We could not find any results for:

Make sure your spelling is correct or try broadening your search.

Gold has surpassed the euro to become the world’s second most significant reserve asset after the U.S. dollar, according to the European Central Bank (ECB). This shift comes amid record-breaking gold purchases and surging prices.

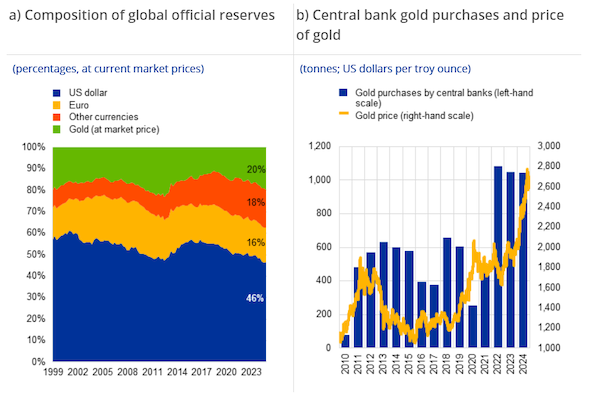

In its annual currency review released Wednesday, the ECB reported that gold accounted for roughly 20% of global official reserves by the end of 2024, overtaking the euro’s 16% share. The U.S. dollar retained its dominant position at 46%, although its share has been gradually declining.

“Central banks continued to accumulate gold at a record pace,” the ECB stated. In 2024, global gold purchases by central banks exceeded 1,000 tonnes for the third consecutive year—double the average annual pace seen during the 2010s.

Global central bank gold holdings are now nearing levels not seen since the Bretton Woods era. Back in the mid-1960s, reserves peaked at around 38,000 tonnes; by the end of 2024, they stood at 36,000 tonnes, according to the ECB.

The World Gold Council identified Poland, Turkey, India, and China as the leading buyers in 2024, collectively responsible for about 25% of all central bank gold acquisitions.

The ECB attributed gold’s growing prominence in global reserves partly to its rising price, which jumped nearly 30% over the year and hit a record $3,500 per ounce in April 2025.

The report also highlights how geopolitical instability has driven central banks to diversify away from the U.S. dollar. Gold, often viewed as a safe-haven asset, has become a preferred alternative.

Gold demand surged after Russia’s invasion of Ukraine in 2022, the ECB noted, adding that bullion has historically served as a shield against potential sanctions, particularly since 1999.

An ECB survey revealed that about two-thirds of central banks cited diversification as a key reason for increasing gold reserves, while two-fifths pointed to geopolitical risk.

The ECB observed a significant uptick in gold holdings among countries closely aligned with China and Russia, especially since the final quarter of 2021. This trend reflects a broader movement of de-dollarization across many developing nations.

Interestingly, the longstanding inverse correlation between gold prices and real interest rates began to break down in 2022. The shift, the ECB suggests, came as central banks prioritized gold as a hedge against sanctions rather than inflation.

Looking ahead, the trend is expected to persist. According to the ECB’s survey, 80% of reserve managers consider geopolitical concerns a critical factor in shaping their gold strategy over the next five to ten years.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Some portions of this content may have been generated or assisted by artificial intelligence (AI) tools and been reviewed for accuracy and quality by our editorial team.

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions