MOU with Zambian company for the supply of 50,000MT of fertiliser

African Potash, the AIM listed exploration company focused on sub-Saharan potash assets, ihas entered into a Memorandum of Understanding with a Zambian fertiliser supply company with a view to supplying them with in excess of 50,000MT of fertiliser, following an introduction by the Common Market for Eastern and Southern Africa.

Highlights:

· First fertiliser Trading MOU in place following the landmark trading agreement with COMESA ACTESA and the Mask Africa Crowd Farm Fund Limited

· African Potash will supply 50,000MT of fertiliser with first delivery targeted for September 2015

· African Potash to utilise its extensive network to source, deliver and finance transaction

· MOU is in line with the Company’s strategy to create a vertical platform for the mining, production and distribution of fertiliser

· Further agreements pursuant to the COMESA ACTESA Trading MOU are being negotiated

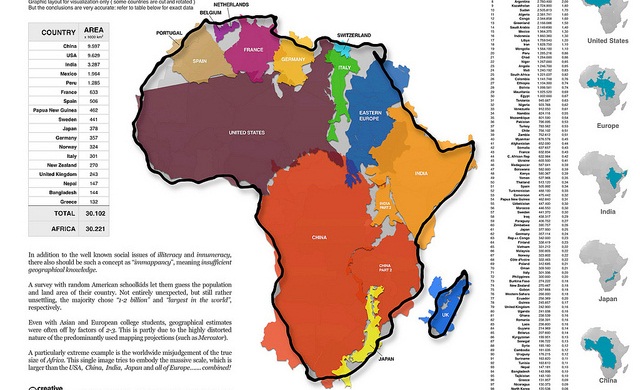

African Potash Executive Chairman Chris Cleverly said, “The signing of this Trading MOU is a landmark for African Potash in its strategy to become a vertically integrated African focused fertiliser business. It is also a significant leap for agriculture in the COMESA region. The Directors assess 65 per cent of Africa’s labour force is engaged in agriculture, 60 per cent of the world’s uncultivated land is also in Africa, and with a fast growing global population it is vital that the continent plays a leading part in the global food chain. There is a need for a structured commercial framework for fertiliser. As an example, the average Ugandan farmer pays twice as much for a bag of fertiliser than his European or American counterpart. It is both our opportunity and our duty to do better than that.”

George James Magai, Director of Trade and Markets of COMESA/ACTESA, said, “This agreement is the beginning of Africa’s green revolution and marks the arrival of African Potash’s vertical market on the continent.”

The Trading MOU with the Zambian fertiliser supply company, which is subject to definitive transaction agreements having been entered into, is being implemented as a result of the trading agreement announced by the Company on 4th August 2015 with COMESA, whereby African Potash and MACFF agreed to supply and deliver at least 500,000MT of fertiliser a year to off-takers identified and introduced by COMESA ACTESA, during an initial 3-year period (subject to a mutual renewal term of 10 years).

With regards to this and other transactions African Potash will source, deliver and fund the delivery of fertiliser through its proprietary network and methods.

COMESA will receive a commission fee on sales made pursuant to the Trading MOU and will, amongst other matters, use its best endeavours to assist on any government related issues in COMESA member states relating to the implementation of the Trading MOU and generally assist and support the implementation of the Trading MOU.

As part of its integrated approach, African Potash will further develop its Lac Dinga Potash Project in the Republic of Congo and is looking at other complimentary opportunities. It is also continuing to explore potential entry points in fertiliser production, manufacture and distribution.

Hot Features

Hot Features