In between completing the proof reading of the latest edition of The Financial Times Guide to Investing (in all good book shops in January!) I’ve been contemplating Warren Buffett’s rationale for investing in Wells Fargo. Looking at Buffett’s investments can teach us a lot about the thinking process we value investors should go through to arrive at a decision to invest. The Wells Fargo case study highlights, among other things, that just because Mr Market is dumping an entire sector we should not follow along, but think independently and rationally about the particular characteristics of a company. Many of the Californian banks were indeed destined to go bust, but Wells Fargo had a special ingredient in the form of talented managers who had cleverly positioned the company to withstand recession.

Another lesson is to think beyond the immediate downturn in the economy and to focus on likely discounted cash flows to shareholders over an horizon stretching decades. Buffett first bought into Wells Fargo in 1989 and the investment is still held today. The shares bought back then have risen over 14-fold and Berkshire Hathaway has collected nice fat dividends in all those years.

The case study is also useful for understanding the way banks work and how they generate returns for shareholders.

Black boxes and “investors”

At the heart of the Wells Fargo story is fear; a fear of what is in the black box of a bank. Most of the time Mr Market is gloriously insouciant about what banks are doing with all those billions of dollars deposited by millions of families just so long as the bank reports rising quarterly earnings.

He knows some of the money is lent out to people to buy houses and some goes to small businesses in the neighbourhood, but as for the rest of it, and how much risk is taken on, Mr Market is blissfully unaware.

Mr Market’s logic is that if the big machine called a bank is producing good dividends then the managers must have a firm grasp of risk, with sound diversification and thoroughly thought-through lending decisions and stacks of collateral backing every loan. Certainly, the bank bosses always sound confident and competent, so that comforts him.

But then recession strikes. The market value of assets used as collateral drops like a stone; indebted companies find orders drying up and they are no longer generating enough cash to meet their loan obligations. Mr Market is now scared. And when Mr Market is scared he sells those nasty risky things called bank shares. And he can do it indiscriminately.

When recession lights up the corners of some black boxes the whole world can see the horror show. The bank managers have been lending to people who were on the edge even in the good times. Now that recession and redundancies are here, hundreds of thousands cannot service their mortgages. Bank underwriters were so desperate to lend to the “companies of tomorrow” that the went easy on loan covenants, often not requiring sound collateral at all, or a trading history, or even proven cash flow generation.

Oh, and then there is lending by way of purchasing financial instruments in the market, whether that be commercial paper, leveraged loans, high-yield bonds or some whizz-bang innovation in the derivative markets. Who knows what their true worth is – in recessions it’s often zero.

Having looked into the dark recesses of some black boxes and been shocked to the core Mr Market starts to fear that every bank is the same. An entire sector is sold off, share prices collapse.

The true investor

In this moment of panic, in steps the true investor. That is, those people who ignore Mr Markets emotions, and coolly assess the facts of each company.

There will be no tarring with the same brush here. Each company examined by a value investor is to be treated as though it was his/her own family business and thought is directed to assessing its long-term viability, its potential to generate cash for shareholders decades into the future.

For that the value investor needs to make a judgement on the strategic position of the firm – does it have competitive advantages permitting high rates of return on capital employed? Judgement is also required about the qualities of the managers – are they both competent and shareholder oriented? And reassurance is needed about the bank’s operational and financial stability both in the short and the long run – sure, it might have some temporary difficulties, but is there a reasonable prospect of lowering its potential for financial distress in the medium term?

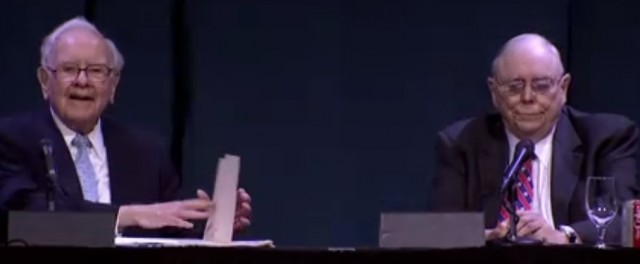

When recession struck in 1990 Warren Buffett and Charlie Munger were there to observe both Mr Market’s panic regarding the banking sector and the strengths of Wells Fargo relative to other banks.

What is a bank?

I’m going to provide a very simplified version of what a bank is and how it is structured – it’s not perfect but will serve to illustrate why Mr Market was correct to fear for thefu

………………To read more subscribe to my premium newsletter Deep Value Shares – click here http://newsletters.advfn.com/deepvalueshares/subscribe-1

Hot Features

Hot Features