Sony (NYSE: SNE, initial buy $13.64) President Kazuo Hirai is not finished with his revamp of the Sony business and the company announced last week that it will restructure its Devices segment, splitting it into three. Under the new operational structure, the semiconductor, battery and storage media businesses will be separated.

The aim of the exercise according to the company’s press release is to enable each of the businesses “to more rapidly adapt to their respective changing market environments and generate sustained growth. The separation will also mean more accountability and make it easier to sell parts of the business that are not making the grade. Sony has demonstrated that they are willing to do this with the sale of the Vaio PC unit last year.

Management will be more easily held accountable as well under the new structure and speed decision making, in line with CEO Hirai’s other moves to try and rejuvenate the company’s performance.

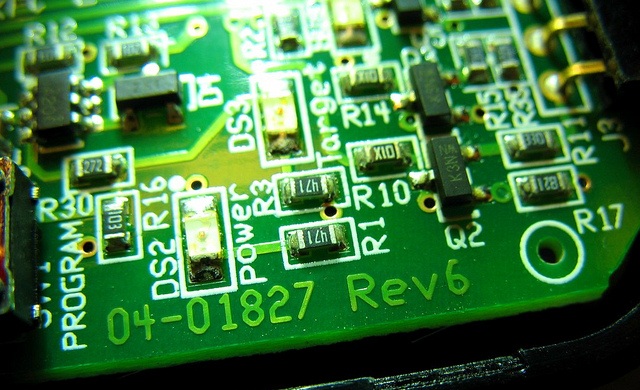

In the semiconductor business, where image sensors are the main game, Sony will establish Sony Semiconductor Solutions Corporation. Research and development (R&D), business control, sales and other operations decisions related to the semiconductor business are currently overseen by business groups and R&D units within Sony Corporation, and this responsibility will be transferred to Sony Semiconductor Solutions management. The new company will aim to commence operations on April 1, 2016.

Terushi Shimizu, currently the deputy chief for the devices segment, will head the semiconductor/sensor business. Two other units in the devices segment, Sony Energy Devices and Sony Storage & Media Devices will operate as separate companies.

It is the semiconductor/sensor business that is where the near term growth opportunity is though. As we have covered in previous commentary about Sony, the company’s image sensors are in popular demand, and generally considered to be as good as or if not better than any others on the market.

They are used in many of the mid-to-high end smartphone models and sales of its image sensors grew about 40% last year. This helped the devices segment expand sales almost 25 percent to ¥927 billion and move from an operating loss of ¥16.9 billion in FY13 to an operating profit of ¥89 billion last fiscal year.

The company dominates with a market share of approximately 40% across smartphones, tablets and cameras. Sony is also targeting expansion of its sensor sales in automobiles, where it current only ranks fifth with a market share of just 5 percent. BCC Research estimates that the broader sensor market for the automotive industry will grow at around a 9.7 percent compounded pace from $22.1 billion in 2015 to around $35.2 billion by 2020.

The medical and wearables markets are other opportunities for Sony’s sensor business that the company is investing in. As we wrote about in the Daily previously, Sony surprised the market somewhat earlier this year when it opted to raise new funds, with much of these apparently earmarked for sensors.

For nearly 15 years, Fat Prophets remains UK’s premier equity research and funds management company. Register today to receive our special report Bargain Hunting, and a no obligation free trial to our popular email service

Hot Features

Hot Features