We could not find any results for:

Make sure your spelling is correct or try broadening your search.

| Share Name | Share Symbol | Market | Type |

|---|---|---|---|

| Tellurian Inc | AMEX:TELL | AMEX | Common Stock |

| Price Change | % Change | Share Price | High Price | Low Price | Open Price | Shares Traded | Last Trade | |

|---|---|---|---|---|---|---|---|---|

| 0.00 | 0.00% | 0.999 | 0 | 00:00:00 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material under §240.14a-12 |

Tellurian Inc.

(Name of Registrant as Specified In Its Charter)

Woodside Energy Group Ltd

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

This filing contains the following communications:

| 1. |

| 2. | A transcript of the conference call held by Woodside on July 22, 2024 relating to the Acquisition. |

| 3. | An investor presentation published by Woodside on July 22, 2024 relating to the Acquisition. |

| 4. | Social media posts of Woodside published on July 22, 2024 relating to the Acquisition. |

1. A press release issued by Woodside on July 22, 2024 relating to the Acquisition:

Woodside Energy Group Ltd

ACN 004 898 962

Mia Yellagonga

11 Mount Street

Perth WA 6000

Australia

T +61 8 9348 4000

www.woodside.com

ASX: WDS

NYSE: WDS

LSE: WDS

Announcement

Monday, 22 July 2024

WOODSIDE TO ACQUIRE TELLURIAN AND DRIFTWOOD LNG

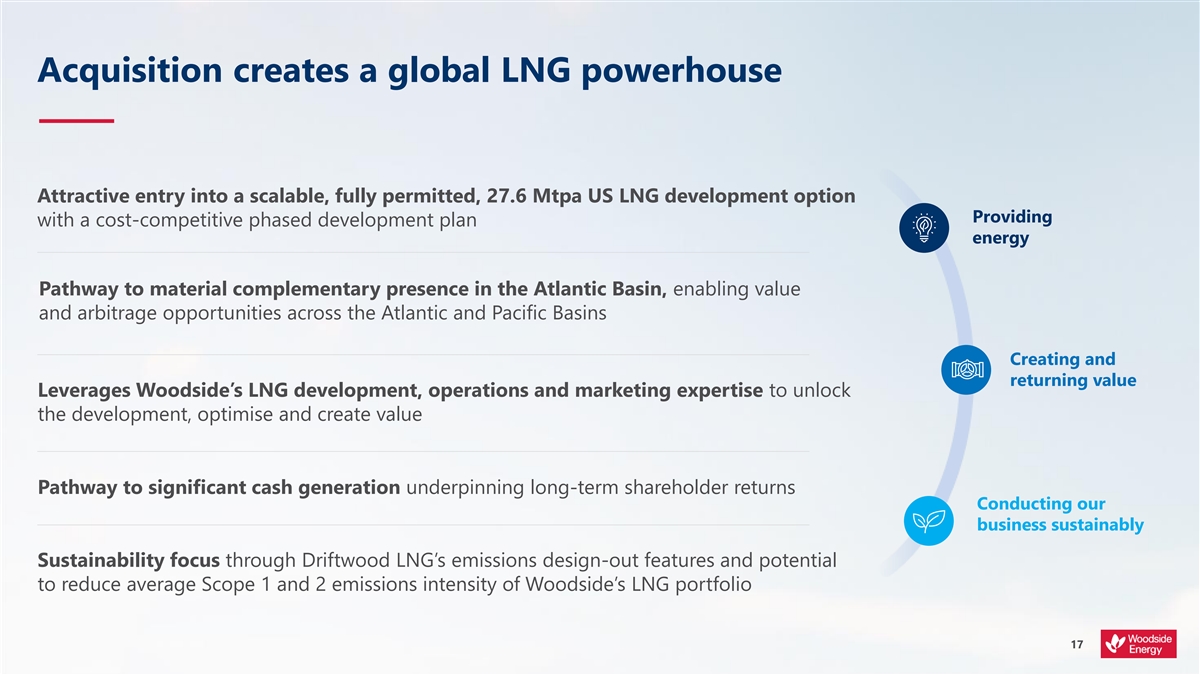

| • | Creates a global LNG powerhouse |

| • | Attractive entry into scalable, fully permitted 27.6 million tonnes per annum (Mtpa) US LNG development option |

| • | Significant cash generation potential to underpin long-term shareholder returns |

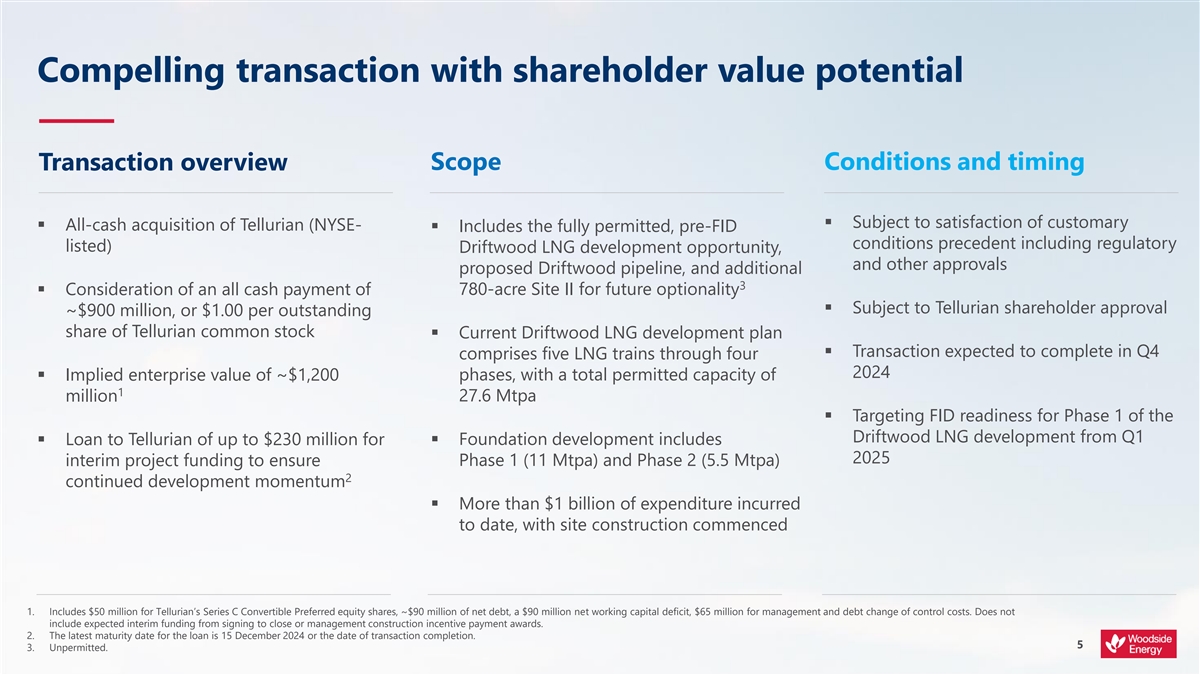

Woodside has entered into a definitive agreement to acquire all issued and outstanding common stock of Tellurian (NYSE: TELL) including its owned and operated US Gulf Coast Driftwood LNG development opportunity (“Driftwood LNG”).

The consideration for the transaction is an all-cash payment of approximately $900 million, or $1.00 per share of outstanding Tellurian common stock. The implied enterprise value is approximately $1,200 million.1 This represents an attractive entry into an opportunity with more than $1 billion of expenditure incurred to date.

“The acquisition of Tellurian and its Driftwood LNG development opportunity positions Woodside to be a global LNG powerhouse,” said Woodside CEO Meg O’Neill.

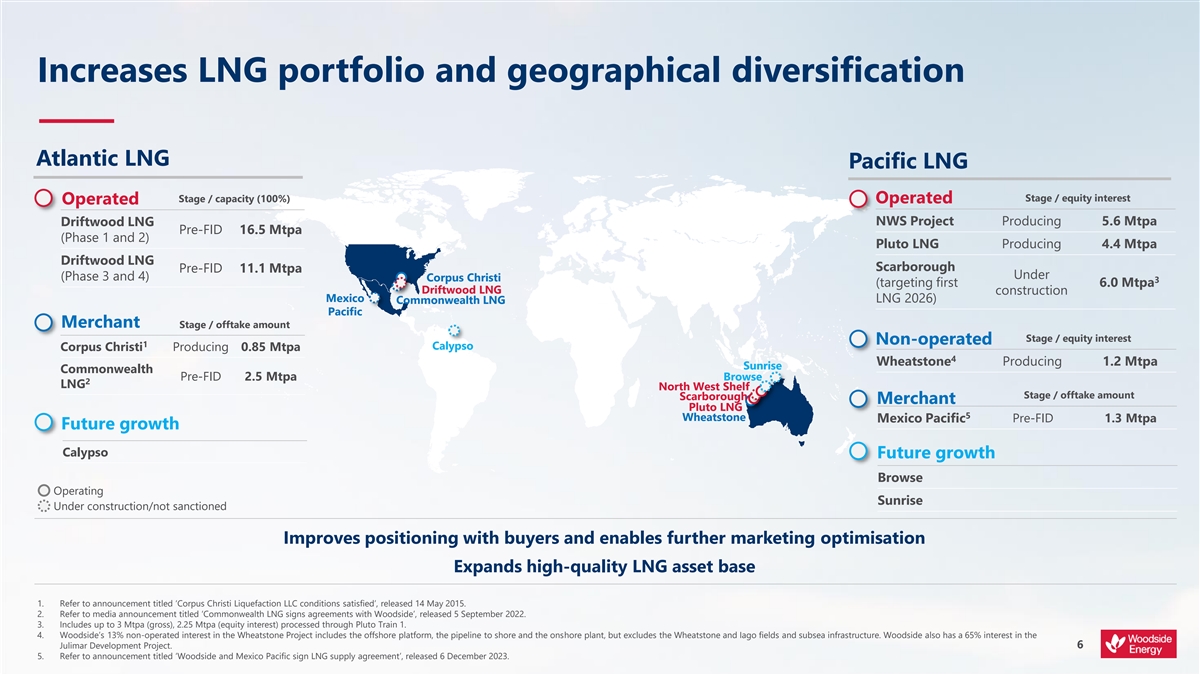

“It adds a scalable US LNG development opportunity to our existing approximately 10 Mtpa of equity LNG in Australia. Having a complementary US position would allow us to better serve customers globally and capture further marketing optimisation opportunities across both the Atlantic and Pacific Basins.

“The Driftwood LNG development opportunity is competitively advantaged. Woodside expects to leverage its global LNG expertise to unlock this fully permitted development and expand our relationship with Bechtel which is the EPC contractor for both Driftwood LNG and our Pluto Train 2 project in Australia.

| 1 | Includes $50 million for Tellurian’s Series C Convertible Preferred equity shares, ~$90 million of net debt, a ~$90 million net working capital adjustment, ~$65 million for management and debt change of control costs. Does not include expected interim funding from signing to close or management construction incentive payment awards. |

Page 1 of 6

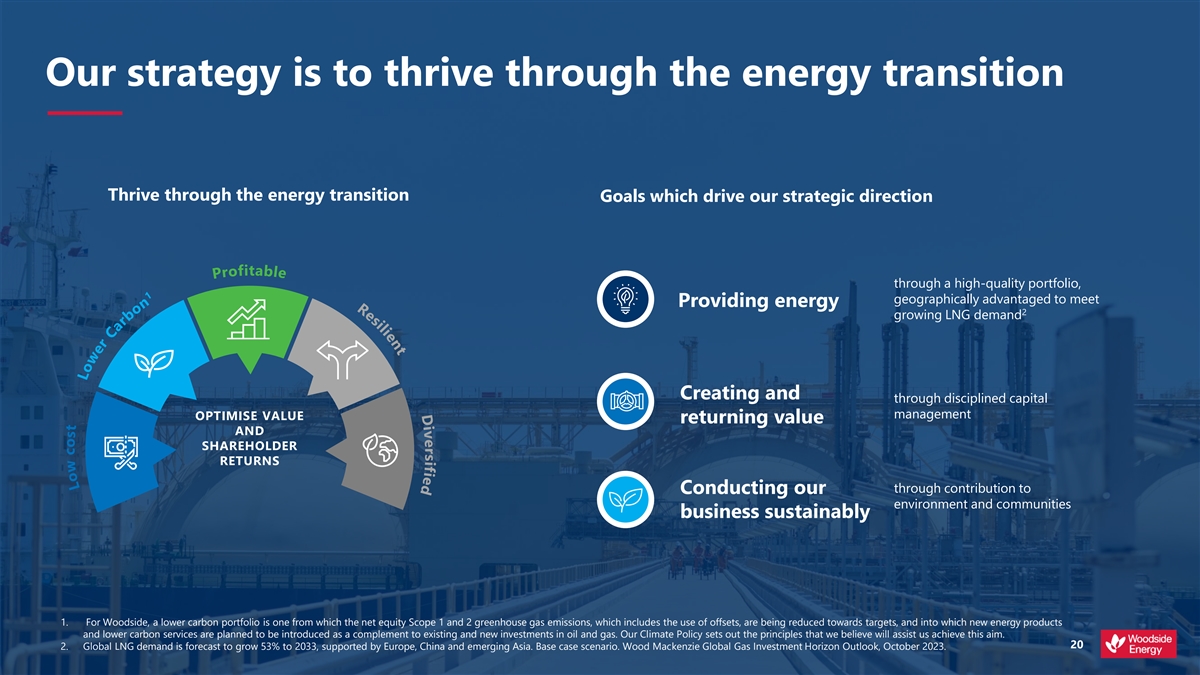

“Through this acquisition, we are delivering on our strategy to thrive through the energy transition. Woodside believes that LNG will play a key role in the energy transition and is well positioned to deliver the energy the world needs while delivering significant value to our shareholders.”

Strategic rationale

The acquisition of Tellurian and its Driftwood LNG development opportunity strengthens Woodside’s positioning to deliver on our strategy to thrive through the energy transition. The expected benefits of the acquisition include:

| • | Expanding Woodside’s position as a leading independent LNG company; |

| • | Adding a high-quality, fully permitted US LNG development option to Woodside’s portfolio; |

| • | Leveraging Woodside’s LNG development, operations and marketing expertise to unlock the development and create value; |

| • | Enabling value creation from marketing optimisation with geographic diversification; |

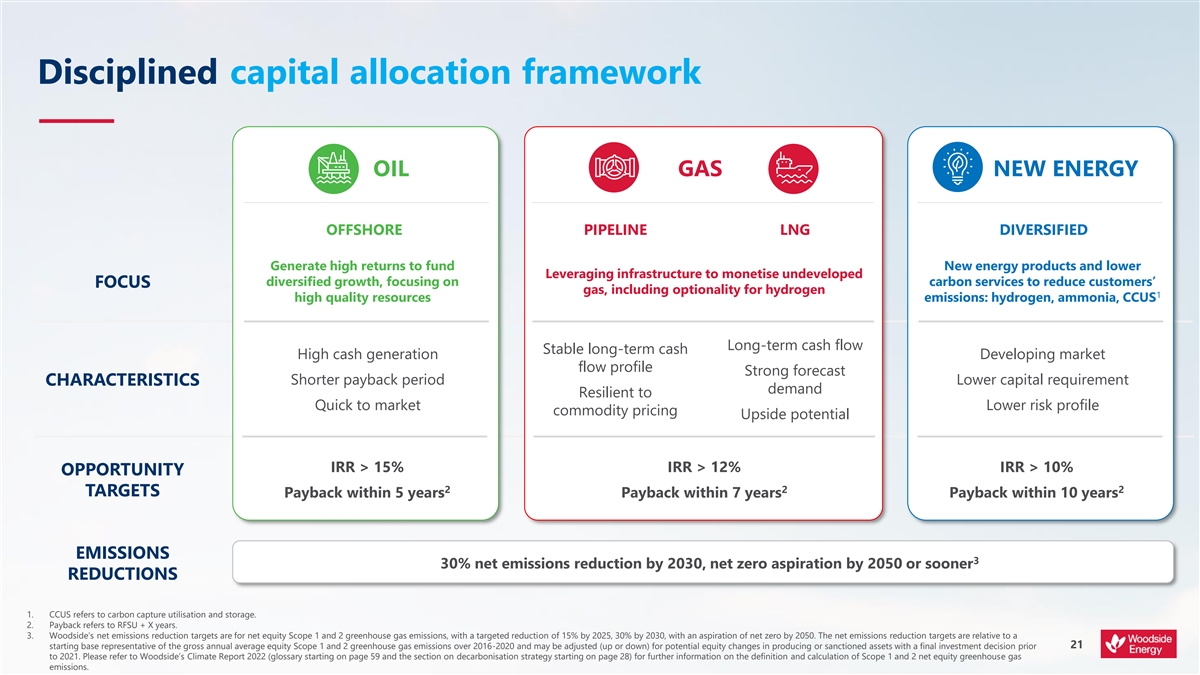

| • | Increasing long-term cashflow generation potential with a phased development to manage investment decisions aligned with Woodside’s capital allocation framework; and |

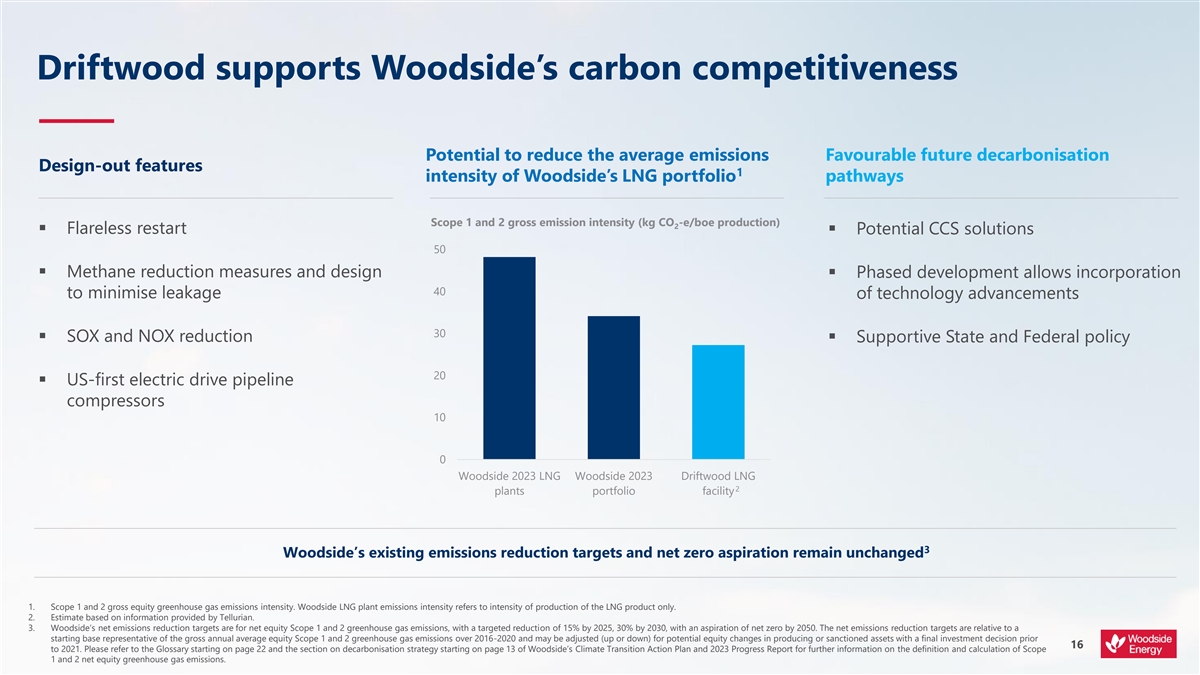

| • | Supporting Woodside’s carbon competitiveness through increased exposure to LNG and potential to reduce the average Scope 1 and 2 emissions intensity of Woodside’s LNG portfolio. |

Woodside’s target of reducing net equity Scope 1 and 2 emissions by 2030, and aspiration for net zero by 2050, are unchanged.2

Driftwood LNG

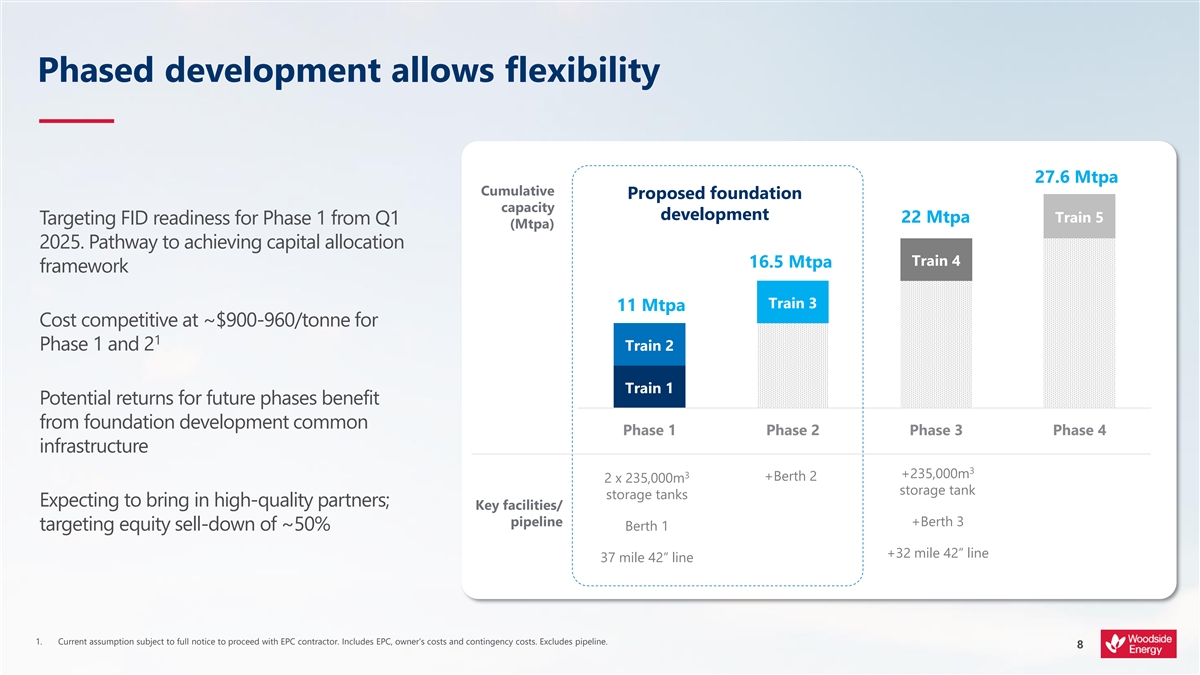

Driftwood LNG is a fully permitted, pre-final investment decision (FID) development opportunity located near Lake Charles, Louisiana. The current development plan comprises five LNG trains through four phases, with a total permitted capacity of 27.6 Mtpa.

The foundation development includes Phase 1 (11 Mtpa) and Phase 2 (5.5 Mtpa). Woodside is targeting FID readiness for Phase 1 of the Driftwood LNG development opportunity from the first quarter of 2025.

The Driftwood LNG development opportunity is competitively advantaged:

| • | The development is fully permitted, and has a valid non-free trade agreement (FTA) export authorisation. The development also recently received an extension of its Federal Energy Regulatory Commission (FERC) authorisation; |

| • | The design is cost and carbon competitive. Woodside expects development costs of ~$900-960/tonne for Phase 1 and 2.3The contracting strategy is a lump-sum turnkey contract with LNG contractor Bechtel; and |

| • | Construction has commenced, with pilings for Trains 1 and 2 complete, foundation work in progress and pilings underway for the LNG tanks. The progress on ground work reduces the risk to EPC timeline and cost. |

| 2 | Woodside’s net emissions reduction targets are for net equity Scope 1 and 2 greenhouse gas emissions, with a targeted reduction of 15% by 2025, 30% by 2030, with an aspiration of net zero by 2050. The net emissions reduction targets are relative to a starting base representative of the gross annual average equity Scope 1 and 2 greenhouse gas emissions over 2016-2020 and may be adjusted (up or down) for potential equity changes in producing or sanctioned assets with a final investment decision prior to 2021. |

| 3 | Includes EPC (engineering, procurement, construction), owner’s costs and contingency costs. Excludes pipeline costs. |

Page 2 of 6

Transaction details

Under the proposed transaction Woodside, or a wholly owned subsidiary of Woodside, will acquire 100% of the issued and outstanding shares of common stock of Tellurian Inc. (“Tellurian”).

Tellurian’s Board of Directors has approved the transaction and has recommended that its shareholders approve the transaction. The transaction is targeting completion in the fourth quarter of the 2024 calendar year.

The transaction is subject to satisfaction of customary conditions precedent, including maintenance of validity for existing authorisations (e.g. Department of Energy (DOE) and FERC), Tellurian shareholder approval, regulatory approval and other approvals.

In connection with entry into a binding agreement to acquire Tellurian, Woodside will provide a loan to Tellurian of up to $230 million to ensure Driftwood LNG site activity and de-risking activities maintain momentum prior to completion of the transaction. The loan is secured by a first priority lien over the borrower’s assets subject to customary exclusions. The latest maturity date for the loan is 15 December 2024 or the date of transaction completion.

Woodside’s sole financial adviser is PJT Partners and its legal adviser is Norton Rose Fulbright.

About Woodside

Woodside led the development of the LNG industry in Australia. With a focused portfolio, Woodside is recognised for its world-class capabilities as an integrated upstream supplier of energy. Woodside’s proven track record and distinctive capabilities are underpinned by 70 years of experience.

About Tellurian

Tellurian aims to generate shareholder value by establishing a competitive LNG enterprise, effectively supplying natural gas to customers worldwide. Headquartered in Houston, Texas, Tellurian is developing Driftwood LNG, an approximately 27.6 Mtpa LNG export facility and associated pipeline.

Teleconference

A conference call providing an overview of the transaction with a question and answer session will be hosted by Woodside CEO and Managing Director Meg O’Neill on Monday, 22 July 2024 at 08:00 AWST/10:00 AEST (19:00 CDT Sunday, 21 July 2024).

We recommend participants pre-register five to 10 minutes prior to the event with one of the following links:

| • |

https://webcast.openbriefing.com/wds-ann-2024/ to listen to a live stream of the question-and-answer session |

| • | https://s1.c-conf.com/diamondpass/10040740-jh78y6.html to participate in the question and answer session. Following pre-registration, participants will receive the teleconference details and a unique access passcode. |

An investor presentation follows this announcement and will be referred to during the conference call. It will also be made available on the Woodside website (www.woodside.com) and has today been submitted to the FCA National Storage Mechanism and will shortly be available for inspection at https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

A copy of the transcript of the conference call will also be submitted to the National Storage Mechanism and will be available for inspection at the web address set out above following the conclusion of the conference call.

Page 3 of 6

| Contacts: | ||

| INVESTORS | MEDIA | |

| Marcela Louzada | Christine Forster (Australia) | |

| M: +61 456 994 243 | M: +61 484 112 469 | |

| E: investor@woodside.com | E: christine.forster@woodside.com | |

| Rob Young (United States) | ||

| M: +1 281 790 2805 | ||

| E: robert.young@woodside.com | ||

This announcement was approved and authorised for release by Woodside’s Disclosure Committee.

Announcement contains inside information

This announcement contains inside information. Marcela Louzada, Vice President Investor Relations is responsible for release of this announcement.

Forward-looking statements

This presentation contains forward-looking statements with respect to Woodside’s business and operations, market conditions, results of operations and financial condition, including, for example, but not limited to, statements regarding Woodside’s proposed acquisition of Tellurian, the development, completion and execution of Woodside’s projects, expectations regarding future capital expenditures, future results of projects, operating activities, new energy products, expectations and plans for renewables production capacity and investments in, and development of, renewables projects, expectations and guidance with respect to production, investment expenditure and gas hub exposure for 2024, and expectations regarding the achievement of Woodside’s net equity Scope 1 and 2 greenhouse gas emissions targets. All statements, other than statements of historical or present facts, are forward-looking statements and generally may be identified by the use of forward-looking words such as ‘pathway’, ‘guidance’, ‘foresee’, ‘likely’, ‘potential’, ‘anticipate’, ‘believe’, ‘aim’, ‘estimate’, ‘expect’, ‘intend’, ‘may’, ‘target’, ‘plan’, ‘strategy’, ‘forecast’, ‘outlook’, ‘project’, ‘schedule’, ‘will’, ‘should’, ‘seek’ and other similar words or expressions. Similarly, statements that describe the objectives, plans, goals or expectations of Woodside are forward-looking statements.

Forward-looking statements in this presentation are not guidance, forecasts, guarantees or predictions of future events or performance, but are in the nature of future expectations that are based on management’s current expectations and assumptions. Those statements and any assumptions on which they are based are subject to change without notice and are subject to inherent known and unknown risks, uncertainties, assumptions and other factors, many of which are beyond the control of Woodside, its related bodies corporate and their respective beneficiaries. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, the occurrence, or failure or certain events to occur, of any event, change or other circumstances that could give rise to the termination of the merger agreement with Tellurian; the risk that the closing conditions for the acquisition of Tellurian will not be satisfied, including the risk that regulatory approvals will not be obtained, the risk that Tellurian shareholder approval will not be obtained, the possibility that the transaction will not be completed in the expected timeframe or at all, potential adverse effects to the businesses of Tellurian during the pendency of the transaction, the risk of security holder litigation relating to the transaction, including resulting expense or delay, the potential that the expected benefits and opportunities of the acquisition, if completed, may not be realised or may take longer to realize than expected; challenges inherent in the development of LNG facilities, fluctuations in commodity prices, actual demand for Woodside products, currency fluctuations, geotechnical factors, drilling and production results, gas commercialisation, development progress, operating results, engineering estimates, reserve and resource estimates, loss of market, industry competition, environmental risks, climate related risks, physical risks, legislative, fiscal and regulatory developments, changes in accounting standards, economic and financial markets conditions in various countries and regions, political risks, project delay or advancement, regulatory approvals, the impact of armed conflict and political instability (such as the ongoing conflict in Ukraine or the Middle East) on economic activity and oil and gas supply and demand, cost estimates, and the effect of future regulatory or legislative actions on Woodside or the industries in which it operates, including potential changes to tax laws, and the impact of general economic conditions, inflationary conditions, prevailing exchange rates and interest rates and conditions in financial markets.

Page 4 of 6

A more detailed summary of the key risks relating to Woodside and its business can be found in the “Risk” section of Woodside’s most recent Annual Report released to the Australian Securities Exchange and the London Stock Exchange and in Woodside’s most recent Annual Report on Form 20-F filed with the United States Securities and Exchange Commission (SEC) and available on the Woodside website at https://www.woodside.com/investors/reports-investor-briefings. You should review and have regard to these risks when considering the information contained in this presentation.

Investors are strongly cautioned not to place undue reliance on any forward-looking statements. Actual results or performance may vary materially from those expressed in, or implied by, any forward-looking statements.

Important additional information and where to find it

This communication may be deemed to be solicitation material in respect of the proposed acquisition of Tellurian by an affiliate of Woodside. In connection with the proposed transaction, Tellurian intends to file relevant materials with the U.S. Securities and Exchange Commission (“SEC”), including Tellurian’s proxy statement in preliminary and definitive form. Promptly after filing the definitive proxy statement, Tellurian will mail the definitive proxy statement and a proxy card to the stockholders of Tellurian.

INVESTORS AND SECURITY HOLDERS OF TELLURIAN ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING TELLURIAN’S PROXY STATEMENT (WHEN THEY ARE AVAILABLE), BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION.

Investors and security holders of Tellurian are or will be able to obtain these documents (when they are available) free of charge from the SEC’s website at www.sec.gov or free of charge from Tellurian on Tellurian’s investor relations website at https://tellurianinc.com/.

Participants in the solicitation

This communication does not constitute a solicitation of proxy, an offer to purchase or a solicitation of an offer to sell any securities. Woodside, Tellurian and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the security holders of Tellurian in connection with the proposed transaction. Information regarding the interests of these directors and executive officers in the proposed transaction will be included in the definitive proxy statement referred to above. Security holders may also obtain information regarding the names, affiliations and interests of Woodside’s directors and executive officers in the Woodside Annual Report on Form 20-F for the fiscal year ended December 31, 2023, which was filed with the SEC on February 27, 2024. Security holders may obtain information regarding the names, affiliations and interests of Tellurian’s directors and executive officers in Tellurian’s definitive proxy statement in connection with its 2024 Annual Meeting of Stockholders (the “Tellurian Proxy Statement”), which was filed with the SEC on April 25, 2024, under “Proposal 1 —Election of Directors to the Company’s Board —Background Information About the Nominees and Other Directors,” “Proposal 1 —Election of Directors to the Company’s Board —Executive Officers,” “Compensation Discussion and Analysis” and “Security Ownership of Certain Beneficial Owners and Management.” To the extent that holdings of Tellurian’s securities have changed since the amounts printed in the Tellurian Proxy Statement, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Information regarding Tellurian’s transactions with related persons is set forth under the caption “Certain Relationships and Related Party Transactions” in the Tellurian Proxy Statement. Additional information regarding the interests of such individuals in the proposed transaction will be included in the definitive proxy statement relating to the proposed transaction when it is filed with the SEC. These documents (when available) may be obtained free of charge from the SEC’s website at www.sec.gov, Woodside’s website at www.woodside.com/investors and Tellurian’s website at https://tellurianinc.com. The contents of the websites referenced above are not deemed to be incorporated by reference into the proxy statement.

Page 5 of 6

Climate strategy and emissions data

All greenhouse gas emissions data in this presentation are estimates, due to the inherent uncertainty and limitations in measuring or quantifying greenhouse gas emissions, and our methodologies for measuring or quantifying greenhouse gas emissions may evolve as best practices continue to develop and data quality and quantity continue to improve.

Woodside “greenhouse gas” or “emissions” information reported are net equity Scope 1 greenhouse gas emissions, Scope 2 greenhouse gas emissions, and/or Scope 3 greenhouse gas emissions, unless otherwise stated.

For more information on Woodside’s climate strategy and performance, including further details regarding Woodside’s targets, aspirations and goals and the underlying methodology, judgements, assumptions and contingencies, refer to Woodside’s Climate Transition Action Plan 2023 (CTAP) available on the Woodside website at https://www.woodside.com/sustainability/climate-change. The glossary and footnotes to this presentation provide clarification regarding the use of terms such as “lower carbon” under Woodside’s climate strategy. A full glossary of terms used in connection with Woodside’s climate strategy is contained in the CTAP.

Page 6 of 6

2. A transcript of the conference call held by Woodside on July 22, 2024 relating to the Acquisition:

Woodside Energy Group Ltd

ACN 004 898 962

Mia Yellagonga

11 Mount Street

Perth WA 6000

Australia

T +61 8 9348 4000

www.woodside.com

ASX: WDS

NYSE: WDS

LSE: WDS

Announcement

Monday, 22 July 2024

WOODSIDE TO ACQUIRE TELLURIAN TRANSCRIPT

Date: 22 July 2024

Time: 08:00 AWST / 10:00 AEST / 19:00 CDT (Sunday, 21 July 2024)

Start of Transcript

Operator: Thank you for standing by and welcome to the Woodside Energy Group Limited investor call. All participants are in a listen only mode. There will be a presentation followed by a question and answer session. If you wish to ask a question, you will need to press the star key followed by the number 1 on your telephone keypad. I would now like to hand the conference over to Ms Meg O’Neill, CEO and Managing Director. Please go ahead.

Meg O’Neill: Good morning everyone and thank you for joining this call. I am excited to announce Woodside’s agreement to acquire Tellurian and its US Gulf Coast Driftwood LNG development. I would like to begin by acknowledging the First Nations people of the various lands on which we live and work and pay my respects to their Elders past, present, and emerging.

Today I am joined on the call by our incoming Chief Operating Officer International, Daniel Kalms, and our Chief Financial Officer, Graham Tiver. In this call, we will provide an overview of the acquisition, deal rationale, and value creation opportunity before opening up to Q&A. Please take the time to read the disclaimers, assumptions, and other important information. I’d like to remind you that all dollar figures in today’s presentation are in US dollars unless otherwise indicated.

Going to slide 4. Today, Woodside has entered into a definitive agreement to acquire Tellurian and its advantaged US LNG development, Driftwood LNG. This acquisition positions Woodside to become a global LNG powerhouse and fits strongly with our strategy to thrive through the energy transition.

Page 1 of 19

The acquisition is an attractive entry into a fully permitted pre-FID development option with expansion potential. Key civil works have already been completed. The Driftwood LNG development offers a pathway to complement our existing Australian LNG position, with an increase in material presence in the Atlantic Basin. This creates opportunity for value optimisation and arbitrage between the basins, underpinned by multiple competitive cost of supply LNG sources.

Another key benefit of this deal is the value Woodside unlocks from the start. We will leverage our LNG development, operations, and marketing expertise. We will bring our multidecade track record as a world class LNG player and our strong relationships with key suppliers and customers. We see a pathway to significant growth and cash generation underpinning shareholder returns in the 2030s.

Finally, this opportunity fits with our decarbonisation plans and has the potential to reduce the average Scope 1 and 2 emissions intensity of our LNG portfolio since it uses technologies to design out emissions.

Slide 5. The transaction comprises a cash offer of $1 per share or a total equity consideration of approximately $900 million, with an implied enterprise value of $1.2 billion. This provides a cost competitive entry into a near FID ready, fully permitted development that has had over $1 billion expenditure incurred to date in engineering and pre-FID civil and site works.

The Driftwood LNG project contemplates construction of five LNG trains in a phased development. It has a total permitted capacity of 27.6 million tonnes per annum. We expect to complete the deal in the fourth quarter this year and are targeting FID readiness for the Phase 1 development from the first quarter of 2025.

Let me explore the key value drivers for this transaction in more detail. Starting with our portfolio, this acquisition improves our already strong asset base, adding depth and optionality to our growth pipeline for the 2030s. It positions Woodside to be a global LNG powerhouse, differentiated with significant exposure across both the Pacific and Atlantic Basins.

Driftwood LNG is a high-quality US LNG development located in Louisiana. It is a fully permitted US development, holding both a valid non-FTA LNG export authorisation from the Department of Energy, and a Federal Energy Regulatory Commission authorisation which was recently approved for an extension. This means it is not impacted by the current US LNG pause.

The engineering procurement and construction contractor for the project is Bechtel, a company recognised in the industry for its capability and reputation for delivery. We have a strong relationship with Bechtel as the EPC contractor for our Pluto Train 2 development in Western Australia and have been very pleased with the progress to date.

Page 2 of 19

The project also includes a 37-mile pipeline, providing multiple options for securing, sorry, providing multiple options for sourcing, low-cost feed gas. Additionally, there is a second 780-acre expansion site further south that offers future development optionality.

I now invite our incoming Chief Operating Officer International, Daniel Kalms, to cover the project in more detail.

Daniel Kalms: Thanks, Meg. I’m very excited about the proposed acquisition we’re announcing today in the high-quality Driftwood development option. The Driftwood LNG development is fully permitted for over 27 million tonnes per annum across multiple phases. Phases 1 and 2 are the proposed foundation development and include three trains of around 5.5 million tonnes per annum each which we would look to further debottleneck to increase capacity.

The Driftwood site is also permitted for further expansion, with Phases 3 and 4 which comprise one train each. The phased approach allows us to manage the pace of investment and also provides the ability to incorporate the latest technology in future phases.

This is a mature development option and we will move at pace, targeting being FID ready for the first phase from the first quarter of next year, with a pathway to achieving the return targets of our capital allocation framework.

We currently estimate a development cost of $900 to $960 per tonne of capacity for Phases 1 and 2. This includes EPC, owner’s costs, and contingency but excludes the pipeline. Let’s have a look at the development concept of Phases 1 and 2 in more detail.

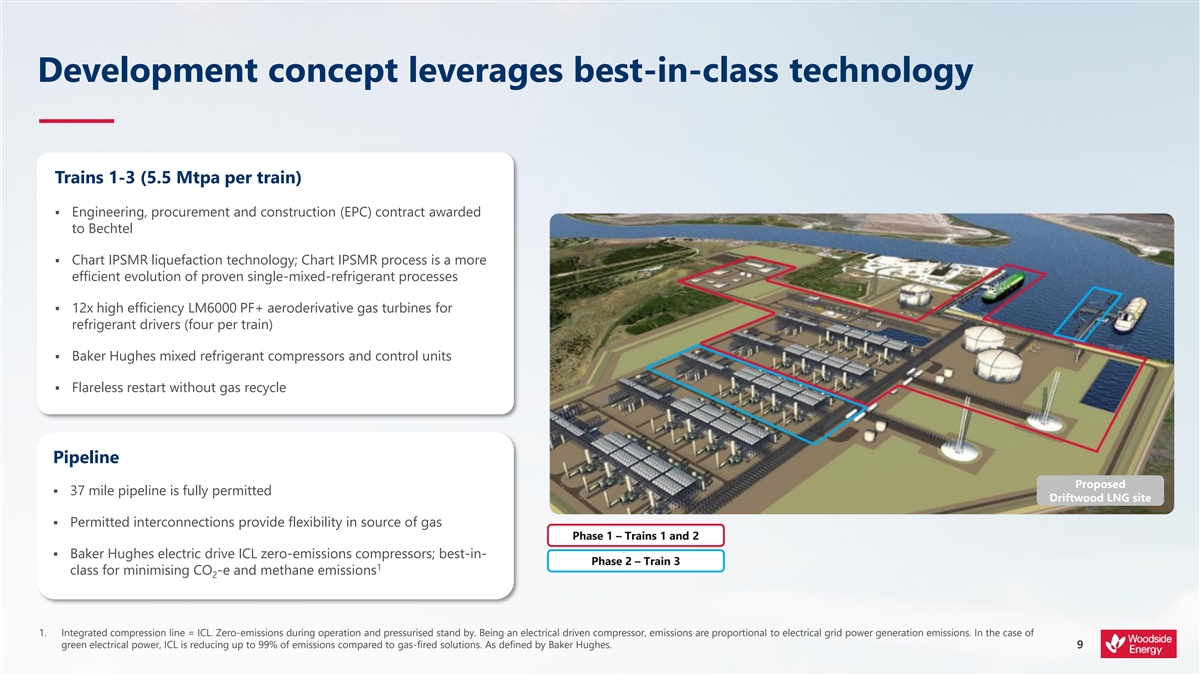

The schematic on slide 9 shows what is included in each of the first two phases. The project design leverages best in class technology with a highly efficient liquefaction process and gas turbines, as well as flareless restart without gas recycle.

With this, we’re very comfortable stepping in at this point in the development. The development is well situated and will have a 37-mile pipeline to source gas from the abundant low cost US gas supplies. The connectivity of the pipeline system will provide us with optionality in sourcing gas.

One of the attractive elements of the Driftwood opportunity is that the construction has commenced, noting it is common in the US for some construction activity ahead of a final investment decision. For Train 1, the gas turbine and LNG compressor foundations are complete. Progress has also been made on some ancillary scopes, including the grading and piling work for the tanks and utilities. This completed groundwork has reduced the risk of the EPC timeline and its associated costs. I’ll now hand back to Meg.

Page 3 of 19

Meg O’Neill: Thank you, Daniel. We are confident we can leverage our LNG expertise to unlock Driftwood LNG. Woodside has 35 years of operating experience in the LNG industry. We pioneered the LNG industry in Australia and shipped our first cargo to Japan in 1989.

We have strong relationships with global customers and a reputation as a reliable energy provider. Additionally, our existing US presence, including our offices in Houston, will simplify integration, including welcoming the Tellurian team into Woodside.

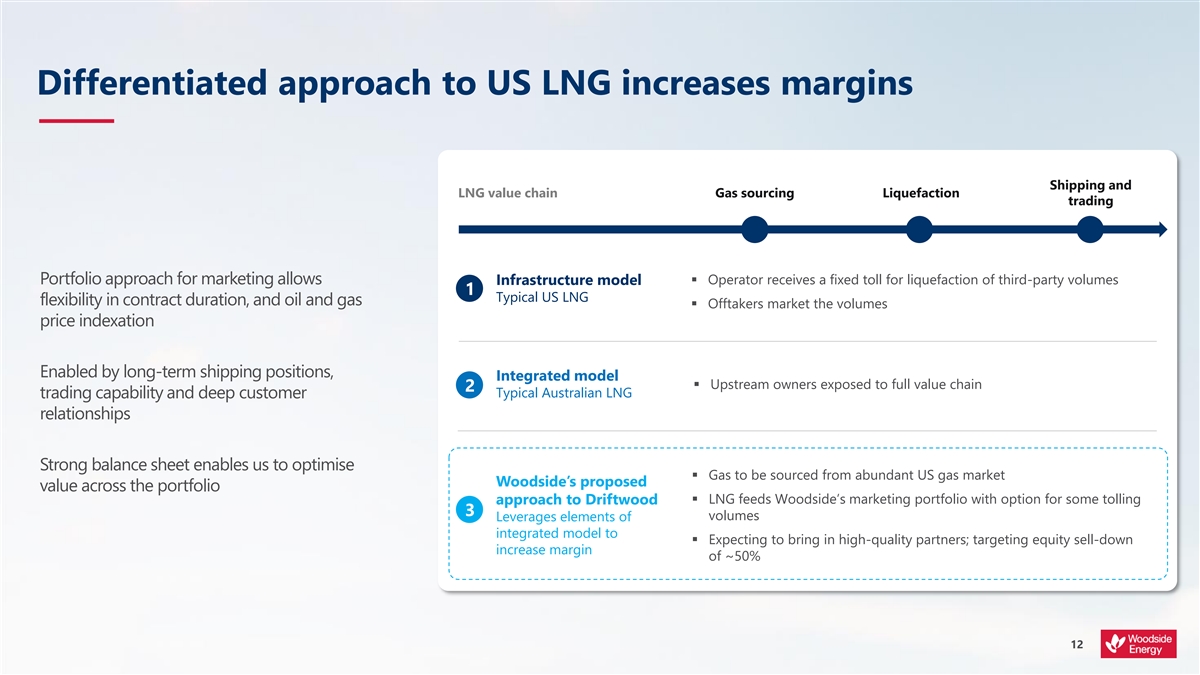

Going to slide 12. Another value driver for this transaction is our differentiated LNG business model. A typical US LNG project follows a traditional infrastructure model. The owners receive a fee for the gas sourced and processed through the facility, which usually provides stable returns with limited margin uplift.

The projects are generally project financed and consequently require long term FOB LNG contracts to be in place before FID for almost all committable project volumes. In our Australian operations, our integrated LNG model provides margin upside across the full value chain.

And we anticipate leveraging elements of this integrated model in the Driftwood LNG opportunity. We expect to retain a reasonable portion of the LNG production for our own portfolio marketing, enabling exposure to higher margins and leveraging our marketing, trading, and optimisation expertise.

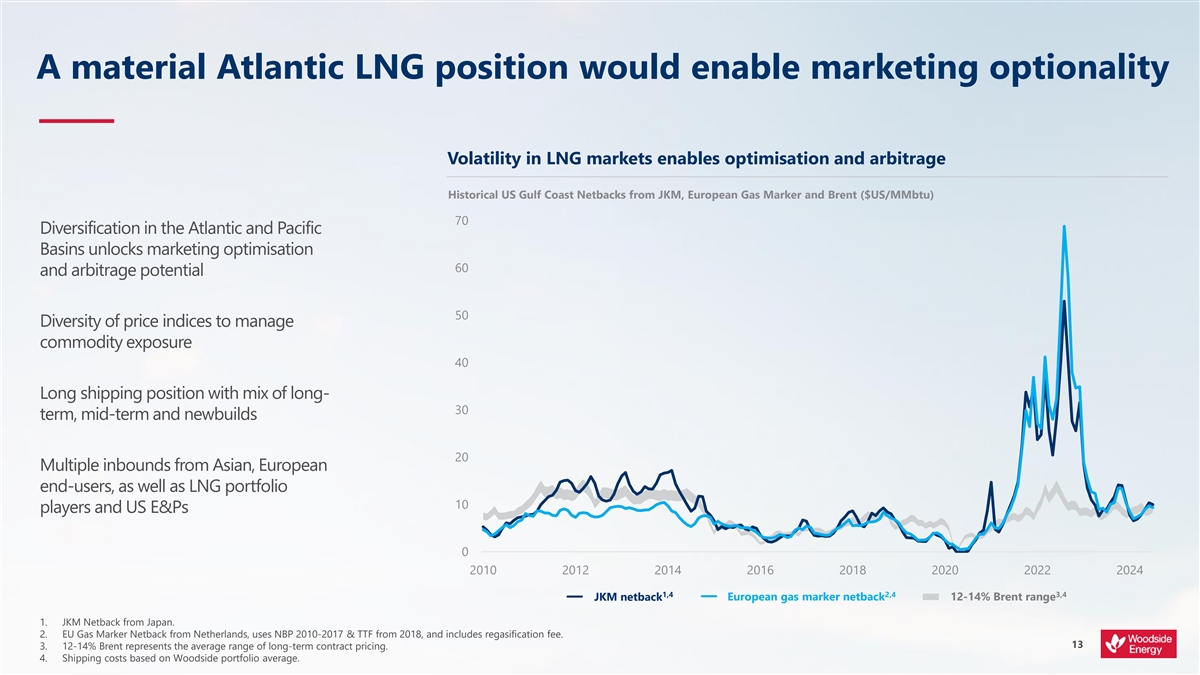

Slide 13 illustrates why we see significant value in complementing our Pacific Basin position with one in the Atlantic Basin. Volumes from the US Gulf Coast can be delivered to Europe or Asia. This additional supply source in the Atlantic, combined with our portfolio LNG sales approach and long shipping strategy provides optionality and flexibility to unlock upside from marketing optimisation and arbitrage between the basins.

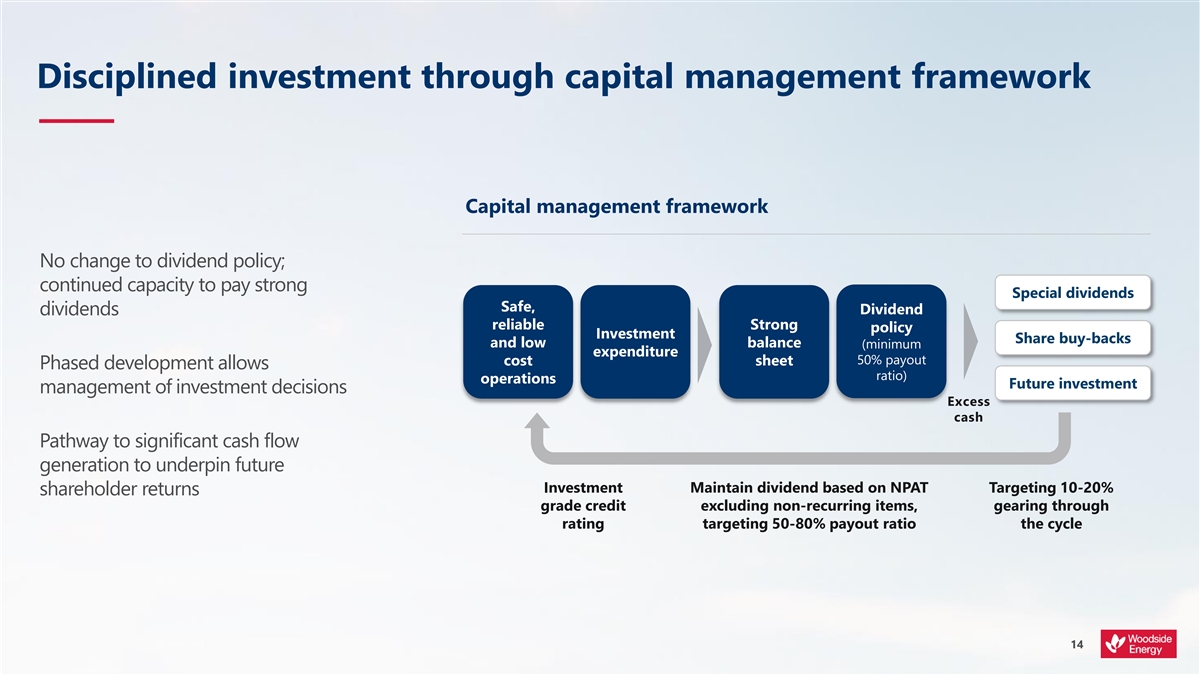

Now that we’ve shared how we plan to unlock value from the Driftwood LNG opportunity, let’s look at how this fits into our capital management framework. While Driftwood LNG is an attractive option, it is still pre-FID. We see a path to it being sanctioned in line with our capital allocation framework and will further progress FID readiness once we take ownership of the asset.

As we optimise the development plan and progress to FID, we will decide on the most value accretive financing strategy for this opportunity. We are disciplined in creating shareholder value, have a track record of positioning the balance sheet to accommodate growth, and we recognise that our strong dividend payout is an important element of our investment case.

Our capital management framework remains unchanged as reported on this slide. We have a strong underlying business generating significant cashflows. We have a robust investment grade credit rating and our balance sheet is in great shape with approximately 13% gearing at the end of June, which is at the lower end of our target range, and liquidity of approximately $8.5 billion.

Page 4 of 19

We have multiple pathways to funding, including bringing in strategic partners to reduce our equity exposure in this project. We have already received multiple inbounds from companies interested in working with us in the US LNG market.

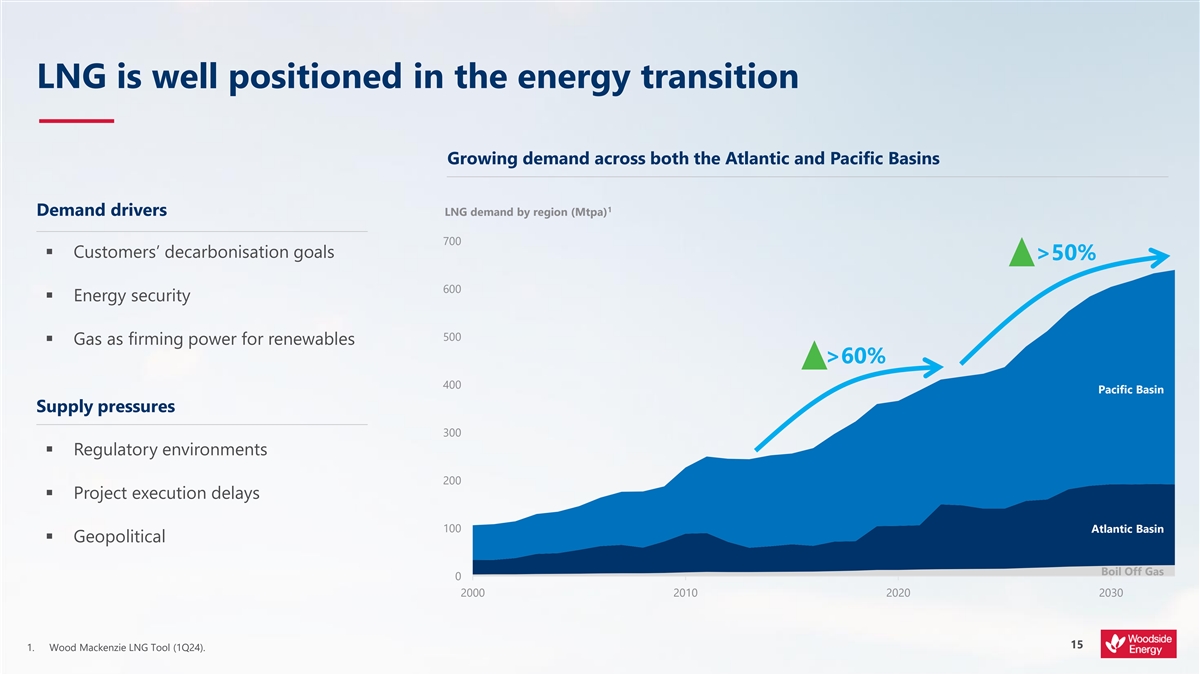

Our strategy for value creation is underpinned by our conviction that LNG will play an important role in the energy transition. LNG demand has grown by more than 60% in the last decade and Wood Mac is forecasting demand to grow by another 50% by 2033. Gas and LNG demand continues to grow globally and this acquisition increases our exposure to this market and strengthens our position as a global LNG player.

At the same time, the Driftwood LNG development is also carbon competitive. The design incorporates elements more advanced than prior generations of LNG trains, meaning it has the potential to reduce the average Scope 1 and 2 emissions intensity of Woodside’s LNG portfolio. There is also potential for further decarbonisation over the life of the asset, given the developing carbon capture and storage industry on the US Gulf Coast.

Going to slide 17. I’m very excited about today’s announcement. I would like to congratulate the Tellurian team members on bringing the Driftwood LNG development to this point and we look forward to getting to know you better.

To recap, this acquisition strongly fits our strategy to thrive through the energy transition. It strengthens our portfolio, giving an enviable mix of Pacific and Atlantic LNG exposure with scalability. Woodside’s multidecade track record in the LNG business gives us confidence we can unlock the development and create shareholder value.

And it increases our LNG exposure with growing demand that will support the energy transition. I will now open up to Q&A. I ask you to limit your questions to two to provide everyone with an opportunity to ask questions.

Operator: Thank you. If you wish to ask a question, please press star 1 on your telephone and wait for your name to be announced. If you wish to cancel your request, please press star 2. If you’re on a speakerphone, please pick up the handset to ask your question. Your first question today comes from Saul Kavonic with MST. Please go ahead.

Saul Kavonic: (MST, Analyst) Thank you, Meg. My main question would be for those of us who have been following Tellurian for some time, I mean Tellurian has been struggling to find LNG buyers to fund this project. They had to sell down this project over the last 12 months. What makes you think Woodside can achieve these things where Tellurian hasn’t managed to do so itself?

Meg O’Neill: Thanks for the question, Saul. Look, the investment thesis is totally different for Woodside. We do need to give Tellurian credit for acquiring a top tier opportunity and for progressing it to the place that we are at today, with engineering—front end engineering largely done, civils well advanced.

Page 5 of 19

But the reality is they were trying to advance the project in a conventional US LNG mode where you need long term, 20-year binding offtake agreements to underpin project financing. We actually have deep capability. We are LNG experts. The ability that we bring to the project is to be able to move this forward on the strength of our capabilities in the marketplace.

I think our track record is an important area to reflect, Saul, if you look at some of the LNG offtake agreements we’ve signed in the first half of this year. We’ve managed to land agreements and offtake deals with top tier buyers and in many ways, I think that illustrates the strength of the Woodside brand in the LNG marketplace.

So we do have confidence that we’ll be able to move the project forward and we do have confidence that we will bring in high quality partners, just as we’ve done at Scarborough.

Saul Kavonic: (MST, Analyst) My second question would be on—could Woodside take FID here without selling down to one of those quality partners? If not, is there any risk to dividend payout dropping below the 80% cusp that we’ve seen over the last few years?

Meg O’Neill: Yes, thanks for the question, Saul. Look, our priorities at this point are first and foremost to work closely with Tellurian to complete all of the conditions precedent required to complete the transaction. We do have work to do as well with Bechtel to firm up the contracts.

As I said, we’ve had multiple inbounds from players who are interested in working with us on the—on US LNG opportunities generically. I think it’s premature to say what we would do as we approach the FID milestone. Again, if you look back at our track record with the Pluto/Scarborough developments, we had brought in one partner on the LNG train but we were holding out to make sure we had the right high quality partners in the offshore at the time we took that FID.

So I think we do have quite a bit of flexibility. But it’s probably too early to say at this point in time what our decision would look like as we approached that FID point. In terms of dividends and shareholder returns, we know our shareholders value our dividend and part of why we reiterated our capital management framework is to be really clear that nothing changes.

We have a strong focus on retaining our strong investment grade credit rating and we are committed to returning value to shareholders through the cycle. Dividend policy is 50% of net profit after tax [Clarification: 50% of net profit after tax excluding non-recurring items] but for the past decade, we’ve been paying out closer to 80% through the ups and downs of the commodity cycle and we recognise our shareholders do value the dividend and we’ll be working hard to ensure we can continue to provide that shareholder return that the market expects from us.

Page 6 of 19

Saul Kavonic: (MST, Analyst) Great. Thank you. I’ll jump back in the queue.

Operator: Your next question comes from Gordon Ramsay with RBC Capital Markets. Please, go ahead.

Gordon Ramsay: (RBC Capital Markets, Analyst) Well, first of all, I just want to say congratulations on the transaction. I’m sure you’re all very proud. First question relates to the target start-up date for Phase 1. You’ve said it will be FID ready in the first quarter of 2025. So I’m interested in the target start-up date and potential CAPEX profile for Woodside, are you able to provide any information there?

Meg O’Neill: Gordon, I’ll hand that over to Daniel.

Gordon Ramsay: (RBC Capital Markets, Analyst) Thank you.

Daniel Kalms: Yes, thanks, Gordon, for the question. As we mentioned we’re targeting FID as early as Quarter 1 of next year. The project is fully permitted. We’ve got a FERC approval that goes out to Quarter 2 of 2029. We believe that if we take FID around that timeframe then we’re able to achieve commercial operations before we get to that date. But it will really depend on when we’re ready to take FID. But as we’ve said, as early as Quarter 1 of next year.

Gordon Ramsay: (RBC Capital Markets, Analyst) Okay. Thanks, Daniel. Then the second question relates to equity partners. I know it’s early stage but I’m just trying to get a feel for what kind of partners you might be targeting, obviously Aramco has been speculated in the press but what about supply chain lock in like owners of European LNG import terminals or European utilities, could you comment on what your strategy would be with a potential partner in the project?

Meg O’Neill: Gordon, I would probably take it back to the way we articulated what we wanted to do with the Scarborough project which is to bring in high-quality partners that share our view of the LNG industry and the importance of LNG to help meet the worlds future energy demands. We’re going to be pretty open-minded within that space. As I said, we’ve had a number of inbounds already but I’m not going to play my cards as to where those inbounds are coming from.

Gordon Ramsay: (RBC Capital Markets, Analyst) Okay. Thank you, Meg.

Meg O’Neill: Thanks, Gordon.

Operator: Your next question comes from Nik Burns with Jarden Australia. Please, go ahead.

Nik Burns: (Jarden Australia, Analyst) Thanks, Meg, and congratulations on the announcement today. Look, some would see this as an unusual step for Woodside acquiring what could be a material, mid-stream infrastructure project. Projects such as these are typically characterised as lower risk but lower reward. Not an area focus for Woodside in the past and not your historic risk reward profile. Can you just run through what your justification for Woodside going down this path is here and if it’s to gain access to Gulf Coast LNG capacity, couldn’t you achieve the same outcome via entering into agreements with one or more other projects? Thank you.

Page 7 of 19

Meg O’Neill: Thanks, Nik. So actually, the slide I think that tells that story best is the one that talks about the differences between the infrastructure and integrated models. So we’ve historically had an integrated model which goes from the reservoir and the molecules all the way through to the customers. We actually see an opportunity to bring part of that strategy to the Tellurian and the Driftwood model where we will be able to offer customers more flexibility than many in the US infrastructure space can.

As I said in my comments, many of those players need project financing. To get project financing they have to be underpinned by long-duration contracts. I think we will be able to bring much of our marketing, and shipping and trading expertise to offer a value uplift versus what a traditional infrastructure investment might look like. Plus, on top of that, we’ve got our capability and development in operations and if you look at Pluto, for example, the way we’ve been able to de-bottleneck that asset over the ten years of operations, I think we’ve got world-class capabilities that allows us to generate additional value versus many others in this space.

Nik Burns: (Jarden Australia, Analyst) Okay, thanks, Meg. My second question, just around the CAPEX estimate, $900 to $960 a tonne, I just wanted to ask you about your confidence in this estimate. Is this based on data from Bechtel relating to this project in particular or is it your own internal estimate? Or and if it is from Bechtel, how long are these costs valid for? Is there an expiry date on that estimate? Thank you.

Meg O’Neill: Yes, thanks, Nik. So these are very recent cost estimates. We’ve been working very closely with the Tellurian team to understand the cost of development. There is further work that needs to happen as we get past the announcement of the deal to work with Bechtel to firm up the contract price that they would be able to present to us post-completion, but the data is extremely recent, and it is based on the Bechtel pricing.

Nik Burns: (Jarden Australia, Analyst) Got it. Thank you.

Operator: Your next question comes from James Byrne with Citi. Please, go ahead.

James Byrne: (Citi, Analyst) Good morning. Congratulations on the deal. So I wanted to ask about returns, picking up what Nik just asked about. Now, if you’re selling into say, Asia, you might get a mid 12s slope which at your $70 long-term assumption is just shy of $9. If we were to buy off-take out of the US, maybe we’re doing that at a toll of say, 2.40-2.50, 2.50 is shipping, if we use say a low to mid three Henry Hub, we’re getting to Asia at that same sort of mid eights to high eights delivered price. But those contract prices are incentivising an infrastructure-like return for US LNG projects.

Page 8 of 19

So how exactly does Woodside go from say an 8% IRR—like if I look at Slide 12, model number 1 of the US projects, which in the current contract environment gets like an 8% IRR, how do we go from that 8% to more like a 12% which you’ve re-iterated today is your target return for LNG? Because at $900 a tonne, it’s not like you’re significantly more competitive than other US LNG projects that are proposed. Sourcing a gas supply I wouldn’t have thought you had a material benefit versus other sources of supply.

Now, you’ve mentioned already flexibility and de-bottlenecking, I guess what I’m asking is how can you help quantify those benefits that would take you from an infrastructure-like return all the way up to that 12% or more IRR?

Meg O’Neill: Thanks for the question, James. Look, as I said, the infrastructure model, which is what many of the US players apply today, is a model that has heavy project financing. To get the project financing it needs to be underpinned with 80% plus of the LNG production capacity being tied up in long-term offtake contracts. And that constrains the value that those players can obtain. Now, the uncontracted, of course, they can place in the market, our approach is quite different.

So you’re absolutely right, the US gas market is a very deep one. So a lot of different sourcing opportunities but again, the place where we see the value uplift is in our ability to place the LNG in the marketplace. And one of the things that I think is really attractive is the fact that as we think about selling this LNG we can sell on multiple different indices. So much of the off take from the US now goes into Europe where it’s attracting TTF pricing. You can go the long way around to Asia where you can attract JKM pricing but we’ve also got the ability to contract against oil indexation.

And if you look at the chart of Slide 13, that gives you a flavour for the variability that we see within those three indices and how having LNG exposure on all three indices allows us the opportunity to capture the market at the points in time where one index is out of sync with others.

James Byrne: (Citi, Analyst) Okay. I guess one of the big strengths that Woodside has is you’re very much an engineering company. I don’t think anyone can argue that you’re an absolute Tier 1 operator of your assets and yet, that integrated model from reservoirs to customer, if you came to us in equity markets with a deal of that model we would have a lot of faith in your ability to achieve a 12% IRR. But what you’ve just described around capturing arbitrage, your historic returns in LNG trading still—I just don’t think that that bridges the gap between the infrastructure-like return and the 12% IRR. Do you not think that there is more risk in achieving a 12% IRR with Driftwood than say a legacy-style commercial model of reservoir to customer?

Meg O’Neill: I don’t James, and there are different types of risks in each type of development. And one of the most significant and inherent risks in the integrated model is the reservoir risk. I think the industry has seen examples over the course of time where reservoirs do better than expected, which is always a good problem to have. But there is always the risk of downside performance and so with this model, we trade that reservoir risk for the certainty of being able to buy gas off the US grid, which is an incredibly, incredibly deep market.

Page 9 of 19

And relative to your comments on the trading margins, so part of why we’ve started doing segment reporting for trading is to help the market understand the value uplift associated with that part of our business and the 2022 was anomalous but the prior year, so 2020, sorry, ’23 was anomalous. No, ’22 was anomalous.

Graham Tiver: Yes.

Meg O’Neill: So ’21 and ’24 [Clarification: ’21 and ‘23] we reported about $300 million profit on that business and again, with that very modest capital investment. And again, as we move into Driftwood we’ll be building out the capacity of our LNG business which offers the ability to, again, generate profit with, profit from that part of the organisation.

James Byrne: (Citi, Analyst) Thank you.

Operator: Your next question comes from Adam Martin with E&P. Please, go ahead.

Adam Martin: (E&P Financial, Analyst) Yes, morning Meg and Daniel. Just on the sell down, I suppose you’re expecting a premium on that 50% sell down given what you paid today and clearly Tellurian sort of struggled to get some momentum. You’re bringing obviously a lot of LNG experience, so are you expecting a premium?

Meg O’Neill: Yes.

Adam Martin: (E&P Financial, Analyst) Good. Good. All right…

Meg O’Neill: And look, just to elaborate on that Adam, one of the things that we think we do is help de-risk the pathway to moving this opportunity forward. So with the strength of our balance sheet, our technical and operations capability, our marketing skills, we will give those third parties who have been calling us confidence that we’ll be able to move this opportunity forward and bring LNG online in the late 2020s. So, yes, we do expect to get value for the additional confidence that we bring to the Driftwood opportunity.

Adam Martin: (E&P Financial, Analyst) Good, that makes sense. Just any views on Trump and further US LNG exports? Clearly, the US is going to grow significantly in terms of total LNG exports in the next three to four years. That has a risk of putting upwards pressure on domestic gas prices in North America, just any views or any work you’ve done around in Trump in your due diligence?

Meg O’Neill: Look, the US permitting process is a long and complex one and whilst the President, senior executives can, or executive leaders can say they want things to move quickly, at the end of the day you still have to go through the processes. We do believe we’re advantaged by not having to have all of our LNG committed via offtake agreements to secure project financing. So we think we’ve got a competitive edge to many other projects in this sector. But at the end of the day, Adam, part of why we think this is an attractive opportunity is the growth in the LNG market that we are anticipating.

Page 10 of 19

Slide 15, I think, illustrates this really well. The LNG market over the past decade grew 60%. We’re expecting growth of 50% in the decade ahead. So whilst there is a lot of new LNG potentially coming into the market, there’s also a lot of increased demand for this product. So we’ve got confidence that we’re well positioned. We’re well positioned to be competitive with those other projects and well positioned to capture the market.

Adam Martin: (E&P Financial, Analyst) Okay. Thanks, Meg. That’s all from me.

Meg O’Neill: Thanks, Adam.

Operator: Your next question comes from Mark Wiseman with Macquarie. Please, go ahead.

Mark Wiseman: (Macquarie, Analyst) Hi Meg. Hi Daniel. Thanks for the update. Just a couple of questions, firstly on the upstream gas position, you obviously do produce some gas in the US but not a heap. Tellurian previously had some upstream assets that I think they’ve divested. Could you maybe just articulate what’s the strategy here in terms of gas procurement. Are you ruling out the idea of going out and buying upstream gas supply in the US?

Meg O’Neill: Yes, thanks for the question, Mark. So you’re correct that at one point in time and until fairly recently Tellurian did have an upstream position and they were developing a strategy that included the resource, so more of a full integrated model in the US but that asset has been divested as of just a few weeks ago.

At this point in time, when we look at the US gas production outlook and we look at the US gas opportunity space, we don’t see a driver for us to enter there. So that’s not going to be a priority for us. As we move towards close our focus is very much going to be on bringing in the partners we need, getting the gas—the upstream gas contracted that we need ahead of that time. So that’s not going to be a near-term focus for us. I think I’ve been clear in the past as well, Mark, that when we look at our skills and capabilities our expertise is in things like complex onshore infrastructure. So LNG plants and deepwater developments.

The onshore game is quite a different game so even if we contemplated something in that space we’d be very cautious about how we did that and who we did that with.

Mark Wiseman: (Macquarie, Analyst) Okay. Thank you. Just a final question then, just on this acquisition process, the Board of Tellurian is supporting your one-dollar-per-share offer, is there a chance that other players come in over the top? Is that possible? Could you maybe just describe some of the background to how we got to this point?

Page 11 of 19

Meg O’Neill: Well, look, I think some of those questions are better positioned for Tellurian, but this opportunity’s been under development since 2017 and we’ve been talking on and off about our interest in US LNG with Tellurian and other players for a number of years. We came to a point where we had sufficient confidence that Driftwood was the right opportunity for us. The thing that I’m really excited about is the fact that we’re coming in, so we’ve got a clean slate by acquiring Tellurian. We have full control of the site so we can be very disciplined in our selection of the partners and very disciplined in the commercial models that we put in place as opposed to having to negotiate with existing incumbents.

So that’s part of why I’m excited about this opportunity. I think it’s quite compelling and I feel like we’ve been working very closely with Tellurian. We’ve got a deeper understanding of this opportunity than anyone else in the marketplace. So I don’t expect anyone to come over the top and Tellurian’s Board has fully backed the deal.

Mark Wiseman: (Macquarie, Analyst) Thanks very much.

Operator: Your next question comes from Dale Koenders with Barrenjoey. Please, go ahead.

Dale Koenders: (Barrenjoey, Analyst) Morning, Meg. I was hoping you could confirm that the $900 to $960 a tonne, how did this equate to total project CAPEX when Tellurian was talking about $14.5 billion of Phase 1 CapEx based on $800 a tonne US liquefaction plus $300 a tonne other costs?

Meg O’Neill: I’ll let Daniel handle that question, Dale. Thanks.

Daniel Kalms: Yes, thanks, Dale. So we’ve given you the range of costs to reflect EPC, owner’s costs and contingencies. As we said, it excludes the pipeline. I think over time Tellurian have made various presentations. What I would say is that the cost that we’re giving you are contemporary. As Meg said before, it reflects the current pricing in the market. We will give more detail as we go forward, and we approach FID but to say that we’ve been pretty clear about what the scope is and the current pricing and we can give you more detail as we go forward.

Dale Koenders: (Barrenjoey, Analyst) So will there be other costs on top of that though for Woodside?

Daniel Kalms: The only thing that we’ve excluded that we’ve listed there is the pipeline, but apart from that there are really two elements. There is the cost for the plant, Driftwood LNG, that we’ve given you the $900 to $960 per tonne and then there is the pipeline cost to be added to that.

Dale Koenders: (Barrenjoey, Analyst) Okay. Thanks. Then maybe more of a question for Meg, the Investor Day last year you spoke about peak CapEx in 2024 for the group, with this project it feels like the peak is becoming more of a plateau and that may mean that the material dividend growth post Scarborough in ’26 is now more a 2029 story. I was wondering if you could provide some comments around those two points.

Page 12 of 19

Meg O’Neill: Yes, good question, Dale. So the CapEx profile, of course, depends a bit on the equity interest that we hold at the time that we progress to FID. If you look at our track record on Scarborough, we also have good form in bringing in high-quality partners post-FID. So that certainly is also an option for us. So we do expect that with this opportunity if we move forward at the pace that we are going to pursue it, which is trying to be FID ready in the first quarter of next year, it will keep our capital investments high for 2025 and 2026.

The real big needle mover for us, and it always has been, is when Scarborough comes online in 2026. So that’s a very significant capital investment our equity share. Once that project starts up the significant capital that we’re investing there ramps down and the revenue we generate from that field ramps up. So that’s probably the key pressure point.

Graham Tiver: Dale, it’s Graham Tiver here as well. I think it’s worthwhile calling out the strength of the balance sheet today as well and that we continue to position it in a strong way. As Meg touched on in her presentation, we have gearing at the low end of our range, 13%. We’ve got $8.5 billion in liquidity, we’re very clear on our capital management framework. Even though the—if you wanted to call it—the high CapEx years of ’25 and ’26, we feel comfortable on what we know today. The balance sheet is well positioned, we can still maintain strong shareholder returns while navigating this period.

Dale Koenders: (Barrenjoey, Analyst) Okay, thanks and then maybe just to confirm on James’s question. The 12% IRR for the project, can you achieve that from Phase 1 Driftwood without the optimisation of LNG trading globally, or is that part of your 12% IRR?

Meg O’Neill: Dale, we’ve said that we have a pathway to achieving our capital allocation framework targets and we’ll provide more detail on that as we get closer to that milestone in time.

Dale Koenders: (Barrenjoey, Analyst) Okay. Thank you.

Operator: Your next question comes from Tom Allen, with UBS. Please go ahead.

Tom Allen: (UBS, Analyst) Good morning, Meg and Daniel. Congratulations on the deal that you’ve announced. Just following up the last question from Dale. Just trying to understand the assumptions on the trading uplift. I was wondering if you might be able to share a range on that trading margin or a specific return uplift that you’re targeting. So Shell for example, who I think are the biggest LNG trader in the world still. But they talk to a 3% to 4% uplift on return on capital employed for projects that they achieve by trading the commodities from that project. Is there a similar range that you can share that you’re targeting on Driftwood?

Page 13 of 19

Meg O’Neill: No Tom, as I said, it would be premature to target that. I don’t know that we would want to be breaking that out or we would be likely to break that out. We’re going to look at the investment in its totality and the returns that we expect to achieve.

Tom Allen: (UBS, Analyst) Oka. Thanks Meg. Can you please share some colour on your marketing strategy for the LNG? So what proportion of the Phase 1 and 2 liquefaction capacity might Woodside plan to take into its trading portfolio and the proportion you’d expect to sell? I think you mentioned Meg earlier on the call, a reasonable proportion would go into your portfolio. Just looking for some more colour or range on that capacity please? Then also what proportion of capacity might be planned to be tolled through the plant to third parties?

Meg O’Neill: Two great questions Tom. So there’s probably a difference between the tolling structure and again the commercial entities. Even in our Australia business we’ve structured things to make sure we’ve got clarity that allow us to do things like bring GIP into Pluto Train 2. We have commercial structures that allow us to bring partners into different places in the venture. It’s premature to say what percentage we would retain. If you look at the slide that shows our position in Atlantic and Pacific, one of the things we recognise is having a bigger position in the Atlantic does create additional value for us. So I do expect we’ll retain a reasonable portion of the LNG, but it’ll be too early to say what the quantum is.

Tom Allen: (UBS, Analyst) Okay, I’ll have to go with reasonable for now. Thanks folks.

Meg O’Neill: Thanks Tom.

Operator: Your next question comes from Rob Koh with Morgan Stanley. Please go ahead.

Rob Koh: (Morgan Stanley, Analyst) Good morning. Congrats on the announcement. I guess I just want to explore the other dimension of your capital budgeting framework here, which is payback by seven years. I guess should we be contemplating scenarios where that gets pushed out? Say, if you took a more infrastructure like a pathway or should we still be thinking roughly seven years from first gas?

Meg O’Neill: Thanks Rob. As I said, when we get closer to FID, we’ll provide more comprehensive economic metrics, but we do have a line of sight to achieving our capital allocation framework. It’ll really depend on the combination that we have of equity in the plants and LNG offtake that we retain for ourselves, as well as proceeds from sell-down. So, we’ve got a few levers that we’re going to be endeavouring to pull over the upcoming period, particularly once we’ve closed on the transaction.

Rob Koh: (Morgan Stanley, Analyst) Okay, thank you. I guess, the second question, I just want to make sure I understand how this fits in with your decarbonisation pathway. I think it’s obviously got a lot of design out benefits from latest technology. Then does that mean that your absolute reduction targets just kind of get met through the natural depletion of the other fields? Is that the way to think about it?

Page 14 of 19

Meg O’Neill: First and foremost, Rob, at a headline level, no change to our climate strategy and no change to our emissions reduction targets. So relevant for Driftwood, no change to the 30% reduction in net equity Scope 1 and 2 greenhouse gas emissions by 2030. There’s a chart in there, I think slide 16 shows the low emissions intensity of Driftwood, versus our existing LNG portfolio, which includes trains that were designed in the 1980s, so you can see the positive impact of advanced technology. So for emissions that are above that decline trend line that we’ve committed to, we’ll be looking to design those out, operate them out, or offset where we need to.

Rob Koh: (Morgan Stanley, Analyst) Okay, makes a lot of sense. If I may I’ll just sneak in one more. There was a deal last year with Blue Owl, the sale and lease back deal on the land. I guess that was contingent on FID. Is that still part of your options for pathway to capital allocation?

Meg O’Neill: No, we’re not progressing that option.

Rob Koh: (Morgan Stanley, Analyst) Okay, that’s clear. Thanks so much.

Meg O’Neill: Thanks, Rob.

Operator: Your next question comes from Henry Meyer with Goldman Sachs. Please go ahead.

Henry Meyer: (Goldman Sachs, Analyst) Morning all. Thanks for the updates. Within the Alaska basin you of course have Calypso as an LNG development opportunity as well. Can you share how Driftwood stacks up competitively against Calypso within the portfolio? How you might be juggling the development timing and spend between both projects, perhaps deferring Calypso?

Meg O’Neill: Good question, Henry. If you go back to the chart that shows Atlantic and Pacific, so page,-slide six, it shows that we have options for future growth in both the Pacific and Atlantic. Calypso’s one, Browse and Sunrise are others. All three of those projects have challenges that are being navigated at this point in time. Calypso we’re working through a number of technical matters, as well as working with the government to ensure we’ve got a fiscal framework and talking with potential customers around things like access to Atlantic LNG as well as exploring the domestic market in Trinidad and Tobago. So there’s still a bit of work to do with Calypso. It is more akin to our traditional integrated LNG models. So, again, from reservoir molecules all the way through to LNG deliveries to customers. But the scope and scale of Calypso is a much smaller asset, as we’ve said in the past, two to three TCF. In terms of moving the needle on Woodside’s LNG portfolio it’s an important opportunity but doesn’t really have the scale of the Driftwood.

Page 15 of 19

Henry Meyer: (Goldman Sachs, Analyst) Got it, thanks Meg. Last one from me, just Tellurian already had some HOAs agreed. Can you share you how any existing agreements may be impacted or retained through the acquisition?

Meg O’Neill: It’s a good question. So there’s not a lot of HOAs in place, but we’re keen to continue talking to a range of players who have interest in LNG from the Driftwood project. You know, there’s a variety of ways to bring partners in: equity position is one and offtake contracts is another way. We’ll continue talking to those players, but at this point in time there’s nothing binding. There’s no price binding agreements that would constrain our ability to progress the project as we see best creating value for our shareholders.

Henry Meyer: (Goldman Sachs, Analyst) Got it, thanks Meg.

Meg O’Neill: Thanks, Henry.

Operator: Your next question comes from Angela Macdonald-Smith with AFR. Please go ahead.

Angela Macdonald-Smith: (AFR, Journalist) Thanks for taking my question. Meg, I’m just wondering to what extent the move in the US reflects difficulties Woodside faces to expand energy in Western Australia and in this region. You’ve obviously seen legal challenges, environmental opposition, issues around NOPSEMA approvals et cetera, delays with Browse and Sunrise. Is it just all easier in the US?

Meg O’Neill: Thanks for the question Angela. Woodside remains a proudly Australian company. If you look at our investment in the Scarborough Energy Project, which is going to be a significant asset for us for the very long term, I think that’s a very important proof point. 75% of our production at this point in time is from Australia. So we do have a strong commitment to doing business here and being an Australian headquartered company.

But we do see an opportunity as well, as I mentioned in the pack, to diversify, to gain access to different customers and in many ways to build on the strengths of the team and the capability that we acquired in the BHP merger, to grow a position in North America. I think this gives us better balance as a corporation, but we remain fully committed to Australia.

Angela Macdonald-Smith: (AFR, Journalist) Okay, thanks. Just another one on climate, obviously this is coming just after your shareholder’s rejected Woodside’s climate plan at the AGM. You’ve just explained about how this fits alongside the emission reductions targets, but I’m just wondering if there’s any read through from this on your new energy ambitions and your 2030 goal for investing in new energy?

Meg O’Neill: Thanks Angela. No impacts on our new energy aspirations. And we retain our goal of investing $5 billion in new energy projects and lower carbon opportunities between now and 2030, as well as the associated emissions abatement target of 5 million tonnes per annum for our customers. And the teams continue to work extremely hard to advance those opportunities.

Page 16 of 19

H2OK is the most advanced, but we’re working with customers and offtakers every single day to try to get confidence that we can profitably progress those investment opportunities.

Angela Macdonald-Smith: (AFR, Journalist) Thanks Meg.

Operator: Your next question comes from Mark Busuttil with JP Morgan. Please go ahead.

Mark Busuttil: (JP Morgan, Analyst) Hi Meg. Just a couple of things. As you mentioned, typically these US projects are infrastructure type assets with 70% to 80% gearing and fully contracted. Can you just confirm that’s not the way we should be thinking about it. We should be thinking about it as largely uncontracted, probably 10% to 20% project gearing in line with your targeted gearing range. Which would equate to US$13 billion of attributable CapEx spread over, I don’t know, four to five years. Is that the way we should be thinking about it?

Meg O’Neill: So at the starting point Mark, that is a fair characterisation. But I would note that we do have an intention to bring partners in. We have received a number of unsolicited requests for collaboration in US LNG from high quality counter parties around the world. So I think it would be, I don’t want to get to our FID decision ahead of our FID decision, but from a Woodside perspective, our equity stake, we would intend to finance with our normal financing mechanisms. And what our partners do will be up to our partners.

Mark Busuttil: (JP Morgan, Analyst) Okay and just on the FID side of it then. What things would need to happen before your FID, and it’s obviously not very far away. I mean, the deal completion is the end of the current calendar year and you’re talking about FID ready in the first quarter of next calendar year. Do you need to have a sell down process in place before you sanction the projects or would be prepared to sanction the projects without it?

Do you need to have offtake contracts in place, do you need to have the project finance in place? Can you give me a bit of an understanding of what needs to happen between now and I guess March 25?

Meg O’Neill: Sure, it is a very fast timeline as you note. So first order of business is to address the conditions precedent in the agreement including a Tellurian shareholder vote and as well as other regulatory approvals. So our first goal is to close the transaction. We need to finalise the contract with Bechtel. As I said, it’s recent vintage data, but there are certain things that could not have been done until or and cannot be done until we’re officially at the table with Bechtel to negotiate.

We do want to bring in partners and the conversations as I said are progressing already. Project financing is probably one I can be definitive on. We do not intend to project finance. The timeline to do that is inconsistent with trying to move the project forward at pace so that is not something we would intend to do. As I said to some of the other questions, we’ll be watching very closely as we head towards FID, particularly in the space of sell downs.

Page 17 of 19

We’ll want to have confidence that we can bring partners in, but whether or not everything is signed, sealed and delivered, we’ll take a close look as we get closer to that milestone. But the team is going to be today working to tackle all of those critical path matters that I just described.

Mark Busuttil: (JP Morgan, Analyst) Okay, thanks, Meg.

Operator: Your next question comes from Matt Mckenzie with The West. Please go ahead.

Matt Mckenzie: (The West, Journalist) Good morning. A couple of things and they’re reasonably similar to what Angela asked, but just to get a bit of an idea. Should we consider that investing in America is potentially a better option than Browse or projects in Australia? How do they sort of compare, or can they both be done together?

Meg O’Neill: Look Matt, I think both can be done. Browse as we’ve talked about in the past is extremely important to help meet Western Australia’s domestic gas needs, particularly in the 2030s. So we do continue to push hard to advance Browse. The critical path on Browse is environmental approvals, and that is not fully within our control.

So we do want to make sure that we are advancing opportunities that we have greater control over to help ensure that Woodside is a strong and resilient business. Not just for the 2030s but all the way, sorry not just for the 2020s, but all the way through the 2030s, which is what we think Driftwood offers us.

Matt Mckenzie: (The West, Journalist) Okay and a second question. It seems like you’re making more progress in the US in terms of potential gas investments than say something like H2OK. I’ve been asked to just put to you a question about the broader theme of gas versus green hydrogen. Can you just talk a little bit about how you see that playing out in your portfolio?

Meg O’Neill: We’ve got deep conviction around the role of gas and LNG in particular in helping meet the worlds energy need while it tackles the question of climate change. And Slide 15 in our pack is probably the best illustration of how we think LNG’s demand is going to grow over time. Look, the world also wants to develop low carbon energy sources, but the balance that our customers are trying to strike is the balance between lower carbon and higher cost.

So we want to be working on opportunities that offer both of those things. We’re not zealots about the colour. We think we need to be keeping the aperture open for all sorts of lower carbon energy sources regardless of how they’re manufactured, if it’s electrolysis or if it’s using gas as a feed stock.

Matt Mckenzie: (The West, Journalist) Thank you.

Page 18 of 19

Meg O’Neill: Thanks Matt.

Operator: That concludes our question and answer session. I’ll now hand back to Ms O’Neill for closing remarks.

Meg O’Neill: Alright, well thank you everyone for taking time to participate in the call. Woodside’s Second Quarter 2024 report will be released tomorrow and our Half-Year report on the 27th of August. And I look forward to speaking with all of you again in August. Thank you for joining us today.

Operator: That does conclude our conference for today. Thank you for participating. You may now disconnect.

End of Transcript

Contacts:

| INVESTORS | MEDIA | |

| Marcela Louzada | Christine Forster (Australia) | |

| M: +61 456 994 243 | M: +61 484 112 469 | |

| E: investor@woodside.com | E: christine.forster@woodside.com | |

| Rob Young (United States) | ||

| M: +1 281 790 2805 | ||

| E: robert.young@woodside.com | ||

This announcement was approved and authorised for release by Woodside’s Disclosure Committee.

Page 19 of 19

|

|

3. An investor presentation published by Woodside on July 22, 2024 relating to the Acquisition: |

WOODSIDE TO ACQUIRE TELLURIAN AND DRIFTWOOD LNG 22 July 2024 www.woodside.com investor@woodside.com