fees, recording charges and other similar fees and charges, incurred in connection with this Agreement and the Transactions (collectively, “Transfer Taxes”) pursuant to Bankruptcy Code section 1146(a). Purchaser and the Seller shall cooperate in good faith to minimize, to the extent permissible under applicable Law, the amount of any Transfer Taxes due with respect to the Transactions. In the event any Transfer Taxes are required to be paid with respect to the Transactions, Seller shall be solely responsible for such Transfer Taxes and shall indemnify, defend and hold harmless the Purchaser against any such Transfer Taxes.

2.11Allocation of Purchase Price.

(a)Reasonably promptly after the Closing Date, but no later than 45 days thereafter, Purchaser will prepare and deliver to the Seller, an allocation schedule setting forth the Purchase Price, Assumed Liabilities, and any other items that are treated as consideration paid by Purchaser for applicable Tax purposes to be allocated among the Transferred Assets, pursuant to (and to the extent necessary to comply with) Section 1060 of the Code and the applicable regulations promulgated thereunder (the “Proposed Allocation Statement”). The Seller will have 20 Business Days following delivery of the Proposed Allocation Statement during which to notify Purchaser in writing (an “Allocation Notice of Objection”) of any objections to the Proposed Allocation Statement, setting forth in reasonable detail the basis of its objections. If the Seller fail to deliver an Allocation Notice of Objection in accordance with this Section 2.11(a), the Proposed Allocation Statement will be conclusive and binding on all parties and will become the “Final Allocation Statement.” If the Seller submits an Allocation Notice of Objection, then for 20 Business Days after the date that Purchaser receives the Allocation Notice of Objection, Purchaser and the Seller will use their commercially reasonable efforts to agree on the allocations in good faith. Failing such agreement within 20 Business Days of such notice, the unresolved allocations will be submitted to an independent, nationally recognized accounting firm mutually agreeable to Purchaser and the Seller, which firm will be instructed to determine its best estimate of the allocation schedule based on its determination of the unresolved allocations and provide a written description of the basis for its determination within 45 Business Days after submission, such written determination to be final, binding and conclusive. The allocations determined by such accounting firm (or those on the Proposed Allocation Statement to the extent the Seller did not object) will be conclusive and binding on all parties and will become the “Final Allocation Statement.” The fees and expenses of such accounting firm will be paid by and apportioned between the Seller and Purchaser based on the aggregate dollar amount in dispute and the relative recovery as determined by the accounting firm or the Seller and Purchaser, respectively (such that, by way of example, if the amount in dispute is $100 and it is resolved $70 in favor of the Purchaser and $30 in favor of the Seller, then the Seller would bear 70% of the fees and expenses of such accounting firm and Purchaser would bear 30% of the fees and expenses).

(b)Except to the extent otherwise required by a “determination” within the meaning of Section 1313(a) of the Code or by applicable Law, or as agreed to between the parties as a result of any proposed assessment or reassessment by a relevant Tax authority, the Seller and Purchaser and their respective Affiliates will report, act and file Tax Returns (including IRS Form 8594) in all respects and for all purposes consistent with the Final Allocation Statement and neither the Seller nor Purchaser will take any position (whether in audits, Tax Returns, or otherwise) that is inconsistent with the Final Allocation Statement.

ARTICLE 3

REPRESENTATIONS AND WARRANTIES OF THE SELLER

Except as disclosed in a document herewith delivered by the Seller to Purchaser (the “Seller Schedules”), the Seller hereby makes the representations and warranties contained in this Article 3 to Purchaser.

3.1Organization, Good Standing and Other Matters. The Seller is duly organized, validly existing and in good standing under the Laws of its jurisdiction of organization and has, subject to the necessary authority of the Bankruptcy Court, the requisite limited liability company power and authority to operate the Business and necessary to own, lease or operate the properties and assets owned, leased or operated by it to carry on the Business as now being conducted, except where the failure to be so duly organized, validly existing and in good standing, or to have such power and authority, would not, individually or in the aggregate, have a Material Adverse Effect. The Seller is duly qualified to do business as a foreign limited liability company in each jurisdiction in which the nature of the Business as currently conducted by it or the property owned or leased by it makes such qualification necessary, except where the failure to be so qualified would not, individually or in the aggregate, have a Material Adverse Effect.

3.2Authority and Enforceability. Subject to Bankruptcy Court approval, the Seller has all requisite power and authority to execute and deliver this Agreement and each of the Related Documents to which it is (or at Closing, will be) a party and to perform its obligations hereunder and thereunder and to consummate the Transactions. The execution, delivery and performance of this Agreement and the each of the Related Documents to which the Seller is (or at Closing, will be) a party thereto, and the consummation by the Seller of the Transactions, has been duly authorized and approved by all necessary limited liability company action on the part of the Seller and are subject to the approval of the Bankruptcy Court. This Agreement has been, and each Related Document will be, at or prior to the Closing, duly executed and delivered by the Seller and, assuming the due execution and delivery by the other parties hereto or thereto, and subject to the approval of the Bankruptcy Court, constitutes a valid and binding obligation of the Seller, enforceable against it in accordance with its respective terms, except to the extent that such enforceability may be subject to, and limited by, the Enforceability Exceptions.

3.3No Conflict; Required Filings and Consents. Except (a) as required by the HSR Act and any other Antitrust Laws that require the consent, waiver, approval, Order or Permit of, or declaration or filing with, or notification to, any Person or Governmental Authority, (b) such filings as may be required in connection with the Transfer Taxes described in Section 2.10 and

(c)as otherwise set forth on Schedule 3.3, the execution and delivery of this Agreement by the Seller does not and the execution and delivery of the Related Documents by the Seller will not,

and the consummation of the Transactions hereby and thereby will not (i) violate the provisions of the Organizational Documents of the Seller, (ii) subject to the entry of the Sale Order, violate any Law or Order to which the Seller is subject or by which its properties or assets are bound,

(iii) require the Seller to obtain any Consent, or give any notice to, or make any filing with, any Governmental Authority on or prior to the Closing Date (except as required by the Bankruptcy Code or the Sale Order), (iv) subject to the entry of the Sale Order, result in a breach of or constitute a default (with or without due notice or lapse of time or both), give rise to any right of termination, cancellation or acceleration under, or require the Consent of any third party to, any Assigned Contract or (v) subject to the entry of the Sale Order, result in the imposition or creation of any Lien upon or with respect to any of the assets or properties of the Seller; excluding from the foregoing clauses (ii) through (v) any Consents, approvals, notices and filings the absence of which, and violations, breaches, defaults, rights of acceleration, cancellation or termination, and Liens, the existence of which would not, individually or in the aggregate, have a Material Adverse Effect.

3.4Compliance With Laws; Permits.

(a)Except as set forth on Schedule 3.4(a), to the Seller’s Knowledge, (i) the Seller is conducting the Business in compliance in all material respects with all material Laws applicable to the Business and (ii) the Seller has not received any written notice since the Petition Date of any material violations of any material Law applicable to its conduct of the Business.

(b)Except as set forth on Schedule 3.4(b), to the Seller’s Knowledge, (i) the Seller possess all material Permits required for the operation of the Business as currently conducted (the “Seller Permits”) and (ii) the Seller has not received as of the date hereof any written notice of any cancellation, suspension, revocation, invalidation or non-renewal of any Permit since the Petition Date.

3.5Litigation. Except as set forth on Schedule 3.5, there is no Action pending or, to the Seller’s Knowledge, formally threatened in writing, against the Seller before any Governmental Authority that would have a Material Adverse Effect or affect the Transferred Assets in any material respect after the entry of the Sale Order, if determined adversely and after taking into effect applicable insurance coverage.

3.6Real Property; Personal Property.

(a)Schedule 3.6(a) lists the addresses for the material real property owned by the Seller or an Affiliate that is used for, held for use in or otherwise related to the Business (the “Owned Real Property”). Except as set forth on Schedule 3.6(a), the Seller or an Affiliate has fee simple title to such Owned Real Property and shall deliver title to the Owned Real Property at Closing, Free and Clear.

(b)Schedule 3.6(b) sets forth a list of all leases of tangible assets and other personal property of the Seller as of the date hereof involving annual payments in excess of

$100,000. The Seller has good and valid title to, or in the case of leased tangible assets and other personal property, a valid leasehold interest in (or other right to use), all of the material tangible

assets and other personal property that are necessary for the Seller to conduct the Business (including the Transferred Assets set forth in Sections 2.1(a), (e) and (f)) in each case, Free and Clear. All such material tangible assets, fixtures and personal property are in good condition and repair, normal wear and tear excepted.

3.7Environmental Matters. Except for matters that relate to an Excluded Liability or as disclosed on Schedule 3.8:

(a)the Business and the Transferred Assets are in compliance in all material respects with all applicable Environmental Laws;

(b)there are no written notices, writs, injunctions, decrees, Orders or judgments outstanding, or any actions, suits, proceedings or investigations pending or threatened, relating to compliance with or material Liability under any Environmental Law affecting the Business or the Owned Real Property; and

(c)there has been no waste generated or released by Seller or any of its Affiliates or any legally responsible predecessor corporation of Seller, that has given or could reasonably be expected to give rise to any Liability under any Environmental Law for which the Business would incur material Liability.

3.8Assigned Contracts. With respect to the Assigned Contracts, except as set forth on Schedule 3.8, (i) as of the Petition Date except as a result of, or arising in connection with, the filing of the Bankruptcy Cases, the Seller has not received any written notice of any default or event that (with due notice or lapse of time or both) would constitute a default by the Seller under any Assigned Contract, other than defaults that have been cured or waived in writing or would not reasonably be expected to have a Material Adverse Effect, (ii) to the Seller’s Knowledge, each Assigned Contract is a legal, valid and binding obligation of the Seller and is in full force and effect (except to the extent subject to, and limited by, the Enforceability Exceptions) and (iii) to the Seller’s Knowledge, no other party to any Assigned Contract is (with or without the lapse of time or the giving of notice, or both) in material breach of or in material default under any Assigned Contract. The Seller has made available to Purchaser true, correct and complete copies of each of the Assigned Contracts listed on Schedule 3.8, together with all amendments thereto.

3.9Brokers and Finders. Except as set forth on Schedule 3.9, the Seller has not, directly or indirectly, entered into any agreement with any Person that would obligate the Seller to pay any commission, brokerage fee or “finder’s fee” in connection with the Transactions.

3.10Employees. The Seller is not a party to any collective bargaining agreement or other agreement with a labor union or like organization covering any of the Transferring Employees. As of the date hereof, there is no pending or, to the Knowledge of the Seller, threatened strike, lockout, slowdown or work stoppage involving the Transferring Employees.