We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Share Name | Share Symbol | Market | Type |

|---|---|---|---|

| Oceanic Iron Ore Corp | TSXV:FEO | TSX Venture | Common Stock |

| Price Change | % Change | Share Price | Bid Price | Offer Price | High Price | Low Price | Open Price | Shares Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0.00 | 0.00% | 0.06 | 0.055 | 0.06 | 0.06 | 0.06 | 0.06 | 55,000 | 15:54:27 |

TSX Venture Exchange: FEO

All figures in U.S. Dollars Unless Otherwise Noted

CAPEX ESTIMATE RESULTS IN REDUCTION OF INITIAL CAPITAL COST BY 58% TO USD $1.19 BILLION

POST TAX NPV8 OF USD $1.4 BILLION

MAINTAINS ROBUST POST TAX IRR OF 17% CONSISTENT WITH 2012 PFS

LOW NPV / INITIAL CAPEX RATIO OF 1.18 FOR A LONG LIFE BULK COMMODITY PROJECT

MAINTAINED LOW OPERATING COSTS AT USD $30.70/TONNE

LOW STRIP RATIO OF 0.81 : 1 OVER A 28 YEAR MINE LIFE

POTENTIAL FOR EXTENSION OF THE MINE LIFE BEYOND 28 YEARS

HIGH QUALITY CONCENTRATE GRADING 66.6% Fe AT AN INITIAL RATE OF 5 MTPA (EXPANSION TO 10 MTPA)

VANCOUVER, Dec. 19, 2019 /CNW/ - Oceanic Iron Ore Corp. ("Oceanic", or the "Company") is pleased to announce the results of a National Instrument 43-101 ("NI 43-101") Preliminary Economic Assessment (the "Study") prepared by BBA Engineering Ltd. ("BBA") in respect of the Company's Hopes Advance Project (the "Project").

A Pre-Feasibility Study was completed on the Project in 2012 ("2012 PFS"). The Company is not treating the economic results of the 2012 PFS or the related Mineral Reserve estimates as current. However, some of the scientific and technical information generated during the 2012 PFS is used as a basis for the Study.

The objective of the PEA was to rescope the Project profile and production scale using Measured and Indicated Mineral Resources estimated within three of the 10 defined deposits in order to reduce the up-front capital required to bring the Project to commercial production. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

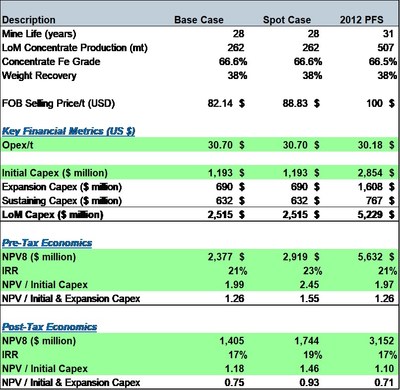

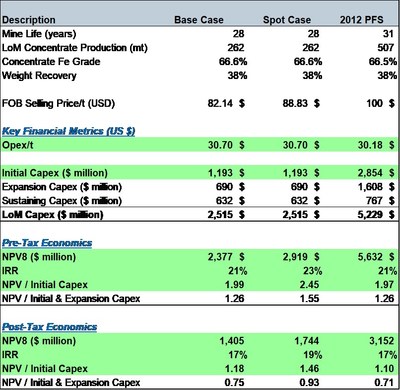

Key differences in this Study compared to the 2012 PFS include the following:

* Numbers may not add up due to rounding.

The results of the Study attribute significant value to the Project and present a significant reduction in initial capital expenditure requirements, all while achieving the same post tax IRR as the 2012 PFS. Importantly, the Project achieves an NPV / Initial Capex Ratio of 1.18, which is rare for bulk/base metal projects where capital requirements are typically very high.

Additional Attributes of the Project:

Steven Dean, Executive Chairman of Oceanic said: "The challenge with bulk commodity development projects is that the initial capex to get the project to commercial production is typically very high. The objective of this study was to outline a path forward for Hopes Advance that envisions a significantly reduced initial capex by reducing start up scale while retaining optionality on future expansion funded from future cash flows. A simplified energy efficient process flow sheet, seasonal shipping, combined with lower port and power capex amongst other things has managed to achieve a reduction of initial capex from the 2012 PFS of 60% while maintaining a low cash cost per tonne and similar IRRs. As a result, we believe this makes Hopes Advance a more financeable, and therefore an attractive project in today's market."

The Study

The Study was led by the Montreal office of BBA, a Canadian consulting engineering firm with over 900 employees, who have extensive experience with iron ore projects, particularly in the Labrador Trough. Working alongside BBA was Wood (formerly, AMEC Foster Wheeler), who worked with the Company on Port related infrastructure in the Company's previous studies.

The Company presents two cases as part of the Study with the only variable between the cases being the FOB selling price. The Base Case assumes an FOB selling price of approximately USD $82/t (approximately US $105/t CFR). The alternate case presents the economics of the Project using a spot price of approximately USD $89/t FOB (November 22nd 2019).

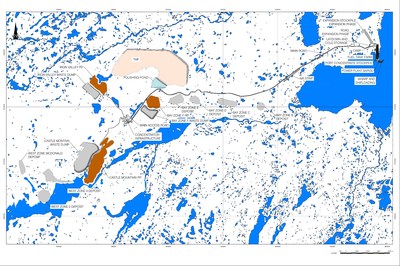

In both cases, the Study is based on initial production of approximately 5 million tonnes per annum of dry concentrate followed by an expansion in year 5 to approximately 10 million tonnes per annum. The financial analysis for the Study is limited to a 28-year mine life and considers only 3 of the 10 deposits for which mineral resources have been estimated. The Company believes that the remaining resources could support continued operations well beyond 28 years. The 28‑year mine plan for the Study is based on mining the Castle Mountain, Iron Valley and Bay Zone F deposits whereas the 2012 PFS considered mining all 10 of the Hopes Advance deposits at an initial concentrate production rate of 10 Mtpa with an expansion to 20 Mtpa in year 11 over a 30 year mine life. For both initial and expansion phases of the Study, power is self-generated using diesel fuel. Concentrate is filtered at the concentrator site and transported year-round by truck to a port stockpile where it is shipped only during summer months (under the 2012 PFS, concentrate in a slurry state was pumped to the port and re-dried. The rescoped approach eliminates costs related to regrinding and drying the concentrate at the port). Such seasonal shipping results in reduced port installation costs and the avoidance of having to use higher cost ice class vessels during the winter. For the Study, BBA is proposing a modified process flowsheet which is more energy efficient, aimed at reducing power requirements (and fuel storage) and expected to improve the Project's carbon footprint compared to the initial phase in the 2012 PFS which required significantly more electric power which was generated using heavy fuel oil.

Updated Value in Use Study Reaffirms Product Desirability of Hopes Advance Product

In 2013, the Company commissioned and received a Product Value in Use Marketing Study ("2013 VIU Study") from Vulcantech Technologies. The 2013 VIU Study concluded that, in addition to the iron unit premium for the high grade Hopes Advance product at 66.6% Fe measured against the 62% Fe benchmark, the low impurities associated with the Hopes Advance product could attract an additional quality premium for steel producers in China, Korea, Japan, and Taiwan.

In 2019, the Company commissioned Vulcantech Technologies to update its VIU study (the "2019 VIU Study") in order to obtain current market data as to the potential pricing and demand for Hopes Advance Iron Ore.

The 2019 VIU Study concludes that:

Hopes Advance's Competitive Cost Profile Compared to Industry Producers*

The Base Case FOB Price of US $82.14 and shipping costs of US $22.83/t (to Qingdao, China), results in a CFR price of US $104.97/t. In comparing the Hopes Advance product economics to that of producers, it is important to factor in the premium applied in the pricing of the Hopes Advance product to other iron ore products. By way of example, by using the implied premium of the Hopes Advance product to product from the Pilbara region of Australia as a reduction or credit to the operating cost at Hopes Advance, a more meaningful and appropriate operating cost comparison per tonne of product shipped is achieved. As per Table 2 below, the net effective operating costs at Hopes Advance are arguably very competitive to Pilbara blends, the largest source of seaborne iron ore.

Table 2 – Calculation of Net Effective Operating Cost at Hopes Advance versus the Pilbara Fines

Estimated CFR Price per tonne of concentrate | $104.97 |

CFR Forward Price - Pilbara Fines 61.5 | ($87.05)** |

Implied Premium for grade and quality of Hopes Advance concentrate vs Pilbara Fines | $17.92 |

Life of Mine operating cost per tonne – Hopes Advance | $30.70 |

Less: Implied Premium of Hopes Advance concentrate vs Pilbara Fines | ($17.92) |

Net Effective Comparative Operating Cost per tonne – Hopes Advance | $12.78 |

*This section is based on analysis by the Company and is not contained in the technical report for the Study

**Source – BAIINFO Iron Ore Daily, Issue 19-227, December 4, 2019

Metallurgical Testwork and Process Flowsheet

No new metallurgical testwork has been performed on the Project since the 2012 PFS. As such, the current PEA relies on previous testwork. This testwork consisted of bench scale tests as well as a pilot test program. Generally, the results of the testwork indicated the following characteristics for the mineralized material tested:

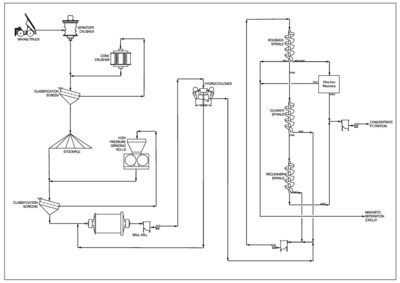

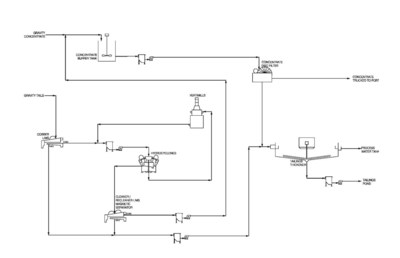

The conceptual flowsheet and plant design proposed in the Study are based on the following:

A simplified mineral processing flowsheet is shown in Figures 1 and 2.

A description of the proposed process is set out below:

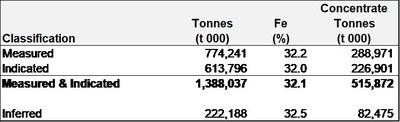

Mineral Resource Estimate

The Hopes Advance iron deposits comprise a total of 10 mineral deposits. These deposits are a typical stratigraphic iron deposit similar to other Labrador Trough iron deposits of Lake Superior-type iron formations, located at the northern end of the Labrador Trough.

The Hopes Advance iron formations are thick Sokoman Iron Formation, with magnetite, magnetite and hematite units that strike east-west to northeast and have gentle dips to the south and southeast. The iron formations are typically 40–70 m thick, and often crop out at surface. The three largest deposits are the Castle Mountain, Bay Zone F and Iron Valley deposits.

Mineral Resources that were estimated assuming open pit mining methods in 2012 were reviewed in 2019 to determine if they were still current. These reviews included checks on the confidence classification assignments based on changes to defined terms between the 2010 and 2014 editions of the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves, inputs into the Whittle optimisation shells that constrain the estimate, and commodity price assumptions as a result of the 2019 VIU Study. Eddy Canova, P. Geo, a consultant to the Company concluded that the estimates remain current, and have an effective date of 20 November, 2019, which is the date the reviews were completed.

Mineral Resources were estimated for the Bay Zone B, C, D, E, F, Castle Mountain, Iron Valley, West Zone 2, West Zone 4 and West Macdonald deposits, and are totalled in Table 3.

Notes:

1 | The Qualified Person responsible for the estimates (including the current Mineral Resource estimates) is Mr. Eddy Canova, P. Geo, a |

2 | Mineral Resources are reported assuming open pit mining methods. Mineral Resources were initially reported with an effective date |

3 | Mineral Resources are classified using the 2014 CIM Definition Standards. Mineral Resources are not Mineral Reserves and do not have |

4 | The Mineral Resources were estimated using a block model with parent blocks of 50 m by 50 m by 15 m sub-blocked to a minimum size |

5 | Estimates have been rounded and may result in summation differences |

Mine Plan

The proposed mining method selected for the Project consists of a conventional open pit, truck and shovel, drill and blast operation. The mineralized material and waste rock will be mined with 10 m high benches, drilled, blasted and loaded into a fleet of 292 t capacity haul trucks with diesel hydraulic shovels. The mineralized material will be hauled to the primary crushing facility and the waste rock will be hauled to either the waste rock piles or to the tailings facility to be used as construction material.

Even though the Hopes Advance Bay Mineral Resources are contained within ten (10) distinct deposits, the Study is limited to the Castle Mountain, Iron Valley, and Bay Zone F deposits. These three deposits provide sufficient material to sustain the first 28 years of operation at the production rate considered in the Study. Each of these deposits has favorable economics (higher grade and lower strip ratios than the other deposits) and they are also the three largest resource bases of the ten deposits. Only mineral resources classified as Measured and Indicated are considered in the mine plan as potential mill feed.

Table 4 below presents the subset of the Mineral Resources that are contained within the open pit designs that were used to develop the life of mine plan for the Study. The resource subset is reported above a cut-off grade of 25% Fe and includes mining dilution and mining losses which were estimated to be 1.5% and 5% respectively.

Table 4: Subset of Mineral Resources within the PEA mine plan (25% Fe Cut-Off Grade)

Deposit | Measured Resources | Indicated Resources | Total Resources | Waste | Strip | ||||||

Tonnes | Fe | WR | Tonnes | Fe | WR | Tonnes | Fe | WR | Tonnes | ||

(Mt) | (%) | (%) | (Mt) | (%) | (%) | (Mt) | (%) | (%) | (Mt) | ||

Castle Mountain | 266 | 32.6 | 38.0 | 107 | 32.6 | 38.0 | 372 | 32.6 | 38.0 | 317 | 0.85 |

Iron Valley | 34 | 34.1 | 40.0 | 57 | 33.9 | 40.0 | 91 | 34.0 | 40.0 | 62 | 0.68 |

Bay Zone F | 107 | 33.0 | 39.0 | 114 | 32.7 | 38.0 | 221 | 32.8 | 38.5 | 178 | 0.80 |

Total | 406 | 32.8 | 38.4 | 278 | 32.9 | 38.4 | 684 | 32.9 | 38.4 | 557 | 0.81 |

* Numbers may not add up due to rounding.

Processing Plan

The Process design basis for both the initial and expansion phases of the Study is outlined in Table 5.

Table 5: Proposed process design basis

Parameter | Unit** | Initial Phase* | Expansion Phase* |

Total feed processing rate | Mtpa | 13.3 | 26.5 |

Weight recovery (per project phase) | % | 39.1% | 38.2% |

Weight recovery (LOM) | % | 38.4% | |

Concentrate produced (Total) | Mtpa | 5.18 | 10.13 |

Concentrate produced (gravity ~ 84%) | Mtpa | 4.35 | 8.51 |

Concentrate produced (magnetic ~ 16%) | Mtpa | 0.83 | 1.62 |

Final Concentrate Grade (%Fe , % SiO2) | % | 66.6% Fe, 4.50% SiO2 | |

* Initial Phase from Yr 1 to Yr 4. Expansion Phase from Yr 5 to Yr 28. Excludes ramp-up years Yr 1 & Yr 5 ** All tonnages are in dry metric tonnes | |||

Site Infrastructure Conceptual Layout

The general site plot plan and main infrastructure features for the Project is based on the plan and layout developed during the 2012 PFS. Mining of the Castle Mountain, Iron Valley and Bay Zone F deposits only are considered for the Study. The other mineralized areas are left unencumbered in consideration of future mining.

Key Metrics of the Study

* Numbers may not add up due to rounding. The PEA is based on Mineral Resources. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The mine plan is based on Mineral Resources that have not been classified as Mineral Reserves, and there is no certainty that the PEA based on these Mineral Resources will be realized.

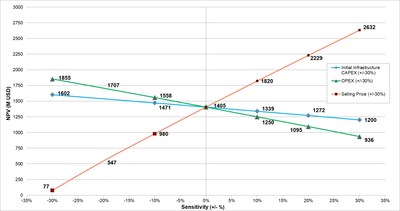

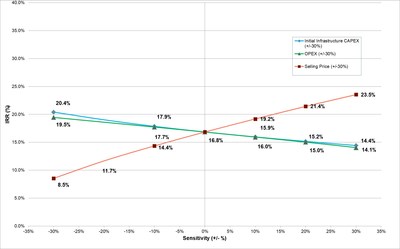

Figure 4 below highlights the sensitivity of post-tax NPV8 and IRR to the FOB concentrate selling price, the initial capex and the LOM operating costs:

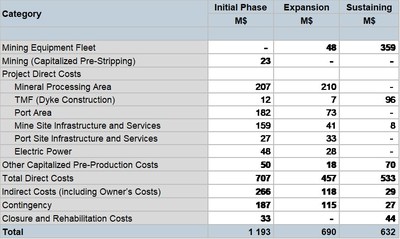

Capital Costs

Construction and Sustaining Capital Costs are set out below. The reduction in capital costs versus the 2012 PEA is largely due to the rescoped sizing of the plant and related infrastructure given the reduced production profile of the Project. Considering that concentrate is trucked to the port and not pumped, this eliminates costs related to regrinding and drying the concentrate. Furthermore, a strategy of leasing the mining, site service and concentrate hauling equipment and the barge-based power plant has been adopted in this PEA. This transfers costs from capital costs to operating costs.

* Numbers may not add up due to rounding.

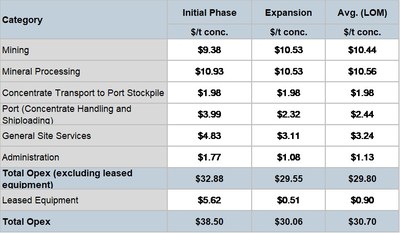

Operating Costs

A summary of the estimated operating costs is set out below:

* Numbers may not add up due to rounding.

The low operating costs are a function of a number of factors including:

Operating Costs exclude the 2% royalty payable to the previous holders of the Project. The Study assumes that the Company will exercise its right to purchase half of this royalty for $3 million at the commencement of commercial production.

Environmental Permitting

To date, all of the terrestrial baseline work for the Environmental Impact Assessment has been completed. The outstanding components include marine baseline data inventories and additional consultations with relevant stakeholders.

A time sensitive migratory bird survey was completed during May 2016. Further, in September 2016, the Company completed baseline data collection focused on marine mammals, fish studies, water quality, and mollusk habitat. With the insights obtained from baseline data collection and environmental studies the Company will engage in additional future dialogue with Inuit stakeholders in the region to optimize the Project's benefits and minimize the impacts associated with the Project's construction and subsequent operations.

Next Steps

In the coming months, the Company will be focused on the following activities:

Technical Disclosure

A NI 43-101 technical report is being prepared by BBA in respect of the Study. The technical information contained in this news release has been reviewed and approved by Mr. Derek Blais, P. Eng., of BBA with the exception of the Mineral Resource estimate which was reviewed and approved by Mr. E. Canova and the mine design and mine plan which have been prepared and approved by Mr. J. Cassoff, P. Eng. These individuals are all Qualified Persons as defined by NI 43-101 and independent of the Company.

OCEANIC IRON ORE CORP. (www.oceanicironore.com)

On behalf of the Board of Directors

"Steven Dean"

Executive Chairman

Tel: 604 566 9080

Fax: 604 566 9081

About Oceanic:

Oceanic is focused on the development of its 100% owned Hopes Advance, Morgan Lake and Roberts Lake iron ore development projects located on the coast in the Labrador Trough in Québec, Canada. In December 2019, the Company published the results of a preliminary economic assessment completed in respect of the flagship Hopes Advance project outlining a base case pre-tax NPV8 of USD$2.4 bn (post-tax NPV8 of USD $1.4 bn) over a 28 year mine life, supported by a NI 43-101 measured and indicated mineral resource of approximately 1.36 bn tonnes and a life of mine operating cost of approximately USD $30/tonne. Further information in respect of the Morgan Lake and Roberts Lake projects, both of which have been explored historically and which have defined historical resources, is also available on the Company's website.

Forward Looking Statements:

This news release includes certain "Forward-Looking Statements" as that term is used in applicable securities law. All statements included herein, other than statements of historical fact, including, without limitation, statements regarding the Study, the assumptions and pricing contained in the Study, the economic analysis contained in the Study, the results of the Study, the technical report for the Study, the development of the Project, securing a partner for the Project, securing additional financing for the Project, the mineral resources at the Project, and future plans and objectives of Oceanic are forward-looking statements that involve various risks and uncertainties. In certain cases, forward-looking statements can be identified by the use of words such as "plans", "expects" or "does not expect", "scheduled", "objective", "believes", "assumes", "likely", or variations of such words and phrases or statements that certain actions, events or results "potentially", "may", "could", "would", "should", "might" or "will" be taken, occur or be achieved. There can be no assurance that such statements will prove to be accurate, and actual results could differ materially from those expressed or implied by such statements. Forward-looking statements are based on certain assumptions that management believes are reasonable at the time they are made. In making the forward-looking statements in this presentation, the Company has applied several material assumptions, including, but not limited to, the assumption that: (1) there being no significant disruptions affecting operations, whether due to labour/supply disruptions, damage to equipment or otherwise; (2) permitting, development, expansion and power supply proceeding on a basis consistent with the Company's current expectations; (3) certain price assumptions for iron ore; (4) prices for availability of natural gas, fuel oil, electricity, parts and equipment and other key supplies remaining consistent with current levels; (5) the accuracy of current mineral resource estimates on the Company's property; and (6) labour and material costs increasing on a basis consistent with the Company's current expectations. Important factors that could cause actual results to differ materially from the Company's expectations are disclosed under the heading "Risks and Uncertainties " in the Company's MD&A filed November 21, 2019 (a copy of which is publicly available on SEDAR at www.sedar.com under the Company's profile) and elsewhere in documents filed from time to time, including MD&A, with the TSX Venture Exchange and other regulatory authorities. Such factors include, among others, risks related to the ability of the Company to obtain necessary financing and adequate insurance; the ability of the Company to secure a partner for the Project; the economy generally; fluctuations in the currency markets; fluctuations in the spot and forward price of iron ore or certain other commodities (e.g., diesel fuel and electricity); changes in interest rates; disruption to the credit markets and delays in obtaining financing; the possibility of cost overruns or unanticipated expenses; employee relations. Accordingly, readers are advised not to place undue reliance on Forward-Looking Statements. Except as required under applicable securities legislation, the Company undertakes no obligation to publicly update or revise Forward-Looking Statements, whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE Oceanic Iron Ore Corp.

Copyright 2019 Canada NewsWire

1 Year Oceanic Iron Ore Chart |

1 Month Oceanic Iron Ore Chart |

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions