We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Name | Symbol | Market | Type |

|---|---|---|---|

| American Rebel Holdings Inc | NASDAQ:AREBW | NASDAQ | Equity Warrant |

| Price Change | % Change | Price | Bid Price | Offer Price | High Price | Low Price | Open Price | Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0.00 | 0.00% | 0.0082 | 0.0045 | 0.01 | 0.01 | 0.01 | 0.01 | 91 | 22:00:00 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported)

(Exact name of registrant as specified in its charter)

| (State

or other jurisdiction of incorporation) |

(Commission

File Number) |

(IRS

Employer Identification No.) |

| ||

| (Address of principal executive offices) | (Zip Code) |

Registrant’s

telephone number, including area code:

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.02 Sale of Unregistered Securities.

On September 27, 2024, the Company authorized the issuance of 360,000 shares of common stock, valued at $0.448 per share, to a consultant pursuant to the terms of a consulting agreement.

The issuance of the shares of Common Stock will not be registered under the Securities Act of 1933, as amended, in reliance upon the exemption from the registration requirements of that Act provided by Section 4(a)(2) thereof. The recipient of shares is an accredited investor with the experience and expertise to evaluate the merits and risks of an investment in securities of the Registrant and the financial means to bear the risks of such an investment.

Item 3.03 Material Modification to Rights of Security Holders.

To the extent required by Item 3.03 of Form 8-K, the information contained in Item 5.03 herein is incorporated by reference into this Item 3.03.

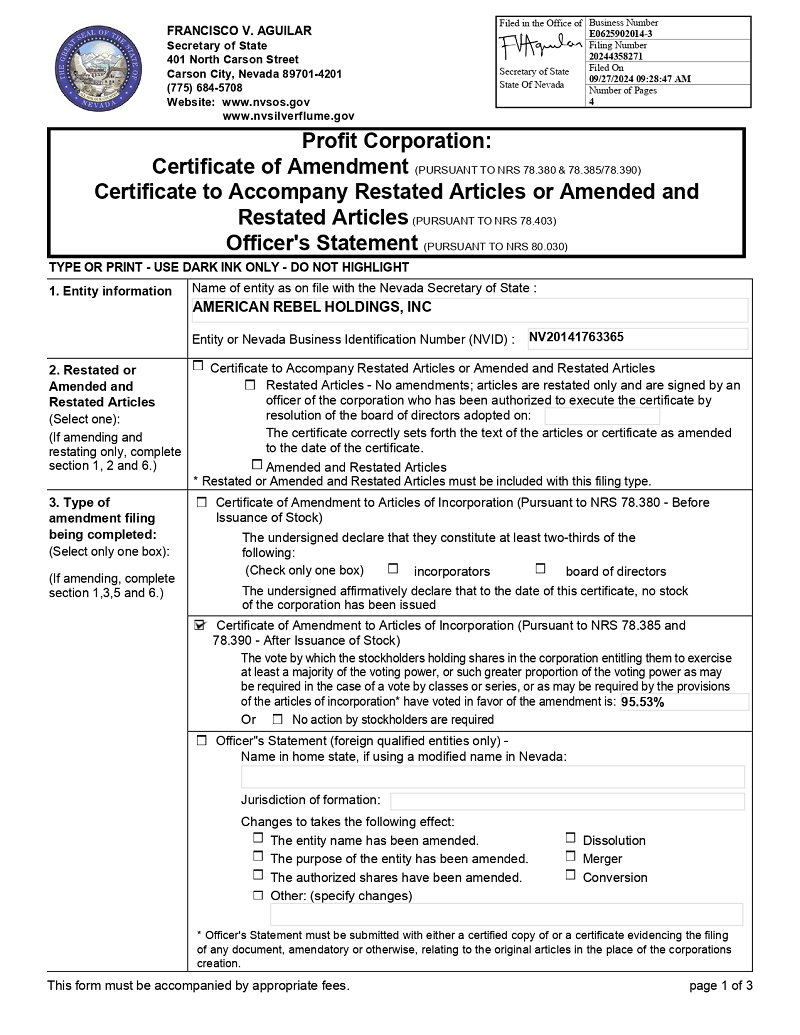

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

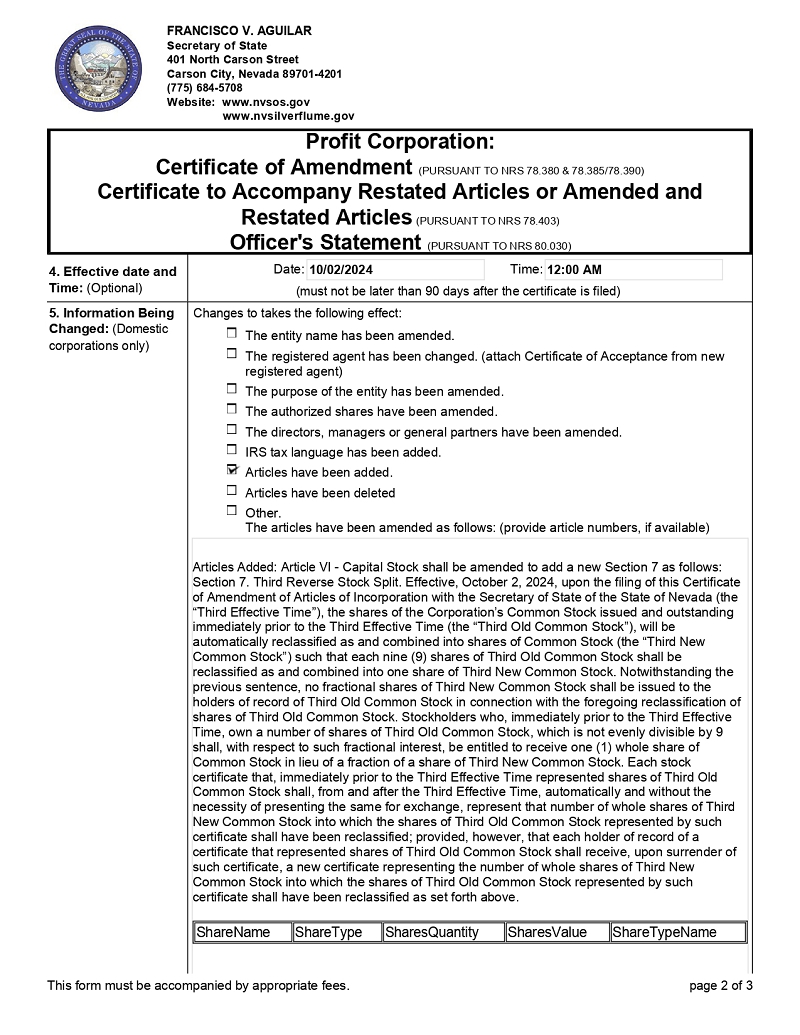

In connection with the various corporate actions disclosed in the Definitive Information Statement on Schedule 14C (the “Information Statement”) filed by American Rebel Holdings, Inc. (the “Company”) with the United States Securities and Exchange Commission (the “SEC”) on March 5, 2024, the stockholders of the Company approved a Certificate of Amendment to the Company’s Second Amended and Restated Articles of Incorporation (the “Certificate of Amendment”) on February 13, 2024 to effect a reverse stock split of the Company’s shares of common stock, par value $0.001 per share (the “Common Stock”), at a ratio of up to 1-for-10 (the “Reverse Stock Split”), with such ratio to be determined in the sole discretion of the Company’s Board of Directors (the “Board”) and with the Reverse Stock Split to be effected at such time and date, if at all, as determined by the Board in its sole discretion at any time within twelve (12) months of such stockholder approval. The Board set the Reverse Stock Split ratio at 1-for-9 and approved and authorized the filing of the Certificate of Amendment with the Certificate of Amendment to become effective as of 12:00 a.m. on October 2, 2024 (the “Effective Time”).

As a result of the Reverse Stock Split, every nine (9) shares of the Company’s pre-Reverse Stock Split Common Stock will be combined into one (1) share of the Company’s post-Reverse Stock Split Common Stock, without any change in par value per share. No fractional shares will be issued in connection with the Reverse Stock Split and all such fractional interests will be rounded up to the nearest whole number of shares of Common Stock.

The Reverse Stock Split is intended for the Company to regain compliance with the minimum bid price requirement of $1.00 per share of Common Stock for continued listing on The Nasdaq Capital Market (“Nasdaq”). The Reverse Stock Split will be effective at 12:00 a.m. on October 2, 2024, and the Common Stock is expected to begin trading on a Reverse Stock Split-adjusted basis on Nasdaq at the opening of the market on October 2, 2024. The trading symbol for the common stock will remain “AREB,” and the new CUSIP number of the common stock following the Reverse Stock Split is 02919L505.

The Company’s transfer agent, Securities Transfer Corporation, is acting as the exchange agent and paying agent for the Reverse Stock Split.

| 2 |

The Reverse Stock Split does not affect the Company’s authorized preferred stock. After the Reverse Stock Split, the Company’s authorized preferred Stock of 10,000,000 shares remained unchanged. Additionally, the Reverse Stock Split will not affect the par value of the preferred stock, or previously designated series of preferred stock, except to affect, where applicable, the conversion rates of such preferred stock. The Reverse Stock Split will have no effect on the voting rights of the outstanding shares of Series A Preferred Stock, which shall remain at 1,000:1, or the conversion rights of the Series C and D Convertible Preferred Stock, which shall remain at 5:1 (each share of Series C and D Convertible Preferred Stock is convertible into five shares of Common Stock).

Each stockholder’s percentage ownership interest in the Company and proportional voting power remains virtually unchanged as a result of the Reverse Stock Split, except for minor changes and adjustments that will result from rounding fractional shares into whole shares. The rights and privileges of the holders of shares of Common Stock will be substantially unaffected by the Reverse Stock Split.

In addition, the Reverse Stock Split will apply to the Common Stock issuable upon the exercise of the Company’s outstanding warrants, stock options and other derivative securities, with proportionate adjustments to be made to the exercise prices thereof. All outstanding Company options, warrants, and convertible/derivative securities entitling the holders thereof to purchase shares of Common Stock, if any, will enable such holders to purchase, upon exercise thereof, fewer of the number of shares of Common Stock which such holders would have been able to purchase upon exercise thereof immediately preceding the Reverse Stock Split, at the same total price (but a higher per share price) required to be paid upon exercise thereof immediately preceding the Reverse Stock Split

The summary of the Certificate of Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Certificate of Amendment, a copy of which is attached hereto as Exhibit 3.1 and is incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

On September 27, 2024, the Company issued a press release with respect to the Reverse Stock Split. A copy of the press release is furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K (this “Current Report”).

The information contained in this Item 7.01 of this Current Report, including Exhibit 99.1 hereto, is being furnished pursuant to Item 7.01 and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and it shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or under the Exchange Act, whether made before or after the date hereof, except as expressly set forth by specific reference in such filing to this Item 7.01 of this Current Report.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit Number | Description | |

| 3.1 | Certificate of Amendment to Second Amended and Restated Articles of Incorporation to be effective on October 2, 2024 | |

| 99.1 | Reverse Stock Split Press Release dated September 27, 2024 | |

| 104 | Cover Page Interactive Data File |

| 3 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| AMERICAN REBEL HOLDINGS, INC. | ||||

| Date: | September 27, 2024 | By: | /s/ Charles A. Ross, Jr. | |

| Charles A. Ross, Jr. | ||||

| Chief Executive Officer | ||||

| 4 |

Exhibit 3.1

Exhibit 99.1

AMERICAN REBEL ANNOUNCES 1-FOR-9 REVERSE STOCK SPLIT

Nashville, TN / September 27, 2024 / GLOBE NEWSWIRE / — American Rebel Holdings, Inc. (NASDAQ: AREB) — America’s Patriotic Brand (the “Company”), today announced that it will effect a reverse stock split of its outstanding shares of common stock, par value $0.001 per share (the “Common Stock”), at a ratio of 1-for-9, to be effective as of 12:00 a.m. Eastern Time on October 2, 2024.

The Company’s Common Stock will begin trading on a reverse stock split-adjusted basis at the opening of The Nasdaq Capital Market (“Nasdaq”) on Wednesday, October 2, 2024. Following the reverse stock split, the Common Stock will continue to trade on Nasdaq under the symbol “AREB” with the new CUSIP number, 02919L505. The reverse stock split is intended for the Company to regain compliance with the minimum bid price requirement of $1.00 per share of common stock for continued listing on Nasdaq.

The reverse stock split will not change the authorized number of shares of our Common Stock. No fractional shares will be issued in connection with the reverse stock split and all such fractional interests will be rounded up to the nearest whole number of shares of Common Stock. In addition, the reverse stock split will apply to the Common Stock issuable upon the exercise of the Company’s outstanding derivative securities, with proportionate adjustments to be made to the exercise prices and number of derivates thereof and under the Company’s equity incentive plans.

The reverse stock split will reduce the number of issued and outstanding shares of the Company’s common stock from approximately 9.2 million to approximately 1.02 million.

On February 13, 2024, the stockholders of the Company approved a Certificate of Amendment to the Company’s Second Amended and Restated Articles of Incorporation to effect a reverse stock split of the Common Stock, at a ratio of up to 1-for-10, with such ratio to be determined in the sole discretion of the Company’s board of directors (the “Board”) and with the reverse stock split to be effected at such time and date, if at all, as determined by the Board in its sole discretion at any time within twelve (12) months of such stockholder approval. The Board approved the reverse stock split at a ratio of 1-for-9 on September 17, 2024.

Securities Transfer Corporation is acting as the exchange agent and paying agent for the reverse stock split. Stockholders holding their shares in book-entry form or in brokerage accounts need not take any action in connection with the reverse stock split.

Securities Transfer Corporation will provide instructions to any stockholders with certificates regarding the process in connection with the exchange of pre-reverse stock split stock certificates for ownership in book-entry form or stock certificates on a post-reverse stock split basis. Stockholders are encouraged to contact their bank, broker or custodian with any procedural questions.

About American Rebel Holdings, Inc.

American Rebel Holdings, Inc. (NASDAQ: AREB) has operated primarily as a designer, manufacturer and marketer of branded safes and personal security and self-defense products and has recently transitioned into the beverage industry through the introduction of American Rebel Beer. The Company also designs and produces branded apparel and accessories. To learn more, visit www.americanrebel.com and www.americanrebelbeer.com. For investor information, visit www.americanrebel.com/investor-relations .

Cautionary Note Regarding Forward-Looking Statements:

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The Company desires to take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and is including this cautionary statement in connection with this safe harbor legislation. The words “forecasts” “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “could,” “target,” “potential,” “is likely,” “expect” and similar expressions, as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking statements primarily on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, and financial needs. Important factors that could cause actual results to differ from those in the forward-looking statements include our ability to raise adequate working and expansion capital, our ability to efficiently incorporate acquisitions into our operations, the use of non-GAAP based pro forma financial estimates, our ability to introduce new products, our ability to meet production demands, our ability to expand our sales organization to address existing and new markets that we intend to target, our ability to meet or exceed financial and reporting estimates, any effects of the reverse stock split, our ability to continue to meet Nasdaq listing requirements, and the Risk Factors contained within our filings with the SEC, including our Annual Report on Form 10-K for the year ended December 31, 2023. Any forward-looking statement made by us herein speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future developments or otherwise, except as may be required by law.

SOURCE: American Rebel Holdings, Inc.

Company Contact:

info@americanrebel.com

Investor Relations:

Brian Prenoveau

MZ North America

+1 (561) 489-5315

AREB@mzgroup.us

1 Year American Rebel Chart |

1 Month American Rebel Chart |

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions