UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to

Section 14(a) of the Securities Exchange Act of 1934

| | | | | |

Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

| | | | | |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-12 |

TROIKA MEDIA GROUP, INC.

(Name of Registrant as Specified in Its Charter)

| | | | | | | | |

Payment of Filing Fee (Check the appropriate box): |

☒ | No fee required. |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

☐ | Fee paid previously with preliminary materials. |

| |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

2023

NOTICE OF ANNUAL MEETING &

PROXY STATEMENT

TROIKA MEDIA GROUP, INC.

October 31, 2023

Dear Fellow Stockholder:

On behalf of the Board of Directors (the “Board”) of Troika Media Group, Inc. (the “Company” or “Troika”) thank you for investing in Troika. It is my pleasure to invite you to attend the Annual Meeting of Stockholders of Troika Media Group, Inc. to be held on Friday, December 15, 2023, at 10:00 a.m., Eastern time. This year’s Annual Meeting will be conducted virtually via live audio webcast. Each holder of common stock as of 5:00 p.m., Eastern time, on the record date of October 18, 2023, will be able to participate in the Annual Meeting via live webcast through the unique join link and password delivered to them prior to the meeting. Stockholders will also be able to vote their shares and submit questions via the Internet during the meeting by participating in the webcast.

During the Annual Meeting, stockholders will be asked to elect all of the members of the board of directors and to ratify the appointment of RBSM LLP as our independent auditor for the period January 1, 2023, to December 31, 2023. We also will be asking stockholders to approve, by an advisory vote, our 2022 transition period executive compensation as disclosed in the Proxy Statement for the Annual Meeting (a “say-on-pay” vote) and the frequency of future stockholder votes on executive compensation (a “say on frequency” vote). All of these matters are important, and we urge you to vote in favor of the Board’s recommendations.

We are furnishing proxy materials to our stockholders over the Internet. This process expedites the delivery of proxy materials to our stockholders, lowers our costs and reduces the environmental impact of the Annual Meeting. Today we are sending to each of our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access the Proxy Statement for the Annual Meeting, and our 2022 Annual Report, as well as how to vote via proxy over the Internet.

It is important that you vote your shares of common stock virtually or by proxy, regardless of the number of shares you own. You will find the instructions for voting on your Notice of Internet Availability of Proxy Materials or proxy card. We appreciate your prompt attention.

The board invites you to participate in the Annual Meeting so that management can listen to your suggestions, answer your questions, and discuss business developments and trends with you. Thank you for your support, and we look forward to joining you at the Annual Meeting.

Sincerely,

Randall D. Miles

Chairman

25 West 39th Street

New York, NY 10018

NOTICE OF 2023 ANNUAL

MEETING OF STOCKHOLDERS

MEETING INFORMATION

The Board of Directors of Troika Media Group, Inc. (the “Company” or “Troika”) hereby notifies you of the Company’s 2023 Annual Meeting of Stockholders (the “Annual Meeting”) to occur on Friday, December 15, 2023 at 10:00 a.m. Eastern time virtually via live webcast at www.virtualshareholdermeeting.com/TRKA2023.

ITEMS OF BUSINESS

The Annual Meeting will be held to vote upon:

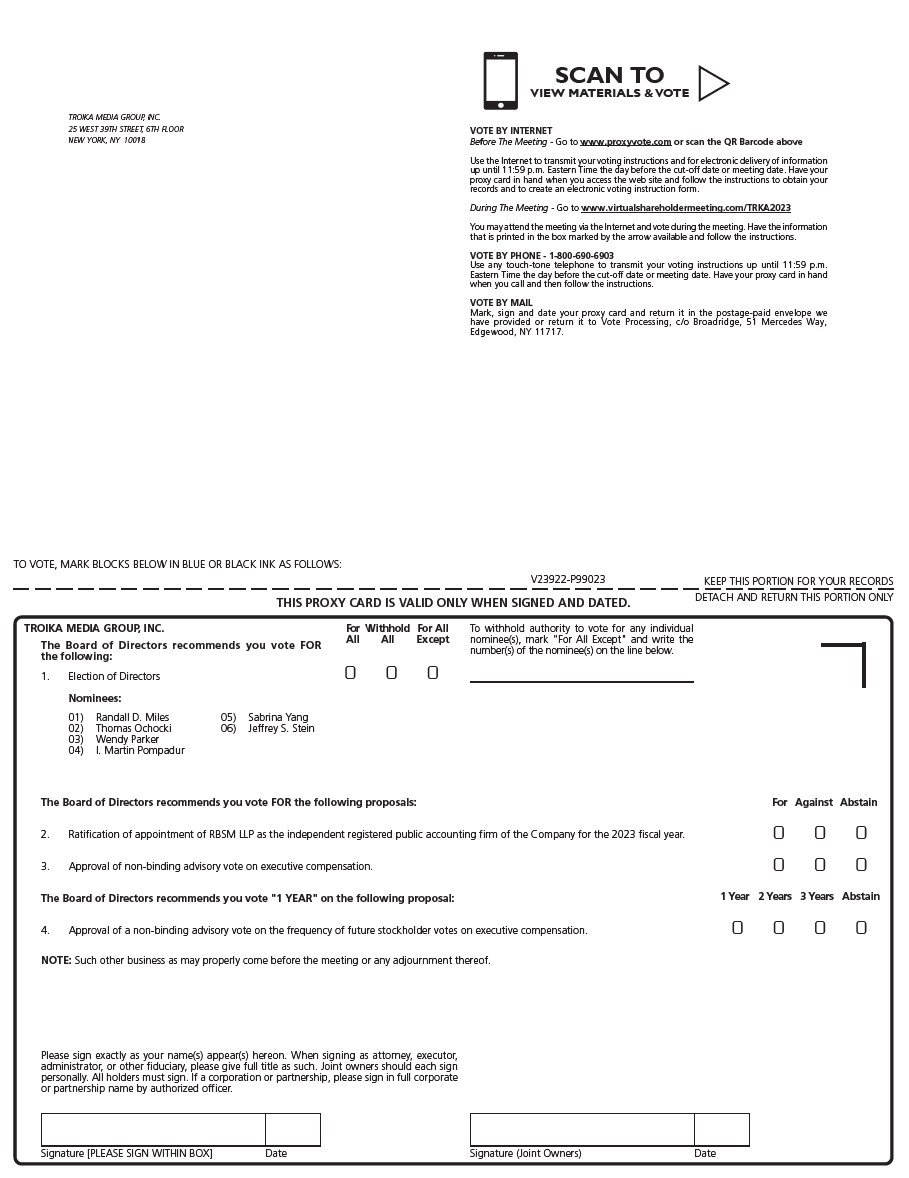

1.To elect the six (6) nominees named in the attached Proxy Statement to the Board of Directors.

2.To ratify the appointment of RBSM, LLP as Troika’s independent registered public accounting firm for 2023

3.To conduct a non-binding advisory vote on the compensation of Troika’s named executive officers.

4.To conduct a non-binding advisory vote to determine whether future stockholder advisory votes on the compensation of Troika’s named executive officers should occur either every one, two or three years.

5.Any other business properly presented that may be acted upon at the Annual Meeting.

RECORD DATE

Holders of Troika common stock as of the record date of 5:00 p.m., Eastern time, on October 18, 2023 are entitled to vote at the 2023 Annual Meeting.

MAILING OR AVAILABILITY DATE

In accordance with Securities and Exchange Commission we are providing stockholders with access to proxy materials on the Internet instead of mailing printed copies. We are mailing to stockholders, commencing on or about October 31, 2023, a Notice of Internet Availability of Proxy Materials to provide:

▪directions for accessing and reviewing the proxy materials on the Internet and submitting a proxy over the Internet; and

▪instructions for requesting copies of proxy materials in printed form or by email, at no charge; and a control number for use in submitting proxies.

View the Proxy Statement and the 2022 Annual Report to Shareholders online OR you can receive a free paper or email copy of the material(s) by (14 days before the meeting). If you would like to request a copy of the material(s) for this and/or future shareholder meetings, you may (1) visit www.proxyvote.com, (2) call 1-800-690-6903 or (3) send an email to sendmaterial@proxyvote.com. If sending an email, please include your control number (indicated on notice card) in the subject line. Unless requested, you will not otherwise receive a paper or email copy.

ABOUT PROXY VOTING

If you are a registered stockholder, you may vote online at www.proxyvote.com, by telephone or by mailing a proxy card. You may also vote online during the virtual Annual Meeting. If you hold shares through a bank, broker or other institution, you may vote your shares by any method specified on the voting instruction form they provide. See details under “Information about the Proxy Statement and Voting.” We encourage you to vote your shares as soon as possible.

By order of the Board of Directors

Derek McKinney

Vice President, General

Counsel & Corporate Secretary

October 31, 2023

| | | | | | | | | | | |

| REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS: |

ONLINE Proxyvote.com

| PHONE 1-800-690-6903

| REGULAR MAIL Mark, sign and date the proxy card and return it in the postage-paid envelope

| AT THE MEETING www.virtualshareholdermeeting.com/TRKA2023

|

| Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. Eastern Time the day before the date of Annual Meeting. Shareholders should have their proxy card in hand when they access the web site and follow the instructions to obtain their records and to create an electronic voting instruction form. |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON DECEMBER 15, 2023:

The Notice of 2023 Annual Meeting of Stockholders, the Proxy Statement, the 2022 Annual Report, and instructions for voting via the Internet can be accessed at www.virtualshareholdermeeting.com/TRKA2023.

TABLE OF CONTENTS

2023 PROXY EXECUTIVE SUMMARY

This executive summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement and our other filings with the SEC, including our 2022 Transition Report on Form 10-KT, carefully before voting. References in this Proxy Statement to “TMG,” “Company”, “Troika” and to “we,” “us,” “our” and similar terms, refer to Troika Media Group, Inc.

ANNUAL MEETING LOGISTICS

| | | | | |

Time and Date | 10:00 a.m., Eastern time, on December 15, 2023 |

Meeting Webcast Registration Address | www.virtualshareholdermeeting.com/TRKA2023 |

Voting | Stockholders of Troika common stock as of the record date of 5:00 p.m., Eastern time, on October 18, 2023 are entitled to vote at the 2023 Annual Meeting. |

Total Votes Per Proposal | 1 for 1 votes, based on 16,676,762 shares of common stock outstanding as of the record date |

| Deadline to Vote | Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. Eastern Time the day before the date of the Annual Meeting. Shareholders should have their proxy card in hand when they access the web site and follow the instructions to obtain their records and to create an electronic voting instruction form. |

ANNUAL MEETING AGENDA

| | | | | | | | |

| Proposal | Board Recommendation |

| 1 | To elect the six (6) nominees named in the attached Proxy Statement to the Board of Directors. | FOR each nominee |

| 2 | To ratify the appointment of RBSM, LLP as Troika’s independent registered public accounting firm for 2023 | FOR |

| 3 | To conduct a non-binding advisory vote on the compensation of Troika’s named executive officers. | FOR |

| 4 | To conduct a non-binding advisory vote to determine whether future stockholder advisory votes on the compensation of Troika’s named executive officers should occur either every one, two or three years. | ONE YEAR |

HOW TO CAST YOUR VOTE

Your vote is important. You are eligible to vote if you were a shareholder of record as of 5:00 p.m. (Eastern time) on October 18, 2023. Even if you plan to attend the meeting, please vote as soon as possible using one of the following methods. In all cases, you should have your proxy card in hand.

| | | | | | | | | | | |

| REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS: |

ONLINE Proxyvote.com

| PHONE 1-800-690-6903

| REGULAR MAIL Mark, sign and date the proxy card and return it in the postage-paid envelope

| AT THE MEETING www.virtualshareholdermeeting.com/TRKA2023

|

| Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. Eastern Time the day before the date of Annual Meeting. Shareholders should have their proxy card in hand when they access the web site and follow the instructions to obtain their records and to create an electronic voting instruction form. |

1

2023 Proxy Statement

2023 Proxy Statement

ABOUT TROIKA MEDIA GROUP, INC.

TMG is a professional services company that architects and builds enterprise value in consumer brands to generate scalable, performance-driven revenue growth. The Company delivers three solutions pillars: TMG CREATES brands and experiences and CONNECTS consumers through emerging technology products and ecosystems to deliver PERFORMANCE based measurable business outcomes. The Company is headquarted in New York, New York and currently employs approximately 90 people.

2022 HIGHLIGHTS

Earlier this year we shared with you our financial results for the six months ended December 31, 2022, a transition reporting period as a result of the Company’s change in fiscal year to December 31 from June 30 (the “Transition Period”).

The six month Transition Period highlights include:

▪Successive record revenue of approximately $187.9 million

▪Revenue increase of 1125% over the comparative prior year period

▪Continued strong revenue growth in new revenue streams

▪Growing demand for Performance Solutions within Home Improvement, Residential Services, Legal and Professional Services Sectors

▪Successful completion of restructuring of operations and cost optimizations following the acquisition of Converge

The results of operations for the six months ended December 31, 2022, were fundamentally powered by the Converge acquisition, which resulted in diversifying the Company’s revenue streams and created efficiencies recognized by integrating the acquired businesses.

Revenues for the six months ended December 31, 2022, increased $172.6 million, or 1125%, to $187.9 million as compared with the prior year period. The increase in revenue was directly attributable to the Converge business, which accounted for approximately $180.3 million, or 96%, of the Company’s total revenue for the six months ended December 31, 2022. The incremental revenue to the business was comprised of performance solutions revenue of $75.7 million, or 40%, and managed services revenue of $104.6 million or 56%.

In 2022, we were primarily focused on the integration of the Converge and Troika business and closing operations that were loss-making or not core to our strategy. We also made a number of changes in the Board of Directors to expand the skill set of our directors, namely to boost the experience of the Board with restructuring matters. During the course of last year we also made significant changes to a number of leadership positions within the Company.

Our business strategy is to build upon Converge’s success and revenues by continuing its focus on performance driven business outcomes and delivering measurable outcomes that is underwritten by our enterprise technology and analytics expertise. The Company is now able to complement the core capabilities of Converge to deliver the key attributes of a successful customer engagement business.

2

2023 Proxy Statement

2023 Proxy Statement

SUMMARY OF DIRECTOR NOMINEES

We are asking stockholders to elect the following seven director nominees, all of whom currently serve as members of the Board of Directors of Troika (the “Board”). Our director nominees possess diverse and complementary qualifications and have the skills and attributes necessary for a well-functioning, highly-qualified and independent Board. The information below provides highlights of our directors’ roles and characteristics:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Name | Age | Director Since | Occupation | Independent | 2022 Board Committees |

Audit | Comp | N&G | Spec |

Randall D. Miles (Chair of the Board) | 67 | 2022 | Chairman & CEO of SCM Capital Group | l | l | l | l | l |

Thomas Ochocki | 47 | 2018 | Chief Executive Officer and majority stockholder of Union Investment Management Ltd. | | | | | |

Wendy Parker | 58 | 2022 | London, England based barrister and has been a member of Gatehouse Chambers’ Commercial, Property and Insurance Groups in London | l | | l | | |

I. Martin Pompadur | 88 | 2021 | Private Investor and Consultant | l | l | l | l | |

Jeffrey S. Stein | 54 | 2022 | Founder and Managing Partner of Stein Advisors LLC | l | | | l | l |

Sabrina Yang | 44 | 2022 | Chief Financial Officer of Final Bell Holdings, Inc. | l | l | | | |

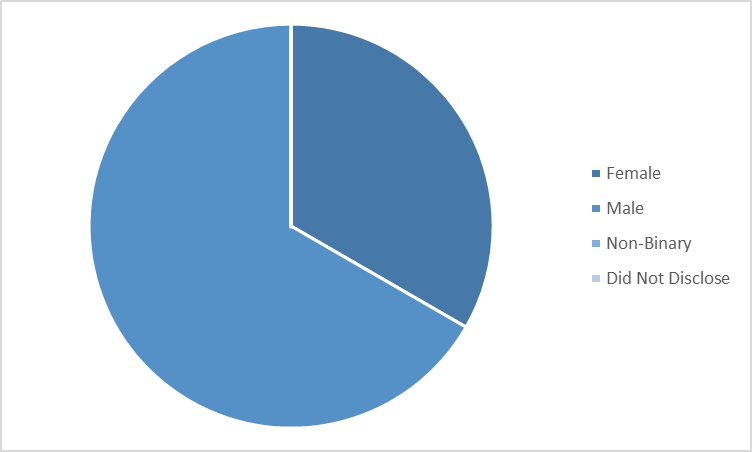

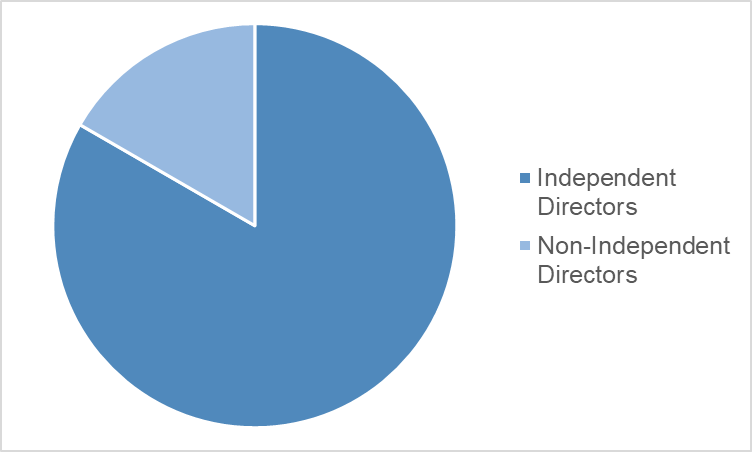

BOARD INDEPENDENCE AND DIVERSITY

| | | | | | | | | | | |

INDEPENDENCE | GENDER DIVERSITY | AVERAGE AGE | AVERAGE

TENURE |

| 83% | 33% | 57 | 2YEARS |

3

2023 Proxy Statement

2023 Proxy Statement

BOARD DIVERSITY MATRIX

(as of September 29, 2023)

| | | | | | | | | | | | | | |

| Board Size: |

| Total Number of Directors | 6 |

| Part I. Gender Identity | Female | Male | Non-Binary | Did Not Disclose Gender |

| Directors | 2 | 4 | 0 | 0 |

| Part II Demographic Background |

| African American or Black | 0 | 0 | 0 | 0 |

| Alaskan Native or Native American | 0 | 0 | 0 | 0 |

| Asian | 1 | 0 | 0 | 0 |

| Hispanic or Latinx | 0 | 0 | 0 | 0 |

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 |

| White | 1 | 5 | 0 | 0 |

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 |

| LGBTQ+ | 0 |

| Did Not Disclose Demographic Background | 0 |

DIRECTOR SKILLS MATRIX

| | | | | | | | | | | | | | | | | | | | | |

| Randall

Miles | Thomas

Ochocki | Wendy

Parker | Martin

Pompadur | | Sabrina

Yang | Jeffrey S. Stein |

| Other board experience | l | l | | l | | | l |

| Business development and M&A experience | l | | | | | | l |

| Diversity (e.g., ethnic, racial, gender identity) | | | l | | | l | |

| Higher education, training, certification | l | | | | | l | l |

| Financial literacy | l | | | l | | l | l |

| Fundraising experience | l | l | | | | | l |

| Global business experience | l | l | l | | | | l |

| Independence | l | | l | l | | l | l |

| Industry experience | | | | | | | |

| Legal | | | l | | | | l |

| Manufacturing experience | | | | | | | |

| Marketing and branding experience | | l | | | | | |

| Regulatory experience | | | | l | | | l |

| Senior leadership experience | l | l | l | l | | l | l |

__

4

2023 Proxy Statement

2023 Proxy Statement

GOVERNANCE PRACTICES

We are committed to robust governance practices that protect the long-term interests of our stockholders and establish strong Board and management accountability. Under our Bylaws and the Nevada Business Corporation Act, our business and affairs are managed by or under the direction of the Board,which selectively delegates responsibilities to its standing committees.

The Board currently operates under its current governance practices in accordance with applicable statutory and regulatory requirements, including those of the Securities and Exchange Commission (the”SEC”) and National Association of Securities Dealers Automated Quotations Stock Market (“Nasdaq”). Under such practices, we expect directors to regularly attend meetings of the Board and committees on which they serve and to review the materials sent to them in advance of those meetings. While we do not maintain a formal policy on annual meeting attendance, we expect directors to participate in the Annual Meeting.

The Board generally expects to hold at least four (4) regular meetings per year and to meet on other occasions when circumstances require. Directors spend additional time preparing for Board and committee meetings, and we call upon directors for advice between meetings.

We have adopted key corporate governance best practices, including:

| | | | | | | | |

| Elections: | Classified Board

Frequency of Director Elections

Voting Standard

Mandatory Retirement Age or Tenure

| No

Annual

Plurality

No

|

| Chair: | Separate Chair of the Board and CEO

Independent Chair of the Board

| Yes

Yes

|

| Meetings: | Number of Board Meetings in 2022

Directors Attending at Least 75% of Board Meetings in 2022

Directors Meet without Management Present

Number of Standing Committee Meetings Held in 2022

(not including Special Committee Meetings) | 11

All

Yes

9 |

| Director Status: | Directors “Overboarded” per ISS or Glass Lewis Voting Guidelines

Material Related-Party Transactions with Directors

Family Relationships with Executive Officers or Other Directors

Shares Pledged by Directors | None

None

None

None

|

2022 BOARD COMMITTEE MEETINGS AND ATTENDANCE

The Board and its committees meet throughout the year on a set schedule, and also hold special meetings and act by written consent from time to time as appropriate. Directors are expected to attend all meetings of the Board and all meetings of the committees of which they are members. Members may attend by telephone or video conference. The Board held at least 11 meetings during 2022, and there were at least 31 committee meetings in 2022 (including Special Committee meetings).

All directors attended at least 75% of the aggregate of all meetings of the Board and committees on which they served. It is Company practice that all directors attend our annual meetings. All directors who were on the Board at that time attended our 2022 annual meeting of shareholders.

5

2023 Proxy Statement

2023 Proxy Statement

OVERVIEW OF COMMITTEES IN 2022

The Board operated four committees in 2022, including Audit, Nomination and Governance, Compensation and Special Committees. Charters of each of the Audit, Compensation and Nominating and Governance Committees conform to the applicable Nasdaq listing standards, including that all members of each such committee are independent, and each committee reviews its charter at least annually and as regulatory developments and business circumstances warrant. Each of the committees considers revisions to its respective charter from time to time to reflect evolving best practices. The descriptions below of the roles and

responsibilities of each of the committees of the Board are qualified by reference to the complete committee charters, which are available on our website at www.troikamedia.com.

In addition to the Committees of the Board listed below, the Company also formed (i) a Special Committee in 2022 to manage matters related to ongoing negotiations with the Company’s senior lender, Blue Torch Finance LLC (“Blue Torch”), and the holders of the Company’s Series E Preferred Stock and (ii) a Special Litigation Committee in 2023 to oversee the litigation filed against the Company by the former owners of Converge (the “Converge Sellers”).

| | | | | | | | |

| | |

| AUDIT COMMITTEE |

Meetings held in 2022: 5 | | Purpose - The Audit Committee was established by the Board for the purpose of overseeing the accounting and financial reporting processes of the Company and audits of the financial statements of the Company.

Responsibility - The Committee is primarily responsible for: ▪monitoring the quality and integrity of the Company’s financial statements and systems of internal controls regarding risk management,finance and accounting; ▪monitoring the independent auditor’s qualifications and independence;

▪monitoring the performance of the Company’s internal audit function and independent auditors; and

▪issuing the report required by the Securities and Exchange Commission to be included in the Company’s annual proxy statement.

The Audit Committee also has established procedures for the receipt, retention and treatment, on a confidential basis, of complaints received regarding accounting, internal controls and auditing matters. |

| Committee Members: | |

▪Randall D. Miles, Chair | |

▪Sabrina Yang | |

▪I.Martin Pompadur | |

The Board has determined that each member of the Audit Committee is financially literate and independent, as defined by the rules of the Securities and Exchange Commission (the “SEC”) and Nasdaq’s listing standards. The Board has identified Randall D. Miles and Sabrina Yang as Audit Committee financial experts. The Board has not evaluated the performance of the Audit Committee in compliance with regulatory requirements, but plans to conduct a review in 2023. |

6

2023 Proxy Statement

2023 Proxy Statement

| | | | | | | | |

| COMPENSATION COMMITTEE |

Meetings held in 2022: 2 | | Purpose - The purpose of the Compensation Committee is to provide oversight of the compensation and benefits provided to employees of the Company.

Responsibility - The Committee is primarily responsible to: ▪discharge the Board’s responsibilities relating to compensation of the Company’s Chief Executive Officer or other person serving as the Company’s principal executive officer and all of the Company’s other “officers”as defined in Rule 16a-l(f) promulgated under the Securities Exchange Act of 1934 (the “Exchange Act”); and

▪also have overall responsibility for approving or recommending to the Board approval of, and evaluating all compensation plans, policies and programs of the Company. |

| Committee Members: | |

▪I.Martin Pompadur, Chair | |

▪Randall D. Miles | |

▪Wendy Parker | |

The Board has determined each member of the Compensation Committee is independent, as defined by the rules of the SEC and Nasdaq’s listing standards. In addition, each committee member is a “non-employee director” as defined in Rule 16b-3 under the Exchange. The Committee has not engaged any independent consultant to analyze the compensation of its executive officers. The Board has not evaluated the performance of the Compensation in compliance with regulatory requirements, but plans to conduct a review in 2023. |

| | | | | | | | |

| NOMINATING AND GOVERNANCE COMMITTEE |

Meetings held in 2022: 2 | | Purpose - The purpose of the Nominating and Governance Committee is to ensure that the Board is appropriately constituted to meet its fiduciary obligations to stockholders of the Company.

Responsibility - The Committee is primarily responsible to: ▪recommend to the Board the director nominees for the next annual meeting of stockholders;

▪lead the Board in its annual review of the Board’s performance;

▪to recommend to the Board director nominees for each Board committee; and

▪develop and recommend to the Board corporate governance guidelines applicable to the Corporation. |

| Committee Members: | |

▪Randall D. Miles, Chair | |

▪I. Martin Pompadur | |

▪Jeffrey S. Stein | |

The Board has determined each member of the Nominating and Governance Committee is independent, as defined by the rules of the SEC and Nasdaq’s listing standards. The Board did not evaluate the performance of the Nominating and Governance Committee in compliance with regulatory requirements in 2022, but plans to conduct a review in 2023. |

EXECUTIVE SESSIONS

The Board meets often in executive session led by the Board’s non-executive Chairman for the independent directors to meet without management present. Board members have access to our employees outside of Board meetings.

CORPORATE CODE OF CONDUCT

The Company has adopted the Troika Corporate Code of Conduct and applies to all employees, including the Chief Executive Officer and Chief Financial Officer and, where applicable, to its non-employee directors. The Troika Code of

Conduct is available on our website at www.troikamedia.com.

We have implemented whistleblower procedures, which establish formal protocols for receiving and handling complaints from employees. Copies of our procedure is available on our website at www.troikamedia.com.

Members of the Board of Directors and other section 16 executive officers are prohibited under the Company’s policy against insider trading from hedging the economic risk of their ownership of Troika stock, including options or other derivatives related to our stock.

7

2023 Proxy Statement

2023 Proxy Statement

BOARD AND COMMITTEE EVALUATION PROCESS

The Board believes that self-evaluations of the Board, the committees and individual directors are important elements of corporate governance and essential to ensuring the effective functioning of our Board. The Board will implement formal mechanisms in 2023 to annually assess its performance and that of its committees and individual directors. Beginning in 2023, annually, the Board will evaluates its performance and each committee will evaluate its own performance.

BOARD COMPOSITION AND TRANSITIONS

This year and last have been years of transition for the Company and the Board triggered by the acquisition of Converge and the integration of the Converge business with the Troika business. With the Converge acquisition and the closing of the Mission, Troika IO and Troika Design businesses, a large portion of the management and the Board departed the Company, including Robert Machinist (Chief Executive Officer and Chairman), Christopher Broderick (Chief Operating Officer and Chief Financial Officer), Kevin Dundas (Chief Executive Officer of Mission), Daniel Pappalardo (President of Troika Design Group and Director), Kyle Hill (President of Troika IO), Michael Tenore (General Counsel and Secretary), Jeff Kurtz (Director), and Daniel Jankowski (Director).

During the course of 2022, Board members Thomas Ochocki and I. Martin Pomapdur joined with the Company’s new Chairman, Randall D. Miles, and with other new Board members including Wendy Parker, Sabrina Yang, Jeffery S. Stein and Grant Lyon to form the current Board. The additions of Randall D. Miles, Jeffrey S. Stein and Grant Lyon in 2022 added substantial restructuring skill to the Board. Wendy Parker brought significant corporate legal experience and Sabrina Yang has added additional seasoned financial expertise to the Board.

We have also had many changes in management during 2022 and 2023. On May 19, 2022 Sadiq (Sid) Toama was appointed Chief Executive Officer of the Company and on May 23, 2022, Erica Naidrich was appointed

Chief Financial Officer of the Company. Effective as of August 14, 2023, the Company terminated the employment of Sadiq Toama and Erica Naidrich for “Cause,” pursuant to the terms of their respective employment agreements.

Effective immediately following the August 14, 2023 terminations, the Company appointed Grant Lyon, a member of the Board, as the Company’s Interim Chief Executive Officer and Eric Glover as the Company’s Interim Chief Financial Officer. The Company entered into an engagement letter (the “Areté Engagement Letter”) with Areté Capital Partners, LLC (“Areté”), a consulting firm founded and owned by Mr. Lyon, pursuant to which Areté has made Mr. Lyon and Mr. Glover available to serve as the Interim Chief Executive Officer and Interim Chief Financial Officer, respectively, for approximately $35,000 per week. Mr. Lyon and Mr. Glover do not receive any direct compensation from the Company for their Services.

BOARD QUALIFICATION AND SELECTION PROCESS

The Board considers recommendations for Board nominees from the Nominating and Governance Committee. Directors should have relevant expertise and experience and be able to offer advice and guidance to our Chief Executive Officer based on that expertise and experience. Each director should be able to read and understand basic financial statements, should have sufficient time to devote to our affairs, should have demonstrated excellence in his or her field, should have the ability to exercise sound business judgment, and should have the commitment to rigorously represent the long-term interests of our stockholders. In selecting directors, the Nominating and Governance Committee seeks to achieve a mix of directors that enhances the diversity of background, age, skills, and experience on the Board to maintain a balance of knowledge, experience, and capability. A majority of directors should be independent under applicable Nasdaq listing standards, board and committee charters and guidelines, and applicable laws and regulations.

The Board adopted a Policy Regarding Qualifications of Directors for use by the Nominating and Governance Committee to

8

2023 Proxy Statement

2023 Proxy Statement

evaluate potential nominees (the “Qualification Policy”). The Qualification Policy includes the following:

▪Integrity and Ethical Values. Candidates should possess the highest personal and professional standards of integrity and ethical values.

▪Commitment. Candidates must be committed to promoting and enhancing the long term value of the Company for its stockholders.

▪Absence of Conflicts of Interest. Candidates should not have any interests that would materially impair his or her ability to (i) exercise independent judgment, or (ii) otherwise discharge the fiduciary duties owed as a director to the Company and its stockholders.

▪Fair and Equal Representation. Candidates must be able to represent fairly and equally all stockholders of the Company without favoring or advancing any particular shareholder or other constituency of the Company.

▪Achievement. Candidates must have demonstrated achievement in one or more fields of business, professional, governmental, community, scientific or educational endeavor, and possess mature and objective business judgment and expertise.

▪Oversight. Candidates are expected to have sound judgment, derived from management or policy-making experience (which may be as an advisor or consultant), that demonstrates an ability to function effectively in an oversight role.

▪Business Understanding. Candidates must have a general appreciation regarding major issues facing public companies of a size and operational scope similar to the Corporation. These include:

•contemporary governance concerns;

•regulatory obligations of a public issuer;

•strategic business planning;

•competition in a global economy; and

•basic concepts of corporate accounting and finance.

▪Available Time. Candidates must have, and be prepared to devote, adequate time to the Board and its Committees. It is expected that each candidate will be able to arrange their business and professional commitments, including service on the boards of other companies and organizations, so that they are available to attend the meetings of the Company’s Board and any Committees on which they serve, as well as the Company’s Annual Meeting of Stockholders.

▪Board Policies. The candidate’s election must not conflict with any applicable Board policies.

▪Limited Exceptions. Under exceptional and limited circumstances, the Nominating and Governance Committee may approve the candidacy of a nominee who does not satisfy all of these requirements if it believes the service of such nominee is in the best interests of the Company and its stockholders.

▪Additional Qualifications. In approving candidates to be recommended for election as director, the Committee will also assure that:

•at least a majority of the directors serving at any time on the Board are independent, as defined under the rules of Nasdaq;

•at least three of the directors satisfy the financial literacy requirements required for service on the audit committee under the rules of Nasdaq

•at least one of the directors qualifies as an audit committee financial expert under the rules of the Securities and Exchange Commission; and

•the independent directors should have general familiarity with an industry or industries in which the Corporation conducts a substantial portion of its business or in related industries.

In addition, during the annual review of the Charter of the Nominating and Governance Committee in 2023, the Committee made a recommendation to the Board, which the Board approved, to add a new section to the

9

2023 Proxy Statement

2023 Proxy Statement

Qualification Policy relating to diversity, as set forth below:

▪Diversity. The Nominating and Governance Committee will consider factors that promote diversity of views and experience when evaluating the suitability of individuals for nomination. In performing its responsibilities for identifying, screening, and recommending candidates to the board in connection each director search, the Committee is committed to including in the initial candidate pool one or more highly qualified candidates who reflect diverse backgrounds, skills, and experiences, including individuals with diversity of gender identity, sexual orientation, race, ethnicity and national origin, and diversity of viewpoints, education, and professional experience (including individuals from non-executive corporate positions and non-traditional environments).

The Board seeks to maintain a membership comprised of directors who can productively contribute to our success. From time to time, the Board may change the criteria for directorship to maximize the opportunity to achieve this success. When this occurs, existing directors will be evaluated according to the new criteria. A director who no longer meets the complete criteria for board membership may be asked to adjust his or her committee assignments or resign from the board.

The Board does not believe that a fixed retirement age for directors or a limit on the number of director terms is appropriate. Directors who have served on the Board for an extended period of time are able to provide continuity and valuable insight into our company, our operations, and our prospects based on their experience with, and understanding of, our history, policies and objectives. The Board believes that, as an alternative to fixed term limits, it can ensure that the Board continues to evolve and adopt new ideas and viewpoints through the director nomination process described above.

When the Board or its Nominating and Governance Committee identifies a need to add a new director with specific qualifications or to fill a vacancy on the Board, the Chair of the Nominating and Corporate Governance Committee will initiate a search, seeking input

from other directors and senior management, review any candidates that the Nominating and Governance Committee has previously identified, and, if necessary, hire a search firm. The Nominating and Governance Committee then will identify the initial list of candidates who satisfy the specific criteria and otherwise qualify for membership on the Board. Based on a satisfactory outcome of those interviews, the Nominating and Governance Committee will make its recommendation on the candidate to the Board.

The Nominating and Governance Committee has a policy to consider submissions of recommendations for the nomination of directors from stockholders who meet the minimum percentage ownership requirements that the Board may establish from time to time. Acceptance of a recommendation for consideration does not imply that the Committee will nominate the recommended director. All stockholder nominating recommendations must be in writing, addressed to the Committee care of the Company’s corporate secretary at the Company’s principal offices. Submissions must be made by mail, courier or personal delivery. E-mailed submissions will not be considered.

A nominating recommendation must be accompanied by certain information about the recommending stockholder(s) and the nominee such as share ownership and holding periods, the relationship between the nominee and the stockholder(s), qualification of the nominee and the nominee’s willingness to serve the interests of all stockholders and to be interviewed by the Nominating and Governance Committee.

A stockholder (or group of stockholders) wishing to submit a nominating recommendation for an annual meeting of stockholders must ensure that it is received by the Company, as provided above, not later than 120 calendar days prior to the first anniversary of the date of the proxy statement for the prior annual meeting of stockholders. In the event that the date of the annual meeting of stockholders for the current year is more than 30 days following the first anniversary date of the annual meeting of stockholders for the prior year, the submission of a recommendation will be considered timely if it is submitted a reasonable time in advance of the mailing of the Company’s proxy statement for the annual meeting of stockholders for the

10

2023 Proxy Statement

2023 Proxy Statement

current year. A full copy of the policy can be found attached to the charter of the Nominating and Governance Committee on the Company’s website at www.troikamedia.com.

DIRECTOR INDEPENDENCE

The Board, through the Nominating and Governance Committee, conducts an annual review of the independence of its Board members. With the assistance of legal counsel to the Company, the Nominating and Governance Committee has reviewed the applicable standards for Board and Committee member independence. A summary of the answers to annual questionnaires completed by each of the directors and a report of transactions with director-affiliated entities are also made available to the Nominating and Governance Committee to enable its comprehensive independence review. On the basis of this review, the Nominating and Governance Committee has delivered a report to the full Board, and the Board has made its independence determinations based upon the committee’s report and the supporting information.

Under Nasdaq listing rules, independent directors must comprise a majority of a listed company’s board of directors. In addition, Nasdaq rules require that, subject to specified exceptions, each member of a listed company’s audit, compensation, and Nominating and Governance committees be independent. Under Nasdaq rules, an individual will qualify as an “independent director” only if, in the opinion of the company’s board of directors, he or she does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Audit committee members must also satisfy additional independence criteria, including those set forth in Rule 10A-3 under the Exchange Act. In order to be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries, other than compensation for board or committee service, and may not be an affiliated person of the listed company or any of its subsidiaries.

Compensation committee members must also satisfy additional independence criteria, including those set forth in Rule 10C-1 under the Exchange Act. In determining independence requirements for members of compensation committees, Nasdaq and other national securities exchanges and national securities associations are to consider relevant factors that include (a) the source of compensation of a director, including any consulting, advisory or other compensatory fee paid by the listed company to the director, and (b) whether the director is affiliated with the listed company, a subsidiary of the listed company or an affiliate of a subsidiary of the listed company.

The Board annually reviews the independence of all non-employee directors. The Board has determined that Randall D. Miles, Wendy Parker, I. Martin Pompadur, Jeffrey S. Stein, Grant Lyon (until his appointment as Interim Chief Executive Officer on August 14, 2023) and Sabrina Yang each qualifies as an independent director in accordance with the rules of Nasdaq and Rules 10C-1 and 10A-3 under the Exchange Act. The Board meets often in executive session led by the Board’s non-executive Chairman for the independent directors to meet without management present.

BOARD OVERSIGHT OF RISK

The Board has responsibility for the oversight of our risk management processes and, either as a whole or through its committees, regularly discusses with management our major risk exposures, their potential impact on our business, and the steps we take to manage them. The risk oversight process includes receiving regular reports from committees and members of senior management to enable the board to understand our risk identification, risk management and risk mitigation strategies with respect to areas of potential material risk, including operations, finance, legal, regulatory, strategic, and reputational risk.

The Audit Committee reviews information regarding liquidity and operations, and oversees our management of financial risks. Periodically, the Audit Committee reviews our policies with respect to risk assessment, risk management, loss prevention, and regulatory compliance. Oversight by the Audit Committee includes the Chief Financial Officer reporting directly to the

11

2023 Proxy Statement

2023 Proxy Statement

audit committee at least quarterly to provide an update on management’s efforts to manage risk.

Matters of significant strategic risk, including cybersecurity risks, are considered by the Board as a whole.

TRANSACTIONS WITH RELATED PERSONS

The Audit Committee is responsible for reviewing and approving, prior to our entry into any such transaction, all transactions in which we are a participant and in which any of the following persons has or will have a direct or indirect material interest:

•our executive officers;

•our directors;

•the beneficial owners of more than five (5%) percent of our securities;

•the immediate family members of any of the foregoing persons; and

•any other persons whom our Board determines may be considered related persons.

For purposes of this policy, “immediate family members” means any child, stepchild, parent, stepparent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law, and any person (other than a tenant or employee) sharing the household with the executive officer, director, or five (5%) percent beneficial owner.

In reviewing and approving such transactions, our Audit Committee shall obtain, or shall direct our management to obtain on its behalf, all information that the Committee believes to be relevant and important to a review of the transaction prior to its approval. Following receipt of the necessary information, a discussion shall be held of the relevant factors if deemed to be necessary by the Committee prior to approval. If a discussion is not deemed to be necessary, approval may be given by written consent of the Committee. This approval authority may also be delegated to the Chair of the Audit Committee in some circumstances. No related person transaction shall be entered into prior to the completion of these procedures.

Our Audit Committee shall approve only those related person transactions that are determined to be in, or not inconsistent with, our best interest and our stockholders’ best interests,

taking into account all available facts and circumstances as the Committee determines in good faith to be necessary. These facts and circumstances will typically include, but not be limited to, the benefits of the transaction to us; the impact on a director’s independence in the event the related person is a director, an immediate family member of a director or an entity in which a director is a partner, stockholder or executive officer; the availability of other sources for comparable products or services; the terms of the transaction; and the terms of comparable transactions that would be available to unrelated third parties or to employees generally. No member of our Audit Committee shall participate in any review, consideration, or approval of any related person transaction with respect to which the member or any of his or her immediate family members is the related person.

The following is a description of the transactions we have engaged in during the Transition Period ended December 31, 2022 and the year ended June 30, 2022, with our directors, executive officers, and beneficial owners of more than five (5%) percent of our voting securities and their affiliates.

See “Executive Compensation” for the terms and conditions of employment agreements and senior management consulting agreements and options and warrants issued to officers, directors, consultants, and senior management of the Company.

Converge Direct, LLC Acquisition

Certain terms of the acquisition of Converge resulted in amounts remaining to be paid to the Converge Sellers, including (i) an approximate $4.34 million payment under the terms of the Membership Interest Purchase Agreement dated as of November 22, 2021 and (ii) a $5.0 million payment pursuant to a side letter agreement, dated as of March 9, 2022, by the Company and Converge Direct, LLC which specified that $5.0 million of the purchase price will be retained by the Company for working capital and be repaid twelve (12) months from the acquisition date.

Michael Carrano, Thomas Marianacci, Maarten Terry, and Sadiq Toama, in their capacities as Converge Sellers filed a complaint (the “Complaint”) under the caption Carrano et al. v. Troika Media Group, Inc. and CD Acquisition Corporation, Case No. 653449/2023 in the Supreme Court of the State of New York, New

12

2023 Proxy Statement

2023 Proxy Statement

York County against the Company and CD Acquisition Corporation (together, the “Defendants”). The Defendants have not yet been served with a Summons or the Complaint.

Union Ventures Limited purchase of Mission-Media Holdings Limited

On August 1, 2022, Troika-Mission Holdings, Inc., (“TM Holdings"), a subsidiary of the Company, entered into an Equity Purchase Agreement with Union Ventures Limited, a company organized under the law of England and Wales ("UVL"). UVL is a company owned by Union Investments Management Limited, which is a stockholder of the Company and affiliated with Daniel Jankowski, a former director of the Company, and Thomas Ochocki, a current Director of the Company. UVL purchased from TM Holdings, all of TM Holdings’ right, title, and interest in and to the shares (the "Mission UK Shares") of Mission-Media Holdings Limited, a private limited company incorporated under the laws of England and Wales (“Mission Holdings”), including Mission UK’s subsidiary, Mission-Media Limited, a company organized under the laws of England and Wales (“Mission Media UK”). As consideration for all the Mission UK Shares, UVL paid TM Holdings an aggregate purchase price of $1,000 USD. Mr. Ochocki recused himself from the decision to sell the Mission UK Shares to UVL.

Union Eight Limited and Mission Media Limited

On July 1, 2021 Mission Media UK entered into a Consultancy Agreement with Service Company (the “U8L Consultancy Agreement”) with Union Eight Limited (“U8L”) in which U8L agreed to interface with investors and provide strategic advice related to Mission Media UK in exchange for a start-up fee of £150,000 and a monthly retainer of £25,000. In 2022, the U8L Consultancy Agreement was terminated prior to the expiration of its 2-year term in exchange for a termination payment. U8L is a current stockholder of the Company and is affiliated with Thomas Ochocki, a current director of the Company and former director of Mission Media UK. Daniel Jankowski, a former director of the Company and Mission Media UK, is also affiliated with U8L. U8L was also granted Company Restricted Stock Units.

Ochocki Director Letter

In connection with the subscription for Company shares by Mr. Peter Coates, the Company executed an agreement with Mr. Coates dated May 5, 2017 agreeing that for so long as Mr. Coates (or any of his family members, trusts, or investment vehicles) or Mr. Ochocki owns any shares in the Company, Mr. Ochocki will serve as a director of the Company as Mr. Coates’ designee.

The Areté Engagement Letter

The Company entered into the Areté Engagement Letter with Areté, a consulting firm founded and owned by Mr. Lyon, pursuant to which Areté has made Mr. Lyon and Mr. Glover available to serve as the Interim Chief Executive Officer and Interim Chief Financial Officer, respectively, for approximately $35,000 per week. Mr. Lyon and Mr. Glover do not receive any direct compensation from the Company for their Services.

13

2023 Proxy Statement

2023 Proxy Statement

ELECTION OF DIRECTORS

(PROXY ITEM NO. 1)

REQUIRED VOTE

Each director must be elected by a plurality of the votes cast at the Annual Meeting. A “plurality” means that the director nominees who receive the highest number of shares voted “for” their election are elected. With respect to the election of directors, you may vote “for” or “withhold” authority to vote for each of the nominees for the Board. If you “withhold” authority to vote with respect to one or more nominees, your vote will have no effect on the election of such nominees. Broker non-votes will have no effect on the election of the nominees. In a contested election for directors (an election in which the number of nominees for election as directors is greater than the number of directors to be elected) the vote standard would remain a plurality of votes cast.

At the Annual Meeting, stockholders will elect the entire Board to serve for the ensuing year and until their successors are elected and qualified. The Board has designated as nominees for election the seven persons named below, each of whom currently serves as a director.

Shares of common stock that are voted as recommended by the Board will be voted in

favor of the election as directors of the nominees named below. If any nominee becomes unavailable for any reason or if a vacancy should occur before the election, which we do not anticipate, the shares represented by a duly completed proxy may be voted in favor of such other person as may be determined by the Proxy Committee.

2023 DIRECTOR NOMINEES

Seven members of our Board are standing for election to hold office until the 2024 Annual Meeting of Stockholders.

The Board has determined that the nominees, as a whole, have the right mix of characteristics, skills, and experience to provide effective oversight of Troika. Of the six nominees, two directors self-identify as female and one director is considered ethnically or racially diverse. The average age of the nominees is 57 years old and, given the relatively short history of the Company, the average tenure is approximately 2 years.

The principal occupation and certain other biographical information about the nominees is set forth on the following pages.

14

2023 Proxy Statement

2023 Proxy Statement

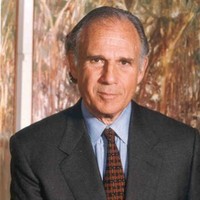

| | | | | | | | |

| RANDALL D. MILES (Chairman of the Board) |

Age: 67

Director since: July, 2022

Chairman & CEO of SCM Capital Group BBA from the University of Washington and FINRA licenses Series 7, 24, 63, and 79 | CAREER: Mr. Miles serves as Chairman & CEO of SCM Capital Group, a global transaction and strategic advisory firm. Mr. Miles sits on the boards of eXp World Holdings, Inc. (NASDAQ:EXPI) as Vice Chairman, and private equity backed Arthur H Thomas Companies as Vice Chairman, and Kuity, Inc. as Chairman. For over 30 years Mr. Miles has held senior executive leadership positions in global financial services, financial technology, and investment banking companies. His extensive investment banking background at bulge bracket, regional and boutique firms advising companies on strategic and financial needs, has crossed many disciplines while serving as CEO, Executive Committee Chair, Head of FIG, Head of M&A, and other responsibilities. Mr. Miles' transactional and advisory experience is complemented by leadership of public and private equity backed financial technology, specialty finance, and software companies: Chairman and CEO at LIONMTS, where he was nominated for the Ernst & Young Entrepreneur of the Year award, CEO at Syngence Corporation, COO of AtlasBanc Holdings Corp., and CEO of Advantage Funding / NAFCO Holdings. Mr. Miles has broad public, private and nonprofit board experience and has been active for many years in leadership roles with the Make-A-Wish Foundation.

|

REASONS FOR ELECTION TO THE BOARD:

In considering Mr. Miles for director of the Company, the Board considered his significant expertise in advising companies on strategic and financial matters. The Board also considered his experience as a director for a variety of other successful early stage private and public companies. |

2023 BOARD COMMITTEES: ▪Audit (Chair) ▪Nominating and Governance (Chair) ▪Compensation ▪Special ▪Special Litigation | OTHER PUBLIC COMPANY BOARDS: ▪eXp World Holdings, Inc. ▪RESAAS Services, Inc.

|

SKILLS: ▪Leadership ▪Governance ▪Business ▪Fiduciary Literacy ▪Fund Raising ▪International | FORMER PUBLIC COMPANY BOARDS: ▪LION MTS

A |

15

2023 Proxy Statement

2023 Proxy Statement

| | | | | | | | |

| THOMAS OCHOCKI |

Age: 47

Director since: 2018

Chief Executive Officer and majority stockholder of Union Investment Management Ltd London Securities Institute Financial Training Company (qualified and SFA registered); Liverpool University Psychology & Computer Science joint honors BSc;Davies International College 3- A levels & 1 AS-Level | CAREER: Mr. Ochocki is serving on the Board of Directors representing the Coates families’ equity interest, and has over twenty (20) years of experience in stock brokering, private equity, and investment banking in the United Kingdom. He is currently Chief Executive Officer and majority stockholder of Union Investment Management Ltd., whose history dates back to The Union Discount Company of London (est. 1885). An Old Cholmeleian of Highgate School, Mr. Ochocki read Psychology & Computer Science at Liverpool University prior to working with Sony Interactive Entertainment on the PlayStation launch titles. He went on to manage and facilitate the development of over 50 published video games before switching to his predominant career in the capital markets. |

REASONS FOR ELECTION TO THE BOARD:

The Company executed an agreement with Peter Coates dated May 5, 2018 agreeing that so long as Mr. Coates (or any of his family members, trusts or investment vehicles) or Mr. Ochocki own any shares in the Company, Mr. Coates would have the right to appoint a director. Mr. Ochocki is currently Mr. Coates’ designee. |

2023 BOARD COMMITTEES: ▪None |

SKILLS: ▪Business ▪Finance ▪Industry

|

| | | | | | | | |

| WENDY PARKER |

Age: 58

Director since: April, 2022

London, England based barrister and has been a member of Gatehouse Chambers’ Commercial, Property and Insurance Groups in London | CAREER: Ms. Parker is a London, England based barrister and has been a member of Gatehouse Chambers’ Commercial, Property and Insurance Groups in London where she undertakes most areas of work within those fields. She has developed a strong practice both as an adviser and advocate and has experience of appearing in the specialist commercial and property forums as well as Tribunals and the Court of Appeal. Ms. Parker has been involved in many technically complex cases. She has a strong academic background which she combines with a practical and common sense approach in order to assist clients in achieving their objectives. Ms. Parker is a member of the United Kingdom Chancery Bar Association and the COMBAR (the Specialist Bar Association for Commercial Barristers advising the international business community). |

REASONS FOR ELECTION TO THE BOARD:

In considering Ms. Parker for director of the Company, the Board considered her significant expertise in advising companies on legal and restructuring matters. |

2023 BOARD COMMITTEES: ▪Compensation ▪Special Litigation

|

SKILLS: ▪Business ▪International ▪Legal ▪Restructuring |

16

2023 Proxy Statement

2023 Proxy Statement

| | | | | | | | |

| I. Martin Pompadur |

Age: 88

Director since: April, 2021

American Broadcasting Companies, Inc. for 17 years, including as director BA from Williams College and LLB from the University of Michigan Law School | CAREER: Mr. Pompadur was elected to the Board of Directors in April 2021 upon the listing on the Nasdaq Capital Market. Mr. Pompadur is a private investor, senior advisor, consultant, and Board member. Mr. Pompadur entered the media field when in 1960, he joined American Broadcasting Companies, Inc. ("ABC, Inc."). He remained at ABC, Inc. for 17 years, culminating with his becoming the youngest person ever appointed to the ABC, Inc. Board of Directors. |

REASONS FOR ELECTION TO THE BOARD:

In considering Mr. Pompadur for director of the Company, the Board considered his significant expertise in media. The Board also considered his experience as a director for a variety of other public companies. |

2023 BOARD COMMITTEES: ▪Audit ▪Nominating and Governance ▪Compensation (Chair) |

OTHER PUBLIC COMPANY BOARDS: ▪Nexstar Broadcasting Group ▪Truili Media Group ▪Chicken Soup for the Soul Entertainment A |

SKILLS: ▪Business ▪Finance ▪Industry ▪International | FORMER PUBLIC COMPANY BOARDS: ▪The American Broadcasting Corporation ▪Golden Falcon Acquisition Corporation |

| | | | | | | | |

| JEFFREY S. STEIN |

Age: 54

Director since: November, 2022

Founder and Managing Partner of Stein Advisors, LLC New York University, M.B.A. with honors in Finance and Accounting Brandeis University, BA Economics | CAREER: Mr. Stein is an accomplished corporate executive and director who provides the perspective of a successful investment professional with over thirty (30) years of experience in both the debt and equity asset classes. Mr. Stein is Founder and Managing Partner of Stein Advisors LLC, a financial advisory firm that provides consulting services to public and private companies and institutional investors. Previously, Mr. Stein was a Co-Founder and Principal of Durham Asset Management LLC, a global event driven distressed debt and special situations equity asset management firm. From January 2003 through December 2009, Mr. Stein served as Co-Director of Research at Durham responsible for the identification, evaluation, and management of investments for the various Durham portfolios. Mr. Stein was a member of the Executive and Investment Committees at Durham responsible for oversight of the management company and investment funds, development and execution of the investment strategy, portfolio composition and risk management. Mr. Stein is a Certified Turnaround Professional (CTP) as designated by the Turnaround Management Association (TMA). |

REASONS FOR ELECTION TO THE BOARD:

In considering Mr. Lyon for director of the Company, the Board considered his significant expertise in advising companies on restructuring matters. |

2023 BOARD COMMITTEES: ▪Nominating and Governance ▪Special ▪Special Litigation | OTHER PUBLIC COMPANY BOARDS: ▪Ambac Financial Group, Inc. |

SKILLS: ▪Leadership ▪Governance ▪Business ▪International ▪Finance ▪Risk Management | FORMER PUBLIC COMPANY BOARDS: •Dynegy Inc. •GWG Holdings, Inc. •Westmoreland Coal Company |

17

2023 Proxy Statement

2023 Proxy Statement

| | | | | | | | |

| SABRINA YANG |

Age: 44

Director since: March, 2022

Vice President of Finance at Grove Point Marinas Louisiana State University, MS Accounting and Applied Statistics. Northeastern University of China BA English and International Business | CAREER: Ms. Yang is a seasoned finance and operations executive with over seventeen (17) years of experience in Strategy, Finance, Operations, FP&A, M&A advisory, and Investor Relations. Sabrina currently holds the position of Vice President of Finance at Grove Point Marinas, a real estate aggregator with a portfolio of over $300 million AUM. In her role, she oversees all financial and accounting operations, in addition to spearheading the company's acquisition initiatives. Last year, Sabrina served as the CFO for a data-driven advertising technology SaaS company, Apollo Program, where she ran all operational, financial, and administrative functions. She fully embraced the start-up spirit and mentality and led the company to profitability. Apollo was later successfully sold to Stagwell, a public traded marketing holding company. Prior to Apollo Program, Sabrina served as CFO of Final Bell Holdings, Inc. (“Final Bell”), a B2B manufacturing leader in providing end-to-end product development and supply chain solutions to leading cannabis brands in the United States and Canada. During her tenure at Final Bell, she led the company through its initial public offering process, establishing a path for Final Bell to become a publicly traded company on the Canadian Stock Exchange. In conjunction with the IPO, she oversaw debt financing of approximately $60m to provide adequate liquidity until completion of the IPO transaction. Throughout her term, Sabrina also managed and integrated all of Final Bell’s administrative functions, including accounting, finance, legal, HR, and IT operations, in most cases creating and implementing corporate procedures and building professional teams from scratch. Earlier in her career, she held various roles in strategy, business development, operations, data analytics and FP&A at Whittle School & Studios, the Topps Company and Undertone, a digital advertising company. She obtained her training at KPMG in itsTransaction Services team, in which she advised clients on strategy, corporate finance, valuation, financial modeling, M&A and debt financing.

Sabrina is passionate about people and culture, consistently striving to create an environment where everyone feels they belong and can grow with the organization long-term. She started a women leadership forum to empower, inspire and support all women in the workplace. |

REASONS FOR ELECTION TO THE BOARD:

In considering Ms. Yang for director of the Company, the Board considered her significant accounting, M&A and corporate finance expertise. |

2023 BOARD COMMITTEES: ▪Audit

|

SKILLS: ▪Business ▪Finance ▪Industry |

| | | | | |

| RECOMMENDATION OF THE BOARD OF DIRECTORS |

| THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE ELECTION OF THE SEVEN NOMINEES LISTED ABOVE AS DIRECTORS. UNLESS A CONTRARY CHOICE IS SPECIFIED, PROXIES SOLICITED BY THE BOARD WILL BE VOTED FOR THE ELECTION OF THE SEVEN NOMINEES LISTED ABOVE AS DIRECTORS. |

18

2023 Proxy Statement

2023 Proxy Statement

RATIFICATION OF APPOINTMENT OF THE INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

(PROXY ITEM NO. 2)

REQUIRED VOTE

The ratification of RBSM, LLP (“RBSM”) as our independent auditor for the period January 1, 2023, to December 31, 2023, must be approved by affirmative votes constituting a majority of the votes entitled to be voted and present in person or represented by proxy at the Annual Meeting. Abstentions, if there are any, will have the same effect as a vote AGAINST the proposal. Because this proposal is considered a routine matter, discretionary votes by brokers will be counted.

RATIFICATION OF APPOINTMENT OF RBSM, LLP

The Audit Committee is directly responsible for the appointment, retention, termination and oversight of the work of the independent auditor employed by the Company to audit the books of the Company and its subsidiaries (with the input, if the Committee so desires, of Company management). The independent auditors are ultimately accountable to the Committee.

The Audit Committee has selected, and the Board has ratified the selection of, RBSM to serve as our independent registered public accounting firm for 2023. RBSM has served as the Company’s independent registered public accounting firm since 2014 In accordance with SEC rules and RBSM policies, audit partners are subject to rotation requirements that limit the number of consecutive years an individual partner may provide service to our Company. For lead partners and engagement quality review partners, the maximum number of consecutive years of service in that capacity is five years.

The Audit Committee and the Board believe the continued retention of RBSM as our independent registered public accounting firm is in the best interest of the Company and our stockholders, and we are asking our

stockholders to ratify the selection of RBSM as our independent registered public accounting firm for 2023. Factors considered by the audit committee in deciding to engage RBSM included:

•RBSM’s technical expertise and knowledge of our company’s industry;

•RBSM’s objectivity and professional skepticism;

•the appropriateness of RBSM’s fees; and

•RBSM’s independence and the appropriateness of controls and processes in place that help ensure RBSM’s continued independence.

Although ratification is not required by our By-laws or otherwise, the Board is submitting the selection of RBSM to our stockholders for ratification because we value our stockholders’ views on the Company’s independent registered public accounting firm and as a matter of good corporate practice. In the event our stockholders fail to ratify the selection, it will be considered a recommendation to the Board and the Audit Committee to consider the selection of a different firm. In addition, even if stockholders ratify the selection of RBSM, the Audit Committee may in its discretion select a different independent registered public accounting firm at any time during the year if it determines such a change would be in the best interests of the Company and our stockholders.

Representatives of RBSM will participate in the Annual Meeting. The RBSM representatives will have the opportunity to make a statement if they desire to do so, and we expect that they will be available to respond to appropriate questions.

19

2023 Proxy Statement

2023 Proxy Statement

INDEPENDENT REGISTERED PUBLIC ACCOUNTANT FIRM FEES

The following table sets forth the aggregate fees billed to us by RBSM for professional services rendered for the Transition Period ended December 31, 2022 and the prior fiscal year ended June 30, 2022.

| | | | | | | | | | | | | | | |

| | Six Month Transition Period Ended December 31, 2022 | | Prior Fiscal

Year ended

June 30, 2022 | |

| Audit Fees (1) | | $ | 347,350 | | | $ | 460,000 | | |

| Audit-related Fees (2) | | — | | | 520,000 | | |

| Tax Fees (3) | | — | | | — | | |

| All Other Fees | | — | | | — | | |

| Total Fees | | $ | 347,350 | | | $ | 980,000 | | |

(1) Includes services relating to the audit of annual consolidated financial statements, review of quarterly consolidated financial statements, statutory audits, comfort letters, and consents and review of documentation filed with SEC-registered and other securities offerings.

(2) Includes services related to assistance with general accounting matters, work performed on acquisitions and divestitures, employee benefit plan audits, and assistance with statutory audit matters.

(3) Includes services for tax compliance, tax advice, and tax planning.

AUDIT COMMITTEE PRE-APPROVAL POLICIES AND PROCEDURES

The Audit Committee has the sole authority to approve the independent auditor’s fee arrangements and other terms of service, and to preapprove any permitted non-audit services to

be provided by the independent auditor. The Audit Committee is required to review with the lead audit partner whether any of the audit team members receive any discretionary compensation from the audit firm with respect to non-audit services performed by the independent auditor.

| | | | | |

| RECOMMENDATION OF THE BOARD OF DIRECTORS |

| THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE RATIFICATION OF RBSM, LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2023, PROXIES SOLICITED BY THE BOARD WILL BE VOTED FOR THE RATIFICATION. |

20

2023 Proxy Statement

2023 Proxy Statement

AUDIT COMMITTEE REPORT

ROLE OF THE AUDIT COMMITTEE

The Audit Committee was established by the Board of Directors of the Company for the purpose of overseeing the accounting and financial reporting processes of the Company and audits of the financial statements of the Company. The Audit Committee is primarily responsible for: (1) monitoring the quality and integrity of the Company’s financial statements and systems of internal controls regarding risk management, finance and accounting; (2) monitoring the independent auditor’s qualifications and independence; (3) monitoring the performance of the Company’s internal audit function and independent auditors; and (4) issuing this report required by the SEC to be included in the Company’s annual proxy statement.

The Audit Committee’s responsibility is one of oversight. It is the responsibility of the Company’s management to prepare consolidated financial statements in accordance with applicable law and regulations and of the Company’s independent auditor to audit those financial statements. The Audit Committee relies on the integrity of those persons and organizations within and outside the Company from whom the Audit Committee receives information, and the accuracy of the financial and other information provided to the Committee by such persons or organizations.

FINANCIAL STATEMENTS

Consistent with its monitoring and oversight responsibilities, the Audit Committee met with management and RBSM, the independent auditor of TMG, to review and discuss the audited consolidated financial statements for the Transition Period ended December 31, 2022. Management represented that TMG had prepared the consolidated financial statements in accordance with U.S. generally accepted accounting principles. The Audit Committee discussed with RBSM the matters required by the PCAOB in accordance with Auditing Standard No. 1301, “Communications with Audit Committees.”

The Audit Committee received from RBSM the written communication that is required by

PCAOB Rule 3526, “Communication with Audit Committees Concerning Independence,” and the Audit Committee discussed with RBSM that firm’s independence. The Audit Committee also considered whether RBSM’s provision of non-audit services and the audit and non-audit fees paid to RBSM were compatible with maintaining that firm’s independence. On the basis of these reviews, the Audit Committee determined that RBSM has the requisite independence.

As reported in the Company’s 10-KTA (Amendment No. 2) filed with SEC on May 15, 2023 for the transition period ended December 31, 2022, the Company’s management, with the participation of the Company’s Principal Executive Officer and Principal Financial Officer, evaluated the effectiveness of the Company’s disclosure controls and procedures as of the end of the period covered by the 10-KTA. Based upon that evaluation, the Principal Executive Officer and the Principal Financial Officer concluded that, as of the end of the period covered by the 10-KTA, the Company’s disclosure controls and procedures were not effective. The Audit Committee received periodic updates from management and RBSM at Audit Committee meetings throughout the year and provided oversight of the process. Prior to filing TMG’s Transition Period Report on Form 10-KT for the Transition Period ended December 31, 2022, or the Form 10‑KT, with the SEC, the Audit Committee also reviewed the Report of Independent Registered Public Accounting Firm provided by RBSM and also included in the Form 10-KT. RBSM’s report included in the Form 10-KT related to its audit of TMG’s consolidated financial statements.

Based upon the Audit Committee’s discussions with management and RBSM and the Audit Committee’s review of the information provided by, and the representations of, management and RBSM, the Audit Committee approved the inclusion in the Form 10-KT of the audited consolidated financial statements as of and for the Transition Period ended December 31, 2022. The Audit Committee approved the appointment and retention of RBSM as TMG’s independent auditor for the January 1, 2023, to December 31, 2023, and recommended that the appointment be submitted for ratification by the stockholders of TMG.

21

2023 Proxy Statement

2023 Proxy Statement

AUDIT COMMITTEE CHARTER

The Board has adopted a written charter for the Audit Committee. The charter sets out the purpose, membership and organization, and key responsibilities of the Audit Committee.

| | | | | | | | |

| Audit Committee Members |

| Randall D. Miles | Sabrina Yang | I. Martin Pompadur |

22

2023 Proxy Statement

2023 Proxy Statement

NON-BINDING ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION

(PROXY ITEM NO. 3)

REQUIRED VOTE

The advisory “say-on-pay” vote to approve our 2022 executive compensation must be approved by affirmative votes constituting a majority of the votes entitled to be voted and present in person or represented by proxy at the Annual Meeting. Abstentions, if there are any, will have the same effect as a vote AGAINST the proposal. Broker non-votes will have no effect on the outcome of this proposal, because they are not entitled to be cast on the matter.

SAY ON PAY VOTE

In accordance with the requirements of Section 14A of the Exchange Act and the related rules of the SEC, we are including in these proxy materials a separate resolution subject to shareholder vote to approve, in a non-binding vote, the compensation of our Named Executive Officers (“NEOs”) as defined by the SEC in Item 402 of Regulation S-K as disclosed later in this Proxy Statement. The following resolution will be submitted for a shareholder vote at the Annual Meeting:

“RESOLVED, that the stockholders of Troika Media Group, Inc. (the “Company”) approve, on a nonbinding advisory basis, the compensation paid to the Named Executive Officers of the Company with respect to the six month transition period ended December 31, 2022, as disclosed, pursuant to Item 402 of Regulation S-K promulgated by the Securities and Exchange Commission, in the Proxy Statement for the 2023 Annual Meeting of Stockholders, including the compensation tables and narrative discussion set forth under “Executive Compensation” therein.”

Our compensation program is intended to provide appropriate and balanced incentives toward achieving our annual and long-term strategic objectives and to create an alignment of interests between our executives and stockholders. This approach is intended to